The financial activity of our elected officials holds a unique place in the public imagination. We are drawn to watch what powerful people do with their own money, particularly in a dynamic environment of shifting stock prices and market fluctuations.

Thanks to the STOCK Act, this activity is no longer private. It is a matter of public record that provides a special opportunity for market analysis.

This publicly available data is more than a list of transactions. It offers a window into the investment strategies and beliefs of those who operate at the highest levels of government. Analyzing these disclosures can provide valuable context on how political and economic realities intersect, revealing a unique perspective on the forces shaping our economy.

If you want to check what politicians are buying, we have made several different lists here:

Scrutinizing recent congressional trading activity reveals a distinct narrative that transcends the fate of any one stock. When we connect the dots, a clear pattern emerges. Knowing which specific stocks of companies attract a high volume of purchases can offer insight into their perceived value. More importantly, when many of these trades point to the same types of individual companies, it signals a strategic shift. We can then identify which market sectors or entire industry is collectively seen as being best positioned for future long-term growth, with capital moving toward those areas.

This report will serve as your guide to this crucial information. We will break down the top stocks being bought and sold by members of Congress and explain the potential implications behind these moves. Our goal is to help you use this unique data to better understand the major trends and strategic shifts happening in the market today.

What Gives Politicians the Right to Trade? Understanding the Legal Basis

The notion that lawmakers can actively trade on the stock market often surprises and concerns the public. While politicians hold positions of public trust and have access to privileged information, they are legally allowed to participate in the financial markets—just like any private citizen. They commonly use standard investment accounts and brokerage accounts to buy and sell equity securities on major stock exchanges.

However, this activity is subject to specific laws and oversight mechanisms that aim to promote transparency, mitigate conflicts of interest, and prevent abuse of power. Still, the effectiveness of these controls remains a contentious issue.

Key Legal Safeguards Governing Political Trading

The STOCK Act (Stop Trading on Congressional Knowledge Act of 2012)

This foundational legislation was passed in response to public concern over congressional insider trading. It requires that members of Congress, their spouses, and senior staff disclose most securities transactions over $1,000.

- Disclosures must be made within 45 days of the transaction.

- The information is made public and searchable, allowing constituents, media, and watchdog groups to monitor activity.

- Applies to trades in equity securities, stock funds, mutual funds, and other financial instruments.

Insider Trading Laws

Although elected officials can trade, they are prohibited from using confidential or non-public information gained through their positions to benefit financially.

- Insider trading laws apply equally to members of Congress.

- Trades based on non-public government knowledge such as pending legislation or regulatory decisions are illegal.

- Proving intent or misuse of information remains difficult, leading to limited enforcement despite recurring suspicion.

Ethics Committees and Oversight

Congressional ethics committees are responsible for monitoring members’ financial behavior and ensuring compliance with rules.

- Committees can investigate suspected violations or conflicts of interest.

- However, oversight is often reactive and slow, relying heavily on public scrutiny and whistleblower reports.

- Critics argue that self-policing mechanisms create loopholes and erode public trust.

Why the Debate Persists

Despite these regulations, many Americans feel the current system lacks teeth. The public perception is that politicians may still exploit their unique positions for financial gain, even if their actions are technically legal. This concern has fueled calls for more drastic reforms, including:

- A complete ban on individual stock ownership for lawmakers

- Required use of blind trusts to separate legislators from direct investment decisions

- Real-time disclosures or shorter filing windows to increase accountability

In summary, while it is legal for politicians to buy and sell stocks, their trading is surrounded by controversy. The current legal framework allows participation in the markets but struggles to fully safeguard against conflicts of interest. As the stock market continues to intersect with policymaking, the debate over congressional trading is likely to intensify, placing more pressure on legislators to either improve enforcement or adopt stricter limitations.

Tracking Political Trades with Gainify: Your Real-Time Edge

Staying informed about congressional trading activity can provide valuable insights into market trends, sector rotations, and shifting political priorities. One of the most effective tools for monitoring this activity is Gainify – a platform specifically designed to track, analyze, and visualize trades made by U.S. politicians.

Gainify aggregates public disclosure data directly from government sources, transforming raw filings into a streamlined, user-friendly interface that investors and analysts can use to identify patterns and act with confidence.

Key Features of Gainify

- Explore Top-Traded Stocks: Instantly see which stocks are being bought or sold most frequently by politicians.

- Search by Ticker: Enter a stock symbol to find out if, when, and how frequently it has been traded by members of Congress.

- Track Post-Trade Performance: Analyze how stock prices behave after congressional trades to identify potential trading signals.

- Monitor Industry Shifts: Understand where political capital is flowing across sectors such as tech, energy, health, or defense.

Whether you’re optimizing your portfolio, conducting market analysis, or just curious, Gainify empowers you to make informed, timely decisions with a unique window into the intersection of politics and finance.

