Hydrogen has moved from a futuristic concept to a cornerstone of the global clean-energy transition, and hydrogen stocks are gaining momentum as investors take notice.

From powering trucks and factories to storing renewable energy, the hydrogen economy is expanding fast and investors are starting to take notice.

By 2026, the hydrogen revolution has moved beyond experimentation and into execution, with capital, policy, and industrial demand beginning to align in a meaningful way.

According to data from the Hydrogen Council and McKinsey, more than 500 clean-hydrogen projects are now in development across the globe, representing well over $100 billion in committed investment. The International Energy Agency notes that hydrogen is emerging as one of the fastest-growing segments of the global energy transition, fueled by aggressive climate policies and industrial demand.

Below, we spotlight 10 leading hydrogen stocks driving this transformation – from global industrial giants scaling infrastructure to next-generation innovators – pushing the boundaries of hydrogen technology.

What Is Hydrogen and How Can It Power the Future?

Hydrogen is the most abundant element in the universe and one of the most versatile energy carriers ever developed. When used as a fuel, it produces electricity and water vapor, with zero carbon emissions.

Hydrogen can be produced in several ways:

- Gray hydrogen is made from natural gas and releases carbon dioxide.

- Blue hydrogen also comes from natural gas but captures and stores the emissions.

- Green hydrogen is created by splitting water using renewable electricity, producing a completely carbon-free fuel.

Hydrogen’s greatest strength is its flexibility. It can store large amounts of energy, power long-distance transport, and support heavy industries that are difficult to electrify. Trucks, ships, airplanes, and steel plants can all operate on hydrogen, making it vital for deep decarbonization.

As technology advances and costs fall, hydrogen is increasingly seen as the missing link in the clean-energy transition. It has the potential to connect renewables, transportation, and manufacturing into a single, sustainable energy system for the future.

How Big Can Hydrogen Become?

Source | Focus Area | Market Size & Forecast | Time Frame | Key Insight |

MarketsandMarkets (2025) | Global hydrogen market | USD 243 billion (2023) → USD 411 billion (2030) | 2023–2030 | Core hydrogen demand rising steadily with global policy support. |

Grand View Research (2025) | Hydrogen generation segment | USD 187 billion (2024) → USD 317 billion (2030) | 2024–2030 | Generation capacity expanding as new projects reach scale. |

Astute Analytica (2025) | Total hydrogen market (long term) | USD 1.6 trillion (2050 est.) | 2024-2050 | Hydrogen seen as a trillion-dollar market by mid-century. |

Hydrogen Council & McKinsey (2025) | Global project investment | 500+ clean-hydrogen projects; USD 100 billion+ committed | Current | Strong project pipeline and corporate investment momentum. |

International Energy Agency (IEA, 2025) | Global hydrogen demand | 125-585 million tonnes per year (by 2050) | 2025-2050 | Hydrogen demand could multiply five-fold depending on policy. |

PwC (2024) | Green-hydrogen production cost | Costs expected to fall 50%+ by 2030 | 2024-2030 | Cost declines critical for competitiveness with fossil fuels. |

10 Leading Hydrogen Stocks Powering the Clean Energy Revolution

Below, we spotlight 10 leading hydrogen stocks driving this global transformation — from industrial giants scaling hydrogen infrastructure to next-generation innovators pushing the boundaries of clean energy technology. Together, these companies are shaping the future of a low-carbon economy and redefining what’s possible in the hydrogen era.

