Private prison stocks remain a controversial but significant corner of the U.S. equity market. The two dominant players, CoreCivic (NYSE: CXW) and GEO Group (NYSE: GEO), control over 70% of the U.S. private prison and detention market. Both companies operate in many ways like specialized real estate investment trusts (REITs), leasing critical infrastructure to the government and generating stable cash flows through long-term contracts.

But with overall incarceration rates falling, immigration enforcement under Trump’s 2025 policies may reshape the industry’s growth path. Here’s a detailed look at the companies, their capacity, and the broader prison trends.

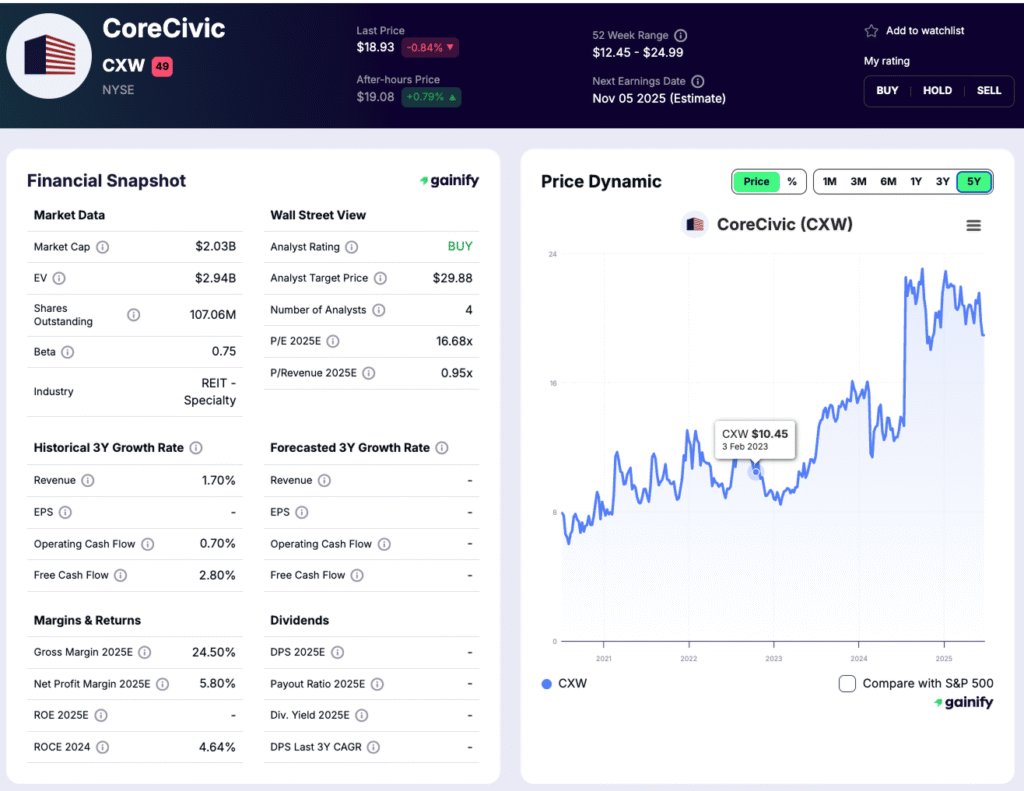

CoreCivic (CXW) – The Real Estate Powerhouse

Overview

- Founded: 1983, headquartered in Brentwood, Tennessee.

- FY2025 revenue estimate: ~$2.13 billion.

- FY2025 EBITDA estimate: ~$371.5 million.

- Largest private owner of correctional real estate in the U.S. with 15.3 million sq. ft. of government-leased space.

Bed Capacity

- Safety segment (prisons & detention): 62,329 beds

- Properties (leased correctional facilities): 10,314 beds

- Community (reentry and halfway houses): 4,159 beds

- Idle capacity: 13,479 beds

👉 Total bed capacity: 90,281 (76,802 active, 13,479 idle).

Key Strengths

- Scale advantage as the largest private operator.

- Diversification into reentry, halfway houses, and government property leasing.

- Idle bed inventory provides optionality if government demand rises.

