Artificial Intelligence is no longer a concept in biotech.

It is becoming the engine that powers AI drug discovery, molecular design, and precision medicine.

Today, algorithms can predict how new compounds will interact with human biology, optimize molecular structures through protein motion analysis, and model clinical trial outcomes before patients are enrolled.

AI is accelerating the drug development process by integrating omics data, high-content screening, and computational toxicology models, cutting years off traditional timelines.

For investors, this represents one of the most powerful intersections of the stock market, clinical data, and computational science in decades.

This space is compelling because of the breadth of scientific and technological approaches. Some companies are pure AI-first innovators, building their platforms on large language models, neural networks, and automated experimentation systems designed for drug design and discovery.

Their platforms scale across antibody therapeutics, mRNA vaccine development, and rare disease research, positioning them at the leading edge of pharmaceutical AI applications. Other biotechnology companies are embedding AI into their pipelines to accelerate R&D, refine clinical trial outcomes, and improve efficiency in life sciences research.

By layering AI into genomics, single-cell assays, and surface plasmon resonance platforms, these companies increase the probability of success across every stage of development.

This article will cover two categories:

- Pure-Play AI Biotech Stocks – companies entirely focused on AI-driven drug design.

- Biotech Companies Using AI – established players leveraging AI as a powerful tool.

By the end, you will have a clear picture of which companies are leading in AI-driven biotechnology and how they differ in risk, scale, and long-term potential.

Pure-Play AI Biotech Stocks

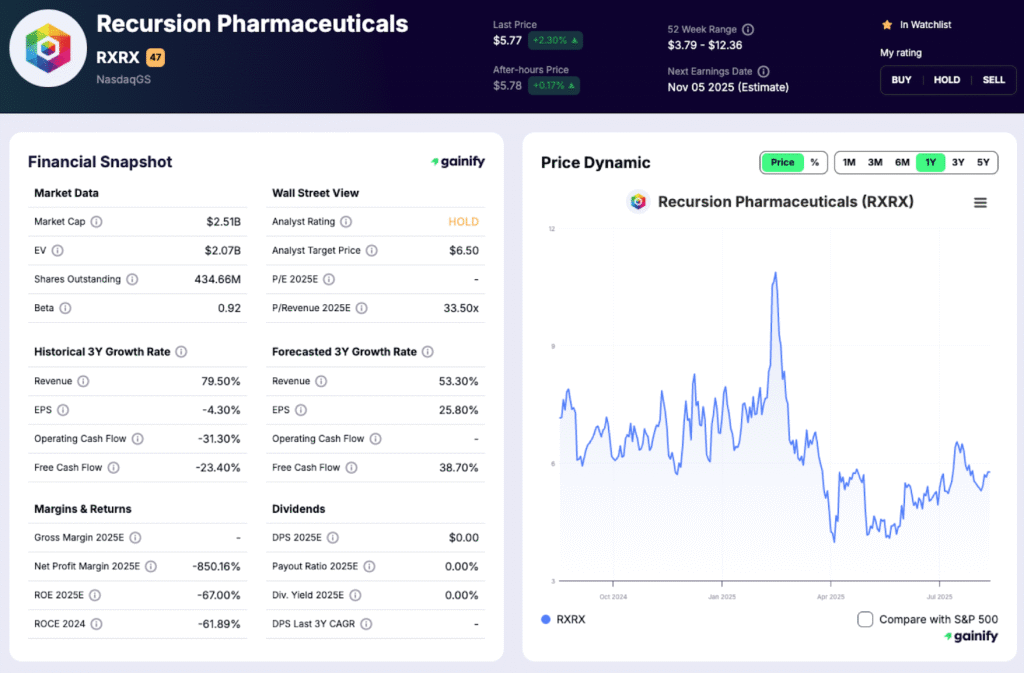

1. Recursion Pharmaceuticals (RXRX)

Recursion is building a data-driven platform for drug discovery, training AI on billions of cellular images to predict how compounds interact with human biology. Its goal is to transform drug development into a scalable, repeatable process rather than a trial-and-error exercise. The company has expanded its capabilities through acquisitions, including partnerships that bring deeper expertise in applying AI-powered diagnostics and scenario models to drug design. This positions Recursion as one of the clearest examples of AI-first innovation in biotechnology.

