Car stocks are entering a defining phase as the global automotive industry emerges from years of supply-chain disruption, pandemic volatility, and aggressive capital spending on electrification. Car stocks are now confronting a normalization cycle marked by slower unit growth, intensified competition, and widening strategic divergence. Valuations across the sector reflect this transition, with many legacy automakers trading at single-digit forward earnings multiples, well below historical norms.

Unlike pure-play EV companies, traditional automotive stocks benefit from scale, brand equity, and global distribution. However, these advantages must now be balanced against structural challenges. Electrification timelines are being recalibrated, software and platform investments remain capital-intensive, and regional demand patterns, particularly in China and Europe, are shifting rapidly. At the same time, internal combustion engine vehicles and hybrids continue to generate the majority of industry cash flows, funding dividends, buybacks, and long-term transformation efforts.

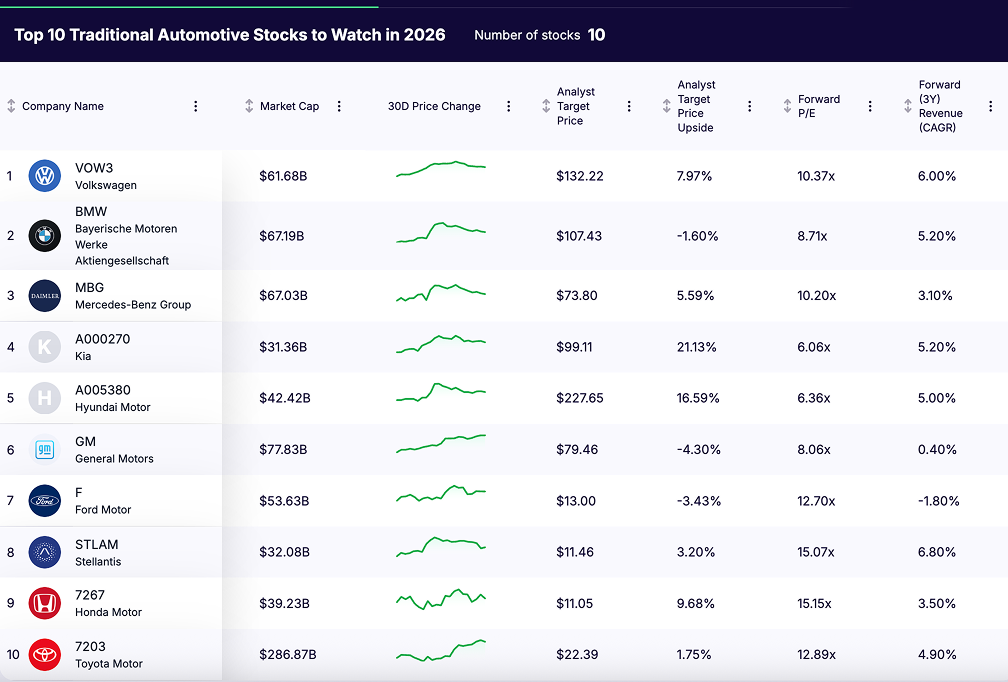

For investors, 2026 is shaping up to be a year of selectivity rather than broad beta exposure across car stocks. The opportunity lies in identifying manufacturers with resilient margins, disciplined capital allocation, and credible electrification strategies that preserve shareholder value. This analysis examines ten traditional car stocks that form the core of the global automotive industry and are positioned to define the next phase of sector performance.

Key Investment Highlights

- Traditional automakers have experienced a significant valuation compression over the past three years, with companies such as Toyota Motor and Volkswagen Group now showing early signs of stabilization

- Hybrid vehicles and premium internal combustion models remain critical profit drivers, particularly for manufacturers like BMW Group and Mercedes-Benz Group, as the pace of full EV adoption moderates

- European and Asian automakers continue to trade at meaningful discounts to historical averages despite maintaining strong global market share and brand positioning

- Capital discipline, cost control, and platform rationalization are increasingly rewarded by investors, favoring companies that prioritize margins and cash flow over aggressive volume growth

- Geographic diversification remains a key structural advantage, helping global manufacturers absorb regional demand shifts and regulatory volatility more effectively

