Social media sits at the heart of the digital economy. These platforms decide how billions of people connect, share, shop, and even shape opinions.

Social media now connects more than 5.4 billion people, nearly two-thirds of the world’s population. The average user spends almost 2.5 hours every day scrolling, sharing, and streaming across platforms.

For investors, social media stocks offer more than just advertising exposure. They open doors to subscription revenues, data licensing, and even politically driven narratives.

In 2026, the industry is split between two camps. Global giants like Alphabet and Meta dominate with unmatched scale, while challengers like Reddit, Pinterest, or Match thrive by serving highly engaged niche audiences.

Knowing where each company operates, how it monetizes its users, and what risks it faces is essential for spotting real opportunities in this fast-moving sector.

Top 10 US-Listed Social Media Stocks by Market Cap (Jan 2026)

Rank | Company | Ticker | Geography | Core Platforms | |

1 | $3.89T | Global | YouTube | ||

2 | $1.64T | Global | Facebook, Instagram, WhatsApp, Threads | ||

3 | $50.47B | China | Baidu Tieba, AI-based content | ||

4 | $48.42B | Primarily US | Reddit | ||

5 | $18.57B | Global | Pinterest | ||

6 | $14.82B | North America, Europe | Snapchat | ||

7 | $11.13B | China | Bilibili | ||

8 | $9.29B | China | Boss Zhipin (job-based social) | ||

9 | $7.69B | Global | Tinder, Hinge, OkCupid | ||

10 | $3.81B | US | Truth Social |

Top 10 US-Listed Social Media Stocks (Jan 2026)

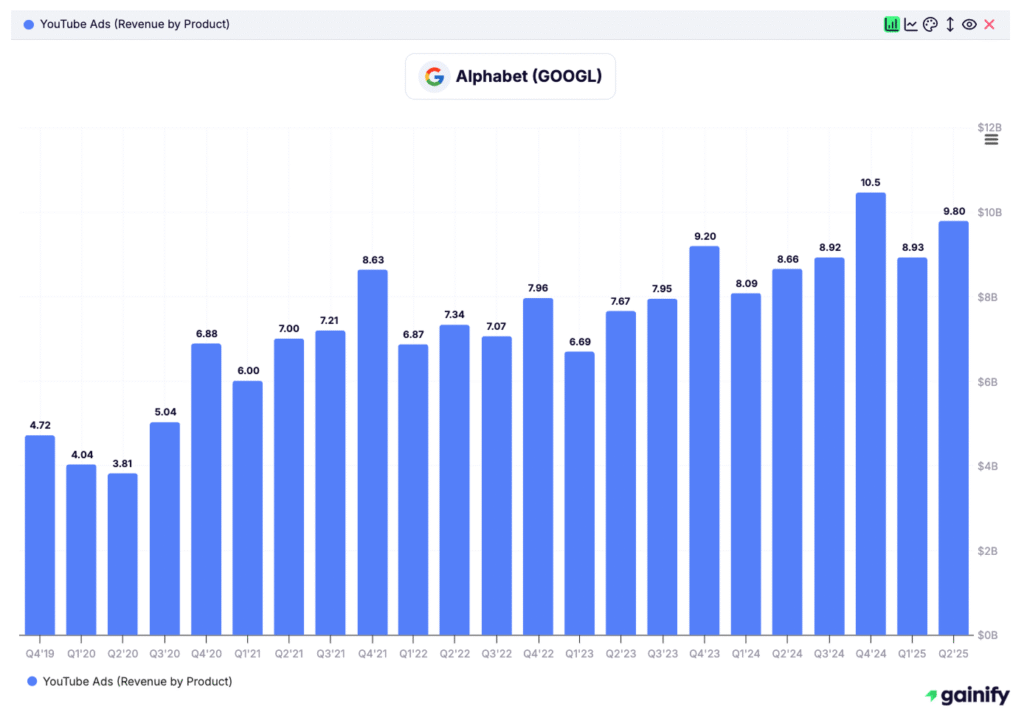

1. Alphabet (GOOGL)

- Geography: Global

- Platforms: YouTube, YouTube Shorts, YouTube Premium

- Angles to watch:

- YouTube has over 2.5 billion monthly users, making it the most powerful video platform worldwide.

- Shorts (its TikTok rival) is seeing rapid adoption and deeper integration into the ad stack.

- Diversification is strong: ad revenue, subscriptions (Premium, Music), and growing creator monetization tools.

- Regulatory headwinds include EU rules on digital advertising and ongoing antitrust scrutiny in the US.

- For investors, Alphabet offers both stability as a mega-cap and optionality in AI-powered video.