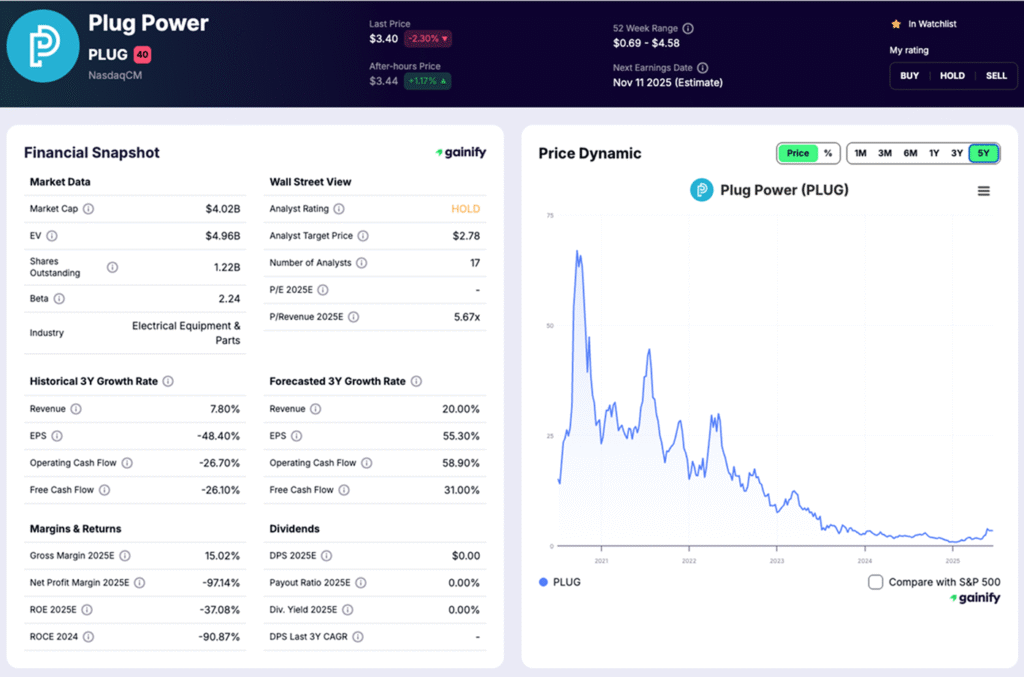

1️⃣ Plug Power (PLUG)

Market Cap: $4.02 B | P/E 2025E: N/A

What they do: Plug Power designs, builds, and operates hydrogen fuel-cell systems, electrolyzers, and green-hydrogen plants that supply power for logistics, mobility, and industrial customers. Its systems are used by major clients such as Amazon, Walmart, and Home Depot, and the company remains one of the few players with vertically integrated hydrogen capabilities, spanning generation, liquefaction, distribution, and end-use fuel-cell technology.

Why it matters: Plug Power is positioned at the heart of the emerging U.S. hydrogen economy, serving as both producer and infrastructure developer. Its scale-up in electrolyzer manufacturing and hydrogen production could support regional hydrogen hubs and industrial decarbonization. The company’s model of supplying clean hydrogen as a service gives it exposure to recurring revenue growth as adoption accelerates.

What to watch: Commissioning of its Rochester Gigafactory, performance of new hydrogen-production facilities, and progress toward profitability and cash-flow breakeven by 2026.

Key risk: Persistent cash burn and capital needs may constrain growth if cost reductions and project execution lag expectations.

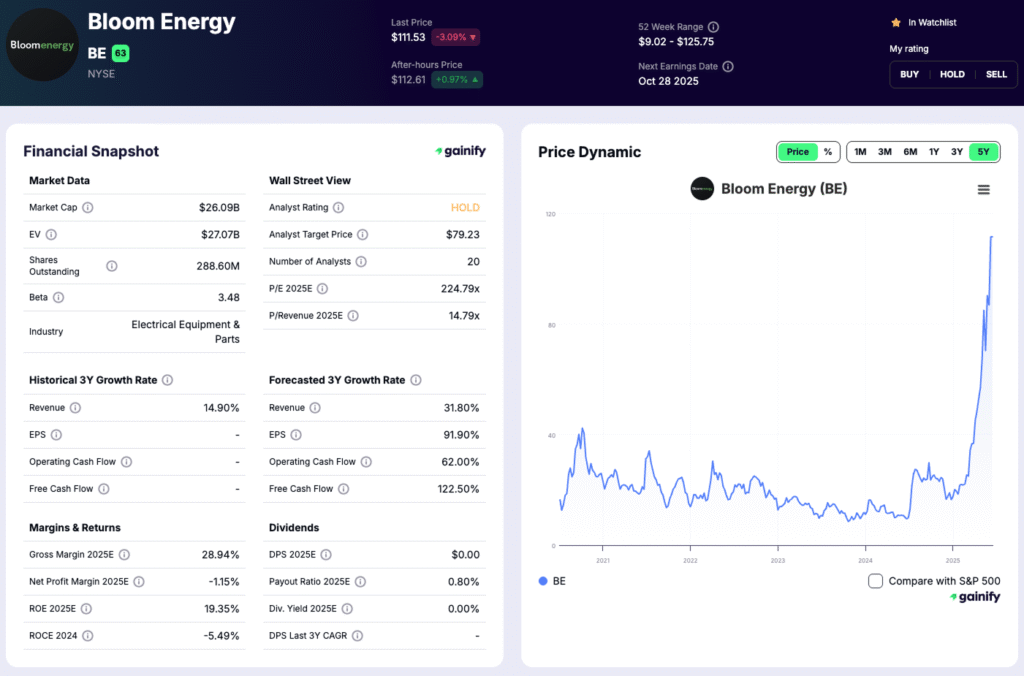

2️⃣ Bloom Energy (BE)

Market Cap: $26.09 B | P/E 2025E: 222.8x

What they do: Bloom Energy designs and manufactures solid-oxide fuel-cell systems that provide on-site, high-efficiency power for commercial, industrial, and utility clients. Its technology runs on natural gas, biogas, or hydrogen, allowing a flexible transition path to zero-carbon energy. The company also produces electrolyzers used to generate green hydrogen at scale.

