In modern investing, separating real business strength from financial noise requires more than just tracking earnings per share.

Cash is what truly sustains companies through market cycles and is one of the most effective ways to measure it is through free cash flow yield (FCF yield).

In today’s volatile markets, understanding how to interpret FCF yield can help investors identify businesses that generate genuine, recurring cash while avoiding those reliant on debt or accounting tricks. It’s a metric that speaks directly to financial quality, valuation discipline, and long-term resilience.

A good free cash flow yield depends on the industry, company size, and growth stage. Some signals always stand out: steady cash generation and smart reinvestment often point to lasting value. Spotting those traits is what separates skilled investors from speculators.

In this guide, we’ll break down:

- How to calculate and interpret FCF yield using practical formulas.

- What ranges are considered attractive under different market conditions.

- How sector and company size affect what’s “good.”

- And how to apply FCF yield in building a cash-rich, resilient portfolio.

By the end, you’ll know how to use this metric not as a buzzword, but as a precision tool for smarter investing and better decision-making.

What Is Free Cash Flow? (And Why It Matters)

Free cash flow (FCF) is one of the most reliable ways to measure a company’s financial strength.

It shows how much cash a business generates after covering its operating costs and capital expenditures (CapEx).

This is the real cash left over that can be used to:

- Pay dividends

- Buy back shares

- Repay debt

- Reinvest in growth opportunities

Free cash flow reveals how efficiently a company turns its operations into liquidity for shareholders and lenders.

Depending on the purpose of the analysis, investors usually evaluate two main types of free cash flow:

Two Main Types of Free Cash Flow

1. FCFF (Free Cash Flow to the Firm):

This version looks at the cash available to both equity and debt holders — the entire capital structure.

FCFF = Operating Cash Flow (OCF) − Capital Expenditures + Interest×(1−Tax Rate)

It is commonly used in enterprise valuation models like Discounted Cash Flow (DCF) because it reflects the full cash-generating ability of the firm before financing decisions.

2. FCFE (Free Cash Flow to Equity):

This version focuses only on the cash available to common shareholders after accounting for net changes in debt.

FCFE = Operating Cash Flow (OCF) − Capital Expenditures + Net Borrowing

It captures the company’s capacity to fund dividends, share buybacks, or reinvestment, after considering the impact of debt financing.

In both definitions:

- Cash from Operations reflects the cash generated from the company’s core activities, already adjusted for non-cash expenses like depreciation and changes in working capital.

- Capital Expenditures represent necessary investments in property, plant, equipment, or technology to maintain or expand operations.

What Is Considered a Good Free Cash Flow Yield?

A “good” free cash flow yield (FCF yield) depends heavily on multiple factors, including market conditions, sector characteristics, capital intensity, and a company’s maturity stage. There is no one-size-fits-all answer. Context always matters.

Free Cash Flow Yield | Typical Interpretation |

< 2% | |

2%–4% | Reasonable for well-established businesses in mature industries with stable cash flows and modest capital expenditure needs. |

4%–8% | Attractive territory, often indicates undervaluation for companies with strong operational fundamentals and disciplined capital allocation. |

> 8% | Potential deep value, but can also signal elevated risk, deteriorating fundamentals, or structurally declining businesses requiring careful analysis. |

Context is Critical:

- During bull markets, FCF yields often compress as market capitalizations rise faster than improvements in underlying cash generation.

- During bear markets, FCF yields typically expand as stock prices decline more sharply than business fundamentals, sometimes creating genuine long-term buying opportunities.

General Rule of Thumb:

A 4%–8% free cash flow yield is typically considered attractive for companies with:

- Moderate or low capital expenditure requirements,

- Resilient cash from operations,

- Healthy capital structures,

- And consistent ability to reinvest cash at high returns.

However, in high-growth sectors (like cloud computing, artificial intelligence, or biotech), even lower free cash flow yields can be justified by future scalability. Conversely, in capital-intensive industries (such as energy, industrials, or telecom), investors often demand higher free cash flow yields to compensate for greater reinvestment risks and cyclicality.

✅ Key Takeaway: Evaluating free cash flow yield in isolation can be misleading. The best investors always frame FCF yield relative to sector maturity, reinvestment needs, risk profile, and broader market conditions.

