As cyber threats like ransomware and phishing attacks continue to grow in scale and sophistication, the need for strong digital protection is more important than ever. For long-term investors, cybersecurity is not just a defensive sector. It is a fast-growing opportunity tied to the future of business, technology, and national security.

The global cybersecurity market was valued at $204 billion in 2025, according to Data Bridge Market Research. Other reputable sources such as Research & Markets put the figure at $267.15 billion, while Fortune Business Insights estimates it at $219 billion. Despite these differences, one thing is clear. The market is expanding rapidly. Forecasts show growth to over $560 billion by 2032, with projected annual growth rates ranging from 8.9% to 14.3%.

This growth is driven by increased use of artificial intelligence, automation tools, and cloud-based systems in both public and private sectors. From personal identity protection to enterprise-level threat detection, cybersecurity companies are becoming essential partners across the digital economy.

In this article, we highlight nine leading cybersecurity stocks. These companies include cloud-native security innovators, legacy software providers, and fast-moving AI-powered platforms. Each one plays a distinct role in defending global infrastructure and shows potential for long-term capital appreciation.

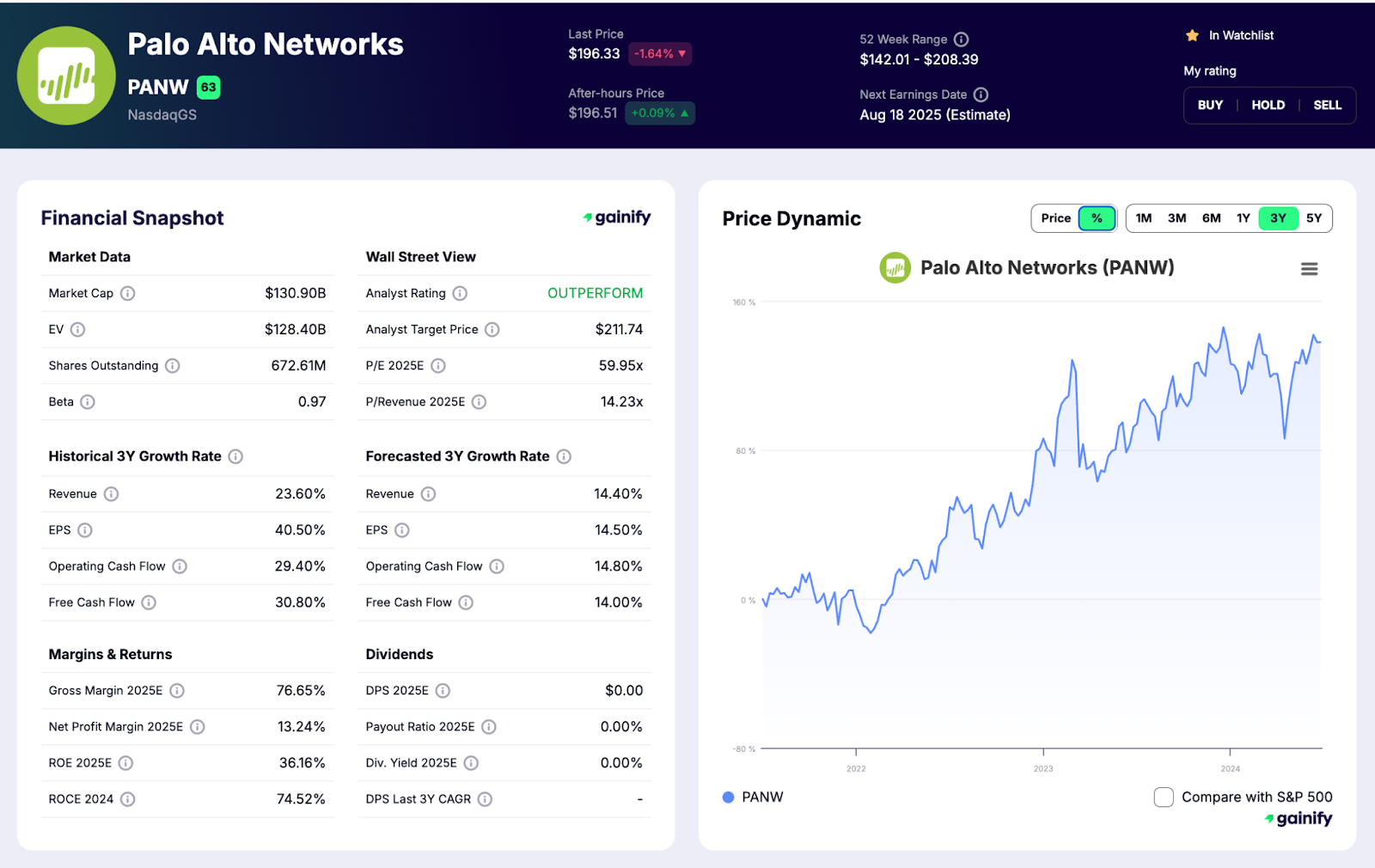

1. Palo Alto Networks (PANW)

- Market Cap: $133 billion

- Revenue LTM: $9.56 billion

- Why it matters: Palo Alto Networks is one of the leading cybersecurity companies in the world, known for its advanced next-generation firewalls and expanding suite of cloud-based cybersecurity solutions.

It plays a central role in modern enterprise security. The company protects businesses from ransomware, phishing attacks, and more sophisticated threats by combining network security, endpoint protection, and AI-driven threat intelligence.

Palo Alto is also a top holding in the iShares Cybersecurity ETF (ticker: IHAK) and a favorite among institutional investors. Its strong brand, consistent innovation, and large customer base make it one of the most reliable choices for long-term investors looking for exposure to the cybersecurity sector.

