Investors often ask, “Is market cap the same as valuation?”

The simple answer is NO. While market capitalization reflects what the market is currently willing to pay for a company’s shares, valuation focuses on what the business is actually worth based on its financial fundamentals and future prospects.

Understanding the difference between market cap and valuation is critical for investors who want to avoid overpaying for stocks or misjudging a company’s true financial health. Although the two terms are frequently used together in financial discussions, they represent very different concepts, and confusing them can lead to poor investment decisions.

Market capitalization (Market Cap) represents the total value of a company’s outstanding shares based on its current stock price, but it does not assess the company’s underlying financial strength or whether the stock is fairly priced. Valuation evaluates a company’s fundamentals to estimate its intrinsic value and determine whether the market price is justified.

In today’s volatile markets, investors who understand the distinction between what a company costs and what it is truly worth are better positioned to make disciplined, long-term investment decisions.

Key Takeaways

- Market capitalization reflects the current market value of a company’s equity, but it does not indicate whether a stock is fairly priced or financially strong

- Valuation analysis determines a company’s intrinsic value through a comprehensive assessment of its cash flows, asset base, capital structure, earnings capacity, and long-term growth prospects

- Same market cap companies can have very different valuations due to variations in profitability, balance sheet strength, and expectations for future earnings growth

- Informed investing requires combining market capitalization data with valuation analysis to identify mispriced stocks and make disciplined, long-term investment decisions

What Is Market Capitalization?

Market capitalization represents the dollar value of a public company’s total equity. It is calculated by multiplying the current stock price by the number of outstanding shares. This is one of the most common methods investors use to categorize companies by size, ranging from micro-caps to large-cap companies.

Formula for Calculating Market Capitalization

Market Capitalization = Current Share Price × Outstanding Shares

For example, if Company A has 1 billion shares outstanding and the current price per share is $50, its total value in dollar terms is $50 billion.

Categories Based on Company Size

- Mega-Cap Stocks: Over $200 billion (e.g., Apple, Microsoft, Amazon)

- Large-Cap Stocks: Between $10 billion and $200 billion (e.g., Coca-Cola, AMD, UBER)

- Mid-Cap Stocks: Between $2 billion and $10 billion (e.g., GAP, Modenra, NIO)

- Small-Cap Stocks: Between $300 million and $2 billion (e.g., Build-A-Bear Workshop, Big Lots)

- Micro-Cap Stocks: Below $300 million

While this is a straightforward calculation, it does not account for a company’s debt obligations, cash reserves, or long-term growth prospects. That’s where comprehensive valuation methods come into play.

What Is Valuation?

Valuation is the foundation of sound investing. It goes beyond a company’s market price to answer the critical question: “What is this business really worth?”

While stock prices fluctuate based on market sentiment and short-term trends, valuation focuses on a company’s fundamentals, analyzing financial performance, projected future cash flows, debt obligations, corporate assets, and expected returns for common shareholders.

In short, valuation transforms speculation into strategic, data-driven investment decisions.

Key Valuation Methods

Valuation is not based on a single formula. Different businesses, industries, and investment objectives require different approaches to estimating intrinsic value. Some methods focus on the cash a company is expected to generate over time, while others compare a company’s price to earnings, assets, or cash flow relative to similar businesses. Understanding how these approaches differ helps investors choose the most appropriate valuation framework for a given company and market environment.

Cash flow–based valuation methods

Cash flow–based valuation methods are built on a simple principle: the value of a business is determined by the cash it can generate for its owners over time. Rather than relying on current market prices, these approaches estimate intrinsic value by projecting future cash flows and discounting them back to their present value. The discounted cash flow model and the dividend discount model are two of the most widely used frameworks within this category.

- Discounted Cash Flow (DCF): Often considered the most comprehensive valuation model, DCF estimates the present value of a company’s expected future cash flows. This method requires careful forecasting of revenue growth, profit margins, and risk-adjusted discount rates, providing a detailed picture of intrinsic value.

- Dividend Discount Model (DDM): Specifically designed for dividend-paying stocks, DDM calculates a company’s value based on the present value of expected future dividend payments. It is highly relevant for long-term investors seeking stable income streams from large-cap, dividend-focused companies.

Common Market Multiples

Market multiples are relative valuation tools that compare a company’s market price or enterprise value to key financial metrics such as earnings, book value, or cash flow. Rather than estimating intrinsic value directly, these ratios help investors assess how a company is priced relative to peers, historical averages, or the broader market. While multiples are useful for quick comparisons, they are most effective when used alongside fundamental analysis and cash flow–based valuation methods.

- Price-to-Earnings (P/E) Ratio: Assesses how much investors are paying for each dollar of a company’s earnings. A higher ratio may indicate growth expectations, but it can also signal overvaluation if not supported by fundamentals.

- Price-to-Book (P/B) Ratio: Compares a stock’s market price to its book value, useful for evaluating asset-heavy industries or companies with significant tangible assets.

