Imagine looking back over a decade and seeing certain companies not merely survive, but thrive, multiplying their value far beyond average market trends. These are not fleeting successes driven by temporary fads or penny stock rallies, but often the result of deep-seated advantages, strong economic moat, and sustained relevance in a dynamic global economy. Uncovering these stories offers invaluable insights into the forces that drive shareholder value and wealth creation in the stock market.

As someone who has navigated the complexities of investment analytics and observed countless market cycles, I can tell you that understanding the engines of past success is a powerful lesson. It is not about predicting the future with certainty, but about recognizing the characteristics that have historically led to superior investment return for long-term investors. This detailed guide will simplify complex ideas for the beginner investor.

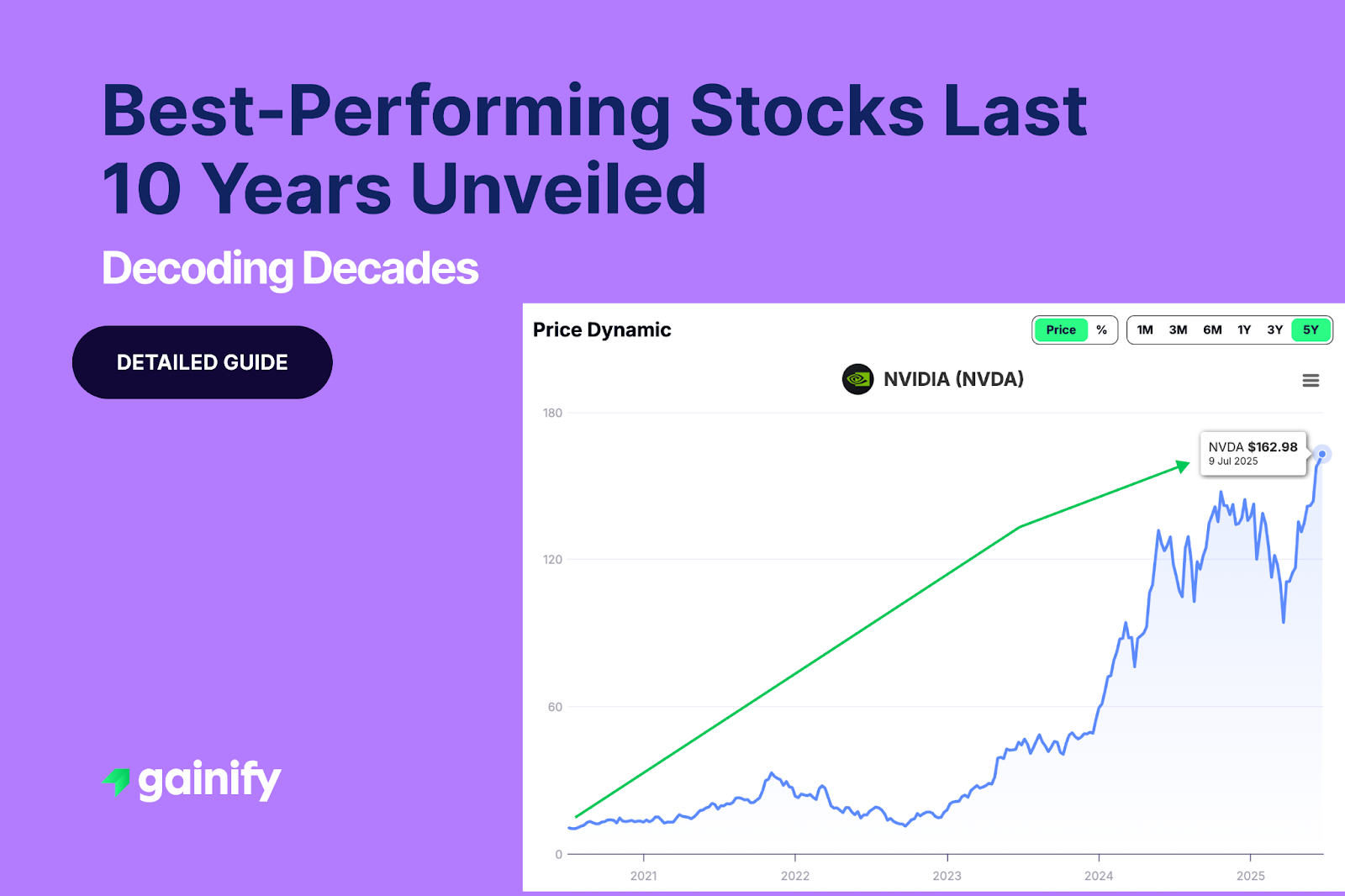

In this guide, we will unveil a select group of companies that have delivered astounding Compound Annual Growth Rate (CAGR) over the past ten years. We will explore what propelled them to the forefront, offering a glimpse into the qualities that define true, sustained outperformance in the equity market. Prepare to delve into the fascinating journeys of companies that truly reshaped their industries and rewarded their shareholders.

What Defines “Best-Performing Stocks”? A Decade of Growth

When we talk about the best-performing stocks of the last 10 years, we are looking beyond simple share price increases. Our focus is on the Compound Annual Growth Rate (CAGR), a powerful metric that represents the smoothed annualized share price gain over a specified period. This calculation accounts for compounding, providing a more accurate picture of an investment value consistent growth over a decade than simple average returns. We specifically highlight companies that have not only achieved impressive CAGR but also maintained a significant presence in the financial markets, defined by a current market cap exceeding $50 billion.

The past decade has been a period of profound technological advancement and shifting consumer behaviors, creating fertile ground for companies that could adapt and innovate. These top performers often share common traits: they disrupt established industries, leverage emerging technologies, and possess robust business models that allow for sustained expansion. Understanding and potentially investing in such companies, when approached as part of a diversified portfolio and a well-defined investment strategy, can lead to substantial long-term gains.

