If you’re recently starting out on your investment journey, getting up to speed with all the best practices, tools, and terminologies can be daunting.

Luckily, today’s investment apps make it pretty easy to get started. You don’t need deep economics or investing knowledge (although it undoubtedly helps) to start investing.

Many of today’s investing apps cater to beginners by doing a lot of the heavy lifting for you.

Whether it’s with customized stock screening on 1000+ parameters, customized charting, or replicating winning investor’s portfolios – there are plenty of features to help you build your first investment portfolio.

With fractional shares available through many online brokers, you don’t even need to buy a full share (which can be quite expensive for top companies – Costco for example is trading at just under $900 per share as of January 2026)

High prices for top stocks like Microsoft, Tesla, and Costco won’t stop you from building a winning portfolio. Fractional shares enable you to own a piece of top companies without buying a full share.

Many major stock investing platforms also charge low or zero fees on trades – so even if you only have a little bit of money to invest, your returns won’t be eaten up (or completely wiped out) by per trade fees.

Mobile apps make it easier than ever to access online brokers and place trades. Do it all while you’re waiting for your morning coffee.

In this blog we’ll walk you through the best investing apps for beginners in 2026 – from beginner-friendly apps to more specialized platforms for retirement saving.

Criteria for Selecting Beginner-Friendly Apps

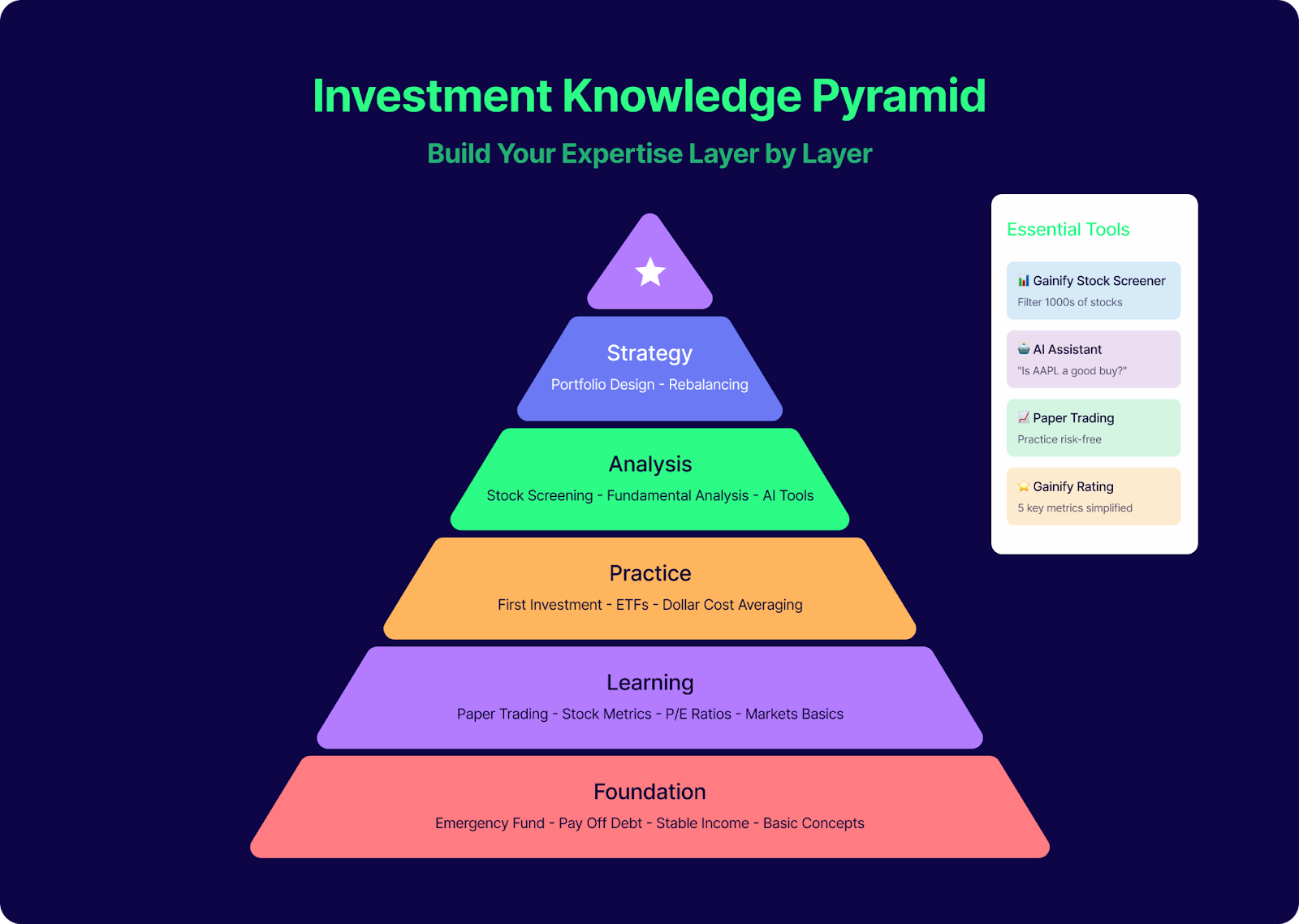

Successful investing requires both execution (buying stocks) AND research (choosing the right stocks).

