TL;DR: Uranium mining stocks are gaining renewed attention as AI, cloud computing, and data centers drive a sharp increase in global electricity demand. Nuclear energy is emerging as a key solution for reliable baseload energy, while uranium supply remains constrained after years of underinvestment. This article highlights 14 uranium mining stocks of particular interest in 2026, representing the largest and most strategically important uranium minders globally.

Uranium mining stocks sit at the foundation of the nuclear energy supply chain. As demand for electricity accelerates, driven by AI workloads, hyperscale data centers, and broader electrification, utilities are increasingly relying on nuclear power to deliver stable, around-the-clock energy. As nuclear becomes a larger part of the power mix, attention shifts upstream to the companies that supply the fuel, especially those with scalable production.

The supply side remains tight. Many uranium mines were idled during the prolonged downturn of the 2010s, and new projects take years to permit, finance, and build. As a result, uranium production has been slow to respond even as long-term demand expectations rise.

At the same time, utilities are moving back to long-term contracting to secure future supply. These contracts provide visibility and pricing support for uranium miners, reinforcing the importance of scale, asset quality, and jurisdictional stability.

The 14 uranium mining stocks below represent the core of the global uranium supply landscape heading into 2026. Together, they account for a significant share of current and future uranium production and offer investors exposure to one of the most supply-constrained segments of the global energy market.

Key takeaways

- AI demand: Data centers and AI workloads are driving sustained growth in electricity consumption

- Tight supply: Years of underinvestment have constrained global uranium production

- Long contracts: Utilities are returning to multi-year uranium supply agreements

- Miner focus: Established producers and advanced developers are best positioned in this cycle

Why Uranium Mining Stocks Matter in 2026

Several long-term forces are reinforcing the importance of uranium mining stocks as part of the global energy mix.

- Energy security: Nuclear power enables countries to generate large volumes of electricity domestically and reliably. As power demand rises and grids face increasing strain, governments and utilities are placing greater emphasis on energy sources that reduce exposure to fuel price volatility and supply disruptions. Uranium-backed nuclear generation offers long-term predictability that few other energy sources can match.

- Net-zero goals: Decarbonisation at scale requires stable baseload power. Wind and solar are essential components of the transition, but their intermittency limits how far they can go on their own. Nuclear energy provides a constant, low-carbon source of electricity, making it a foundational element in many national decarbonisation strategies and long-term power planning models.

- Expanding demand: Global uranium demand continues to grow as new reactors come online and existing nuclear fleets operate longer than originally planned. According to the World Nuclear Association, uranium demand is expected to increase by roughly 28 percent by 2030 and nearly double by 2040, driven by reactor buildouts, life extensions, and rising electricity consumption.

- Long-term planning: Nuclear power depends on multi-year fuel procurement cycles. Utilities typically secure uranium through long-term contracts rather than spot purchases, which increases the strategic importance of reliable producers with scale, reserve life, and operating visibility.

Top 14 Uranium Mining Stocks (A to U)

