The global agriculture sector in 2026 is entering a structurally different phase. Demand for food, feed, and fuel continues to rise, while climate volatility, supply-chain realignment, and the adoption of precision and sustainable farming technologies are redefining how value is created across the industry. What matters now is not acreage or harvest volume, but productivity per unit of input, resilience of supply chains, and capital efficiency.

As a result, the most attractive investment opportunities are not in farming operations themselves, which remain cyclical and margin constrained. They are found upstream and downstream in agriculture related companies such as machinery manufacturers, seed and trait developers, crop input producers, animal health specialists, processors, and protein suppliers that keep the global food system running. These businesses benefit from structural demand rather than relying solely on commodity price cycles.

Their earnings are tied to long-term trends:

- the global need to increase yield per acre,

- the expansion of biofuel and renewable diesel feed stocks,

- rising protein consumption in emerging markets, and

- the modernization of agricultural infrastructure and automation.

This shift creates a different return profile. These companies tend to have higher pricing power, more recurring revenue, and more resilient cash flows than farming operations themselves.

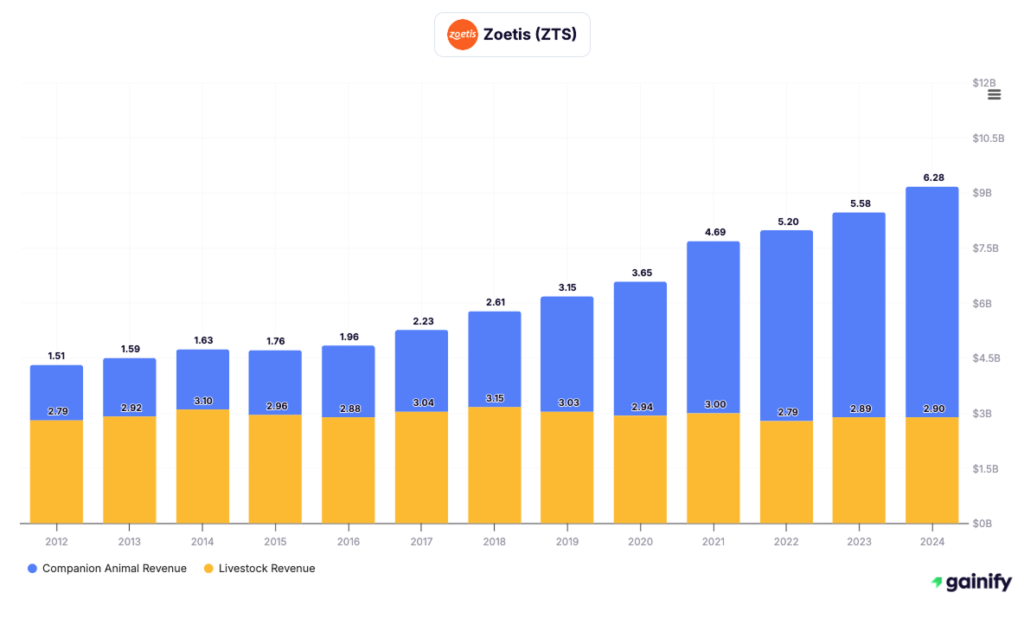

Against that backdrop, seven agriculture-linked companies stand out heading into 2026: Bayer, Deere, Zoetis, Corteva, Nutrien, Archer-Daniels-Midland, and Tyson Foods. Together, they offer diversified exposure to the entire agricultural value chain, each with its own catalysts, balance-sheet strength, and strategic relevance.

Key Takeaways

- Technology is reshaping agriculture as the industry accelerates toward precision equipment, data-driven input optimization, and more efficient protein production. These shifts are expanding the role of companies that enable productivity rather than those that produce crops themselves.

- Durable revenue streams make companies like Deere, Corteva, Bayer, Zoetis, Nutrien, ADM, and Tyson stand out. Most of their demand is recurring, service-based, or consumption-linked, allowing them to perform through commodity cycles rather than being defined by them.