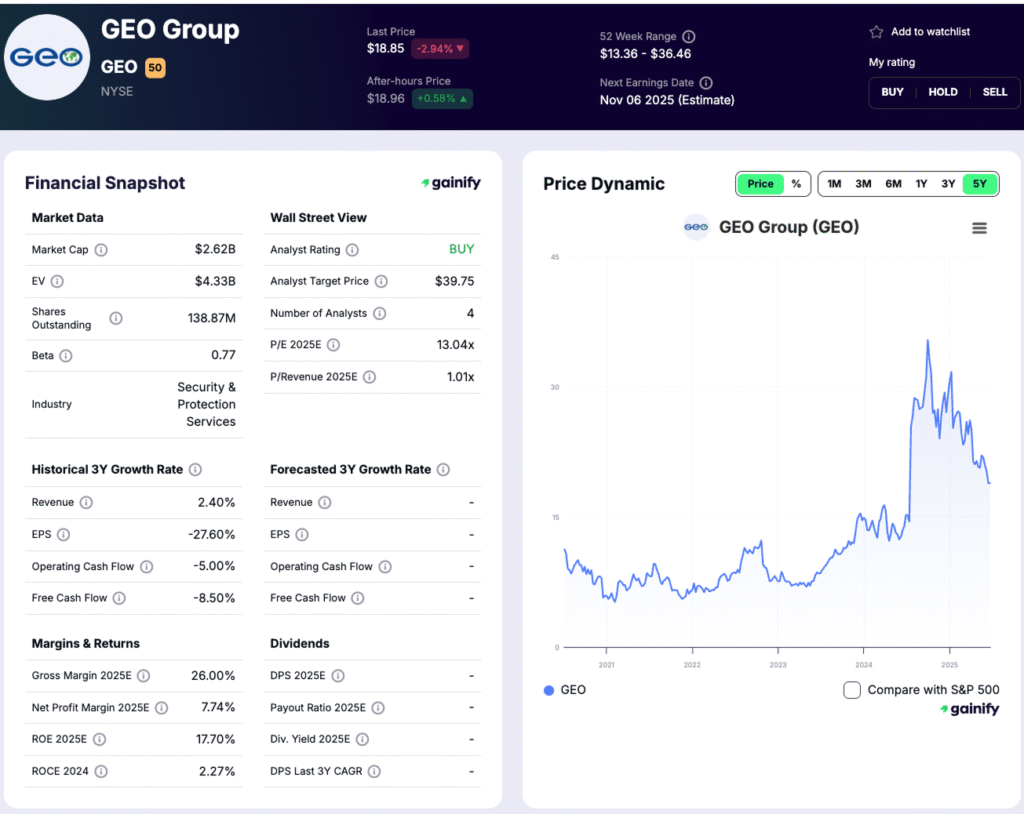

GEO Group (GEO) – The ICE Leader

Overview

- Founded: 1984, headquartered in Boca Raton, Florida.

- FY2025 revenue estimate: ~$2.60 billion.

- FY2025 EBITDA estimate: ~$471.8 million.

- Operates as a REIT with correctional facilities, ICE contracts, electronic monitoring, and transportation.

Bed Capacity

- Owned/leased: 57,000 beds

- Managed only: 22,000 beds

👉 Total bed capacity: ~79,000 beds

ICE Dominance

- 42% of ICE’s private detention beds.

- Exclusive provider of ICE’s ISAP electronic monitoring program.

- Exclusive subcontractor for ICE’s secure air transport.

Key Strengths

- Most leveraged to U.S. immigration policy.

- Broader service mix than CXW, with recurring revenues from monitoring and transport.

- International footprint in South America, the UK, and Australia.