The Growth Titans: Top Performers Revealed

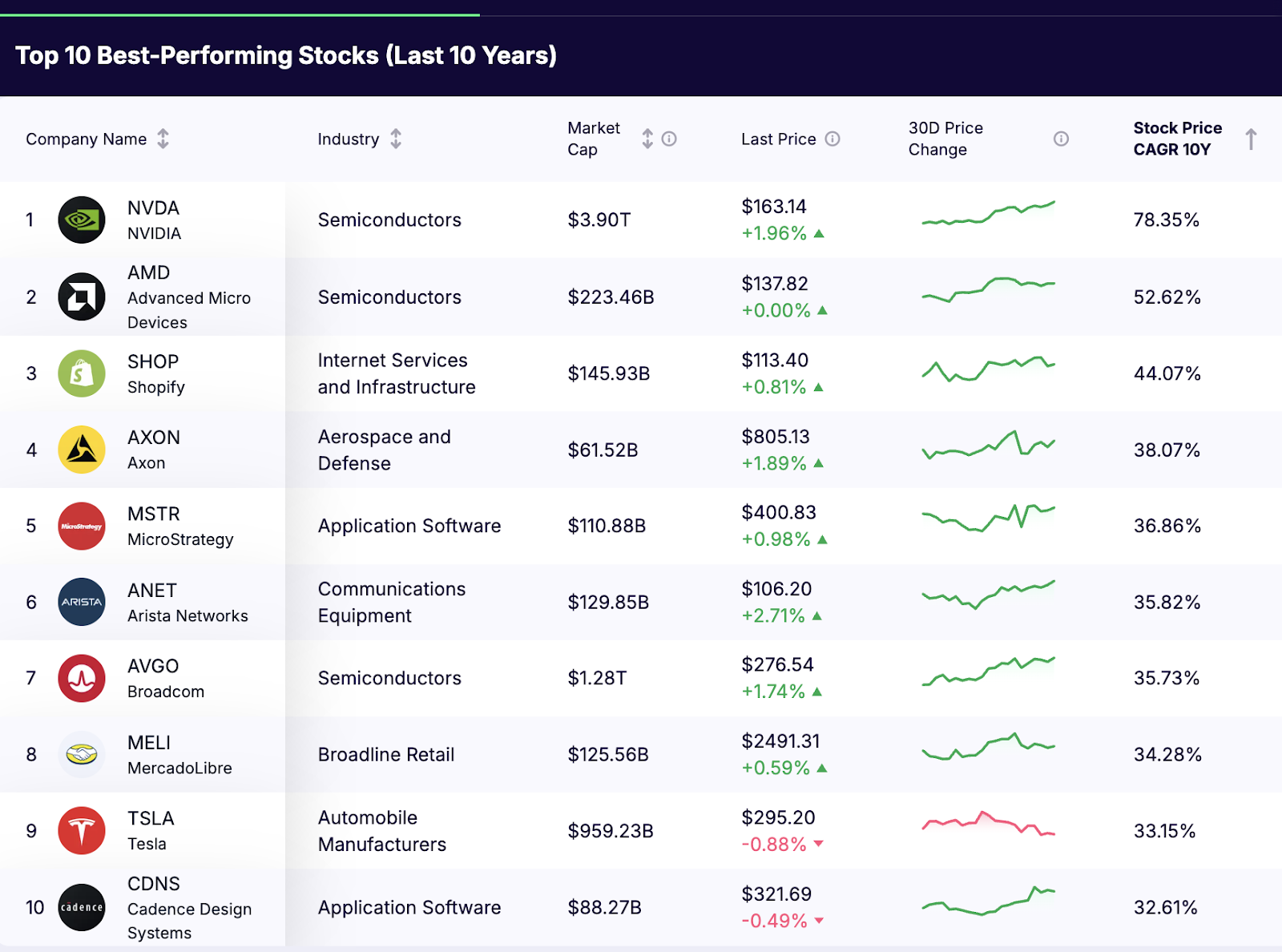

Based on a review of stock market data for the best-performing stocks last 10 years (companies with current market capitalization over $50 billion as of recent data), here are some of the companies that have truly excelled, showcasing remarkable CAGR figures. It is important to note that while these companies are now often mega-cap stocks, their initial share price and market cap ten years ago were significantly smaller, demonstrating immense market appreciation.

10. Cadence Design Systems (CDNS): An application software company.

- Market Cap 10 Years Ago: $5.35 Billion

- Current Market Cap: $88.00 Billion

- 10-Year CAGR: 32.61%

- Cadence provides software, hardware, and IP to design and verify advanced semiconductors, making it integral to the digital transformation and chip industry.

9. Tesla (TSLA): A leader in automobile manufacturers.

- Market Cap 10 Years Ago: $58.53 Billion

- Current Market Cap: $959.23 Billion

- 10-Year CAGR: 33.15%

- Tesla’s pioneering role in electric vehicles and battery technology, alongside its brand strength and ambitious ventures into areas like robotaxis and humanoids, has driven its transformative growth.

8. MercadoLibre (MELI): A broadline retail powerhouse.

- Market Cap 10 Years Ago: $6.80 Billion

- Current Market Cap: $125.56 Billion

- 10-Year CAGR: 34.28%

- Often called the “Amazon of Latin America”, MercadoLibre’s growth reflects the booming e-commerce and fintech adoption across the region.

7. Broadcom (AVGO): Another semiconductors giant.

- Market Cap 10 Years Ago: $59.21 Billion

- Current Market Cap: $1.28 Trillion

- 10-Year CAGR: 35.73%

- Broadcom’s performance stems from its broad portfolio of semiconductor and infrastructure software solutions, driven by demand in areas like broadband and enterprise storage.

6. Arista Networks (ANET): In communications equipment.

- Market Cap 10 Years Ago: $6.44 Billion

- Current Market Cap: $133.55 Billion

- 10-Year CAGR: 35.82%

- Arista has excelled by providing high-performance networking solutions for large data centers and cloud computing environments, a critical area of growth.

