Elon Musk’s investment portfolio in 2026 offers a rare window into how one individual is reshaping multiple industries at once. While most investors diversify across sectors and markets, Musk concentrates his capital in a handful of companies he either leads or controls. These businesses are active building blocks shaping the future today.

At the center of his public holdings is Tesla, a company that continues to dominate headlines. Its innovations in electric vehicles, autonomous driving, and robotics play a key role in defining the narrative around future-focused investing. Tesla remains Musk’s most visible asset and the anchor of his market presence.

But Tesla is only part of the picture. Musk’s long-term strategy also includes several privately held companies, most notably SpaceX, which is widely viewed as the most anticipated IPO, potentially already in 2026. Alongside SpaceX, he continues to invest in xAI, Neuralink, and The Boring Company. These businesses are not publicly traded and remain largely owned or controlled by Musk, but they play an important role in his broader long-term ambitions.

There is no official filing or public document that lists all of Musk’s holdings. However, through company disclosures, funding rounds, and infrastructure developments, we can see where his capital is flowing. In 2026, that capital is focused on artificial intelligence, robotics, space logistics, and advanced transit systems.

This article offers a clear, fact-based breakdown of where Elon Musk is investing right now. Each section examines a specific company, highlights recent activity, and explains how it fits into Musk’s broader investment goals. Whether public or private, these ventures are closely aligned and built to scale across industries that are still taking shape.

Musk’s Investment Strategy in 2026: Scale, Control, and Deep Infrastructure

Elon Musk’s investment approach in 2026 is defined by focus, not diversification. Unlike traditional investors who spread risk across sectors and asset classes, Musk channels his capital into a small group of companies he either founded or actively controls. These firms are operational platforms that give him direct influence over the technologies he believes will define the future.

His strategy centers on three key principles:

- Long-term control: Musk prioritizes ownership over influence. He maintains significant equity stakes and leadership roles in every core company he’s involved with, including a 59% stake in xAI, 40%-45% in Space X, and over 12.8% in Tesla. This level of control allows him to direct capital, talent, and product development without compromise.

- Full-stack integration: Musk invests in companies that own the entire technology stack: from data collection and hardware to software and end-user experience. Whether it’s Grok running on Colossus hardware at xAI, or Tesla integrating chips, vehicles, and autonomy software, he avoids relying on third-party ecosystems whenever possible.

- Strategic alignment: Every investment supports a shared goal: building foundational infrastructure for transportation, artificial intelligence, energy, and space. His companies are not siloed. They are intentionally designed to reinforce each other through shared technology, cross-company procurement, and unified long-term planning.

Rather than reacting to short-term market conditions, Musk takes calculated risks aimed at shaping long-range outcomes. His bets on AI, autonomy, and aerospace reflect a belief that the next wave of economic and technological growth will come from systems that are scalable, automated, and deeply integrated.

This strategy has positioned Musk at the center of multiple emerging markets from large language models to orbital logistics. The following sections examine how that capital is being deployed across specific companies in 2026, beginning with the cornerstone of his public holdings: Tesla.

1. Tesla: The Public Cornerstone of a Private Empire

foundation of his public investment presence. It anchors his exposure to listed markets and plays a central role in advancing his broader strategic ambitions.