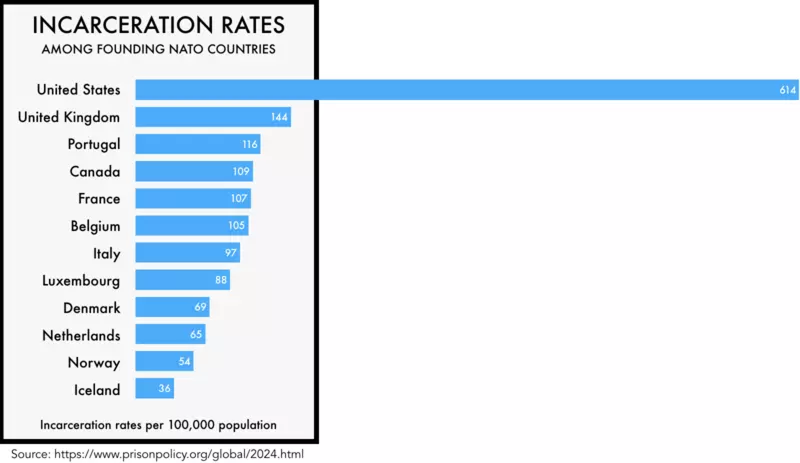

U.S. Prison Trends: Declining Incarceration, Growing Detention

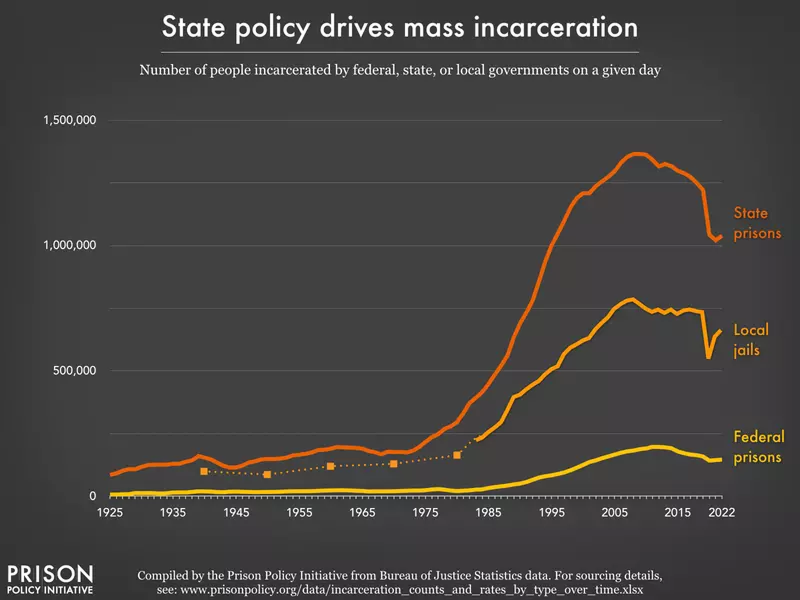

Despite its reputation, the U.S. prison population has flattened and modestly declined in recent years:

- Peak: ~2.3 million inmates (2008–2010).

- Current: ~1.9 million in custody across federal, state, and local systems.

- Private sector share: ~8% of total inmates.

Key Trends

- General incarceration is no longer growing, reflecting sentencing reforms and lower crime rates.

- ICE detention is expanding as a share of private contracts.

- GEO and CXW collectively dominate the market, holding 70%+ of private beds.

Trump’s 2025 ICE Policies: A Tailwind for Private Prisons

The Trump 2025 administration has prioritized tougher immigration enforcement, a clear catalyst for private prison stocks:

- Expansion of ICE detention capacity.

- Greater reliance on private operators for detention, monitoring, and transportation.

- Policy reversal from prior efforts to phase out federal private prison contracts.

Company Impact

- GEO Group (GEO): Positioned to benefit most with exclusive ICE contracts and its monitoring/transportation dominance.

- CoreCivic (CXW): Gains flexibility with 13,479 idle beds that can be reactivated to meet rising ICE demand.

Investment Angle: Which Private Prison Stock Stands Out?

- CoreCivic (CXW) → More of a real estate-driven play, with scale, diversification, and leverage to physical capacity.

- GEO Group (GEO) → A service-driven play, with heavier exposure to ICE enforcement, monitoring, and global contracts.

Both face political and reputational risks but offer investors government-backed cash flows and exposure to shifting U.S. policy priorities.

✅ Bottom Line:

With prison populations flattening, the future of private prison stocks will hinge on immigration enforcement. Under Trump’s 2025 policies, GEO looks best positioned for ICE-driven growth, while CXW provides scale and real estate leverage. Together, they remain the two essential players in the U.S. private prison market.