Operating profit margin is a critical measure of profitability that helps investors and business owners evaluate how efficiently a company turns revenue into true operating profit. However, answering the question “What Is a Good Operating Profit Margin?” requires much more context.

What qualifies as “good” depends heavily on the company’s industry, business model, maturity stage, and cost structure. A margin that looks impressive in one sector might be considered weak in another.

Generally, operating margins above 12% are viewed as healthy across many industries, while margins exceeding 20% often reflect exceptional operational strength and durable competitive advantages.

Because operating margins vary so widely across sectors, it is essential to benchmark them against the relevant industry average to make any meaningful evaluation.

Key Takeaways

- Good margin benchmarks: Operating profit margins above 12% are generally considered healthy, while margins above 20% often reflect strong operational efficiency, depending on the industry.

- Industry context matters: Operating margins must be compared against sector averages, since cost structures and competitive dynamics vary widely across businesses.

- Trends over time: Stable or expanding operating margins often signal improving business quality, while declining margins may indicate rising costs or competitive pressure.

- Use with other metrics: Operating margin is most powerful when combined with revenue growth, cash flow, and valuation analysis rather than used in isolation.

What Is Operating Profit Margin and How Is It Calculated?

Operating profit margin measures the percentage of a company’s revenue that remains after covering all core operating costs, but before deducting interest and taxes. This makes it one of the most useful indicators of a company’s underlying operating performance, as it focuses strictly on the profitability of the core business.

Because it excludes financing decisions and tax effects, operating profit margin provides a clearer view of how efficiently a company runs its day-to-day operations compared to net income, which can be influenced by capital structure, tax strategies, or one-time items.

Operating Profit (EBIT) Explained

Definition of Operating Profit (EBIT): Operating profit – also known as EBIT (Earnings Before Interest and Taxes) – is calculated as revenue minus two broad categories of expenses:

- Direct Costs of Goods Sold: These are the costs directly tied to producing goods and services, including variable costs like raw materials, labor tied to production, and production costs.

- Operating Expenses: These include broader overhead costs such as rent, utilities, administrative expenses, advertising costs, salaries for support staff, and other costs required to run the business but not directly tied to production.

Operating Profit = Revenue − Cost of Goods Sold − Operating Expenses

By excluding financing costs (interest) and tax charges, operating profit isolates the performance of a company’s daily operations, giving a clearer and more reliable picture than net income, which can be influenced by non-operating activities.

Operating Profit Margin Formula

Operating profit margin is calculated using the following formula:

Operating Profit Margin = Operating Profit / Revenue × 100

This formula expresses operating profit as a percentage of total revenue, allowing investors and business owners to compare profitability across companies and industries regardless of size.

A higher operating profit margin indicates that a company is retaining more profit from each dollar of revenue after covering operating costs, while a lower margin suggests tighter cost structures or greater competitive pressure.

Why Operating Margin Matters for Investors

Operating margin is a critical measure of operating profitability that offers deep insight into a company’s operational strength and long-term sustainability. Rather than simply reflecting accounting profits, it shows how efficiently a business manages its operational costs, variable costs, administrative expenses, and other day-to-day expenses to convert revenue into actual profit.

A high operating margin indicates that a company retains a larger share of revenue after covering its operating expenses. This operational efficiency provides flexibility: companies with strong margins are better positioned to reinvest in growth initiatives, return capital to shareholders through dividends or share buybacks, or reduce debt — all without needing to rely heavily on external financing.

Strong operating margins also often signal competitive advantages such as pricing power, brand loyalty, or cost leadership. Businesses that consistently maintain healthy margins tend to have better control over their production costs and overhead costs, creating more resilient business models. Conversely, companies with persistently thin margins may face greater risk if revenues slow, cost pressures rise, or market competition intensifies. Thin margins leave less room for error and reduce a company’s ability to absorb unexpected operational shocks, maintain strategic reinvestments, or sustain cash distributions to investors.