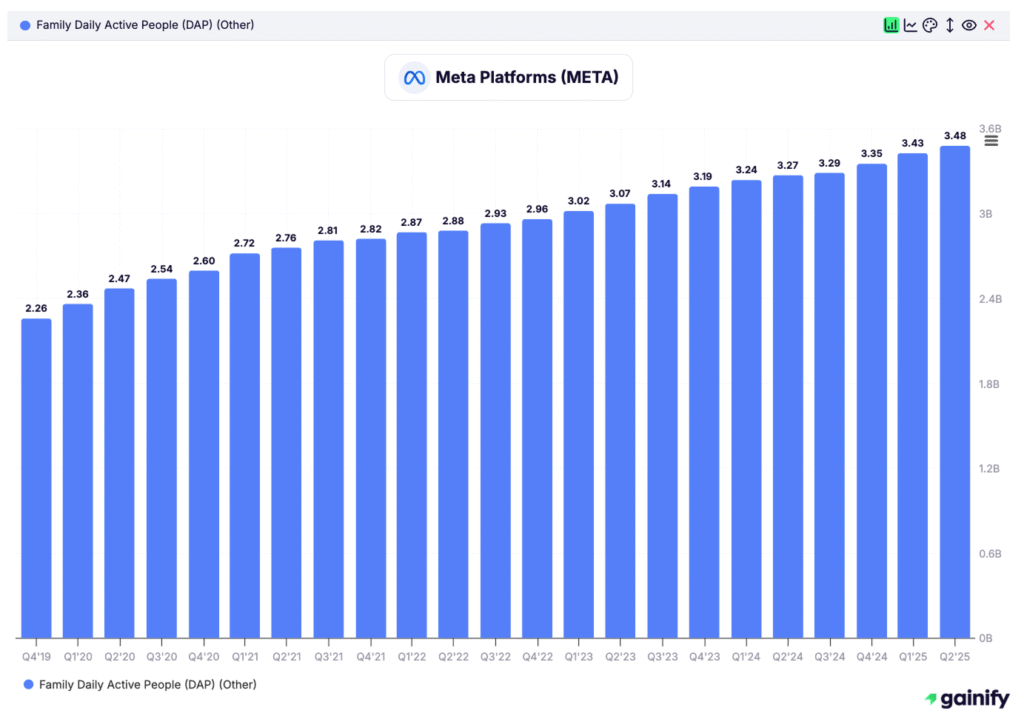

2. Meta Platforms (META)

- Geography: Global

- Platforms: Facebook, Instagram, WhatsApp, Threads

- Angles to watch:

- Meta’s ecosystem still captures the most daily user attention globally, with Family Daily Active People reaching over 3.5 billion in Q3 2025.

- Instagram Reels monetization is improving, narrowing the gap with TikTok.

- WhatsApp is under-monetized but now pushing payments and business messaging.

- Reality Labs continues to lose billions annually, testing investor patience.

- AI-driven ad targeting is boosting ROI, which helped recovery after Apple’s iOS privacy changes.

3. Baidu (BIDU)

- Geography: China

- Platforms: Baidu Tieba, AI-driven content

- Angles to watch:

- Baidu is positioning itself as China’s AI leader, with generative AI tools integrated across search and content.

- Tieba is smaller than Western peers but remains a sticky forum-like platform.

- Ad revenue is cyclical, tied to China’s economy, which has been under pressure.

- Valuation multiples are modest compared to US peers, but sentiment swings with Chinese policy.

- Baidu is more of an AI story now, but its social features add depth to its ecosystem.

4. Reddit (RDDT)

- Geography: Primarily US, expanding globally

- Platforms: Reddit forums and communities

- Angles to watch:

- Went public in 2024 and still finding its footing as a public company.

- Strongly community-driven, which makes ad targeting tricky but offers unique engagement.

- New data licensing deals (for AI training) could become a major non-ad revenue stream.

- High valuation (forward P/E over 100x) raises expectations for rapid growth.

- Volatility is extreme, but Reddit’s role as a cultural hub for retail investors adds intrigue.

