In a financial world historically dominated by legacy brokerages and private banks, Robinhood Markets, Inc. was born from a singular, disruptive idea:

To provide a simple, commission-free trading platform for everyone.

Co-founded by Vladimir Tenev and Baiju Bhatt, Robinhood’s initial strategy was a direct challenge to the old guard, democratizing stock trading and quickly becoming the first online brokerage for a generation of investors. This initial success, however, has been dramatically eclipsed by its recent growth.

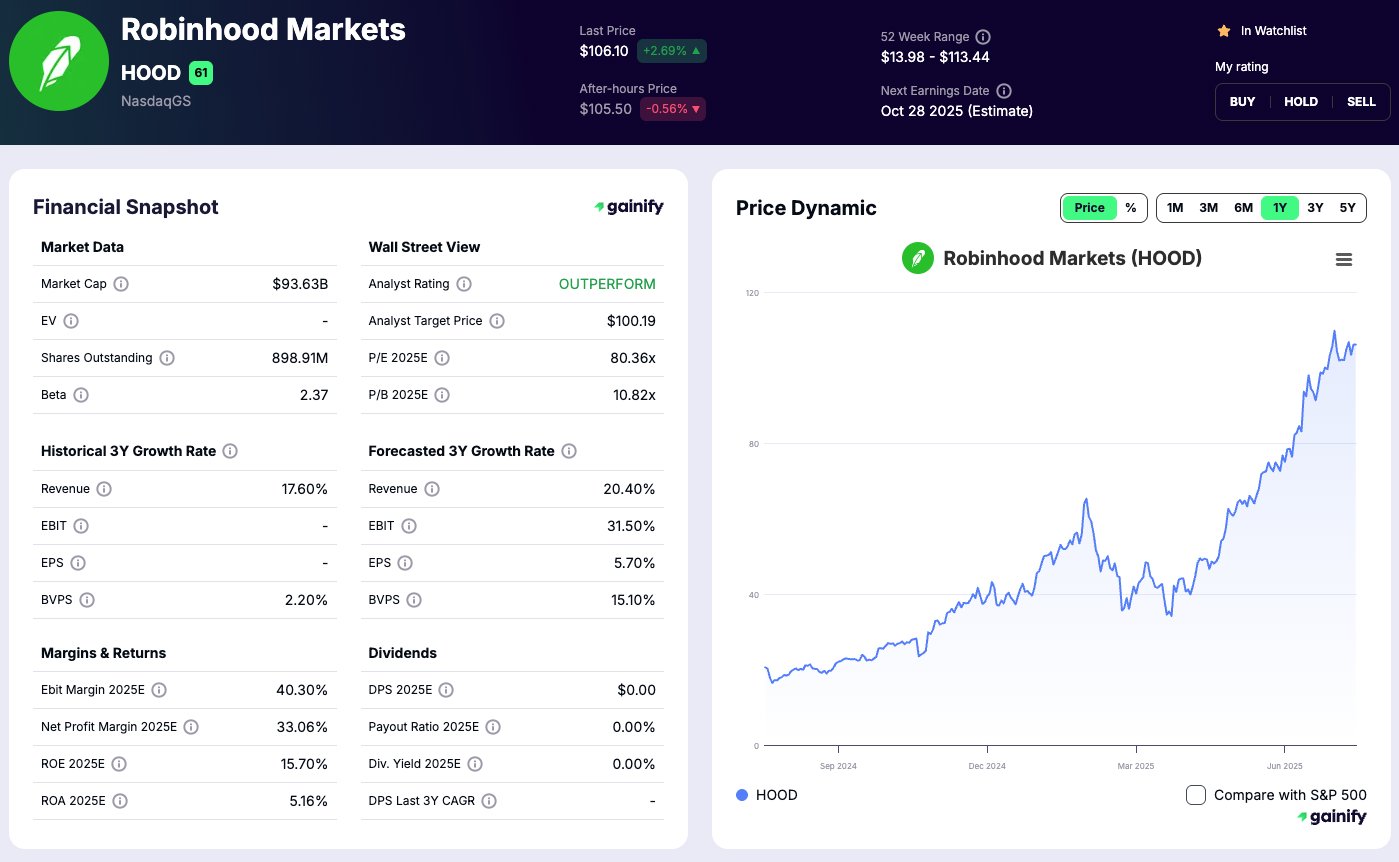

As evidenced by its record-breaking Q3 2025 financial results, Robinhood has successfully pivoted from a disruptor to a diversified financial powerhouse. Its total platform assets have nearly doubled to a staggering $333 billion, and the company’s market capitalization has grown exponentially, reaching new highs in 2025. This rapid and profitable expansion is not a fluke; it is the product of a deliberate, multi-pronged strategy to build a full-service financial brokerage that captures a greater share of its customers’ financial lives.

