The financial markets have always been a stage for dramatic market movements, but in recent years, a new phenomenon has taken center stage: MEME STOCKS. These are not your traditional stocks whose share price is solely dictated by earnings reports or industry fundamentals. Instead, their rapid, often bewildering, ascent and descent are fueled by the collective power of retail traders organized through social networks and viral online sentiment, leading to a true meme stock craze.

Imagine a company, perhaps one facing significant financial challenges, suddenly experiencing a meteoric price increase in its share price, seemingly overnight. Or perhaps it’s a fundamentally strong company whose market valuation gets propelled well beyond its intrinsic worth by the same forces. This isn’t the result of groundbreaking innovation or a stellar annualized return projection. It is the raw energy of retail traders, galvanized by internet culture and shared enthusiasm, often challenging the established norms of the stock market. This meme stock frenzy was notably amplified during the COVID-19 pandemic, as more individuals turned to online brokerages and mobile trading apps for self-directed investing.

As a financial professional deeply immersed in the dynamics of market changes, I can attest to the unprecedented nature of this trend. While fascinating, it presents a unique blend of opportunity and extreme investment risk. Understanding what are meme stocks is not merely about identifying specific companies; it is about grasping a new form of investor behaviour driven by collective investor psychology.

This guide will demystify meme stocks, exploring their origins, characteristics, and the inherent risks they carry. We will look at prominent examples that have captured global attention and discuss why a cautious and informed approach is paramount for any investor considering these highly volatile investment options.

What Are Meme Stocks? The Rise of Social Investing

Meme stocks refer to the shares of companies whose share price experiences rapid, often unpredictable, and significant surges primarily due to viral social media communication and online community engagement, rather than fundamental analysis of their business performance. These movements are typically driven by retail traders coordinating or inspiring mass buying through platforms like Reddit, X (formerly Twitter), and Discord. The term itself blends “meme” (an internet phenomenon) with “stock” to describe this unique asset class.

The rise of meme stocks has highlighted the growing influence of individual retail traders in the financial markets, empowered by commission-free stock trading platforms like Robinhood and Charles Schwab, and readily available information (or misinformation). The COVID-19 pandemic, with people spending more time at home and stimulus checks available, provided a unique catalyst for the meme stock craze. These traders often targeted companies that had high short interest, meaning a large percentage of their shares were being short sold by large institutional investors or high-frequency hedge funds who bet against their success. This often led to dramatic short squeezes.

Key characteristics that define meme stocks include:

- Viral Social Media Hype: Their price movements are disproportionately influenced by discussions, memes, and calls to action across social networks. This represents a powerful, if unpredictable, form of market sentiment. The actions of influential figures, such as Roaring Kitty during the initial meme stock craze, demonstrated this power.

- High Volatility: Meme stocks are notorious for extreme market fluctuation and rapid price increase or decrease. Their share price can skyrocket within days or weeks, only to crash just as quickly. This makes them exceptionally high investment risk vehicles.

- Disconnect from Fundamentals: The share price often bears little to no relation to the company’s underlying fundamental value, cash flow, profitability, or annual and quarterly reports. Companies might have weak balance sheets or face significant industry challenges, yet see their market valuation soar. Traditional fundamental analysis often struggles to explain these movements.

- Short Squeeze Potential: When retail traders buy heavily into stocks with high short interest, these short selling institutions are forced to buy back shares to limit losses, further driving up the share price in a “short squeeze” and causing margin calls.

- Strong Community Loyalty: A distinctive culture often emerges among meme stock investors, characterized by terms like “diamond hands” (holding through volatility) and “paper hands” (selling early). This collective identity reinforces buying pressure within the shareholder base.

- High Trading Volume: These periods of intense interest see a massive surge in daily average volume on the stock exchanges, far exceeding typical stock trading activity for the company.

- Accessibility through Online Brokerages: The rise of online brokerages made it easy for amateur traders to participate through mobile trading apps and fractional stock purchases, enabling even small investment amounts to buy fractional shares of high-priced stocks. This business model is often supported by payment for order flow.