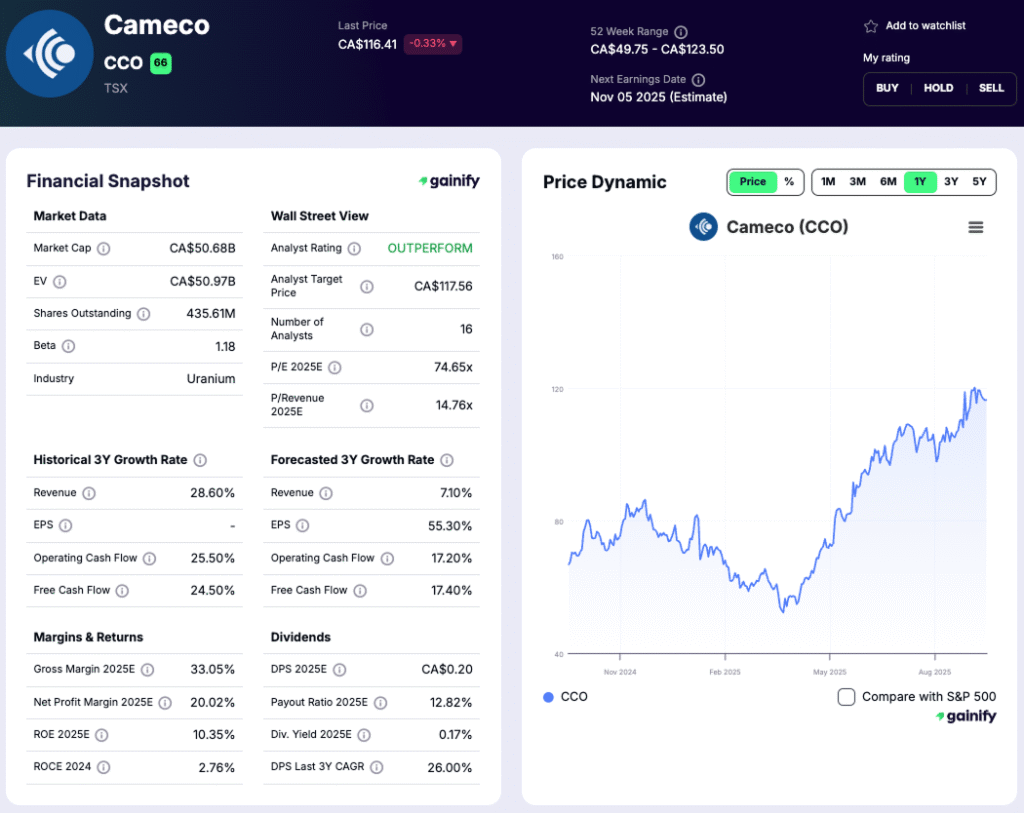

1. Cameco (NYSE:CCJ) – Canada

- What It Does: One of the world’s largest uranium producers (delivers 17% of annual global supply), operating the high-grade McArthur River and Cigar Lake mines in Canada’s Athabasca Basin.

- Catalysts: Restart of McArthur River; long-term utility contracts; diversification into nuclear services via joint ownership of Westinghouse (with Brookfield).

2. Kazatomprom (LSE:KAP) – Kazakhstan

- What It Does: The largest uranium producer globally, responsible for over 21% of annual global supply, using low-cost in-situ recovery (ISR).

- Catalysts: Global cost leader; strategic partnerships with China and Russia; however, exposed to geopolitical and state-control risks.

3. BHP Group (ASX:BHP) – Australia

- What It Does: One of the world’s largest diversified mining companies, producing iron ore, copper, nickel, and coal with uranium as a byproduct.

- Assets: Owns the Olympic Dam mine in South Australia, which contains the world’s largest known uranium resource along with major copper and gold deposits.

- Catalysts: Olympic Dam provides BHP with long-term optionality in uranium markets. Although uranium is not BHP’s core focus, rising demand and prices could increase its strategic importance.

4. China National Nuclear Corporation (SHSE:CNNC) – China

- What It Does: A state-owned nuclear giant involved across the entire fuel cycle, from uranium mining and conversion to reactor design and operation.

- Assets: Operates uranium mines in China and joint ventures abroad, including interests in Namibia’s Rossing mine.

- Catalysts: Plays a central role in supporting China’s nuclear expansion; backed by state financing and policy.

5. China General Nuclear Power Group (SHSE:CGN) – China

- What It Does: Another major state-backed nuclear utility and developer, with strong international mining interests.

- Assets: Majority owner of Namibia’s Husab mine, one of the largest uranium mines in the world, and stakes in other overseas projects.

- Catalysts: Aggressive nuclear buildout in China; global expansion strategy; long-term demand growth ensures stable offtake.

