A Sector Searching for Its Next Upswing

The global hotel industry in 2025 stands at an important turning point. Travel volumes remain strong, occupancy rates have largely returned to pre-pandemic levels, and room pricing continues to edge higher. Yet hotel stocks have lagged behind the broader market as rising labor and financing costs weigh on profitability and the recovery in corporate travel remains uneven.

By late 2025, performance across regions has become increasingly uneven. Europe and parts of Asia are seeing steady price growth and record tourist arrivals, while the United States faces softer domestic travel and rising competition from short-term rentals. The result is a market where fundamentals are improving, but investor sentiment remains cautious.

For investors, hotel stocks now provide a balanced combination of income, resilience, and cyclical opportunity. They offer diversification benefits but still carry risks tied to margin pressure and business travel trends. The real differentiator will be which operators can defend profitability while positioning for the next leg of global travel growth.

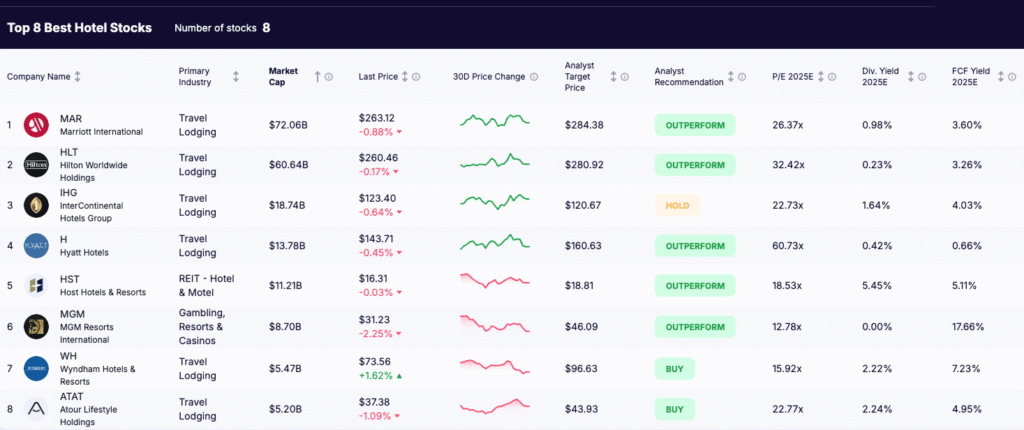

Here are the Top 8 Hotel Stocks to Follow in 2025, representing leading global brands and regional players that stand to benefit from the continued normalization of travel and accommodation demand.

Key Highlights

- Hotel stocks have underperformed the S&P 500 by nearly 15% in 2025, reflecting investor caution despite solid travel volumes and steady growth in room rates.

- Global occupancy levels remain close to 70%, supported by strong leisure demand in Europe and Asia, though business and group travel continue to lag pre-pandemic norms.

- While brand loyalty and pricing power remain strengths, rising labor costs, financing expenses, and slower corporate recovery could limit the pace of any 2026 rebound.