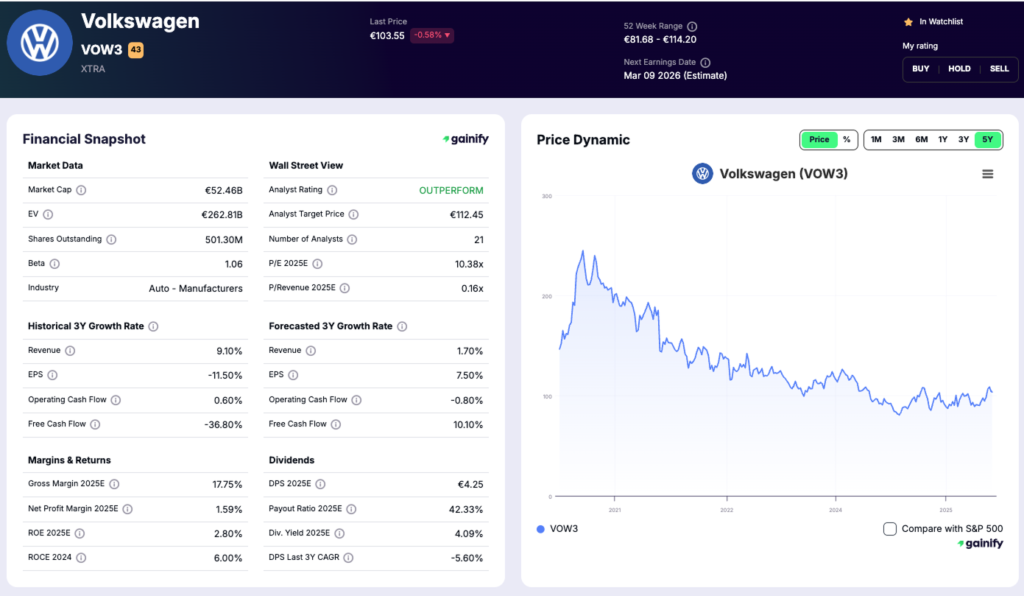

1. Volkswagen Group (XTRA: VOW3)

- Share price: €104.05

- Market capitalization: $62 billion

- Forward P/E: 10.37x

- Analyst target upside: 7.97%

Vehicle portfolio overview

Volkswagen operates one of the most comprehensive automotive portfolios globally, spanning mass-market vehicles under the Volkswagen brand, premium offerings through Audi, and high-margin luxury exposure via Porsche. This breadth provides volume scale, pricing flexibility, and resilience across economic cycles.

The group’s strategy centers on shared modular platforms, enabling cost efficiencies across powertrains and regions. While electrification remains a priority, internal combustion and hybrid vehicles continue to represent the majority of sales and cash generation, particularly in Europe and emerging markets.

Financial and revenue context

Volkswagen generates very large absolute revenue, supported by its global footprint and brand diversification. However, group margins have come under pressure from elevated EV investment, restructuring initiatives, and weaker demand trends in China. Premium brands partially offset these pressures, helping stabilize overall profitability.

Investment thesis

Volkswagen represents a deep-value incumbent with optionality. The stock trades at a discount that reflects concerns around organizational complexity and software execution rather than balance-sheet weakness. If management continues to streamline operations, improve capital discipline, and narrow the performance gap between brands, valuation normalization is achievable.

For investors, Volkswagen offers exposure to scale and global relevance at a price that already discounts execution risk.

Key risks

- Organizational complexity, which can dilute accountability and slow decision-making

- China market exposure, where competition and pricing pressure remain intense

- High capital intensity tied to electrification and software development

- Execution risk in simplifying platforms and improving returns on invested capital

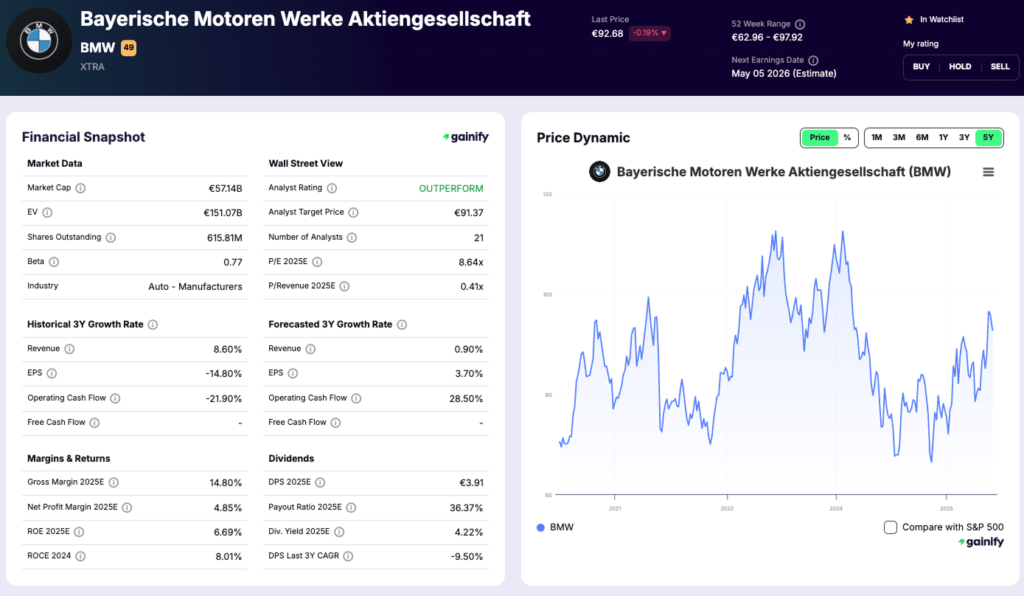

2. BMW Group (XTRA: BMW)

- Share price: €93.04

- Market capitalization: $67 billion

- Forward P/E: 8.71x

- Analyst target upside: minus 1.60%

Vehicle portfolio overview

BMW operates a focused premium automotive portfolio, centered on the BMW, MINI, and Rolls-Royce brands. Unlike volume-driven peers, BMW emphasizes performance, design, and brand differentiation, allowing it to sustain higher average selling prices and more stable margins across cycles.

The company has adopted a powertrain-agnostic platform strategy, enabling internal combustion, hybrid, and electric vehicles to be produced on shared architectures. This approach provides flexibility as EV adoption progresses at an uneven pace across regions.