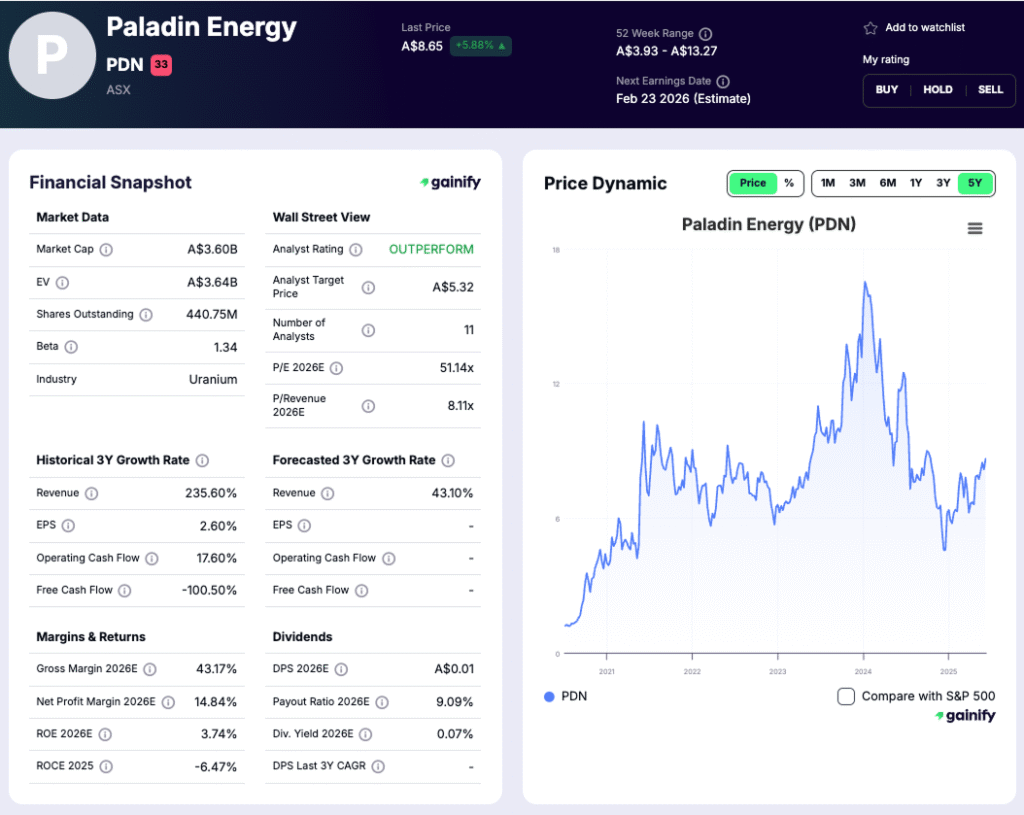

6. Paladin Energy (ASX:PDN) – Australia

- What It Does: Owns the Langer Heinrich mine in Namibia, one of Africa’s most important uranium operations.

- Catalysts: Restart of Langer Heinrich; exposure to African supply; levered to rising uranium prices.

