Best nickel stocks are entering 2026 at a pivotal moment for the global metals and mining complex. After an extended period marked by aggressive supply growth, pricing pressure, and investor fatigue, the nickel market is shifting from a cycle driven by excess capacity toward one defined by cost discipline, asset quality, and long-term demand durability. This transition has created a widening gap between structurally advantaged producers and higher-cost, more speculative operators.

Nickel remains a strategically important metal despite near-term price weakness. Its role in stainless steel production continues to anchor baseline demand, while its importance in electric vehicle batteries, energy storage, and industrial decarbonization underpins a longer-term growth narrative. However, unlike earlier cycles, the path forward is unlikely to be linear. Supply growth from Indonesia has reset the global cost curve, forcing capital allocation discipline and accelerating consolidation among producers.

For investors, 2026 is shaping up as a year where selectivity matters more than exposure. The companies highlighted below represent the 7 best nickel stocks to watch for 2026, spanning global mining leaders and targeted producers positioned to navigate a lower-for-longer pricing environment while retaining upside to any demand inflection.

Key Highlights

- Nickel markets remain oversupplied, but demand growth from EVs and energy transition applications continues to compound into the late 2020s.

- Low-cost, diversified miners dominate the investable universe, with Vale, BHP, and Glencore controlling meaningful global supply.

- Select mid-cap producers offer optionality, but balance sheet risk and cost curves remain the key differentiators.

