The global energy landscape is undergoing a critical transformation, shaped by growing technological demands and evolving infrastructure needs.

Nuclear energy, long viewed with skepticism, is increasingly recognized as a vital component of a modern, secure, and scalable power system. This resurgence reflects more than a short-term reaction to market trends. It signals a deeper re-evaluation of nuclear power’s role in meeting future energy demands, particularly those driven by artificial intelligence and data-intensive technologies.

One of the most urgent pressures on the global power grid today is the exponential rise in electricity consumption from AI infrastructure. Data centers, especially those supporting generative AI models, require constant, high-capacity energy. Unlike intermittent renewable sources, nuclear power provides a stable baseload supply that can operate continuously, making it an ideal partner for these mission-critical operations. With tech giants such as Microsoft, Google, and Meta committing massive capital to AI infrastructure, their pursuit of nuclear-linked energy solutions is creating a powerful new demand driver for the sector.

The International Energy Agency (IEA) forecasts that global nuclear power generation will reach an all-time high in 2026, exceeding the previous peak set in 2021. This growth suggests not only recovery but a structural shift toward long-term nuclear adoption. The rising emphasis on energy security, infrastructure resilience, and technological scalability is creating favorable conditions for nuclear investment and policy support. As demand from AI compounds with geopolitical and economic concerns, the foundation for nuclear’s sustained relevance continues to strengthen.

This article explores the key companies poised to benefit from this nuclear revival. From uranium miners and enrichment specialists to advanced reactor developers and regulated utilities, we examine the players driving the next era of energy innovation. For investors seeking long-term opportunities supported by macro trends in digitalization, electrification, and infrastructure security, nuclear energy stands out as a strategic sector worthy of close attention.

The Resurgence of Nuclear Power: A Global Imperative

Decarbonization and Energy Security

As countries push toward net-zero emissions, nuclear energy is stepping into the spotlight. Unlike fossil fuels, nuclear plants produce virtually no greenhouse gases during operation. And unlike many renewables, they provide consistent power, day and night. This dual benefit makes nuclear one of the few technologies capable of supporting both environmental goals and industrial-scale energy needs.

Momentum is building globally:

- Over 30 nations have committed to tripling nuclear capacity by 2050

- International agreements, like the 2023 COP conference declaration, are creating shared targets

- These commitments provide a stable policy framework that supports large-scale investment

But the shift to nuclear isn’t only about climate. With recent geopolitical shocks and rising energy prices, governments are placing new emphasis on energy independence. Nuclear power, generated within national borders, is becoming a cornerstone of domestic energy resilience.

This evolving priority is visible in several ways:

- In the U.S., energy discussions now focus more on “national security” than generic “energy security”

- Nuclear is being classified as strategic infrastructure, opening the door for more direct government investment

- Accelerated approval timelines and funding mechanisms are being introduced to support the expansion of nuclear power

By meeting both environmental and national resilience objectives, nuclear power is gaining bipartisan support and attracting long-term capital – a sign of growing investor confidence.

The AI Energy Nexus

Artificial intelligence is driving an explosive increase in energy demand. Data centers that power AI models require constant, high-density electricity. Because renewable energy sources like wind and solar are intermittent, they alone cannot meet these growing demands.

Growth projections:

- Global data center electricity use is expected to grow at 16% annually (2023–2028).

- Generative AI demand is projected to grow by 65% annually.

- AI inference demand may rise 122% annually through 2028.

- Deloitte projects that U.S. data center power capacity will rise from 33 GW in 2024 to 176 GW by 2035.

This explosive demand highlights the need for reliable, round-the-clock power, making nuclear energy a practical and scalable solution.

Why nuclear fits:

- Capacity factor over 92%, compared to ~35% for wind and ~25% for solar.

- 24/7 availability is crucial for AI infrastructure uptime.

- Tech companies (Amazon, Google, Microsoft, Meta) are exploring direct nuclear partnerships.

- Nuclear is evolving from a utility-scale solution to a private-sector strategic energy resource.

Governmental Tailwinds

Governments around the world are backing nuclear energy with targeted policy and financial support. These initiatives are designed to simplify regulations, support reactor innovation, and secure domestic supply chains.

United States actions:

- Former President Trump signed executive orders to accelerate uranium mining and reactor deployment.

- The Department of Energy set a goal for at least 3 new reactors to be online by July 4, 2026.

- These efforts reduce regulatory risks and improve capital access for nuclear ventures.

International support:

- UK invested £38 billion into the Sizewell C plant, taking a 45% government stake.

- China approved 10 new reactors in 2025, investing over 200 billion yuan.

- EU member states are extending plant lifespans and committing to new nuclear builds.

Top Nuclear Energy Stocks: A Deep Dive

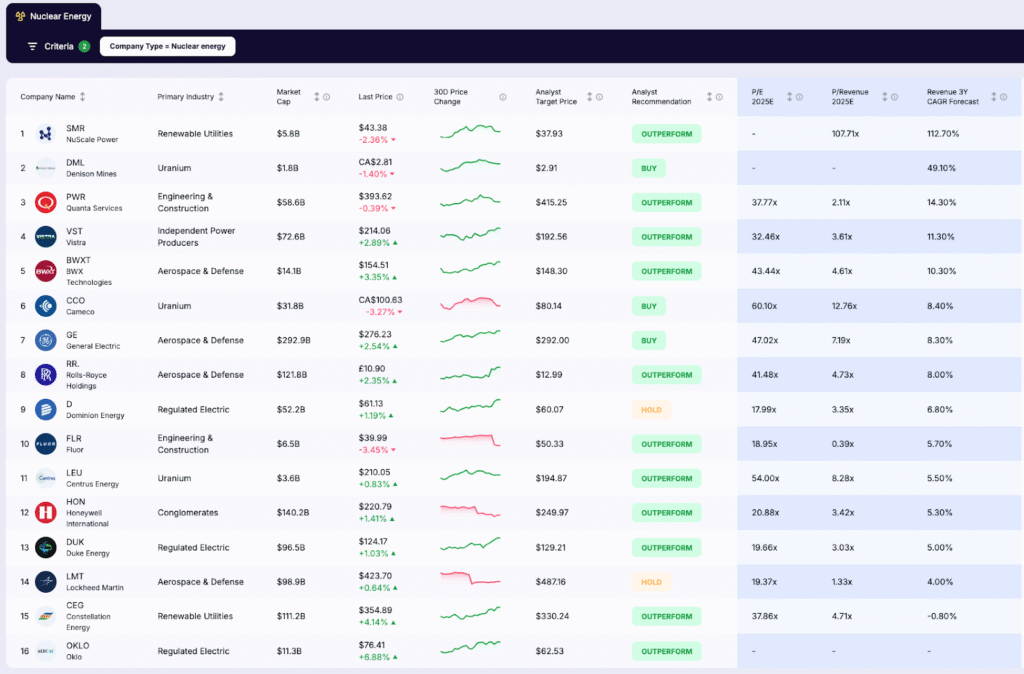

The following section provides a comprehensive look at leading companies in the nuclear energy sector, incorporating data from the provided stock screener and additional research.