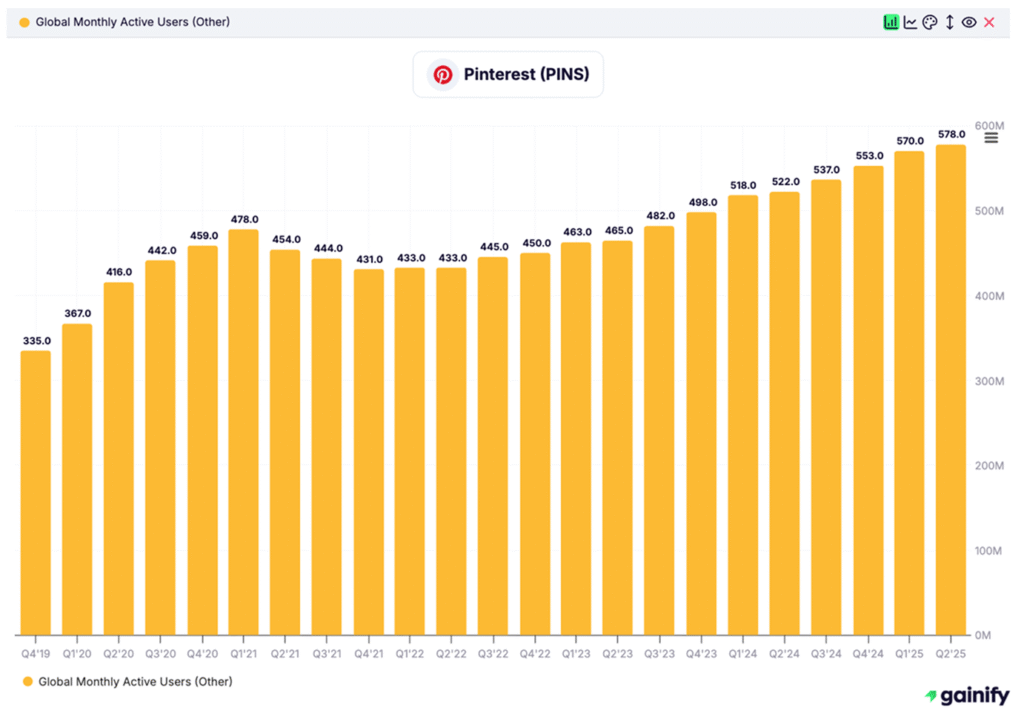

5. Pinterest (PINS)

- Geography: Global

- Platforms: Pinterest

- Angles to watch:

- Pinterest is uniquely positioned at the intersection of inspiration and e-commerce.

- Users come to the platform with purchase intent, which advertisers love.

- Partnerships with Shopify and Amazon improve conversion from “pin to purchase.”

- Revenue is growing steadily, though user growth has plateaued in North America.

- An overlooked but profitable niche play compared to larger ad-driven peers.

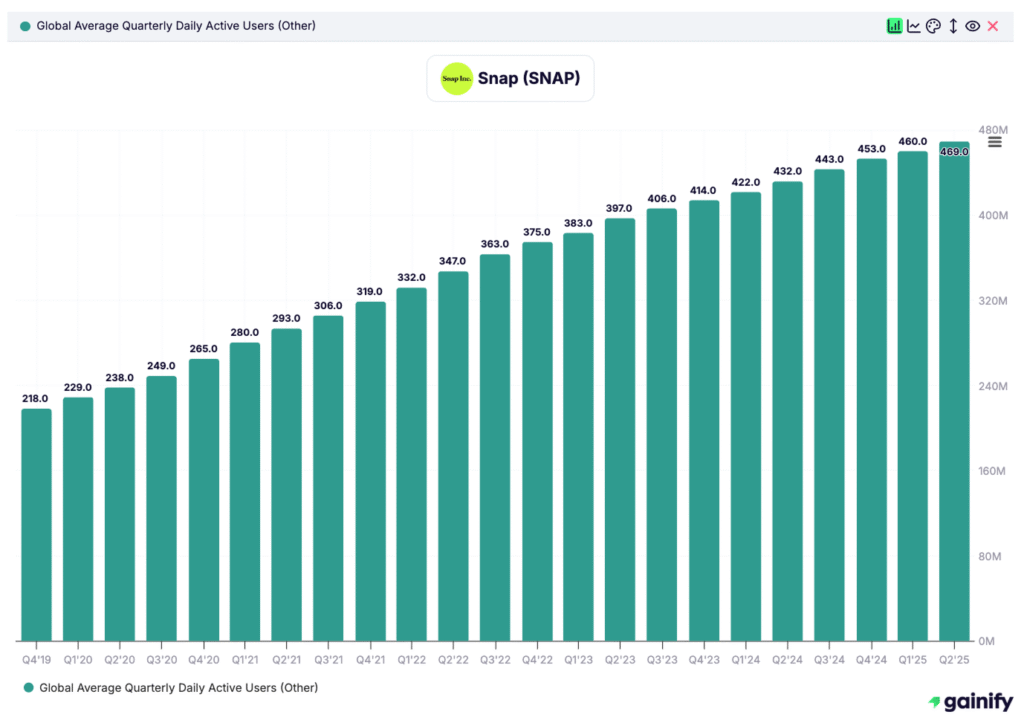

6. Snap (SNAP)

- Geography: North America, Europe

- Platforms: Snapchat, AR lenses, Snap Map

- Angles to watch:

- Snapchat is the default social app for Gen Z in the US.

- Augmented reality is its differentiator, with branded AR ads and filters.

- Monetization struggles continue, as engagement does not always translate into strong ad revenues.

- Competition from TikTok and Instagram Reels pressures growth.

