The Vanguard S&P 500 Exchange-Traded Fund, commonly referred to by its ticker symbol VOO, is one of the most widely followed investment products in the market today.

It is frequently highlighted by financial professionals and is used by both individual investors and large institutions as a foundational component of long-term portfolios.

What makes this fund so widely adopted is not only its simplicity and cost efficiency, but also its connection to one of the most recognized benchmarks in global finance.

Before evaluating whether it suits your investment approach, it is important to understand what VOO represents, how it is constructed, and why it plays such a central role in modern portfolio strategy.

VOO Explained

VOO is the ticker symbol for the Vanguard S&P 500 Exchange-Traded Fund, a fund designed to closely track the performance of the S&P 500 Index. The index itself represents 500 of the largest and most influential publicly traded companies in the United States and is widely viewed as a key barometer of the U.S. equity market.

The fund achieves this tracking by holding the same companies in the same market-capitalization-weighted proportions as the index. When an investor buys shares of VOO, they are effectively purchasing a small ownership stake in all 500 companies that make up the S&P 500. This structure provides broad diversification across sectors such as technology, healthcare, financials, consumer discretionary, and more.

VOO trades on the stock market like any individual stock, offering real-time pricing, high liquidity, and the ability to buy or sell throughout the trading day. Its passive approach minimizes portfolio turnover and contributes to the fund’s historically low expense ratio, making it one of the most cost-efficient ways to access large-cap U.S. equities.

In essence, VOO serves as a straightforward and transparent method for investors to gain exposure to the collective performance of the largest U.S. companies in a single, convenient investment vehicle.

Is VOO the same thing as the S&P 500

VOO closely tracks the S&P 500 Index, but the two are not the same. The S&P 500 Index is a market benchmark that represents 500 of the largest publicly traded companies in the United States. It is used as a broad measure of U.S. large-cap equity performance and is often viewed as a reflection of overall economic health.

VOO, on the other hand, is the Vanguard S&P 500 Exchange-Traded Fund that seeks to replicate the index. Instead of being a calculation or benchmark, it is an investable fund that buys and holds the same companies in the same market-cap-weighted proportions as the index. When investors purchase VOO, they are buying shares in a fund that owns these underlying stocks on their behalf.

In short, the S&P 500 is the benchmark, while VOO is the vehicle designed to track it.

Is VOO a good buy right now?

The investment case for VOO depends primarily on an investor’s time horizon and risk tolerance. The fund is designed to replicate the performance of the S&P 500 Index, which has historically produced strong results over long periods despite periods of short-term volatility. Investors with a long horizon typically rely on the resilience of broad market earnings growth, and VOO has reflected that pattern consistently.