When choosing your first investment app, check their investment minimums. The best apps will let you start with as little as $1. You don’t want to have to wait until you have thousands saved just to get started.

Next, check the app’s fee structure. Many investing apps offer commission-free trading. But some charge monthly fees or have hidden costs. Ensure you understand the fee structure before investing, otherwise your returns can quickly dwindle away as they’re eaten up by fees.

Finally, consider which investment types are available. Some apps may only let you trade stocks, even limiting purchases to US stocks. Others may offer a broader range of asset types (such as ETFs and Crypto) and trade types (for example Futures and Options).

Practice/paper trading accounts can also be a bonus – enabling you to test your investment thesis with virtual funds (I.e. fake money) in a simulated trading environment.

But keep this in mind – while investing apps help you buy/sell stocks, dedicated research platforms like Gainify.io help you choose WHICH stocks to buy.

Gainify makes investing easy by giving you access to:

- Customized screening: Filter 30,000+ global stocks using 1000+ data points like P/E ratio, dividend yield, and revenue growth. Find stocks that match your specific investing criteria.

- Custom charting: Compare several companies side-by-side using 1000+ financial metrics. Create unlimited chart boards organized by theme, sector, or strategy. Plot different scales together (like revenue vs. margins) with Multi-axis, and zoom from quarterly earnings to decade-long trends instantly with smart timeline controls.

- Gainify rating: Simplifies stock evaluation into a single number based on 20 factors, boiled down into 5 simple categories (Outlook, Valuation, Health, Performance, Momentum. Helps you quickly identify quality stocks without analyzing countless metrics.

You’ll also have access to Gainfy’s AI stock assistant to ask questions like

“How does Apple compare to Microsoft?”

and get instant, easy-to-understand answers without complex financial jargon – and AI earnings call summaries for key takeaways.

Other Gainify features include:

- Largest database of analyst estimates available to retail investors

- Pre-built stock screeners to find your first investment in seconds

- Earnings call calendar so you never miss important info

- Top investor tracking to replicate strategies & portfolios

The best part? You can get started for free (no credit card required.) Try Gainify today!

Pair your investing app with a dedicated stock research tool to uncover quality companies worth investing in, and then execute your trades using your chosen investing platform/brokerage service.

Best Overall Investment App for Beginners

Fidelity Investments is a top choice if you’re seeking zero account fees and zero trading fees.

You’ll be able to take advantage of fractional share investing – with trades as low as $1.

Importantly, the learning center helps you level up your investing knowledge and build your confidence.

Analyze your investment options with intuitive charting functionality and simple stock research tools. Powerful enough for informed investing, yet straightforward enough for beginner investors.

One feature less commonly found among investing apps is Fidelity’s zero-fee index funds – enabling you to invest in entire indices without ongoing fees.

Open an individual account, retirement account, or even an interest paying cash management account to facilitate your trading and store your profits.

Honorable mention

Webull also deserves consideration for beginners who want more comprehensive research tools alongside their trading.

The platform offers commission-free trading, fractional shares, and advanced charting to help you learn technical analysis.

It also provides AI-powered analysis and paper trading features, making it an excellent choice if you want to practice before risking real money (recommended.)

Plus, their educational content helps you understand market fundamentals as you build your first portfolio.

Top App for Retirement Savers

If retirement is your goal then Fidelity Go – which handles all types of IRAs including Traditional, Roth, SEP, and Rollover accounts – stands out as a clear winner.

This robo-advisor puts management of your portfolio on autopilot and charges nothing for accounts under $25,000. As your account grows above this amount, you’ll unlock unlimited 30-minute calls with professional human advisors.

Honorable mention

Another stock investing app worth checking out is Charles Schwab’s Intelligent Portfolios. You’ll need a little bit of capital to get started ($5,000 to get started) but as your account grows and exceeds $50,000 you’ll gain access to tax loss harvesting. This will help you save money on taxes and increase your profit margins.

But if tax loss harvesting is a priority for you, there are investing apps which provide access to this feature for small accounts. So there’s no need to save up $50K just to access this helpful feature.

Ideal App for Tax-Optimized Investing

Unlock free tax loss harvesting with Betterment Investing. The platform automatically sells your losing investments to offset your tax bill – a feature that enables 70% of users to fully cover their advisory fees.

One neat feature, similar to Gainify’s pre-built stock screeners and top investor portfolios, is the ability to choose from portfolios such as:

- Broad global diversification

- Innovative technology

- Socially responsible

- Climate impact

- Cash reserve

- Crypto ETF

Honorable mention

Mezzi is a specialized tax optimization platform – but instead of enabling you to trade, it focuses on working alongside your existing brokerage accounts.

All your gains and losses across different brokerages and tax lots will be organized and optimized – making it easy to identify optimal tax-saving opportunities.