Financial and revenue context

BMW continues to deliver industry-leading automotive margins relative to traditional peers, supported by disciplined pricing and limited reliance on incentives. While volumes fluctuate with economic conditions, profitability remains resilient, particularly in Europe and North America.

Investment thesis

BMW represents a margin-first premium automaker. The stock trades at a valuation that reflects maturity rather than deterioration. For investors, the appeal lies in earnings quality, capital discipline, and optionality from electrification without overcommitting capital prematurely.

BMW’s strategy prioritizes return on invested capital over rapid EV penetration, a stance that has increasingly resonated with investors.

Key risks

- Cyclical exposure to premium vehicle demand

- Competitive intensity in luxury EV segments

- Regulatory pressure in Europe on emissions compliance

- Currency volatility, given global production and sales mix

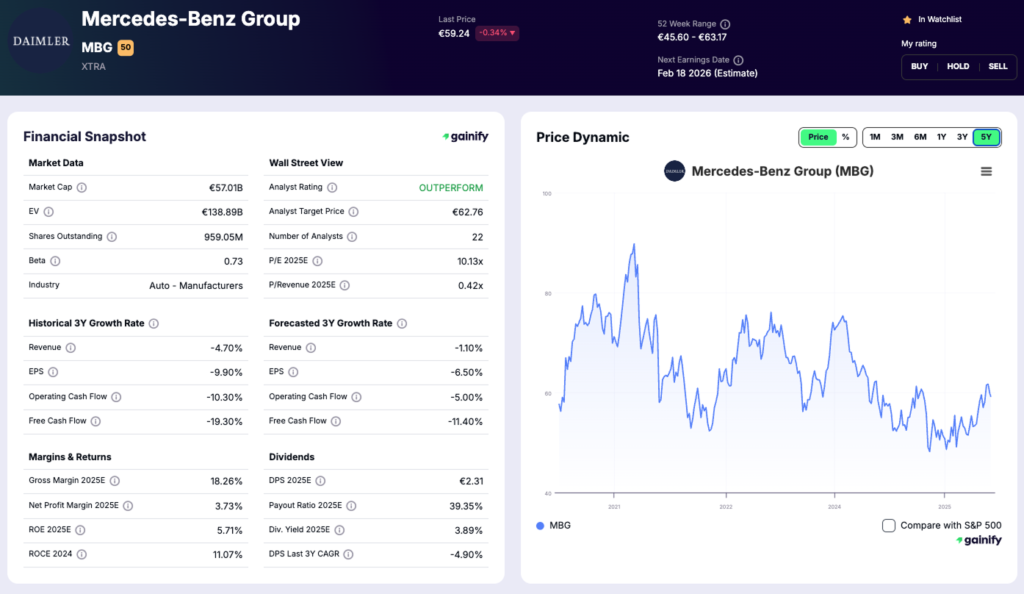

3. Mercedes-Benz Group (XTRA: MBG)

- Share price: €69.51

- Market capitalization: $67 billion

- Forward P/E: 10.20x

- Analyst target upside: 5.59%

Vehicle portfolio overview

Mercedes-Benz has deliberately repositioned its portfolio toward the luxury and ultra-luxury segments, prioritizing pricing power, customization, and brand exclusivity over volume growth. Core strength lies in high-end sedans, SUVs, and performance models, where brand equity supports premium pricing.

The company’s electrification strategy focuses on premium EVs rather than mass adoption, aiming to protect margins while meeting regulatory requirements. Internal combustion and hybrid vehicles continue to represent the majority of sales and remain critical to cash generation.

Financial and revenue context

Mercedes-Benz consistently generates solid automotive margins and meaningful industrial cash flow, supported by disciplined pricing and a premium-weighted product mix. In Q3 2025, the Cars division delivered an adjusted return on sales of 4.8 percent, within the company’s full-year guidance range, while industrial free cash flow totaled EUR 1.4 billion, reflecting continued cash generation despite lower global volumes. While profitability remains sensitive to demand trends in Europe, the U.S., and China, the company’s premium positioning provides relative insulation compared with volume-focused peers.

Investment thesis

Mercedes-Benz represents a pricing-power-driven luxury automaker. The valuation reflects moderate growth expectations but does not fully discount the durability of the brand’s premium positioning. If management maintains cost discipline and avoids excessive EV-related capital dilution, earnings stability can support shareholder returns.

For investors, Mercedes offers exposure to the high end of the automotive market with a clearer margin focus than most legacy peers.

Key risks

- Cyclicality in luxury vehicle demand, particularly during economic slowdowns

- Competitive pressure in premium EV segments from both incumbents and new entrants