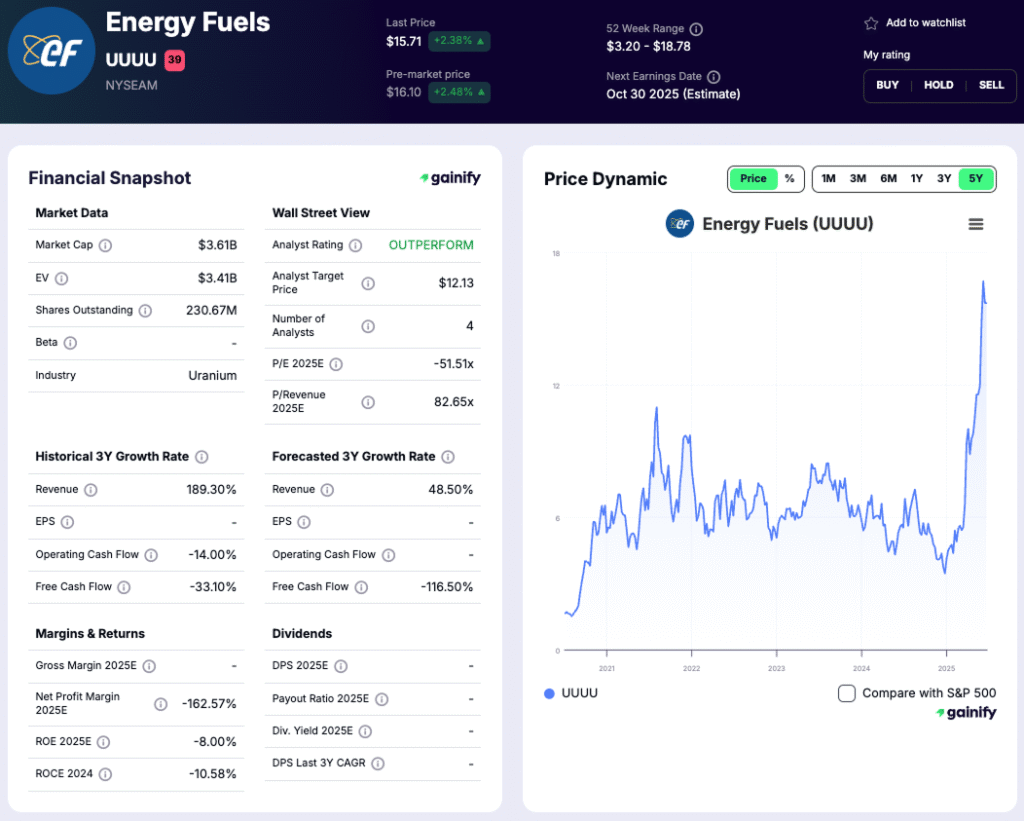

7. Energy Fuels (TSX:UUUU) – United States

- What It Does: Leading U.S. uranium producer; owns White Mesa Mill in Utah (the only conventional uranium mill operating in the U.S.); also expanding into rare earths.

- Catalysts: Positioned to benefit from U.S. government contracts for domestic supply; diversification into critical minerals.

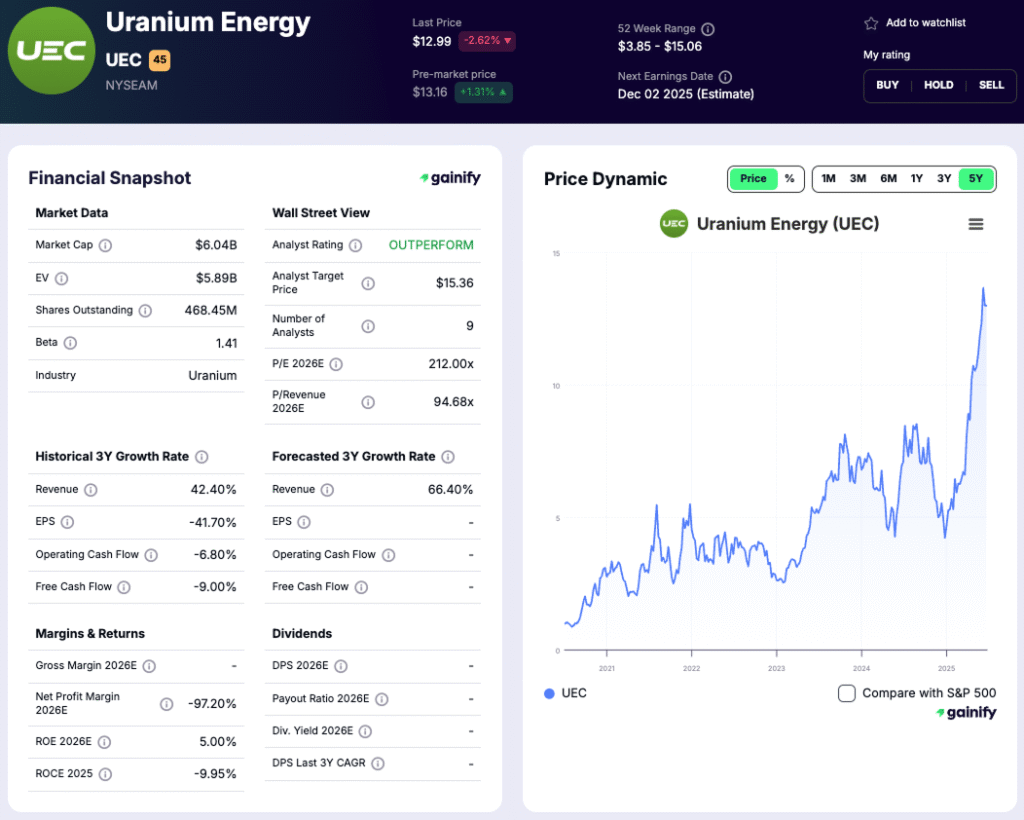

8. Uranium Energy Corp (NYSE:UEC) – United States

- What It Does: U.S.-based producer focused on ISR projects in Texas and Wyoming, with additional assets in Canada’s Athabasca Basin.

