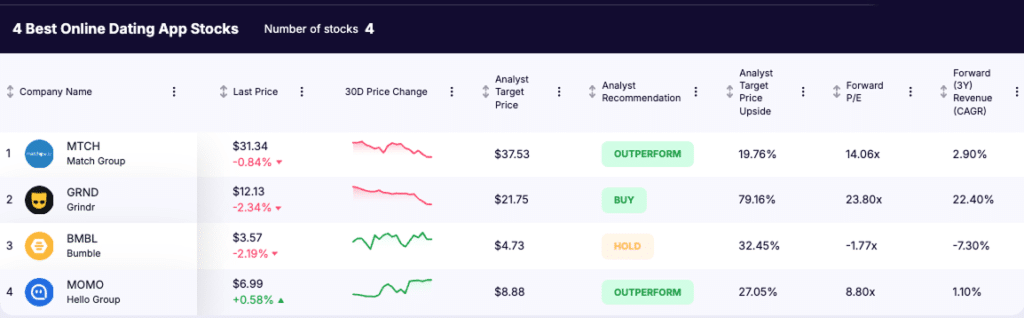

Dating app stocks have become an increasingly important part of the consumer internet investment landscape. As mobile platforms continue to shape how people meet and interact, online dating companies have evolved into scalable, subscription-based businesses with global reach.

This article focuses on the 4 best online dating stocks to follow in 2026, highlighting the companies that matter most in the public markets. What began as simple mobile apps has grown into a mature industry built on recurring revenue, network effects, and strong brands. For investors, understanding how these businesses monetize users, generate cash flow, and compete over time is essential when evaluating long-term opportunities in this space.

Key Highlights

- Industry scale: Dating app companies operate global platforms built on subscriptions and recurring revenue

- Monetization focus: Revenue per paying user is a key driver of long-term performance

- Different profiles: The four stocks offer varying exposure to scale, growth, and geographic markets

- Investor lens: Cash flow discipline and user engagement matter more than short-term user growth

1. Match Group (NASDAQ: MTCH)

What it is

Match Group is the largest publicly traded online dating company globally. It operates a diversified portfolio of dating platforms, including Tinder, Hinge, Match.com, and others, serving different demographics and relationship preferences. This portfolio model reduces reliance on any single app and provides flexibility in pricing and product experimentation.

Recent developments

Recent results show continued improvement in revenue per paying user, which reached $20.58 in the latest reporting period. This reflects stronger monetization through premium features and pricing optimization, even as overall payer counts fluctuate.

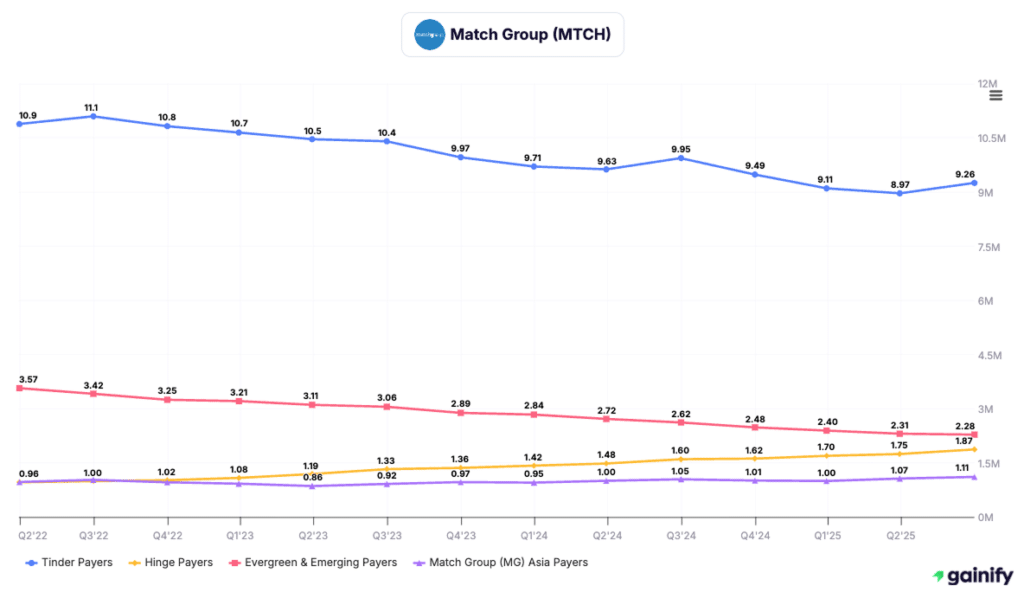

Key payer trends

- Tinder payers remain the largest contributor but have trended lower over recent periods, highlighting saturation in mature markets and changing engagement patterns.