- Regulatory cost escalation in Europe related to emissions and safety standards

- China market exposure, where demand trends can shift rapidly

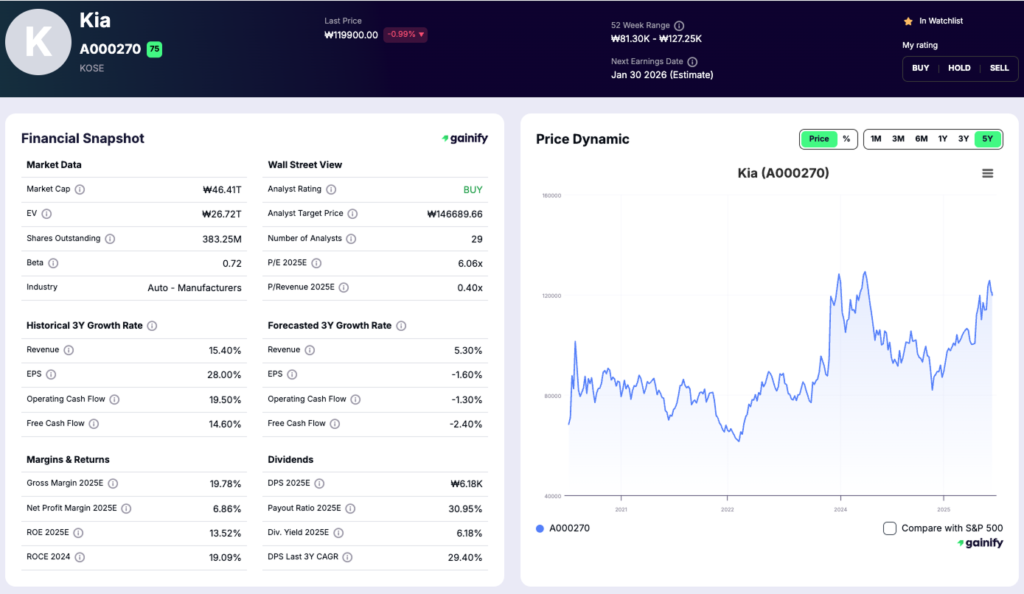

4. Kia (KOSE: 000270)

- Share price: ₩119,900

- Market capitalization: $31 billion

- Forward P/E: 6.06x

- Analyst target upside: 21.13%

Vehicle portfolio overview

Kia has evolved from a value-oriented manufacturer into a globally competitive mass-market and near-premium automaker, with a portfolio spanning compact cars, SUVs, and light commercial vehicles. Design differentiation and improved interior quality have strengthened brand perception, particularly in North America and Europe.

The company maintains a balanced powertrain strategy, with internal combustion and hybrid vehicles driving the majority of volumes and profitability, while electric models are introduced selectively across key segments. This approach allows Kia to adapt to uneven EV adoption without materially compromising margins.

Financial and revenue context

Kia continues to deliver solid profitability and steady top-line expansion, supported by favorable product mix and disciplined pricing. Based on forward estimates, the company is expected to generate approximately 5.2 percent annual revenue growth over the next three years, reflecting stable global demand and continued market share gains in core regions.

Investment thesis

Kia represents a valuation-supported growth-at-a-reasonable-price car stock. Trading at a low forward earnings multiple, the stock reflects conservative expectations despite improving brand strength and consistent revenue growth. If management sustains margin discipline while gradually scaling electrified offerings, the current discount could narrow.

For investors, Kia offers exposure to global automotive demand with a more favorable risk-reward profile than many higher-cost peers.

Key risks

- Cyclical exposure to global vehicle demand

- Pricing pressure in competitive mass-market segments

- Execution risk as EV offerings scale

- Currency and regional demand volatility, particularly in emerging markets

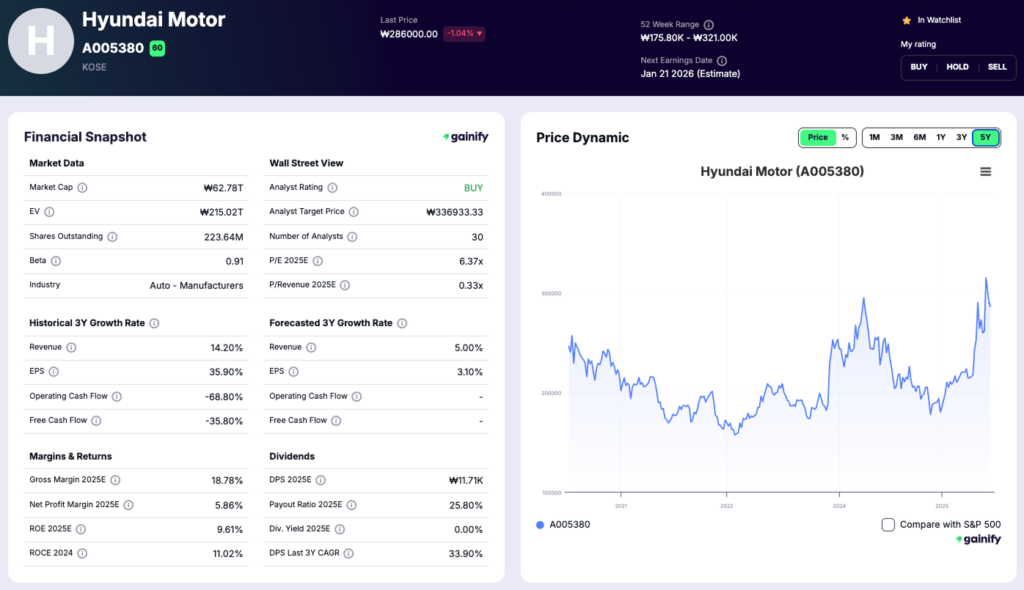

5. Hyundai Motor (KOSE: 005380)

- Share price: ₩286,000

- Market capitalization: $42 billion

- Forward P/E: 6.36x

- Analyst target upside: 16.59%

Vehicle portfolio overview

Hyundai Motor operates a broad, globally diversified automotive portfolio, spanning passenger vehicles, SUVs, and light commercial models. The brand competes primarily in the mass-market segment but has steadily improved product quality, technology integration, and design appeal, narrowing the gap with more premium peers.