This transformation presents a new, critical dilemma for investors. The platform that once focused solely on the low-cost Robinhood app for self-directed trading now offers sophisticated advisory services, a robust retirement platform, and even a nascent private banking experience. The central question is no longer just about commissions, but about whether this new, comprehensive Robinhood is a suitable and complete financial home for a user’s entire wealth-building journey.

This article will provide an in-depth, up-to-the-minute analysis of Robinhood’s 2026 platform. We will critically examine its newest offerings, from its AI-powered tools and global crypto expansion to the new banking services, weighing their potential against the platform’s enduring limitations and controversies. This detailed look is designed to provide you with the necessary context and data to make an informed decision about whether Robinhood aligns with your specific investment objectives.

Robinhood’s Evolution: From Disrupter to Financial Hub

Robinhood has moved well beyond its initial focus on a minimalist, mobile-first experience to offer a robust suite of tools designed to compete with established players and even services once reserved for the high-net worth. The fin tech company’s strategy has evolved from being just a simple app for stock trading to a more comprehensive financial ecosystem. This strategic pivot is best evidenced by its Q3 2025 financial results and new product rollouts.

Key Features and Offerings:

Financial Strength & Growth: As of its Q3 2025 earnings report, Robinhood Markets, Inc. demonstrated a dramatic shift in its financial standing. Total platform assets grew by 119% year-over-year to a record $333 billion, while total net revenue increased 100% to $1,274 million, with a net income of $556 million. This growth was fueled by an increase in funded customers to 26.8 million and a 81% LTM jump in Robinhood Gold subscribers to 3.9 million, solidifying Robinhood’s position as a profitable, large-scale financial institution.

Trading & Tools: While the core appeal remains zero-commission trades on stocks, ETFs, and options, Robinhood has significantly enhanced its capabilities. Robinhood Financial offers margin trading with competitive margin rates for Gold members. For serious traders, the “Robinhood Legend” platform provides Nasdaq Level II market data, advanced charting features, a wide range of technical indicators, and drawing tools. This represents a concerted effort to move beyond basic trading and cater to day trading enthusiasts. Robinhood’s trading volumes have seen a massive boost, with equity notional trading volumes increasing 126% to a record $647 billion and options contracts traded increasing 38% to a record 610 million in Q3 2025.

Wealth Management & Advisory: Robinhood has officially entered the wealth management space with a new offering. Robinhood Strategies, its SEC-registered investment advisor service, provides expert-managed portfolios. This is not a simple robo advisor but a hybrid model combining algorithmic efficiency with human expertise from a team of seasoned professionals. The service offers portfolio management tailored to a user’s investor profile and includes advanced features like Monte Carlo simulations to model future outcomes. As of Q3 2025, Robinhood Strategies is managing over $0.5 billion in assets and serving over 100,000 customers.

Retirement & Banking: Robinhood Retirement offers Traditional and Roth IRAs, with a generous 1% match on contributions (3% for Gold members), which is one of the industry’s strongest incentives. Robinhood Retirement assets under custody grew 250% year-over-year to a record $24.2 billion. In a major strategic move, the company is also launching Robinhood Banking, a new suite of services aiming to bring private banking benefits to the mass market. This includes traditional checking and savings accounts with a high APY and up to $2.5M in FDIC insurance through partner banks, as well as features like on-demand cash delivery and advice on tax advantages for Gold members, bridging the gap to a full-service financial brokerage.

Global Expansion and New Products: Robinhood has aggressively expanded its footprint, completing acquisitions of global cryptocurrency exchange Bitstamp and Canadian firm WonderFi. This has allowed it to launch new products like stock tokens in Europe for over 200 US stocks, as well as American Depositary Receipts (ADRs) for international stocks. In 2025, Robinhood also unveiled a suite of new crypto products, including crypto perpetual futures in the EU, a new Layer 2 blockchain to facilitate tokenized assets, and crypto staking for eligible US customers. The company’s crypto trading revenue nearly doubled year-over-year to $268 million in Q3 2025.