Table 1: Top Nuclear Energy Stocks at a Glance

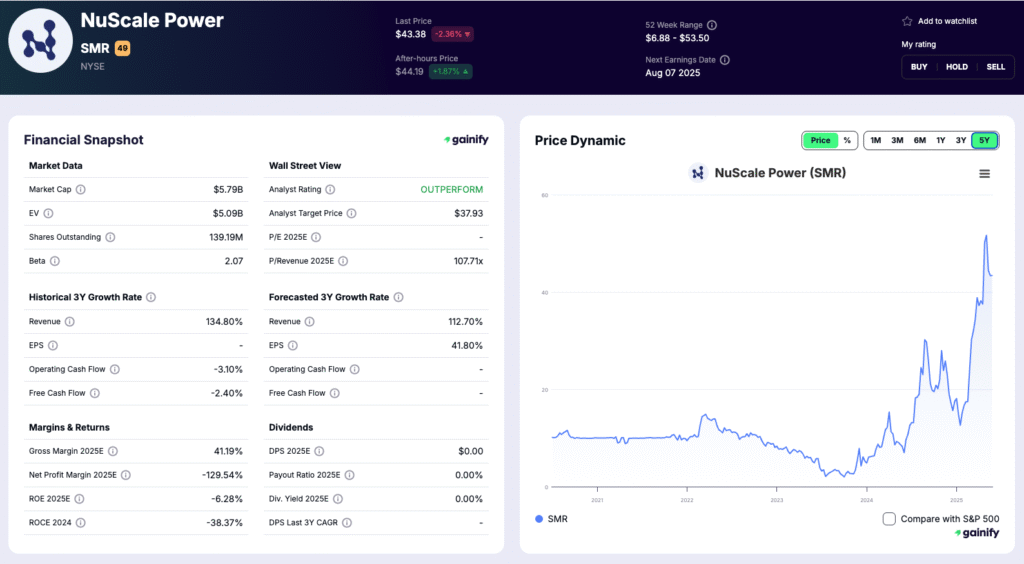

NuScale Power (SMR)

NuScale Power is a trailblazer in advanced nuclear technology, specializing in Small Modular Reactors (SMRs). Their flagship product, the VOYGR 12 SMR power plant, features 12 NuScale Power Modules, each capable of generating 77 MWe, totaling up to 924 MWe of carbon free electricity. Their SMR design is notably the only one with U.S. approval, providing them with a significant regulatory head start in the market.

NuScale has materially expanded its commercial pipeline. In the United States, the company and its exclusive global partner ENTRA1 Energy announced an agreement with the Tennessee Valley Authority to develop up to 6 gigawatts of new nuclear capacity, representing the largest SMR deployment program ever announced in the U.S. This would involve approximately 72 NuScale Power Modules across multiple sites, materially strengthening NuScale’s long-term opportunity set. In Europe, work continues on the RoPower Doicești project in Romania, where NuScale is completing Phase 2 of Fluor’s FEED study ahead of a final investment decision expected in late 2026 or early 2027.

NuScale remains pre-revenue from electricity generation, but revenue from engineering, licensing, and project services continues to scale. Quarterly revenue reached $8.2 million in Q3 2025, driven primarily by engineering and licensing work supporting the Romanian project. Liquidity strengthened significantly in 2025, with the company raising approximately $475 million in gross proceeds through an at-the-market equity program during the third quarter. As of September 30, 2025, NuScale reported over $520 million in total liquidity, providing multi-year financial runway to support commercialization efforts.

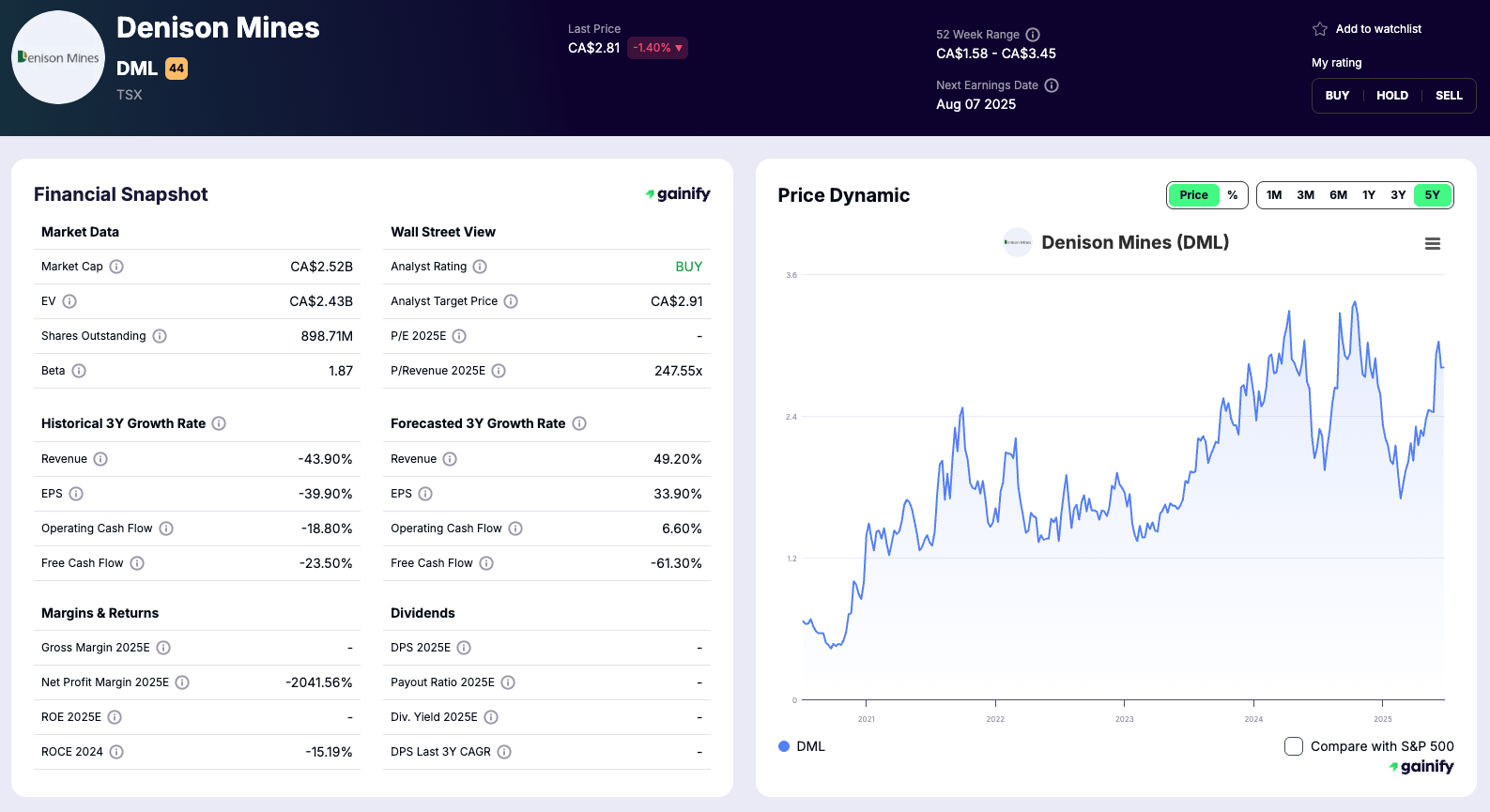

Denison Mines (DNN)

Denison Mines Corp. is focused on the acquisition, exploration, and development of uranium assets in Canada. Its flagship asset is the Wheeler River Uranium Project, in which Denison holds an effective 95% interest. Located in the eastern Athabasca Basin of northern Saskatchewan, Wheeler River is considered the largest undeveloped uranium project in an infrastructure-rich part of the basin, with established access to roads, power, and processing facilities.

The Phoenix Project at Wheeler River represents Denison’s primary growth engine. Phoenix is designed as an in-situ recovery operation, a rare approach in the Athabasca Basin that offers materially lower capital intensity and operating costs compared with conventional mining. By Q3 2025, engineering was largely complete, procurement was well advanced, and the project had received provincial environmental approval, positioning it for a final federal licensing decision in early 2026.

In 2025, Denison re-entered uranium production for the first time in over a decade. Production began at the McClean North deposit using the SABRE mining method at the McClean Lake Joint Venture. During Q3 2025, approximately 2,000 tonnes of high-grade ore were mined, producing more than 85,000 pounds of U₃O₈. This milestone provides Denison with near-term production exposure while Wheeler River advances toward construction.