- Market Cap (Jan 2026): $2.44 Billions

- Analyst 2026 Target Price: $7.00

- P/Revenue 2026: 29.5x

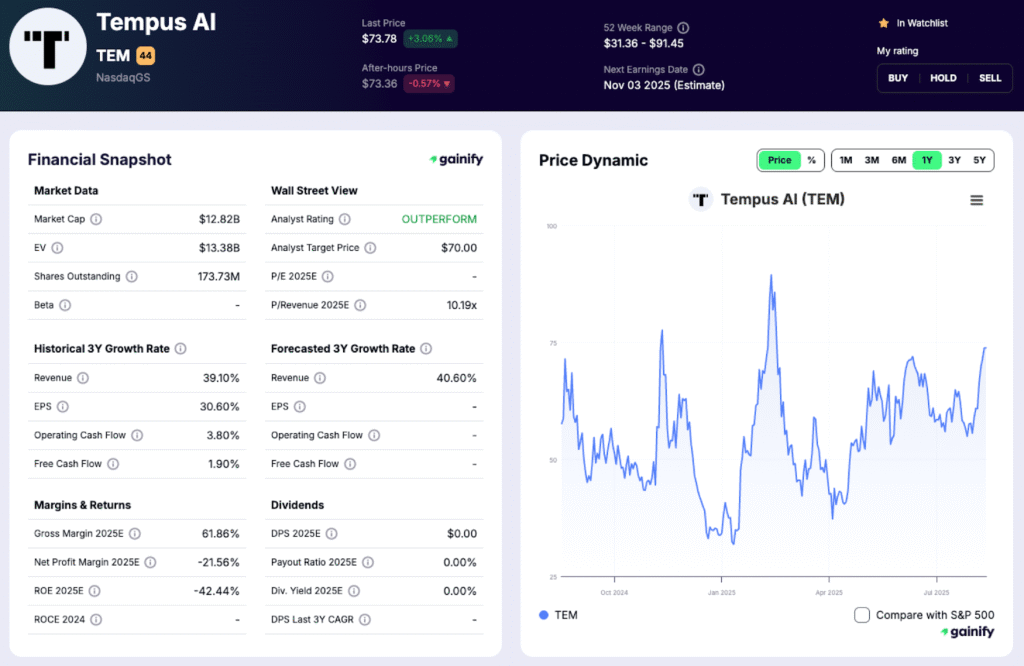

2. Tempus AI (TEM)

Tempus AI is a leading player in precision medicine, offering one of the most extensive AI-integrated platforms in clinical care. It applies AI-powered diagnostics that combine genetic, imaging, and clinical data to generate treatment insights for physicians. Research from Tempus includes neural network–based models for analyzing cellular and imaging data at large scale. While techniques like federated learning are promising in this field, Tempus has not publicly confirmed using them. It reflects a true AI-first approach in personalized medicine, making it one of the most compelling pure-play companies in the space.

- Market Cap (Jan 2026): $11.95 Billions

- Analyst 2026 Target Price: $87.92

- P/Revenue 2026: 7.59x

3. Exscientia (EXAI)

Exscientia was among the first companies to advance an AI-designed drug candidate (DSP-1181) into a Phase I clinical trial, completing design in about 12 months, compared with the multi-year industry norm. Its Centaur AI platform combines generative AI, active learning, and robotics to optimize molecular design rapidly and safely. Through collaborations with Sumitomo Pharma, Sanofi, Bristol-Myers Squibb, Evotec, and the Bill & Melinda Gates Foundation, Exscientia shows how AI accelerates the drug development process from target selection to clinical testing.