Ultimately, operating margin is far more than just a number. It tells a powerful story about how well a company has structured its operations to defend profitability, generate consistent cash flow, and grow share.

What Is a Good Operating Profit Margin?

When asking “What Is a Good Operating Profit Margin?”, the short answer is: it depends heavily on the company’s industry, cost structure, competitive environment, and maturity stage. Different sectors naturally support different margin levels, depending on their ability to control production costs, operational costs, and overhead costs.

For this reason, evaluating a company’s operating margin without benchmarking it against the industry average can easily lead to misleading conclusions. In the United States, the overall average operating margin across sectors typically hovers around 12%, but the variation between industries is wide.

Here’s a more accurate general framework:

Operating Margin | Typical Interpretation |

Negative | Loss-making; often seen in early-stage growth companies, startups, or distressed businesses. |

0% – 5% | Very thin margins; typical in highly competitive, low-margin industries like retail, food production, or airlines. |

5% – 10% | Below average margins; reflects decent cost control but often signals intense sector competition or high operational costs. |

10% – 15% | Moderate margins; often found in stable, mature industries with efficient cost structures and steady cash flow generation. |

15% – 20% | Strong margins; typically signals companies with operational efficiency, brand strength, or competitive pricing advantages. |

Above 20% | Elite performance; often associated with companies in high-margin sectors like software, pharmaceuticals, and professional services, where fixed costs are low and scalability is high. |

Rather than applying a rigid “good or bad” label, investors should always view operating margins in context. Margins should be compared to sector norms, and investors should focus not only on the current level but also whether the margin is stable, improving, or deteriorating over time.

A rising operating margin often signals strengthening operational leverage or strategic pricing improvements, while a declining margin can be a warning sign of competitive pressure, rising variable costs, or operational inefficiencies.

Real-World Examples

Understanding operating profit margins becomes much clearer when looking at real companies across different sectors.

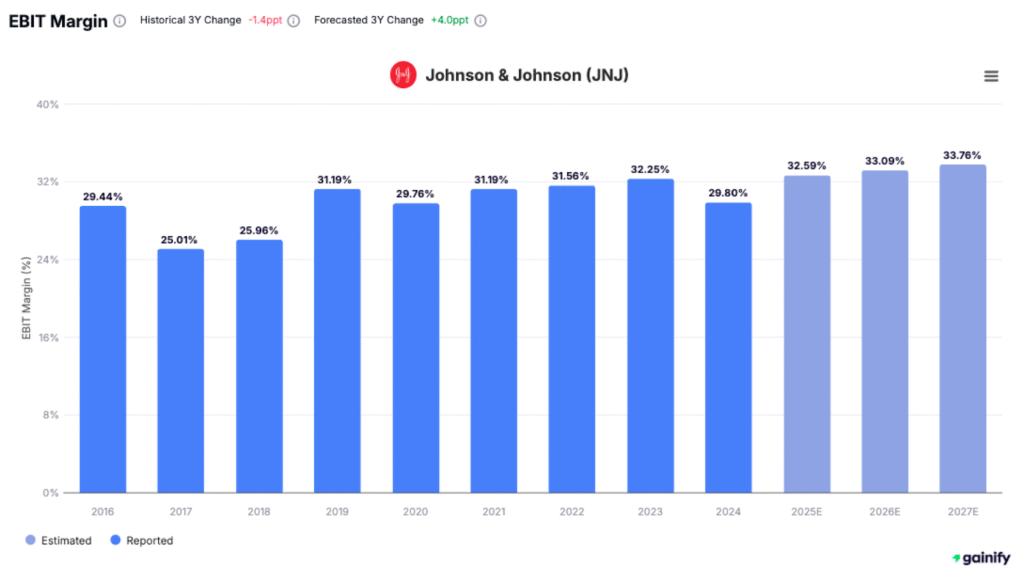

🔹 Johnson & Johnson (JNJ)

Johnson & Johnson has consistently delivered strong operating margins between 29% and 33% over the past several years. As a diversified healthcare leader, JNJ benefits from pricing power, scale, and relatively stable demand. Despite fluctuations in input costs and regulatory pressures, its ability to maintain high margins underscores the financial resilience typical of large pharmaceutical and medical device companies.

