Esports stocks are gaining renewed attention in 2026 as competitive gaming continues to attract massive global audiences across mobile, PC, and console platforms. While esports teams and leagues often struggle financially, the underlying games themselves are reaching record viewership, creating clear winners at the publisher level.

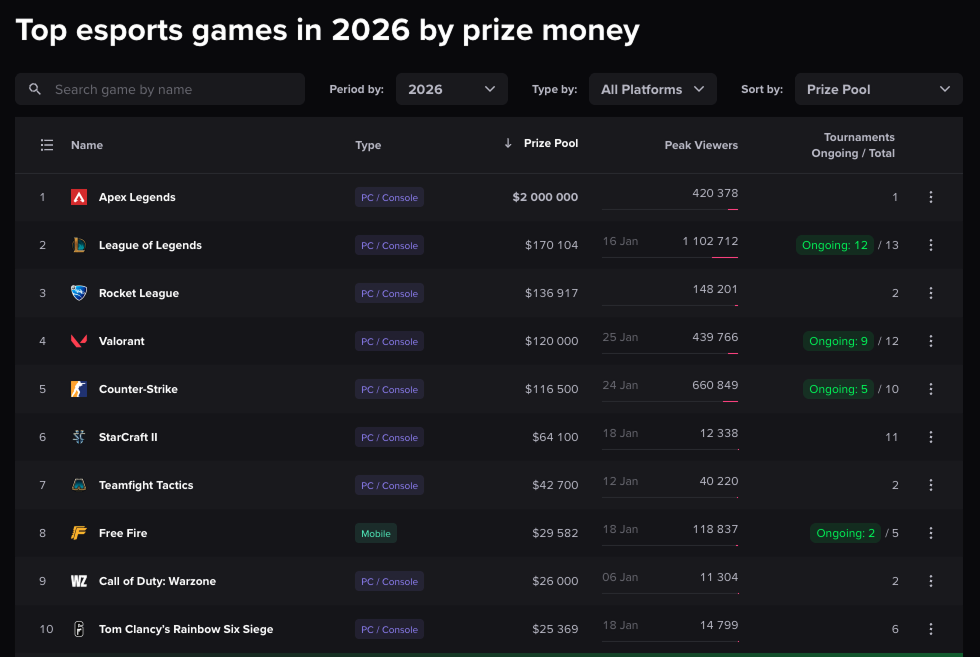

As shown in the image above, the most popular esports games in 2026 by peak viewership include Mobile Legends: Bang Bang, League of Legends, Counter-Strike, Valorant, Apex Legends, and Call of Duty. Several of these titles now attract hundreds of thousands to millions of peak viewers, confirming that esports engagement is not only real but highly concentrated around a small number of franchises.

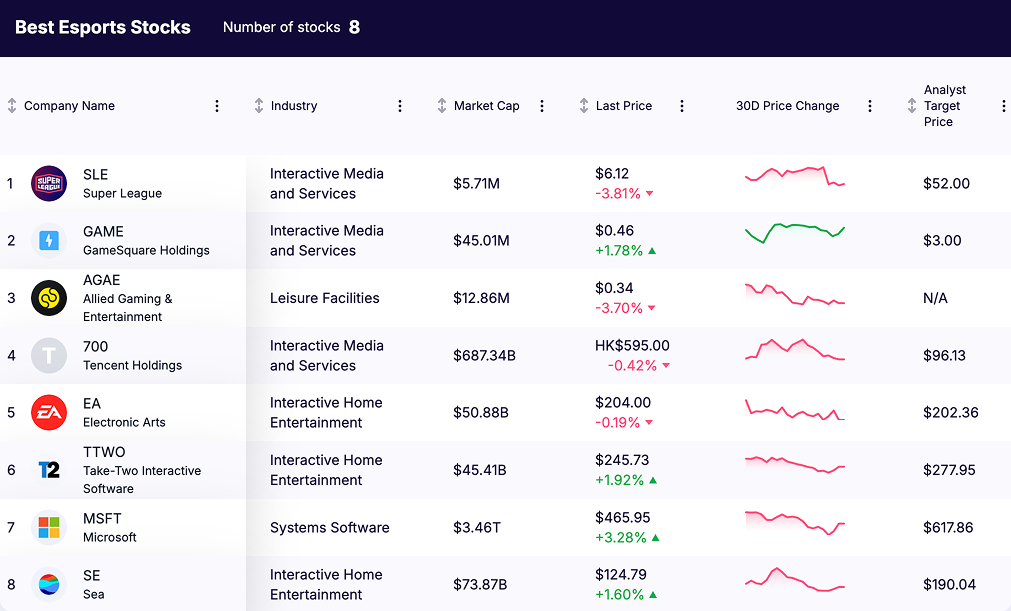

For investors, rhe companies that own and control these games capture the majority of esports economics. Below are the 6 best esports stocks to watch in 2026, split between pure-play esports companies and esports game publishers.