Hyundai follows a multi-path powertrain strategy, maintaining strong exposure to internal combustion and hybrid vehicles while continuing to invest in electric platforms. This flexibility allows the company to respond to regional differences in EV adoption and regulatory pressure without overcommitting capital.

Financial and revenue context

Hyundai has demonstrated consistent revenue growth and resilient operating profitability, supported by scale, vertical integration, and disciplined pricing. Forward estimates imply approximately 5.0 percent annual revenue growth over the next three years, reflecting stable demand across key markets including North America, Europe, and emerging regions.

Investment thesis

Hyundai represents a low-multiple, cash-generative car stock with improving product competitiveness. The valuation reflects skepticism around cyclicality and long-term electrification costs rather than near-term financial stress. If management maintains cost control and continues to optimize its global manufacturing footprint, earnings durability could support multiple expansion.

For investors, Hyundai offers exposure to global auto demand at a discount, with optionality from gradual electrification rather than aggressive transformation.

Key risks

- Exposure to cyclical demand, particularly in emerging markets

- Competitive pressure in mass-market EV and hybrid segments

- Rising input and labor costs

- Currency volatility, given global production and sales mix

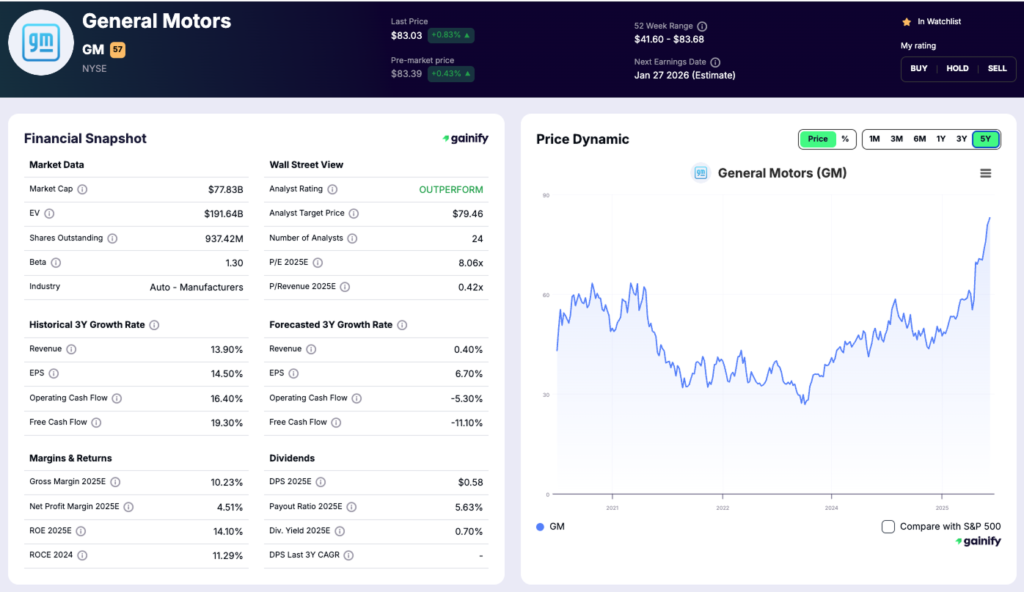

6. General Motors (NYSE: GM)

- Share price: $83.03

- Market capitalization: $78 billion

- Forward P/E: 8.06x

- Analyst target upside: minus 4.30%

Vehicle portfolio overview

General Motors operates a North America–centric automotive portfolio, anchored by full-size pickup trucks, SUVs, and commercial vehicles under the Chevrolet, GMC, and Cadillac brands. These segments continue to generate the majority of GM’s profits, benefiting from strong brand loyalty and pricing power in the U.S. market.

GM is pursuing electrification through dedicated EV platforms while maintaining its core internal combustion lineup. This dual-track strategy reflects management’s focus on preserving near-term cash flow while investing selectively in long-term transition technologies.

Financial and revenue context

GM continues to produce strong operating cash flow, supported by high-margin truck and SUV sales. Forward expectations imply low-single-digit revenue growth, reflecting stable North American demand offset by competitive pricing and elevated investment spending in EVs and software.

Investment thesis

General Motors represents a cash-flow-backed transition story. The stock trades at a valuation that reflects skepticism around EV profitability and capital intensity rather than weakness in the core business. As long as GM’s ICE portfolio continues to fund investment and shareholder returns, downside risk appears partially contained.

For investors, GM offers exposure to U.S. automotive demand with optional upside if EV execution improves without materially eroding margins.

