Top Investors Portfolio Tracking

Rating #83

Warren Buffett

Rating #83

Berkshire Hathaway

Berkshire Hathaway Inc., led by Warren Buffett, follows a value investing philosophy, focusing on buying under...

Filing Date

2026-02-17

Portfolio value

$274.16B

Q4 2025

1 Year

+9.76%

3 Years

+60.97%

5 Years

+68.31%

Top Holdings

Rating #88

Bill Gates

Rating #88

Bill & Melinda Gates Foundation Trust

Bill Gates’ investment philosophy at the Bill & Melinda Gates Foundation Trust is centered on leveraging strat...

Filing Date

2026-02-17

Portfolio value

$35.36B

Q4 2025

1 Year

+15.15%

3 Years

+58.35%

5 Years

+79.53%

Top Holdings

Rating #47

Charlie Munger

Rating #47

Daily Journal

Charlie Munger, who served as vice chairman of Berkshire Hathaway and led Daily Journal Corporation, followed ...

Filing Date

2026-01-13

Portfolio value

$276.65M

Q4 2025

1 Year

+32.12%

3 Years

+85.73%

5 Years

+90.74%

Rating #114

George Soros

Rating #114

Soros Fund Management

Soros Fund Management LLC, founded by George Soros, follows a global macro investing strategy. Soros focuses o...

Filing Date

2026-02-13

Portfolio value

$8.63B

Q4 2025

1 Year

+8.35%

3 Years

+41.10%

5 Years

-10.11%

Top Holdings

Rating #105

Ray Dalio

Rating #105

Bridgewater Associates

Ray Dalio’s investment philosophy at Bridgewater Associates Inc. is centered on a principles-based, systematic...

Filing Date

2026-02-13

Portfolio value

$27.42B

Q4 2025

1 Year

+17.41%

3 Years

+49.14%

5 Years

+32.97%

Top Holdings

Rating #121

Michael Burry

Rating #121

Scion Asset Management

Michael Burry’s investment philosophy at Scion Asset Management, LLC is characterized by a deep-value approach...

Filing Date

2025-11-03

Portfolio value

$1.38B

Q3 2025

1 Year

-8.62%

3 Years

+34.55%

5 Years

+104.23%

Top Holdings

Rating #152

Carl Icahn

Rating #152

Icahn Carl C

Icahn Enterprises L.P., under the leadership of Carl Icahn, employs an activist investing strategy. This appro...

Filing Date

2026-02-17

Portfolio value

$8.45B

Q4 2025

1 Year

+2.44%

3 Years

-67.12%

5 Years

-61.35%

Top Holdings

Rating #93

Bill Ackman

Rating #93

Pershing Square Capital Management

Pershing Square Capital Management, L.P., founded and led by Bill Ackman, employs an activist investing strate...

Filing Date

2026-02-17

Portfolio value

$15.53B

Q4 2025

1 Year

+6.78%

3 Years

+57.09%

5 Years

+79.13%

Top Holdings

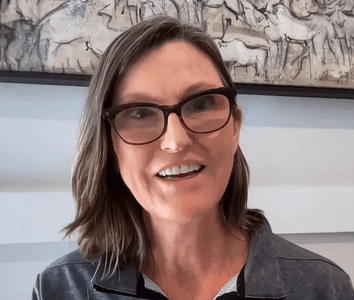

Rating #27

Cathie Wood

Rating #27

Ark Investment Management

Cathie Wood’s investment philosophy at ARK Investment Management LLC is centered on a disruptive innovation ap...

Filing Date

2026-02-11

Portfolio value

$15.07B

Q4 2025

1 Year

+24.12%

3 Years

+124.56%

5 Years

-32.19%

Rating #81

Jim Simons

Rating #81

Renaissance Technologies

Jim Simons' investment philosophy at Renaissance Technologies LLC is distinguished by its reliance on sophisti...

Filing Date

2026-02-12

Portfolio value

$64.46B

Q4 2025

1 Year

+17.11%

3 Years

+62.05%

5 Years

+42.43%

Top Holdings

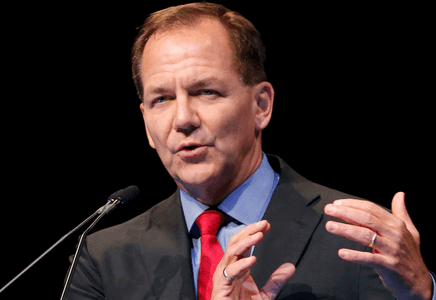

Rating #115

Paul Tudor Jones

Rating #115

Tudor Investment Corp Et Al

Paul Tudor Jones' investment philosophy at Tudor Investment Corp. is centered on a macro-driven, discretionary...

