Investing in stocks in 2026 is about more than just picking the right companies. It’s also about managing risk and allocating capital wisely.

One of the most common questions new investors ask is: “How many shares should I buy?”.

It might sound like simple math, but the answer depends on your goals, your risk tolerance, and your overall portfolio strategy.

In this guide, we’ll break down how to size your positions, calculate share amounts, and apply best practices for long-term success.

Step 1: Define Your Investment Goals

Before diving into numbers, take a moment to define why you’re investing.

Your specific goals will shape the amount of risk you’re comfortable taking, how long you plan to hold an individual stock, and what type of companies you might invest in.

Here are a few common investment goals:

- Long-term growth for long-term investors: Are you looking to build long-term wealth over time through capital appreciation? This strategy often focuses on quality companies with strong fundamentals and growth potential.

- Dividend income: Are you seeking to generate passive income through dividend payments? In this case, you might prioritize companies with a consistent dividend history and allocate based on yield and stability rather than aggressive growth.

- Short-term speculation or day trading: Are you aiming to profit from short-term price movements? Traders often use technical analysis and are more sensitive to timing, liquidity, and price volatility. Risk management becomes especially critical here.

👉 Being clear about your goals helps prevent emotional investing and creates a disciplined framework.

Step 2: Assess Your Available Capital

Once you know your goals, the next step is deciding how much to invest in a single stock. This is critical. Putting too much into one position can hurt your portfolio if the stock falls.

Start by looking at your total investable portfolio. This is the money set aside for investing, not your emergency fund or short-term savings. From there, decide what percentage you are comfortable allocating to one company. The answer will shape your risk level and keep your portfolio balanced.

A Common Guideline

Most financial advisors recommend that no more than 5% to 10% of your total portfolio should be invested in any single company or exchange-traded fund (this common guideline could also apply to other asset classes). This helps you stay diversified and reduces the impact of one bad investment.

Example:

Let’s say your total investment portfolio is worth $50,000. If you follow the 5% rule, you should invest no more than $2,500 in any one stock. This way a diversified portfolio could be achieved.

Even if you’re very confident in the company, it’s usually best to stay disciplined with your allocation. If you’re early in your investing journey, you may want to stay on the conservative side – around 2% to 3% per stock.

Step 3: Use Position Sizing Formulas

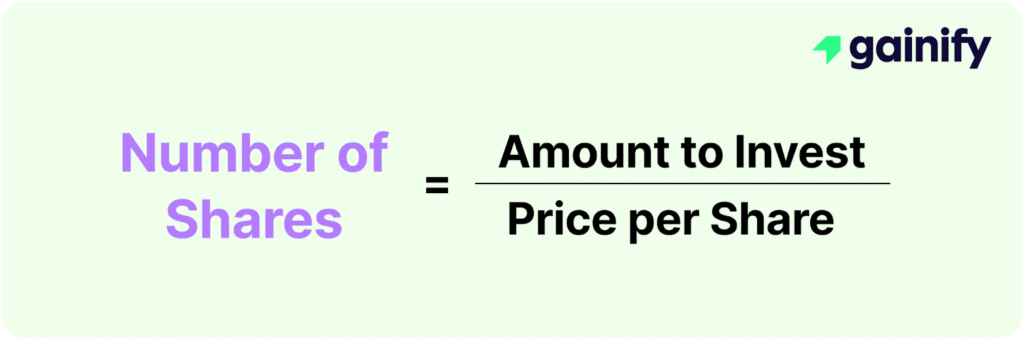

With your capital and goals established, the next step is to determine how many shares to buy using a position sizing formula. One simple and effective way for new investors is to divide the dollar amount you’re willing to invest by the current share price.

Basic Formula

Example:

- Amount to Invest: $2,000

- Stock Price: $40

Number of Shares of Stock = $2,000 / $40 = 50 shares

This straightforward method ensures you stay within your capital limits while taking a position that aligns with your risk tolerance and goals.

While more advanced individual investors may incorporate stop-losses and risk percentages, these are not necessary at the beginning. However, you should remain aware of how much you could lose and monitor your stock holdings regularly.

Things to Keep in Mind:

- Account for trading costs or taxes: Don’t ignore brokerage fees, taxes, and bid-ask spreads. These can eat into profits, especially if you’re buying low-priced stocks or trading frequently.

- Round numbers aren’t mandatory (fractional shares is an option): Round numbers aren’t mandatory: You don’t need to buy in traditional ’round lots’ of 100 shares. Thanks to modern brokerage platforms (such as Charles Schwab, Robinhood and others), investors can now purchase fractional shares, allowing you to invest precise dollar amounts regardless of the individual stock price. This means that even high-priced stocks like Amazon or Tesla are accessible to everyday investors through fractional share investing. Whether you’re starting with $10 or $1,000, fractional shares make it easier to diversify your portfolio without waiting to accumulate larger sums.

- Cash reserves matter: Don’t invest everything at once. Keeping some cash on the sidelines gives you flexibility to take advantage of future opportunities.

- Understand stock splits and price history: Stock splits can make a stock seem more affordable, but they don’t change the fundamental value of your holdings. For example, Broadcom (AVGO) announced a 10-for-1 stock split effective in July 2024. If the share price was $1,200 before the split, it would adjust to $120 after, and your share count would increase tenfold.

Other Key Considerations

Even after determining how many shares to buy, a few important factors can fine-tune your decision-making:

A. Understand the Stock’s Volatility and its Unsystematic Risk

Some stocks naturally fluctuate more than others. Metrics like beta, Average True Range (ATR), or standard deviation can help you assess how volatile an individual stock tends to be. If an individual stock has a history of large price swings, consider reducing your position size to better manage the level of risk and avoid emotional decision-making.

B. Consider Dollar-Cost Averaging (DCA)

If you’re unsure about entering the stock market all at once, DCA is a proven strategy. Instead of buying your entire position in one go, you invest smaller amounts over a period of time—weekly or monthly, for example. This smooths out the impact of market volatility and helps you avoid the pressure of trying to “time the bottom.”

C. Behavioral Discipline and Diversification

Successful investing isn’t just about numbers. It’s also about mindset. Resist the urge to chase trending stocks based on hype (FOMO). Instead, stay focused on your strategy and maintain diversification to protect against major losses. Regularly review and rebalance your portfolio as your goals or market conditions change.

D. Track your portfolio like a pro:

Investing doesn’t stop once you hit the “buy” button. Use portfolio tracking tools like Gainify, Yahoo Finance, or your brokerage’s dashboard to monitor your positions, watch key metrics like P/E, dividend yield, or volatility, and stay on top of news that could affect your investments. Regular portfolio reviews help ensure your allocations stay in line with your goals, especially as prices and company fundamentals change over time.

Final Thoughts

The question “How many shares should I buy?” is more than simple math. It connects to your strategy, your risk tolerance, and your long-term goals.

Smart position sizing reduces risk and builds discipline. It also improves your chances of steady returns, even when markets get volatile.

By setting clear goals, knowing your capital, and using a structured approach, you avoid emotional choices. Instead, you make strategic moves and keep your portfolio diversified.

Markets will always bring hype and fear. A clear framework helps you focus on what matters most: building wealth in a sustainable way.

Whether you are a beginner or an experienced investor, position sizing is a foundation for becoming confident and informed.