- Catalysts: Low-cost ISR production; growth in U.S. as utilities seek non-Russian supply; exposure to long-term federal contracts.

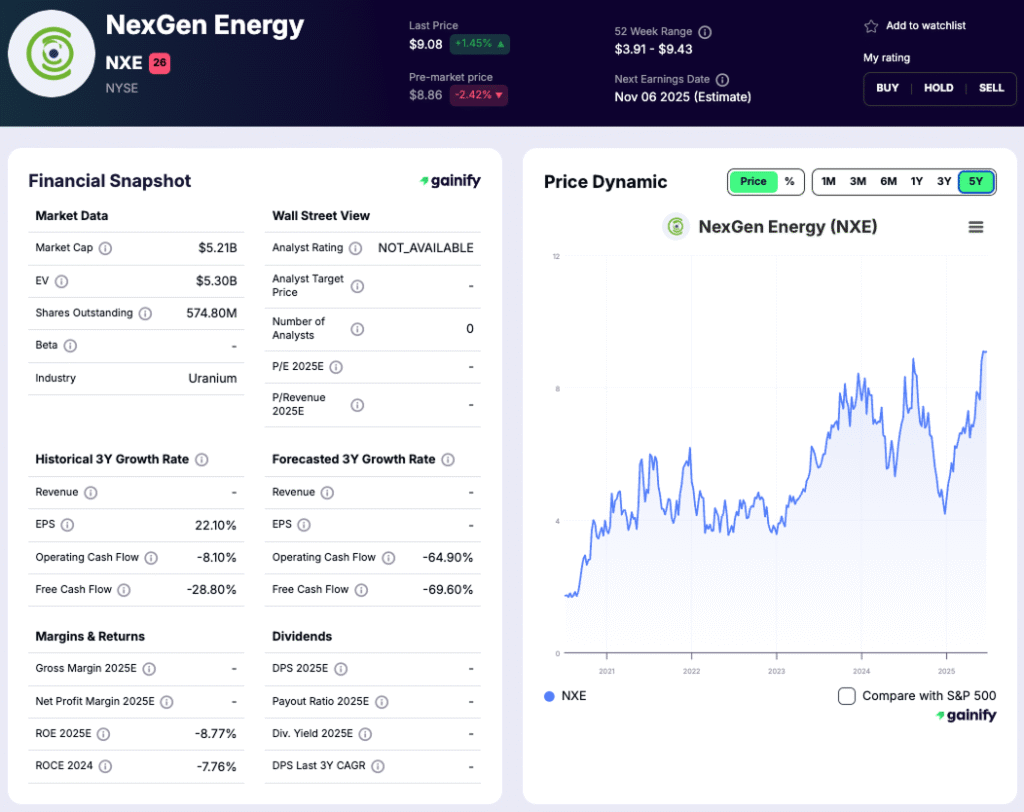

9. NexGen Energy (TSX:NXE) – Canada

- What It Does: Developer of the Arrow project in Saskatchewan’s Athabasca Basin, one of the largest undeveloped uranium projects in the world.

- Catalysts: Exceptionally high-grade resource; potential to be a cornerstone supplier once operational.