- Market Cap (Jan 2026): €633.5 Millions

- Analyst 2026 Target Price: ~$5.70

- P/Revenue 2026: 30x

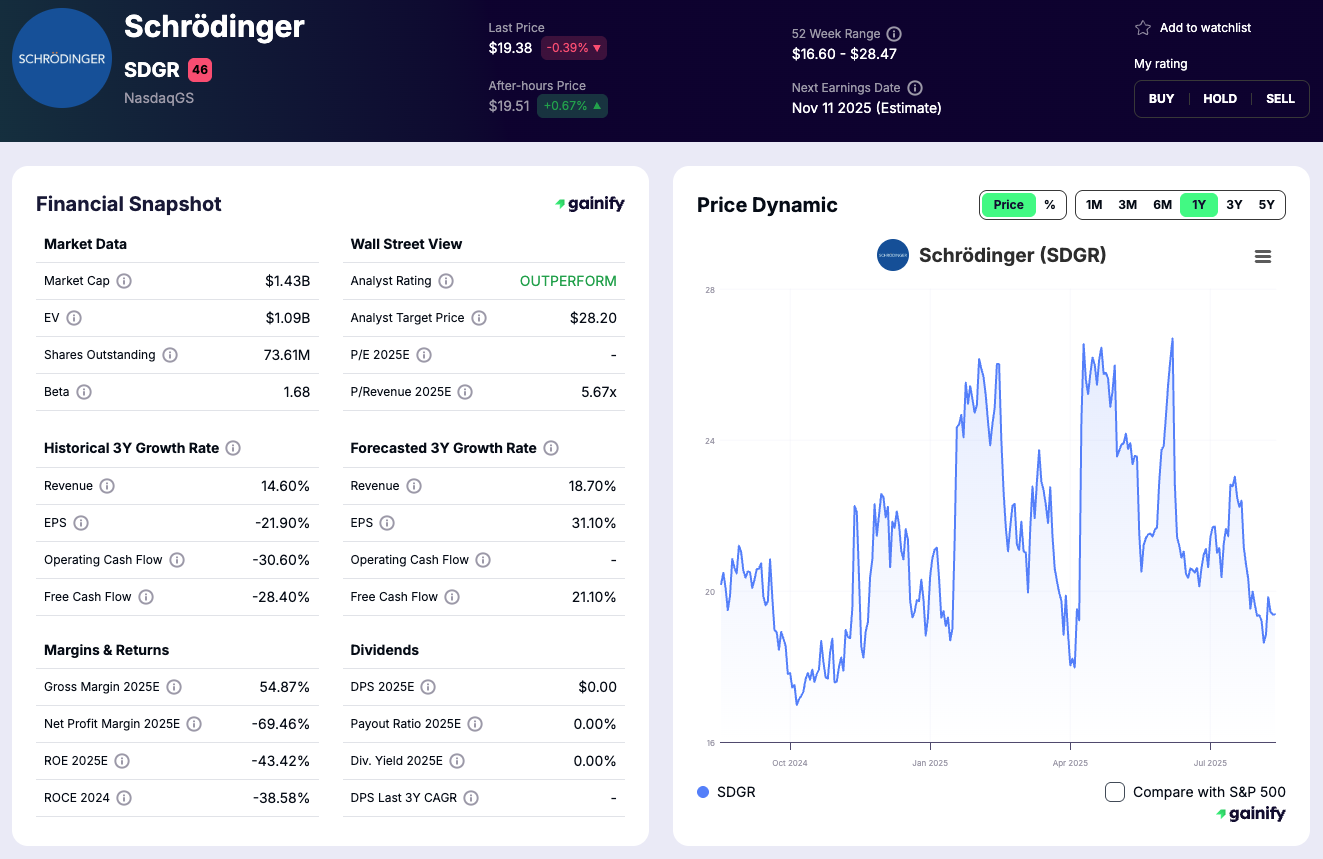

4. Schrödinger (SDGR)

Schrödinger integrates physics-based simulations with machine learning to design new compounds. Its software is widely used across pharmaceutical AI applications, while its internal pipeline applies the same AI tools for oncology and immunology programs. By simulating protein motion analysis and molecular interactions, Schrödinger supports faster drug development processes. With its dual model (licensing software and advancing its own drug pipeline), it captures value across both markets.