Filing Date

2026-02-17

Portfolio value

$54.03B

Q4 2025

1 Year

+11.79%

3 Years

+39.67%

5 Years

+20.80%

Top Holdings

Rating #16

David Tepper

Rating #16

Appaloosa

David Tepper’s investment philosophy at Appaloosa Management LP centers on a flexible, opportunistic approach ...

Filing Date

2026-02-17

Portfolio value

$6.93B

Q4 2025

1 Year

+31.73%

3 Years

+140.50%

5 Years

+153.02%

Top Holdings

Frequently Asked Questions

A top investor is someone who has consistently outperformed the market over many years, proving their skill across different cycles and conditions. Their results show discipline, patience, and a deep understanding of how markets work. They operate with transparency through clear filings and public commentary, and their decisions tend to influence how others think and behave. When they make a move, analysts and everyday investors take notice because their track records command respect. Well-known investing figures such as Warren Buffett, Ray Dalio, and Bill Ackman exemplify this standard. Their insights, investment philosophies, and long-term performance have made them some of the most recognized and admired names in the world of finance.

Investors such as like Warren Buffett, Peter Lynch, Ray Dalio, George Soros, and Charlie Munger are widely regarded as some of the most accomplished figures in the history of modern investing. Their reputations are built on decades of consistent outperformance, thoughtful risk management, and the ability to adapt their strategies across changing market environments. Each is associated with a clearly defined and influential investment philosophy. Buffett and Munger are known for disciplined value investing and a focus on high-quality businesses. Lynch is recognized for identifying growth opportunities through deep fundamental research. Dalio is respected for his macroeconomic expertise and systematic decision frameworks. Soros is known for his understanding of market psychology and the concept of reflexivity. Beyond generating exceptional returns, their writings, interviews, and public insights have shaped how institutions, professionals, and individual investors approach markets. Their work continues to influence portfolio construction, economic thinking, and long-term investment strategy across the global financial community.

Warren Buffett is widely regarded as the leading investor of the modern era, largely because of Berkshire Hathaway's extraordinary compounded annual gain over nearly six decades. From 1965 to 2024, Berkshire achieved an average annual return of approximately 19.9 percent. Over the same period, the S&P 500 delivered about 10.4 percent annually. This difference, sustained over such a long timeframe, produced an overall gain for Berkshire that exceeded 5,500,000 percent, compared with roughly 39,000 percent for the market. Very few investors in history have matched this level of long-term compounding at scale. Buffett's approach, centered on high-quality businesses, disciplined valuation, and long-term thinking, has become a cornerstone of modern investing. His shareholder letters, investment principles, and transparent communication style have shaped how both institutions and individual investors understand capital allocation and business analysis. Other notable investors excel in specific areas such as growth, macroeconomics, or systematic strategies, but Buffett's combination of consistent compounding, durability, and influence continues to set the global benchmark for investment excellence.

Among individuals whose wealth is primarily the result of investing, Warren Buffett remains the richest investor in the United States, with an estimated net worth of $150 billion. His fortune has been built over nearly six decades through disciplined capital allocation at Berkshire Hathaway, and his long-term compounded annual gain of roughly 19.9 percent places him in a category of his own. For those wondering how did Warren Buffett get rich, the answer lies in patient long-term investing, reinvesting earnings, and consistently allocating capital to high-quality businesses with durable competitive advantages. Several other prominent investors also rank among the wealthiest Americans. Bill Gates, with a net worth of approximately $107 billion, oversees a significant portion of his wealth through Cascade Investment, the family office that manages his diversified portfolio across public equities, private holdings, real estate, and infrastructure assets. Although Gates originally built his fortune through Microsoft, Cascade plays a central role in maintaining and growing his wealth today. Other notable investors include Thomas Peterffy (around $73.3 billion) whose success stems from electronic trading and Interactive Brokers; Jeff Yass ($65.7 billion) known for quantitative trading at Susquehanna International Group; Stephen Schwarzman ($51.9 billion) through private equity at Blackstone; and Ken Griffin ($50.4 billion), founder of Citadel and one of the most successful hedge fund managers globally. Collectively, these individuals represent the highest concentration of investment-generated wealth in the United States, each with substantial influence across financial markets and the broader investment landscape.