- Critical system roles define these businesses. They are not pure farming operations. They supply the machinery, seed genetics, fertilizers, animal health products, and processing infrastructure that the global food chain relies on every day. Without them, modern agriculture cannot scale or remain resilient.

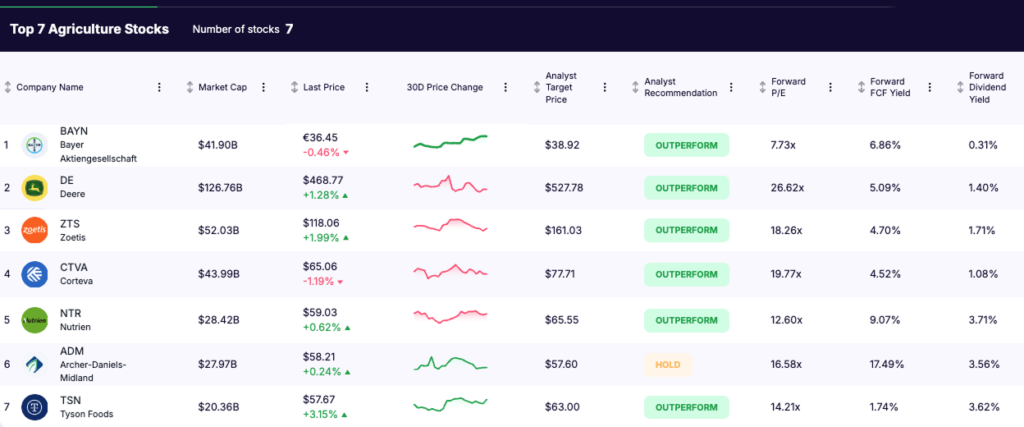

1. Bayer (XTRA: BAYN)

Market Cap: $42B

Industry Role: Crop science, seeds, herbicides

Analyst Rating: Outperform

Forward P/E: 7.7x

Forward FCF Yield: 6.9%

Bayer is one of the world’s largest agriculture-technology companies, operating through crop science, seed genetics, and biotech-driven farming inputs. Its portfolio spans high-value herbicides, pest-control solutions, and advanced seed traits that lift productivity across global row crops. The most recent results highlight the durability of this franchise. Corn Seed and Traits grew 22 percent year over year in Q3 2025 on stronger U.S. planted area and robust LATAM demand, while the Crop Science division delivered a 21.1 percent EBITDA margin over the first nine months of 2025 despite regulatory and pricing pressure.

Financially, Bayer remains valued at distressed levels because of its long-running legal overhangs, but the agricultural engine of the business continues to produce stable revenue and meaningful cash generation. The combination of entrenched market share, multiyear product cycles, and a deep R&D pipeline reinforces Bayer’s central role in global crop productivity.

Investment Thesis: A classic value dislocation supported by essential farm inputs and recurring global demand. If litigation risk continues to normalize or cash-flow visibility improves, the equity has significant re-rating potential.

Key Risk: Legal liabilities continue to shape investor sentiment and remain the defining variable for valuation.