1. Vale (BOVESPA: VALE)

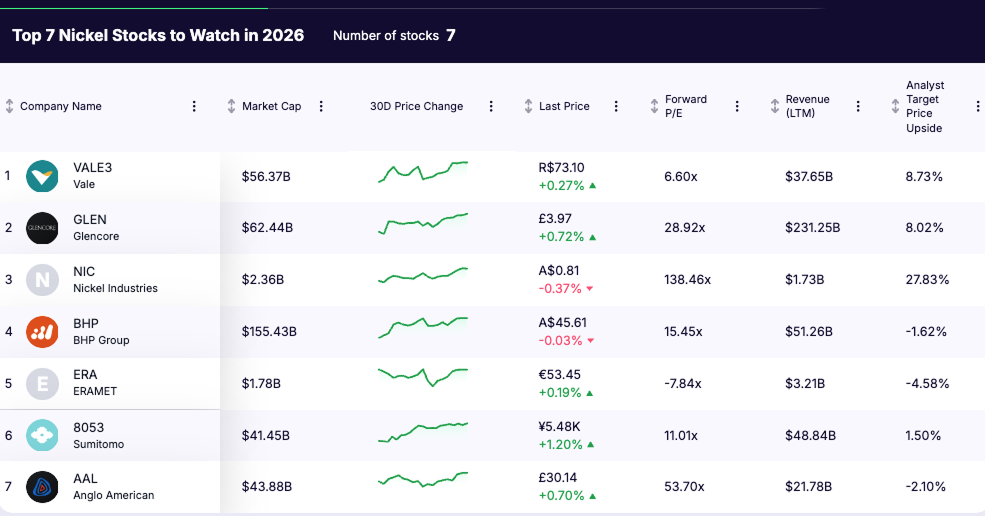

Market cap: $56.37B

Forward P/E: 6.60x

Forward 3Y revenue CAGR: 4.90%

Business overview

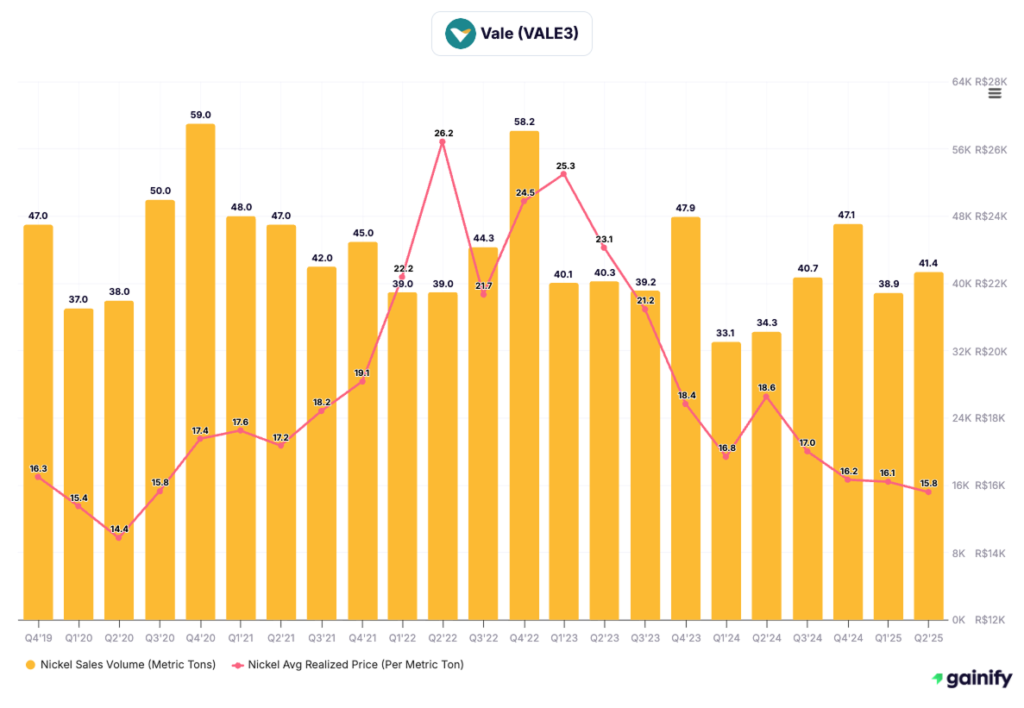

Vale is one of the world’s largest diversified mining companies and a top-tier global nickel producer. Its nickel operations span Canada, Indonesia, and Brazil, supplying both stainless steel markets and higher-purity Class 1 nickel used in battery applications. While iron ore remains Vale’s primary earnings driver, nickel is increasingly positioned as a strategic asset within the company’s energy transition portfolio.

Investment thesis

Vale’s nickel investment case centers on scale, cost position, and portfolio resilience. The company produced approximately 175 kt of nickel in 2025, placing it among the largest global suppliers outside Indonesia. Management has outlined a medium-term plan targeting cash breakeven by 2027 for its nickel operations, reflecting ongoing cost optimization and portfolio simplification. Vale has also committed $3.3B of capital toward base metals development, underscoring nickel’s strategic importance within its future-facing commodities mix. This combination allows Vale to sustain operations at current price levels while preserving upside to any tightening in higher-quality nickel markets later in the decade.

Key risks

- Commodity exposure: nickel remains a smaller contributor relative to iron ore, making earnings sensitivity uneven and dependent on broader commodity cycles.

- Jurisdictional complexity: operations across Brazil, Canada, and Indonesia introduce regulatory, environmental, and political risk that can affect costs and timelines.

- Capital allocation: management must balance reinvestment across multiple commodities, which could limit incremental capital directed toward nickel during weaker pricing periods.