5. MicroStrategy (MSTR): An application software company with substantial Bitcoin holdings.

- Market Cap 10 Years Ago: $4.85 Billion

- Current Market Cap: $110.88 Billion

- 10-Year CAGR: 36.86%

- Its pioneering corporate Bitcoin holding strategy has been a significant driver of its stock performance over this period, impacting its valuation beyond its core enterprise software business.

4. Axon Enterprise (AXON): In aerospace and defense stocks.

- Market Cap 10 Years Ago: $2.52 Billion

- Current Market Cap: $61.52 Billion

- 10-Year CAGR: 38.07%

- Axon’s success is tied to its innovative and integrated public safety technology ecosystem, including Tasers, body cameras, and crucial cloud-based evidence management software. These connected solutions have become increasingly vital for modern law enforcement and public safety agencies, driving its continued relevance today.

3. Shopify (SHOP): A key player in internet services and infrastructure.

- Market Cap 10 Years Ago: $3.82 Billion

- Current Market Cap: $145.93 Billion

- 10-Year CAGR: 44.07% Shopify has empowered millions of businesses to build online stores, capitalizing on the massive shift to e-commerce and digital entrepreneurship.

2. Advanced Micro Devices (AMD): Also in semiconductors.

- Market Cap 10 Years Ago: $2.90 Billion

- Current Market Cap: $223.46 Billion

- 10-Year CAGR: 52.62%

- AMD’s resurgence has come from strong product innovation in CPUs and GPUs, challenging established players and expanding its market share.

1. NVIDIA Corp (NVDA): A leader in semiconductors.

- Market Cap 10 Years Ago: $11.90 Billion

- Current Market Cap: $3.90 Trillion

- 10-Year CAGR: 78.35%

- NVIDIA’s growth has been fueled by its dominance in Graphics Processing Units (GPUs) for gaming, the AI chip market, and the data center industry, showcasing the power of high technology.

The Secrets Behind Sustained Outperformance

What sets these companies apart? While each has a unique story, several common threads weave through their success, offering lessons for any investment strategy.

- Innovation and Disruption: Many of these growth stocks pioneered new technologies or fundamentally reshaped existing industries. They identified unmet needs or created entirely new markets. For example, NVIDIA Corp’s dominance in the AI chip market is a testament to this.

- Strong Management and Execution: Exceptional growth requires visionary leadership such as Elon Musk or Huang Jensen and the ability to execute complex plans effectively, adapting to market changes and competition.

- Favorable Industry Trends: These companies operate within sectors benefiting from powerful secular tailwinds, such as the digital transformation, the rise of artificial intelligence, and global e-commerce adoption. Technology-related stocks feature heavily here.

- Scalability and Network Effects: Their business models often allow for rapid scaling, with some benefiting from economic moat or network effects where their product becomes more valuable as more users adopt it. This boosts shareholder value.

- Global Reach: Many of these companies have expanded their operations and customer bases globally, tapping into vast new markets.

For long-term investors, the lesson is clear: identifying companies with these fundamental strengths, and having the discipline to hold through inevitable market fluctuation and market downturns, can be profoundly rewarding. This exemplifies a core principle of investment management.

A Different Perspective: Beyond the Rearview Mirror

While celebrating the best-performing stocks of the last 10 years offers inspiring stories, it is crucial for investors to adopt a forward-looking mindset. Focusing solely on past winners can present a significant pitfall: the survivorship bias. This means we only see the companies that succeeded, not the many others that attempted similar feats and failed or underperformed. The list represents companies that did perform exceptionally, not a blueprint for guaranteed future success.

Chasing past returns is an investment risk that often disappoints. What worked in the last decade might not be the recipe for the next. The very conditions that propelled these companies to such heights a decade ago (e.g., emerging technologies, lower market cap valuations) may no longer exist. Furthermore, these companies are now often mega-cap stocks, meaning their future growth potential, while still significant, may not be as explosive as when they were smaller.