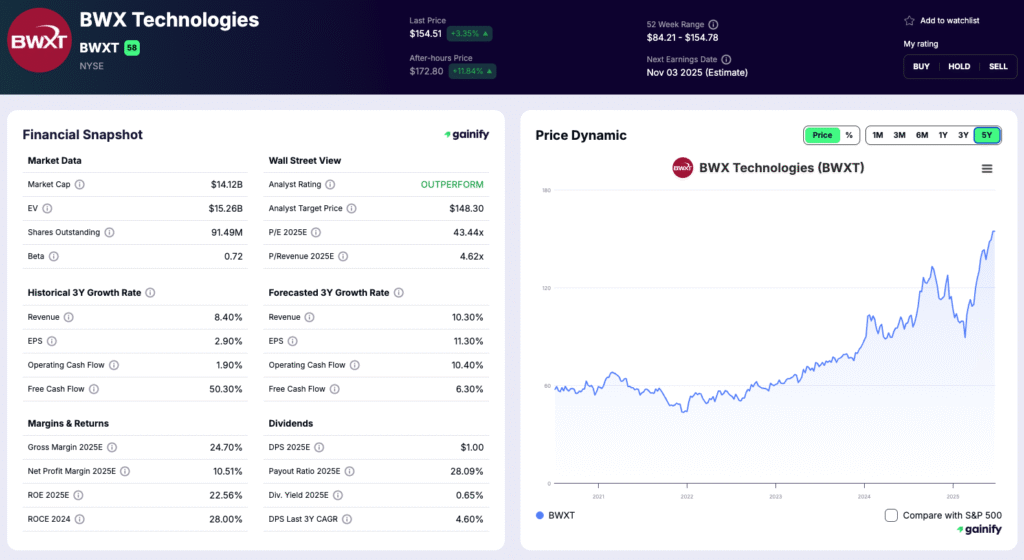

BWX Technologies (BWXT)

BWX Technologies is a leading provider of nuclear technology, components, and services across defense and commercial markets. Its core business is built around highly specialized nuclear solutions, including long-term contracts supporting U.S. naval nuclear propulsion, government fuel programs, and nuclear materials management, which provide stable revenue visibility and margin durability.

The company significantly expanded its commercial footprint in 2025. In January 2025, BWXT completed the acquisition of Kinectrics Inc. for $525 million, adding global nuclear services capabilities spanning power generation, grid reliability, and nuclear medicine. This acquisition materially accelerated growth in the Commercial Operations segment and strengthened BWXT’s exposure to life-extension and maintenance spending across the global nuclear fleet.

BWXT continues to position itself for global nuclear build activity and defense demand. BWXT Canada maintains its manufacturing collaboration with Westinghouse Electric Company, supplying components for AP1000 and AP300 reactor designs used in new nuclear projects worldwide. In parallel, the Aerojet Ordnance Tennessee acquisition expanded BWXT’s specialty metals and high-strength alloy capabilities, reinforcing its role in defense and advanced materials applications.

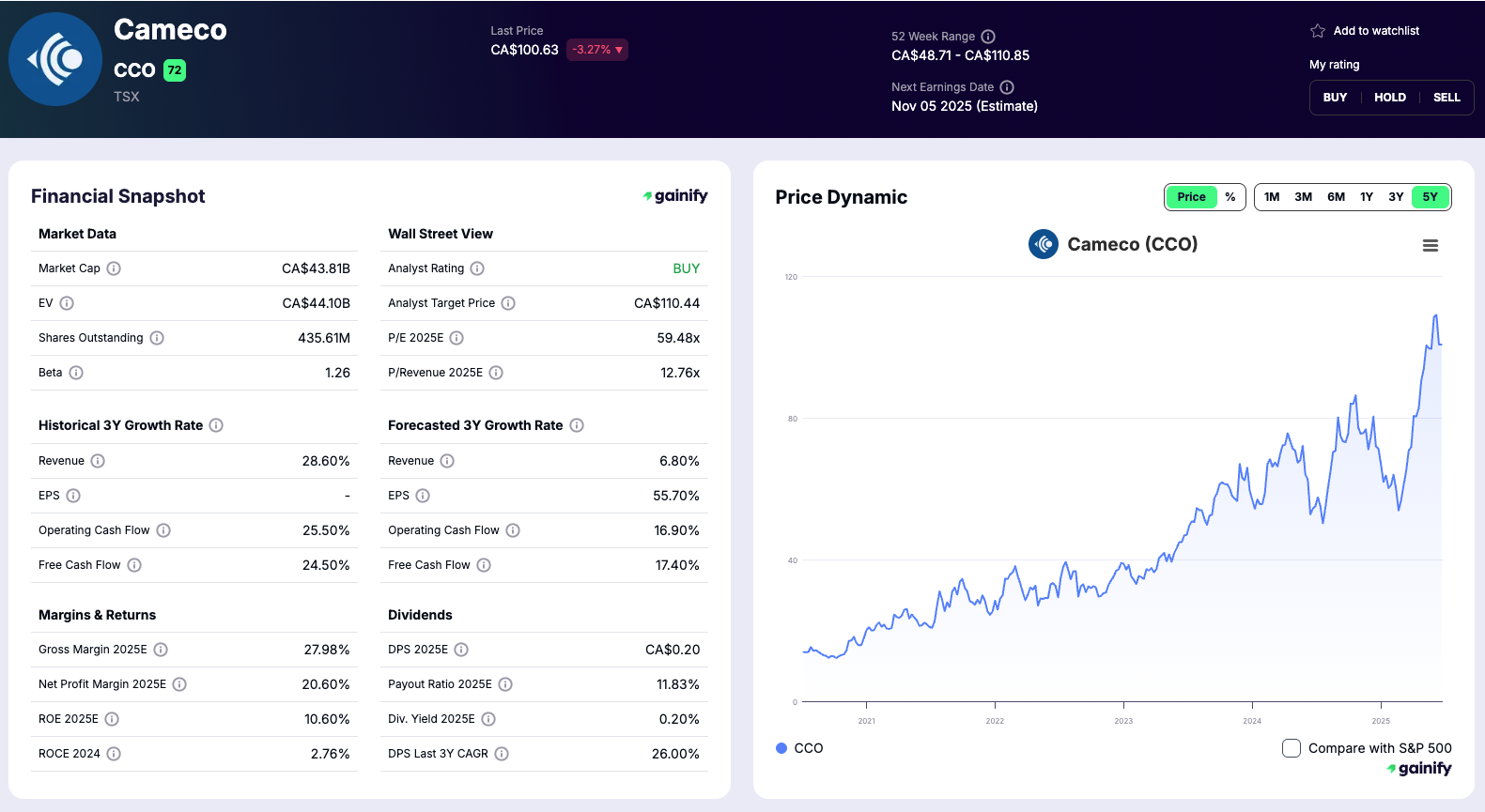

Cameco (CCO)

Cameco Corporation is one of the world’s most strategically important uranium suppliers. The company operates across the nuclear fuel cycle rather than functioning solely as a miner, combining uranium production, fuel services, and downstream exposure. This integrated model positions Cameco as a long-term partner for utilities seeking secure, reliable nuclear fuel supply rather than short-term exposure to uranium price volatility.

Tier-one assets anchor Cameco’s production base. Its flagship operations, including Cigar Lake and McArthur River/Key Lake, rank among the highest-grade uranium deposits globally. These assets benefit from long reserve lives, established infrastructure, and operational flexibility, allowing Cameco to scale production in response to contracting demand rather than spot market conditions. Production increased materially through 2024 and 2025 as the company responded to renewed utility demand.

Downstream exposure strengthens earnings quality. Cameco’s fuel services business and its ownership stake in Westinghouse expand the company’s reach into conversion, fuel fabrication, reactor services, and nuclear technology. This vertical integration allows Cameco to capture value beyond uranium mining and aligns its growth with reactor restarts, life extensions, and new nuclear build programs globally.