2. Glencore (LSE: GLEN)

Market cap: $62.44B

Forward P/E: 28.92x

Revenue (LTM): $231.25B

Business overview

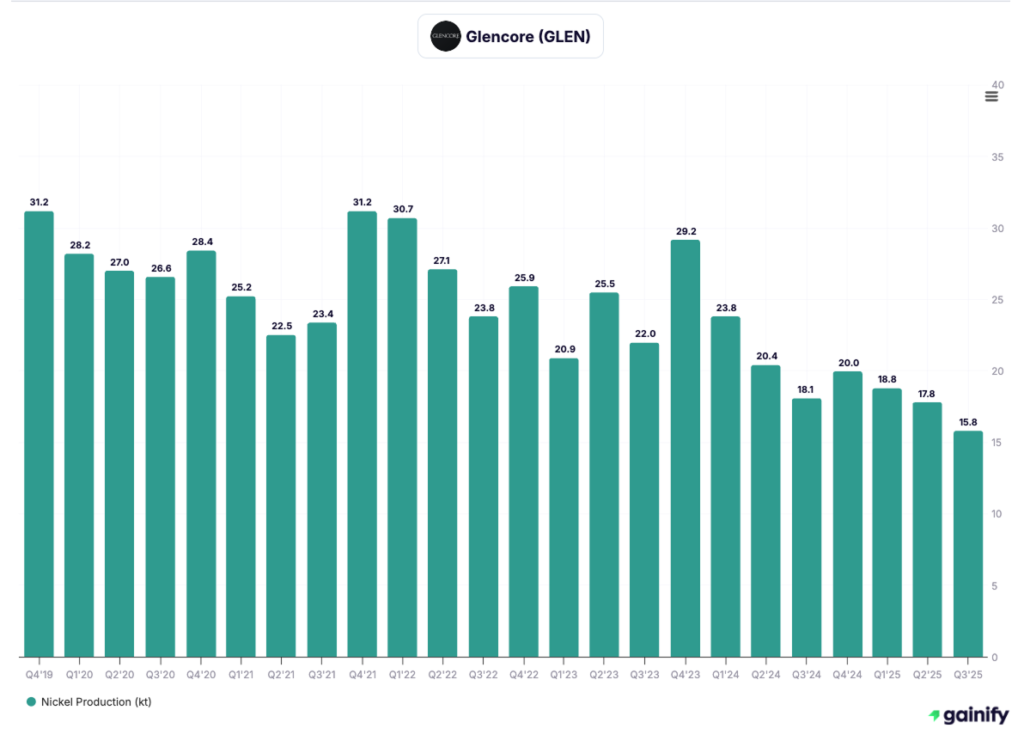

Glencore is one of the world’s largest diversified miners and commodity marketers, with a unique integrated model spanning production, processing, and global trading. Within nickel, Glencore controls a portfolio of long-life assets across Canada, Australia, and New Caledonia, complemented by downstream metallurgical and marketing capabilities that allow the group to optimize margins across cycles rather than relying solely on spot prices.

Investment thesis

Glencore’s nickel exposure is best viewed through the lens of resilience and optionality. At its 2025 Capital Markets Day, management outlined a disciplined capital framework supported by $25.3bn of shareholder returns delivered since 2021, underscoring cash generation through the cycle. In nickel specifically, the company expects production of 70–80kt in 2026, maintaining scale while prioritizing higher-quality units relevant for energy transition demand. Operationally, Glencore has identified $1bn of recurring cost savings across more than 300 initiatives, much of which is expected to be delivered by the end of 2026, reinforcing downside protection even in a lower-price environment.

Key risks

- Geopolitical exposure: nickel operations span multiple jurisdictions, exposing Glencore to regulatory changes, fiscal instability, and permitting delays that can disrupt production or increase costs.

- Price cyclicality: despite diversification, earnings remain sensitive to global nickel and base metal prices, particularly during periods of sustained oversupply.

- Execution discipline: delivering cost savings and maintaining asset reliability across a complex global portfolio requires continued operational focus; slippage could dilute expected returns.