Notable Examples of Meme Stocks

The meme stock craze first captured global attention in early 2021. While some names became synonymous with that initial surge, others have continued to exhibit similar social retail traders driven dynamics and market volatility, often seen trending on StockTwits and other social platforms:

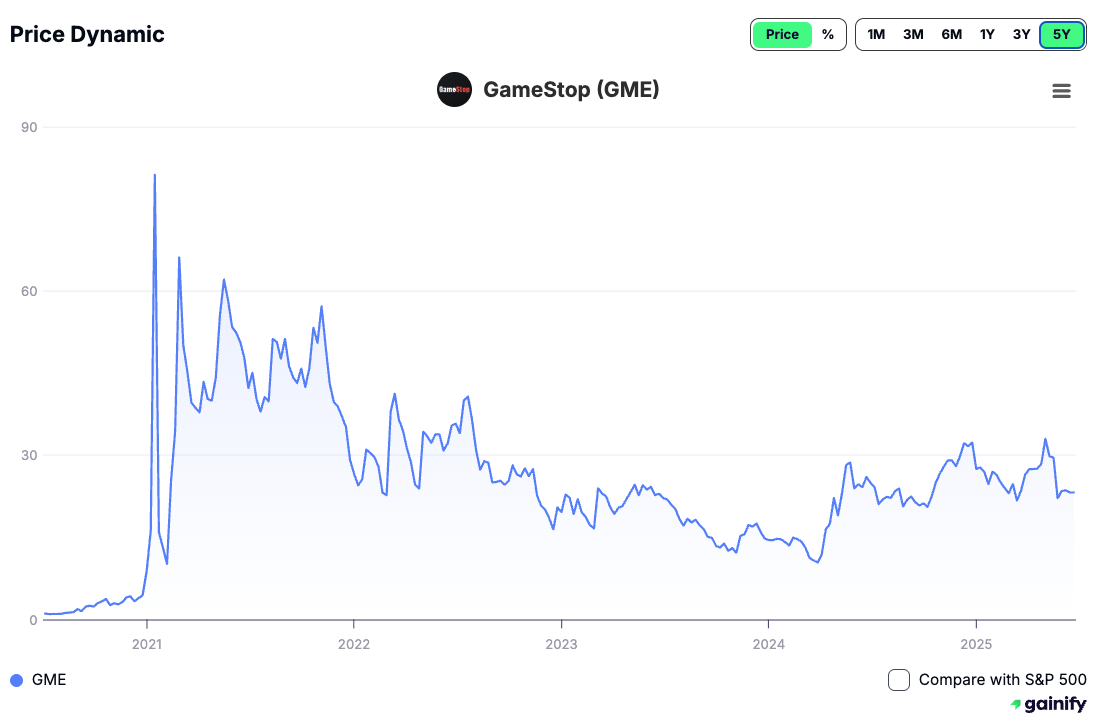

- GameStop Corp. (GME): Perhaps the quintessential meme stock. This video game retailer experienced an unprecedented surge in early 2021, driven by retail traders on Reddit’s r/wallstreetbets forum challenging institutional short selling. Its share price briefly soared from under $20 to over $480.