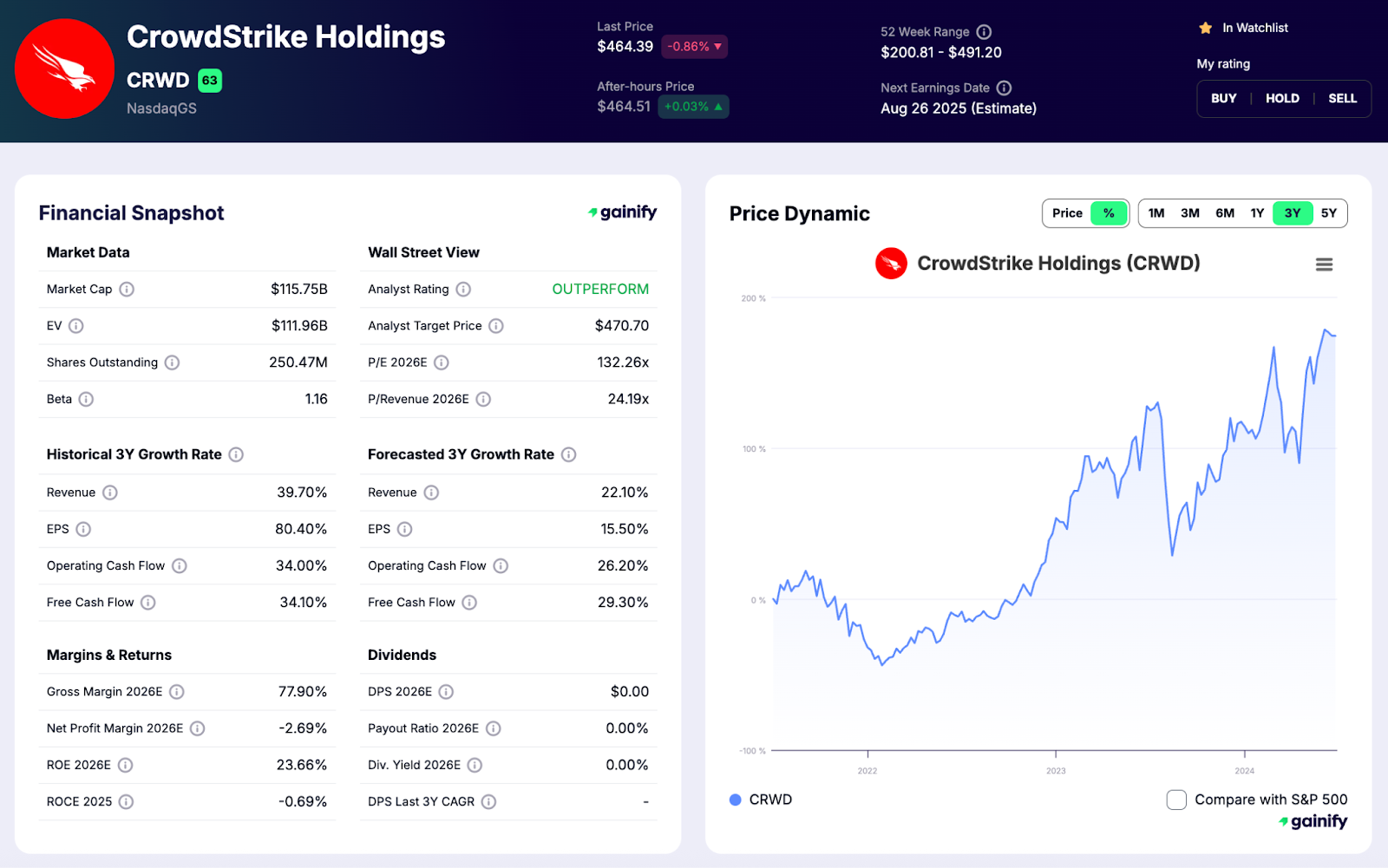

2. CrowdStrike (CRWD)

- Market Cap: $118 billion

- LTM Revenue: $4.57 billion

- Why it matters: CrowdStrike is a cybersecurity company that specializes in cloud-based endpoint protection and AI-powered security solutions. Its flagship Falcon platform leverages artificial intelligence and real-time analytics to detect and prevent advanced threats across devices, networks, and cloud workloads. This proactive approach helps organizations stop breaches before they cause damage.

As a cloud-native software company, CrowdStrike is well-positioned in today’s evolving cybersecurity landscape. The shift toward hybrid and remote work environments has made endpoint security more important than ever. CrowdStrike’s scalable platform provides protection for businesses of all sizes, from small startups to Fortune 500 firms. Its broad adoption reflects a strong vote of confidence from enterprise IT teams and cybersecurity experts.