- Hinge payers have shown consistent growth, standing out as the fastest-growing brand within the portfolio and an important offset to declines elsewhere.

- Evergreen and emerging brands have experienced gradual payer erosion, suggesting consolidation of user attention toward fewer, more differentiated platforms.

- Asia payers remain relatively stable, providing geographic diversification but not yet acting as a major growth driver.

Why it matters

For investors, Match Group represents the most scaled and cash-generative exposure to the dating app industry. Its ability to grow revenue per user is critical in a mature market and supports long-term cash flow, capital returns, and reinvestment into product innovation.

2. Bumble (NASDAQ: BMBL)

What it is

Bumble operates a portfolio of dating and social apps, with a brand built around safety, intentional interactions, and user experience. While smaller than Match Group, Bumble maintains strong brand recognition and international reach through Bumble and Badoo.

Recent developments

Bumble reported an increase in average revenue per paying user to $22.64, signaling improved monetization among its paying user base. This trend highlights pricing power and engagement depth, even as the company works through broader industry headwinds.

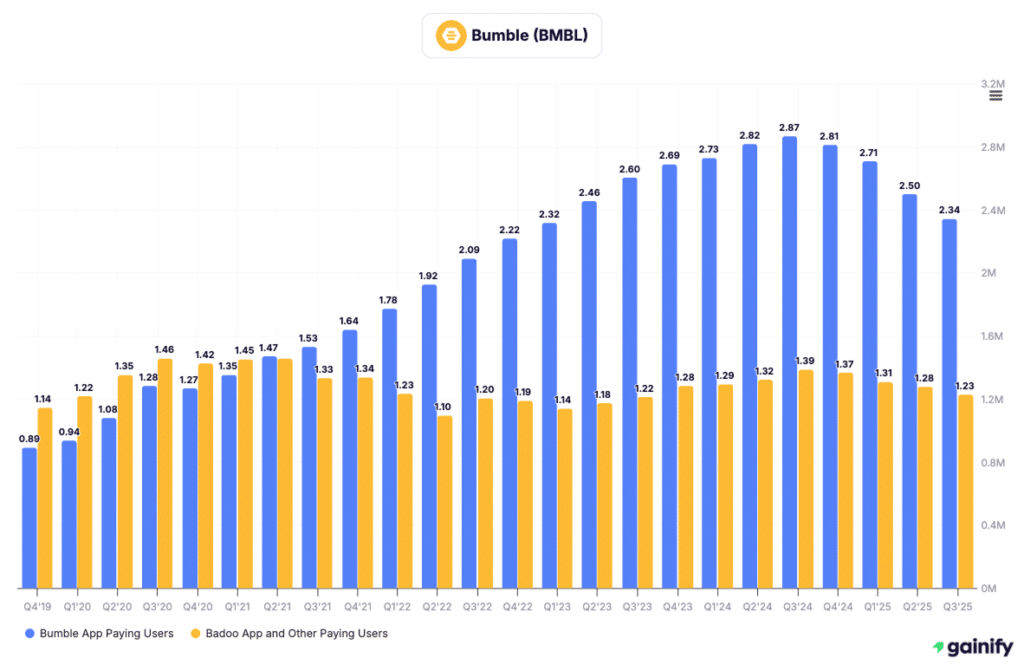

Key payer trends

- Bumble app payers grew steadily over several years and became the primary driver of the company’s payer base, reflecting strong brand traction and global expansion. More recently, Bumble app payer counts have moderated, suggesting softer engagement in mature markets and increased competition.

- Badoo and other platform payers have followed a flatter to declining trend over time, indicating that older platforms are contributing less to incremental payer growth.

Why it matters

Bumble’s investment case centers on execution and monetization quality. If the company can stabilize user engagement while continuing to lift revenue per user, it has a path to improving margins and restoring long-term growth credibility.

3. Grindr (NYSE: GRND)

What it is

Grindr is a niche online dating and social platform focused on the LGBTQ+ community. Its targeted audience results in high engagement levels and a clear value proposition compared to broad, swipe-based platforms.