3. Nickel Industries (ASX: NIC)

Market cap: A$3.21B

Adjusted EBITDA (Q3 2025): US$87M

Total nickel production (Q3 2025): 31,148 tonnes

Business overview

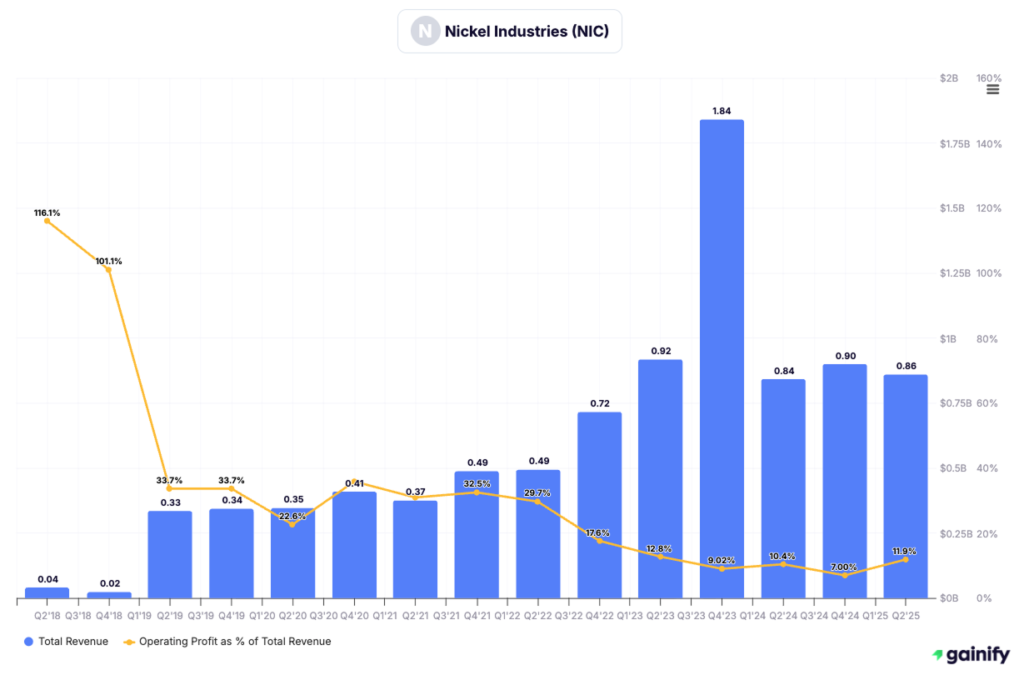

Nickel Industries is a vertically integrated nickel producer with core operations in Indonesia, spanning rotary kiln electric furnace (RKEF) nickel pig iron production, high-pressure acid leach (HPAL) exposure, and upstream mining assets. The company’s strategy is built around scale, cost competitiveness, and downstream integration, positioning it as one of the most efficient producers in the global nickel cost curve. Its asset base is closely aligned with Indonesia’s role as the dominant supplier of primary nickel units.

Investment thesis

Nickel Industries’ appeal lies in its ability to generate cash flow at current nickel prices while retaining leverage to any tightening in higher-quality nickel markets. In Q3 2025, the company produced 31,148 tonnes of nickel from its RKEF operations, benefiting from operating leverage and lower unit costs across its integrated platform. Adjusted EBITDA of US$87M in the quarter highlights resilience despite ongoing volatility in ore pricing and regulatory approvals. The combination of operating scale, diversified processing routes, and progressing HPAL exposure provides optionality to battery-grade nickel demand as the market gradually shifts toward higher-purity products.

Key risks

- Indonesia exposure: regulatory uncertainty around mining quotas, export approvals, and permitting timelines can introduce volatility in volumes and near-term earnings, as seen with recent RKAB delays.

- Commodity sensitivity: earnings remain closely linked to nickel pricing, particularly for lower-grade nickel used in stainless steel, which is currently oversupplied.

- Execution complexity: managing multiple processing routes, joint ventures, and expansion projects increases operational and capital execution risk, especially as HPAL assets move toward full commissioning.