Why it matters: Bloom’s modular systems are increasingly used by data centers, manufacturers, and utilities seeking reliable, low-carbon power. In 2025, Bloom expanded its electrolyzer output and secured new contracts across South Korea, India, and Europe, reinforcing its position as a key bridge from fossil-based fuels to clean hydrogen.

What to watch: Growth of its electrolyzer and microgrid projects, margin improvement from higher production efficiency, and progress toward consistent profitability in 2026.

Key risk: A high valuation, currency exposure, and execution risk from rapid global expansion could pressure margins and investor confidence.

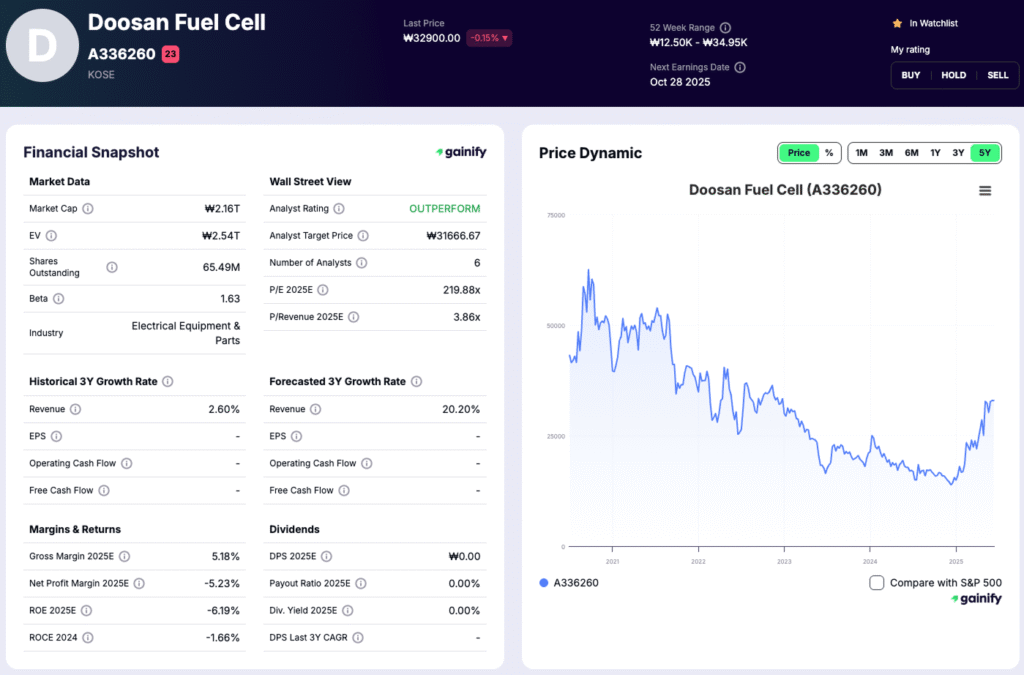

3️⃣ Doosan Fuel Cell (336260)

Market Cap: ₩2.16 T | P/E 2025E: 219.9x

What they do: Doosan Fuel Cell develops and manufactures stationary fuel-cell systems for commercial, industrial, and residential power generation. Its phosphoric-acid and solid-oxide fuel cells provide efficient, low-emission energy for buildings and distributed grids, and the company is expanding into hydrogen-based power plants.

Why it matters: As South Korea accelerates its Hydrogen Economy Roadmap, Doosan is emerging as a national leader in distributed hydrogen power. Strong policy incentives, rising exports to Japan, China, and Southeast Asia, and its integration with Doosan Group’s energy businesses strengthen its long-term position.

What to watch: Commercial rollout of residential and small-scale fuel cells, and international project wins that diversify revenue.

Key risk: Heavy dependence on domestic subsidies and slow overseas scaling could limit profitability beyond Korea’s home market.