Esports Stocks in 2026: Highlights

- Esports viewership in 2026 is concentrated in a small number of games, including League of Legends, Apex Legends, Call of Duty, and Free Fire.

- Game publishers capture most esports value, since they own the underlying titles and competitive ecosystems.

- Tencent, Electronic Arts, Microsoft, and Sea Limited are the most important publicly traded esports publishers.

- Mobile esports is now a major growth driver, increasing the relevance of companies like Sea Limited.

- Pure-play esports stocks offer direct exposure but carry higher risk and weaker economics.

Pure-Play Esports Stocks

These companies are directly focused on esports leagues, tournaments, venues, and competitive gaming media. Esports is their core business.

1) Super League Enterprise (NASDAQ: SLGG)

Focus: Esports leagues, competitive gaming content, amateur and semi-pro competitions

Super League Enterprise operates esports leagues and produces competitive gaming content aimed at grassroots and community-level competition.

Why it counts in 2026: As esports participation expands beyond elite professionals, demand for organized amateur and semi-pro competition grows. SLGG’s revenue is tied directly to esports participation and programming rather than game ownership.

Investor takeaway: SLGG remains the closest pure-play esports stock in public markets, offering high sensitivity to esports engagement trends, but also higher risk.

2) GameSquare Holdings (NASDAQ: GAME)

Focus: Esports organizations, tournaments, media, creator and talent management

GameSquare operates esports teams, tournaments, and esports-focused media, while also managing creators and competitive gaming talent.

Why it counts in 2026: High-viewership esports titles drive demand for teams, creators, and branded esports content. GameSquare sits close to that demand layer.

Investor takeaway: GAME is still a pure esports bet, though with some exposure to broader gaming media and creators.

3) Allied Gaming & Entertainment (NASDAQ: AGAE)

Focus: Esports arenas, live events, competitive gaming experiences

Allied Gaming & Entertainment focuses on physical esports venues and live competitive gaming events.

Why it counts in 2026: Despite the rise of online viewership, live esports events remain an important engagement and sponsorship layer within the ecosystem.

Investor takeaway: AGAE is a small-cap, high-risk esports stock with direct exposure to live esports experiences.

Esports Game Publishers

Esports game publishers sit at the core of the esports economy. These companies own the intellectual property behind the most-watched competitive games, giving them control over tournament structures, monetization, and long-term franchise direction. While esports is not their only business, it plays a meaningful strategic role by driving engagement, recurring spending, and brand longevity.

In 2026, esports viewership and monetization are highly concentrated among a small group of publishers that control globally dominant titles.

4) Tencent Holdings (SEHK: 700)

Esports titles: League of Legends, Valorant (via Riot Games)

The 2026 viewership data shows League of Legends remaining one of the most-watched esports titles globally, with over 1 million peak viewers, while Valorant continues to grow as a top-tier tactical shooter esports title.

Why it counts in 2026: Tencent owns Riot Games outright, giving it full control over two of the most important esports ecosystems in the world. Riot operates tightly managed global leagues, consistent tournament calendars, and highly monetized competitive formats. This level of control has produced some of the most stable and enduring esports ecosystems to date.

Investor takeaway: Tencent is arguably the most important esports publisher globally, offering indirect but powerful exposure to the highest-viewership PC esports franchises.

5) Electronic Arts (NASDAQ: EA)

Esports titles: Apex Legends, EA Sports FC

According to the 2026 data, Apex Legends remains one of the top esports games by peak viewership, supported by a global competitive circuit and large prize pools. EA Sports FC continues to anchor competitive sports gaming through recurring seasonal tournaments.

Why it counts in 2026: Esports extends the lifespan of EA’s franchises by driving engagement, live-service monetization, and long-term player retention. Competitive gaming reinforces EA’s shift toward recurring digital revenue rather than one-time releases.

Investor takeaway: EA offers direct, listed exposure to high-viewership esports titles, making it one of the clearest esports publisher investments in U.S. markets.

6) Take-Two Interactive (NASDAQ: TTWO)

Esports titles: NBA 2K

While NBA 2K does not match the raw viewership of top PC or mobile esports titles, it maintains a stable and loyal competitive audience, closely tied to global sports fandom.