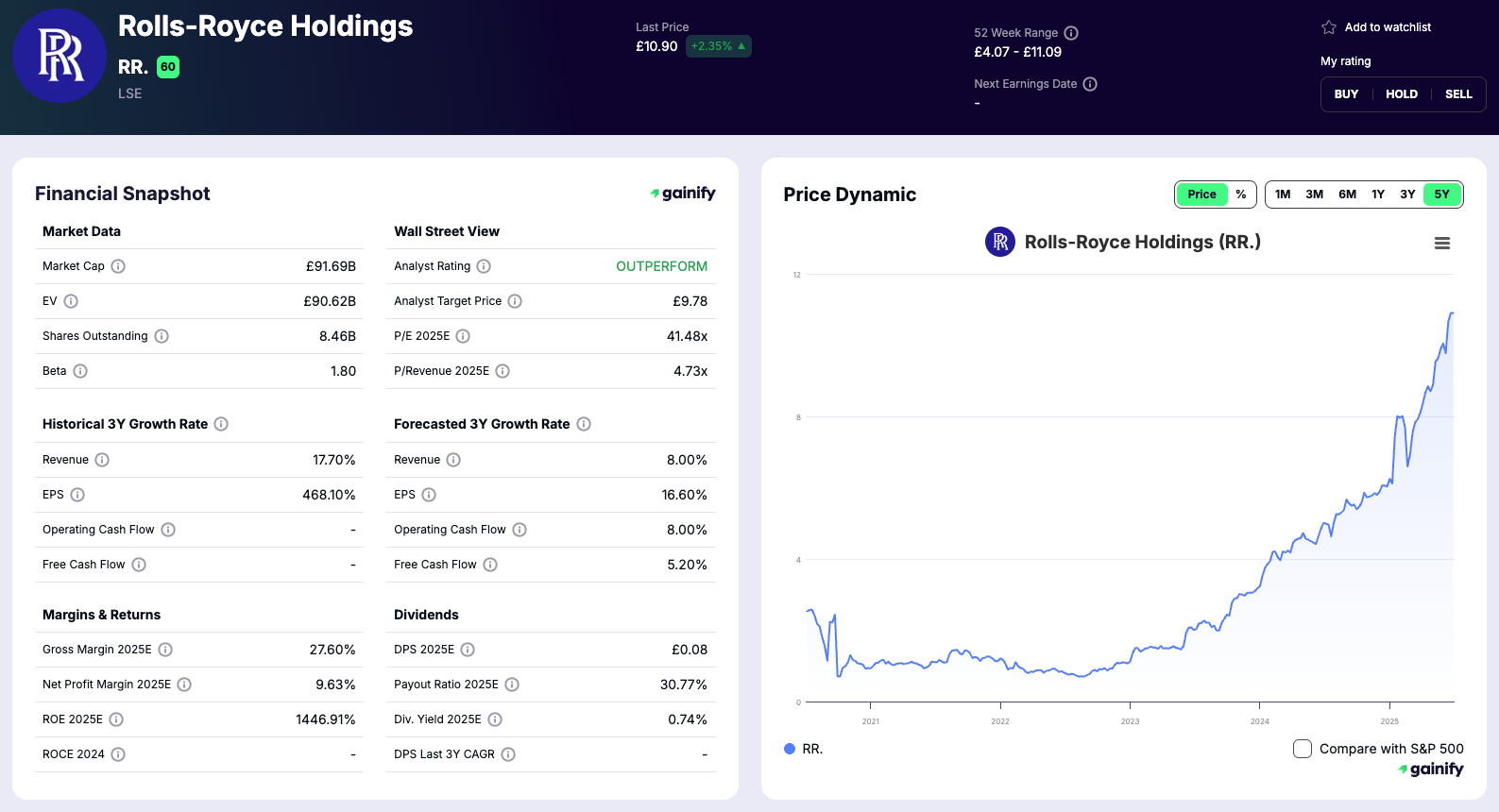

Rolls-Royce Holdings (RR.)

Rolls-Royce is building a meaningful position in civil nuclear through its SMR division. Rolls-Royce SMR is developing a 470 MW small modular reactor designed for standardized, factory-led construction and faster deployment. In 2025, the SMR business reached several milestones, including selection as the preferred technology provider by Great British Energy-Nuclear in the UK, advancement to the final stage of Sweden’s nuclear technology selection process, and formal entry into the U.S. regulatory process. These steps materially reduce execution and regulatory risk and support potential deployment in the early 2030s.

The company’s nuclear exposure is complemented by long-standing defense propulsion capabilities. Rolls-Royce remains a core supplier of nuclear propulsion systems for the Royal Navy and is expanding its role in advanced nuclear applications through participation in the U.S. Project Pele microreactor program. These programs reinforce the company’s position at the intersection of defense, energy security, and next-generation nuclear technology.

Financial performance improved sharply as the transformation strategy gained traction. In 2024, Rolls-Royce delivered strong profit and revenue growth, and momentum continued through 2025. As of October 2025, management reaffirmed full-year guidance for underlying operating profit of £3.1–3.2 billion and free cash flow of £3.0–3.1 billion, reflecting improved operational execution across Civil Aerospace, Defence, and Power Systems. Large engine flying hours exceeded pre-pandemic levels, and order intake remained robust across end markets.

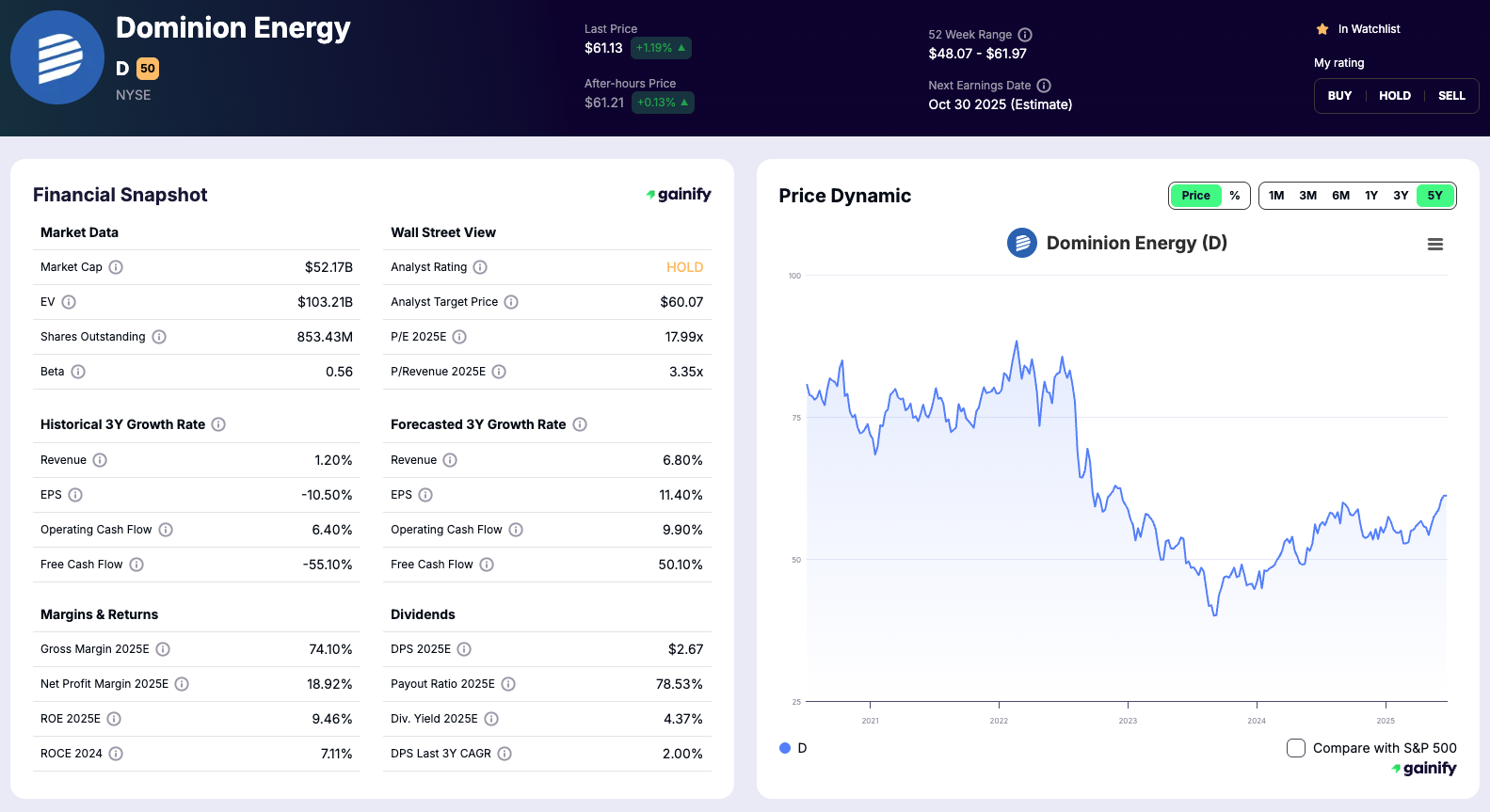

Dominion Energy (D)

Dominion Energy is a predominantly regulated utility company, with approximately 90% of its earnings generated from electric and gas utilities subject to state regulation in Virginia, North Carolina, and South Carolina. Regulated operations form the backbone of the business, providing stable cash flows, predictable returns, and limited exposure to commodity price volatility or wholesale power markets.