Several women stand out as influential and highly respected investors, each shaping global finance through their leadership, strategy, and performance. Cathie Wood, founder of ARK Invest, is widely known for her high-conviction thematic investing in innovation and disruptive technologies. Abigail Johnson, CEO of Fidelity Investments, oversees one of the largest asset managers in the world and is regarded as one of the most powerful figures in global investing. Mellody Hobson, co-CEO of Ariel Investments, is recognized for her long-term value approach and her leadership across corporate governance and financial education. Geraldine Weiss, often called the "Grande Dame of Dividends," pioneered dividend-based value investing and became one of the first women to gain national prominence in the field. Mary Callahan Erdoes, CEO of J.P. Morgan Asset and Wealth Management, manages trillions of dollars in client assets and is considered one of the most influential leaders in institutional investing today. Beyond traditional fund managers, figures such as Nancy Pelosi are frequently cited in discussions about investing due to the strong historical performance associated with her household’s trades. Analysis of the Nancy Pelosi stock portfolio has drawn significant public interest and debate, highlighting how political figures can also become part of broader conversations around market insight and capital allocation. Together, these women represent some of the most accomplished investors and capital allocators in the world, noted for their performance, strategic insight, and impact across global markets.

The Gainify platform provides real-time visibility into the most recent disclosed trades from leading investors. Users can track newly initiated positions, additions to existing holdings, trims, and complete exits, as well as explore full portfolio breakdowns for each manager. The platform also aggregates activity across all filings to highlight the most significant top investor buys and top investor sells, offering a clear view of where sophisticated capital is moving in the market.

You can explore complete investor portfolios directly on our platform. Each investor profile gives you a clear view of their current holdings, their most recent trades, and how their allocations have shifted over time. The interface makes it easy to follow position changes, new entries, trims, and full exits as they are disclosed. You can also stay continuously updated. Enable alerts to be notified whenever an investor files a new report or makes a significant move. Simply select "Get Alert on Every Trade" to receive real-time updates as soon as activity becomes public.

Following the decisions of leading investors and funds can provide valuable insight into market trends, sector convictions, and emerging opportunities that may not be immediately visible to the broader market. Their portfolios often reflect deep research, disciplined frameworks, and long-term strategic thinking, making their activity a helpful reference point for your own analysis. Observing how top investors allocate capital can highlight patterns, themes, or shifts in sentiment. However, their moves should complement rather than replace your own due diligence. The Gainify platform supports this process with a wide range of tools for stock research, portfolio evaluation, and idea generation.

The platform uses data taken directly from official public filings, audited disclosures, and licensed market data providers. Every update is processed and added as soon as new information is released, ensuring that investor portfolios and trade activity remain both reliable and timely. This approach provides a consistently accurate view of top-investor holdings as they evolve. For additional perspective, users who want to see opinions from other investors can also review public feedback on platforms such as Trustpilot or Google Business, where real users share their experiences with the data and tools provided.

Yes. With your current account, you can explore investor rankings, review full portfolios, track recent trades, and filter activity by category. You can also build custom watchlists to follow specific investors or funds. Additional features, such as receiving alerts when new filings or trades are reported, are available based on your subscription plan.

On every investor profile, such as Michael Burry portfolio, you will find a green "Compare Statistics" button in the top-right corner. This tool allows you to select additional investors and compare their portfolios side by side. You can review how each investor's equity allocation has evolved over time and see differences in sector exposure, position weights, and trading activity. The comparison view also includes long-term performance metrics. You can analyze each investor's 1-year, 3-year, and 5-year CAGR to understand how their strategies have performed over different market cycles relative to each other.

You can add any stock from a top investor's portfolio directly to your stock watchlist. Open the investor's profile, scroll through the holdings table, and select the star icon in the rightmost column to save an individual position. If you want to follow the entire portfolio, you can use the "Fork Holdings" button at the top of the page. This instantly creates a full watchlist based on that investor's complete set of holdings.

Market data is sourced from S&P Global Market Intelligence. All insights and analysis are developed by Gainify. Copyright © 2026, S&P Global Market Intelligence. All rights reserved.

View Data ProvidersNEWSLETTER

Market data is sourced from S&P Global Market Intelligence. All insights and analysis are developed by Gainify. Copyright © 2026, S&P Global Market Intelligence. All rights reserved.

View Data ProvidersGainify provides tools and content designed to help users explore and understand the world of investing. All information available through our platform is for educational and informational use only. It is not intended as financial, investment or legal advice, and should not be treated as a recommendation or endorsement of any investment approach.

Our content is general in nature and does not account for your personal financial circumstances. Any investment decisions you make are your responsibility. We strongly recommend speaking with a licensed financial advisor or professional before acting on any information found on Gainify. Before using Gainify, please review our Terms of Service.