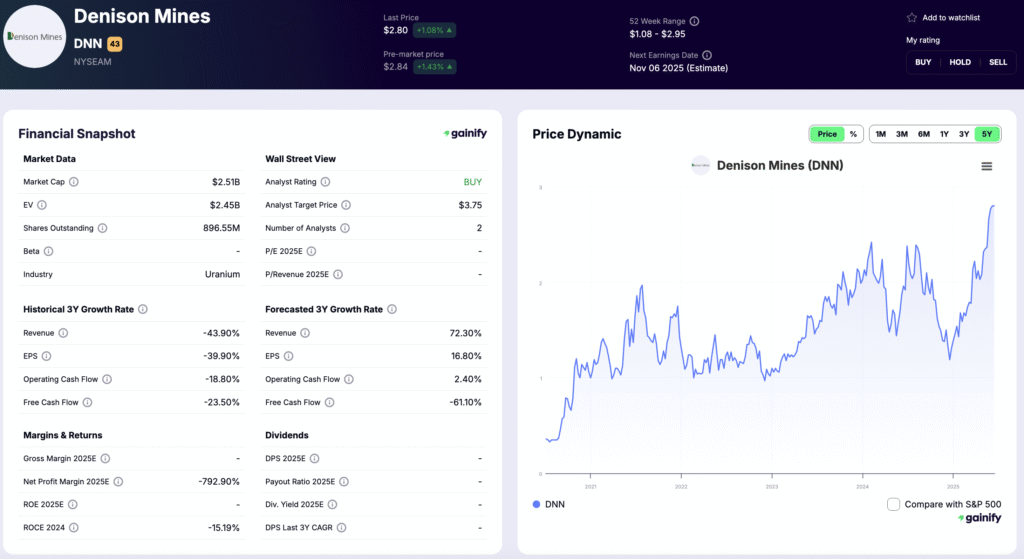

10. Denison Mines (TSX:DML) – Canada

- What It Does: Exploration and development company with flagship Wheeler River project in the Athabasca Basin.

- Catalysts: First Canadian project designed for ISR mining; partnership potential with Cameco and Orano in the Basin.

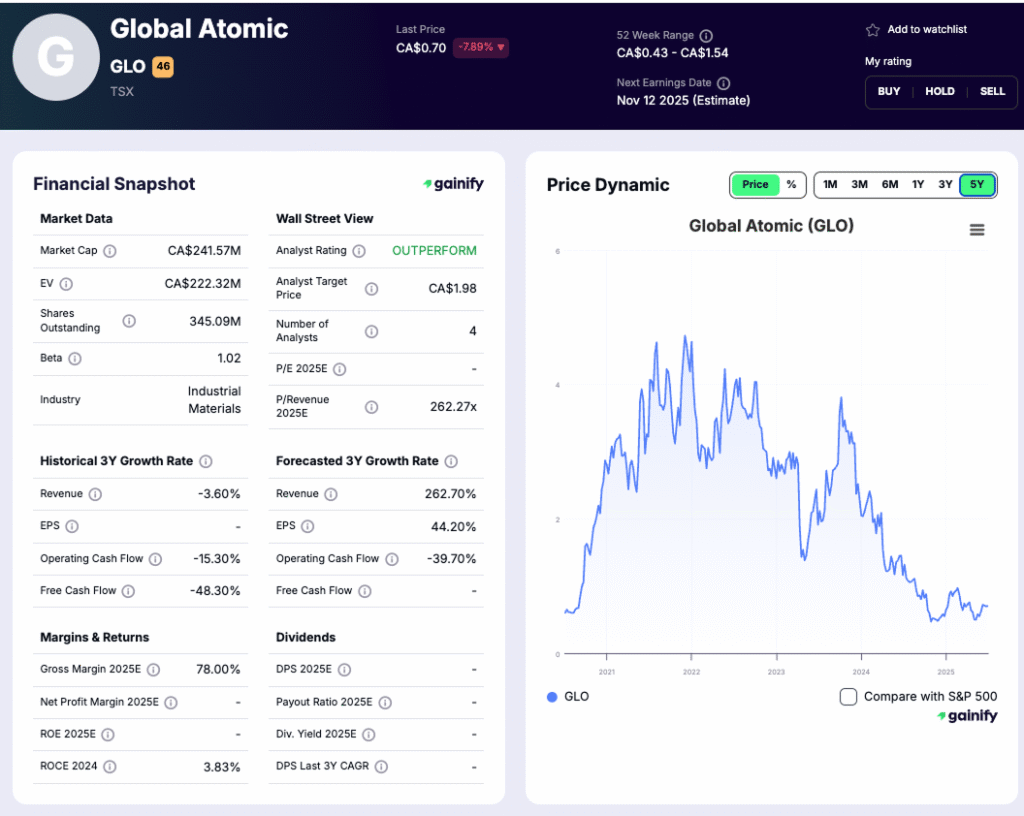

11. Global Atomic (TSX:GLO) – Canada

- What It Does: Developing the Dasa project in Niger, one of Africa’s largest undeveloped uranium deposits.