Top 8 Hotel Stocks to Watch

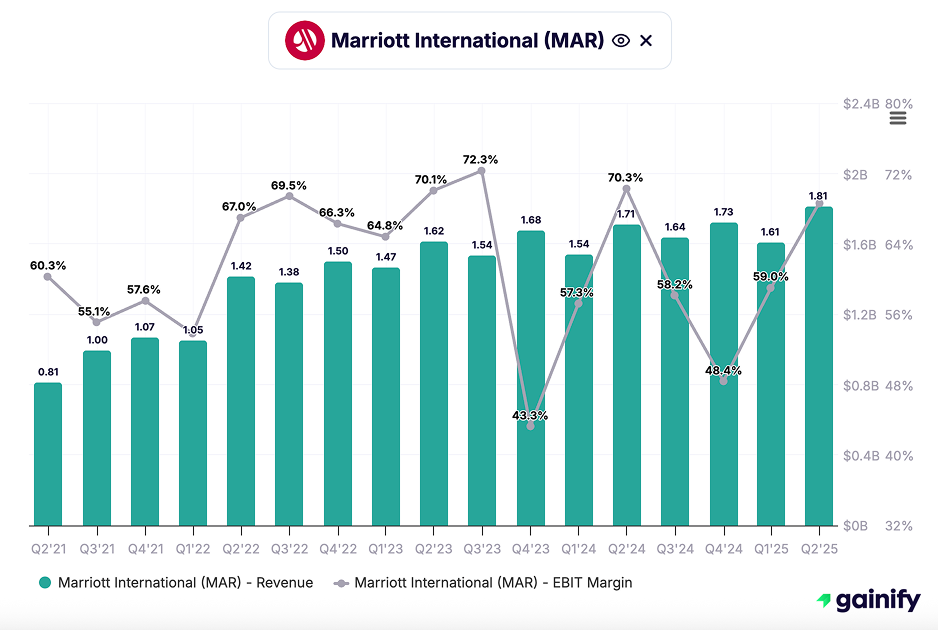

1. Marriott International (MAR)

Market Cap: $72.1B | P/E (2025E): 26.4x | Dividend Yield: 0.98% | Rating: Outperform

Overview: Marriott (MAR) is the world’s largest hotel company, operating 9,600+ properties across 30+ brands in 143 countries, supported by the Marriott Bonvoy program with ~248 million members.

→ Core strength: unmatched global scale and loyalty network.

Investment thesis:Marriott’s asset-light franchise and management model produces high-margin, fee-based earnings and exceptional cash generation. Its breadth across segments and regions makes it a durable compounder.

→ Core driver: asset-light model powering resilient, high-return earnings.

Latest Developments (Q2 2025)

- Global RevPAR rose 1.5 % y/y, driven by international demand offsetting U.S. softness.

- Added ~17,300 net rooms (+4.7 % YoY); development pipeline at a record ~3,900 hotels / 590K rooms.

- Returned $2.1 B YTD to shareholders through dividends and buybacks ($0.7 B in Q2 alone).

Key risks: Labor and energy cost inflation could pressure margins; U.S. softness and higher interest rates may temper owner growth; execution risk on the large global pipeline persists.

→ Core concern: margin compression from macro cost pressures.

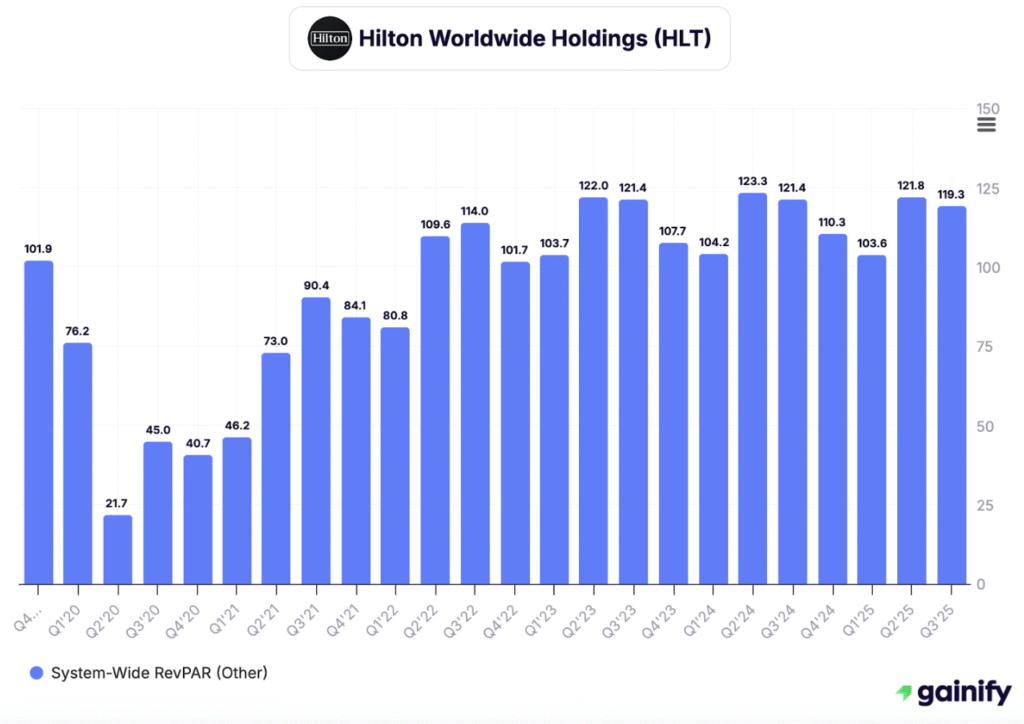

2. Hilton Worldwide Holdings ($HLT)

Market Cap: $60.6B | P/E (2025E): 32.4x | Dividend Yield: 0.23% | Rating: Outperform

What it does: Hilton operates and franchises 8,000+ properties across 18 brands, including Waldorf Astoria, Hilton Hotels, and DoubleTree, generating most of its earnings through management and franchise fees.