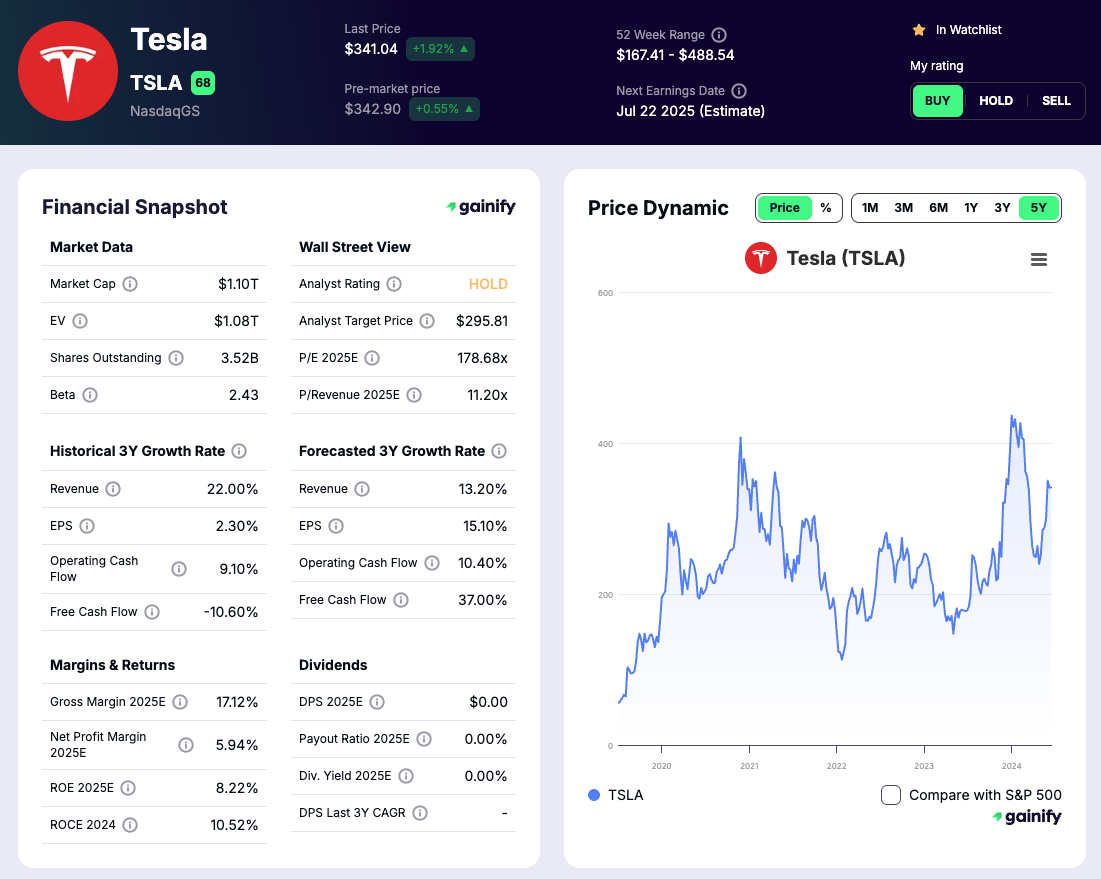

In September 2025, Musk disclosed a high-profile purchase of 2,568,732 Tesla shares at an average price of about $389, a near-$1.0 billion investment that brought his total holdings to roughly 509.4 million shares. At the current trading price of around $448 per share, Musk’s Tesla stake is valued at approximately $228 billion, making it by far the largest single component of his portfolio and a dominant driver of his net worth.

Tesla’s corporate governance story has been a major focus over the past year. In November 2025, Tesla shareholders approved a historic compensation package for Musk that could be worth up to $1 trillion over the next decade, contingent on ambitious performance targets tied to market capitalization growth, vehicle production, robotaxi deployment, and humanoid robotics milestones. The proposal passed with roughly 75 percent support at the annual meeting, even as prominent institutional investors and proxy advisory firms voiced concerns about governance, dilution, and executive risk.

The package itself is structured in performance-based stock tranches that only vest if Tesla hits successive milestones, starting with a $2 trillion valuation and extending toward an $8.5 trillion valuation tied to substantial operational and market achievements. This outcome followed legal challenges to earlier pay arrangements and underscores the degree to which Musk’s compensation and control remain central issues for shareholders.

Operationally, Tesla in 2025–2026 continues to evolve beyond its original identity as an electric vehicle maker. The company is advancing across multiple fronts:

- Electric vehicles: Tesla continues to lead the global EV market with strong sales, expanding production capacity, and growing adoption in emerging regions. Its core business remains profitable and provides the cash flow to fund more ambitious initiatives.

- Autonomous mobility: A major milestone is the planned rollout of Tesla’s robotaxi service in Austin by mid-2025, with national expansion underway through 2026. This move signals a shift from personal vehicle sales to transportation-as-a-service, powered by Tesla’s in-house full self-driving system.

- Robotics: Tesla is investing heavily in Optimus, its humanoid robot platform. Supporting this initiative, the company is acquiring large volumes of Nvidia and AMD GPUs to train and deploy AI models at scale. These hardware purchases mirror those at xAI, showing clear operational alignment across Musk’s companies.

Why it matters

Tesla is no longer just an automaker. It has become a strategic hub for Musk’s wider technological ambitions. As the only major public company in his portfolio, Tesla offers investors rare exposure to a tightly integrated vision of mobility, AI, and automation. It continues to be a key signal for market trends tied to disruptive innovation, climate risk solutions, and long-term capital growth strategies.

