The stock market in early 2026 is powered by innovation and momentum.

The S&P 500 trades near record highs, and valuations have climbed to levels not seen in more than fifteen years.

The rally has been driven by advances in artificial intelligence, automation, and digital infrastructure.

Companies in semiconductors, cloud computing, and data centers continue to lead market performance, while more traditional sectors lag behind. Earnings growth has concentrated among a small number of technology and innovation leaders.

Monetary policy has begun to ease with the first three rate cuts already in place, yet liquidity is no longer the dominant force. Market direction is now shaped by expectations for productivity gains and long-term structural change across industries.

With valuations elevated, Wall Street analysts have become increasingly selective. Their attention is focused on large-cap companies valued above $50 billion that combine innovation, consistent execution, and durable growth potential.

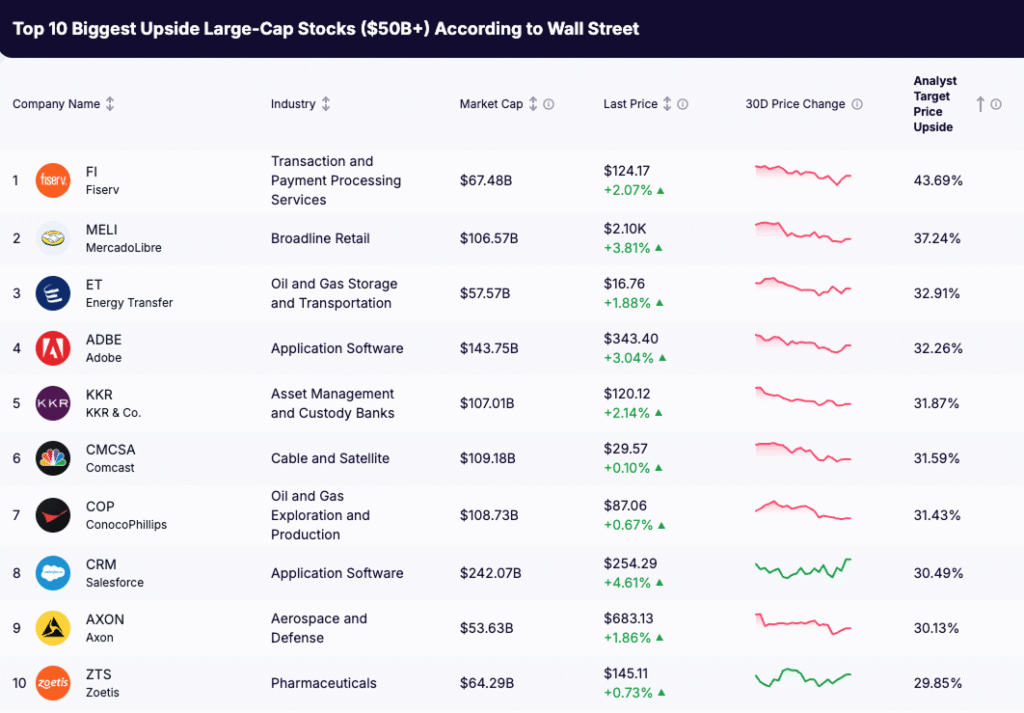

👇 Here are the TOP 10 STOCKS recommended by Wall Street Analysts at the start of 2026.

Top 10 Stocks Recommended by Wall Street Analysts

These are the large-cap companies with the highest consensus price upside based on Wall Street estimates as of January 2026.

Rank | Company | Industry | Market Cap | Analyst Upside |

|---|---|---|---|---|

1 | Interactive Entertainment | $56.82B | +72.95% | |

2 | Enterprise Software | $152.97B | +52.80% | |

3 | Enterprise Software | $562.30B | +51.34% | |

4 | Crypto & Financial Services | $63.78B | +43.26% | |

5 | Utilities & Power Generation | $55.98B | +42.26% | |

6 | Arm Holdings (ARM) | Semiconductors | $121.73B | +40.62% |

7 | Entertainment & Streaming | $415.78B | +38.13% | |

8 | E-commerce & Digital Services | $77.84B | +36.91% | |

9 | Mobility & Delivery Platforms | $172.17B | +36.58% | |

10 | Telecommunications | $223.23B | +35.15% |

Source:Gainify, Wall Street analyst consensus, January 2026

How Smart Investors Think About What Stocks to Buy Today

Professional investors don’t chase momentum. They follow a process. The same logic can help everyday investors make better decisions.

1️⃣ Understand the Macro Landscape

When rates stabilize and inflation moderates, earnings quality becomes more important than valuation alone. Focus on companies that can grow profits even when GDP slows.

2️⃣ Prioritize Financial Strength

Look for low leverage, strong cash conversion, and consistent capital discipline. A solid balance sheet is the foundation for long-term compounding.

3️⃣ Follow the Long-Term Trends

Big themes drive lasting performance. The leading secular trends into 2030 include:

- Artificial Intelligence and Cloud Computing

- Digital Payments and Financial Infrastructure

- Clean Energy Transition

- Biotechnology and Healthcare Innovation

- Cybersecurity and Defense Technology

The goal is not to predict which trend wins first, but to own the businesses enabling all of them.

4️⃣ Diversify with Purpose

Diversification isn’t just about holding more stocks. It’s about combining different sources of growth. Mix cyclical sectors like energy and finance with structural innovators in areas such as AI, software, and biotechnology.

5️⃣ Manage Risk with Discipline

Even professional analysts miss the mark. The key difference is risk control. Use position sizing, stop-loss limits, and regular reviews to manage exposure.

The Bottom Line

As valuations sit close to 15-year highs, the question “what stocks to buy today” has never been more relevant or more complex.

The best opportunities are rarely found in short-term swings. They come from companies that blend innovation with strong balance sheets, disciplined execution, and the ability to adapt to long-term change.

Wall Street’s top 10 names reflect this balance. They include payment networks expanding digital finance, software leaders harnessing AI, and energy firms delivering stable cash flow in a shifting global economy. Together, they represent where growth and resilience meet.

For investors, 2026 is less about chasing momentum and more about owning the businesses that will define the next decade.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham

Disclaimer

This article is intended for educational and informational purposes only. It does not constitute financial advice, investment recommendation, or an offer to buy or sell any security. All data are based on publicly available analyst consensus as of January 2026 and are subject to change. Investors should conduct their own due diligence or consult a licensed financial advisor before making investment decisions.