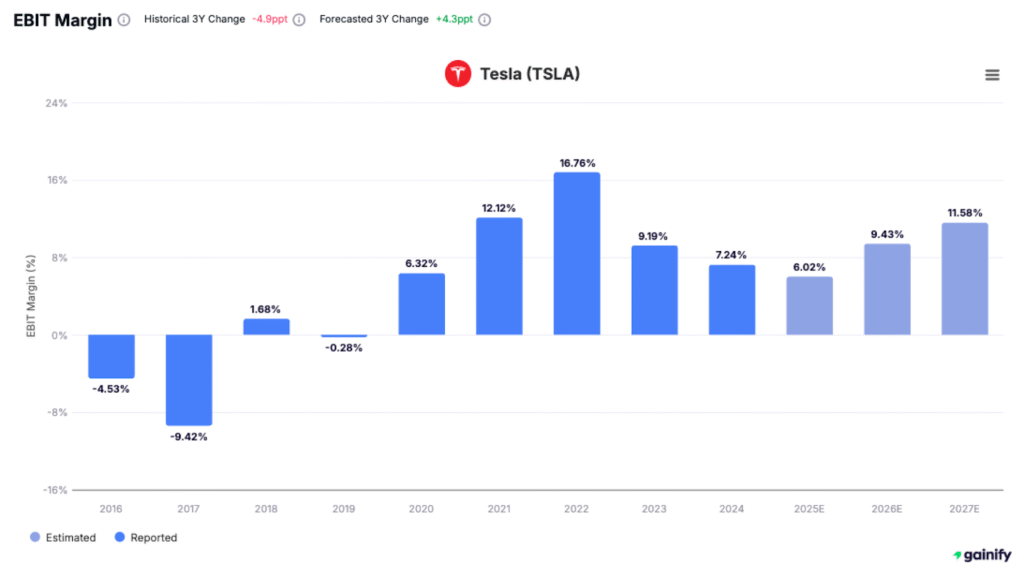

🔹 Tesla (TSLA)

Tesla’s journey with operating margins illustrates how dynamic this metric can be during different phases of company growth. Between 2016 and 2022, Tesla’s margins evolved from deep losses (-9% to -4%) to profitability peaking at around 17%. However, recent competitive pressures, price cuts, and rising production costs have compressed its margins to around 6–9%. Tesla’s example shows how margins can fluctuate dramatically as companies scale production and navigate changing market environments.