Recommended App for Passive Investors

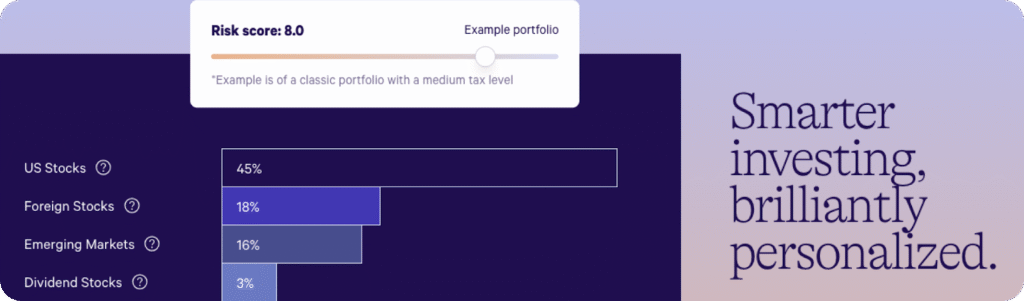

If you prefer a “set it and forget it” investing approach, check out Wealthfront. Its automated investing platform helps you build diversified portfolios and handles all the “trading, rebalancing, and busywork.”

You’ll be able to access over 200 ETFs for hands-off investing – from which Wealthfront will build you a portfolio comprised of low-cost index funds from up to 17 global asset classes.

Simply answer questions about your goals and risk tolerance – Wealthfront will the create and manage a portfolio for you.

However, you will need at least $500 to get started. Worse than some platforms that offer $1 minimums – but still not out of reach for most beginner investors. When it comes to trading you’ll be able to take advantage of fractional shares.

The platform does come with a 0.25% annual advisory fee (as of January 2026) – although tax loss harvesting may enable you to cover some of this.

Honorable mention

M1 Finance’s pie system lets you set your portfolio based on allocation percentages (how much you want to allocate to each industry or stock). Once set, M1 Finance will maintain your target portfolio percentages for you.

You can also earn a modest annual percentage yield on your uninvested cash and even borrow against your invested capital.

Account types on offer include individual & joint brokerage, retirement, crypto, and trust accounts.

Keep in mind that $3 monthly platform fee applies if you have less than $10K in assets. But there are no commissions, trading, or management fees.

Micro-Investing App for Novices

Micro-investing is just another name for investing small amounts of money. I.e., low minimum trade amounts. Public covers a huge range of asset classes and enables you to purchase stocks fractionally.

You’ll be able to build a portfolio with:

Bonds, high-yield investment accounts, treasury and IRAs are also available.

Should you choose to open a yield or bond account, you’ll be able to earn an annual percentage on your cash or investment.

Standout features not found in all investment apps include:

- AI: Public’s “Alpha” AI agent leverages GPT-4 technology to deliver investment analysis.

- Key moments: AI-generated summaries that explain every major stock price movement

- Earnings analysis: Public’s Earnings Hub provides AI-generated earnings recaps.

While market hours trading (9:30-16:00 EST) is free for all members, there are fees for other types of trades and services. Extended hours and OTC stock trading costs $2.99 per trade for non-Premium members. Index options carry fees of $0.35-$0.50 per contract. Stock and ETF options are free for everyone.

Getting your money out of Public can also cost you money as well. Outgoing wires cost $25, but ACH transfers are free.

Honorable mention

Robinhood remains popular for good reason. You’ll benefit from fractional shares enabling you to invest your pocket change or coffee money.

It doesn’t offer a lot of unique features compared to other stock investing apps, but it does offer expert managed portfolios for just $5/month plus fees.

While it doesn’t match the AI assistant and summarization features offered by Public, Robinhood’s AI research assistant, Cortex, is now live and continuing to expand in 2026.

Socially Responsible Investment Options

Previously mentioned platforms Betterment and Wealthfront both help you achieve your socially responsible and impact investing goals.

Betterment offers three ESG-focused portfolios:

- Broad Impact: Covers environmental, social, and governance aspects.

- Climate Impact: Focuses on green investments.

- Social Impact: Provides exposure to companies supporting social equity and minority empowerment.

Keep in mind that Betterment doesn’t choose individual stocks for this portfolio based on its own analysis. Instead, selections are made based on ESG classifications and scores given by 3rd parties.

This means that even if a stock makes it into one of Betterment’s portfolios, it is not an endorsement or indication of future strong performance.

Wealthfront offers a Socially Responsible portfolio and also maintains 45+ pre-built collections (some of them ESG-focused, such as the renewable energy collection) that enable you to quickly find individual stocks matching your investment strategy.

Investing Apps for Kids and Teens

Youth investing is a hands-on way for your children to learn about stocks. Investing apps for kids are few and far between, but Fidelity Youth is one of the few platforms that actually allows teens ages 13-17 to invest real money in stocks and ETFs.

As a parent, you can maintain visibility of your child’s activity through transaction monitoring and activity notifications.

Financial education is a core component of the Fidelity Youth app. Your child can earn rewards for completing educational content – and you’ll have access to the same content so you can learn together and guide them.

Other standout features include:

- Actual investing: Teens can buy fractional shares of real stocks and ETFs with as little as $1.

- No fees: Zero account fees, subscription fees, or minimum balances.

- Gift card exchange: Convert unused gift cards into investable cash.

- Educational rewards: Interactive lessons with rewards for completion.

- Automatic allowance: You can schedule weekly or biweekly deposits for your children.

Any uninvested cash automatically goes into a money market fund earning 3.41% (as of January 2026).

If you’re concerned about the SIPC coverage up to $500,000 plus Fidelity’s Customer Protection Guarantee security of your child’s funds, protect against losses from unauthorized activity.