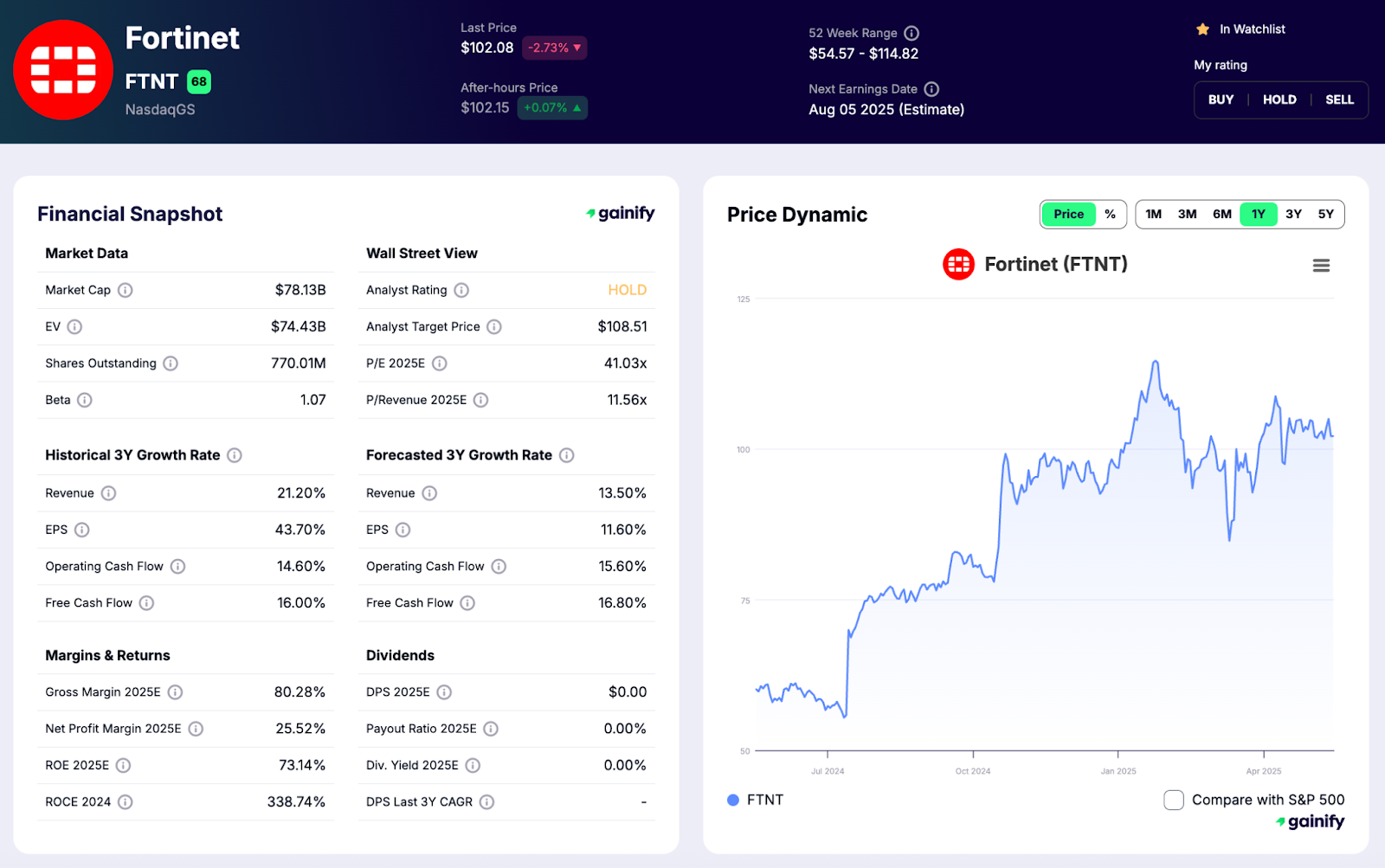

3. Fortinet (FTNT)

- Market Cap: $58 billion

- LTM Revenue: $6.56 billion

- Why it matters: Fortinet Inc. is a global cybersecurity company best known for its leadership in network firewalls and advanced threat protection. Its FortiGate product line is widely deployed across enterprise, government, and service provider environments. Through its integrated Security Fabric platform, Fortinet delivers unified security across endpoints, networks, and multi-cloud environments, addressing the growing need for scalable, real-time cyber defense.

With annual revenues surpassing $6 billion and a broad portfolio of cybersecurity products, Fortinet is a core player in the cybersecurity sector. Its consistent innovation, high enterprise adoption, and strong presence in both hardware and software security make it a go-to name for organizations seeking reliable and efficient protection. As cyber threats increase, Fortinet remains well positioned for long-term growth.