A central pillar of Dominion’s long-term strategy is large-scale regulated infrastructure investment, most notably the 5.2 GW offshore wind project under construction off the coast of Virginia Beach. This project is designed to operate within the regulated rate base, supporting long-term earnings growth while expanding the company’s portfolio of carbon-free generation assets.

Dominion also relies on nuclear generation as a long-duration baseload asset, highlighted by regulatory approval in 2025 to extend operations at the V.C. Summer Nuclear Station by 20 years. Financially, the company reported trailing twelve-month revenue of $14.46 billion and net income of $2.12 billion, while maintaining a quarterly dividend of 66.75 cents per share. With a market capitalization of $52.2 billion and a forward dividend yield of approximately 4.4%, Dominion remains positioned as a stable, income-focused utility with earnings growth tied to regulated capital deployment rather than market cycles.

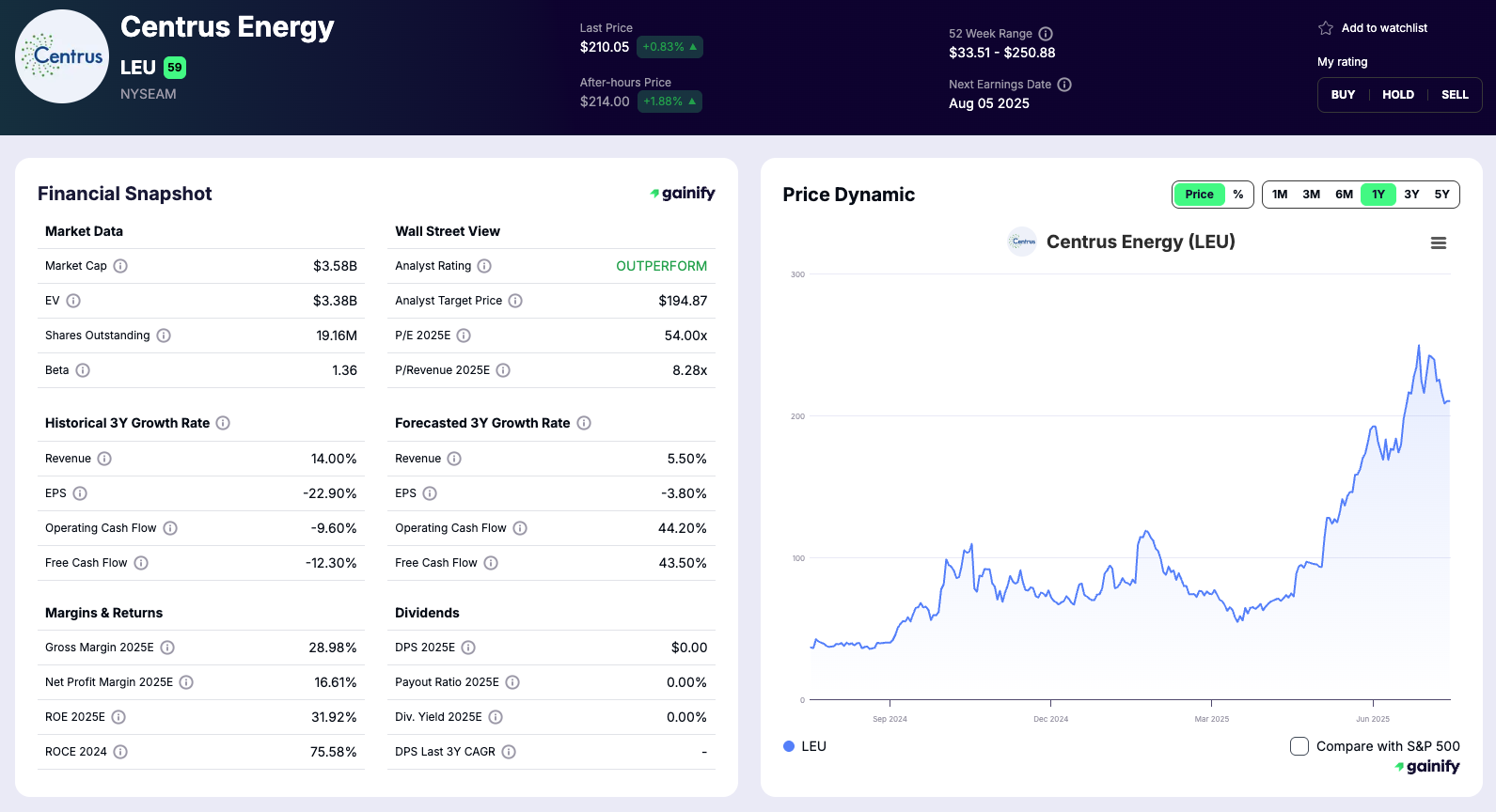

Centrus Energy (LEU)

Centrus Energy Corp. is a U.S.-based nuclear fuel supplier with a specialized focus on High-Assay Low-Enriched Uranium (HALEU), a critical fuel required by most next-generation nuclear reactor designs. Centrus is currently the only U.S. company licensed to enrich uranium to HALEU levels, giving it a unique strategic position as domestic nuclear fuel supply becomes a national priority.

A second core element of Centrus’ business is rebuilding domestic uranium enrichment capacity. Through its subsidiary, American Centrifuge Operating LLC, the company has secured U.S. Department of Energy awards to expand Low Enriched Uranium production and advance HALEU output at its Piketon, Ohio facility. These programs are intended to support both the existing reactor fleet and future advanced reactors while reducing U.S. dependence on foreign enrichment services.

Centrus is also focused on scaling manufacturing and infrastructure to support long-term growth. The company committed $60 million to resume and expand centrifuge manufacturing at its Oak Ridge, Tennessee facility, enabling future capacity expansion. As of late 2025, Centrus reported annual revenue of $442 million, net income of $73.2 million, and a contracted revenue backlog extending through 2040, reflecting its transition toward longer-duration, government-backed fuel supply contracts.