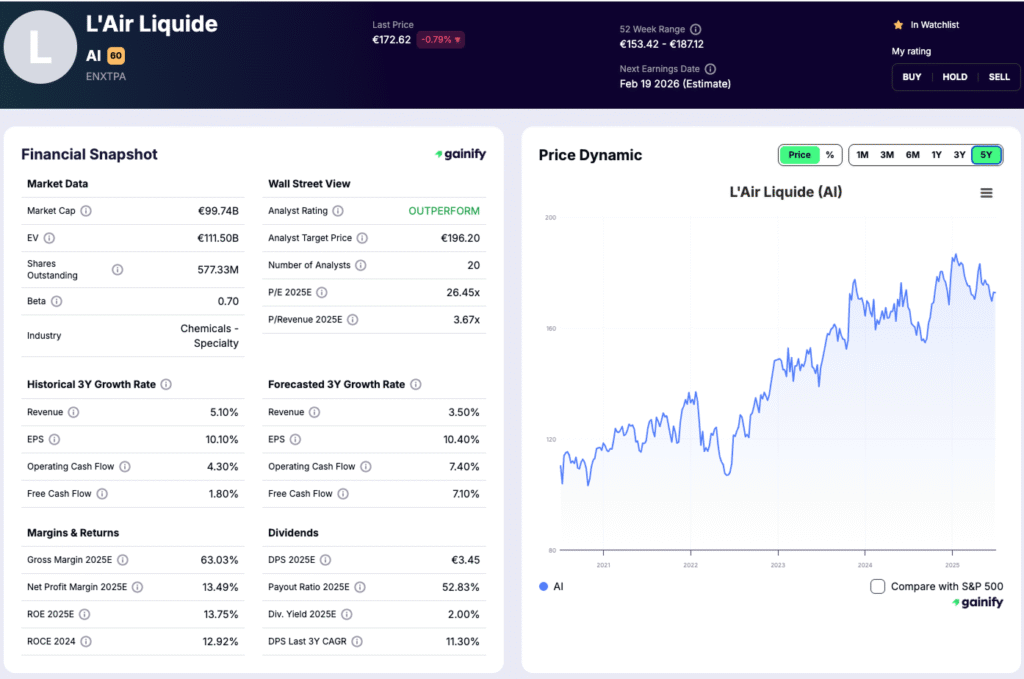

4️⃣ Air Liquide (AI)

Market Cap: €99.74 B | P/E 2025E: 26.45x

What they do: Air Liquide is a global leader in industrial gases, supplying oxygen, nitrogen, and hydrogen to healthcare, energy, and manufacturing customers. The company operates a vast hydrogen network that includes production, liquefaction, and distribution facilities across Europe, North America, and Asia. Its new projects focus on low-carbon and renewable hydrogen, integrating carbon-capture and electrolyzer technologies.

Why it matters: Air Liquide plays a central role in building Europe’s hydrogen infrastructure, supported by EU funding and partnerships with energy majors. In 2025 it expanded its renewable hydrogen footprint in France, the Netherlands, and Texas, positioning itself as a key bridge between industrial decarbonization and mobility solutions.

What to watch: Execution of large-scale electrolyzer projects, efficiency gains from renewable integration, and the company’s ability to balance growth with returns.

Key risk: Exposure to industrial demand cycles and slower policy implementation could delay the payoff from its clean-hydrogen investments.

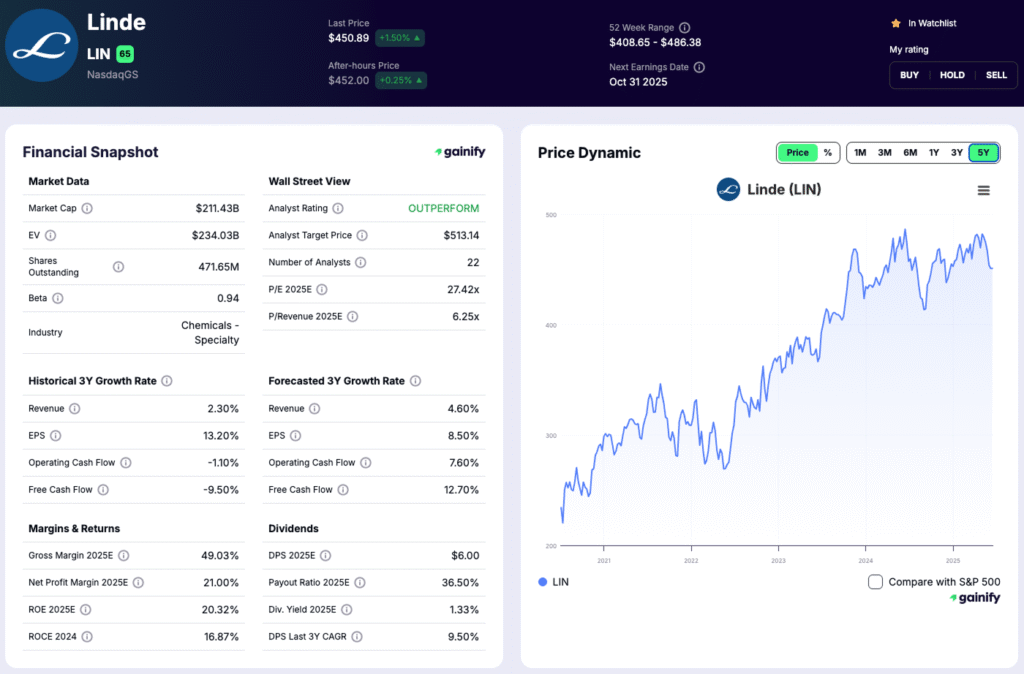

5️⃣ Linde (LIN)

Market Cap: $211.43 B | P/E 2025E: 27.42x

What they do: Linde is one of the world’s largest suppliers of industrial gases and a pioneer in hydrogen production and distribution. The company designs, builds, and operates large-scale hydrogen plants, pipelines, and storage systems serving the refining, steel, and energy sectors. Linde’s growing clean-hydrogen portfolio includes electrolyzer projects in the United States and Europe and partnerships focused on low-carbon hydrogen for heavy industry and mobility.