Recent developments

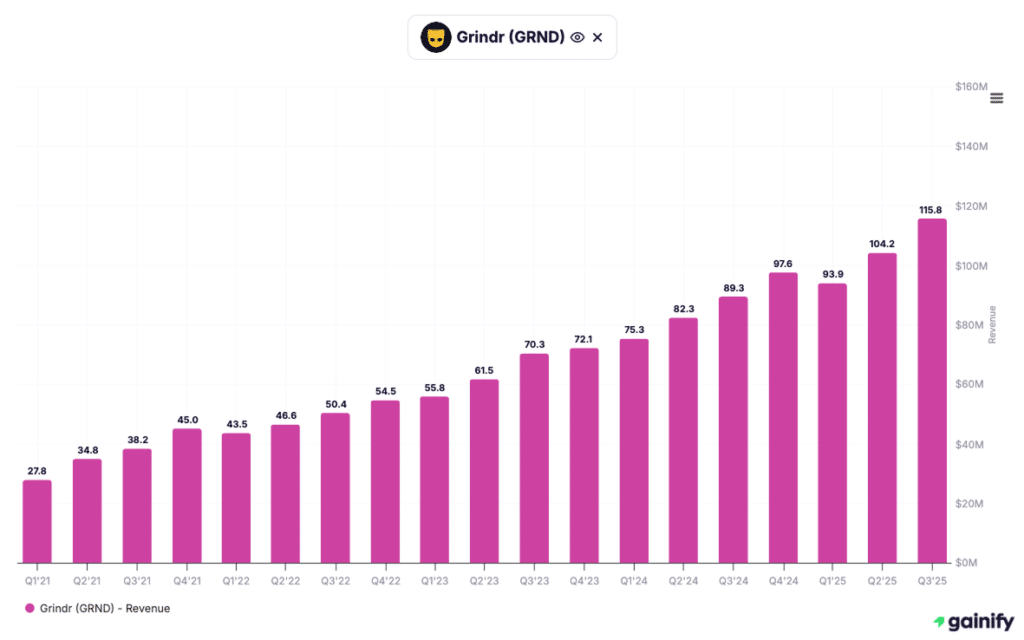

Grindr delivered 30% year-over-year revenue growth in its most recent period, reflecting successful expansion of premium features and higher subscription adoption across its user base.

Key payer trends

- Average paying users have increased consistently over time, highlighting Grindr’s ability to convert free users into subscribers.

- Payer growth has remained resilient across recent periods, even as broader dating platforms face engagement pressure.

- The trend shows a gradual and sustained expansion of the paying user base, rather than short-lived spikes driven by promotions.

Why it matters

Grindr stands out as a growth-oriented monetization story. With a focused audience and improving economics, small improvements in execution can translate into outsized revenue and margin impact, making it a higher-risk, higher-upside name in the sector.

4. Hello Group (NASDAQ: MOMO)

What it is

Hello Group operates a portfolio of social and dating platforms primarily across Asia, with Momo and Tantan as its core products. Unlike Western dating apps that focus narrowly on matchmaking, Hello Group blends dating with broader social and entertainment features, creating a different engagement and monetization model.