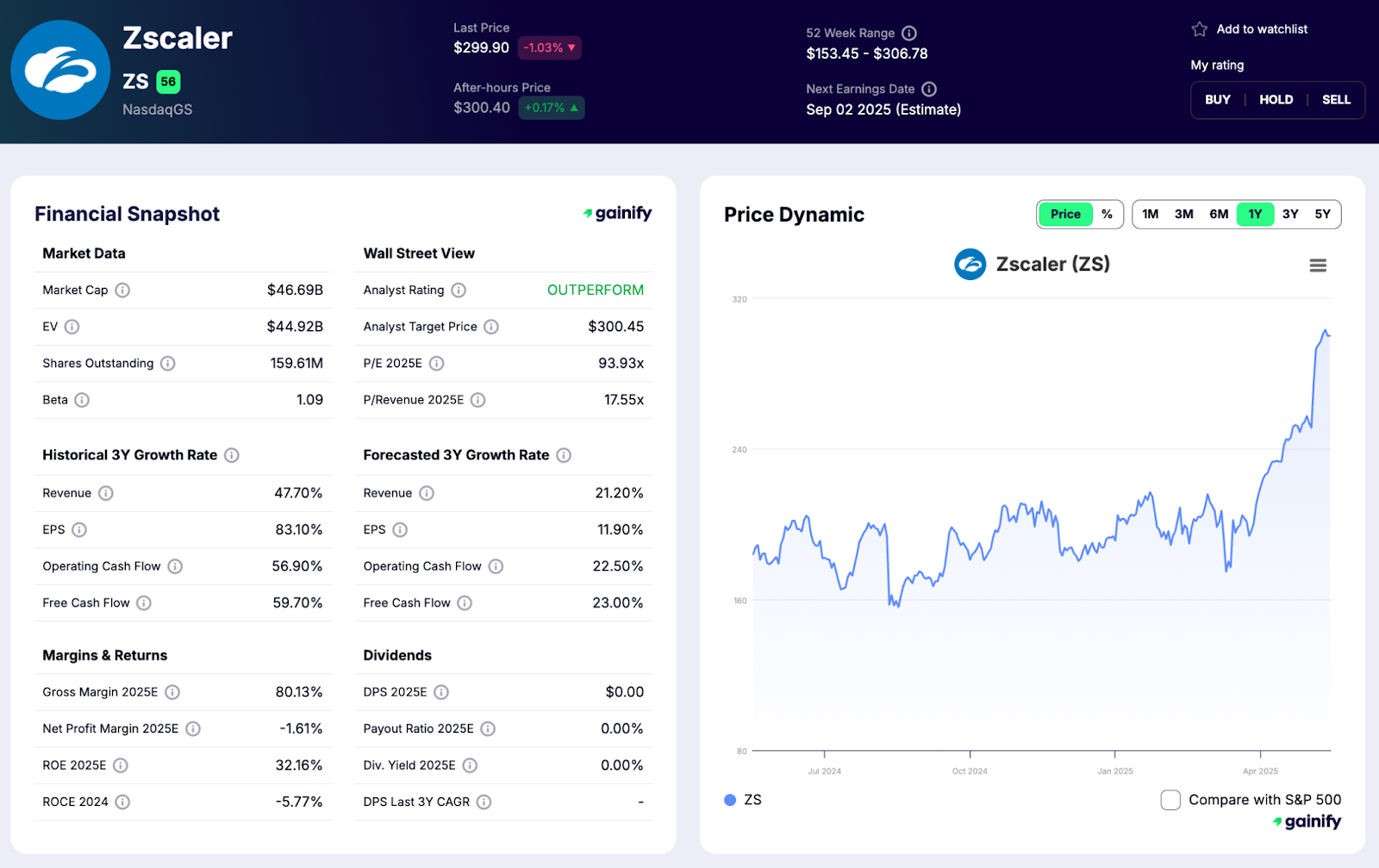

4. Zscaler (ZS)

- Market Cap: $35 billion

- LTM Revenue: $2.83 billion

- Why it matters: Zscaler Inc. is a leading cloud-native cybersecurity company that pioneered the Zero Trust security model. Its platform secures user access to applications regardless of location or device, making it ideal for today’s cloud-first and hybrid work environments. Zscaler’s solutions focus on secure access to the internet and internal applications without relying on traditional network perimeters.

With growing demand for application security and cloud data protection, Zscaler has become a key player in securing digital transformation. Its services help organizations reduce risk, improve performance, and scale security more effectively. As companies shift to cloud infrastructure and remote operations, Zscaler’s role in modern cybersecurity architecture continues to expand rapidly.