- Market Cap (Jan 2026): $1.35 Billions

- Analyst 2026 Target Price: $25.00

- P/Revenue 2026: 4.47x

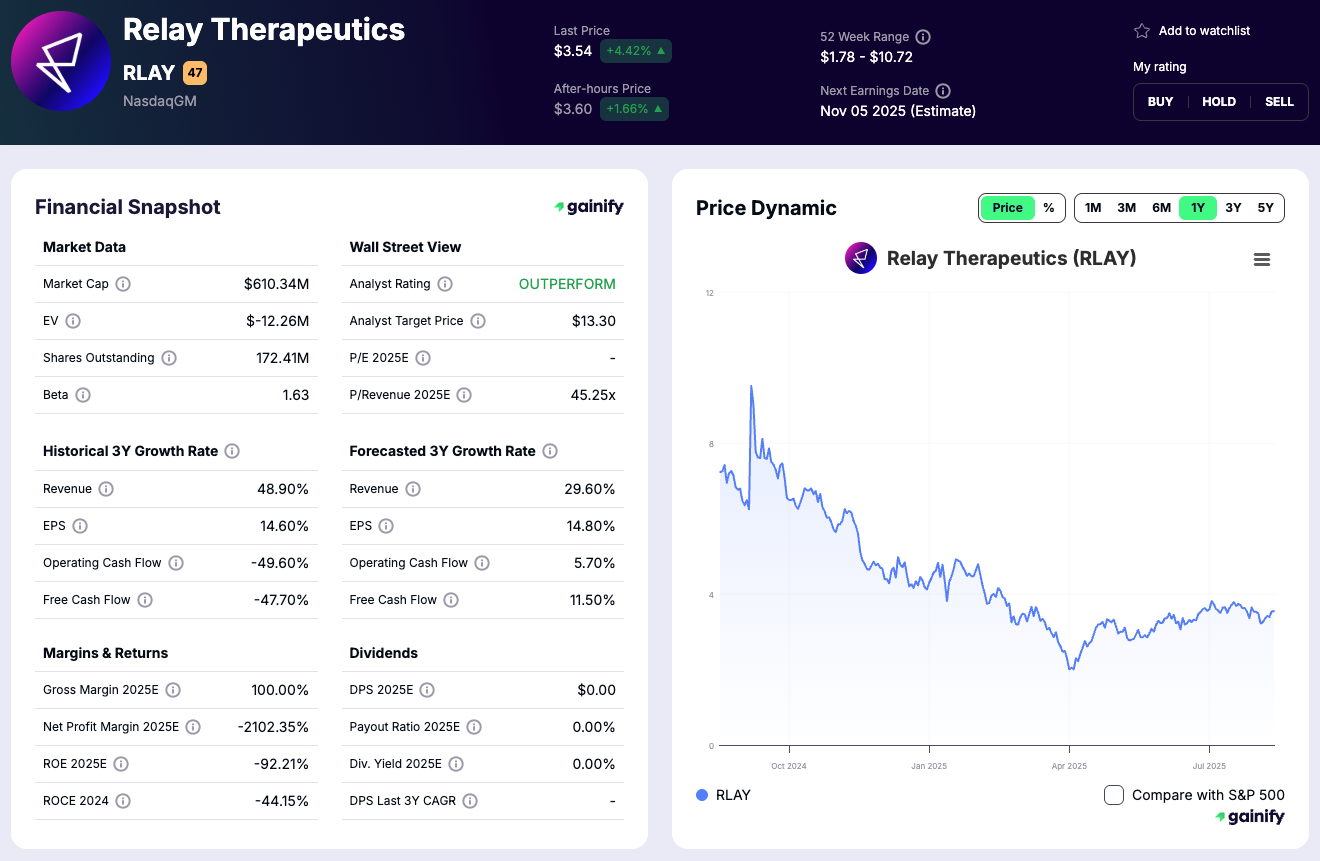

5. Relay Therapeutics (RLAY)

Relay Therapeutics applies structural biology and AI modeling to drug targets once thought undruggable. Its Dynamo platform uses protein motion analysis to reveal new binding sites and guide oncology drug design. The company integrates single-cell assays and omics data to validate targets, strengthening the scientific foundation of its pipeline. Although early stage, partnerships with major pharma signal confidence in its long-term potential.