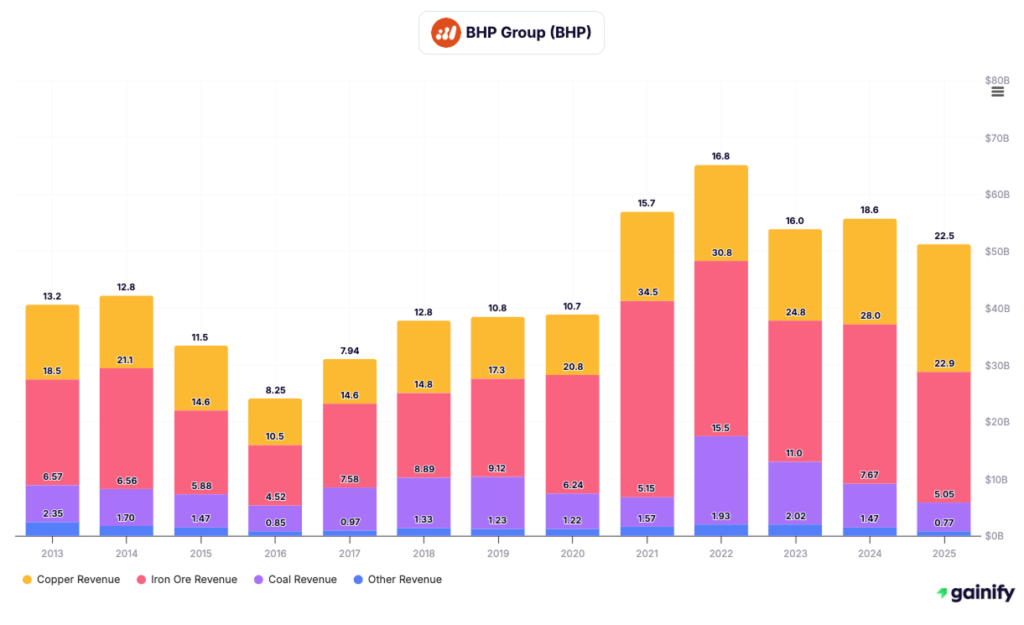

4. BHP Group (ASX: BHP)

Market cap: $155.43B

Forward P/E: 15.45x

Revenue (LTM): $51.26B

Business overview

BHP is one of the world’s largest diversified mining companies, with a portfolio spanning iron ore, copper, coal, potash, and nickel. Nickel sits within BHP’s broader energy transition exposure, supplying a critical input for batteries and electrification while benefiting from the company’s scale, balance sheet strength, and operational discipline. Unlike pure-play nickel producers, BHP approaches the metal as part of a long-cycle portfolio optimized for resilience across commodity cycles.

Investment thesis

BHP’s nickel exposure is best understood through balance sheet durability and optionality rather than near-term volume growth. In FY25, the group generated $26.0B in underlying EBITDA, supporting disciplined capital allocation even amid weaker commodity pricing. Net operating cash flow reached $18.7B, underscoring BHP’s ability to self-fund operations, dividends, and selective growth without reliance on external financing.

Importantly for nickel investors, BHP has demonstrated a willingness to preserve long-term value by suspending higher-cost operations when market conditions deteriorate, rather than pursuing uneconomic output. As of FY25, group net debt stood at $12.9B, keeping leverage low and providing flexibility to reaccelerate nickel exposure when the cost curve tightens and pricing improves. This positioning allows BHP to retain upside to a future nickel recovery while limiting downside risk during periods of surplus.

Key risks

- Portfolio dilution: nickel represents a relatively small share of group earnings, meaning upside from a nickel-specific recovery may be diluted by performance in iron ore, copper, or coal.

- Operational timing: temporary suspension of higher-cost nickel operations may delay volume recovery if market conditions improve faster than expected.

- Commodity cyclicality: despite diversification, BHP remains exposed to global industrial demand, and prolonged weakness across multiple commodities could pressure cash flow and capital allocation flexibility.