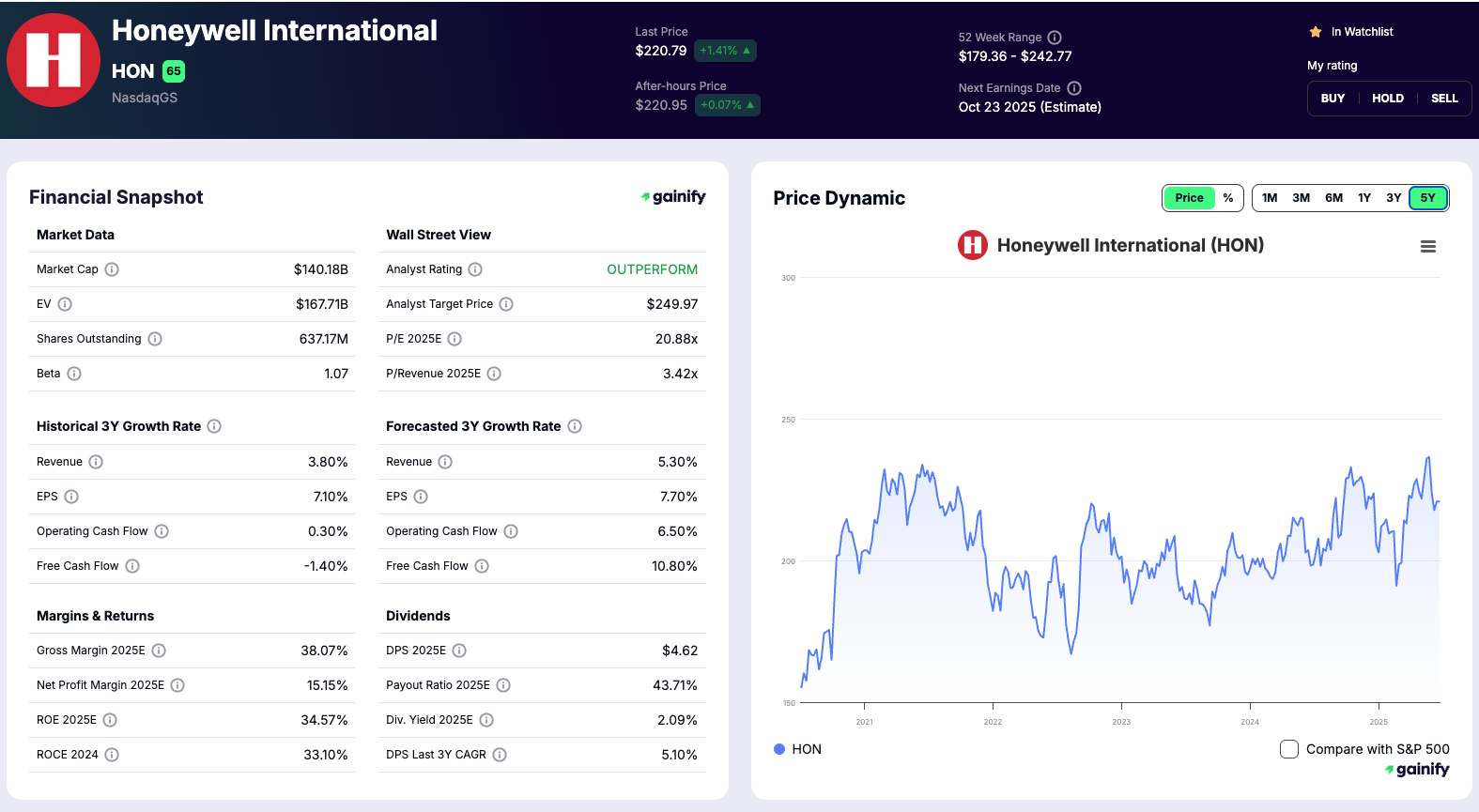

Honeywell International (HON)

Honeywell International, through its Federal Solutions division, operates four sites for the U.S. Department of Energy (DOE) and National Nuclear Security Administration (NNSA). These sites are central to the nation’s security, nuclear deterrence, and energy independence. These include Sandia National Laboratories, Oak Ridge Reservation, Kansas City National Security Campus, and he Savannah River Site.

Honeywell’s mission is to deliver strategic outcomes for its partners by driving optimal performance and operational excellence, upholding the highest standards in efficiency, safety, and mission success. They leverage the Honeywell Forge data platform, expertise in quantum computing, and the Honeywell Operating System to drive technical performance in national security applications. They also apply commercial best practices to their federal government customers, focusing on making their businesses safe, secure, and more sustainable.

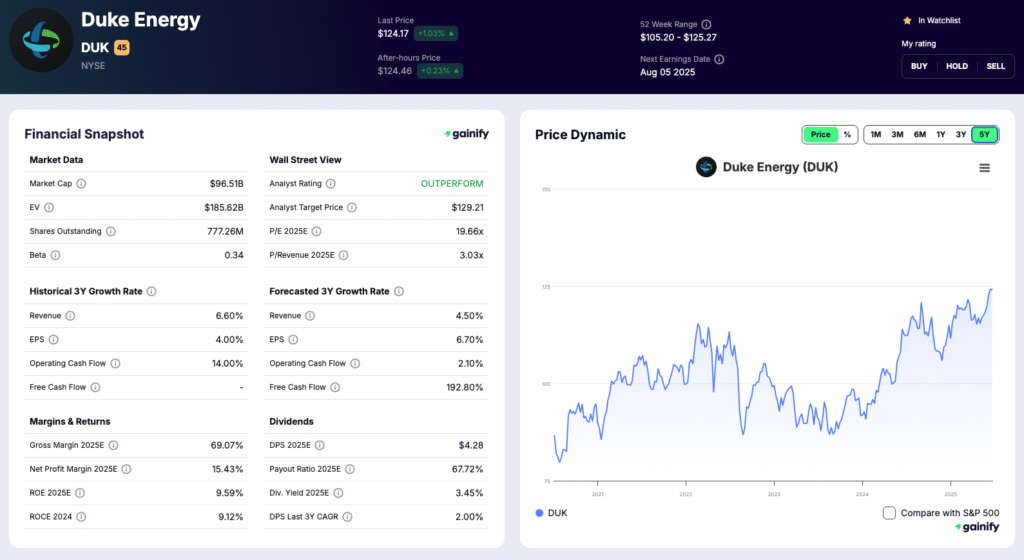

Duke Energy (DUK)

Duke Energy is a major energy company based in Charlotte, North Carolina, operating as an energy company across the United States. They own 58,200 megawatts of base load and peak generation in the United States, distributing electricity to 7.2 million customers. Nearly half of Duke Energy’s Carolinas generation comes from its nuclear power plants.

Duke Energy’s total revenue increased from $22.37 billion in 2015 to $30.36 billion in 2024, reflecting long-term growth driven by rate base expansion and customer demand. In 2024, the company’s revenue grew by approximately 4.46%, and analysts continue to expect stable mid-single-digit growth over the next several years based on regulated rate cases and infrastructure investments. In Q3 2025, Duke Energy reported operating revenues of $8.54 billion, a 4.8% increase year-over-year, alongside net income of roughly $1.42 billion for the quarter ended September 30, 2025, supported by higher electricity rates and strong demand.

Lockheed Martin (LMT)

Lockheed Martin’s Skunk Works team has been exploring compact nuclear fusion technology, aiming to create a highly efficient and scalable energy source. Their approach seeks to replicate the fusion process that powers the sun using a compact magnetic confinement system. The concept, sometimes referred to as a high-beta design, proposes a much smaller footprint compared to traditional tokamaks, potentially enabling reactors compact enough for mobile or modular applications.

While initial announcements projected rapid development timelines, no functional prototype has been publicly demonstrated to date. However, Lockheed continues to invest in advancing fusion technology, which, if successful, could one day be used to generate electricity or power propulsion systems. The company’s broader portfolio spans advanced aerospace and defense technologies, including aeronautics, missiles and fire control, rotary and mission systems, and space-based platforms.