- Catalysts: Transformative potential once in production; however, exposed to political instability and resource nationalism in Niger.

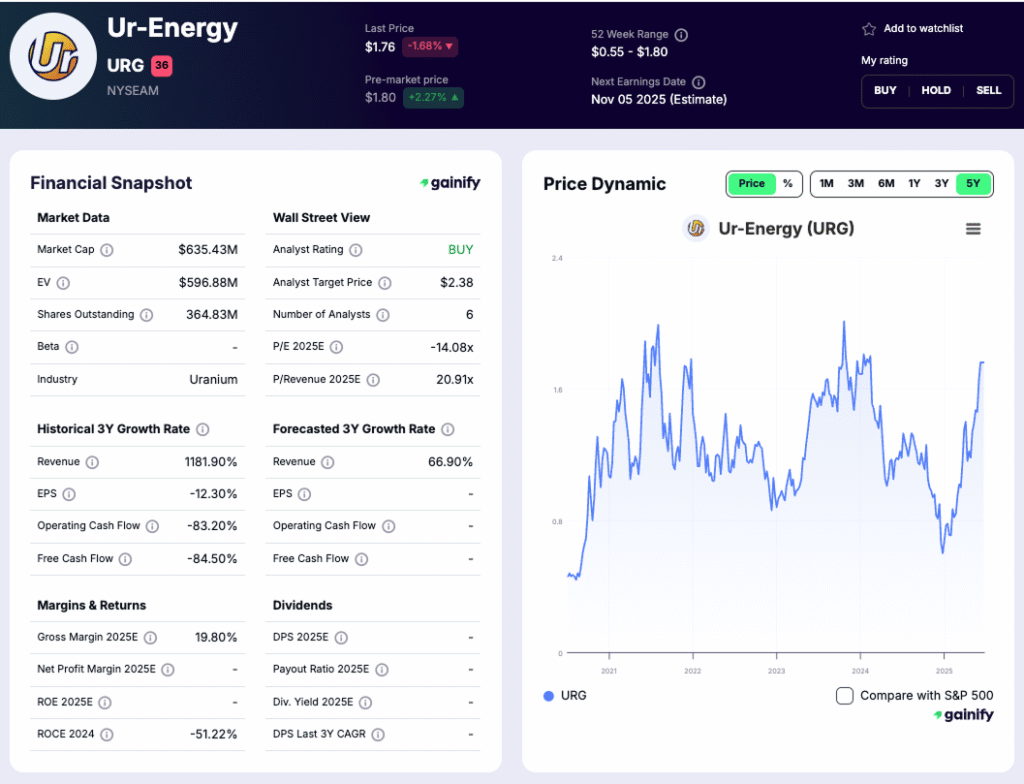

12. Ur-Energy (TSX:URG) – United States

- What It Does: Small-cap ISR producer with projects in Wyoming, including Lost Creek and Shirley Basin.

- Catalysts: Restart of Lost Creek; positioned to benefit from U.S. domestic uranium supply initiatives.

13. Navoi Mining & Metallurgy Combine (Private) – Uzbekistan

- What It Does: State-owned company and one of the world’s largest uranium producers. Operates several uranium mines across Uzbekistan, primarily using in-situ recovery (ISR) technology.

- Assets: Multiple ISR projects across the Kyzylkum Desert region; integrated uranium production facilities.

- Catalysts: Rising output as Uzbekistan increases its role in global uranium markets; government initiatives to attract foreign investment into mining; strategic partnerships with Russia and China.

14. Orano (Private, France – formerly Areva)

- What It Does: A major French state-owned nuclear fuel company with uranium mining operations in Niger, Kazakhstan, and Canada.

- Catalysts: Supplies European utilities; vertically integrated across the nuclear fuel cycle; political instability in Niger remains a risk.

Key Producing Regions

- Kazakhstan – The world’s largest producer, supplying over 40% of global uranium output. Production is dominated by Kazatomprom, which relies heavily on low-cost in-situ recovery (ISR) methods.