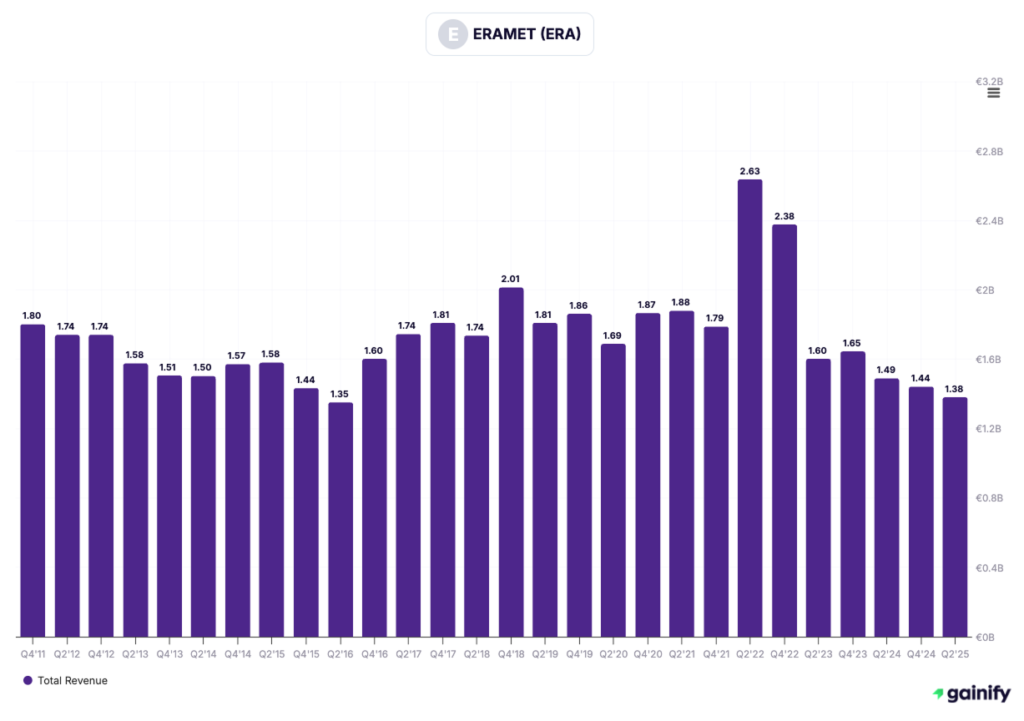

5. Eramet (ENXTPA: ERA)

Market cap: $1.78B

Forward P/E: -7.84x

Revenue (LTM): $3.21B

Business overview

Eramet is a global mining and metals company with core exposure to nickel, manganese, and lithium, positioning it squarely within the critical materials supply chain for batteries and energy transition technologies. Nickel remains a foundational earnings contributor, particularly through Eramet’s Indonesian operations, while lithium has emerged as a strategic growth pillar through the company’s proprietary Direct Lithium Extraction platform. This dual exposure gives Eramet leverage to both traditional stainless steel demand and higher-purity battery materials.

Investment thesis

Eramet’s investment case is centered on asset quality, technological differentiation, and optionality through the cycle. The company’s flagship Centenario project in Argentina is a Tier-1 brine asset designed for 24 kt-LCE of annual capacity, with ramp-up on track to reach close to full utilization by the end of 2026. Crucially, Eramet’s proprietary DLE process has demonstrated greater than 90% lithium recovery and over 99% impurity rejection, materially improving yield, cost structure, and environmental footprint compared with conventional evaporation methods.

From a portfolio perspective, Eramet benefits from operational flexibility. Nickel assets provide near-term cash flow exposure to industrial demand, while lithium offers asymmetric upside as battery-grade supply tightens. Despite generating $3.21B in trailing revenue, the stock trades at a negative forward P/E, reflecting depressed pricing rather than asset impairment. As higher-cost supply exits and demand quality improves, Eramet is positioned to benefit from both margin recovery in nickel and volume growth in lithium.

Key risks

- Commodity cyclicality: Nickel pricing remains under pressure due to surplus supply, particularly from Indonesia, which can weigh on near-term earnings volatility.

- Execution complexity: Scaling advanced processing technologies such as DLE requires precise operational control, and ramp-up delays could impact expected returns.

- Jurisdictional exposure: Operations across Indonesia, New Caledonia, and Argentina introduce regulatory, fiscal, and permitting risks that can affect project economics.

6. Sumitomo Corporation (TSE: 8053)

Market cap: $41.45B

Forward P/E: 11.01x

Revenue (LTM): $48.84B

Business overview

Sumitomo Corporation is a diversified Japanese trading house with exposure across industrials, infrastructure, energy transition, and natural resources. For nickel-focused investors, the appeal lies in optionality rather than pure-play exposure. Sumitomo participates across multiple resource-linked value chains while offsetting commodity cyclicality with large, cash-generative non-resource businesses. This structure provides resilience across price cycles while retaining upside leverage when commodities tighten.

Investment thesis

Sumitomo’s role in a nickel portfolio is best understood as a cycle-resilient compounder with embedded commodity upside. The company has improved earnings visibility and balance sheet discipline, which is critical in an environment where nickel prices remain range-bound. In the first half of FY2025, profit attributable to owners of the parent reached ¥301.2B, and management reaffirmed a full-year profit forecast of ¥570.0B, signaling confidence despite mixed global growth and volatile commodity markets.

This setup creates a favorable asymmetric profile for 2026. If nickel prices remain subdued, diversified earnings and disciplined capital allocation can still support returns. If the market tightens later in the cycle, Sumitomo’s exposure to upstream and midstream resources provides incremental upside without requiring a binary commodity bet.

Key risks

- Commodity sensitivity: Despite diversification, earnings remain exposed to weaker commodity prices or operational disruptions in resource-linked segments.

- FX and macro exposure: Yen volatility and global demand slowdowns can affect consolidated earnings, particularly given the company’s international footprint.

- Conglomerate discount: Portfolio breadth can dilute the nickel narrative and delay market recognition of incremental improvements.