- Market Cap (Jan 2026): $1.38 Billions

- Analyst 2026 Target Price: $14.60

- P/Revenue 2026: 103.8x

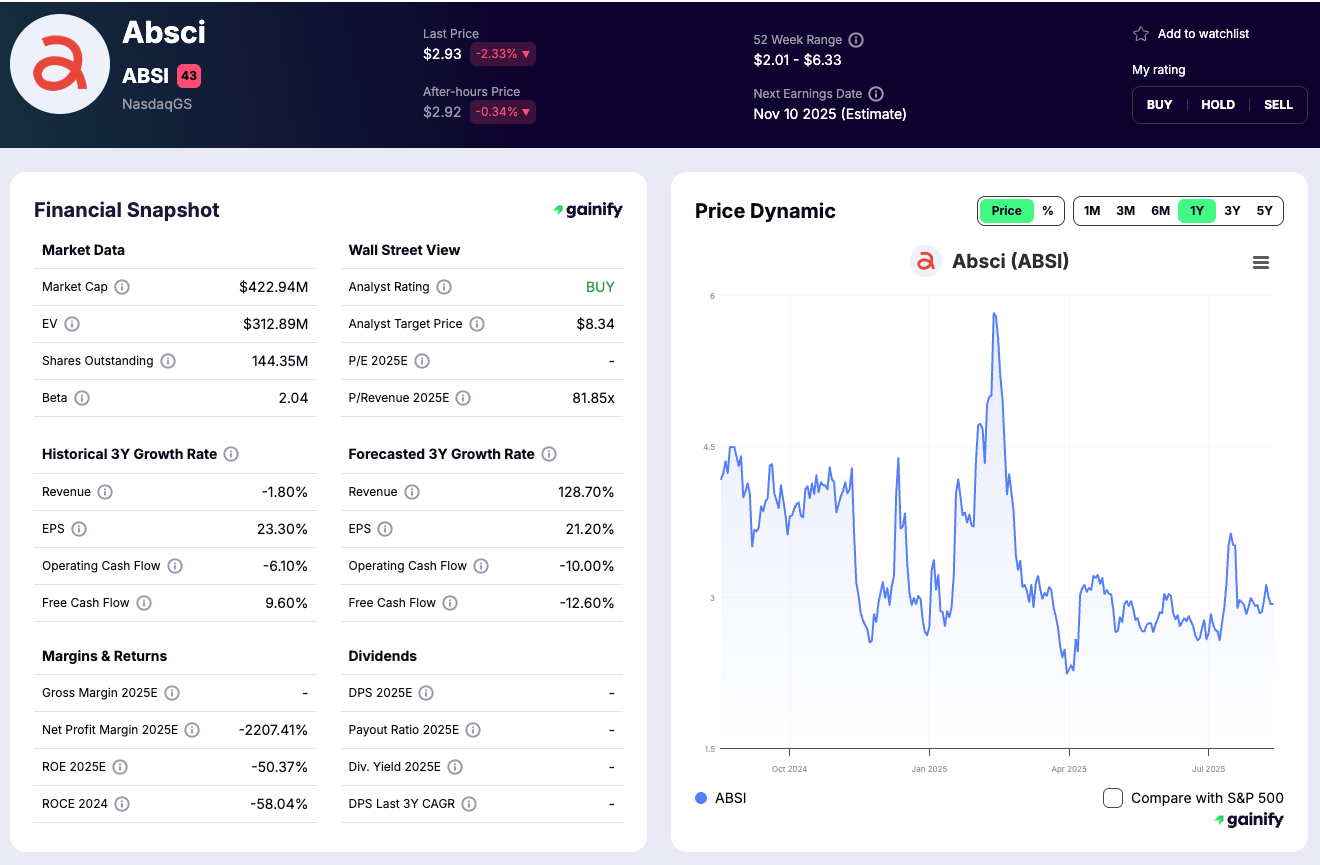

6. Absci (ABSI)

Absci’s AI-driven drug creation platform, Integrated Drug Creation, combines generative AI with synthetic biology to rapidly design novel protein-based drug candidates. The company’s technology can create and validate new antibodies from scratch, a process known as de novo design. This approach allows Absci to simultaneously optimize multiple drug characteristics, potentially accelerating time to clinic and improving the probability of success. Absci’s pipeline includes programs for inflammatory bowel disease (ABS-101) and androgenic alopecia (ABS-201), with partnerships with major pharmaceutical companies like AstraZeneca and Almirall validating its platform.

- Market Cap (Jan 2026): $497.7 Millions

- Analyst 2026 Target Price: $8.05

- P/Revenue 2026: 26.9x

Biotech Companies Using AI, but Not Pure Plays

These companies are not built as AI-first businesses, but they are embedding AI at scale to strengthen R&D pipelines, accelerate trial outcomes, and improve drug development efficiency.

- CRISPR Therapeutics (CRSP)

CRISPR Therapeutics applies AI to gene editing technologies, improving guide RNA design, predicting off-target edits, and enhancing editing efficiency. AI supports the development of immune-modulating therapeutic cancer vaccines and other CRISPR-based therapies, strengthening its oncology pipeline. - NeoGenomics (NEO)

NeoGenomics integrates AI into oncology diagnostics, analyzing omics data and molecular signatures to improve precision testing. Its labs apply AI-powered imaging studies and data interpretation to better match patients with targeted therapies, directly supporting clinical trial outcomes in precision oncology. - BioNTech (BNTX)

