Artificial Intelligence has moved from theory to practice in healthcare. It is now a cornerstone of how modern medicine is delivered, from diagnostics to treatment and beyond. From reading imaging studies in seconds to running scenario models that accelerate research, AI is fundamentally changing the way healthcare works. For investors, this is one of the most powerful intersections of the stock market, medical equipment, and clinical data in decades.

What makes this moment so compelling is the breadth of companies involved. On one side are nimble innovators building their entire businesses around AI, and on the other are established giants weaving AI into proven products and services. Together, they form a landscape where growth potential and stability exist side by side.

This article will introduce a curated set of companies applying AI in healthcare, including:

- Tempus AI (TEM)

- Recursion Pharmaceuticals (RXRX)

- IQVIA (IQV)

- Veeva Systems (VEEV)

- Teladoc Health (TDOC)

- Medtronic (MDT)

- Boston Scientific (BSX)

- Becton Dickinson (BDX)

- GE HealthCare Technologies (GEHC)

- Intuitive Surgical (ISRG)

- Moderna (MRNA)

- Elevation Oncology (ELEV)

- Novartis (NVS)

- Hims & Hers Health (HIMS)

- UnitedHealth Group (UNH)

These names represent different parts of the healthcare ecosystem. Some are focused on research and drug discovery, others on medical equipment and diagnostics, and still others on digital health and patient services. Each demonstrates how AI can unlock efficiency, accuracy, or entirely new ways of delivering care.

In the sections that follow, we’ll look at how these companies are using AI, what markets they serve, and what analysts expect from them over the coming years. The goal is not only to highlight growth stories but also to show how established players are embedding AI into systems that already reach millions of patients.

For investors, this blend of companies provides choice. Growth-focused readers may find opportunity in younger firms pushing the boundaries of AI-driven innovation. Those seeking resilience may lean toward large multinationals applying AI to expand margins and scale. By the end of this article, you will have a clear picture of where AI is creating value in healthcare and which companies are best positioned to benefit.

Leading AI Healthcare Stocks

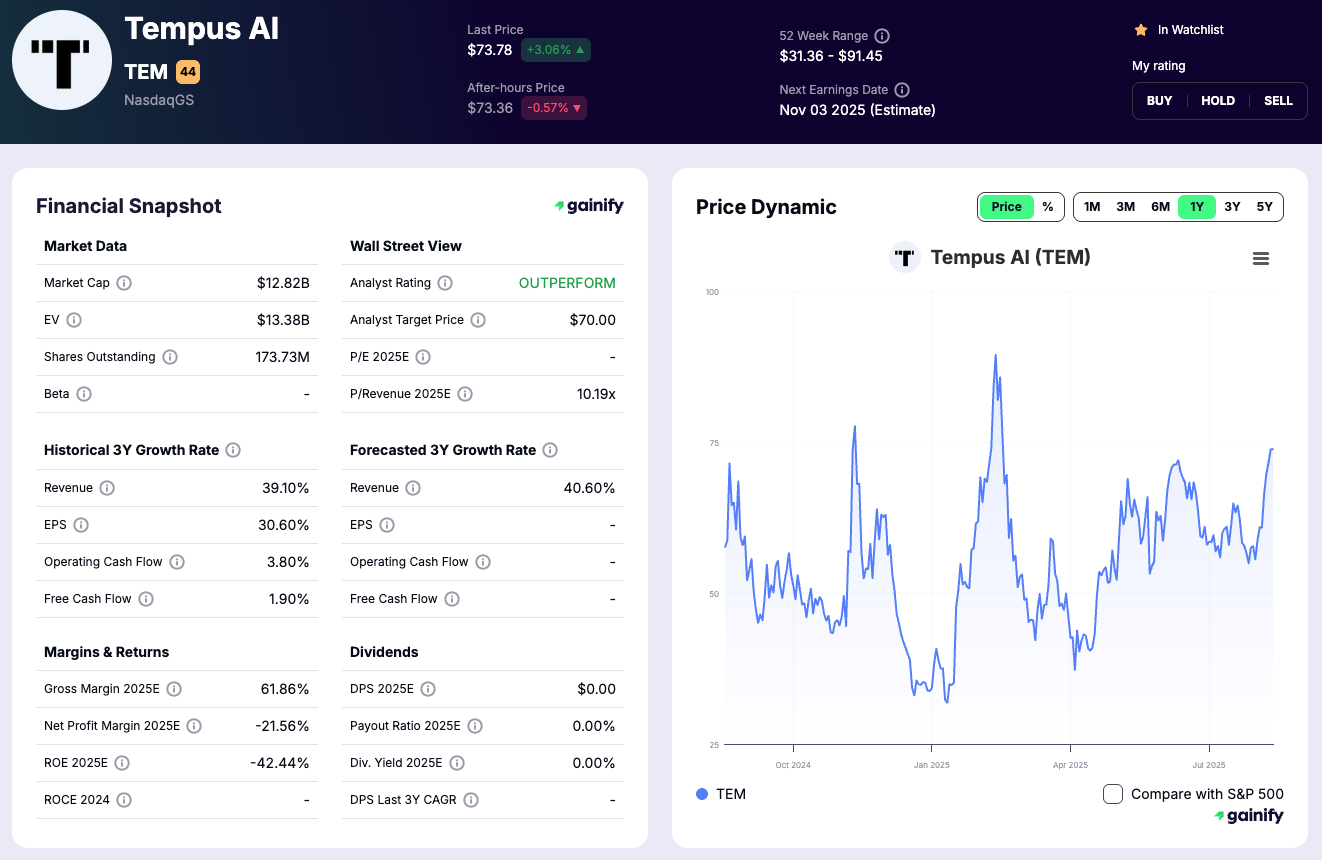

1. Tempus AI (TEM)

Tempus AI is a leading player in precision medicine, offering one of the most extensive AI-integrated platforms in clinical care. It applies AI-powered diagnostics that combine genetic, imaging, and clinical data to generate treatment insights for physicians. Research from Tempus includes neural network–based models for analyzing cellular and imaging data at large scale. While techniques like federated learning are promising in this field, Tempus has not publicly confirmed using them. It reflects a true AI-first approach in personalized medicine, making it one of the most compelling pure-play companies in the space.