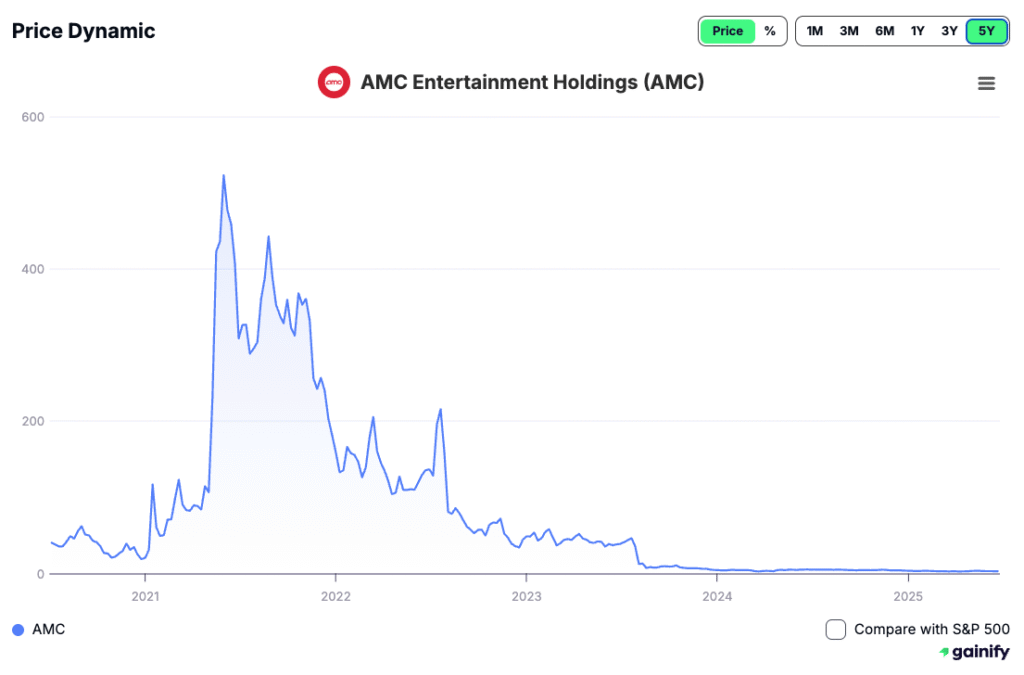

- AMC Entertainment Holdings Inc (AMC): This movie theater chain became another prominent meme stock target. Facing liquidity concerns during the COVID-19 pandemic, its share price was similarly propelled by retail traders enthusiasm, creating a dramatic market appreciation far removed from its immediate financial outlook, sometimes followed by an equity raise to capitalize on the high valuation.

- Bed Bath & Beyond (BBBY): This home goods retailer saw several meme surges before eventually filing for bankruptcy, serving as a cautionary tale of the risks involved. Its volatility showcased how rapidly fortunes can change.

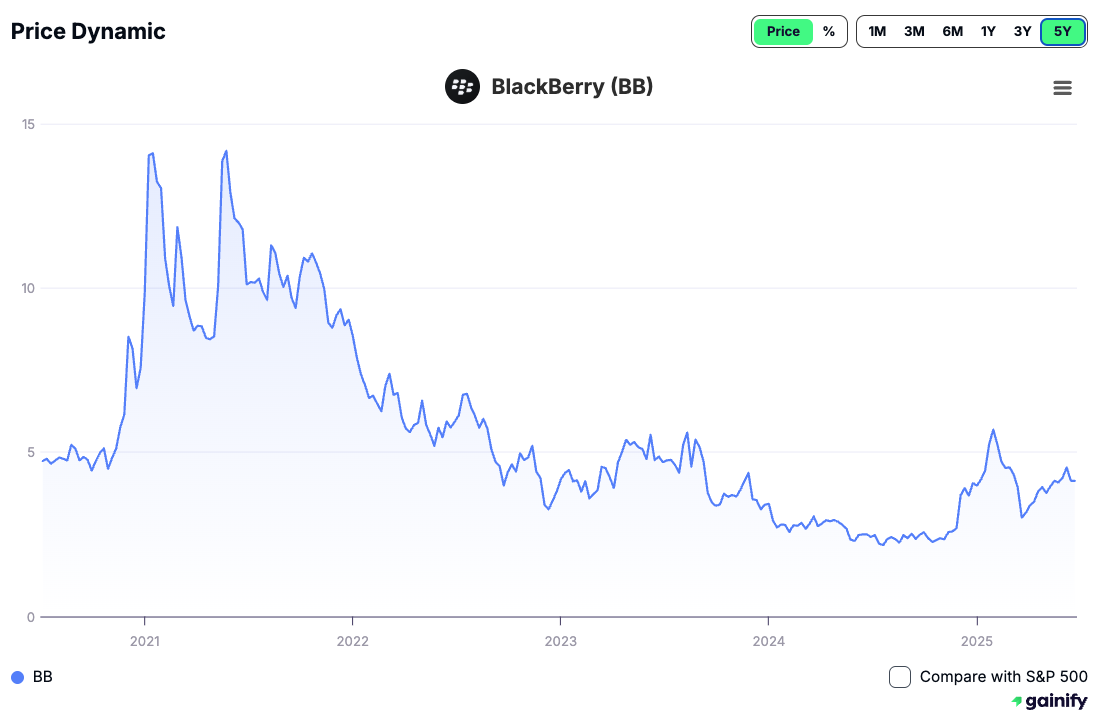

- BlackBerry (BB): The former smartphone giant, now a software company, also experienced significant market fluctuation as a meme stock, demonstrating how even companies with established names can be caught in the social media trading frenzy.