Key risks

- Sustained losses in EV operations, delaying profitability

- High exposure to the U.S. market, increasing cyclical sensitivity

- Labor and input cost pressure

- Execution risk in scaling software and electrification platforms

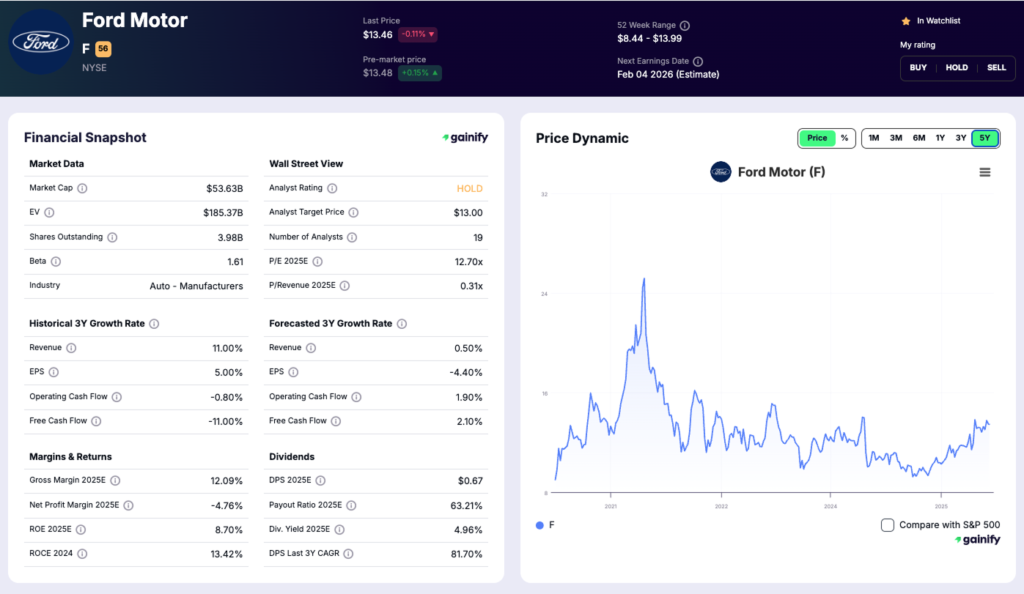

7. Ford Motor (NYSE: F)

- Share price: $13.46

- Market capitalization: $54 billion

- Forward P/E: 12.70x

- Analyst target upside: minus 3.43%

Vehicle portfolio overview

Ford’s automotive business is structured around distinct operating segments, with strong exposure to internal combustion vehicles and commercial platforms. The Ford Blue division, anchored by F-Series trucks and SUVs, remains the company’s primary profit engine, supported by brand loyalty and scale in North America. Ford Pro adds a differentiated commercial and fleet offering that enhances earnings stability.

Electrification is pursued through a separate EV-focused segment, while hybrids and ICE vehicles continue to dominate volumes and cash generation. This segmentation reflects Ford’s effort to balance near-term profitability with long-term transformation.

Financial and revenue context

According to the Q3 2025 earnings release, Ford generated $44 billion in car revenue during the quarter and delivered adjusted EBIT of $2.6 billion, driven primarily by its ICE and commercial businesses. While EV operations remained loss-making, overall results underscored the cash-generative strength of Ford’s core portfolio.

Investment thesis

Ford represents a cash-flow-supported restructuring story. The current valuation reflects investor caution around EV losses and capital intensity rather than deterioration in the core business. If management continues to protect profitability in Ford Blue and Ford Pro while containing EV-related losses, earnings durability could support a gradual re-rating.

For investors, Ford offers exposure to U.S. automotive demand with optional upside tied to improved cost discipline in electrification.

Key risks

- Persistent EV operating losses, delaying margin recovery

- High reliance on North American demand, increasing cyclical exposure

- Input cost and labor pressure, particularly in trucks and commercial vehicles

- Execution risk in managing a multi-segment operating structure

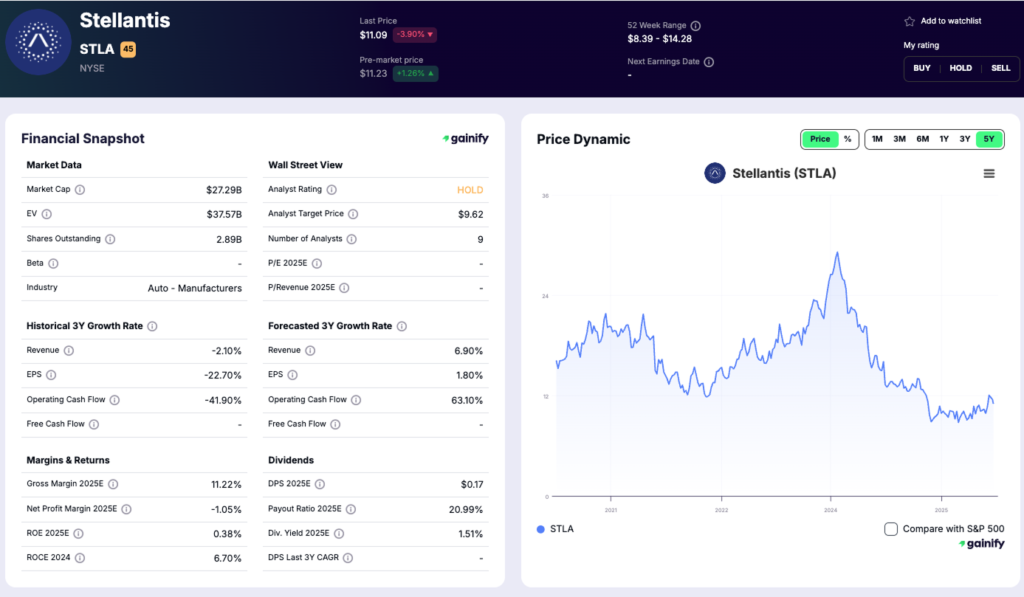

8. Stellantis (NYSE: STLA)

- Share price: $11.09

- Market capitalization: $32 billion

- Forward P/E: 15.07x

- Analyst target upside: 3.20%

Vehicle portfolio overview

Stellantis operates one of the most diversified global automaker portfolios, spanning U.S. truck and SUV franchises (Jeep, Ram) alongside major European mass-market brands (Peugeot, Citroën, Fiat, Opel/Vauxhall). This breadth provides resilience across regions and segments, but also increases operational complexity and raises the bar for platform discipline.