- Market Cap (Aug 2025): $12.82 Billions

- Analyst 2025 Target Price: $70.00

- P/Revenue 2025: 10.2x

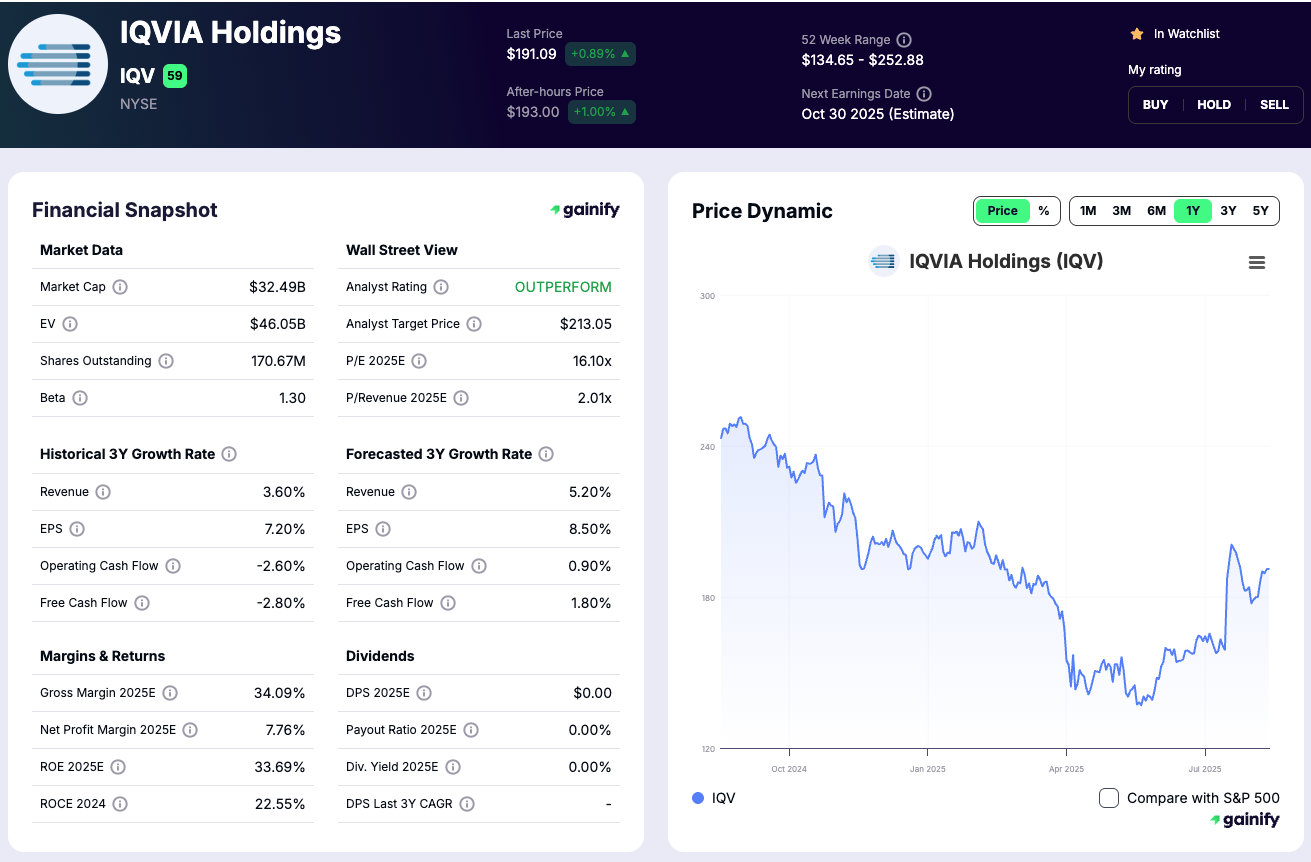

2. IQVIA (IQV)

IQVIA is a global leader in clinical research and data analytics, using AI to optimize how clinical trials are designed and executed. Its systems apply predictive analytics and scenario models to identify eligible patients more quickly, streamline recruitment, and forecast trial outcomes with greater accuracy. By combining natural language processing with structured clinical data, IQVIA reduces both the time and cost of drug development for pharmaceutical clients. This integration of AI into trial management reinforces IQVIA’s position as one of the most influential companies in healthcare innovation.

- Market Cap (Aug 2025): $32.5 Billions

- Analyst 2025 Target Price: $213.05

- P/Revenue 2025: 2.0x

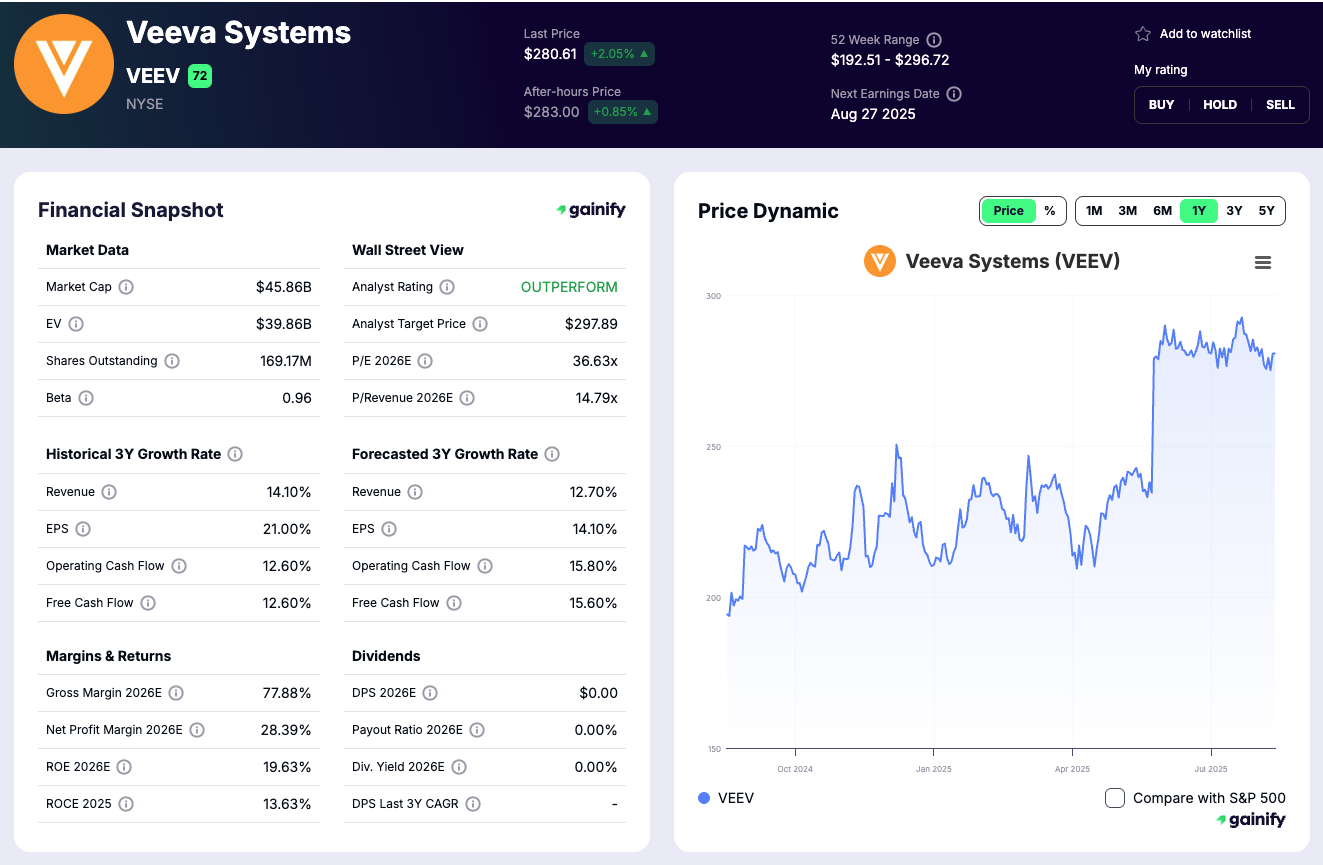

3. Veeva Systems (VEEV)

Veeva Systems is a leader in cloud solutions for life sciences, and its adoption of AI strengthens how pharmaceutical and biotech companies operate. Within its platforms, AI supports customer targeting, treatment adoption modeling, and regulatory compliance. These capabilities help companies identify the right physicians, anticipate prescribing behavior, and manage strict reporting standards. By embedding AI into its life sciences cloud, Veeva enhances efficiency across the commercial and clinical spectrum.