2. xAI and the Colossus Supercluster: Building the Core of Musk’s AI Strategy

Among Elon Musk’s private ventures, xAI has become a central pillar of his long-term strategy. Founded in 2023, xAI is focused on developing large-scale artificial intelligence systems that can reason, interact, and scale across consumer and enterprise use cases.

In January 2026, xAI completed an upsized Series E funding round, raising $20 billion from a group of strategic and institutional investors, including Nvidia and Cisco Investments. The round significantly exceeded its original target and materially strengthened xAI’s balance sheet. Following the raise, xAI’s valuation is reported to be north of $200 billion, placing it among the most highly valued private AI companies globally. Musk remains the controlling shareholder, with an ownership stake estimated at roughly 59% prior to the Series E, retaining strategic control of the company.

xAI’s strategy is built around three tightly integrated pillars:

Large language models

xAI’s flagship model, Grok, continues to evolve rapidly and is deployed directly inside X Corp.. This real-time deployment provides a continuous feedback loop between live user interaction and model training. Enterprise-oriented versions are now being tested with select partners, signaling broader commercial ambitions.

Compute infrastructure

At the core of xAI’s scale advantage is the Colossus Supercluster in Memphis. Following the Series E raise, xAI has accelerated its infrastructure buildout, with the cluster operating at hundreds of thousands of high-end GPUs and a clear roadmap toward significantly higher capacity. This compute footprint positions xAI among the most heavily capitalized AI platforms globally.

Data and distribution

Through its integration with X, xAI benefits from direct access to large volumes of real-world conversational data and an immediate global distribution channel. This combination allows rapid iteration, immediate deployment, and large-scale testing of AI-driven features across social, productivity, and emerging enterprise use cases.

Why it matters

xAI is no longer best viewed as a standalone startup. With the completion of its $20 billion Series E, it now operates as a core engine of Musk’s AI strategy, unifying data, infrastructure, and model development under a single, vertically integrated stack. While xAI remains private, it plays a foundational role in Musk’s broader portfolio, anchoring long-duration bets on artificial intelligence, compute infrastructure, and platform-level leverage that may shape multiple industries over the coming decade.d AI stack. This includes the data (X), the infrastructure (Colossus), and the models (Grok). While xAI remains private, it plays a foundational role in his investment portfolio, anchoring long-term bets on artificial intelligence, alternative assets, and future market gains across multiple industries.

3. X (formerly Twitter): From Social Network to AI-Driven Revenue Platform

Since acquiring Twitter in 2022, Elon Musk has transformed the platform into X, a private company now focused on artificial intelligence, data licensing, and financial services. What was once a business built primarily on traditional advertising is becoming a key part of Musk’s broader technology ecosystem.

In early 2025, X was officially merged into xAI, Musk’s artificial intelligence company. This integration gives xAI access to one of the largest sources of real-time human interaction data in the world. Musk held a 42 percent ownership stake in X Corp., giving him continued control over the platform’s strategic direction.

The company’s financial performance has begun to show tangible improvement. In 2021, Twitter generated roughly $4.5 billion in advertising revenue, a level that fell sharply following Elon Musk’s takeover. By 2025, however, X has started to stabilize and rebuild its revenue base. Over the first nine months of 2025, the company generated approximately $2.0 billion in total revenue, putting it on pace for $2.9–$3.1 billion for the full year.

Momentum accelerated in the third quarter of 2025, when revenue reached $752 million, up 17% year over year. Advertising demand has improved meaningfully, with major brands such as Apple and Disney returning to the platform. Engagement trends have also strengthened, with video views rising more than 40% on a daily basis, supporting higher monetization.

Importantly, revenue diversification is playing a larger role. Data licensing, subscriptions, and payments have emerged as meaningful contributors, helping offset lingering volatility in advertising and supporting overall revenue growth. These newer revenue streams were a key factor behind the stronger 2025 outlook.

Operating performance has improved, but profitability remains mixed. In the third quarter, X reported EBITDA of $454 million, signaling better operating leverage and cost control. At the same time, the company posted a net loss of $577 million, driven largely by restructuring charges, debt servicing costs, and continued investment in AI and infrastructure.

Debt remains the company’s most significant financial challenge. X continues to carry roughly $12.5 billion in debt, with annual interest expenses estimated at over $1.3 billion. While higher EBITDA and improving cash generation provide some relief, the capital structure remains tight. Ongoing refinancing efforts are aimed at lowering interest costs and extending maturities, which will be critical to sustaining long-term financial stability.