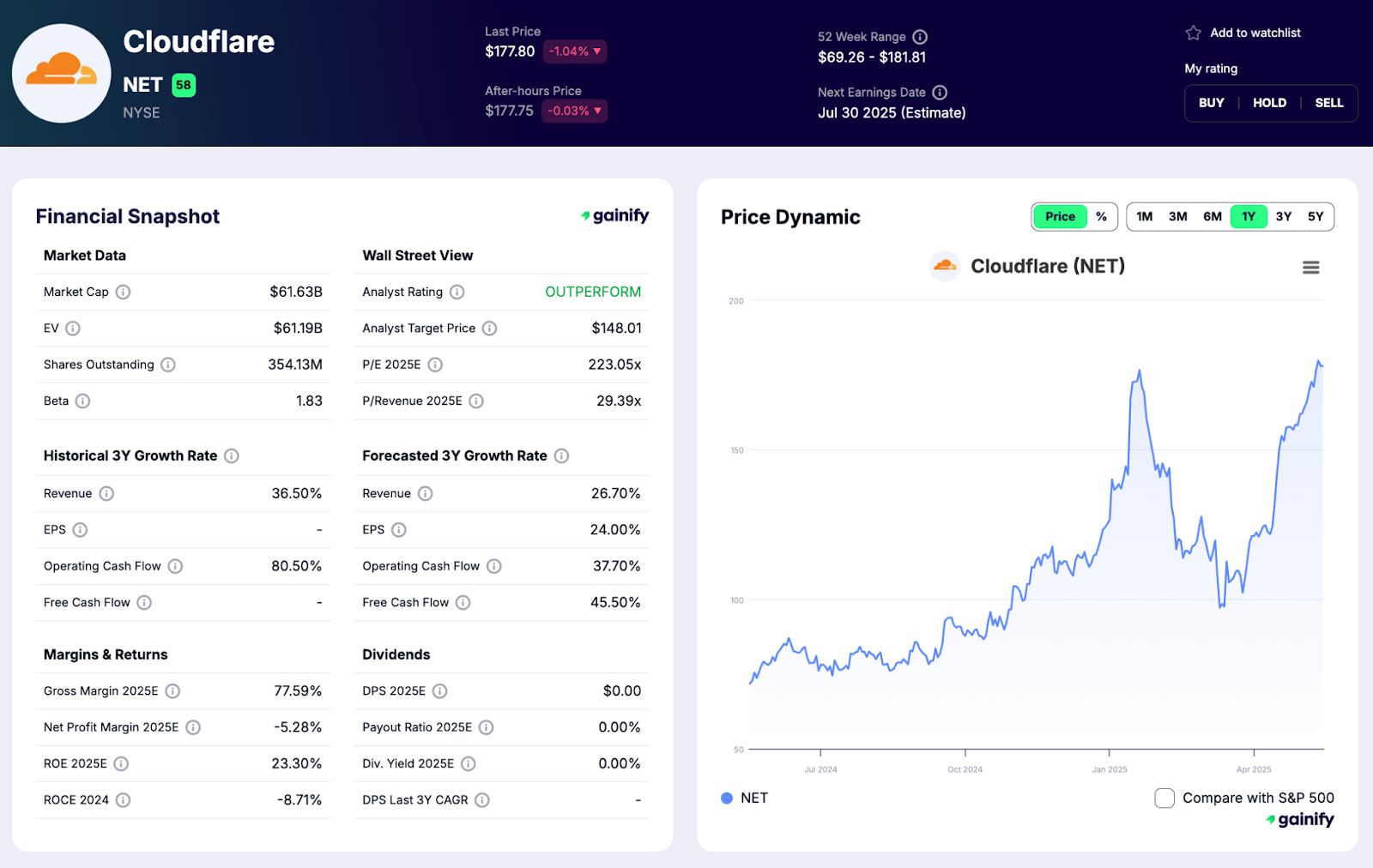

5. Cloudflare (NET)

- Market Cap: $66 billion

- 2024 Revenue: $2.01 billion

- Why it matters: Cloudflare Inc. is a key player in internet infrastructure and cybersecurity. The company protects and accelerates millions of websites around the world. Its cloud-based platform offers strong defense against threats like DDoS attacks, phishing attempts, and malicious bots. At the same time, it improves web performance by optimizing how content is delivered. This combination of security and speed sets Cloudflare apart.

As more businesses shift online and rely on cloud services, Cloudflare has become an important tool in the modern cybersecurity toolkit. It is often used as a replacement or complement to traditional firewalls and antivirus software. The company serves a wide range of customers, including small startups and large corporations. This growing adoption reflects the strong demand for reliable cloud-native security solutions.

6. CyberArk (CYBR)

- Market Cap: $23 billion

- LTM Revenue: $1.30 billion

- Why it matters: CyberArk is a leading provider of identity security and privileged access management solutions. The company helps organizations protect their most sensitive systems by securing access for administrators, applications, and machines. Its platform is designed to prevent credential theft, insider threats, and lateral movement within networks, which are among the most common attack vectors in modern cyber incidents.