→ Core strength: global brand equity and highly efficient franchise model.

Investment thesis: Hilton’s asset-light structure delivers predictable, high-margin cash flow supported by consistent global brand performance. Its expansion in high-growth markets such as India and Southeast Asia enhances its long-term unit growth outlook.

→ Core driver: scalable franchise model fueling steady earnings growth and global reach.

Latest Developments (Q3 2025)

- Global comparable RevPAR declined approximately 1.1% year over year, with U.S. RevPAR down 2.3% as domestic demand softened.

- Hilton added ~23,200 net rooms during the quarter, bringing net unit growth to 6.5% year over year; the development pipeline reached a record ~515,000 rooms.

- Despite softer RevPAR, adjusted EPS of $2.11 beat expectations, and management raised full-year 2025 EPS guidance while narrowing RevPAR growth to flat to +1%.

Key risks: Premium valuation could cap near-term upside; a slowdown in global travel or luxury demand may weigh on margins; rising development costs could delay pipeline conversion.

→ Core concern: elevated valuation amid potential travel demand moderation.

3. InterContinental Hotels Group ($IHG)

Market Cap: $18.7B | P/E (2025E): 22.7× | Dividend Yield: 1.64% | Rating: Hold

Overview: IHG manages global brands such as Holiday Inn, Crowne Plaza, Kimpton, and InterContinental across 100+ countries, with most of its earnings derived from long-term franchise and management agreements.

→ Core strength: diversified brand portfolio and franchise model underpin stable cash flows.

Investment thesis: IHG’s asset-light structure supports steady fee-based earnings and strong cash conversion. Its balanced exposure to the U.S. and Europe provides resilience through market cycles.

→ Core driver: franchise earnings resilience and geographic balance.

Latest developments:

- Year-to-date global RevPAR +1.4 %, easing -0.1 % in Q3 as Americas softened (-0.9 %) while EMEAA (+2.8 %) partly offset weaker Greater China (-1.8 %).

- Opened 14,500 rooms (99 hotels) in the quarter, +17 % y/y, with signings up +18 %; total pipeline 342 k rooms (2,316 hotels), up 4.7 % y/y.

- Delivered net system growth +5.2 % y/y, supported by conversions and boutique brand expansion; completed $700 M of 2025’s $900 M buyback program, reducing share count by 3.9 %.

Key risks: Currency fluctuations and weaker European business travel could weigh on earnings; slower recovery in China remains a drag on near-term growth.

→ Core concern: regional softness and FX exposure may limit upside momentum.