Overall, the latest results suggest that X is regaining operational footing, supported by improving engagement, returning advertisers, and expanding non-ad revenue streams. However, leverage remains high, and progress on debt reduction will be a key determinant of the company’s financial trajectory going forward.

Why it matters

X is no longer just a social media app. It is now a data-rich, AI-integrated platform that feeds directly into Musk’s artificial intelligence strategy through xAI. With growing non-advertising revenue, improved operating margins, and a tighter link to AI development, X is becoming one of the most strategically important private companies in Musk’s portfolio. Its success reflects a larger shift in how digital platforms can evolve from ad-dependent businesses into engines of AI training, data monetization, and financial product delivery.

4. SpaceX: Engineering Recession-Resilient Infrastructure in Orbit

SpaceX remains one of the most important private companies in Elon Musk’s portfolio, not only because of its technological ambition, but because it represents a long-term investment in physical infrastructure beyond Earth. Musk is estimated to own roughly 40–45% of the company, making SpaceX a core pillar of his private holdings.

In 2026, SpaceX continues to focus its capital and engineering resources on two main areas: Starbase, its launch and development facility, and Starlink, its growing satellite internet business.

- Starbase development: Located in Boca Chica, Texas, Starbase serves as the central hub for the Starship program. The facility supports the company’s plan to enable regular, reusable spaceflight for both cargo and humans. These capabilities are critical to Musk’s long-term goal of building infrastructure for missions to the Moon and eventually to Mars.

- Starlink expansion: Starlink has become one of the world’s largest satellite constellations, providing global internet coverage in remote and underserved regions. The service also enables real-time data transmission for environmental monitoring, emergency response, and commercial communications, giving it both commercial value and geopolitical relevance.

From a valuation perspective, investor expectations around SpaceX have accelerated meaningfully. Secondary market activity and internal discussions in late 2025 and early 2026 point to implied valuations approaching $1.5 trillion, driven by confidence in Starlink’s scale, SpaceX’s launch dominance, and the long-term optionality embedded in Starship. At those levels, Elon Musk’s estimated 40–45% stake alone would imply $600–675 billion of value, making SpaceX one of the single largest contributors to his overall net worth. While the company remains private and management has not committed to a near-term listing, these figures help explain why SpaceX is widely regarded as the most anticipated IPO whenever it ultimately reaches public markets.

Why it matters

SpaceX represents a new category of long-term investment. It is an example of how infrastructure in orbit can serve as a hedge against global economic volatility, supply chain risks, and terrestrial disruption. For investors and planners focused on portfolio resilience, strategic wealth planning, and alternative assets, SpaceX offers exposure to an industry with increasing relevance and long-term growth potential. Its private status limits direct investment, but its partnerships, suppliers, and future IPO potential make it one of the most closely watched companies in global markets.

5. Neuralink and The Boring Company: Moonshots with Strategic Purpose

While they receive less media coverage than Tesla or SpaceX, Neuralink and The Boring Company are essential components of Elon Musk’s long-term investment strategy. Both are privately held and focused on solving complex, high-risk problems in healthcare and infrastructure. Together, they reflect Musk’s willingness to pursue ventures with long timelines and potentially transformative impact.

In 2026, both companies are making steady progress across two very different sectors.

- Neuralink: The neurotechnology startup is now FDA-approved for human clinical trials, marking a major milestone for the company. Its current implant aims to restore vision in patients with certain types of blindness, and additional trials are underway to treat neurological disorders. Neuralink’s scientific team continues to publish research and white papers outlining how its brain–computer interfaces interpret and transmit neural signals. The technology is still early-stage, but it holds long-term potential in medicine, assistive devices, and even human–AI integration.

- The Boring Company: This infrastructure firm is working on tunnel-based transportation systems in cities such as Las Vegas and Dubai. The Vegas Loop is already operational in limited areas, and plans are in development to expand to other urban environments. The goal is to create fast, low-cost alternatives to surface transportation, helping cities reduce congestion and improve mobility. While progress is slower compared to Musk’s other ventures, the company remains active and aligned with his broader goal of building scalable, energy-efficient infrastructure.

Both companies are privately funded, with Musk retaining majority ownership and operational influence. Although neither generates significant revenue at this stage, they represent long-term bets on industries where innovation has been historically slow and capital-intensive.

Why it matters

Neuralink and The Boring Company are examples of how Musk deploys capital into calculated risks with high potential payoff. These companies offer exposure to frontier areas like biotech, real estate infrastructure, and urban mobility, all of which are gaining relevance in a world facing demographic, health, and transportation challenges. For long-term thinkers focused on strategic diversification, portfolio resilience, and innovation-driven returns, these ventures demonstrate how bold ideas can be part of a grounded investment thesis.