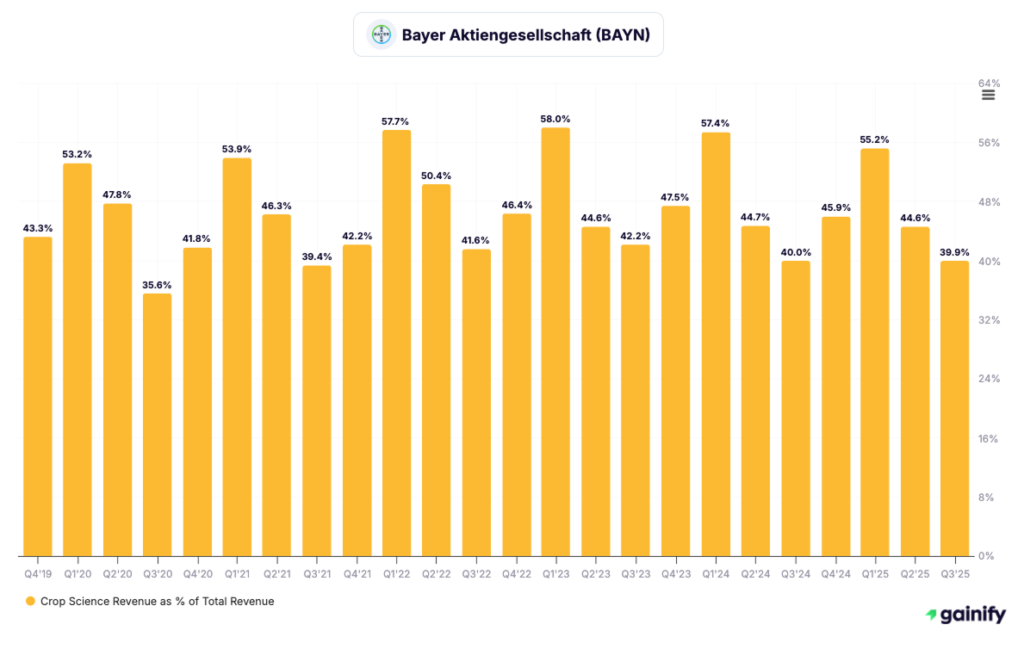

2. Deere & Co. (NYSE: DE)

Market Cap: $127B

Industry Role: Agricultural machinery & precision tech

Analyst Rating: Outperform

Forward P/E: 26.6x

Forward FCF Yield: 5.1%

Deere is the global leader in agricultural equipment and the clear technological front-runner in precision agriculture. Its ecosystem of autonomous tractors, connected implements, and AI-driven field analytics positions the company at the center of farming’s digital transformation. As producers shift toward data-enabled decision-making and automation, Deere’s platform becomes increasingly embedded in daily farm operations.

While machinery demand is cyclical, Deere’s mix is gradually shifting toward software, connectivity, and precision-ag features that generate recurring revenue and improve earnings stability. The company’s recent performance illustrates this resilience. Deere delivered approximately 5.0 billion dollars in net income in fiscal 2025, and for fiscal 2026 it guided to 4.0 to 4.75 billion dollars even as equipment volumes are expected to moderate. Maintaining this level of profitability through a softer cycle highlights the durability of its business model.

Investment Thesis: Deere is the most direct long-term investment in the modernization and automation of global agriculture. Precision systems, advanced sensors, and integrated software are still in the early stages of adoption, and Deere’s scale advantage positions it to capture the majority of this structural shift.

Key Risk: Equipment demand is sensitive to swings in farm income. A downturn in commodity prices or tightening farmer cash flow can pressure large-ag equipment sales and near-term earnings.