Restrictions also prevent teens from accessing high-risk investments like penny stocks, options, margin trading, or cryptocurrency.

You can – as their parent – also close the account or cancel the debit card at any time, if needed.

Honorable mention

Acorns Early focuses on money management fundamentals rather than investing. Its smart money app and debit card for kids helps your children build practical skills like budgeting, saving, and earning.

Set up paid tasks (like chores) in the app, help your child learn about money with age-appropriate lessons, and let your children set their own savings goals.

Family and friends can contribute through Giftlinks, for example when gifting money for birthdays or special events.

Security features include bank-level encryption, FDIC insurance up to $250,000, and automatic blocking of unsafe spending categories.

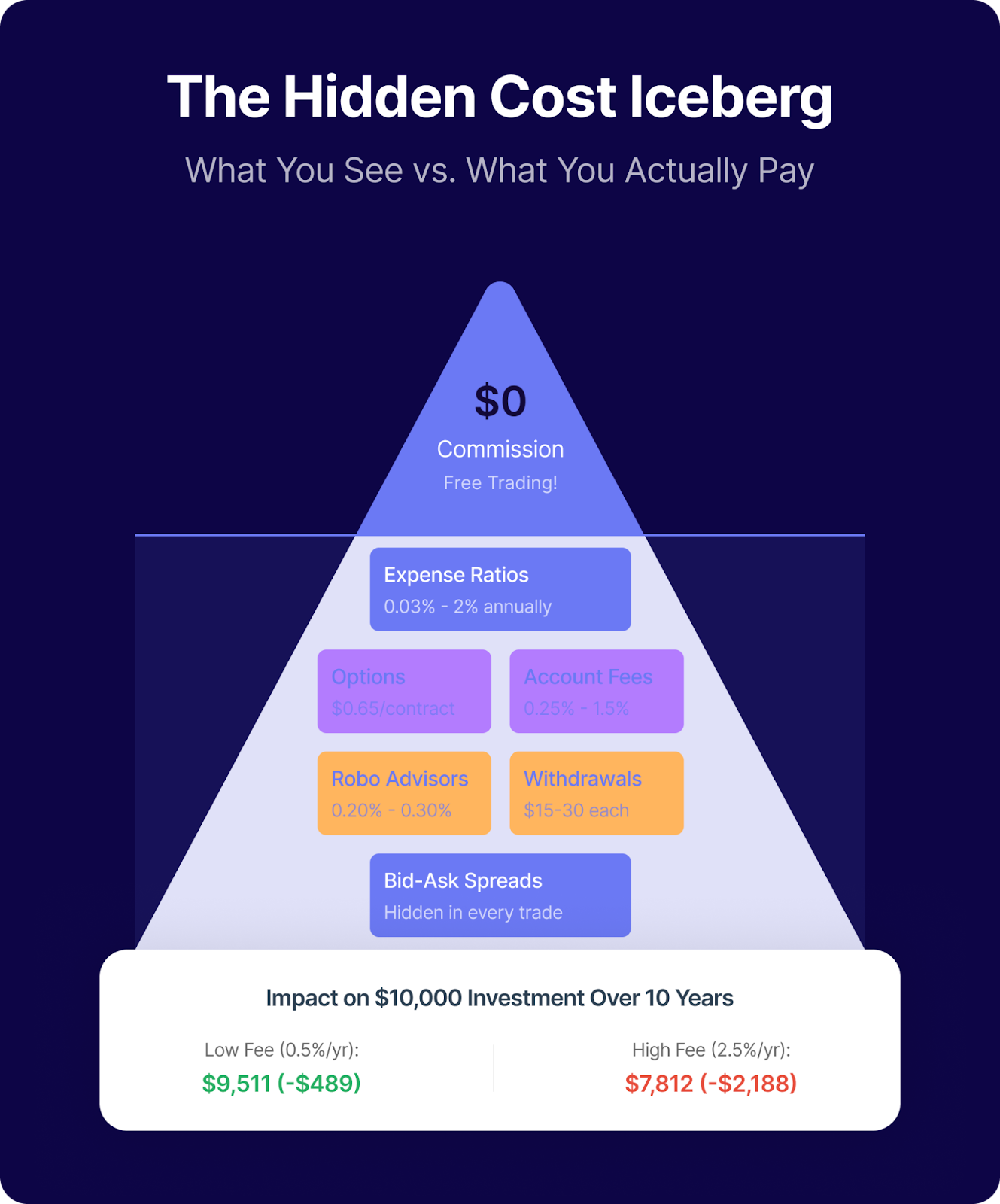

Understanding Cost Structures in Investing Apps

While most major investing apps and brokerage services offer zero-commission trading, you still want to keep your eye out for other “hidden” fees and costs.

These platforms need to make money from you somehow, so if you’re not paying an upfront monthly fee for access to the platform, you’re likely paying somewhere in the form of fees.

- Mutual funds and ETFs charge expense ratios, typically 0.03-2% annually.

- Options trades usually cost $0.50-0.65 or more per contract (sometimes a base fee is also included) – it wouldn’t be unusual to pay $10 or more for a 10-share trade.

- Account maintenance fees typically run 0.25% annually but can be as high as 1.5%.

- Robo advisor fees typically range from 0.20% to 0.30%

But strong competition in the industry has broadly driven costs down. So most platforms are quite reasonable in the fees they charge.