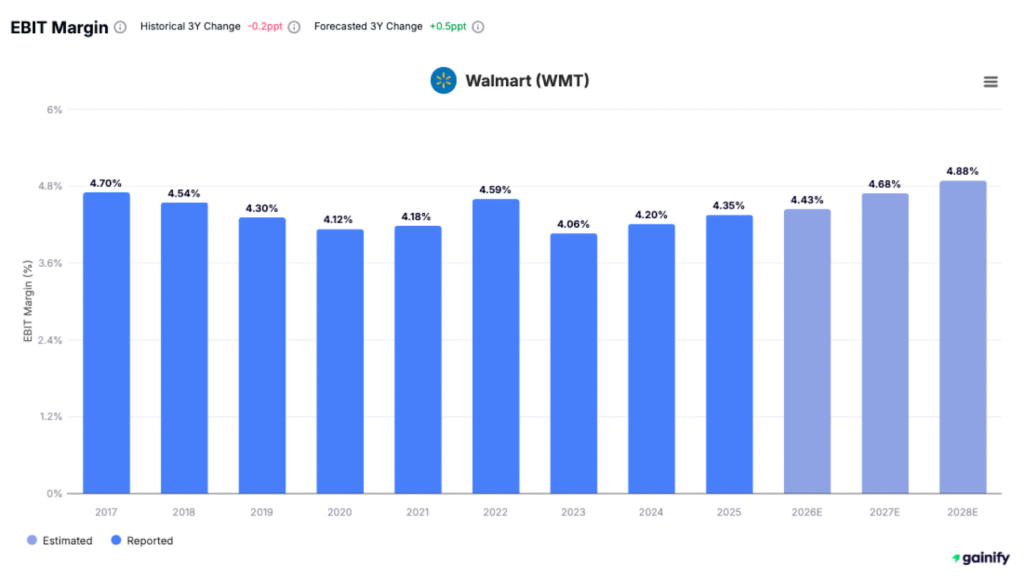

🔹 Walmart (WMT)

Walmart operates with consistently thin operating margins around 4–5%, which is normal for the retail industry. Retailers face significant variable costs such as labor, logistics, and inventory management. Even with its massive scale advantages, Walmart’s operating margin reflects the fierce price competition inherent in the consumer staples sector.

Each example highlights a key point:

👉 What Is a Good Operating Profit Margin? It depends heavily on the industry structure, competitive environment, and operational leverage of the business.

👉 A 4% margin in retail could be considered excellent, while a 10% margin in tech might signal concerns.

That’s why it’s essential to benchmark operating margins not in isolation, but relative to industry averages, business models, and company maturity.

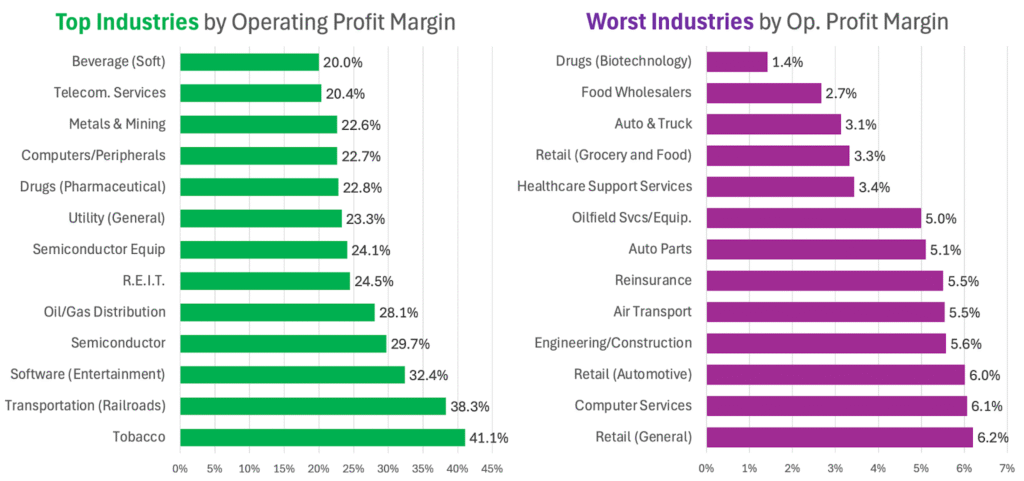

Industry Average Operating Margins

When evaluating a company’s operating profit margin, context is everything. What qualifies as a “good” margin in one industry may be unsustainably high or worryingly low in another. That’s because cost structures, pricing power, and operational efficiency vary dramatically across sectors.

For example, software and tobacco companies often post margins above 30% due to low variable costs and strong competitive advantages. In contrast, retailers, food wholesalers, and construction firms typically operate with much thinner margins, often below 6%, due to intense competition and high operating costs.

The average operating profit margin in the U.S. across all industries is around 12%. This makes it a useful baseline, but not a benchmark on its own. Instead, investors should compare a company’s margin to its industry average, assess whether it’s improving or declining over time, and consider how it reflects the company’s business model, pricing strategies, and cost control.

In short, benchmarking is essential. Without it, even a double-digit margin can be misleading.