Top Political Buys: Reading Between the Lines

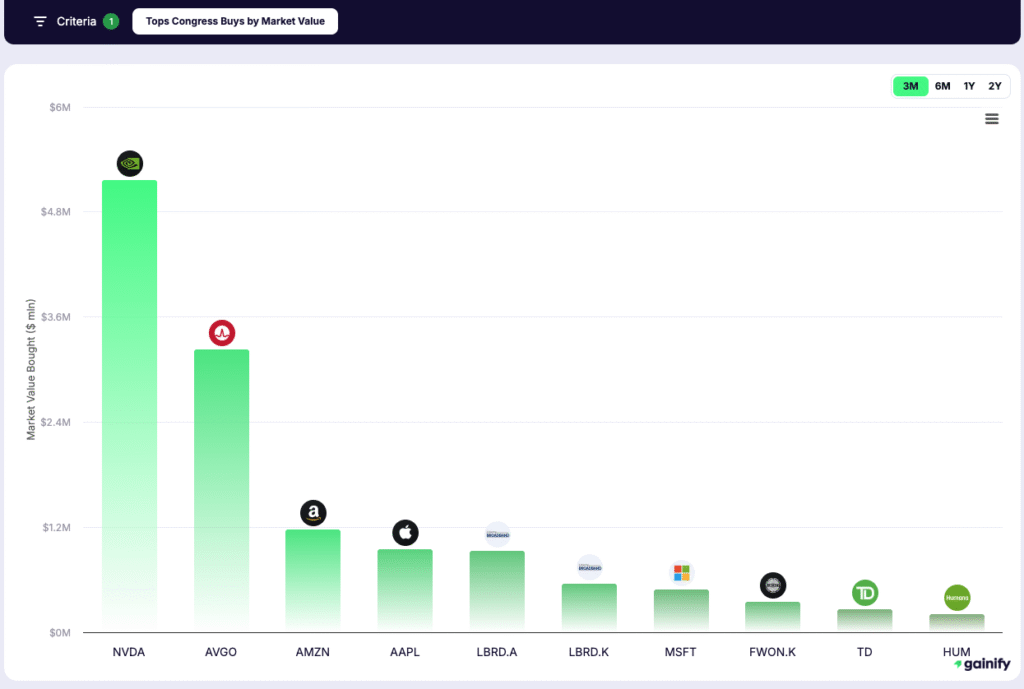

Let’s examine the ten most actively bought stocks by congressional members over the last three months (May, June, and July 2025), measured by market value:

- Nvidia (NASDAQ:NVDA) – Approximately $5.2 million worth of NVDA shares were purchased. Nvidia is a global leader in AI and graphics processing, powering advancements in data centers, machine learning, and autonomous systems.

- Broadcom (NASDAQ:AVGO) – Around $3.2 million in trades were made. Broadcom is a key supplier of semiconductors and infrastructure software for the mobile, broadband, and enterprise sectors.

- Amazon (NASDAQ:AMZN) – Trades totaling about $1.2 million were reported. Amazon dominates e-commerce, leads in cloud computing, and continues to expand across logistics, media, and AI.

- Apple (NASDAQ:AAPL) – Roughly $1.0 million in purchases occurred. Apple is globally known for its consumer electronics and integrated software ecosystem, driving strong customer loyalty and revenue streams.

- Liberty Broadband Corp. (NASDAQ:LBRD.A) – Around $0.9 million in trades were reported. The company holds significant ownership in Charter Communications and focuses on broadband and cable operations.

- Liberty Broadband Corp. (NASDAQ:LBRD.K) – This alternate share class saw approximately $0.6 million in purchases. It represents voting differences but tracks the same broadband-focused operations as LBRD.A.

- Microsoft (NASDAQ:MSFT) – Trades totalingroughly $0.5 million were disclosed. Microsoft is a dominant force in enterprise software, cloud infrastructure, and artificial intelligence solutions.

- Liberty Media Formula One (NASDAQ:FWON.K) – Approximately $0.4 million was invested. This company manages the commercial rights to Formula One racing and monetizes global broadcasting and sponsorship.

- TD Bank (TSX:TD) – Roughly $0.3 million in shares were purchased. TD is one of North America’s largest banking institutions, offering services across personal, commercial, and investment banking.

- Humana (NYSE:HUM) – Around $0.2 million worth of stock was acquired. Humana provides health insurance and Medicare-focused plans, with a strong presence in the U.S. healthcare system.