If you plan to make regular withdrawals, you should also factor in wire transfer or other withdrawal fees to ensure they don’t significantly reduce your profits.

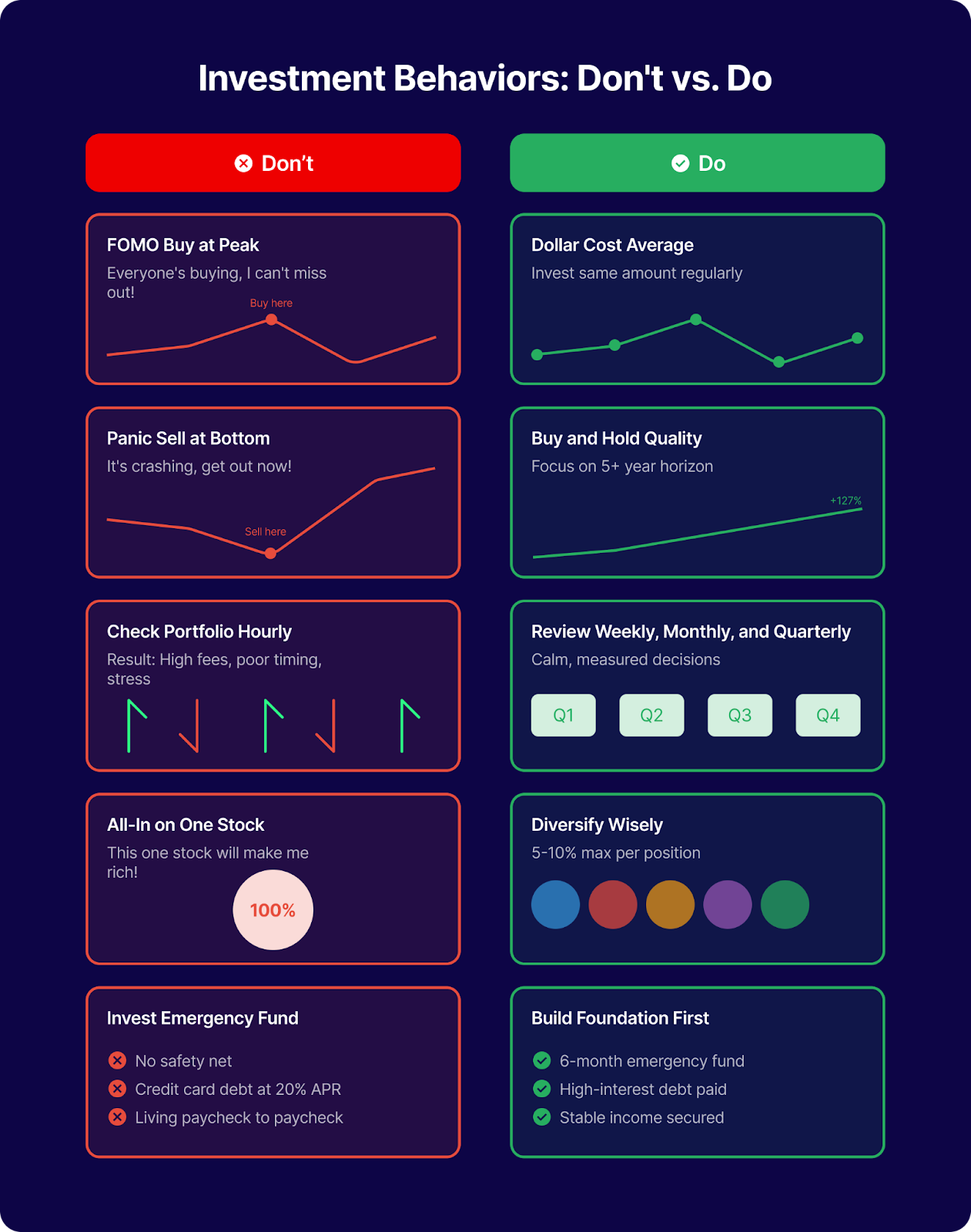

Avoiding Common Pitfalls in Investment Apps

When beginning your investment journey, avoiding common mistakes can save you a lot of money (and stress.) Below are the most critical pitfalls to watch. We cover:

- Setting the right foundations for successful investing

- How to manage your emotions when trading

- How often should you check your portfolio

- How frequently you should trade

- Why not time the market

- Portfolio diversification

- Positing sizing

- Rebalancing

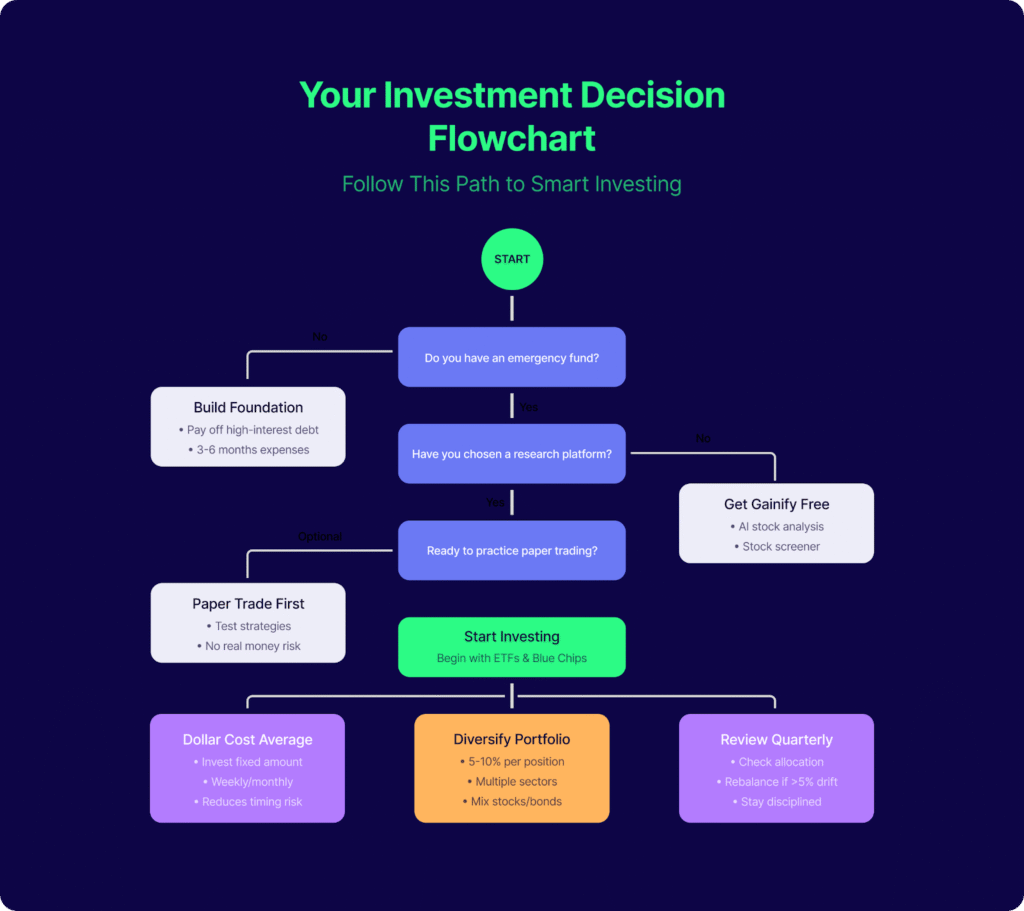

Not setting a stable foundation

Firstly, don’t invest more than you’re willing to lose. You shouldn’t put yourself into financial difficulty to invest.

Before you start investing, try to build a stable foundation. Your first priorities should be:

- Building an emergency fund: 3-6 months of expenses in high-yield savings

- Paying off high-interest debt: Credit cards with an APR above 15% APR should be eliminated first

- Establishing stable income: Consistent cash flow to support monthly contributions

Emotional trading

The biggest mistake you can make as a beginner investor is emotional trading. Not to say that this only impacts beginners (investors of all levels suffer from this), but when you’re just starting out, it can be especially prominent in your decision-making.

As an investor at any experience level, you should avoid:

- FOMO buying: Purchasing stocks at market peaks due to social media hype

- Panic selling: Dumping investments during market dips

Letting investing take over your life

Instead of checking your portfolio each hour and reacting to small daily swings, try automated portfolio management or simple ETF investing instead. Feel free to check in once a day or week to see how your investments are performing – but try to make decisions based on strong fundamentals rather than intraday movements.

Start with Gainify’s stock screener to filter thousands of stocks using beginner-friendly criteria like dividend yield, P/E ratio, and market cap. Once you’ve identified potential stocks to invest in, check each stock’s Gainify Rating – a single score that evaluates a company’s health, outlook, momentum, and more.

For deeper insight, use Gainify’s AI assistant. Simply ask questions like “Is Apple a good long-term investment?” or “What are the risks of investing in Tesla?”

This will help you uncover quality companies worth investing in, based on strong fundamentals and growth prospects. Balance your personal assessment with Analyst Estimates and 3-year forward estimates on key valuation metrics.

Over trading

Another mistake you can make is over-trading. Each sale in a taxable account triggers potential capital gains taxes. Buy-and-hold strategies can simplify not only your portfolio management but also your taxes.

Focus on long-term investing (holding assets for 5+ years) rather than short-term trading. Here’s why:

- Compounding: Long-term investors benefit from compound returns, where your gains generate additional gains over time.

- Lower stress and costs: Buy-and-hold strategies reduce transaction costs and eliminate the stress of daily market monitoring.

- Tax considerations: Long-term capital gains may receive favorable tax treatment compared to short-term gains taxed as ordinary income.

Trying to time the market

Timing the market is difficult for even the best investors. Instead of attempting to do this, try dollar cost averaging.

How it works: Invest a fixed amount regularly (weekly/monthly) regardless of stock prices.

Doing so reduces the impact of market volatility on your portfolio and prevents emotional timing decisions.

Given that most platforms offer commission-free trading, there’s no penalty for more frequent purchases associated with dollar cost averaging.

Not diversifying your portfolio

Relying solely on individual stocks exposes you to company-specific failures. Diversified portfolio construction involves spreading investments across different assets to reduce risk.

To diversify your portfolio:

- Don’t put all eggs in one basket: Avoid investing everything in a single stock or sector.

- Start simple: Begin with broad market ETFs that instantly diversify across hundreds of companies.