6. Political Shifts, Trump 2.0, and Economic Policy Risks

Musk has reduced his political donations significantly after contributing over $300 million to Republican efforts, including support for Donald Trump.

- Strategic pullback: Musk has stated he wants to focus on companies and avoid distractions. This decision aligns with institutional concerns over policy uncertainty and Proposals versus policy misalignment.

- Global impact: Tariffs, tech regulations, and broader economic shifts are now being met with internal strategies at Musk’s firms. His AI policy teams and legal arms are building internal resilience to respond dynamically.

Why it matters

This reduction in political activity is a key part of Musk’s modern investment strategy. For those managing credit portfolios or planning careful estate planning, understanding how politics affect asset values and tariff rates is essential.

Summary Table: Musk’s Investment Positions and Their Implications

Sector | Focus | Musk’s Stake | Estimated Value of Musk’s Stake |

xAI with X | Supercomputing, AI (Grok) | 59.0% | $120–140 billion |

Tesla | Robotaxi, Optimus, GPUs | 12.8% | $228 billion |

SpaceX | Starbase, Starship, Starlink | 40.0%-45.0% | $600–675 billion |

Neuralink | Neural implants, vision tech | >50%* | $4B billion |

The Boring Company | Tunneling infrastructure | >90%* | $5 billion |

Final Thoughts: Musk’s Portfolio as a Map of the Future

Elon Musk’s investments are not merely financial bets. They are carefully structured positions in strategic sectors such as infrastructure, artificial intelligence, energy, and transportation. In 2026, his portfolio represents a highly integrated ecosystem designed to scale innovation across multiple industries. Each of Musk’s companies supports the objectives of the others: Tesla advances vehicle automation and robotics, SpaceX provides global connectivity and launch infrastructure, xAI develops foundational AI models, and X enables real-time data collection and user interaction. Neuralink and The Boring Company represent focused investments in next-generation health technologies and urban mobility.

For investors, wealth managers, and strategic planners, Musk’s approach offers a valuable case study in high-conviction capital allocation. His portfolio is not diversified in the traditional sense but is instead unified by a clear vision for technological transformation. By concentrating control, integrating technology stacks, and aligning company missions, Musk has created a blueprint for building long-term economic resilience and innovation leadership.

Whether tracking publicly traded assets like Tesla or monitoring developments at private firms such as SpaceX and xAI, stakeholders can gain insights into emerging trends that may define the next global growth cycle. Musk’s portfolio is not oriented around the present. It is designed to shape the structure of future markets and the industries that will drive them.

Frequently Asked Questions (FAQ)

Q: Can individual investors access Musk’s private companies like xAI and SpaceX?

A: Direct investment in private companies such as xAI or SpaceX remains largely limited to institutional investors and private equity participants. However, both companies are widely expected to pursue public listings over time, with SpaceX in particular viewed as one of the most anticipated IPOs when market conditions allow.

In the meantime, retail investors can gain indirect exposure through publicly traded partners and suppliers. For example, companies like Nvidia ($NVDA), which supports AI and GPU infrastructure, or Microsoft ($MSFT), which collaborates on AI initiatives, offer entry points. Tesla ($TSLA) also serves as a publicly listed proxy for Musk’s broader technology strategy.

Q: Do Musk’s strategic decisions affect public stock prices?

A: Yes, often materially. For example, Tesla’s share price reacts sharply to developments in electric vehicle adoption, robotaxi progress, and AI integration. Public sentiment and analyst forecasts are also influenced by Musk’s announcements, especially when they involve forward-looking innovations or regulatory breakthroughs.

Q: How can investors align with Musk’s long-term vision?

A: Stay informed through quarterly earnings calls, Investor Days, and research releases from Tesla. Consider investment exposure via ETFs focused on innovation or robotics, public suppliers, and thematic funds tied to AI, space, and autonomous technologies. Diversified vehicles like ARK Invest or technology-focused indices can also serve as tools to participate in the trend without concentrated risk.

Q: Is Musk’s investment approach relevant to estate or strategic wealth planning?

A: Absolutely. His model blends high-growth potential, technological disruption, and capital resilience, offering useful insights for multigenerational estate strategies. For wealth managers, family offices, and high-net-worth individuals, Musk’s capital allocation across public and private markets provides a compelling case study in strategic diversification, alternative asset exposure, and future-proofing wealth through innovation.