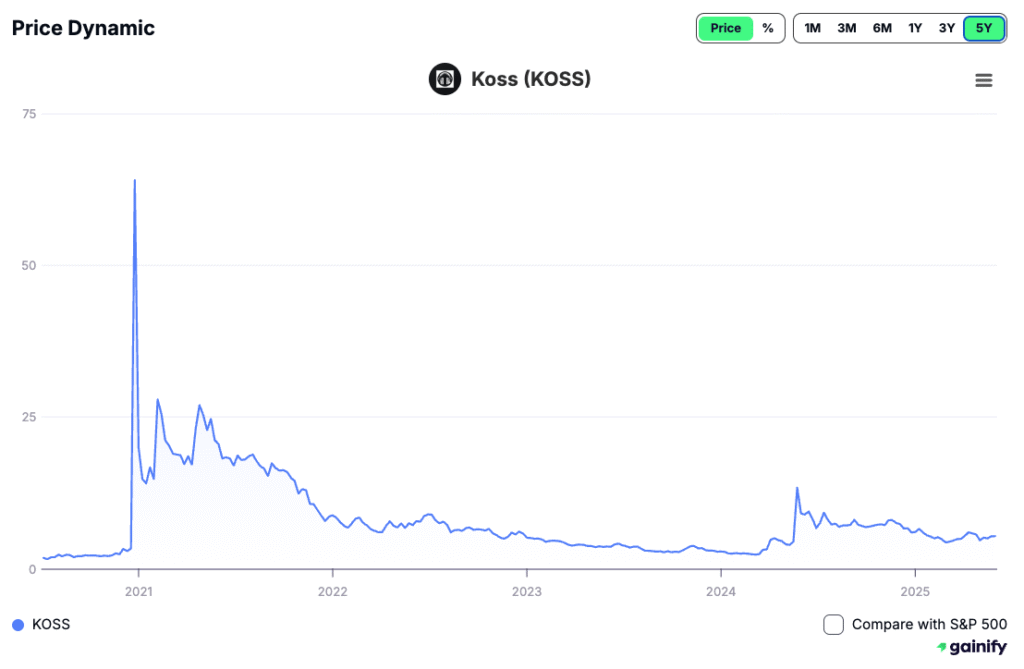

- Koss Corporation (KOSS): This small headphone maker was another early participant in the meme stock craze, experiencing dramatic price increases driven by a large short interest and retail trader coordination, similar to GameStop.