The Political Selling Spree: What It Means

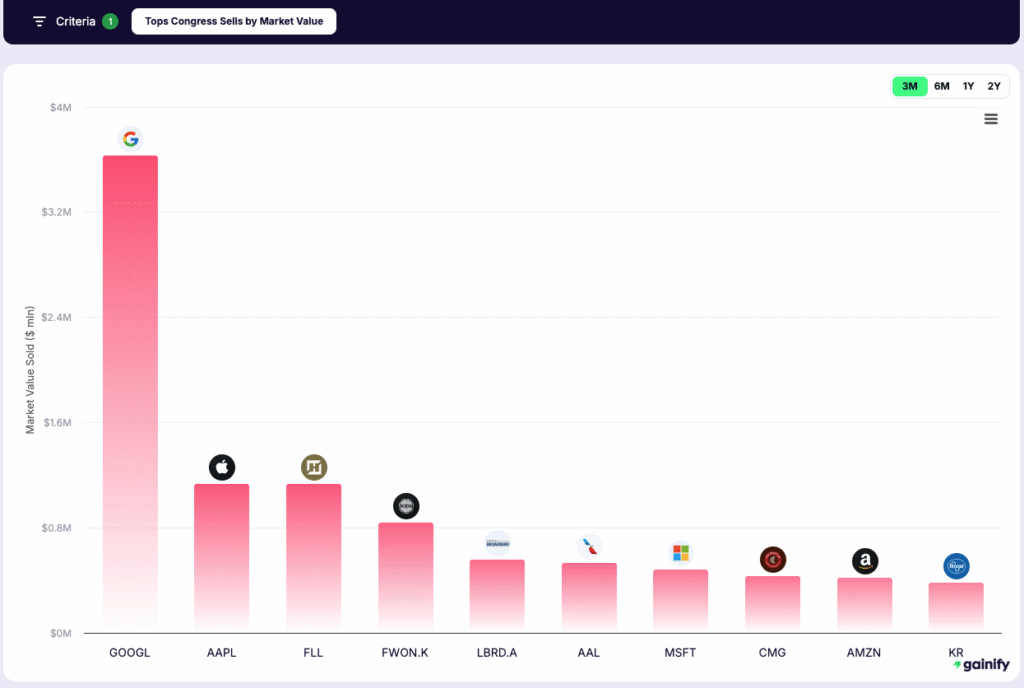

Below are the ten most actively sold stocks by congressional members from May to July 2025, including concise summaries and the approximate value sold:

- Google (NASDAQ:GOOGL)– Roughly $3.6 million in shares were sold. Alphabet, Google’s parent company, remains a powerhouse in online search, digital ads, and cloud computing, but political investors trimmed their exposure.

- Apple (NASDAQ:AAPL) – Approximately $1.1 million worth of Apple shares were offloaded. Apple continues to dominate global consumer electronics, though trades may reflect short-term strategy shifts.

- Full House Resorts (NASDAQ:FLL) – About $1.1 million was sold. Full House Resorts owns, develops, and manages casino and hotel properties across the U.S., operating in both established and emerging gaming markets.

- Formula One Group (NASDAQ:FWON.K) – Sales totaled roughly $0.8 million. This entertainment firm monetizes the global commercial rights to Formula One racing, attracting viewers and advertisers worldwide.

- Liberty Broadband Corp. (NASDAQ:LBRD.A) – Around $0.6 million in sales were recorded. The company manages broadband infrastructure investments, particularly through its stake in Charter Communications.

- American Airlines (NASDAQ:AAL) – Approximately $0.6 million was divested. One of the world’s largest airlines, AAL focuses on domestic and international passenger travel and operational efficiency.

- Microsoft (NASDAQ:MSFT) – Roughly $0.5 million was sold. Microsoft remains a dominant force in software and AI but saw a reduction in congressional holdings over the quarter.

- Chipotle Mexican Grill (NYSE:CMG) – Sales totaled around $0.4 million. Known for fast-casual dining and sustainability branding, Chipotle continues to perform well in the consumer discretionary space.

- Amazon (NASDAQ:AMZN) – Approximately $0.4 million was sold. While still a giant in e-commerce and cloud services, AMZN’s appearance on both buy and sell lists signals portfolio balancing.

- Kroger (NYSE:KR) – About $0.4 million in shares were sold. Kroger operates supermarkets across the U.S., focusing on affordable groceries, pharmacies, and private-label consumer products.

Calls for Reform: Should Politicians Be Allowed to Trade?

In recent years, public debate has intensified around whether elected officials should be allowed to actively trade on the stock market. Critics argue that access to privileged information, even if not directly classified – gives lawmakers an unfair advantage in timing their trades. This has led to growing bipartisan support for stronger restrictions or outright bans.

Proposals include:

- Mandatory use of blind trusts for all investment accounts

- Prohibitions on holding or trading individual stocks while in office

- Real-time disclosure of all trades

- Shorter reporting windows and stiffer penalties for violations

Proponents of reform emphasize that such measures would restore trust in public institutions and reduce opportunities for conflicts of interest. Others argue that banning trading could deter qualified professionals from entering politics. Regardless of the stance, the debate highlights the tension between personal financial autonomy and public accountability.

Final Thoughts: Political Trades as Strategic Market Signals

Political stock trades can serve as a valuable reference point for understanding stock market activity. The investment decisions made by lawmakers reflect patterns in sector focus, regulatory developments, and capital movement. These decisions influence share prices, investor sentiment, and long-term positioning across markets.

Platforms like Gainify provide access to real-time political trade data, enabling investors to track specific tickers, monitor patterns, and follow activity across the entire industry. This information supports research across investment accounts, brokerage accounts, and diversified portfolios.

Political trades can be integrated into broader investment strategies, supporting market analysis, portfolio reviews, and sector evaluations. Investors may also consider the relevance of taxation implications, capital gains, and timing when reviewing their own holdings.

In a dynamic stock market shaped by regulation and policy, the actions of lawmakers offer a practical signal for those seeking to align their approach with emerging trends. When applied with discipline and clarity, this data supports informed and strategic decision-making.