- Investors are watching for cost discipline and whether AR can become a scalable revenue driver.

7. Bilibili (BILI)

- Geography: China

- Platforms: Bilibili video, anime and gaming communities

- Angles to watch:

- Known as the “YouTube for Chinese Gen Z,” it blends video, gaming, and fan culture.

- Extremely loyal communities but monetization remains weak compared to engagement.

- Losses are narrowing, but still a path-to-profitability story.

- Regulatory overhang in China keeps valuations volatile.

- Strong cultural moat, but business execution is the main investor concern.

8. Kanzhun (BZ)

- Geography: China

- Platforms: Boss Zhipin (job-based networking)

- Angles to watch:

- Unique mix of job search + social networking.

- Revenue closely tied to hiring cycles and corporate sentiment in China.

- Operates in a less saturated social media niche, giving it a differentiated angle.

- Exposure to Chinese macro risk is high, but upside comes from digitization of HR.

- Lower volatility than entertainment-driven platforms like Bilibili.

9. Match Group (MTCH)

- Geography: Global

- Platforms: Tinder, Hinge, OkCupid, Plenty of Fish

- Angles to watch:

- Match dominates online dating with the largest portfolio of apps.

- Unlike ad-reliant peers, it is heavily subscription-based, giving revenue stability.

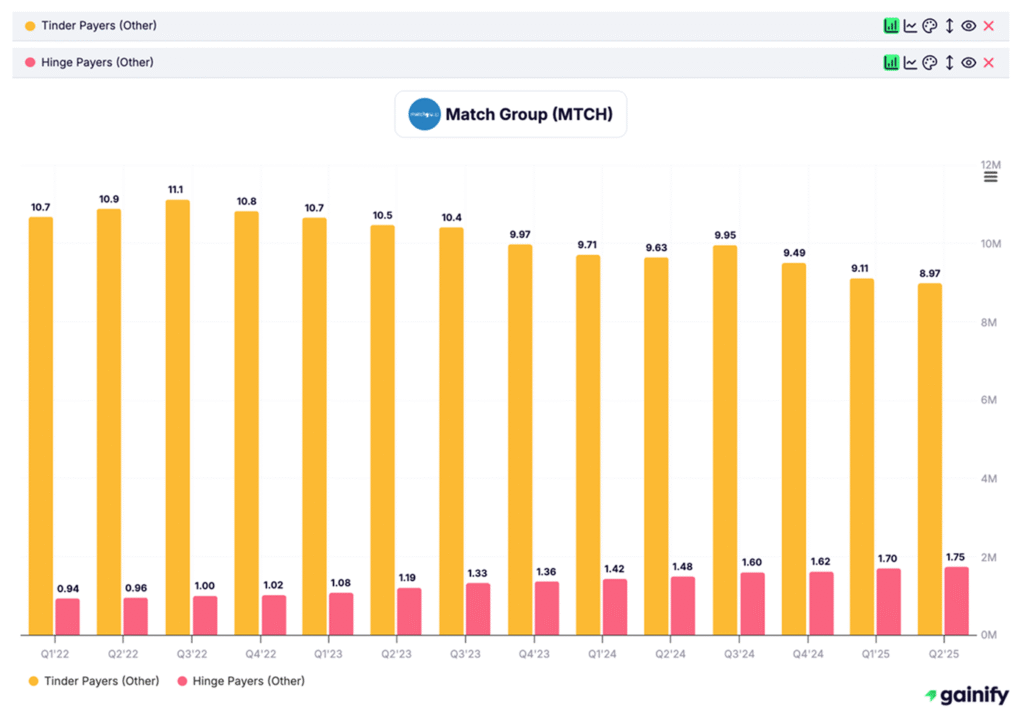

- Growth has shifted from Tinder (maturing) to Hinge (rapid expansion).

- Investor focus is on margins, as subscriptions provide predictable but slower growth.

- Considered more of a “digital services” play than pure social, but network effects are strong.

10. Trump Media & Technology Group (DJT)

- Geography: US

- Platforms: Truth Social

- Angles to watch:

- The most politically charged stock on the list.

- Truth Social has a small but highly engaged user base.

- Valuation is detached from fundamentals, moving more on political narratives than revenue.

- For investors, it is a speculative trading vehicle, not a fundamentals-driven long-term hold.

Key Takeaways

- Scale vs niche: Alphabet and Meta offer global platforms; Reddit, Match, and DJT serve smaller but highly engaged communities.

- Monetization models differ: Ads dominate, but Match thrives on subscriptions, while Reddit experiments with data licensing.

- Geographic risk: US-listed Chinese stocks (BIDU, BILI, BZ) face both growth opportunity and high policy risk.

- AI as a theme: Ad targeting, personalization, and data licensing are reshaping social media business models.