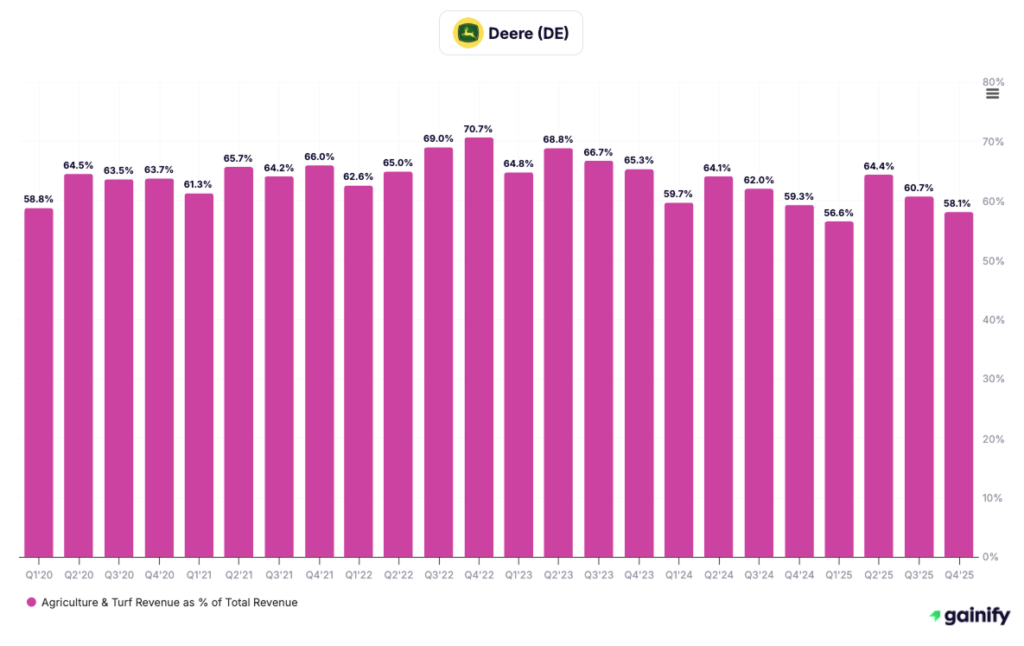

3. Zoetis (NYSE: ZTS)

Market Cap: $52B

Industry Role: Animal health & protein production

Analyst Rating: Outperform

Forward P/E: 18.3x

Forward FCF Yield: 4.7%

Zoetis is the global leader in animal health, supplying vaccines, therapeutics, diagnostics, and biologics that support both livestock productivity and the fast-growing companion-animal market. Its portfolio spans hundreds of products sold across more than 100 countries, giving Zoetis broad exposure to structural protein demand and steady veterinary spending. High regulatory barriers, strong brand loyalty among veterinarians, and continuous innovation create a durable competitive moat.

Financial performance remains resilient. In the most recent quarter, revenue reached roughly 2.4 billion dollars, up slightly year over year, while net income increased to more than 700 million dollars, supported by pricing gains and healthy demand across core franchises. Companion-animal products continue to drive margin strength, while livestock markets are recovering from last year’s disease pressure and supply-chain disruptions.

Investment Thesis: Zoetis offers one of the most stable growth profiles in agriculture-linked equities. Demand for protein and veterinary care expands steadily regardless of economic cycles, and the company’s industry leadership supports strong margins and recurring revenue. It is a long-duration compounder tied to structural rather than cyclical trends.

Key Risk: Livestock disease outbreaks, regulatory changes, or export disruptions can weigh on specific product lines, although Zoetis’ diversified portfolio typically limits the impact.

