In 2026’s fast-moving stock market, knowing a company personally can be an advantage, but only if it’s backed by structured analysis.

Many successful investors, including Warren Buffett, emphasize investing in individual companies you understand. But does using a product like an iPhone or watching Netflix mean the share of stock is worth adding to your investment portfolio?

This guide breaks down exactly what to look for when buying stock of a company you know. You’ll learn how to analyze financial statements, assess earnings per share, benchmark against public companies, and align purchases with your broader investment strategies. Whether you’re investing in common stock, fractional shares, or building exposure through stock funds, this framework will help you make better stock investments based on more than just brand familiarity.

Start With What You Know — Then Go Deeper

Loving a product is a great starting point, but never the final reason to invest. Just because you use a product every day doesn’t mean its stock price is a bargain, or that the company behind it is financially healthy. In fact, personal attachment can cloud judgment and lead to what behavioral economists call “familiarity bias.”

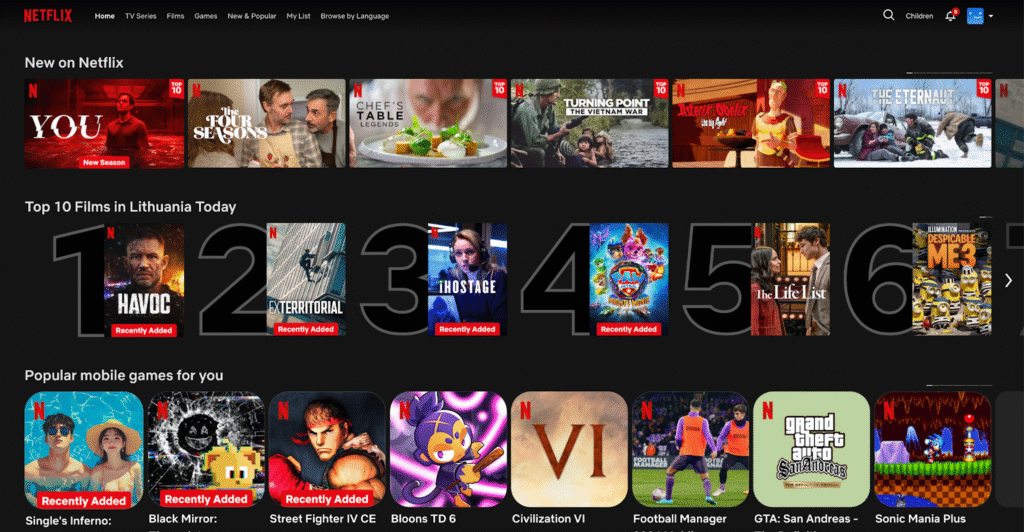

Let’s say you own an iPhone, binge-watch Netflix, or start every morning with McDonald’s. That gives you valuable first-hand exposure to a company’s brand, but to turn that into stock market insight, ask deeper questions:

- What do I truly value in this product or service? Is it design, reliability, customer service, or exclusivity?

- Is demand growing or plateauing? Are lines forming at stores? Are products constantly out of stock? Are others talking about it online and offline?

- What do other consumers say? What are the top complaints, customer ratings, or pain points?

- Are better or cheaper alternatives on the rise? Could a new player disrupt the space, or are competitors gaining ground with innovation or pricing?

- How “sticky” is this product in my life? If it vanished tomorrow, would I immediately look for a replacement—or not notice?

Now let’s apply that lens:

🔹Apple: You may love the seamless experience across iPhone, Mac, and AirPods. But what percentage of the company’s revenue still depends on iPhone sales? Are services like iCloud or Apple Music scaling fast enough to diversify? Is EPS growth keeping pace with share price appreciation, or is the market pricing in perfection?

🔹 Netflix: Addictive content, yes, but how sustainable is its lead? Churn rates are climbing in some markets, password sharing is being cracked down on, and big players like Disney+ and Amazon Prime are gaining ground. Are profit margins expanding despite rising content costs?