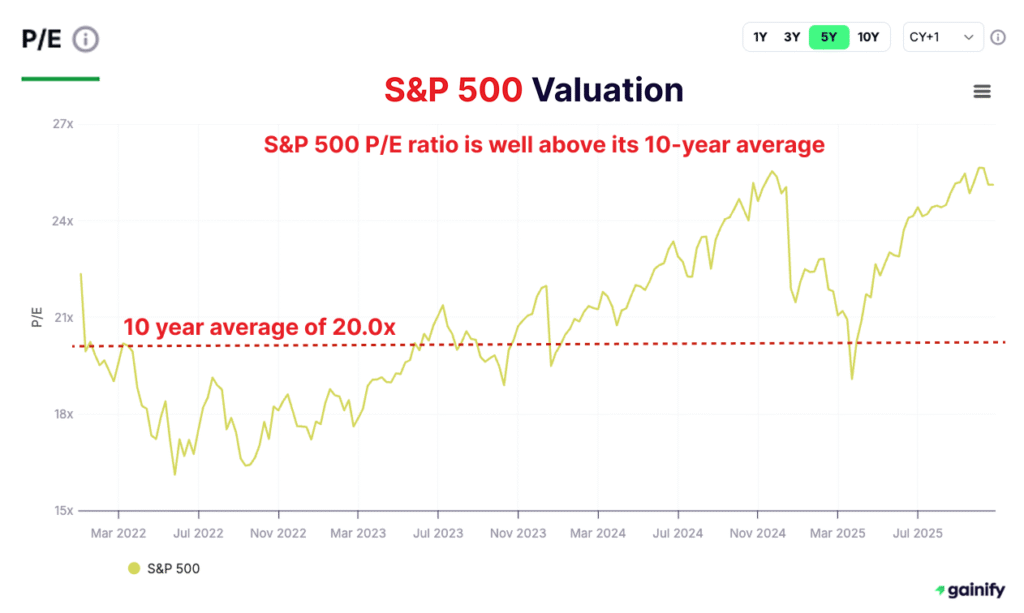

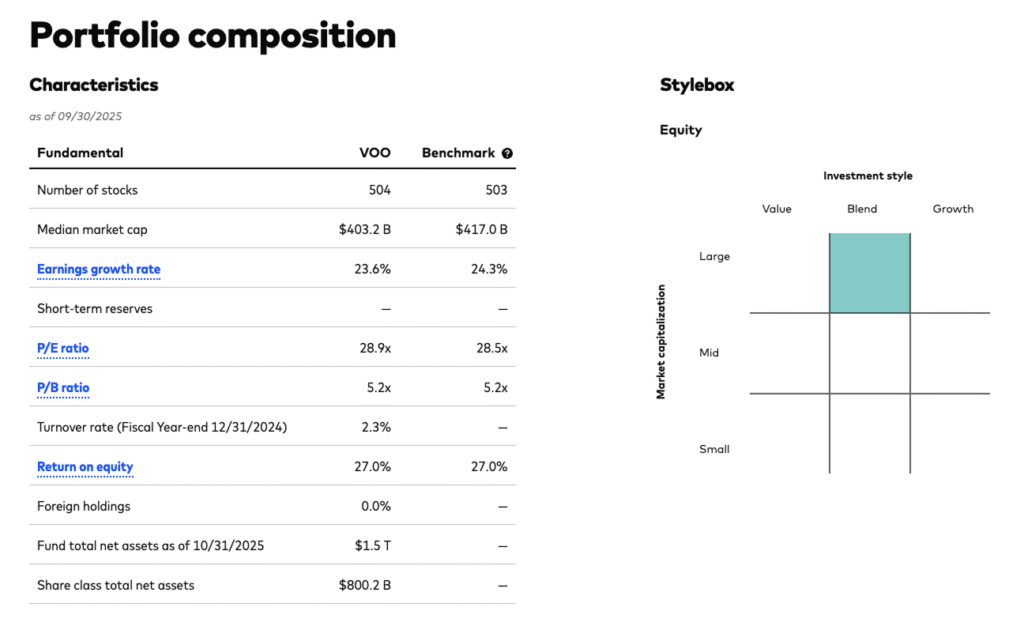

Current market valuations are an important consideration. The forward price-to-earnings ratio of the S&P 500 is meaningfully above its long-term average. A forward multiple near 25.6 times earnings compares with an approximate ten-year average close to 20.0 times. Academic and industry research indicates that periods of elevated valuation have historically been followed by below-average real returns over the subsequent decade. This relationship reflects the tendency for high starting multiples to limit the scope for further valuation expansion. Earnings growth could moderate the current ratio without significant price adjustment, although the possibility of valuation reversion remains part of the expected return profile.

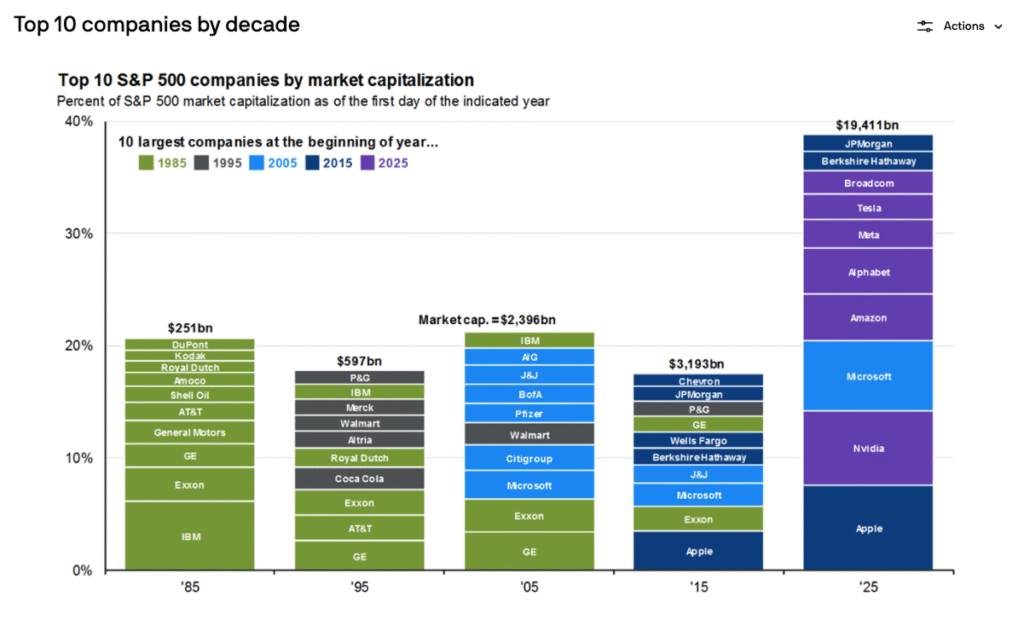

Market concentration is an additional factor to consider. The largest ten companies in the S&P 500 now account for approximately 41.6 percent of the index’s total market capitalization, which is the highest level in several decades. Their share of total index earnings, at roughly 33.0 percent, remains materially lower than their market value weight. This imbalance indicates that index performance is increasingly driven by a very limited group of firms, many of which are in the technology and artificial intelligence related sectors.