4. Corteva ( NYSE: CTVA)

Market Cap: $44B

Industry Role: Seed genetics & crop protection

Analyst Rating: Outperform

Forward P/E: 19.8x

Forward FCF Yield: 4.5%

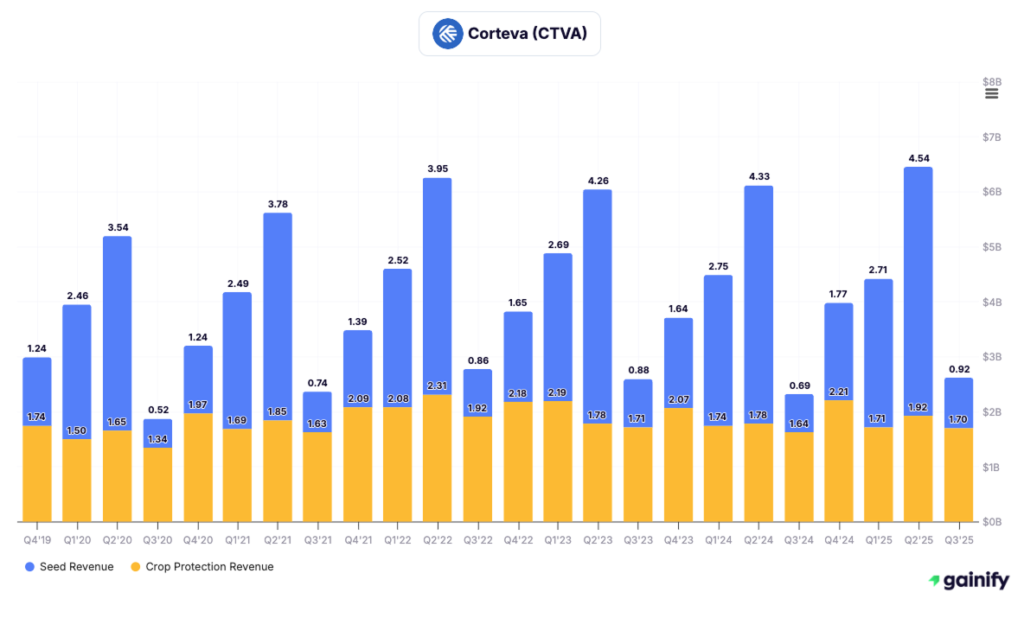

Corteva is one of the most important pure-play agriculture technology companies, supplying advanced seeds, biotech traits, and crop protection products that improve yield and input efficiency. Its competitive strength lies in a balanced portfolio: seeds generate roughly half of total revenue, while crop protection accounts for the rest, giving Corteva diversified exposure across the global farming cycle.

Recent results show the company’s operational momentum. Management has delivered sequential improvement in profitability, with EBITDA margins recovering meaningfully as new product launches take hold and pricing benefits flow through the system. At the same time, demand for next-generation seed traits and biological crop inputs continues to expand, positioning Corteva to benefit from the shift toward more sustainable and precision-driven farming practices.

Investment Thesis: Corteva is a structural growth story inside agriculture. Its long product cycles, IP-backed competitive moat, and growing mix of higher-margin seed and biological products support durable earnings power. As input optimization becomes a priority for farmers globally, Corteva sits at the center of the trend.

Key Risk: Weather volatility and competitive pricing pressure in crop protection can create year-to-year variability, but the long-term trajectory remains supported by strong innovation and rising global yield requirements.

5. Nutrien (NYSE: NTR)

Market Cap: ~$28B

Industry Role: Fertilizers (potash, nitrogen, retail services)