Why it matters: Linde’s unmatched engineering expertise and existing global network make it a cornerstone in scaling the hydrogen value chain. In 2025, it expanded its U.S. Gulf Coast production hub and launched a major joint venture in Germany aimed at supplying renewable hydrogen to industrial customers.

What to watch: Execution on flagship projects in North America and Europe, profitability of new hydrogen ventures, and sustained capital discipline amid heavy investment cycles.

Key risk: Cyclical industrial demand and cost inflation could temporarily offset gains from its hydrogen growth pipeline.

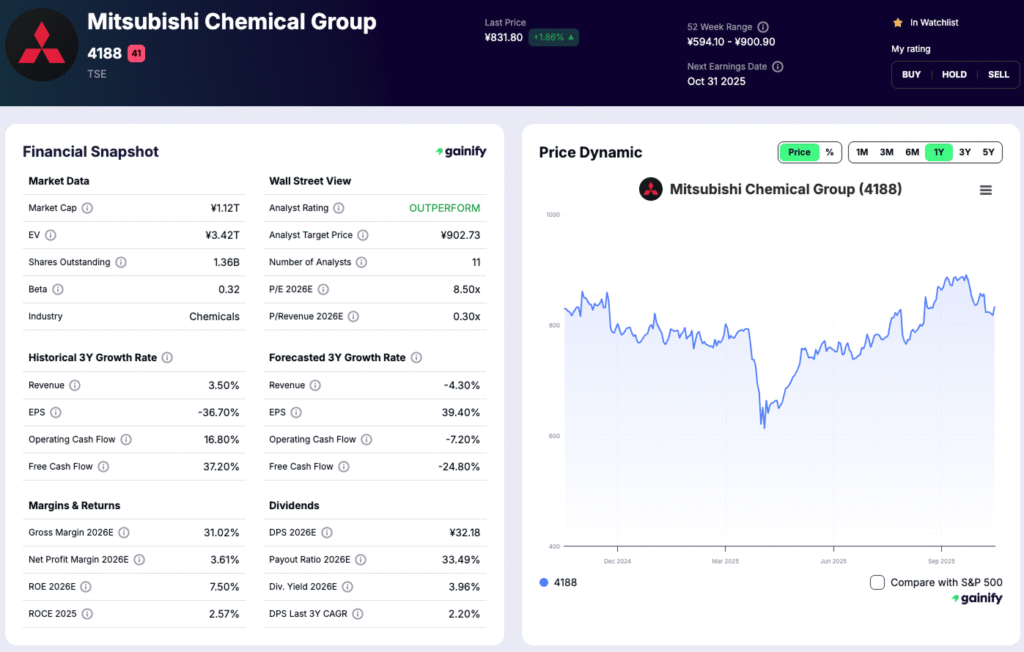

6️⃣ Mitsubishi Chemical Group (4188)

Market Cap: ¥1.12 T | P/E 2025E: 9.33x

What they do: Mitsubishi Chemical Group develops advanced materials and chemical products used across the clean-energy and hydrogen value chain. Its innovations include membranes, storage materials, and catalysts that enhance hydrogen production, transport, and fuel-cell efficiency.

Why it matters: As Japan accelerates its hydrogen and ammonia roadmap, Mitsubishi Chemical is leveraging its expertise in specialty polymers and carbon materials to supply next-generation components essential for hydrogen infrastructure. The company’s partnerships with automakers and energy developers position it to benefit from Japan’s push toward a domestic clean-fuel ecosystem.

What to watch: Commercial rollout of new hydrogen-compatible materials, collaboration with global fuel-cell manufacturers, and steady recovery in high-margin specialty products.

Key risk: Weakness in petrochemical pricing and slower adoption of advanced materials in hydrogen systems could limit near-term profitability.