Why it counts in 2026: Esports strengthens the NBA 2K franchise by supporting community engagement, influencer-driven content, and recurring in-game spending. The NBA 2K League also provides brand alignment with professional sports, which differentiates it from other esports ecosystems.

Investor takeaway: TTWO provides focused esports exposure tied to a durable sports franchise, with esports acting as a reinforcement layer rather than a primary revenue driver.

7) Microsoft (NASDAQ: MSFT)

Esports titles: Call of Duty, Overwatch

The 2026 viewership data shows Call of Duty maintaining strong esports engagement, supported by frequent tournaments and a large console player base.

Why it counts in 2026: Microsoft controls both the competitive franchises and the platforms they operate on. This allows it to capture value across game publishing, esports ecosystems, distribution, and infrastructure. Esports strengthens engagement across Microsoft’s broader gaming and services portfolio.

Investor takeaway: MSFT is the most diversified esports stock, with esports embedded within a larger gaming, cloud, and platform strategy.

8) Sea Limited (NYSE: SE)

Esports titles: Free Fire

The image data highlights Free Fire as one of the most-watched mobile esports games in 2026, with particularly strong engagement in Southeast Asia and Latin America.

Why it counts in 2026: Sea Limited, through Garena, owns and operates both Free Fire and its esports ecosystem. Mobile esports continues to dominate global viewership, and Free Fire remains one of the most important competitive titles in that segment.

Investor takeaway: SE is one of the few publicly traded companies with direct exposure to mobile esports, which now represents one of the largest esports audiences worldwide.

Esports in 2026: What the Viewership Data Shows

The 2026 esports viewership data makes one thing clear: audience attention is highly concentrated in a small number of games, and those games are controlled by an even smaller group of companies. As shown in the image above, peak viewership drops sharply after the top tier, reinforcing why ownership of leading franchises matters more than operating teams or leagues.

At the top sits Mobile Legends: Bang Bang, which recorded 5.68 million peak viewers in 2026. While this is the most-watched esports title globally, it is not directly investable, as the game is owned by Moonton, a subsidiary of the private company ByteDance. This highlights a recurring theme in esports: some of the largest audiences sit outside public markets.

Among publicly investable franchises, League of Legends stands out with 1.10 million peak viewers. The game is developed by Riot Games, which is wholly owned by Tencent, making Tencent Holdings the primary listed beneficiary of this viewership. Valorant, also owned by Riot Games, reached 439,766 peak viewers, further reinforcing Tencent’s central role in global esports.

Counter-Strike, with 660,849 peak viewers, remains one of the most durable esports titles, but it is owned by Valve, which is privately held. As a result, there is no direct public stock exposure to Counter-Strike esports despite its massive audience.

Apex Legends, which attracted 420,378 peak viewers and boasts one of the largest prize pools in esports, is published by Electronic Arts (EA). This makes EA one of the clearest publicly listed esports stocks tied to high-viewership competitive gaming. EA Sports FC, another EA title, also maintains a consistent esports audience, further strengthening EA’s exposure.

Call of Duty, with 190,297 peak viewers, is now part of Microsoft’s gaming portfolio following its acquisition of Activision. This positions Microsoft (MSFT) as a major beneficiary of console esports viewership.

Finally, Free Fire, which reached 118,837 peak viewers, is owned by Garena, a subsidiary of Sea Limited (SE). Free Fire’s strong mobile esports presence makes Sea Limited one of the few listed companies with meaningful exposure to mobile esports audiences.

Investor takeaway: The viewership data shows that most esports value flows to a small group of publishers, particularly Tencent, Electronic Arts, Microsoft, and Sea Limited. While pure-play esports operators exist, the companies that own the most-watched games consistently capture the majority of audience attention and long-term monetization potential.

Why Publishers Matter More Than Teams

The viewership data makes one thing clear. Most esports value flows to:

- Companies that own the games

- Companies that control tournaments and ecosystems

- Companies that monetize engagement at scale

Pure-play esports operators offer direct exposure but face structural challenges. Publishers benefit regardless of which teams win, and they scale monetization more effectively as viewership grows.

Final Investor Takeaway

Esports in 2026 is defined by massive viewership concentration around a small number of global titles. Investors looking at esports stocks should focus less on individual teams and more on:

- Which companies own the most-watched games

- Which companies monetize esports at scale

Pure-play esports stocks provide higher sensitivity to esports growth, while publishers like EA, Microsoft, and Sea Limited offer more durable exposure backed by real audience data.