Analyst Rating: Outperform

Forward P/E: 12.6x

Forward FCF Yield: 9.1%

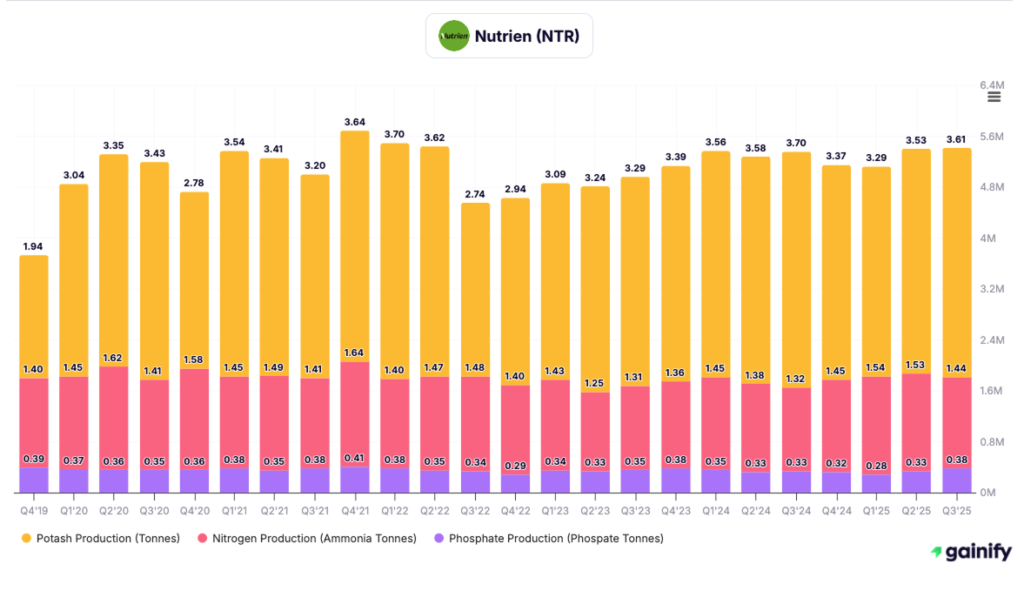

Nutrien is the world’s largest provider of potash and one of the leading producers of nitrogen and phosphate fertilizers. The company also operates the largest agricultural retail network in North America, giving it unmatched distribution reach and direct exposure to farmer spending. This dual model provides a level of revenue diversification that most fertilizer peers cannot replicate.

Recent performance captures both the cyclical pressure in global nutrient prices and the resilience created by Nutrien’s integrated model. Potash EBITDA is down 7 percent year to date, yet still contributed 1.2 billion dollars, underscoring the segment’s structural profitability despite lower realized prices. Nitrogen EBITDA declined more sharply, falling 31 percent year to date as global ammonia and urea benchmarks normalized. Retail, which serves as Nutrien’s stabilizer, saw sales decline 4 percent and adjusted EBITDA fall 7 percent year to date, but continues to generate consistent margin contribution. Across the portfolio, the company reduced controllable costs by 270 million dollars and delivered 2.1 billion dollars in free cash flow before working capital.

Investment Thesis: Nutrien offers one of the most compelling combinations in agriculture: global fertilizer leadership plus a defensive retail channel. Its potash position provides strategic leverage to global food security and long-term soil nutrient needs, while its retail footprint smooths earnings through down-cycles. As crop prices normalize and nutrient demand recovers, Nutrien is positioned for meaningful cash-flow improvement.

Key Risk: Fertilizer pricing remains inherently volatile, and capital-intensive production assets create operating leverage in both directions. However, Nutrien’s scale and integrated model help buffer the extremes.