- Market Cap (Aug 2025): $45.9 Billions

- Analyst 2025 Target Price: $297.89

- P/Revenue 2025: 14.8x

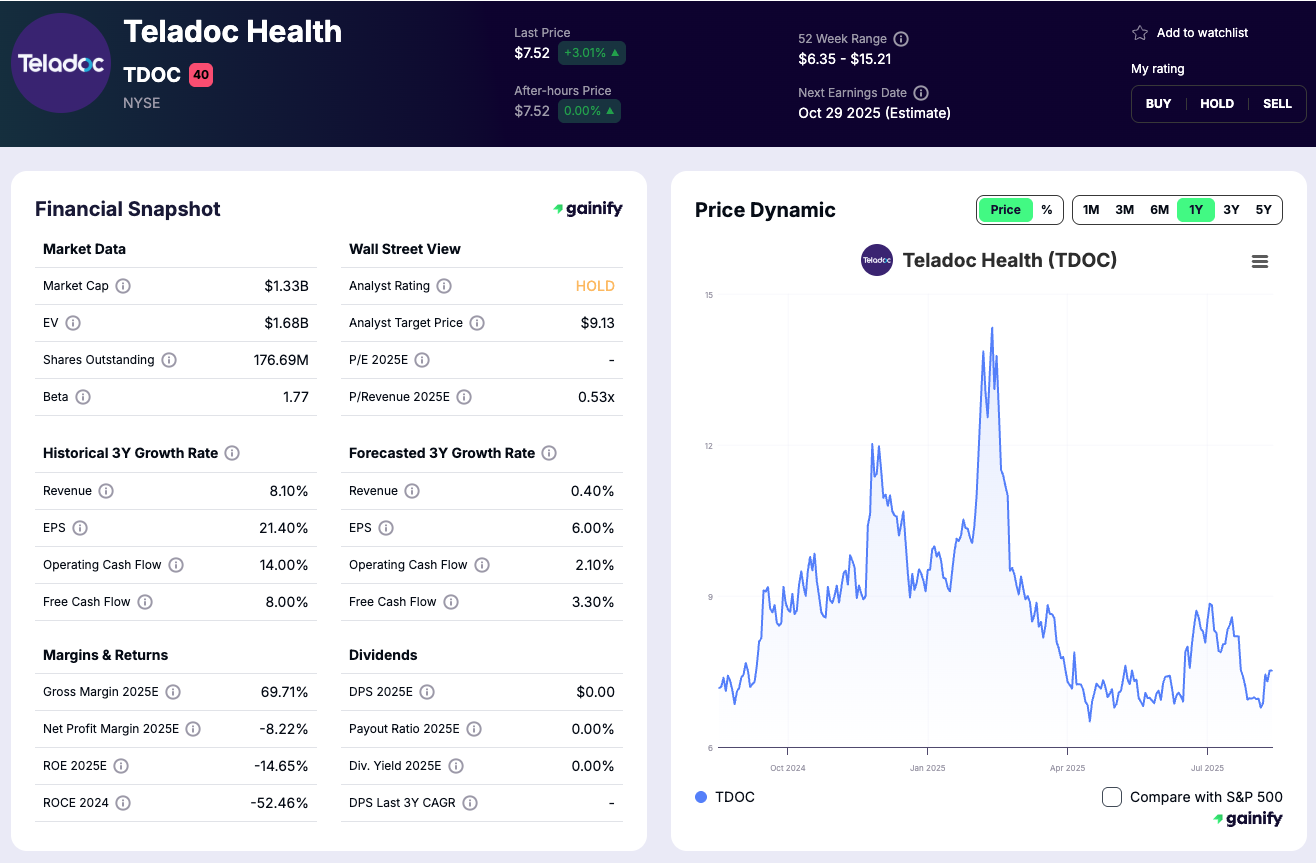

4. Teladoc Health (TDOC)

Teladoc Health is one of the most recognized virtual care platforms in the world, and AI is central to its patient experience. Its systems use predictive analytics to triage patients, route them to the appropriate care pathways, and assist clinicians during consultations. In chronic care management, AI helps monitor conditions such as diabetes and hypertension by detecting risks early. This use of AI allows Teladoc to scale personalized care while improving efficiency in telehealth delivery.

- Market Cap (Aug 2025): $1.3 Billions

- Analyst 2025 Target Price: $9.13

- P/Revenue 2025: 0.5x

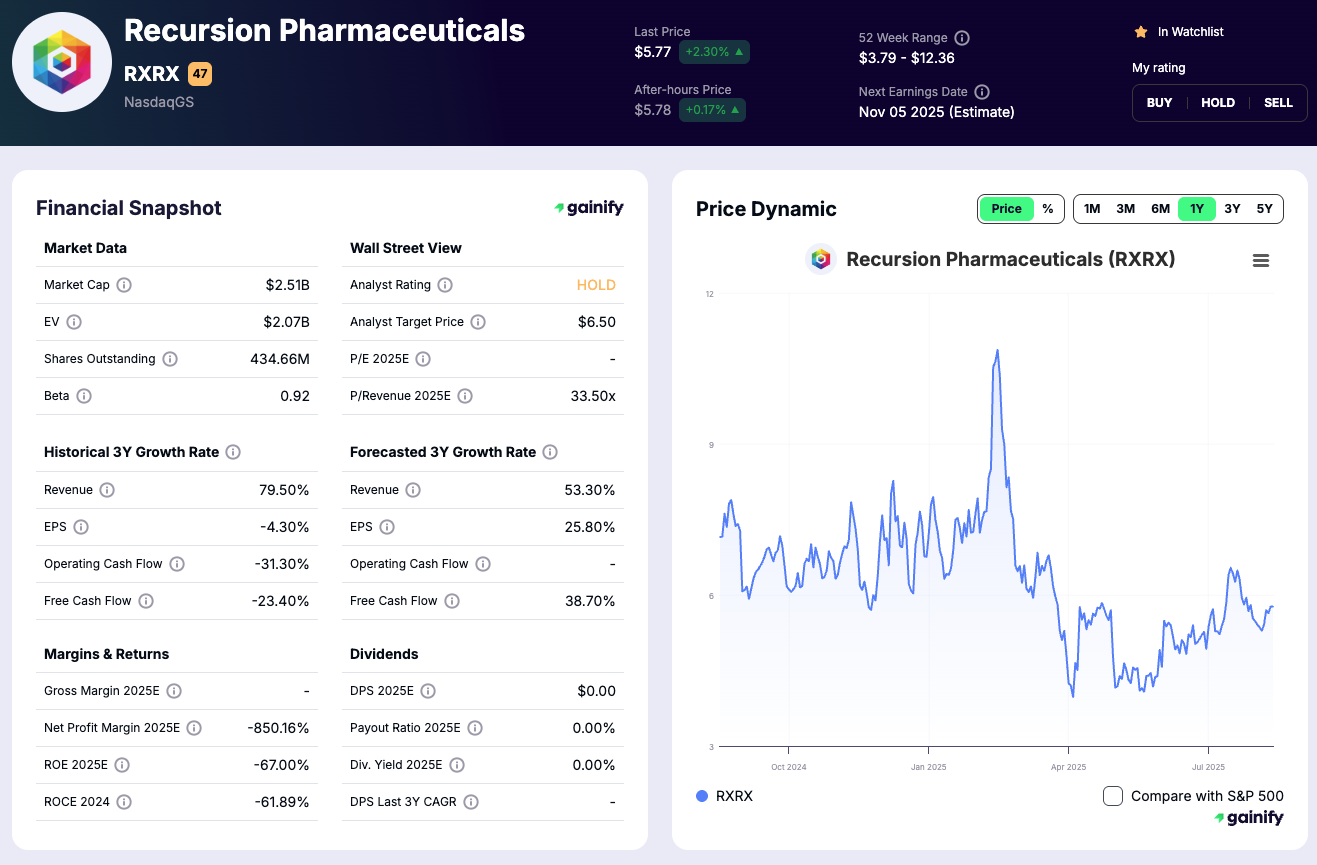

5. Recursion Pharmaceuticals (RXRX)

Recursion is building a data-driven platform for drug discovery, training AI on billions of cellular images to predict how compounds interact with human biology. Its goal is to transform drug development into a scalable, repeatable process rather than a trial-and-error exercise. The company has expanded its capabilities through acquisitions, including partnerships that bring deeper expertise in applying AI-powered diagnostics and scenario models to drug design. This positions Recursion as one of the clearest examples of AI-first innovation in biotechnology.