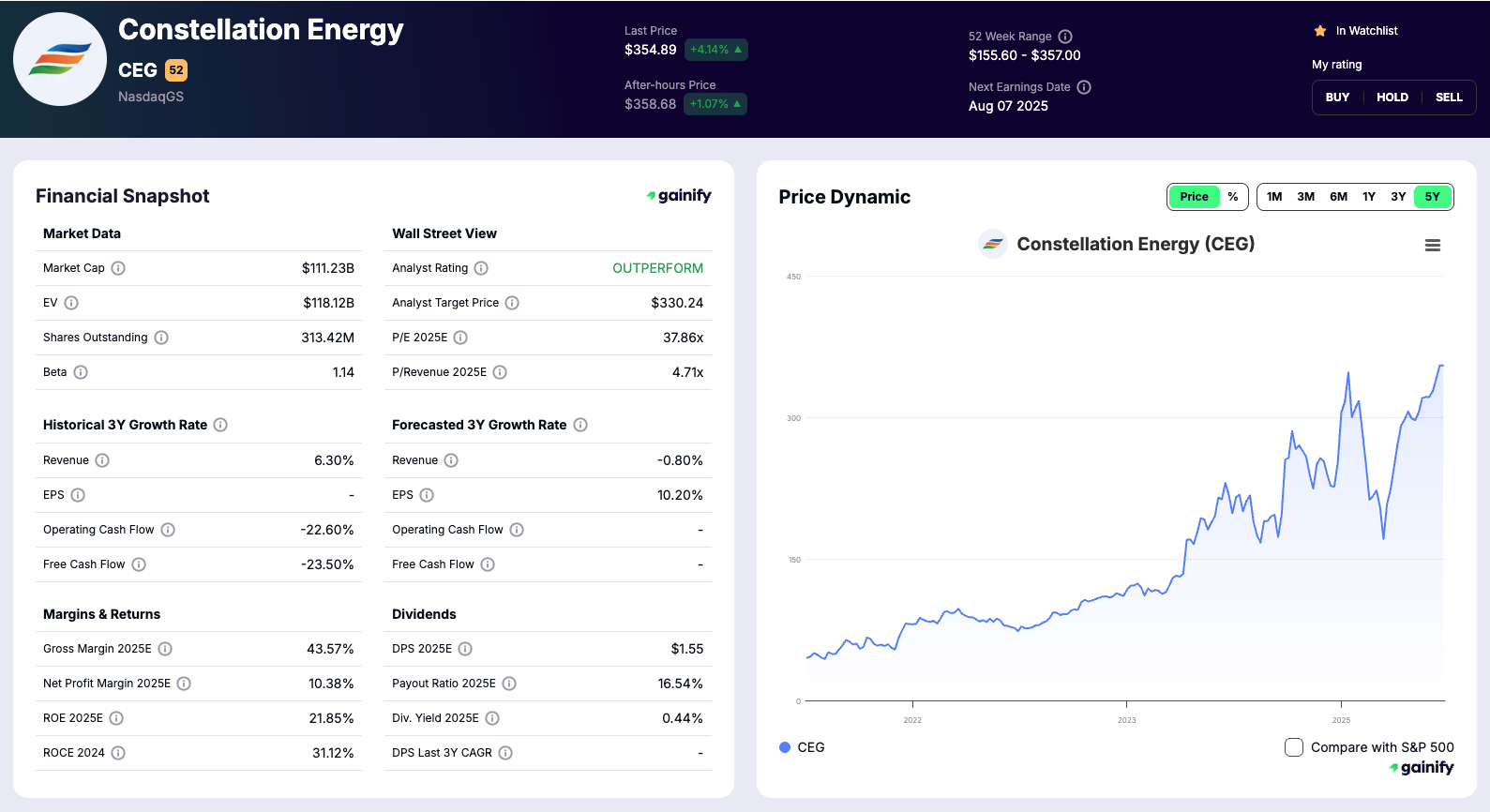

Constellation Energy (CEG)

Constellation Energy is the largest producer of clean power in the U.S., operating over 20 nuclear reactors and responsible for approximately 10% of the nation’s nuclear power generation. Their core business revolves around providing carbon free electricity, with nuclear power being a key component due to its 24/7 output, negligible carbon footprint, and scalability, which is highly sought after by AI data centers.

Constellation Energy is making a significant move by acquiring Calpine in a $26.6 billion deal, which will expand their portfolio to include natural gas and geothermal plants crucial for flexible generation in high growth markets. Additionally, Constellation has secured a 20 year power purchase agreement with Microsoft, further integrating them into the AI infrastructure supply chain.

Financially, Constellation Energy remains fundamentally strong. As of the trailing twelve months through Q3 2025, the company generated approximately $26.3 billion in revenue and about $4.0 billion in net income, which implies a profit margin in the high-teens. This performance reflects steady demand for its regulated and contracted utility services, disciplined cost management, and contributions from clean energy and nuclear generation assets.

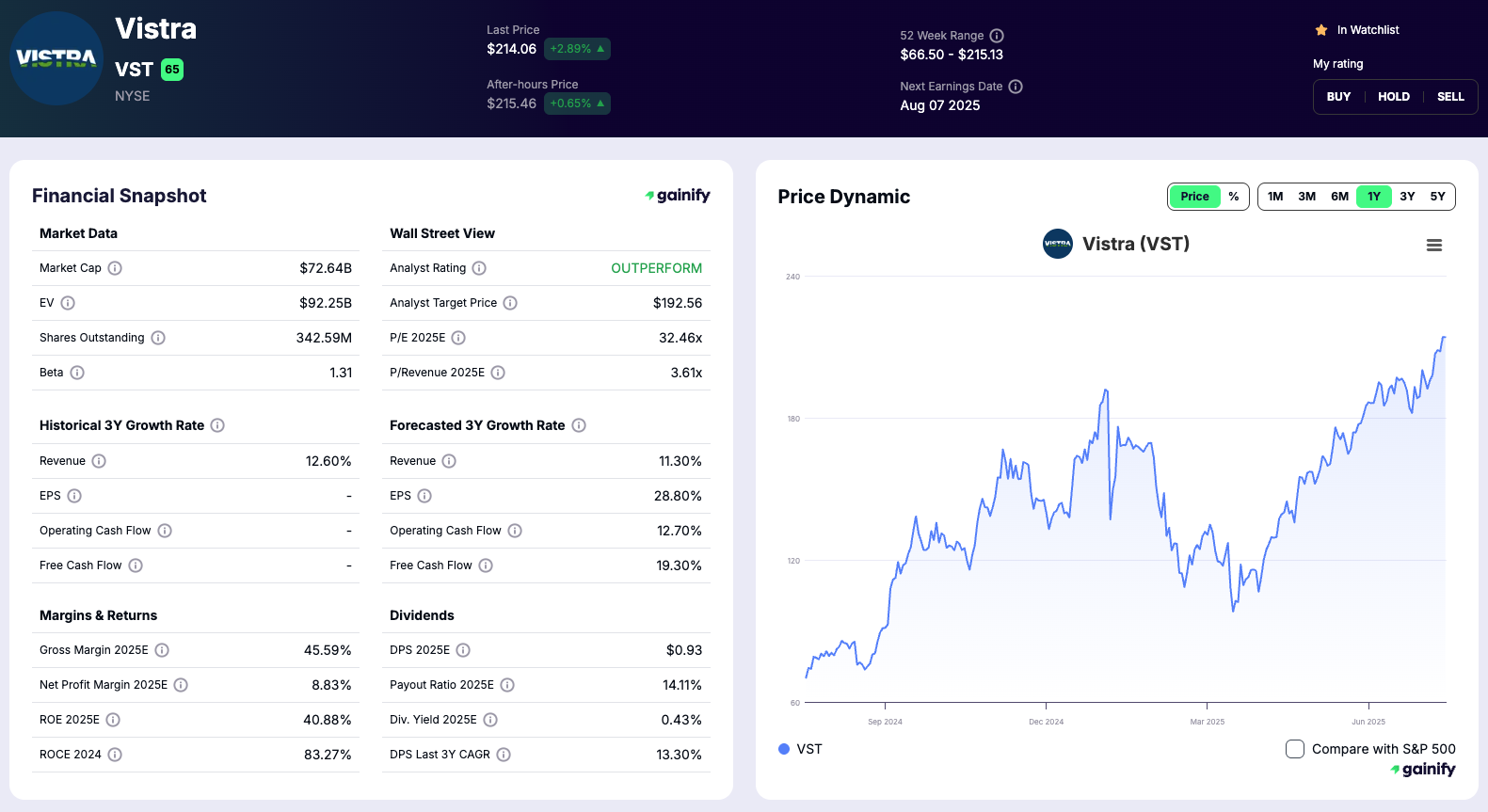

Vistra Corp (VST)

Vistra Corp is a holding company that provides electricity and power generation services. The company operates through several segments, including Retail, Texas, East, West, Sunset, and Asset Closure, covering electricity generation, wholesale energy sales, commodity risk management, and fuel production.

In July 2025, Vistra’s Perry Nuclear Plant received a 20 year license extension, ensuring operations through 2046. The company also reportedly boosted capacity with a $1.9 billion gas plant deal and contract expansion in July 2025. Vistra has also benefited from increased electricity consumption tied to data centers and AI-related infrastructure, with its mix of nuclear baseload and flexible gas generation positioning it to capture both stable and incremental load growth.