BioNTech expanded its AI footprint through the acquisition of InstaDeep, a leader in deep learning and generative AI solutions. AI now powers its mRNA vaccine development programs, including work on the H5N1 avian influenza vaccine and antibody therapeutics. BioNTech is also advancing immune-modulating therapeutic cancer vaccines, using AI to model responses and optimize development. - Moderna (MRNA)

Moderna integrates AI into mRNA vaccine development, using algorithms to predict immune responses, optimize mRNA sequences, and simulate clinical trial outcomes. By combining omics data, wet-lab automation, and pharmaceutical AI applications, Moderna accelerates therapies ranging from rare diseases to pandemic-scale vaccines. - Novo Nordisk (NVO)

Novo Nordisk is embedding AI into drug design and metabolic disease research. Through AI-driven modeling, it enhances candidate screening for diabetes and obesity treatments, while exploring AI infrastructure to scale its R&D productivity across the biopharma industry. - AbbVie (ABBV)

AbbVie is advancing AI integration through its Research and Development Convergence Hub, applying computational toxicology models, high-content screening, and generative AI tools to accelerate pipeline discovery. The company is particularly focused on oncology and immunology programs where AI can improve trial design and therapeutic targeting. - Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb uses AI across oncology and cardiovascular research, embedding it into clinical trial optimization and patient selection. Its AI-enhanced platforms analyze single-cell assays and surface plasmon resonance data to refine antibody therapeutics and expand discovery pipelines.

A Different Way to See It

Investors are naturally drawn to the headline AI-first biotech names like Recursion and Tempus, where the business model revolves entirely around generative AI solutions, deep learning, and automated drug design. These platforms are high risk, but they also represent some of the boldest bets in the biopharma industry, with the potential to reshape the entire drug development process if successful.

At the same time, established biotechs such as BioNTech, CRISPR Therapeutics, and Moderna are embedding AI into pipelines that already generate billions in revenue. They may not trade at an “AI premium,” but they are steadily deploying predictive analytics, scenario models, and pharmaceutical AI applications to improve clinical trial outcomes, reduce discovery timelines, and enhance the efficiency of large-scale programs such as mRNA vaccine development or gene editing technologies.

The takeaway for investors is clear: the most resilient strategy is not choosing one side or the other, but understanding how these two approaches complement each other. AI-first innovators bring growth potential and asymmetric upside, while AI-enhanced biotechs deliver scale, resilience, and immediate clinical impact. Together, they create a balanced pathway to capture long-term value in the AI biotech revolution.

FAQ

Q1. Which stock is the purest AI biotech play?

A1: Recursion (RXRX) and Exscientia (EXAI) are considered the closest to AI-first biotech, as their business models are built entirely around algorithms, automation, and pharmaceutical AI applications.

Q2. How does AI help traditional biotechs like CRISPR Therapeutics?

A2: AI enhances gene editing technologies by designing safer guide RNAs, predicting off-target edits, and optimizing efficiency. This improves the safety and precision of CRISPR-based therapies, including potential immune-modulating therapeutic cancer vaccines.

Q3. Which companies are leaders in AI plus diagnostics?

A3: NeoGenomics (NEO) and Tempus AI (TEM) are strong examples. They apply AI to molecular data, patient risk profiles, and clinical trial outcomes, supporting more accurate diagnostics and targeted therapy development.

Q4. What type of investor should own AI biotech stocks?

A4: These companies are best suited for investors with long-term horizons and a tolerance for market volatility. The space is still early in its evolution, but breakthroughs in drug design, AI drug discovery, and mRNA vaccine development can generate asymmetric upside.

Key Takeaways

- Pure plays like Recursion, Tempus, Exscientia, Schrödinger, Relay, and Absci are at the frontier of AI drug discovery and drug development processes.

- Established players like CRISPR, NeoGenomics, BioNTech, and Moderna embed AI into proven pipelines, enhancing clinical trial outcomes and expanding into fields like immune-modulating therapeutic cancer vaccines.

- Large companies such as AbbVie, Bristol-Myers Squibb, and Novo Nordisk show how pharmaceutical AI applications scale across global operations.

- Smaller innovators like IO Biotech, Tiziana Life Sciences, Palvella Therapeutics, and OKYO Pharma demonstrate niche applications in autoimmune diseases, ALS, and rare cancers.

- For investors, the choice is between growth potential from pure AI-first models and resilience from established biopharma adopting AI infrastructure. Both are critical to navigating the future of biotech within the Biopharma Industry.