- Market Cap (Aug 2025): $2.5 Billions

- Analyst 2025 Target Price: $6.50

- P/Revenue 2025: 2.5x

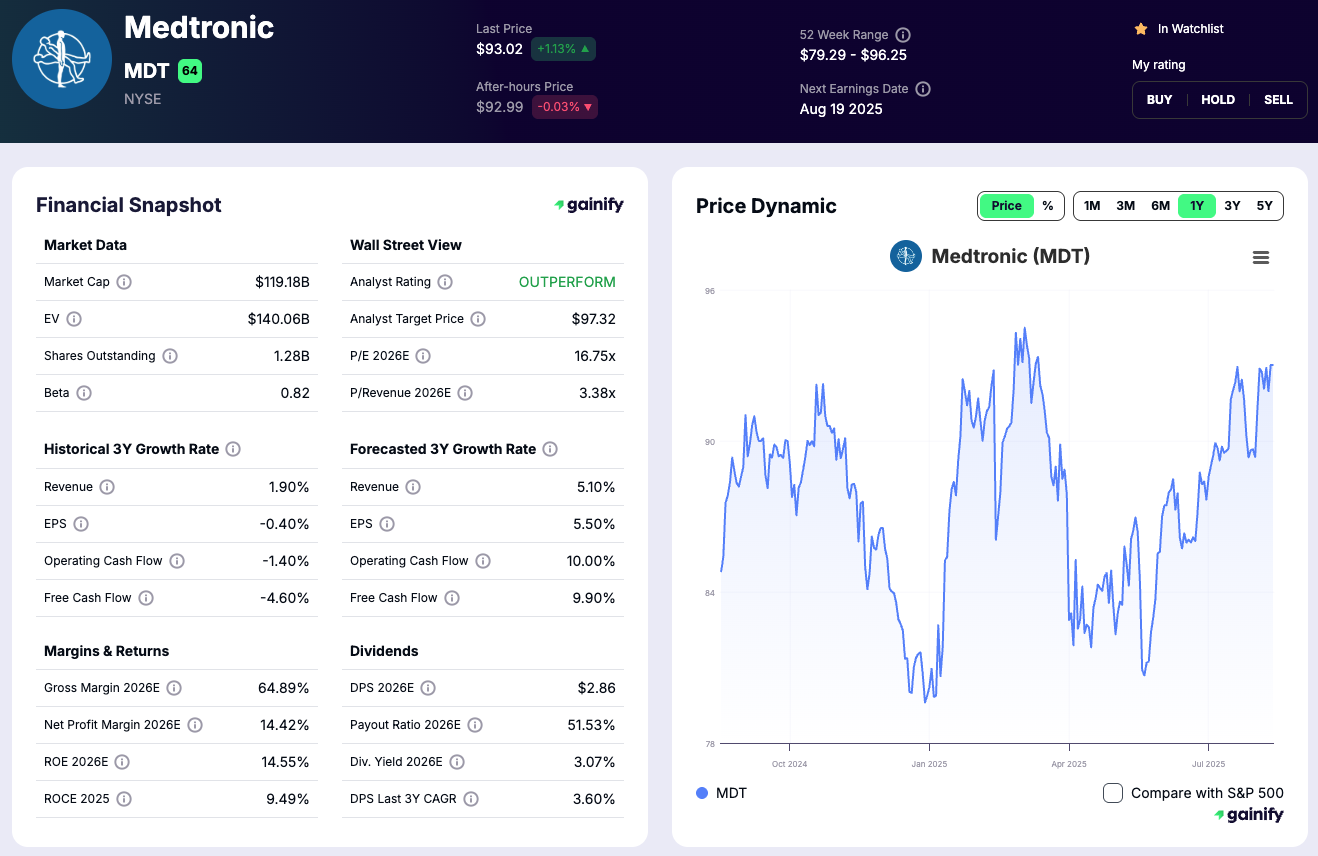

6. Medtronic (MDT)

Medtronic is embedding AI across its medical equipment portfolio, enhancing both diagnostics and treatment delivery. The GI Genius system applies AI to colonoscopy imaging studies, flagging polyps in real time to improve early cancer detection. Its Touch Surgery Enterprise platform uses AI to tag surgical video for training and review. In diabetes, Medtronic’s smart insulin pumps rely on predictive analytics to deliver insulin more precisely. The company has also developed AI methods to address bias in oximeter readings, improving patient risk profiles across diverse populations. These innovations show how AI makes Medtronic’s devices smarter and outcomes more consistent.

- Market Cap (Aug 2025): $119.2 Billions

- Analyst 2025 Target Price: $97.32

- P/Revenue 2025: 3.4x

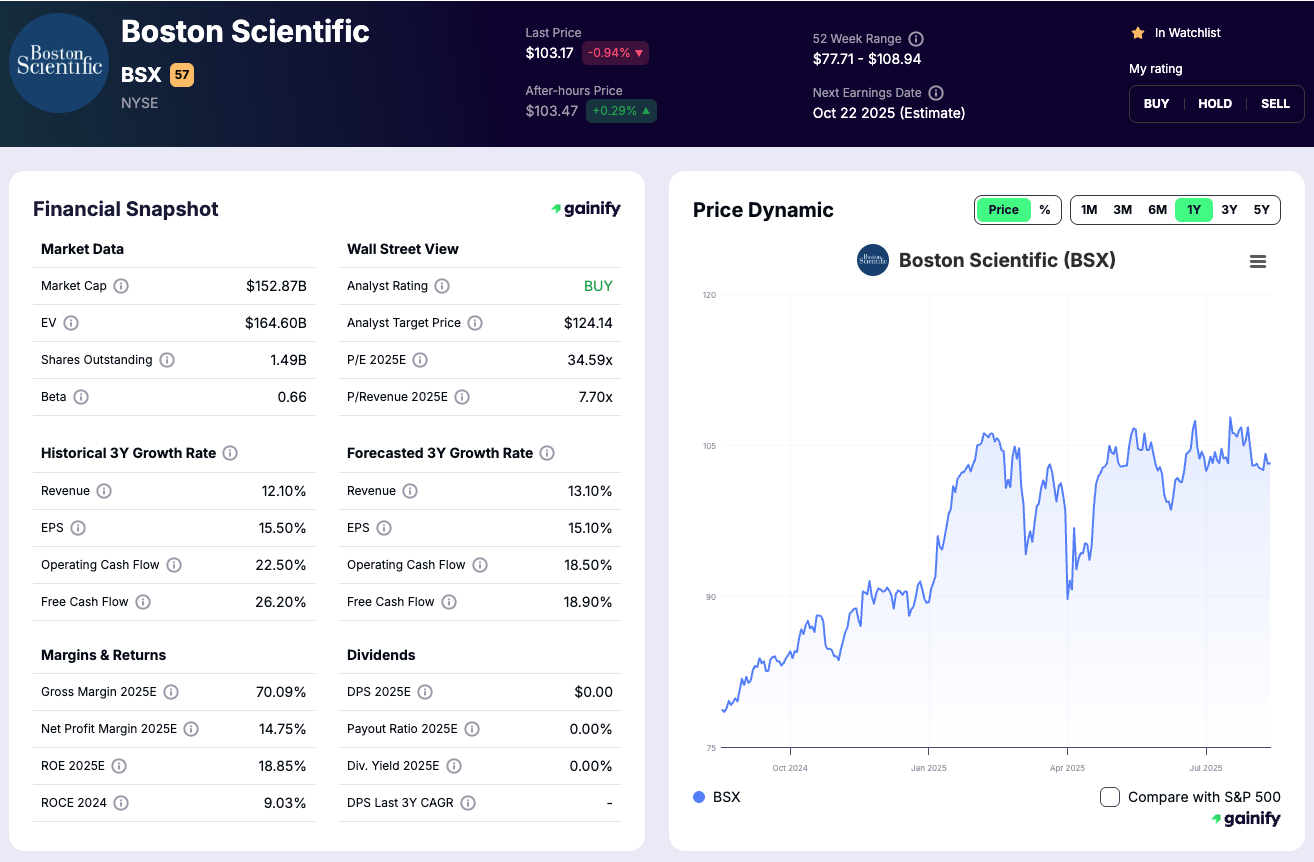

7. Boston Scientific (BSX)

Boston Scientific integrates AI into its cardiac devices and surgical systems, supporting physicians with smarter diagnostics and treatment tools. By combining predictive analytics with imaging studies, the company enhances how implants and diagnostic equipment function in real-world settings. AI is also used to model potential complications, improving patient safety and treatment planning. While there have been setbacks in certain products such as TAVR, Boston Scientific continues to expand AI across its medical equipment portfolio to strengthen outcomes and long-term adoption.