- EV/EBITDA Multiple: A popular tool for comparing companies across industries, this ratio considers a firm’s total enterprise value relative to its earnings before interest, taxes, depreciation, and amortization. It helps investors assess profitability independent of capital structure.

- Price/Earnings-to-Growth (PEG) Ratio: Refines the P/E ratio by factoring in a company’s earnings growth rate. A PEG ratio below 1.0 is typically seen as a sign of undervaluation relative to expected growth.

Unlike market capitalization, which merely reflects current market sentiment, these valuation models offer investors a deeper, more accurate assessment of whether a stock is overpriced or presents an attractive opportunity.

In today’s volatile financial markets, mastering valuation techniques is essential for building a resilient, long-term investment strategy and avoiding costly mistakes driven by hype and momentum.

Key Differences Between Market Cap and Valuation

Although market capitalization and valuation are often discussed together, they serve very different purposes in investment analysis. Market capitalization describes how the market currently prices a company’s equity, while valuation seeks to determine what the business is worth based on its financial fundamentals. Understanding these differences helps investors avoid relying on price alone when assessing investment opportunities.

Aspect | Market Cap | Valuation |

Definition | Equity value based on share price | Intrinsic value based on financial analysis |

Calculation | Price x Outstanding Shares | Varies: DCF, P/E, EV, and more |

Purpose | Measures company size | Determines fair market value |

Considers Debt & Cash | No | Yes |

Dynamic or Static? | Dynamic with stock price changes | Based on comprehensive financial review |

Why This Distinction Matters

- Avoid Overpaying for Overhyped Stocks

Relying solely on headline market prices or market capitalization can lead to costly mistakes. By analyzing key financial metrics such as cash flow projections, debt obligations, and profitability trends, investors can avoid paying inflated prices for companies whose valuations are disconnected from their true financial performance. - Uncover Hidden Value in Overlooked Companies

Some of the best investment opportunities lie in companies that the broader market has undervalued. Businesses with a low current stock price but strong balance sheets, solid cash flows, and long-term growth potential often go unnoticed. Investors who understand how to identify these undervalued assets can position themselves for substantial upside as the market eventually corrects. - Enhance Portfolio Performance with Smarter Strategies

A clear grasp of both market cap classifications and valuation methodologies enables investors to make better-informed decisions about asset allocation and risk management. This knowledge supports building a diversified, balanced portfolio that is resilient through varying market cycles, whether in periods of rapid growth or economic downturns.

For serious, long-term investors focused on preserving wealth and achieving sustainable growth, the ability to distinguish between a company’s market value perception and its true intrinsic worth is not just helpful – it is essential. Mastering this distinction is what separates average market participants from disciplined investors who build lasting financial success.

Final Thoughts

While market capitalization is a popular method for classifying companies by size, it should never be mistaken for a complete financial assessment. To make informed investment decisions, investors must move beyond surface-level metrics like the current market price and incorporate comprehensive valuation models that assess true business fundamentals.

By understanding the critical difference between these two concepts, you can better navigate changing market conditions, avoid emotional decisions during both bear and bull markets, and strategically position your investment portfolio for sustainable long-term growth.

Whether you are analyzing large-cap stocks for stability or exploring small-cap companies for aggressive growth potential, always remember that market cap tells you what the market is currently willing to pay, but valuation helps you determine whether that price is truly justified.

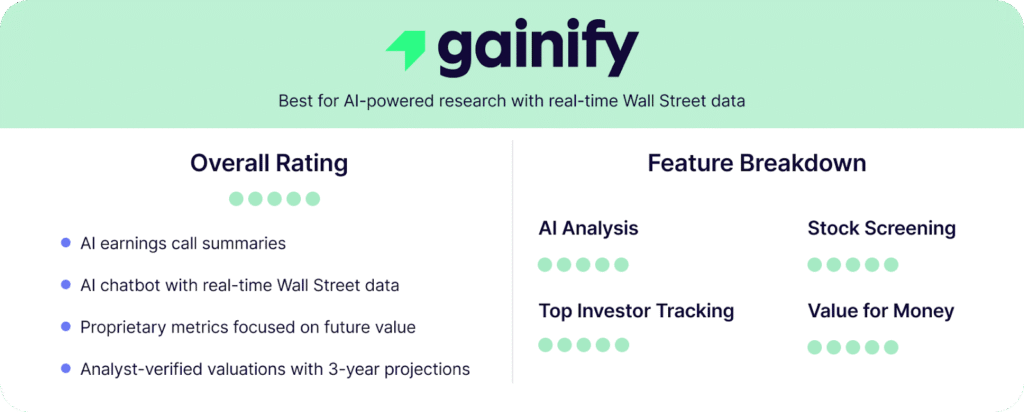

To simplify and elevate your investment analysis, consider using the Gainify.io equity research platform. Gainify.io provides advanced valuation tools, professional-grade financial models, and comprehensive company insights to help you uncover undervalued opportunities and make data-driven investment decisions with confidence.