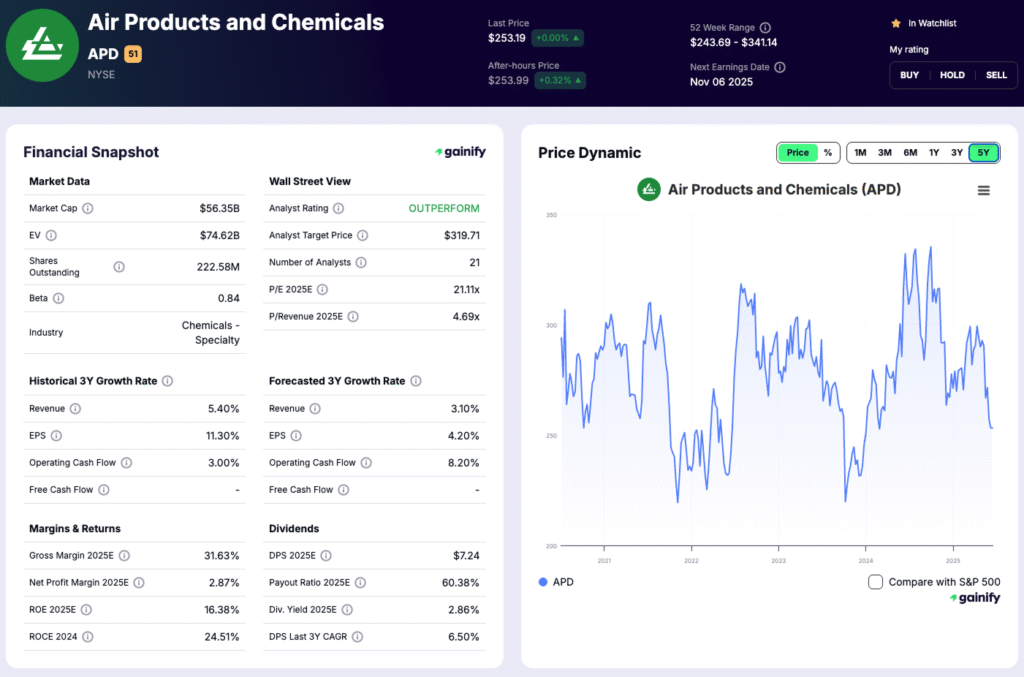

7️⃣ Air Products and Chemicals (APD)

Market Cap: $56.35 B | P/E 2025E: 20.66x

What they do: Air Products and Chemicals designs, builds, and operates large-scale hydrogen and industrial-gas facilities around the world. The company is developing some of the largest green- and blue-hydrogen projects in existence, including the flagship NEOM Green Hydrogen Project in Saudi Arabia and new clean-ammonia plants in North America.

Why it matters: With decades of engineering expertise, Air Products has become a cornerstone in global hydrogen supply and distribution, enabling refueling networks, decarbonized steel production, and ammonia exports. Its long-term contracts and government-backed projects provide strong revenue visibility as hydrogen demand scales.

What to watch: Execution on NEOM and Louisiana projects, progress on cost containment, and delivery of early cash flow from clean-hydrogen ventures.

Key risk: Cost overruns, construction delays, or regulatory shifts could compress margins and delay expected returns on capital.

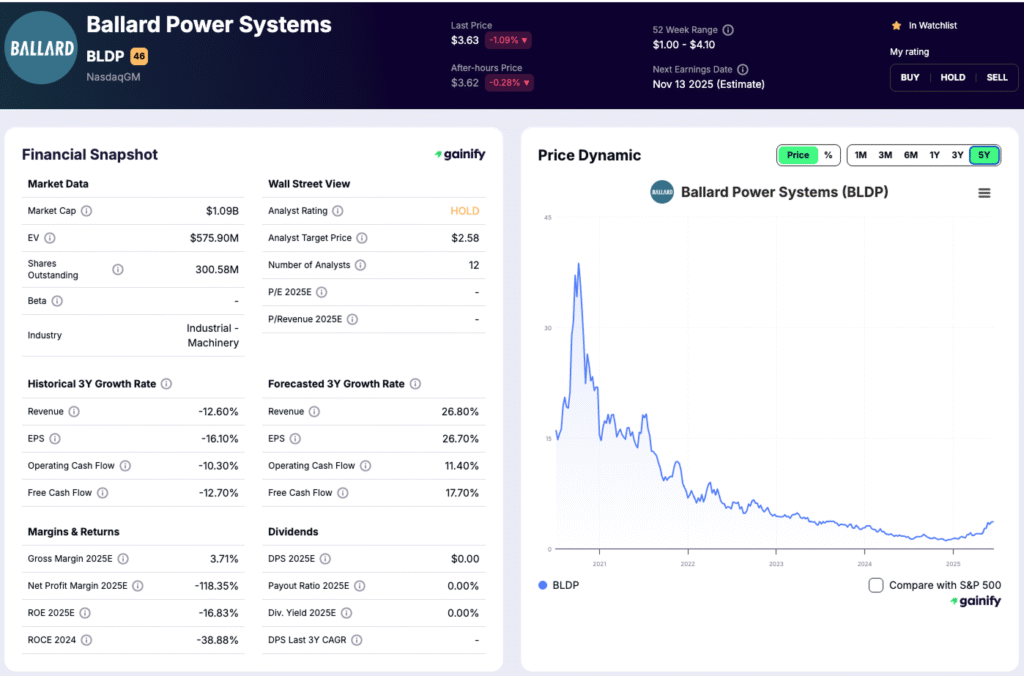

8️⃣ Ballard Power Systems (BLDP)

Market Cap: $1.09 B | P/E 2025E: N/A

What they do: Ballard Power Systems designs and manufactures proton-exchange-membrane (PEM) fuel-cell engines used in buses, trucks, trains, and marine vessels. The company also supplies fuel-cell stacks and modules for stationary power and backup energy applications, with growing exposure in Europe and Asia.