- Market Cap (Aug 2025): $152.9 Billions

- Analyst 2025 Target Price: $124.14

- P/Revenue 2025: 7.7x

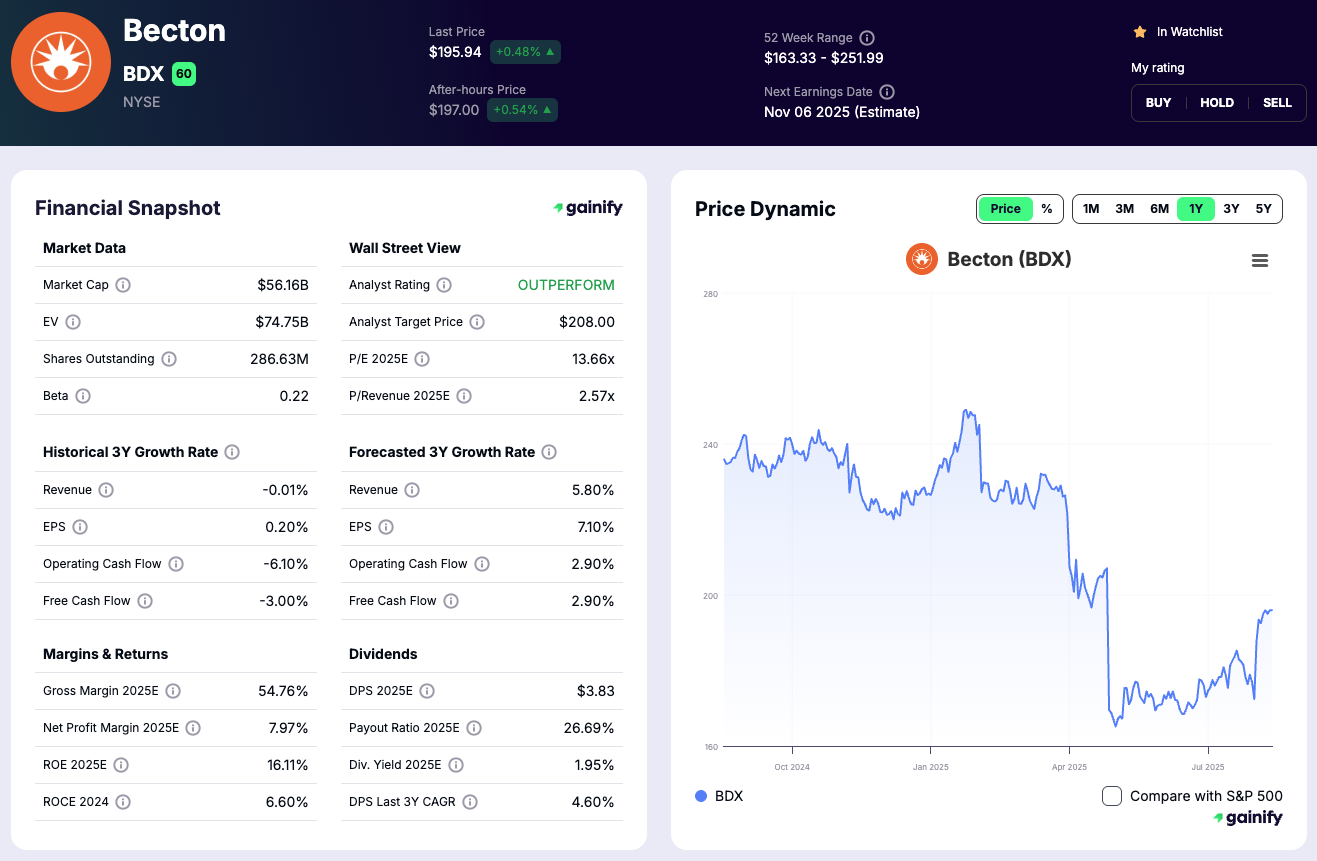

8. Becton, Dickinson and Company (BDX)

Becton Dickinson applies AI across its diagnostics and laboratory systems to improve speed and accuracy. Its platforms support automated scheduling of lab processes and optimize inventory management, reducing waste and delays. By integrating test results into broader clinical data systems, BDX helps hospitals accelerate turnaround times and improve efficiency. These AI-driven capabilities also lower the risk of human error, strengthening Becton Dickinson’s role as a critical partner in global healthcare operations.

- Market Cap (Aug 2025): $56.2 Billions

- Analyst 2025 Target Price: $208.00

- P/Revenue 2025: 2.6x

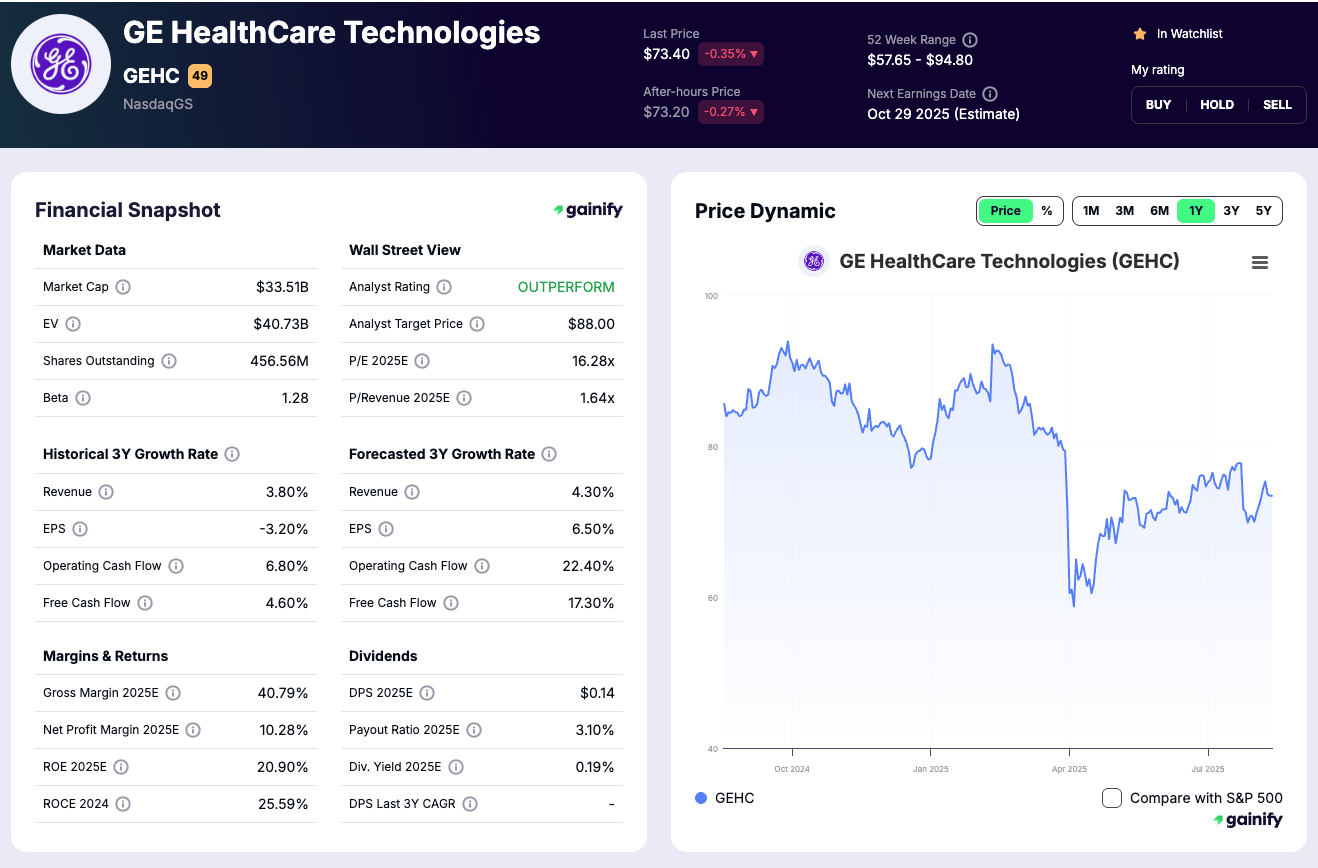

9. GE HealthCare Technologies (GEHC)

GE HealthCare is embedding AI deeply into its imaging platforms to enhance clinical workflows. Its systems deliver AI-powered diagnostics that reduce scan times and flag abnormalities in imaging studies, giving clinicians faster, more reliable insights. The company also uses predictive analytics to forecast equipment maintenance, minimizing downtime for hospitals and improving operational efficiency. By applying advanced models such as neural networks to clinical data, GE HealthCare increases the long-term value of its large installed base of scanners and imaging equipment.