The company’s near-term strategy continues to rely on profit-rich trucks and SUVs to fund product renewal and electrification, while European brands compete on scale and cost efficiency in a more price-sensitive environment.

Financial and revenue context

In Q3 2025, Stellantis reported net revenues of €37.2 billion, up from €33.0 billion in Q3 2024, driven primarily by improved volume and mix. Consolidated shipments increased to 1,300 thousand units from 1,148 thousand units year over year, reflecting a normalization in North America and improved performance in Enlarged Europe.

Investment thesis

Stellantis is best viewed as a cash-generation and execution story rather than a pure growth name. The investment case rests on management’s ability to sustain pricing and cost discipline while refreshing product cycles, particularly in North America, without sacrificing returns to fund the transition. With a globally diversified footprint and strong brands, the company has the ingredients to defend earnings, but valuation upside is likely driven by evidence of durable margins and stable volumes.

For investors, Stellantis offers diversified exposure with a heavier dependence on operational discipline than headline EV penetration.

Key risks

- North America concentration risk, given the earnings importance of Jeep and Ram

- Pricing and incentive pressure, especially if industry competition intensifies

- Execution risk from managing a large multi-brand portfolio and platform complexity

- Regulatory and transition costs in Europe during electrification and compliance cycles

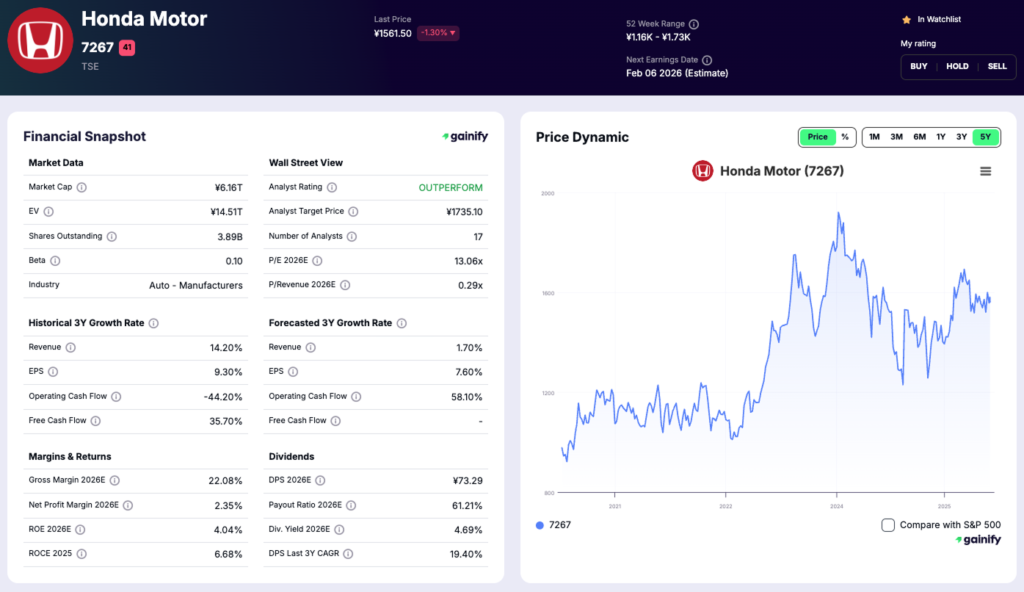

9. Honda Motor (TSE: 7267)

- Share price: ¥1,560

- Market capitalization: $39 billion

- Forward P/E: 15.15x

- Analyst target upside: 9.68%

Vehicle portfolio overview

Honda operates a globally diversified automotive portfolio spanning passenger vehicles, SUVs, and light trucks, with strong positions in North America and Asia. The brand is known for engineering reliability, fuel efficiency, and disciplined product cycles rather than aggressive volume expansion or rapid design turnover.

Honda has taken a measured approach to electrification, prioritizing hybrids and efficiency gains in internal combustion engines while gradually expanding battery-electric offerings. This strategy reflects management’s focus on protecting margins and returns amid uneven global EV adoption.

Financial and revenue context

Honda delivers stable revenue and solid operating profitability, supported by a diversified business mix that includes motorcycles and power products alongside automobiles. This diversification helps smooth earnings volatility during automotive demand cycles and provides additional cash flow to fund long-term investment.

Investment thesis

Honda represents a defensive automotive investment within the traditional automaker universe. The valuation reflects modest growth expectations, but the company’s balance-sheet discipline, diversified earnings base, and conservative electrification strategy reduce downside risk. For investors prioritizing stability over transformation optionality, Honda offers steady exposure to global vehicle demand.