🔹McDonald’s: It’s a staple in good times and bad – classic defensive stock behavior. But look under the hood: Are food input costs rising? Are franchisee tensions growing? Can menu innovation and technology offset inflation and labor pressures?

The key is to start as a user and shift your lens to that of an analyst. Great stock investments require you to see past personal preference and into competitive dynamics, business risk, and long-term economics.

In short: don’t just ask whether you like the product, ask whether the business behind it can defend its market position, grow sustainably, and deliver attractive returns on capital over time. That’s how you transform familiarity into focused investment insight.

Evaluate Financial Health and Performance

Even the most recognizable public companies – whether it’s Apple, Netflix, or McDonald’s – must pass the test of financial strength. Individual stocks, no matter how familiar, need to be supported by hard numbers, not brand appeal. Before you add any share of stock to your investment portfolio, analyze these core financial statements and metrics to assess real performance and resilience:

- Earnings per Share (EPS)

Is EPS growing consistently over time? This metric reflects the company’s profitability on a per-share basis and is a key driver of stock price appreciation. Steady EPS growth typically indicates a healthy, scalable business model that’s creating shareholder value.

- Revenue and Net Income Trends

Review income statements across several years, not just the latest earnings report. Are both top-line (revenue) and bottom-line (net income) figures expanding? Smooth, upward trends suggest operational efficiency and product-market fit. Volatility, on the other hand, may signal cyclical exposure or management inconsistency.

- Balance Sheet Strength

Inspect the company’s balance sheet for excessive debt obligations, rising levels of preferred stock, or increasing outstanding shares due to dilution. A strong equity base, manageable liabilities, and minimal debt enhance a company’s ability to weather market crashes, rising interest rates, or inflationary pressure.

- Cash Flow from Operations

Unlike earnings, cash flow from operations reflects actual cash moving through the business. Focus on this over accounting profits – it supports stock dividends, strategic reinvestments, and debt reduction without requiring external capital. Positive, growing cash flow is a hallmark of a financially sound company.

Why It Matters

Financial fundamentals act as the company’s backbone. They help you distinguish between a truly investable business and one that simply has a strong brand. The stronger the fundamentals, the lower the degree of risk, especially during uncertain market conditions. For long-term investors, this analysis separates fleeting hype from real long-term capital gains potential.

Would you like to add a downloadable checklist for quick due diligence?

Understand the Stock’s Role in Your Portfolio

Buying individual stocks, even ones you know and use daily, should never be a standalone decision. Every investment must serve a defined role in your broader investment portfolio, shaped by your risk tolerance, time horizon, and personal financial objectives.

Before purchasing a share of stock, ask yourself:

- Does This Stock Align With My Time Horizon?

Are you investing for a short-term financial goal, such as saving for a large purchase, or aiming toward a long-term goal, like retirement or building generational wealth? Growth stocks like Apple or Netflix can offer significant upside over longer periods of time, but they also come with more volatility. If your goal is stability, defensive stocks like McDonald’s may be a better fit, especially during uncertain stock market cycles.

- How Does This Fit Within My Investment Strategy?

Is this stock part of a well-diversified approach, or are you concentrating too much in a single company or sector? Whether you invest through mutual funds, stock funds, or directly in individual stocks, it is important to define the purpose of each holding. If you use online brokers and buy fractional shares, you may have the flexibility to build exposure gradually and manage risk more effectively.

- Am I Maintaining Diversification?

If your portfolio is already heavy in technology or consumer discretionary companies, adding another similar stock could increase your risk profile. Compare this company to others you own. Does it complement your stock investments, or create overexposure? A diversified portfolio helps reduce the impact of market downturns.

- Have I Considered the Tax and Account Structure?

Are you holding this stock in a taxable brokerage account, where long-term capital gains and your tax rate affect your net returns? Or is this position held within a tax-advantaged account like a Roth IRA? Your account type, investment strategies, and expected holding duration all influence the stock’s role.