Recent developments

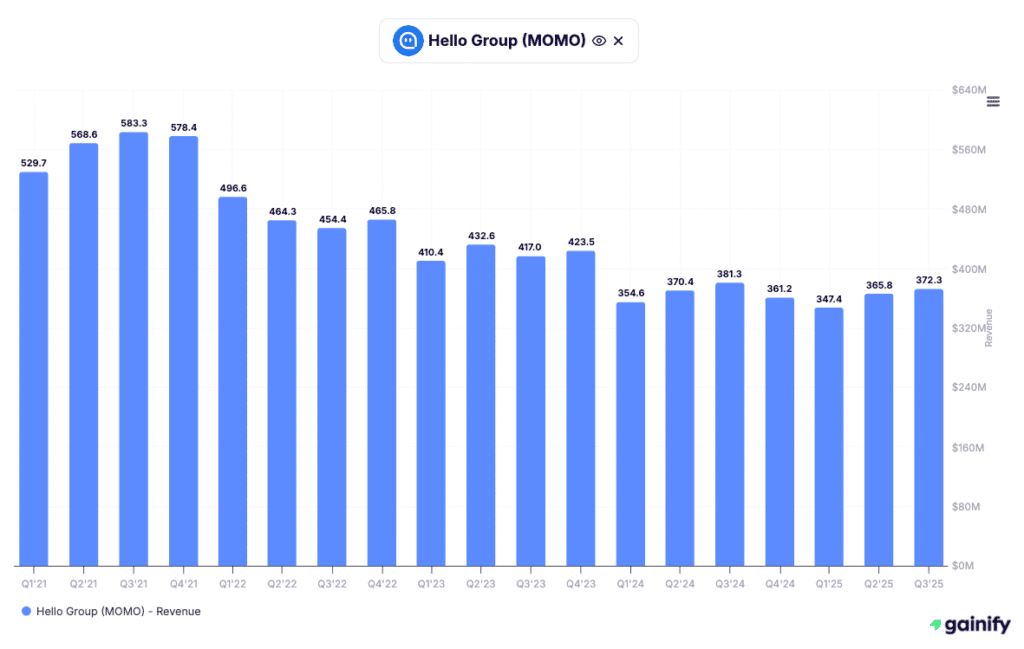

Hello Group’s revenue trend shows a multi-year normalization phase following earlier peaks. After reaching higher levels in prior years, revenue declined as domestic user engagement softened and competition intensified. More recently, revenue has stabilized and shown signs of modest recovery, reflecting cost discipline, product adjustments, and growing contribution from overseas platforms.

Key payer trends

- Revenue peaked in earlier periods and then declined as the domestic market matured.

- The subsequent downtrend moderated over time, indicating a transition from contraction toward stabilization.

- Recent quarters show more consistent revenue levels, suggesting that the business has found a steadier operating base.

- Overseas and newer platforms have become increasingly important in offsetting softness in core domestic products.

Why it matters

For investors, Hello Group represents a transition-stage business rather than a pure growth story. The stabilization of revenue is important because it supports profitability, cash generation, and optionality from international expansion. MOMO offers exposure to Asian social and dating markets with a different lifecycle and risk profile compared to US-based peers, where execution and capital discipline matter more than headline growth.

How Dating App Businesses Make Money

Most dating apps operate on a freemium business model. Users can join and access basic features for free, while paid subscriptions unlock premium functionality such as increased visibility, advanced filters, unlimited messaging, and enhanced matching tools.

As platforms scale, revenue is driven less by total user count and more by how effectively engaged users are monetized.

Key revenue drivers across the industry include:

- Growth in paying users, reflecting conversion from free to premium tiers

- Revenue per paying user, influenced by pricing, feature adoption, and tier mix

- Subscription retention and churn, which determine revenue stability

- Marketing efficiency, including the cost of acquiring and retaining users

As the industry matures, user growth often slows. This makes monetization quality, retention, and cash flow discipline increasingly important for long-term investors.

What Investors Should Focus On

Dating app stocks share some common business traits, but performance can vary significantly between companies. Investors should focus on a small set of core factors that signal long-term sustainability.

User Engagement and Monetization

- Trends in paying user counts

- Changes in revenue per paying user

- The ability to launch and scale new premium features

Financial Quality

- Consistent operating cash flow generation

- Free cash flow over time

- Stable or improving margins

Competitive Positioning

- Brand strength and user trust

- Portfolio diversification versus reliance on a single app

- Geographic exposure and international growth opportunities

Together, these factors provide a clearer view of business health than short-term fluctuations in user numbers alone.

Key Risks in Dating App Stocks

Despite attractive economics, dating app companies face several ongoing risks that investors should monitor closely.

Common risks include:

- Intense competition for user attention and engagement

- Rising customer acquisition costs, especially in mature markets

- Platform fatigue, leading to higher churn

- Regulatory and data privacy scrutiny, particularly around user safety and data handling

Companies that navigate these risks successfully tend to combine disciplined spending, strong brand trust, and continuous improvements in monetization, rather than relying solely on user growth.

Final Thoughts

Dating app stocks represent a unique segment of the consumer technology market. These businesses combine recurring subscription revenue, digital scale, and strong brands, but they also face competitive and engagement-driven challenges.

Companies like Match Group, Grindr, Bumble, and Hello Group offer different ways to gain exposure to this theme, each with its own balance of scale, growth, and risk.

For long-term investors, focusing on monetization quality, revenue per paying user, and cash flow discipline provides a more durable framework than short-term user trends. When approached thoughtfully, dating app stocks can play a meaningful role within a diversified portfolio.