- Market Cap (Aug 2025): $33.5 Billions

- Analyst 2025 Target Price: $88.00

- P/Revenue 2025: 1.6x

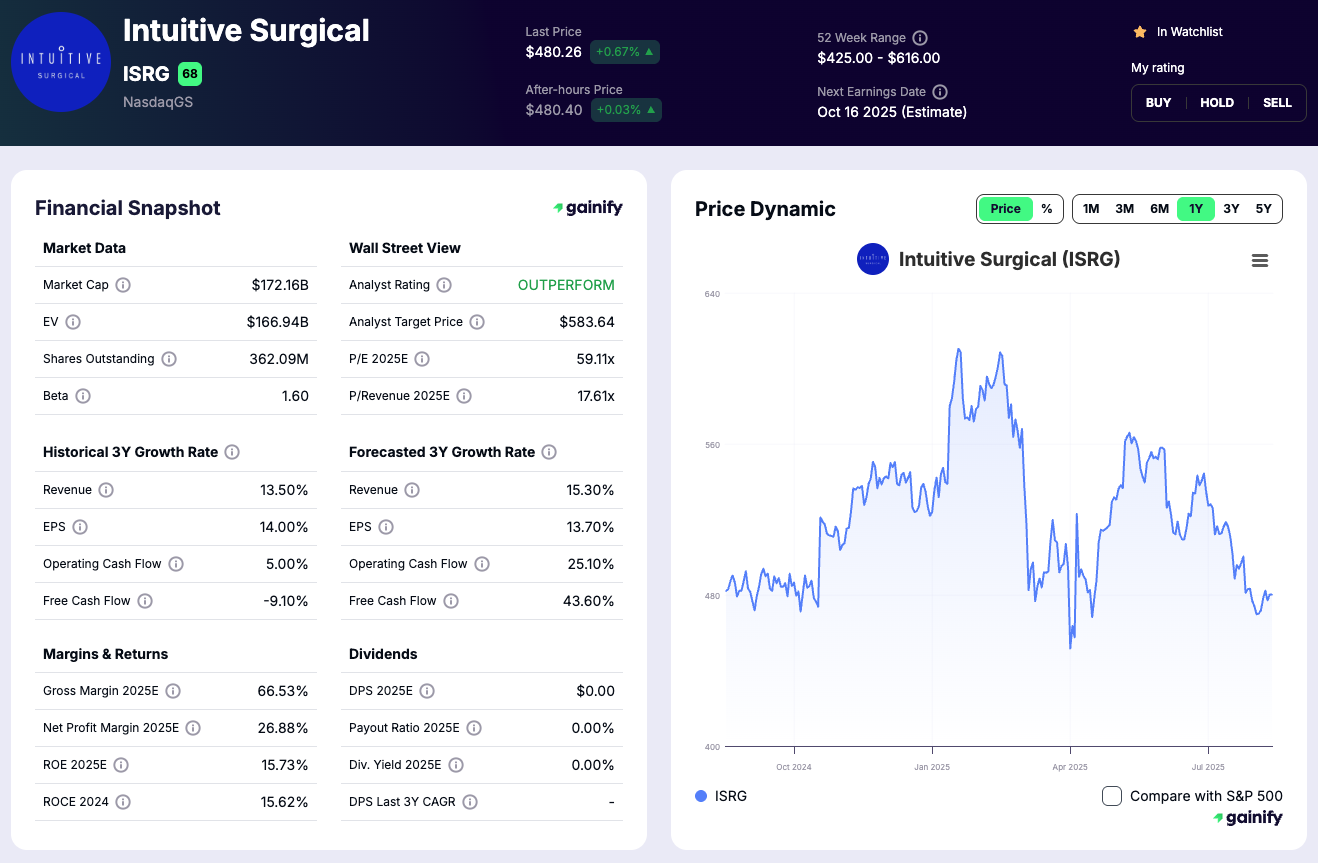

10. Intuitive Surgical (ISRG)

Intuitive Surgical’s da Vinci robotic platform integrates AI to support complex surgical procedures, offering guidance and workflow optimization during operations. Its systems interpret imaging studies in real time and provide predictive insights that help surgeons plan and adapt with greater precision. By reducing surgeon fatigue and enhancing patient outcomes, Intuitive Surgical strengthens its role as a leader at the intersection of robotics, AI, and medical equipment innovation.

- Market Cap (Aug 2025): ~$172B

- Analyst 2025 Target Price: $583.64

- P/Revenue 2025: 17.6x

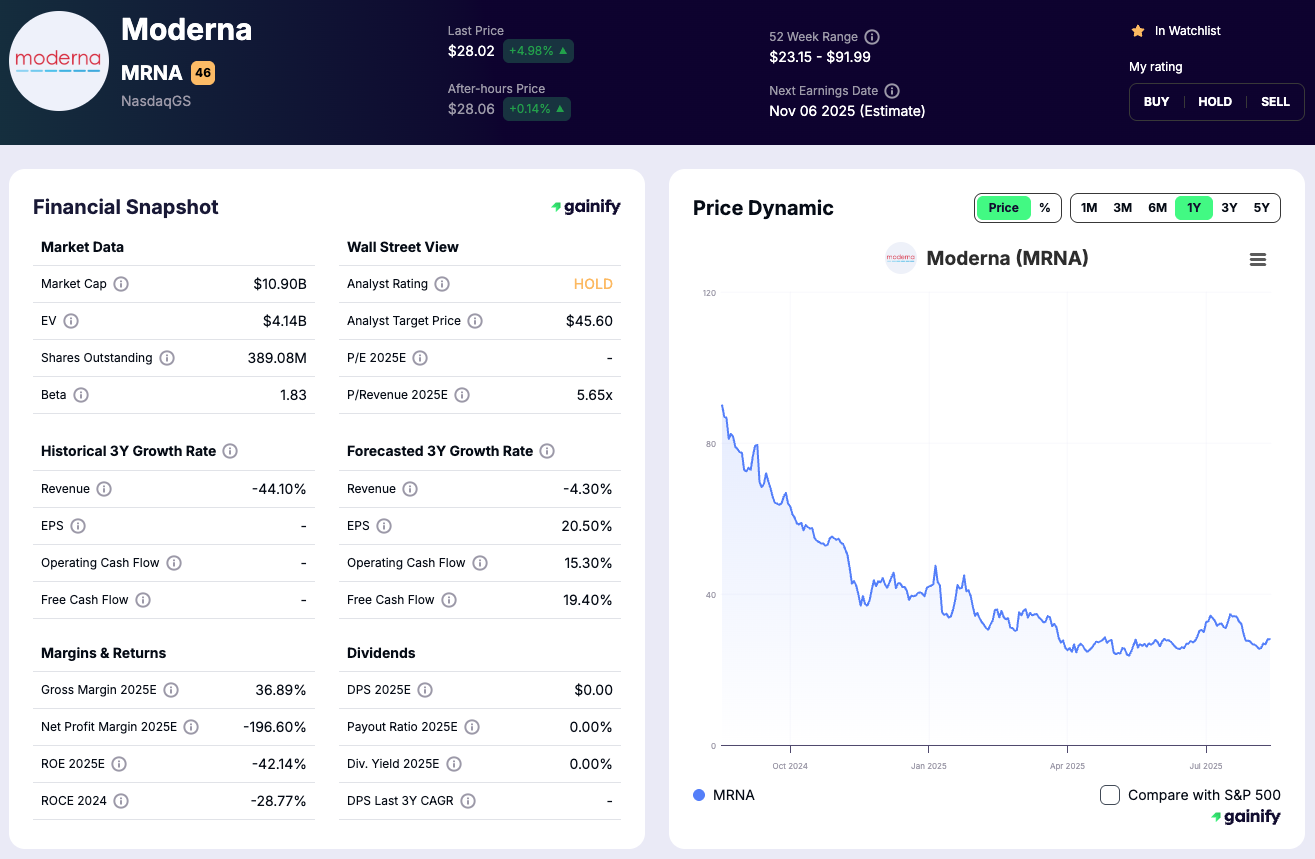

11. Moderna (MRNA)

Moderna applies AI to accelerate the development of mRNA-based therapies, integrating algorithms into every stage of its R&D process. Its systems predict immune responses, optimize mRNA sequence design, and run scenario models that simulate clinical trial outcomes. By combining neural networks with wet lab data, Moderna shortens the timeline from discovery to clinical testing, strengthening its ability to scale new vaccines and therapeutics more rapidly than traditional approaches.