- Canada – Home to the Athabasca Basin in Saskatchewan, which hosts some of the highest-grade uranium deposits on Earth. Mines like Cigar Lake and McArthur River (operated by Cameco) produce uranium with concentrations far richer than the global average.

- Australia and Namibia – Both countries rank among the top producers. Australia has the largest known uranium reserves globally, with mines such as Olympic Dam and Ranger. Namibia is a major exporter through operations like Rossing and Husab, which supply utilities around the world.

- United States – Once a leading uranium producer, U.S. output has declined significantly. However, smaller-scale producers are restarting idled mines in Wyoming, Texas, and Utah, encouraged by government policies that support domestic uranium supply and reduce dependence on imports.

How Uranium Mining Differs from Other Commodities

Uranium mining operates very differently from most commodity markets, which has important implications for investors. Unlike oil, copper, or iron ore, uranium is not primarily traded on open spot markets. Instead, the industry is structured around long-term planning, strict regulation, and limited numbers of qualified suppliers.

Most uranium is sold through multi-year contracts between utilities and miners. These agreements are designed to ensure security of supply rather than maximize short-term price efficiency. As a result, changes in demand often take time to show up in production decisions, which can tighten markets when demand accelerates faster than supply.

There are three main mining methods used globally:

- Open-pit mining – This is used when uranium deposits are close to the surface. Large areas of rock are removed to access the ore, similar to how copper is mined.

- Underground mining – When uranium lies deeper underground, miners create tunnels to reach high-grade deposits. This method is common in places like Canada’s Athabasca Basin, where uranium concentrations are some of the richest in the world.

- In-situ recovery (ISR) – Instead of digging, miners pump a solution into underground ore bodies. This dissolves the uranium, which is then pumped back to the surface. ISR is generally lower-cost and less disruptive to the environment. It is the dominant method in Kazakhstan and is also used in parts of the United States.

Because uranium mines take many years to permit, finance, and develop, supply response is slow. This makes existing producers and advanced development projects especially valuable when utilities return to long-term contracting.

These structural features help explain why uranium mining stocks often move in cycles and why scale, asset quality, and jurisdiction matter so much.

Factors Driving Uranium Prices

1. Supply and Demand Imbalance

Years of low prices led to mine closures and under-investment. Demand is now rising, but supply has been slow to respond, creating a tightening market.

2. Long-Term Utility Contracts

Unlike oil or copper, uranium is mostly sold through multi-year contracts between utilities and miners. Prices in these contracts often lag spot market moves, meaning miners can lock in stable cash flows during bull cycles.

3. Government Policy

Policies to extend or build new reactors directly increase uranium demand. Incentives for domestic mining in the U.S. and Europe also support local producers.

4. Geopolitical Tensions

Sanctions on Russia or instability in supplier nations such as Niger can disrupt supply, driving prices higher.

5. Investor Activity

The entry of funds such as the Sprott Physical Uranium Trust (SPUT), which buys and holds physical uranium, has tightened spot markets and added new financial demand.

Investment Risks

Investing in uranium miners requires tolerance for volatility and awareness of unique sector risks:

- Price Volatility: Uranium prices swing sharply, often disconnected from broader commodities.

- Regulatory Changes: Sudden policy shifts, such as nuclear phase-outs, can slash demand.

- Geopolitical Risk: Concentration of supply in Kazakhstan and Niger exposes the market to instability.

- ESG Concerns: Mining and nuclear waste raise environmental and political challenges.

- Capital Costs: New mines require billions upfront, with long payback horizons.

Conclusion

Uranium’s resurgence is one of the defining energy stories of the 2020s. Nuclear power is now firmly back on the policy agenda, with governments prioritising energy security and climate goals simultaneously.

The top uranium mining stocks from A to U: Cameco, Energy Fuels, Uranium Energy Corp, Kazatomprom, NexGen Energy, Denison Mines, Paladin Energy, Global Atomic, and Ur-Energy give investors a spectrum of opportunities, from established low-cost producers to high-growth developers.

For investors, uranium mining stocks offer powerful upside but demand careful risk management. Diversification across multiple companies and regions, combined with a long-term outlook, may be the best way to gain exposure to a commodity that is becoming indispensable for global energy security.