6. Archer-Daniels-Midland (NYSE: ADM)

Market Cap: ~$28B

Industry Role: Global grain handling & processing

Analyst Rating: Hold

Forward P/E: 16.6x

Forward FCF Yield: 7.5%

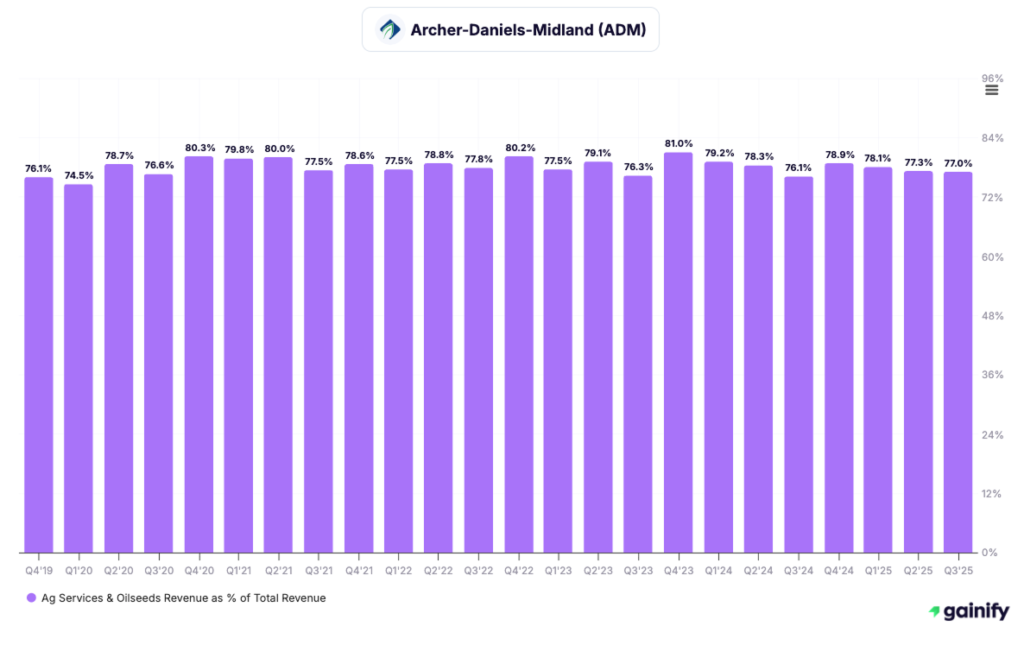

ADM is one of the most important infrastructure companies in the global food system. It moves, processes, and upgrades crops into oils, meal, sweeteners, ethanol, renewable diesel feed stocks, and specialty ingredients used across food, beverage, and industrial markets. Its three segments, Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition, give ADM a balanced mix of cyclical commodity exposure and higher-margin value-added products.

Recent performance reflects a reset from unusually strong prior-year margins, but the core business remains healthy. In the most recent quarter, ADM generated roughly 845 million dollars of segment operating profit, supported by solid crushing activity and strong global export volumes. Working-capital efficiency improved significantly, with inventory reductions exceeding 3 billion dollars year to date, which helped strengthen cash flow and liquidity. Nutrition is still recovering, but margins are stabilizing as cost actions take hold and demand normalizes.

Investment Thesis: ADM provides direct exposure to critical grain origination, transportation, and processing capacity that the global food chain cannot function without. Long-term protein consumption, renewable diesel demand, and emerging-market growth support steady structural needs for ADM’s network. Despite margin fluctuations inherent to commodity cycles, the company’s scale, asset footprint, and ability to generate cash across environments make it a durable operator.

Key Risk: Processing margins and trading results can swing sharply when global crop supplies tighten or when biofuel policy creates uncertainty. Nutrition requires further margin recovery to deliver consistent earnings growth.

7. Tyson Foods (NYSE: TSN)

Market Cap: ~$20B

Industry Role: Protein producer (beef, chicken, pork)

Analyst Rating: Outperform

Forward P/E: 14.2x

Forward Dividend Yield: 3.6%

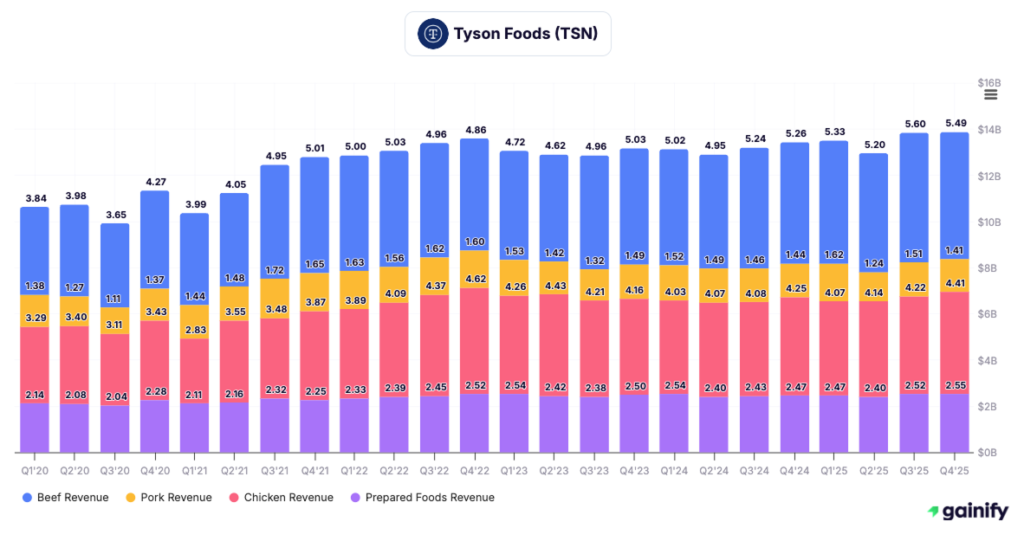

Tyson Foods is one of the world’s largest protein producers, supplying beef, pork, chicken, and prepared foods to global markets. Its scale, integrated operations, and distribution network make it a central pillar of the global protein supply chain. Tyson benefits from long-term trends such as rising protein consumption, population growth, and resilient demand from both retail and food service channels.