- Market Cap (Aug 2025): ~$10.9B

- Analyst 2025 Target Price: $45.60

- P/Revenue 2025: 5.7x

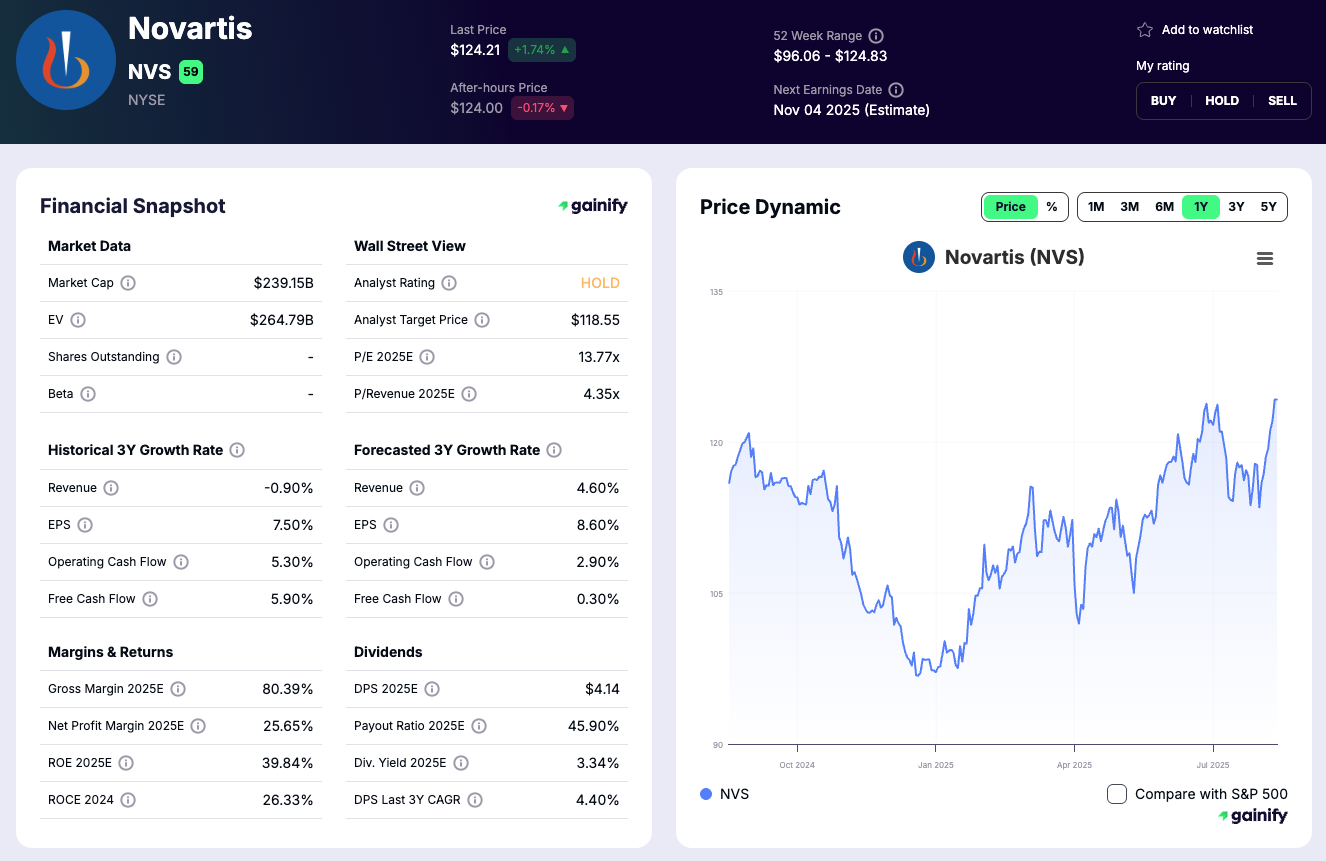

12. Novartis (NVS)

Novartis applies AI across the entire drug development lifecycle, from screening molecules to modeling potential side effects. Its platforms also support workflow improvements, including tools that assist nurses and clinical staff with patient management. While federated learning is a promising approach in global trials, Novartis has not publicly confirmed its use, focusing instead on advanced analytics and secure data-sharing methods. By embedding AI into one of the world’s most established pharmaceutical companies, Novartis demonstrates how scale and innovation can coexist.

- Market Cap (Aug 2025): ~$239.2B

- Analyst 2025 Target Price: $118.55

- P/Revenue 2025: 4.4x

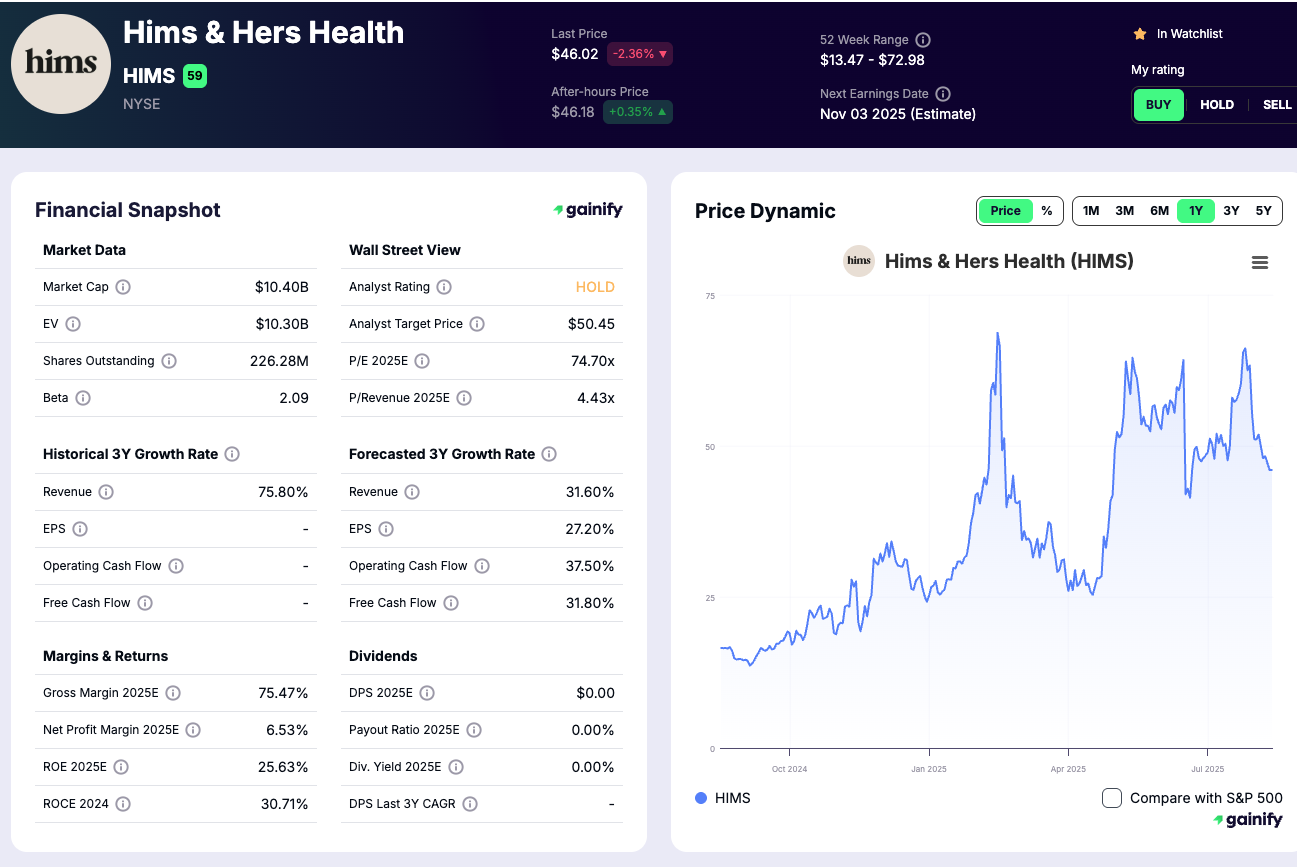

13. Hims & Hers Health (HIMS)

Hims & Hers Health is evolving into an AI-driven digital health provider, using technology to scale personalized care. Its MedMatch tool analyzes anonymized clinical data and patient risk profiles to recommend tailored treatment plans for conditions such as anxiety, depression, and dermatology. The company also integrates automated scheduling and natural language processing into telehealth consultations, improving speed and user experience. These innovations highlight Hims as one of the most agile adopters of AI in consumer healthcare.