The Bottom Line

Even if you are confident in a company’s future, it must align with your overall investment goals, degree of risk tolerance, and portfolio construction. Understanding where a stock fits and what purpose it serves can help you avoid overtrading, overexposure, or emotional decision-making.

Would you like help refining this into a visual decision framework?

Compare to Competitors and the Broader Market

Loving a company’s products is not enough to justify an investment. One of the most common mistakes investors make with familiar businesses is ignoring how the stock compares to its peers and the overall stock market.

A helpful rule of thumb is this: even a great brand can be a poor investment if the share price is too high relative to the company’s fundamentals or competitors.

Before investing in any individual stock, ask critical comparative questions:

- Is Apple’s stock price justified when compared to Samsung or other hardware manufacturers? How do their free cash flow yield and margins compare?

- Does Netflix offer better long-term value than Disney+, considering valuation multiples, content spending, and subscriber trends?

- Is McDonald’s more efficient than Starbucks when it comes to gross profit, unit economics, or international expansion?

What to Benchmark:

🔹 Valuation Metrics

Use price-to-earnings (P/E), PEG ratio, and price-to-book (P/B) to evaluate how expensive the stock is relative to its fundamentals and peers.

🔹 Profitability

Look at EPS growth, operating margin, and gross margin compared to similar public companies in the industry. These help indicate how well the company converts revenue into profit.

🔹 Stock Performance in Different Market Conditions

Study how the stock has performed during market crashes, economic slowdowns, or interest rate hikes. Resilience during tough times can be just as telling as growth during bull runs.

Check Governance and Ownership Dynamics

When evaluating a stock, it’s easy to focus solely on products, performance, and valuation. But the people behind the company—its leadership and governance structure—play a critical role in determining long-term success. Even the best product can be undermined by poor management decisions.

Start by reviewing voting rights. Not all common stock gives shareholders equal say. Dual-class structures may limit your influence, especially in public companies where founders retain control.

Next, assess dilution risk. Are executives regularly issuing new shares or relying heavily on stock-based compensation? A rising number of outstanding shares can reduce the value of your share of stock over time, even if the business grows.

Look closely at the leadership team. Do the company executives have a track record of disciplined growth, innovation, and smart capital allocation? Consistently strong decisions about reinvestment, stock dividends, buybacks, or M&A activity often signal long-term value creation.

Governance does not often grab headlines like product launches or earnings reports, but it can be the deciding factor between a good company and a great investment. Strong, shareholder-aligned leadership supports your stock investments by protecting your interests and maximizing your returns over the long term.

Consider Taxation and Account Type

Taxes can quietly erode your investment returns, so it’s essential to factor them into your decision-making process. Before buying individual stocks, take into account:

- Your tax rate on long-term capital gains, especially if you plan to hold the stock for over a year

- Whether your online broker supports tools like fractional shares, dividend reinvestment, or tax-loss harvesting

- The type of account you’re using — is it a taxable brokerage account, a Roth IRA, or another tax-advantaged account?

A strong-performing stock held in the wrong account, or sold at the wrong time, can generate unnecessary tax drag. Smart investment strategies are not just about finding the right company. They also optimize how and where your capital is deployed.

Final Thoughts: From Brand Familiarity to Financial Clarity

Buying stock in a company you know and love — whether it’s Apple, Netflix, McDonald’s, or Google — can be a smart move, but only if paired with disciplined analysis. Familiarity should spark curiosity, not replace critical thinking.

Your personal experience with a brand gives you a valuable edge. You know how the product feels, how customers react, and what competitors are doing differently. But to make sound stock investments, you must validate that experience through data. Review financial statements, benchmark the company against public companies in its industry, and assess how the stock fits within your investment portfolio based on your risk tolerance, time horizon, and broader investment goals.

The stock market rewards preparation. A familiar product might make you a loyal customer — but only sound analysis can make you a successful investor.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before making any investment decisions.