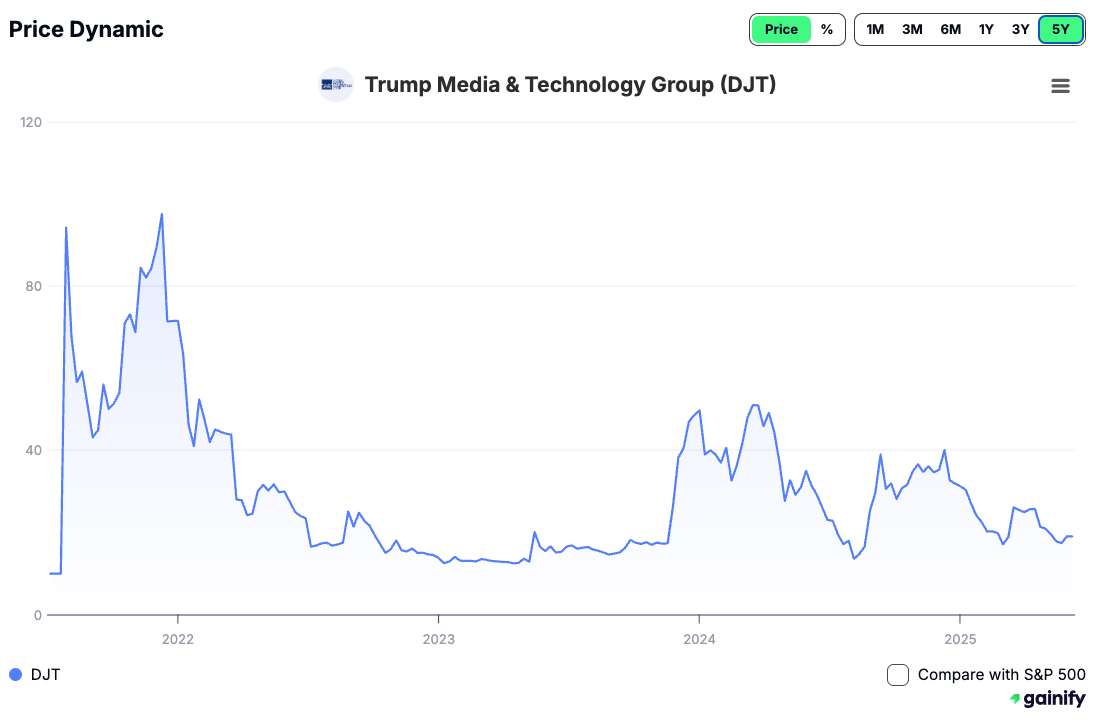

- Trump Media & Technology Group (DJT): This media company also exhibited meme stock characteristics upon its public listing, with its share price experiencing significant volatility driven by social media sentiment and a passionate shareholder base rather than traditional fundamental analysis.

These examples illustrate the powerful, yet often fleeting, impact of concentrated retail trader action on share price.

The Risks of Meme Stock Investing

While the stories of rapid gains can be enticing, investing in meme stocks carries exceptionally high investment risk and is generally not suitable for most long-term investors seeking stable investment return. Understanding these risks is critical before considering any investment decision in this volatile space:

- Extreme Volatility and Rapid Losses: Meme stocks are characterized by wild Market Swings. While this can lead to quick gains, it also means the share price can plummet without warning, leading to substantial, fast losses. The maximum loss potential can be 100% of your investment.

- Disconnect from Fundamentals: The share price is largely driven by market sentiment and speculation, not the company’s fundamental value, cash flow, earnings, or long-term prospects documented in annual and quarterly reports. This makes it incredibly difficult to assess their true fair value estimates or project future investment return using metrics like price-to-earnings ratio.

- Herd Mentality and FOMO (Fear Of Missing Out): The social media communication driven nature of meme stocks can foster a herd mentality, where investors buy based on excitement rather than rational analysis. Behavioral Scientists highlight how emotional biases can lead to poor investment decisions, particularly loss aversion when prices start to fall.

- Market Manipulation Concerns: While retail trader action can be organic, significant coordinated buying or selling can raise concerns about market manipulation, drawing scrutiny from a financial regulator like the U.S. Securities and Exchange Commission (SEC).

- Liquidity Risk: During a rapid decline, the daily average volume can dry up quickly, making it difficult to sell your shares without significantly impacting the share price and realizing massive losses. This often leads to severe liquidity concerns.

- High Capital Gains Taxes: If you do manage to sell a meme stock for a quick profit, those gains are typically classified as short-term capital gain and taxed at your regular marginal income tax rates, which are generally higher than long-term capital gains tax rates. This reduces your net investment return, especially when factoring in transaction costs from frequent trading.

- Margin Calls: For retail traders using leverage in their brokerage accounts, a sharp market drop can lead to margin calls, forcing them to deposit more funds or sell their holdings at a loss.

For the vast majority of investors, particularly beginner investors or those focusing on retirement investing, meme stocks fall into the realm of speculative trading rather than sound investment strategy. They are not typically part of a balanced diversified portfolio, unlike investing in broad index funds like the S&P 500.

A Different Perspective: The Power of the Crowd and Market Evolution

While the investment risk of meme stocks is undeniably high, their emergence has offered a unique, albeit chaotic, perspective on the financial markets. This phenomenon has undeniably highlighted the burgeoning power of the retail trader, demonstrating their collective ability to challenge established institutional players and influence share price in ways previously thought impossible. It has forced a re-evaluation of assumptions about market efficiency and the dynamics of market sentiment.

Some argue that meme stocks represent a democratization of finance, allowing individual investors to push back against what they perceive as opaque or unfair practices by large high-frequency hedge funds engaging in aggressive short selling. They have created a new space where investor psychology plays a starring role, forcing investment analytics and traditional investment management to adapt to social media communication driven narratives. While certainly not a recommended investment strategy for long-term investors, the extreme market volatility associated with these stocks has, for a very small segment of highly experienced and aggressive risk investors, presented unique trading tips and opportunities for active trading. This can involve sophisticated data science and understanding market movements beyond typical fundamental analysis.