As cyber threats become more sophisticated and identity-based attacks continue to rise, CyberArk has become a core component of enterprise security architectures. Its solutions are widely used by large enterprises, financial institutions, and government agencies that require strong controls over privileged access. This positioning makes CyberArk a critical part of the shift toward zero-trust security models and identity-first defense strategies.

7. Check Point Software (CHKP)

- Market Cap: $20 billion

- LTM Revenue: $2.68 billion

- Why it matters: Check Point Software Technologies is one of the longest-standing names in the cybersecurity space. Known for its strong track record in protecting networks from advanced threats, the company offers a broad suite of security products, including firewalls, cloud security, and endpoint protection. It is a reliable option for organizations looking for stability and deep experience in network defense.

The company also appeals to value-focused investors thanks to its consistent generation of free cash flow and disciplined financial management. As global security budgets continue to rise in response to growing cyber threats, Check Point remains a solid choice for long-term investors seeking exposure to cybersecurity with a focus on profitability and resilience.

8. Okta (OKTA)

- Market Cap: $17 billion

- LTM Revenue: $2.84 billion

- Why it matters: Okta is a leading identity and access management company that helps organizations control user authentication and access across their digital systems. Its main offerings, the Customer Identity Cloud and the Workforce Identity Cloud, allow businesses to securely manage logins, permissions, and user activity across a wide range of applications.

As more companies move to the cloud and adopt hybrid work environments, identity security has become a top priority. Okta’s role in verifying users and protecting sensitive information is increasingly important. Its services are used by both large enterprises and smaller firms looking to improve security without sacrificing productivity.

9. SentinelOne (S)

- Market Cap: $5 billion

- LTM Revenue: $956 million

- Why it matters: SentinelOne is a next-generation cybersecurity company focused on AI-powered endpoint protection. Its autonomous platform uses artificial intelligence and machine learning to detect, prevent, and respond to cyber threats in real time. By eliminating the need for human intervention in many threat scenarios, SentinelOne delivers fast, scalable defense across devices and cloud workloads.

Among fast-growing cybersecurity stocks, SentinelOne is gaining attention from angel investors and private equity firms for its innovation and strong market potential. As demand for automated security solutions accelerates, especially in cloud-first environments, the company is well-positioned to capture long-term interest from both enterprise customers and institutional investors.

Why These Stocks Matter to Investors

- Diversified Cybersecurity Exposure

These individual cybersecurity stocks cover everything from antivirus and intrusion detection to zero trust and identity solutions. - Aligned with Market Trends

Cybersecurity threats are growing with digital transformation, and companies are investing more in automation tools, AI-driven detection, cloud-based endpoint security platforms, and professional services. - Growth with Resilience

Revenue from annual subscriptions and recurring services delivers steady cash flow even during tech downturns like the 2022 tech sell-off. - Long-Term Investment Thesis

With geopolitical tensions and digital infrastructure expansion driving budgets, these companies represent a buying opportunity for long-term investors focused on strong demand in the cybersecurity space.

Industry Trends Shaping the Cybersecurity Sector

- AI and Automation

Artificial intelligence is revolutionizing cybersecurity. Stocks in this list are building AI-powered security solutions to adapt to adaptive and artificial intelligence–based attacks. - Cloud-First Strategies

Cloud security demand is growing as businesses shift operations and apps to cloud providers. Platforms like Zscaler and Cloudflare lead as cloud-native vendors. - Rise of Zero Trust & Identity Control

Identity breaches are common attack vectors. Companies such as CyberArk and Okta provide solutions for securing credentials and access. - Cross-Sector Applicability

Tech, finance, healthcare, government, and professional services all require stronger security protocols. That broad need is fueling overall market growth.

Final Takeaway

Cybersecurity stocks offer a compelling mix of innovation, protection, and opportunity. From Fortinet’s firewall dominance to SentinelOne’s AI-first mission, these nine cybersecurity leaders provide diversified exposure to a sector that is now central to digital infrastructure and everyday business operations.

For long-term investors, the cybersecurity industry presents not just a defensive play, but a high-conviction growth opportunity. As threats evolve and organizations prioritize digital resilience, these companies are positioned to benefit from rising demand, strong pricing power, and global tailwinds. Building exposure to this critical sector can add both stability and upside to any forward-looking investment portfolio.