Factors That Influence Operating Margins

Operating margins are not just the result of basic revenue-minus-expense math. They reveal how efficiently a company runs its core operations relative to what it earns. A wide range of internal and external factors influence this critical measure of profitability.

Key factors that shape operating margins:

- Management of Direct Costs and Variable Expenses:

Companies that tightly control raw materials, production costs, logistics, and labor expenses can better protect margins, especially during periods of revenue fluctuation or inflation. - Discipline Around Operating Expenses:

Efficient management of administrative expenses, advertising costs, and other indirect costs ensures overhead does not outpace revenue growth. High-margin businesses often achieve this through automation, centralized services, and lean operational structures. - Pricing Power:

Businesses with strong brands, proprietary technologies, or unique product offerings can sustain premium pricing without sacrificing sales volume. This ability to defend or raise prices directly strengthens operating margins and signals durable competitive advantages. - Optimization of Overhead Costs:

Streamlining operational costs — including facilities, IT infrastructure, and supply chains — enhances margin resilience. Companies that proactively reduce waste and adopt scalable systems often expand margins steadily over time. - Business Model Efficiency:

Firms that invest in scalable business models, focus on structural cost advantages, and avoid excessive fixed costs build higher, more sustainable margins. These efficiencies support stronger operating margins and greater resilience across business cycles.

High and stable operating margins are the result of deliberate strategic management across multiple fronts: cost control, pricing discipline, operational scalability, and business model design.

For investors and business owners, understanding these margin drivers offers critical insights into a company’s financial performance and long-term earning power.

How to Use Operating Margin in Stock Analysis

Operating margin is one of the most effective tools for identifying financially strong companies, but only when used thoughtfully. In stock analysis, it should never be interpreted in isolation. Smart investors use operating margin to uncover operational quality, competitive durability, and financial resilience.

Here’s how to apply it properly:

- Always Benchmark Against Industry Peers:

A 5% operating margin may be excellent in grocery retail but would signal significant underperformance in software or healthcare. Without comparing margins to the industry average, you risk misjudging a company’s true operational standing. - Analyze Margin Trends, Not Just Levels:

Is the company’s margin expanding, stable, or deteriorating over time?

➔ Improving margins can reflect growing economies of scale, better pricing strategies, or operational efficiencies.

➔ Declining margins may hint at rising input costs, loss of pricing power, or internal cost management issues. - Understand the True Margin Drivers:

Investigate whether margin strength stems from sustainable operational advantages (such as supply chain improvements or durable brand strength) or temporary factors like cost-cutting initiatives or accounting adjustments. Surface-level margins can mask deeper operational challenges or strengths. - Integrate Margin Analysis into a Broader Framework:

Operating margin should complement — not replace — other key financial metrics. Combining margin insights with revenue growth trends, valuation multiples (such as P/E or EV/EBITDA), free cash flow generation, and management quality assessments provides a fuller, more reliable investment picture.

Bottom Line:

Operating margins are a powerful measure of profitability and operational excellence, but they must be analyzed relative to peers, across time, and within the broader financial context. Disciplined investors use margins not only to filter stocks but also to understand the deeper economic engine of a business.

Final Thoughts

There is no universal benchmark for what makes a “good” operating profit margin across the stock market. The more important question investors should ask is: How does a company’s operating margin compare to its industry peers, and what is the direction of that trend over time?

In general:

- Margins above 12% often reflect solid cost discipline, efficient management of operating expenses, and early signs of scalable operations.

- Margins above 20% typically point to companies with durable competitive advantages, superior pricing power, and best-in-class operational structures.

Strong operating margins are not achieved by accident. They are the result of consistent control over direct costs, variable costs, overhead, and pricing strategy — all reflected clearly in the income statement.

By mastering how to interpret operating profit margins within their proper industry context, investors and business owners can gain a sharper view into a company’s true financial performance, long-term cash flow potential, and resilience across market cycles.