Why it matters: As one of the earliest pioneers in fuel-cell technology, Ballard has built deep expertise in hydrogen mobility and heavy transport. In 2025, the company advanced next-generation high-efficiency stacks and secured new supply agreements with bus and rail manufacturers in Europe and China. Its long-term partnerships strengthen its foothold in the global zero-emission vehicle market.

What to watch: Commercial adoption of fuel-cell trucks and marine systems, technology cost reductions, and expansion of joint ventures with OEMs.

Key risk: Continued net losses and slower commercialization cycles could challenge near-term financial performance despite strong industry positioning.

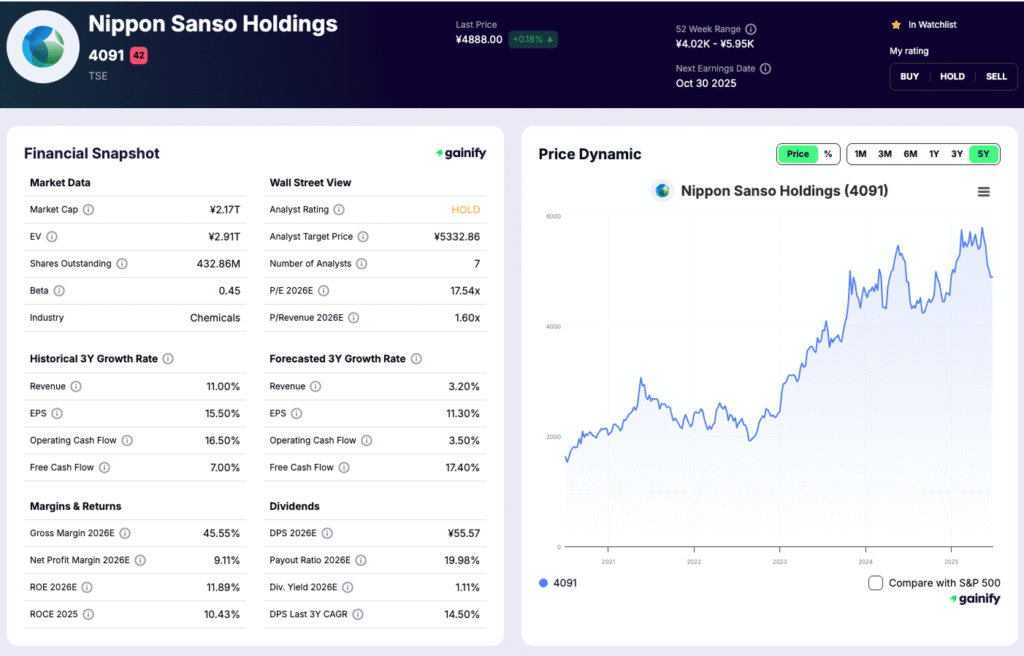

9️⃣ Nippon Sanso Holdings (4091)

Market Cap: ¥2.17 T | P/E 2025E: 19.38×

What they do: Nippon Sanso Holdings is one of the world’s largest industrial gas companies, supplying hydrogen, oxygen, nitrogen, and specialty gases to customers across steel, chemicals, electronics, healthcare, and energy. Through its global operations in Japan, Europe, the Americas, and Asia, the company plays a critical role in hydrogen production, liquefaction, storage, and distribution infrastructure.

Why it matters: Unlike pure-play hydrogen companies, Nippon Sanso is positioned as a picks-and-shovels provider to the hydrogen economy. The company benefits from rising demand for clean hydrogen in heavy industry and energy transition projects without relying solely on hydrogen mobility adoption. In recent years, it has expanded investments in low-carbon hydrogen supply chains, including blue and green hydrogen initiatives tied to industrial decarbonization.

What to watch: Growth in hydrogen supply contracts for steel and chemical customers, progress on low-carbon hydrogen projects, and margin performance as energy costs and contract pricing normalize.

Key risk: Capital intensity and exposure to cyclical industrial demand could pressure returns if hydrogen adoption timelines slip or if energy price volatility persists.