- Capital allocation execution: Long-term returns depend on disciplined investment pacing and portfolio optimization; misallocation could pressure returns even in stable operating conditions.

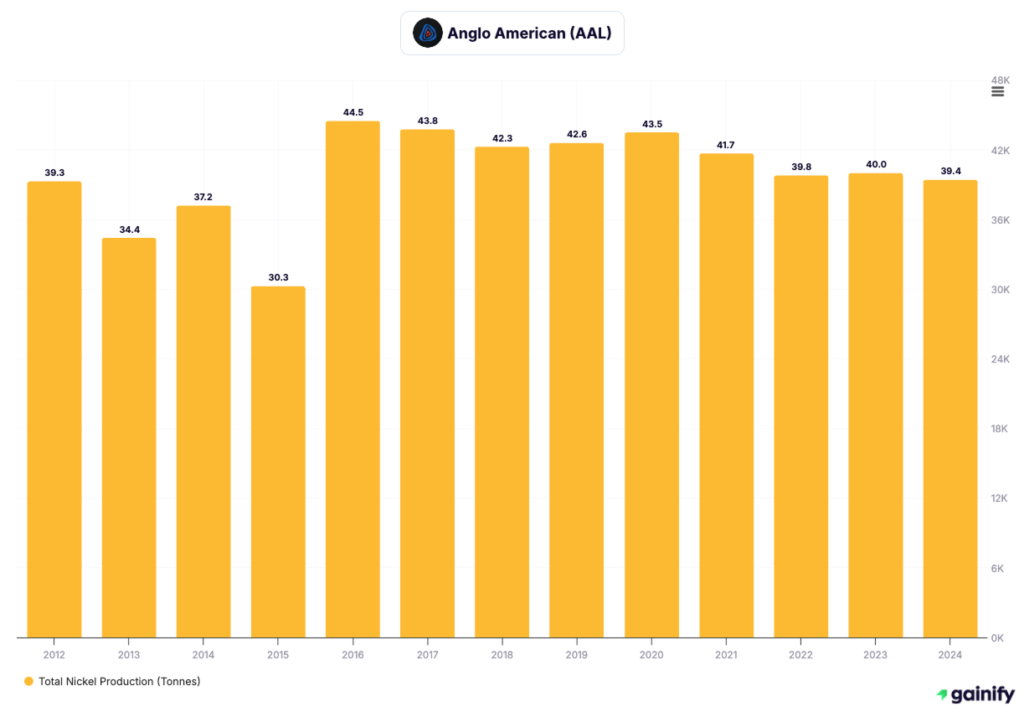

7. Anglo American (LSE: AAL)

Market cap: $43.88B

Forward P/E: 53.70x

Revenue (LTM): $21.78B

Business overview

Anglo American is a diversified global mining group with material exposure to nickel alongside copper, iron ore, and platinum group metals. Nickel sits within the company’s broader portfolio of future-facing metals tied to electrification and decarbonization. Through assets such as Barro Alto and Codemin in Brazil, Anglo maintains exposure to Class 1 nickel suitable for battery supply chains while benefiting from diversification across commodities and geographies.

Investment thesis

Anglo American’s nickel exposure is best viewed through portfolio optionality rather than pure-play leverage. The company is positioning itself as a leading supplier of critical minerals as it reshapes its asset base toward metals with long-term structural demand. Management has outlined a framework to unlock $800M in recurring annual pre-tax synergies and up to $1.4B in annual EBITDA uplift through portfolio optimization and operational efficiencies. While nickel is not the dominant earnings driver today, Anglo’s scale, disciplined capital allocation, and cost control allow it to sustain nickel operations through periods of price weakness while retaining upside to a tighter market later in the decade.

Key risks

- Portfolio dilution: Nickel represents a relatively small share of group earnings, which may limit upside from a nickel-specific recovery.

- Operational complexity: Managing a large, diversified global asset base increases execution risk and may pressure returns during periods of market volatility.

- Commodity cyclicality: Broader exposure to global industrial demand, foreign exchange movements, and cost inflation can overshadow improvements in individual metals such as nickel.