A truly robust investment strategy emphasizes building a diversified portfolio based on future potential, not past performance. This means conducting thorough research, understanding an investment option’s current fair value estimates, assessing future market opportunities, and aligning choices with your personal financial risk tolerance and investment goals.

A financial planner or financial professional can help in this forward-looking process, guiding you through comprehensive investor questionnaires and investing tools. Relying solely on historical annualized return data can lead to suboptimal investment decisions, especially when dealing with the high investment risk associated with aggressive growth stocks. This approach recommends focusing on fundamentals and a margin of safety.

Charting Your Path to Investment Growth

Understanding the best-performing stocks of the last 10 years offers powerful lessons for any investment strategy. These companies exemplify how innovation, strong execution, and favorable industry tailwinds can lead to incredible long-term gains for long-term investors.

Key Takeaways:

- Long-Term Power: Extraordinary investment return is achieved over decades, not days, emphasizing the importance of a long investment time horizon.

- CAGR is Key: Compound Annual Growth Rate reveals true sustained performance, smoothing out market fluctuations and reflecting market appreciation.

- Innovation Drives Growth: The top performers often lead or disrupt their industries through technology and new business models, possessing a significant economic moat.

- Beyond the Past: While inspiring, past performance does not predict future investment return. Focus on future potential, rather than relying on year end strategy based on historical peak price.

- Diversification Remains Paramount: A diversified portfolio (perhaps including an S&P 500 index fund) is crucial to manage investment risk, even when pursuing growth opportunities in mega-cap stocks.

- Personal Alignment: Your financial risk tolerance must guide your investment decisions to ensure comfortable and sustainable investing plans.

Remember, the goal is not to perfectly replicate past success but to apply the underlying principles of strong investment management and disciplined decision-making. As seasoned financial professionals and financial advisors consistently emphasize, a thoughtful approach to personal financial planning is your best guide. This detailed guide aims to provide clarity for the beginner investor. Embrace these insights, understand the dynamics of market changes, and confidently pursue your investment goals in the financial markets.

Frequently Asked Questions about Top-Performing Stocks

Q: What does Stock Price CAGR 10Y mean?

A: Stock Price CAGR 10Y stands for Compound Annual Growth Rate over 10 years. It is a metric that smooths out the investment return over a decade, showing the average annual rate at which the stock’s share price has grown. It is a key measure for long-term gains and assessing consistent performance over a significant time horizon.

Q: Why focus on a 10-year period?

A: A 10-year period is significant for long-term investors because it typically encompasses multiple market cycles, including bull markets and bear markets, providing a more comprehensive view of an investment option’s sustained performance beyond short-term market changes or simple daily average volume metrics.

Q: Are these specific best-performing stocks still good investments today?

A: Past performance is never a guarantee of future investment return. While these companies have demonstrated exceptional growth, their future performance depends on ongoing innovation, market conditions, competition, and their ability to sustain their competitive advantages. Any investment decision requires current research, potentially using Gainify or other analytical tools, and alignment with your investment goals and financial risk tolerance.

Q: What industries were dominant among these top performers?

A: The list highlights the significant role of semiconductors and application software companies, reflecting the broad impact of technology and digitalization over the past decade. E-commerce and specialized industrial tech also feature prominently.

Q: How can I find future top performers?

A: Identifying future top performers involves thorough research into emerging technologies, disruptive business models, strong management teams, and favorable market trends. It is a challenging but rewarding endeavor for long-term investors. Building a diversified portfolio using an S&P 500 index fund or other broad market indices like the Russell 1000 or Russell 2000 is often a more practical investment strategy for many beginner investors, offering broad market appreciation without needing to pick individual winners.

Q: What is a “high market capitalization” in this context?

A: A high market capitalization (over $50 billion in this analysis) indicates that these companies are well-established, often large-cap stocks and leaders in their respective industries. This filters out smaller companies, like a typical penny stock, that might have explosive but unsustainable growth, focusing on mature but still rapidly expanding entities in the financial markets.