Key risks

- Slower perceived EV progress, which may weigh on investor sentiment

- Margin pressure in highly competitive mass-market segments

- Currency fluctuations, given significant overseas production and sales

- Regional demand volatility, particularly in North America and Asia

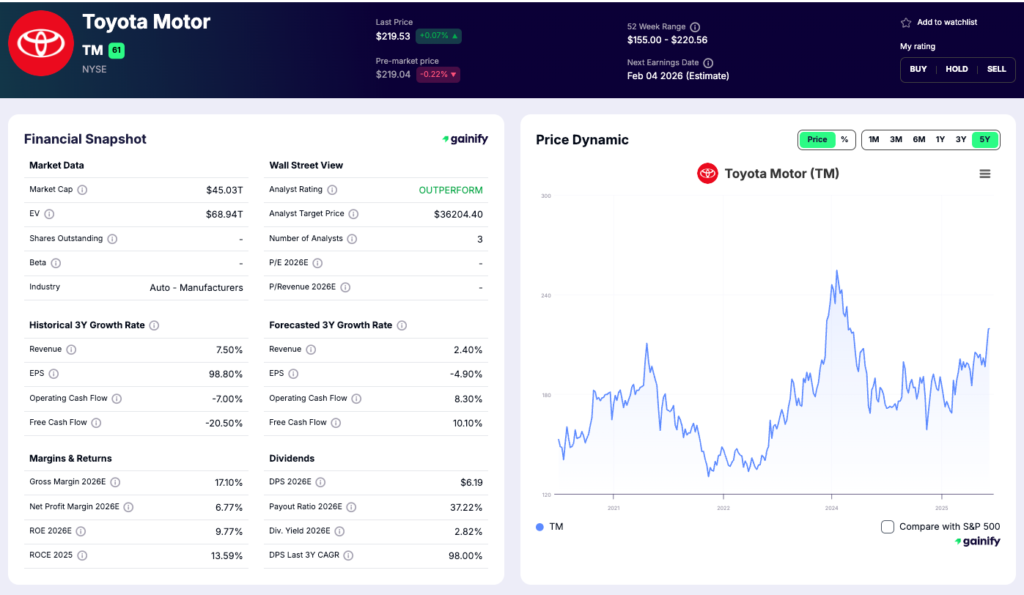

10. Toyota Motor (TSE: 7203)

- Share price: ¥3,420

- Market capitalization: $287 billion

- Forward P/E: 12.89x

- Analyst target upside: 1.75%

Vehicle portfolio overview

Toyota operates the most globally diversified and resilient automotive portfolio among traditional automakers. Its lineup spans mass-market passenger vehicles, SUVs, trucks, and commercial models, with leading positions in North America, Japan, and emerging markets. The Toyota and Lexus brands benefit from strong reputations for reliability, quality, and long product lifecycles.

Toyota has long emphasized hybrid technology as a core pillar of its strategy, maintaining leadership in fuel efficiency while limiting exposure to early-stage EV margin pressure. Internal combustion and hybrid vehicles continue to account for the vast majority of sales and cash generation, with electrification progressing at a measured pace.

Financial and revenue context

Toyota consistently delivers industry-leading revenue scale and strong operating cash flow, supported by high global volumes and disciplined cost control. The company’s diversified geographic footprint and balanced powertrain mix provide resilience across economic cycles and regulatory regimes.

Investment thesis

Toyota represents the benchmark for durability and execution in the global automotive sector. The valuation reflects stability rather than aggressive growth expectations, but the company’s hybrid-first strategy has proven well-aligned with current market realities. By prioritizing returns on capital and operational efficiency over rapid electrification, Toyota has preserved margins while retaining long-term optionality.

For investors, Toyota offers high-quality exposure to global automotive demand with lower execution risk than most peers.

Key risks

- Perception risk from slower full-EV adoption compared with competitors

- Yen volatility, impacting reported earnings

- Regulatory shifts that accelerate EV mandates faster than expected

- Global demand fluctuations, particularly in mature markets

Conclusion

The traditional automotive sector enters 2026 in a markedly different position than it occupied just a few years ago. Following a prolonged period of valuation compression driven by supply-chain disruptions, electrification uncertainty, and uneven global demand, car stocks and car stocks are now priced for caution rather than optimism. While the recovery to date has been modest, it reflects a growing investor preference for discipline, cash flow, and execution over scale-driven expansion narratives.

Across the group, a clear pattern has emerged. Manufacturers with strong exposure to hybrids, premium internal combustion vehicles, and commercial platforms continue to generate the majority of industry profits, providing the financial foundation for gradual electrification. Companies such as Toyota, BMW, Mercedes-Benz, and Stellantis have demonstrated that margin preservation and capital efficiency can coexist with measured transition strategies.

At the same time, the sector remains highly selective. Automakers with heavy capital commitments, complex brand structures, or concentrated regional exposure face greater execution risk as competitive pressure intensifies. For investors, broad exposure to the sector is less compelling than targeted allocation to companies with resilient margins, diversified footprints, and proven capital discipline.

Ultimately, the opportunity in traditional automaker stocks lies not in predicting the speed of full electrification, but in identifying those incumbents capable of navigating transition cycles without eroding shareholder value. In a market that increasingly rewards realism over ambition, durability and execution are once again becoming the primary drivers of long-term returns.