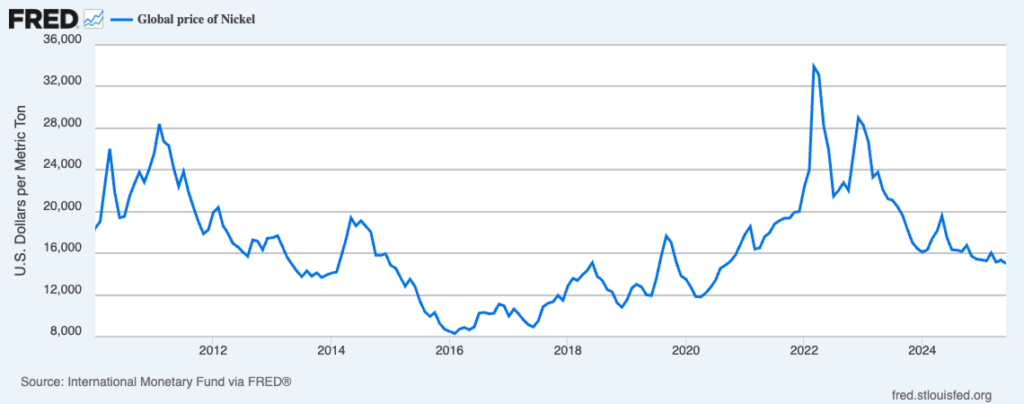

Nickel Market Outlook for 2026

Nickel prices are expected to remain largely range-bound in 2026, with the market still working through the consequences of a multi-year supply shock. Rapid capacity additions in Indonesia, particularly in nickel pig iron and intermediate products, have structurally altered the global supply landscape. This has kept headline prices under pressure and extended the surplus, especially in lower-grade nickel primarily used for stainless steel production. Industry research indicates that this surplus is likely to persist in the near term, limiting the scope for a sharp cyclical rebound.

That said, the composition of demand is becoming increasingly important. While stainless steel continues to account for the majority of nickel consumption, the quality split within the market is widening. Higher-purity Class 1 nickel, which is required for battery chemistries and advanced energy applications, is tightening more gradually. EV demand normalization has been slower than initially expected, but underlying penetration trends remain intact. As battery manufacturers prioritize performance, energy density, and supply security, demand for refined nickel units is improving at the margin.

Looking beyond 2026, the medium-term outlook remains constructive despite current oversupply. Capital investment discipline is beginning to reassert itself as low prices compress margins and strain balance sheets, particularly for higher-cost producers. Project delays, cancellations, and reduced expansion plans are gradually removing marginal supply from the cost curve. At the same time, structural demand drivers tied to electrification, grid storage, and industrial decarbonization remain intact, even if their timelines have extended.

For investors, this environment favors selectivity over speculation. The most attractive opportunities are likely to be found among producers that can generate sustainable cash flow at current price levels, operate in the lower half of the global cost curve, and maintain balance sheet flexibility. These companies retain downside protection in a prolonged surplus while offering meaningful upside leverage if and when the nickel market rebalances later this decade.

Conclusion

Nickel enters 2026 at a turning point rather than a peak. The market is still working through the consequences of years of aggressive supply expansion, particularly in Indonesia, but the excesses that defined the recent cycle are beginning to force discipline. Capital spending is slowing, marginal production is being rationalized, and balance sheet strength is once again separating long-term winners from weaker operators.

In this environment, the opportunity is not in forecasting short-term price moves, but in identifying companies that can generate cash at today’s prices while retaining upside to a gradual rebalancing later in the decade. The seven nickel stocks highlighted in this report reflect that approach. They span global mining leaders, diversified commodity platforms, and focused producers with strategic exposure to battery-grade nickel and future-facing supply chains.

As demand quality improves and cost pressures reshape the industry, nickel is likely to reassert its strategic importance within electrification and industrial decarbonization. Investors willing to look beyond near-term volatility and focus on asset quality, capital discipline, and jurisdictional resilience may find that today’s subdued sentiment provides a more attractive entry point than the cycle highs that preceded it.

Disclaimer

This content is provided for informational and educational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. All opinions expressed are based on publicly available information believed to be reliable at the time of writing but are subject to change without notice. Investing in equities and commodities involves risk, including the potential loss of capital. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.