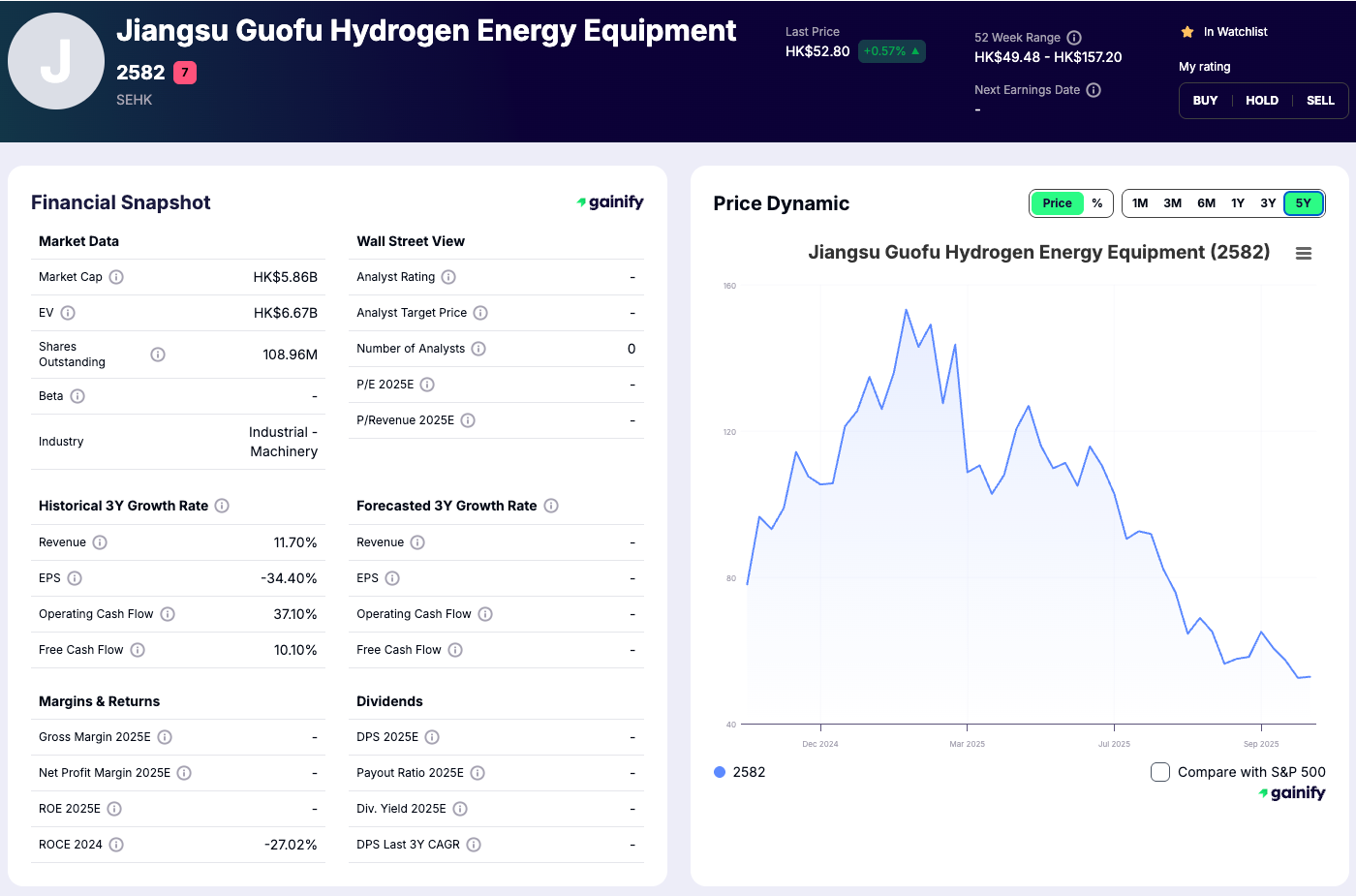

🔟 Jiangsu Guofu Hydrogen Energy Equipment (2582)

Market Cap: HK$5.86 B | P/E 2025E: N/A

What they do: Jiangsu Guofu Hydrogen Energy manufactures hydrogen refueling stations, electrolyzers, and storage systems for China’s expanding hydrogen network. It supplies both state-owned and private-sector clients involved in infrastructure buildouts.

Why it matters: As one of China’s leading hydrogen-equipment suppliers, Guofu is benefiting from government-backed investment and rapid growth in fuel-cell transport. Its 2025 capacity expansion and new regional contracts enhance its position in China’s clean-energy supply chain.

What to watch: Execution on export plans to Southeast Asia, and technology upgrades aimed at improving electrolyzer efficiency.

Key risk: Rising price competition and changing policy incentives could pressure margins and slow earnings momentum.

The Big Picture

Hydrogen’s momentum in 2026 represents more than a passing trend. It signals a structural transformation in the global energy landscape. Governments are committing hundreds of billions toward clean-hydrogen investment, while industries from transportation to steel are integrating hydrogen as a foundation of their decarbonization plans.

From industrial powerhouses such as Linde, Air Liquide, and Air Products to innovative pioneers like Plug Power and Ballard Power, these companies combine the stability of scale with the potential of emerging technology. Together, they form the backbone of an energy transition that is moving from concept to large-scale implementation.

The path forward will not be simple. Profitability, scalability, and execution discipline remain critical challenges, and success will rely on strong balance sheets and sustained policy support. Yet for investors with patience and vision, hydrogen offers one of the most compelling long-term opportunities in global energy, where industrial capability aligns with climate ambition.