A structure with this degree of concentration increases the index’s sensitivity to developments in a small set of companies. Periods of volatility have illustrated this dynamic, with notable declines occurring when sentiment toward these firms shifts. As the weight of the top constituents grows, the potential impact of firm-specific news on overall index returns becomes more pronounced.

A disciplined allocation approach can help address the uncertainty around entry timing. Dollar cost averaging, in which capital is deployed in smaller scheduled increments, provides a method for reducing timing risk and gaining exposure to long-term market growth in a systematic way.

Overall, VOO continues to serve as a core instrument for investors seeking diversified exposure to large United States companies. The decision to initiate a position today should incorporate an investor’s time horizon, return objectives, tolerance for valuation risk, and willingness to accept near-term fluctuations in index performance.

Long-Term Investors | Short-Term Investors |

VOO holds a moderate buy rating from many leading analysts. | The index is highly concentrated, with significant weight in a small number of large technology and AI-oriented companies. |

VOO has delivered consistent long-term historical returns. | The forward P/E ratio of the S&P 500 is above its long-term average. |

VOO is widely viewed as a reliable core holding for passive, broad-market exposure. | Volatility has increased recently, suggesting the possibility of near-term pullbacks. |

Dollar-cost averaging can help smooth entry timing and reduce volatility impact. | Short-term performance may be more sensitive to shifts in sentiment toward the top index constituents. |

How does VOO work?

VOO pools investor capital and allocates it across the companies included in the S&P 500 Index in the same proportions as the index itself.

The fund uses a full-replication approach, which enables it to track the index with a high degree of accuracy and minimal tracking error.

Understanding how the S&P 500 is constructed helps clarify how VOO operates. The S&P 500 consists of approximately 500 large-capitalization United States companies selected by an index committee based on specific quantitative and qualitative standards. These standards ensure that the index reflects the performance of the leading companies in the U.S. equity market.

Below is a summary of the official eligibility criteria required for a company to be added to the S&P 500:

Category | Requirement |

Company Type | Must be a U.S. company (U.S. domicile and primary listing in the United States). |

Exchange Listing | Must be listed on the NYSE, NASDAQ, or CBOE. |

Market Capitalization | Must meet the minimum market-cap threshold defined by S&P Dow Jones Indices, generally above 20 billion dollars in recent methodology updates. |

Public Float | At least 50 percent of shares must be publicly floated. |

Liquidity | Must meet liquidity requirements based on annual dollar value traded relative to float-adjusted market capitalization. |

Financial Viability | Must report positive earnings in the most recent quarter and positive cumulative earnings over the trailing four quarters. |

Corporate Structure | Must issue common stock. Other structures such as preferred shares, partnerships, ADRs, and closed-end funds are excluded. |

Sector Balance | Considered in the context of maintaining appropriate sector representation within the index. |

Operational History | Must have sufficient listed and operating history. |

Committee Discretion | The index committee may include or exclude companies based on qualitative factors or market conditions. |

The index is float-adjusted and market-capitalization weighted, meaning larger companies have a greater influence on performance. Firms that no longer meet inclusion standards may be removed and replaced by stronger candidates. This continuous rebalancing contributes to the index’s long-term tendency to reflect the most competitive and financially stable companies in the U.S. market.

Today, the S&P 500 represents more than 55 trillion dollars in market capitalization and accounts for roughly 80 percent of the U.S. public equity market. Because VOO holds the same companies in the same proportions, it provides investors with a highly accurate and up-to-date representation of the index. When the index committee adds or removes companies, VOO adjusts its holdings accordingly, maintaining alignment with the benchmark.

When companies are added to, or ejected from the index, VOO fund managers sell the holdings of the ejected companies and buy shares in the newly added companies. In this way VOO is always up to date with the rotation of the index itself.

What makes VOO beneficial to investors?

VOO’s appeal can be summarized across three core pillars that define its role as a foundational portfolio holding:

1. Broad and Efficient Market Exposure

VOO provides immediate access to the companies that make up the S&P 500 Index. A single share represents exposure to hundreds of large, established U.S. businesses across multiple sectors. This structure allows investors to capture the performance of the broader U.S. equity market through one instrument.

2. Low-Cost Structure

The fund benefits from a passive replication strategy and Vanguard’s mutual ownership model, which together help maintain one of the lowest expense ratios available in the market. With no external shareholders and limited need for active management, operating costs remain contained and efficiency is passed directly to investors. The exact annual cost (expense ratio) for VOO (Vanguard S&P 500 ETF) is 0.03%.