This perspective does not diminish the inherent dangers of meme stock investing for most, but rather acknowledges their impact on financial markets as a cultural and economic phenomenon. They have undoubtedly contributed to conversations about market access, transparency, payment for order flow, and the evolving role of different market participants and financial regulators. The meme stock frenzy has spurred wider discussions on corporate governance and the power of the shareholder base in a time of digital transformations in finance, from digital banking to the property market.

Frequently Asked Questions about Meme Stocks

Q: What drives meme stock prices?

A: Meme stock prices are primarily driven by virality and collective action among online brokerages users and social networks, rather than traditional financial fundamentals like company earnings or cash flow. This high daily average volume is often fueled by market sentiment and social retail traders.

Q: Are meme stocks a good investment option for beginners?

A: No, meme stocks are generally considered extremely high-risk and are not recommended for beginner investors or those seeking long-term gains for their retirement fund. Their extreme market volatility and disconnect from fundamental value make them highly speculative. They are far riskier than a broad S&P 500 index fund.

Q: What is a “short squeeze” in relation to meme stocks?

A: A short squeeze occurs when a heavily shorted stock rapidly increases in price, forcing short selling institutions (who bet on the price falling) to buy back shares to limit losses. This buying pressure further drives the share price up, creating a dramatic spike. This is a common phenomenon in the meme stock craze.

Q: How does social media affect meme stocks?

A: Social media communication platforms like Reddit and X (formerly Twitter) serve as central hubs for communication, rallying retail traders, and amplifying hype around meme stocks. They are crucial for propagating market sentiment and coordinating buying efforts, transforming how stock trading platforms are used.

Q: Are meme stocks legal?

A: The stock trading of meme stocks itself is legal, as individual investors are free to buy and sell shares through their brokerage accounts. However, activities that could constitute market manipulation (e.g., spreading false information to inflate prices) are illegal and can draw scrutiny from a financial regulator like the U.S. Securities and Exchange Commission (SEC) or even the US government.

Q: What is the typical investment time horizon for meme stocks?

A: The typical investment time horizon for meme stocks is often very short, as their movements are highly speculative and volatile. They are generally approached by active trading participants or amateur traders looking for quick gains, not long-term investors building a retirement fund.

Q: Do financial advisors recommend meme stocks?

A: Most reputable financial advisors would caution against or strongly advise avoiding meme stocks for the majority of their clients due to their extreme investment risk and speculative nature. They prioritize building a sustainable diversified portfolio aligned with investment goals and financial risk tolerance.

Navigating Speculative Frontiers

Understanding what are meme stocks provides a valuable lesson in the complexities of modern financial markets. While their stories of rapid market appreciation can be captivating, they represent a highly speculative frontier driven by unique dynamics of investor psychology and social media communication influence, far removed from traditional investment strategy.

Key Takeaways:

- Socially Driven Volatility: Meme stocks are primarily moved by online sentiment from retail traders, leading to extreme and unpredictable market fluctuations and high investment risk.

- Fundamentals Disconnect: Their share price often detaches from underlying fundamental value and cash flow, making traditional fundamental analysis difficult.

- High Risk, Not for Beginners: The potential for rapid and significant losses means meme stocks are highly speculative and generally unsuitable for beginner investors or long-term investors aiming for a retirement fund. They are much riskier than diversified index funds like the S&P 500.

- Beware of FOMO: Emotional biases and the herd mentality can lead to poor investment decisions in these highly publicized assets.

- Diversification is Key: Focus on building a robust, diversified portfolio that aligns with your financial risk tolerance and investment goals, rather than chasing speculative meme surges.

- Education is Your Shield: Understand the risks involved and treat meme stock investing as highly speculative stock trading, not a core investment strategy. Be aware of high transaction costs and potential short-term capital gain taxes.

Remember, success in the financial markets is typically built on discipline, research, and a well-defined investment plan suited for long-term gains. While the allure of quick profits during a market rally can be strong, a cautious, informed approach to your investment decisions will serve you best in navigating all forms of market changes. Embrace wisdom over hype, and confidently chart your course toward lasting financial prosperity.