- Age-based allocation: In your 20s-30s, consider 70% stocks and 30% bonds; adjust as you age.

- Geographic diversification: Include both U.S. and international investments.

Our analysis of individual stock risks shows that relying solely on individual stocks exposes you to company-specific failures, emotional decision-making, and market timing challenges.

Misjudging position sizing

When just starting out you’re prone to making critical errors in determining how much to invest in each stock.

Common position sizing errors include:

- All-in mentality: Putting all your capital into one “sure thing” stock.

- Equal weighting: Investing the same dollar amount in all stocks regardless of conviction or risk.

- Percentage confusion: Not understanding the difference between share price and position size.

Instead, implement a professional position sizing framework:

- Follow the 5% rule – Never invest more than 5-10% of total portfolio in any single stock.

- Use dollar-based thinking – Focus on dollar amount invested, not number of shares.

- Implement risk-adjusted sizing – Take on smaller positions for volatile stocks, larger for stable blue-chips.

Read our guide on position sizing to learn more.

Not rebalancing your portfolio

Rebalancing is when you adjust your portfolio allocations to see if they still align with the same principles used when you originally purchased the stocks.

Some good rules of thumb are to rebalance when:

- You conduct a quarterly review of allocation percentages

- Any asset class drifts 5% from the target

Rebalance by selling overweighted assets and using new contributions to buy underweighted assets. As always, consider tax implications in taxable accounts.

Creating a Diversified Portfolio

A well-diversified portfolio spreads risk across different asset classes, geographies, and investment types. It helps protect your capital and sets you up for long-term growth.

For a comprehensive guide on building a diversified portfolio with specific fund recommendations and step-by-step instructions, read our detailed article on diversified portfolio examples.

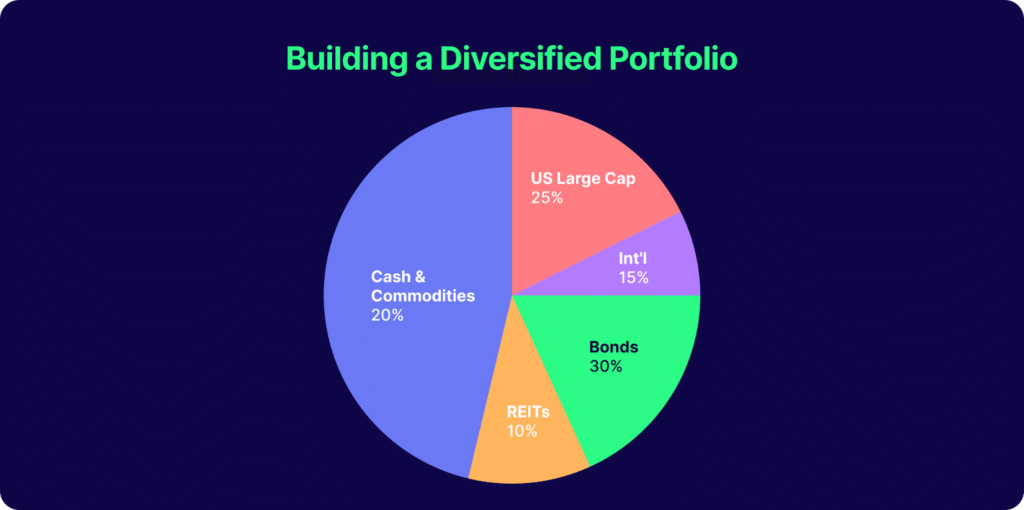

Below is just one example of what a diversified portfolio could look like for you:

- US Large-Cap Stocks (25%): Growth engine with exposure to blue-chip companies

- International Stocks (15%): Geographic diversification beyond US markets

- Bonds (30%): Fixed-income exposure to reduce overall portfolio risk

- Real Estate (REITs) (10%): Alternative asset class and inflation hedge

- Small amounts in commodities and cash (10%): Portfolio ballast and liquidity

However, take all diversified portfolio recommendations with a grain of salt. Only you truly know what best suits your risk profile, investing goals, and life stage.

For example, many investors change strategies as they move into different life stages:

- Ages 30-40: 70% stocks, 20% bonds, 10% alternatives (growth focus)

- Ages 40-60: 50% stocks, 35% bonds, 15% alternatives (balanced approach)

- Ages 60+: 30% stocks, 50% bonds, 20% alternatives/cash (conservative)

The key is intentional diversification – every asset should serve a distinct purpose in YOUR portfolio.

Resources to Ease the Learning Curve

It takes time and practice to get comfortable with investing. Most investment apps aren’t set up to teach you about investing. Instead, they just facilitate trading and give you some insights and charts.

To get the reps in and become a profitable investor with a clear stock research process and investment thesis, you need dedicated tools and resources.

Practice Trading

Before risking your hard-earned money, use paper trading (also called virtual trading) to build confidence and test strategies.

It enables you to place trades, manage positions, and experience market volatility without real financial consequences.

But make sure you take it seriously. If you treat it like monopoly money and don’t build good investing habits, you’ll suffer when it comes to trading with real money.

- Build a stock research process

- Follow strict decision-making criteria

- Focus on building a process and fine-tuning it

- Don’t take risks you wouldn’t take with your own money

- Track your decision-making and keep an investment journal to help you improve

Top paper trading platforms include Webull (paper trading with stocks, ETFs, and options) and TradingView (for beginners learning technical analysis).