3. Liquidity and Operational Simplicity

VOO trades on major U.S. exchanges and offers high liquidity, making it straightforward to buy and sell through standard brokerage platforms. Its straightforward design and consistent alignment with the S&P 500 make it easy to incorporate into diversified portfolios with minimal oversight or complexity.

What is the 10-year annual average return on VOO?

Measured using publicly available performance data, VOO has delivered strong long-term results:

- The 10-year annualized return is approximately 14.5 to 14.8 percent.

- The most recent 12-month return is around 12 percent, reflecting the strength of the large-cap U.S. equity market over the past year.

- The cumulative total return over the last 10 years is estimated in the range of 275 to 290 percent, depending on pricing date and dividend reinvestment assumptions.

These figures align closely with the long-term performance of the S&P 500 Index, which VOO is designed to track. All returns reflect both price changes and the reinvestment of dividends.

The top 10 holdings of VOO

As of January 14, 2026, VOO continues to reflect the structure of the S&P 500 Index with a high concentration in the largest U.S. companies. The top ten constituents represent a significant portion of total assets, consistent with the index’s market-capitalization weighting approach. The prominence of technology and communication services companies remains a defining characteristic of the fund’s composition.

Top 10 Stock Holdings (as of 01/14/2026)

Rank | Company | Ticker | Weight | Market Value | Shares Held |

1 | NVIDIA Corp. | 7.38% | $109.16B | 616,751,278 | |

2 | Apple Inc. | 7.07% | $104.60B | 375,113,926 | |

3 | Microsoft Corp. | 6.25% | $92.44B | 187,888,901 | |

4 | Amazon.com Inc. | 3.87% | $57.21B | 245,309,813 | |

5 | Broadcom Inc. | 3.24% | $47.91B | 118,891,072 | |

6 | Alphabet Inc. Class A | 3.18% | $47.08B | 147,035,707 | |

7 | Alphabet Inc. Class C | 2.56% | $37.79B | 118,036,094 | |

8 | Meta Platforms Inc. (Class A) | 2.40% | $35.52B | 54,823,159 | |

9 | Tesla Inc. | 2.06% | $30.51B | 70,931,179 | |

10 | Berkshire Hathaway Inc. Class B | 1.61% | $23.82B | 46,349,975 |

These holdings reflect the continued dominance of mega-cap technology, semiconductor, and digital platform companies within both VOO and the broader S&P 500.

VOO mirrors the sector allocations of the S&P 500 and therefore represents the current structure of the U.S. large-cap equity market. Information Technology remains the largest sector by a considerable margin.

Sector | Weight |

Information Technology | 34.60% |

Financials | 13.00% |

Communication Services | 10.70% |

Consumer Discretionary | 10.30% |

Health Care | 9.80% |

Industrials | 8.00% |

Consumer Staples | 4.80% |

Energy | 2.80% |

Utilities | 2.40% |

Real Estate | 1.90% |

Materials | 1.70% |

Weighted exposures exclude temporary cash instruments and equity index futures, ensuring the data reflects only equity positions.

Does VOO Pay Dividends or Reinvest Them?

VOO distributes dividends directly to shareholders. The fund receives dividends from the underlying companies in the S&P 500 Index and pays them out on a quarterly basis. These distributions are not automatically reinvested within the fund.

Investors who wish to reinvest dividends can do so through their brokerage’s Dividend Reinvestment Plan (DRIP). Under a DRIP, dividends are used to purchase additional shares of VOO, often including fractional shares, which allows investors to compound returns efficiently over time.

In summary, VOO pays dividends, and reinvestment depends on the investor’s brokerage settings, not the fund itself.

Final Thoughts

VOO remains one of the most established and efficient ways for investors to gain broad exposure to the United States equity market. By tracking the S&P 500 Index, the fund provides access to hundreds of large capitalization companies through a single, low cost instrument. Its structure is transparent, rules based, and supported by Vanguard’s investor owned framework, which helps keep expenses among the lowest in the industry.

From a long term perspective, VOO has delivered strong historical performance, competitive risk adjusted returns, and consistent dividend distributions. It is widely used as a core holding in diversified portfolios, particularly for investors with multi decade horizons.

Shorter term considerations are more nuanced. Elevated valuations, increased concentration in a small group of mega cap technology companies, and occasional periods of index level volatility warrant attention. These factors do not diminish the fund’s structural advantages, but they underscore the importance of aligning investment decisions with personal risk tolerance, time horizon, and entry strategy.

For most investors, VOO offers a straightforward, cost efficient, and institutionally robust way to participate in the long term growth of the United States equity market. It is designed to compound wealth steadily rather than attempt to outperform the market, and it continues to fulfill that purpose with a high degree of reliability.