- Market Cap (Aug 2025): ~$10.4B

- Analyst 2025 Target Price: $50.45

- P/Revenue 2025: 4.4x

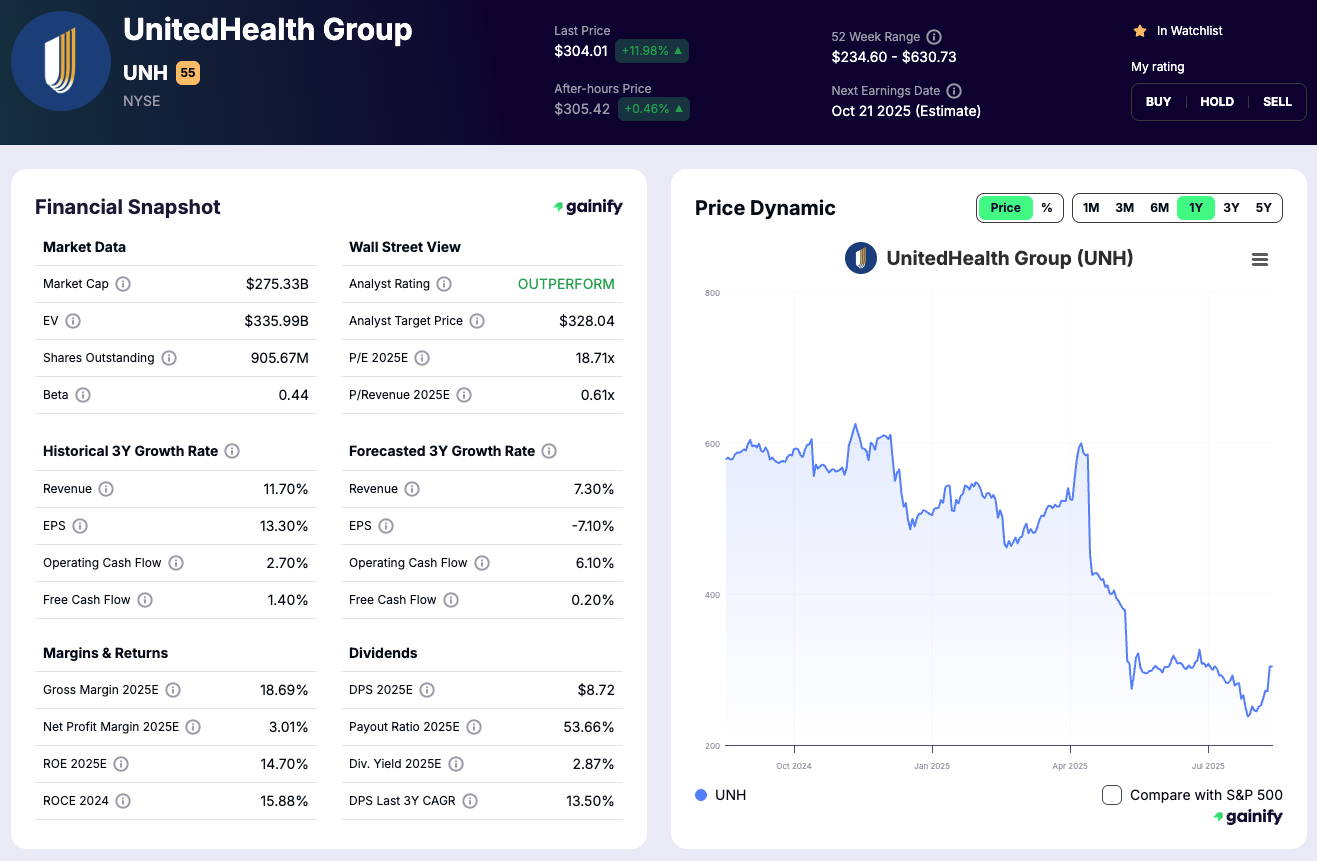

14. UnitedHealth Group (UNH)

UnitedHealth Group, through Optum Health, is one of the largest users of AI in healthcare services, applying advanced analytics across its vast network. Its systems use predictive models to identify patient risk profiles, helping clinicians intervene earlier in chronic disease management. AI also supports administrative efficiency with automated scheduling, claims processing, and natural language processing, reducing costs for providers and payers. With its scale and data access, UnitedHealth is uniquely positioned to demonstrate how AI can reshape population health at a national level.

- Market Cap (Aug 2025): ~$275.3B

- Analyst 2025 Target Price: $328.04

- P/Revenue 2025: 0.6x

A Different Way to See It

Many investors instinctively chase the most visible AI names, the ones that make headlines for breakthroughs in drug discovery or precision medicine. These stories are compelling, but they represent only one side of the opportunity. Some of the strongest returns may come from companies embedding AI into existing systems, especially in areas like medical equipment, imaging studies, and clinical data integration. Here, AI is already delivering measurable improvements in efficiency, accuracy, and patient outcomes.

Large, established firms such as Medtronic, GE HealthCare, and Boston Scientific demonstrate how AI can create value inside businesses with massive installed bases. By weaving AI into surgical tools, diagnostic scanners, and lab systems, they turn incremental improvements into scale advantages. These companies may not always dominate headlines, but they quietly generate durable growth by embedding AI into workflows hospitals already depend on. This approach provides investors with stability while still offering exposure to AI-driven transformation.

On the other end of the spectrum, pure AI-first companies like Tempus AI, Recursion, and IQVIA attempting to reinvent drug discovery and personalized medicine from the ground up. Their business models are built almost entirely on algorithms, neural networks, and genetic data analysis. These firms carry higher execution risk, but they also provide asymmetric upside if their platforms succeed. For investors willing to tolerate volatility, they can serve as growth engines within a portfolio.

The real opportunity lies in balance. A thoughtful mix of AI-first innovators and established companies embedding AI into medical equipment and clinical systems provides exposure to both growth and resilience. One side offers the chance to capture breakthroughs in personalized medicine; the other ensures steady adoption of AI where healthcare already operates at scale. Together, they frame a portfolio strategy that reflects both the excitement and the durability of AI in healthcare.

FAQ

Q1. Which AI healthcare stock is most focused on personalized medicine?

A1: Tempus AI stands out as the purest play. Its platform combines genetic data, imaging studies, and clinical records to generate tailored treatment recommendations, making personalized medicine its entire business model.

Q2. How is AI being applied in medical equipment?

A2: Companies such as Medtronic, GE HealthCare, and Intuitive Surgical use AI to enhance imaging studies, power diagnostics, and guide surgical robotics. These applications improve accuracy, reduce complications, and scale expertise across hospitals.

Q3. Which company benefits most from predictive analytics in clinical trials?

A3: IQVIA is the leader in AI-driven clinical research. Its predictive models help design smarter trials, identify eligible patients faster, and lower costs for pharmaceutical partners by reducing delays.

Q4. What does AI mean for digital-first healthcare companies?

A4: For firms like Teladoc Health and Hims & Hers, AI enables smarter patient routing, automated scheduling, and data-driven insights during consultations. This makes virtual care more efficient while keeping it highly personal.

Q5. Which stocks balance growth potential with stability?

A5: Investors seeking both resilience and exposure to AI may look at large players like Novartis, UnitedHealth Group, and Boston Scientific, which embed AI into proven businesses. These may not offer explosive growth, but they provide steady adoption and scale advantages.

Key Takeaways

AI is no longer experimental in healthcare — it is becoming an essential layer across diagnostics, treatments, and operations. Companies like Tempus AI and Recursion Pharmaceuticals embody the AI-first model, using genetic data, imaging studies, and neural networks to reimagine drug discovery and personalized medicine. Their potential lies in speed, precision, and the ability to scale insights across patient populations.

On the operational side, IQVIA and Veeva are proving how AI improves efficiency in life sciences, from trial design and patient recruitment to compliance and treatment adoption modeling. These companies show that AI does not only create new medicines, it also streamlines the entire pipeline that delivers them.

In the patient-facing space, Teladoc Health and Hims & Hers apply AI in ways that make digital care more accessible. Automated scheduling, natural language processing, and predictive analytics turn virtual consultations into a more personal and data-driven experience. This demonstrates how AI can bridge convenience with clinical relevance.

Meanwhile, medical equipment leaders like Medtronic, GE HealthCare, and Intuitive Surgical are embedding AI directly into the hardware of modern medicine. Whether through AI-powered imaging, surgical robotics, or predictive monitoring, they are making devices smarter and outcomes more consistent. Boston Scientific and Becton Dickinson extend this impact by applying AI to everyday hospital systems, from cardiac devices to lab automation.

Finally, global innovators like Novartis and Moderna bring AI into drug development at scale. By combining clinical data with advanced models, they reduce discovery timelines and improve the odds of success in treatments that reach millions. UnitedHealth Group, through Optum Health, highlights AI’s ability to reshape population health by predicting patient risks and guiding care delivery at scale.

For investors, the takeaway is clear: AI in healthcare is not a single theme but a spectrum. Some companies thrive on high-growth, AI-first strategies, while others generate durable value by embedding AI into products and services already trusted worldwide. A balanced portfolio that includes both sides is positioned to benefit from the next decade of AI-driven healthcare innovation in the stock market.