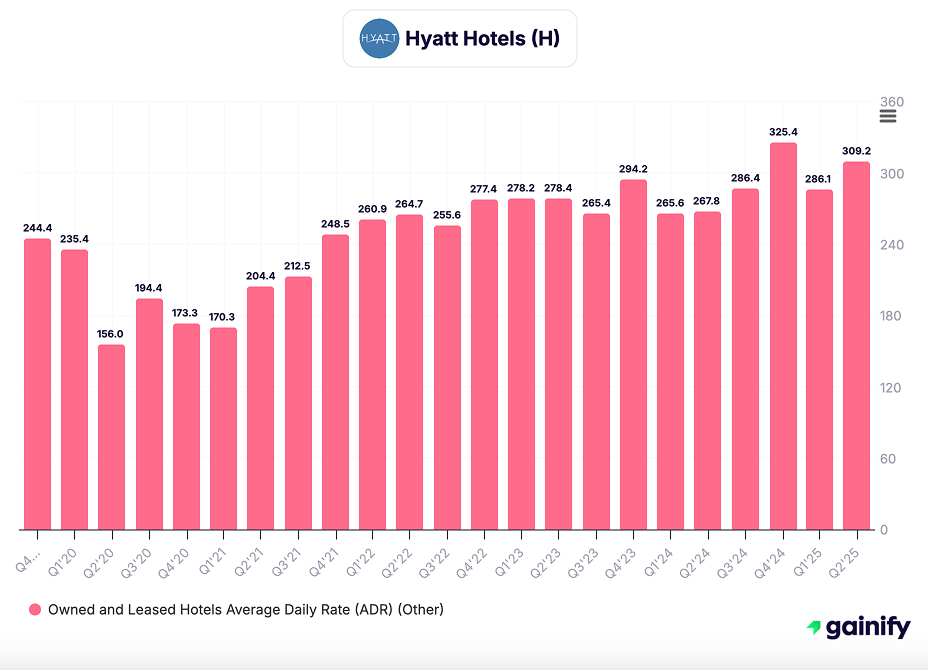

4. Hyatt Hotels ($H)

Market Cap: $13.8B | P/E (2025E): 60.7× | Dividend Yield: 0.42% | Rating: Outperform

Overview: Hyatt focuses on luxury and lifestyle properties under brands like Park Hyatt, Alila and Thompson, carving out a niche in experiential hospitality in destination markets.

→ Core strength: high-end lifestyle positioning and brand uniqueness.

Investment thesis: Hyatt’s premium-tier model, combined with an asset-sales/asset-light strategy, amplifies margin potential and delivers flexibility. The company benefits from travellers willing to pay premium rates for unique experiences.

→ Core driver: luxury / lifestyle differentiation driving pricing power and margin expansion.

Latest developments:

- RevPAR up 1.6 % YoY, supported by luxury and lifestyle strength.

- Net rooms +11.8 % ( +6.5 % excluding acquisitions ); pipeline ~140 K rooms, up 8 %.

- Adjusted EBITDA $303 M and EPS $0.68; full-year outlook sees RevPAR +1–3 % and capital returns ~$300 M.

Key risks: A slowdown in luxury spending or in travel to premium destinations could undermine Hyatt’s growth; elevated valuation leaves little margin for error.

→ Core concern: premium exposure and high multiple heightening sensitivity to demand shifts.

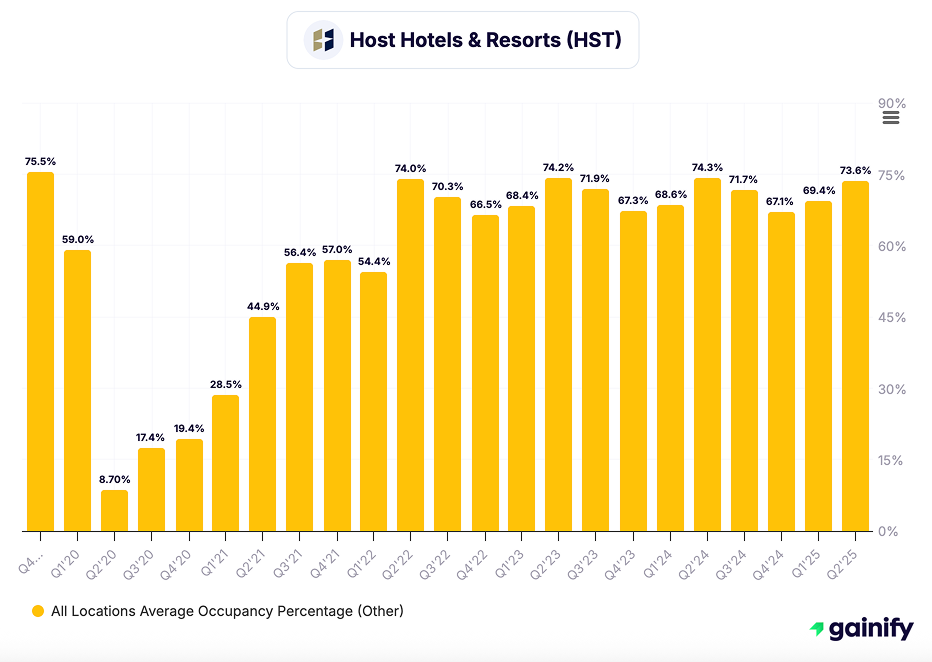

5. Host Hotels & Resorts ($HST)

Market Cap: $11.2B | P/E (2025E): 18.5× | Dividend Yield: 5.45% | Rating: Outperform

Overview: Host (HST) is the largest U.S. lodging REIT, owning ~77 high-quality hotels managed by top brands such as Marriott International, Hyatt Hotels Corporation and Hilton Worldwide Holdings.