The Robinhood Dilemma: Strengths and Strategic Gaps

Robinhood’s rapid growth has been a testament to its strengths, but it is not without significant criticisms. The platform presents a compelling value proposition that must be weighed against its notable drawbacks.

Strengths:

- Accessibility and Low Costs: The Robinhood app remains arguably the most user-friendly way for beginner investors to enter the market. The zero-commission model, coupled with fractional shares, removes the major barriers of high costs and minimum balances that have historically excluded many from stock trading. The ability to buy tiny fractions of expensive stocks makes building a diversified portfolio with limited capital a tangible reality.

- Powerful IRA Incentives: Through Robinhood Financial, the platform has introduced a powerful incentive to attract long-term investors. The generous 1% and 3% IRA matches are a direct, tangible financial benefit that few, if any, competitors match. This, combined with a high APY on uninvested cash (competitive with many high-yield savings accounts), positions Robinhood not just as a trading tool but as a serious contender for a user’s entire savings and retirement strategy.

- Robust Security: Customer accounts are protected by strong industry standards. Securities held on the platform are covered by SIPC insurance up to $500,000, and cash is protected by FDIC insurance up to $2.5 million through a network of partner banks. This gives users peace of mind and demonstrates Robinhood’s commitment to implementing high security standards that are on par with traditional brokerages.

- Financial Strength & Diversification: Robinhood’s Q3 2025 results demonstrate a successful pivot from a reliance on just transaction-based revenue to a more diversified business model. The dramatic growth in total platform assets and profitability solidifies the company’s financial strength, lending it credibility and long-term viability that it may have lacked in its early days. This diversification across different product lines provides the resources to continue its aggressive expansion into new areas like wealth management and banking.

Criticisms & Controversies:

- Gamified Trading: A core criticism from financial experts is the app’s sleek, game-like design. Features like confetti animations and a simple interface can encourage gamified trading and a focus on day trading, which for most investors is a risky and often unprofitable strategy. This design can lead to poor investment decisions rooted in excitement rather than a disciplined, long-term approach.

- Order Execution and PFOF: Robinhood’s business model relies heavily on payment for order flow (PFOF). This is the controversial practice of routing customer orders to market-making firms in exchange for a fee. While this enables the zero-commission structure, it has been a target of regulatory scrutiny from the SEC and others who question whether it consistently provides the best possible execution prices for customers, potentially introducing a conflict of interest.

- Platform Limitations: Despite its recent expansions, a major limitation remains the lack of access to traditional mutual funds, a cornerstone of long-term retirement investing for many. This forces investors who prefer this investment strategy to either use ETFs, which may not always be a perfect substitute, or seek another platform entirely.

- Regulatory Scrutiny: The company’s aggressive expansion into novel areas has not gone unnoticed by regulators. Products like stock tokens, which have been criticized by regulators for their novel and potentially risky nature, and crypto staking continue to face significant regulatory uncertainty. This ongoing scrutiny introduces a layer of risk for both the company and its customers.

- Customer Service & Reliability: The meme stock frenzy exposed significant weaknesses in Robinhood’s infrastructure and customer service. The decision to restrict trading on certain restricted stocks left many users feeling betrayed. While Robinhood has since made significant improvements, including offering 24/7 chat support, the experience created a lasting distrust among a segment of the investor community.

The Final Verdict: Aligning the Platform with Your Profile

Robinhood has evolved into a legitimate and competitive financial platform, but it is not a one-size-fits-all solution. The question of whether it is “good” depends entirely on your personal investor profile and financial philosophy.

For the self-directed, cost-conscious investor who is comfortable with a technology-first approach and seeks to build a portfolio of stocks and ETFs, Robinhood is an excellent, low-cost gateway. Its powerful tools for trading, its generous IRA match, and its new advisory services make it a compelling choice.

However, for the traditional investor who values access to mutual funds, requires in-person or extensive phone-based support, and seeks a conservative, human-led wealth management experience from a legacy firm, Robinhood may still fall short.

Ultimately, Robinhood’s journey from a niche fintech app to a diversified financial service is a story of continuous evolution. Its latest developments, from AI-powered insights to dedicated advisory services, show a commitment to becoming a more serious contender in the modern financial landscape. The new Robinhood is a powerful tool; the key is to understand if it is the right tool for you.