Why Free Cash Flow Matters to Investors

Strong free cash flow is a hallmark of high-quality companies because it reflects much more than just financial flexibility. It captures both operating excellence and intrinsic business value.

Operational Strength:

Companies that consistently generate robust free cash flow demonstrate that their core operations are not only profitable on paper but also efficient at converting revenue into actual cash.

Intrinsic Value Creation:

Free cash flow also plays a central role in valuing companies. Unlike accounting profits, which can be influenced by non-cash items and one-off events, free cash flow anchors a company’s real ability to create wealth for its shareholders over time.

Additionally FCF also shows the company’s ability to:

- Pay dividends from internal resources.

- Buy back shares without issuing debt.

- Fund debt reduction, strengthening financial flexibility.

- Reinvest into profitable growth opportunities — organically.

In other words, companies generating ample free cash flow don’t need to dilute shares outstanding or strain their capital structures to finance operations.

🔔 Key Insight: Free cash flow provides a more accurate picture of business health than net income, especially during volatile stock market conditions. It separates truly resilient businesses from those dependent on cheap debt or aggressive accounting.

How to Calculate Free Cash Flow Yield

There are two primary ways to calculate this crucial financial metric:

1. Standard formula:

Free Cash Flow Yield = Free Cash Flow / Market Capitalization × 100

Where:

Market Capitalization = Current Share Price × Shares Outstanding

2. Alternative formula (per share basis):

Free Cash Flow Yield = Free Cash Flow per Share \ Current Share Price × 100

Where:

Free Cash Flow per Share = Free Cash Flow ÷ Shares Outstanding

Whether you calculate it based on market capitalization or per-share data, the result is consistent, it simply depends on which numbers you are working with.

How Sector and Size Influence Free Cash Flow Yield

Understanding the market environment is crucial:

🔹 Sectors:

- Utilities, consumer staples, healthcare: Higher, more stable FCF yields, driven by predictable flow from operations.

- Technology, biotech, and cloud services: Lower FCF yields, offset by rapid reinvestment and growth.

🔹 Company Size and Market Capitalization:

- Mega-caps: Modest but highly reliable FCF yields due to consistent cash equivalents generation.

- Mid-caps and small-caps: Higher FCF yields, but with greater operational and financing risk.

Investors must always compare FCF yields within similar industries and market capitalization tiers to avoid misleading conclusions.

How to Use Free Cash Flow Yield in Stock Analysis

✅ Identify undervalued stocks:

Look for stocks where free cash flow per share is growing faster than current share price appreciation.

✅ Test financial health:

A high FCF yield coupled with clean capital structures suggests strong fundamentals.

✅ Spot sustainable dividend payers:

Companies with high free cash generation can maintain dividends and execute debt reduction during downturns.

✅ Take advantage of mispriced stocks:

When stock prices drop but flow from operations remains steady, opportunities often arise.

✅ Build a resilient portfolio:

Incorporate FCF yield analysis alongside ROIC, net debt ratios, and margin trends to create a diversified, cash-rich portfolio.

Why Free Cash Flow Yield Is a Valuable Metric

🔹 Focuses on real cash flow, not accounting profits.

🔹 Acts as a reliable indicator for sustainable shareholder returns.

🔹 Reflects capital efficiency, telling investors which companies are truly self-sustaining.

Especially during periods of volatility, when stock markets punish weak fundamentals, companies with strong free cash flow yields historically deliver superior annual returns.