→ Core strength: premium real-estate portfolio with high income yield.

Investment Thesis: Host’s attractive dividend yield and high-quality asset base offer income investors inflation-hedged real estate exposure in lodging. Its portfolio is well-positioned to benefit from leisure travel recovery and long-term asset appreciation.

→ Core driver: stable cash flow + real-estate leverage to global lodging demand.

Latest Developments (Q2 2025):

- Comparable hotel RevPAR rose 3.0% in Q2, and total RevPAR ~$400.91, up ~4.2% year-over-year.

- Adjusted EBITDAre was $496 million (+3.1% YoY) and the company generated total revenue ~$1.59 billion (+8.2% YoY).

- The debt balance stood at ~$5.1 billion with ~$2.3 billion of available liquidity; repurchased ~6.7 million shares for ~$105 million in Q2.

Key Risks: Rising interest rates or declines in real-estate valuations could hurt total returns; weaker group/business travel may dampen performance in core urban hotels.

→ Core concern: asset-heavy REIT structure increases sensitivity to macro and travel-cycle risks.

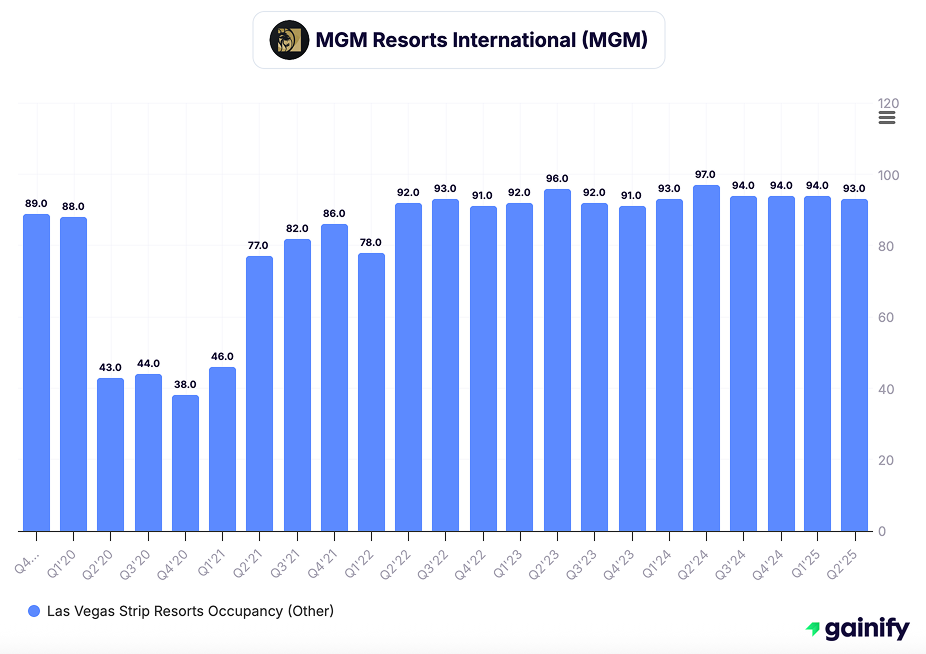

6. MGM Resorts International ($MGM)

Market Cap: $8.7B | P/E (2025E): 12.8× | Dividend Yield: 0.00% | Rating: Outperform

What it does: MGM operates major resorts and casinos such as Bellagio, MGM Grand, and MGM Cotai in Macau, and also runs the online gaming platform BetMGM.

→ Core strength: integrated resort model across travel, gaming and digital-entertainment.

Investment thesis: MGM offers exposure to both global travel and entertainment via its diversified business streams — from luxury resorts to online gaming — positioning it to benefit as U.S. leisure spending remains strong and Asia reopens.

→ Core driver: multiple revenue engines (resorts + online) with leverage to broader demand recovery.

Latest Developments (Q2 2025):

- Consolidated net revenues reached $4.4 billion, up ~2% year-over-year; adjusted EBITDA was $648 million.