Recent performance shows a more pronounced recovery than earlier in the cycle. In the most recent quarter, total sales exceeded 14.5 billion dollars and adjusted operating income increased sharply. The Prepared Foods segment remained the main profit driver, delivering operating margins above 11 percent. The chicken business returned to profitability as Tyson exited low margin volume, improved yield efficiency, and optimized plant utilization. Beef and pork continue to navigate tight livestock supplies but show improving cost discipline.

Investment Thesis: Tyson offers exposure to global protein demand at a point when earnings are inflecting higher. Prepared Foods provides a stable and profitable foundation, while chicken, beef, and pork should improve as supply conditions normalize. Tyson’s scale, integrated model, and diversified protein mix position it for a multi-year margin recovery.

Key Risk: Protein markets remain cyclical. Livestock availability, feed costs, and export dynamics can pressure earnings in beef and pork. Consistent execution in chicken remains important to sustaining the recovery.

Industry Outlook for 2026 and Beyond

The agriculture sector is moving into a structurally different phase defined by technology adoption, input optimization, and far greater emphasis on capital efficiency. The long-term growth profile is no longer driven by acreage expansion, but by productivity gains and the modernization of global food systems.

Several structural drivers support a constructive multi-year outlook:

- Precision agriculture and autonomy accelerating equipment and software adoption. The global smart agriculture market is projected to grow at roughly 12 percent a year through 2035, reflecting broad deployment of sensors, automation, connectivity, and AI-driven decision tools across farming operations.

- Global protein demand continuing to rise, particularly in emerging markets. Population growth, income expansion, and dietary shifts support sustained strength in feed, processing, and animal-health markets.

- Increasing crop-input complexity as farmers manage climate variability and soil degradation. This drives recurring demand for seed traits, biologicals, crop-protection products, and soil nutrients.

- Biofuel and renewable diesel expansion tightening oilseed markets. Growth in renewable diesel capacity has structurally increased demand for soybeans and oilseeds, raising crush volumes and supporting mid-cycle profitability for processors.

- Consolidation across the supply chain improving scale and cost efficiency. Capital scarcity and volatile input markets are accelerating industry rationalization, benefiting market leaders with integrated platforms.

At the macro level, the global agriculture market is expected to grow at approximately 4 to 4.5 percent per year through 2030. But the higher-quality growth resides upstream and downstream in technology, inputs, equipment, and processing, not in traditional farm operations. These segments benefit from secular demand patterns, pricing power, data-driven recurring revenue, and more resilient cash-flow profiles.

Conclusion

Agriculture-related equities provide exposure to one of the world’s most essential systems while avoiding the volatility and low margins of direct farming businesses. The companies upstream and downstream of the farm gate supply the machinery, seeds, crop inputs, animal-health solutions, processing infrastructure, and protein capacity that enable the global food chain to function.

As the sector evolves toward higher capital efficiency, greater automation, and rising global demand for food, feed, and fuel, the investment case strengthens. The most compelling opportunities heading into 2026 are in companies with innovation advantages, scale leadership, strong cash generation, and direct exposure to long-duration structural themes.

For investors seeking durable returns in a cyclical sector, agriculture-linked businesses with technology leverage, diversified revenue streams, and entrenched market positions offer a significantly more attractive risk-reward profile than primary producers.

Disclaimer

This article is intended for informational and educational purposes only and does not constitute financial, investment, or trading advice. The companies and sectors discussed are provided as illustrative examples and should not be interpreted as recommendations to buy or sell any securities. All financial data referenced is based on publicly available information at the time of writing and may change without notice. Investors should conduct their own research, consider their individual financial circumstances, and seek independent advice from a qualified professional before making any investment decisions. Past performance is not indicative of future results, and all investments involve risk, including the potential loss of principal.