Educational Content

One of the best ways to learn about investing is with Gainify. The platform has built in learning features for beginners and seasoned investors alike include:

- Interactive screening: Build custom screens to answer questions like “What makes a good dividend stock?” by filtering for high yield, consistent payout ratios, and earnings stability.

- Easy custom charting: Customize charting with unlimited dashboards to make stock analysis easy for you based on your preferences.

- Interactive AI assistant: Ask questions like “What makes a good dividend stock?” and get instant, jargon-free answers.

- Gainify rating system: Complex analysis simplified into 5 key proprietary metrics. It’s never been easier to get a clear snapshot of a company’s health and potential.

- Educational tooltips: Hover over any metric for instant explanations. Learn as you go based on what is most relevant to you right now.

You’ll also find a range of learning resources, investing strategies, and investor education materials on our website. Top resources include:

- The ultimate guide to stock metrics (link)

- The top 5 investing books for beginners (link)

- How to analyze a stock before investing (link)

- A guide to technical analysis for beginners (link)

- How to start investing – a beginner’s roadmap (link)

- The complete guide to stock analysis and portfolio building (link)

- MOIC – the essential metric every investor should understand (link)

You’ll also be able to learn about P/E ratios, PEG ratios, operating cash flow, EPS, Return on Assets, and more.

Tips for beginner investors

Following Warren Buffett’s investment philosophy, invest in companies and industries you understand. As a beginner:

- Start with companies whose products or services you use daily (Apple, Microsoft, Amazon).

- Avoid complex investments like options or penny stocks until you build experience.

- Focus on large, established companies before exploring smaller growth stocks.

- Use Gainify’s AI assistant to ask simple questions like “What is the Gainify view on Apple?” before investing.

Conclusion: Choosing the Right App for Your Investment Journey

Starting your investment journey in 2026 is easier than ever – with a world of advanced technology and swathes of investing apps at your fingertips. But that doesn’t mean investing has become easier. You still need to have your wits about you, develop and build upon investment strategies, and improve your skills every day.

To get started:

- Find a stock research platform like Gainify to help you find winning companies

- Open an account with a reputable broker (preferably with low minimums and fractional stock purchases)

- Paper trade for a while to get the hang of investing

- Start investing in sectors or assets you know and understand (index funds and ETFs are a good starting point for most)

- Dollar cost average and have a clear investing strategy in place

- Track your progress and improve, rebalance your portfolio

And remember, begin with whatever amount you can afford to lose and diversify your portfolio. As Warren Buffett’s philosophy demonstrates, time in the market beats timing the market – don’t go all in on a single stock over your head. Give yourself the time and experience needed to become a successful investor.

Ready to get started? Sign up for a free Gainify account to research your first stock picks with institutional-grade data, powerful custom screening across 1000+ metrics, dynamic charting capabilities, and built in learning.

Frequently Asked Questions

What’s the minimum amount needed to start investing?

Most modern investing apps allow you to start with as little as $1 thanks to fractional shares. Platforms like Fidelity, Public, and Robinhood have no minimum account balance, making investing accessible regardless of your budget. However, some robo-advisors like Wealthfront require $500 minimum deposits.

Are investing apps safe for beginners?

Yes, SIPC-insured brokers provide up to $500,000 protection per account against broker failure. Look for apps regulated by the SEC and FINRA with bank-level encryption and two-factor authentication. Avoid unregulated platforms promising guaranteed returns.

How important are custom screening and charting tools in my investing app?

Custom screening and charting capabilities can be valuable for research and education but shouldn’t replace your own analysis. Platforms like Public offer basic screening, while Gainify’s custom screener lets you filter 30,000+ stocks by 1000+ metrics and build personalized charts to visualize any financial data – customize everything to suit your specific investment strategy.

How do I choose between a robo-advisor and self-directed investing?

Robo-advisors like Betterment and Wealthfront handle portfolio management automatically, making them ideal for hands-off investors. Self-directed platforms like Fidelity give you control over individual stock picks. Beginners often benefit from starting with robo-advisors before transitioning to self-directed investing as their knowledge grows.

What fees should I watch out for?

While most major platforms offer commission-free stock trading, watch for account maintenance fees (0.25-1.5% annually), options trading fees ($0.50+ per contract), and expense ratios on ETFs/mutual funds (0.03-2% annually). Wire transfer fees for withdrawals can also add up.

Should I use multiple investing apps?

Many investors use one primary broker for most trades and specialized platforms for specific needs. For example, you might use Fidelity for general investing, Betterment for tax-loss harvesting, and Gainify for stock research. Just ensure you can track your overall allocation across platforms.

When should I upgrade from a beginner app to an advanced platform?

Consider upgrading when you consistently want features your current app doesn’t offer, such as advanced charting tools, options trading, or international markets. Most beginners are well-served by platforms like Fidelity that grow with their needs rather than requiring platform switches.

How important is having an AI assistant in my investing app?

AI assistants can be valuable for research and education but shouldn’t replace your own analysis. Platforms like Public offer AI-powered insights, while Gainify’s AI assistant helps answer specific questions about stocks and investing concepts. Use these tools to learn, but always verify important investment decisions through multiple sources.