- The company repurchased 8 million shares (~$217 million) in Q2 and continues to aggressively use buybacks.

- Online gaming segment BetMGM and MGM China each set new records: MGM China delivered market share ~16.6% and strong EBITDAR growth.

Key risks: Regulatory changes, especially in gaming or China, could impact revenue; macro weakness or travel slowdown would hit resort performance.

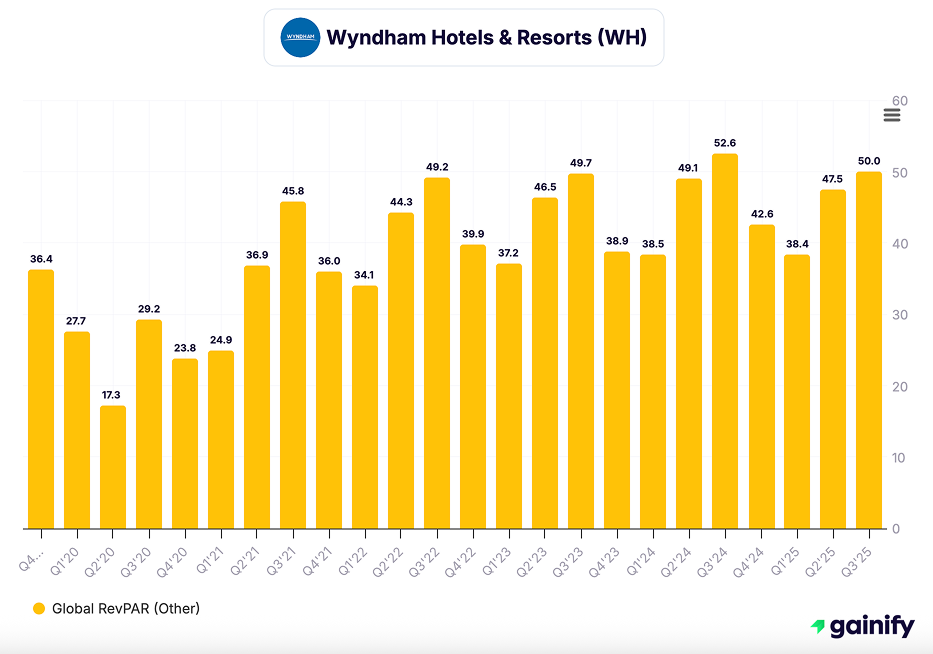

7. Wyndham Hotels & Resorts ($WH)

Market Cap: $5.5B | P/E (2025E): 15.9× | Dividend Yield: 2.22% | Rating: Buy

Overview: Wyndham (WH) operates over 9,000 hotels globally, primarily in the mid-scale and economy segments under brands like Super 8, Days Inn and La Quinta.

→ Core strength: broad affordable-travel footprint and resilient franchise model.

Investment Thesis: Wyndham’s focus on economy and mid-scale lodging makes it more defensible during economic soft patches. Its asset-light franchise base and strong cash flow generation provide steady yield and portfolio stability.

→ Core driver: stable fee income in budget lodging leveraging franchise scale.

Latest Developments (Q3 2025):

- Adjusted EBITDA $213 million (+2% YoY) and adjusted EPS $1.46 (+5% YoY).

- Global RevPAR down ~5% in constant currency, with U.S. –5% and international –2%.

- System-wide rooms grew ~4% YoY; pipeline reached a record ~257,000 rooms, up 4%.

Key Risks: Weaker consumer spending in budget segments could drag occupancy and royalty income; RevPAR declines and franchisee pressure may erode margin.

→ Core concern: exposure to mid-scale lodging makes the stock sensitive to broader consumer downturns and rate erosion.