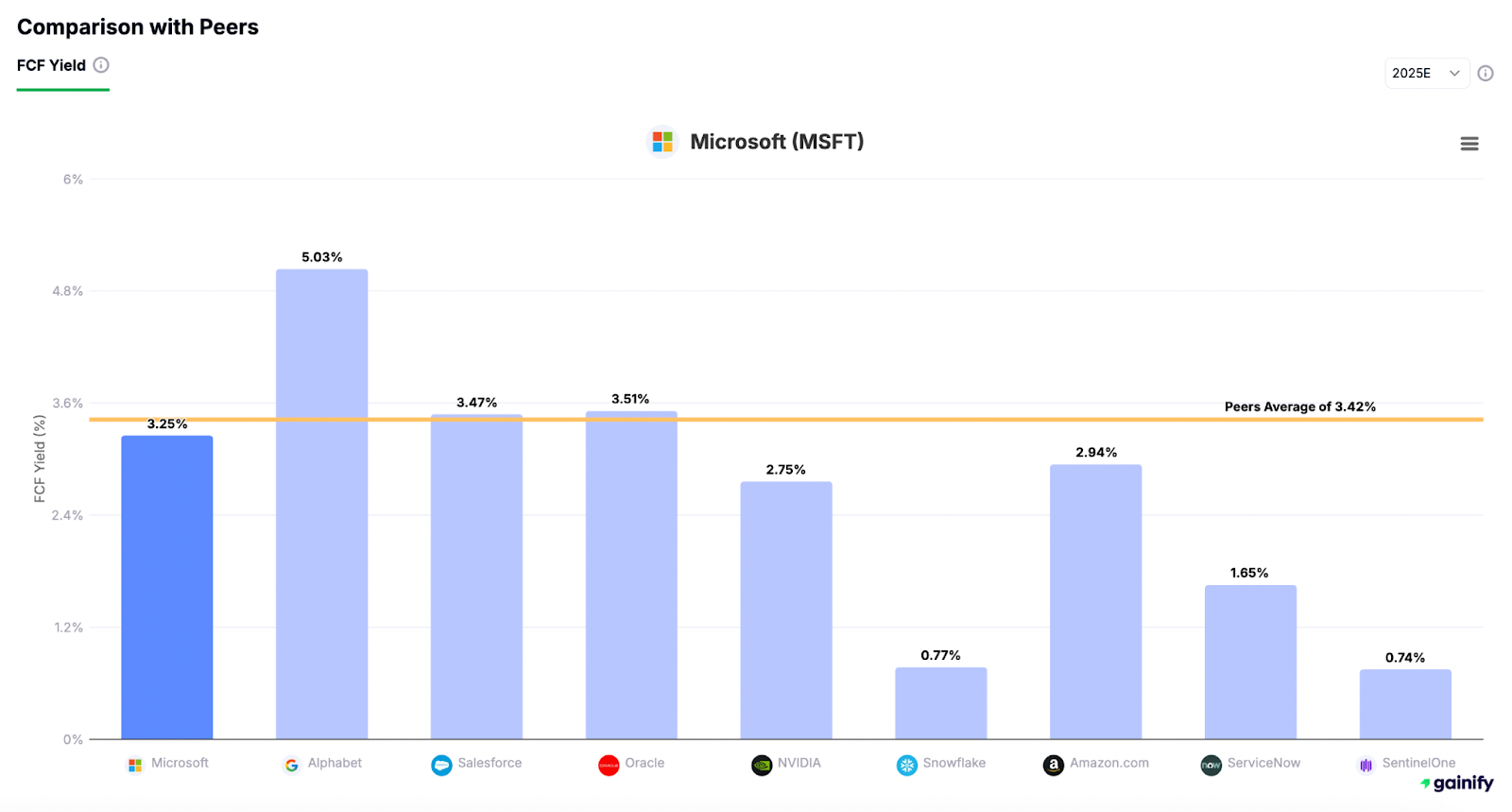

Gainify: Powering Smarter Free Cash Flow Research

At Gainify, we help investors cut through the noise and focus on what truly matters – real cash generation and business value.

Using Gainify’s AI-powered platform, you can:

- Instantly rank companies by free cash flow yield, identifying the strongest cash-generators across industries.

- Track trends in cash from operations relative to current share price, spotting early shifts in market sentiment versus fundamentals.

- Analyze free cash flow per share growth over time to assess a company’s ability to sustainably reward shareholders.

- Evaluate payout capacity, comparing free cash flow against dividends and buybacks to find companies with durable shareholder return profiles.

- Get real-time alerts when free cash flow yield deviations flag potential undervaluation before the broader market catches up.

No guesswork. Just clear, data-driven insights built for smarter, faster, and more professional-grade investing.

Final Thoughts: Why Free Cash Flow Yield Should Anchor Your Strategy

Free cash flow yield isn’t just a helpful tool. It is a cornerstone of serious investing.

Key lessons:

- Target 4%-8% FCF yields for strong risk-adjusted returns.

- Always interpret in context of sector, market capitalization, and company-specific fundamentals.

- Leverage modern platforms like Gainify to stay ahead of market noise and capture real value.

In the long run, it’s cash (not hope) that drives stock price growth. Master free cash flow, and you master investing.