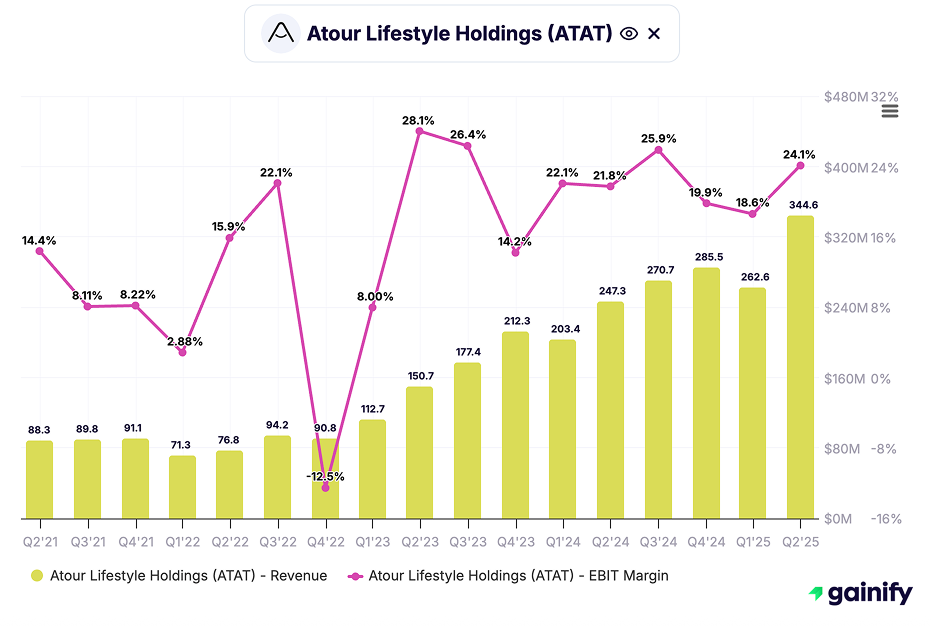

8. Atour Lifestyle Holdings ($ATAT)

Market Cap: $5.2B | P/E (2025E): 22.8× | Dividend Yield: 2.24% | Rating: Buy

What it does: Atour (ATAT) is a Chinese boutique hotel and lifestyle group operating brands such as Atour, Atour S, ZHOTEL, and A.T. House, blending hospitality with branded retail and e-commerce to serve younger domestic travelers.

→ Core strength: integrated hotel and lifestyle retail platform in China’s growing travel market.

Investment Thesis: Atour benefits from China’s expanding middle class and domestic tourism boom, with a hybrid model combining hotels, branded goods, and digital sales. Its asset-light structure supports scalable, high-margin growth.

→ Core driver: lifestyle-led brand expansion aligned with China’s domestic consumption growth.

Latest Developments (Q2 2025)

- Net revenues RMB 2.47 B (+37% YoY); adjusted EBITDA RMB 610 M (+38% YoY).

- Operating network reached 1,824 hotels / 204,784 rooms, up ~29% YoY.

- Retail gross merchandise value rose 85% YoY to RMB 1.14 B on strong e-commerce momentum.

Key Risks: Regulatory tightening or a slowdown in China’s consumer demand could weigh on growth; increasing competition in lifestyle lodging may pressure margins.

→ Core concern: domestic demand softness or policy shifts could constrain near-term expansion.

Global Hotel Industry Outlook (2025)

Region | RevPAR / Performance Outlook | Key Drivers & Insights |

United States | +0.1% (down from +1.8%) | Softer demand due to fewer major events, mild hurricane season, and stronger competition from alternative lodging. |

Canada | +2.4% | Resilient travel demand from U.S. visitors and steady domestic tourism despite trade tensions. |

Latin America | Strong growth | Robust inbound tourism in Mexico, Costa Rica, Colombia, and the Dominican Republic; continued visitor growth expected. |

Europe | +2% to +5% | International arrivals increasing; occupancy steady but rate growth slowing in mature markets. |

Middle East | Solid growth | UAE, Abu Dhabi, and Dubai lead gains from events and new leisure attractions; Saudi Arabia remains strong. |

Asia-Pacific | Strongest global growth | International arrivals up 9% YoY; Japan, Vietnam, Korea, and India driving the region’s top RevPAR gains. |

Bottom Line

The hotel industry is moving from post-pandemic recovery into a phase of slower but more sustainable growth. Cash flows are stabilizing, dividend visibility is improving, and global travel demand continues to normalize rather than accelerate.

For investors, the 8 best hotel stocks offer diversified exposure across leisure, business, and luxury travel. With solid balance sheets, disciplined expansion, and enduring brand strength, these companies present a mix of income potential and selective growth as the hospitality cycle matures.