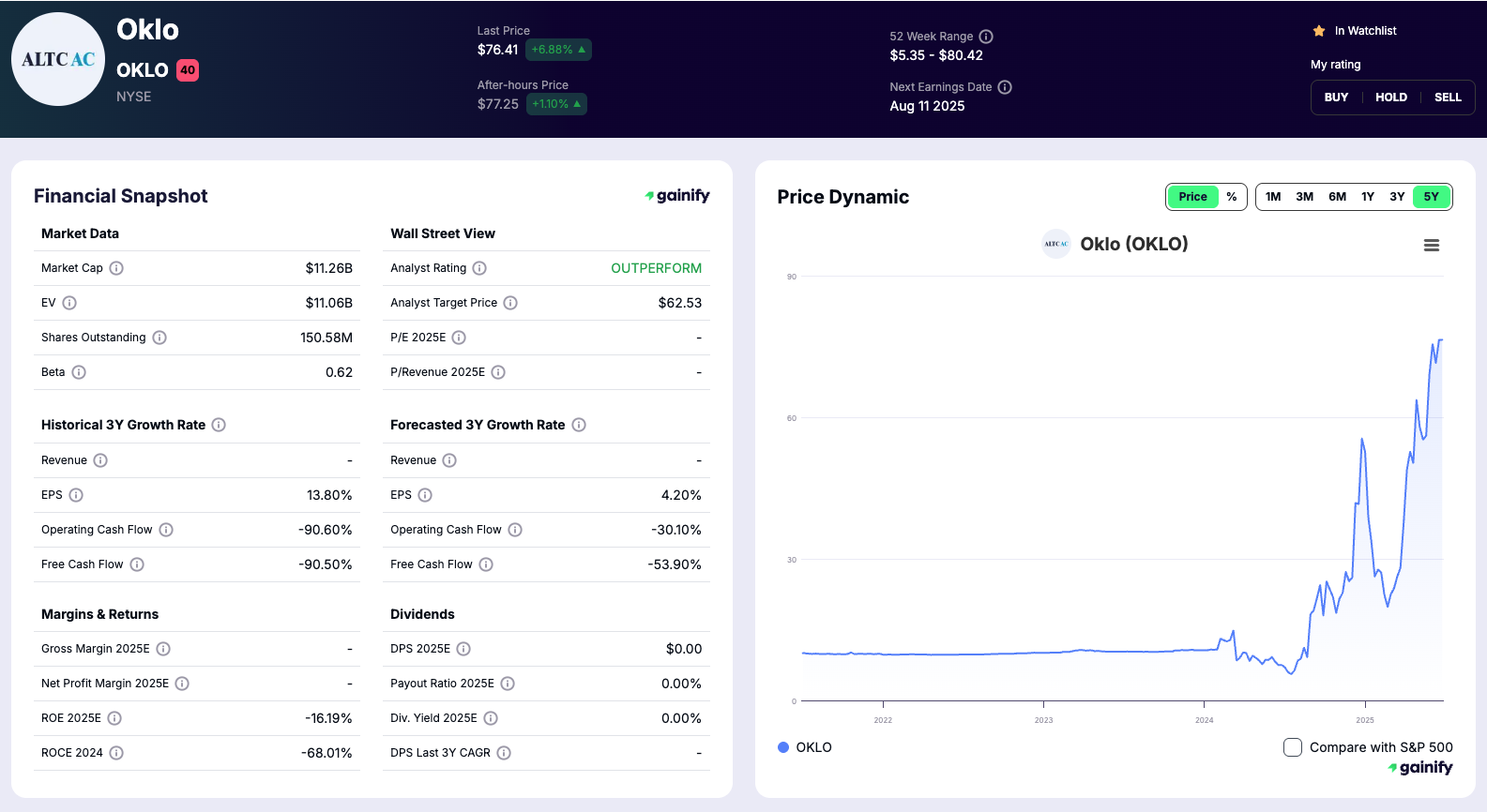

Oklo (OKLO)

Oklo is a company aiming to commercialize small modular nuclear reactors. The company has attracted investors with two key partnerships: one with Liberty Energy Inc. and another with Vertiv. These alliances address energy needs for data centers, factories, and large utility users, blending Oklo’s advanced nuclear designs with dependable natural gas and modern cooling systems.

The partnership with Liberty Energy offers complete energy solutions, starting with Liberty’s natural gas systems for quick energy and transitioning to Oklo’s clean nuclear generation for long term stability. With Vertiv, a global leader in critical infrastructure for digital services, Oklo will develop new power and cooling systems for next generation data centers. A pilot demonstration at Oklo’s first Aurora reactor site will test how nuclear generated steam and electricity can directly support data centers and power cooling systems. Oklo has also made significant progress in nuclear technology by collaborating with national labs and the DOE on nuclear fuel recycling, and was the first company to receive a site use permit from the DOE for a commercial advanced reactor.

Considerations for a Nuanced Perspective

While the nuclear energy sector presents compelling opportunities, a comprehensive understanding requires acknowledging inherent challenges. These considerations are not necessarily deterrents, but rather aspects that warrant careful evaluation for a balanced perspective.

One significant area of concern revolves around nuclear waste management. The waste generated by nuclear reactors remains radioactive for hundreds of thousands of years, necessitating containment for up to one million years. Currently, there are no universally accepted long term storage solutions, and most waste is temporarily stored in above ground facilities that are nearing capacity. The industry is actively exploring more costly and potentially less safe storage options. Advanced reactor designs, such as Small Modular Reactors (SMRs) and Generation IV reactors, offer improved safety, efficiency, and waste reduction capabilities, with SMRs potentially reducing waste production by up to 30% compared to traditional reactors. Despite these advancements, a long term waste repository will still be needed. The Waste Management (WM) Symposia 2025 conference will focus on how the rapidly evolving digital world is transforming radioactive waste management, the nuclear industry, and clean up sectors, aiming for more efficient operations, improved human machine interactions, and enhanced data management.

Public perception also remains a critical factor. Historical nuclear accidents, such as Chernobyl in 1986 and Fukushima in 2011, have left a lasting negative impact on public opinion, despite the industry’s strong safety record in many regions. Media coverage, often sensationalized, and the rapid spread of misinformation on social media can significantly influence public sentiment. To address this, the industry is prioritizing transparency and communication. This involves providing accurate and unbiased information through educational programs in schools and universities, public outreach activities, and online resources. Building trust requires regular public updates and reports on nuclear operations and safety, open decision making processes, and engagement with local communities and stakeholders. Polls over the last decade have generally shown increasing levels of support for nuclear energy, with three quarters of U.S. respondents favoring its use in 2024, up from about half in the 1980s and 1990s.

Regulatory hurdles and lengthy licensing processes have historically been significant barriers to nuclear project development. The technical complexity of nuclear power plants often leads to delays and cost overruns during construction. The industry is addressing these challenges through various strategies. Governments are implementing policies to streamline regulatory processes and provide financial incentives, such as the US executive orders aimed at accelerating nuclear deployment and speeding up regulatory approvals. Innovative financing models like Regulated Asset Base (RAB) and Contracts for Difference (CfD) are being adopted to de risk investments by ensuring stable revenue streams and distributing financial risks between governments and private investors. The ADVANCE Act in the U.S. is also mentioned as a policy driven accelerant for digital innovation in the industry.

Geopolitical factors also play a role in the nuclear energy landscape. The nuclear fuel cycle, particularly uranium mining and enrichment, can be influenced by international relations and supply chain vulnerabilities. However, the current global narrative has shifted from energy security to national security and energy dominance, leading countries to diversify their nuclear fuel supplies. For instance, developments include restarting uranium conversion at the Springfields site in the UK, new mines in Uzbekistan, and EU funding for French enrichment plant expansion. This strategic prioritization by governments can provide a layer of stability and financial backing that insulates projects from pure market economics.

Future Outlook: Beyond the Horizon

The nuclear energy sector is not static; it is a dynamic field characterized by continuous innovation and the emergence of groundbreaking technologies that promise to reshape the future of power generation. Beyond the widely discussed Small Modular Reactors (SMRs), a new generation of advanced reactor designs is gaining traction, offering enhanced safety, efficiency, and versatility.

Emerging Nuclear Technologies

Advanced nuclear reactors extend beyond traditional designs, offering the promise of safer, cheaper, and more efficient generation of emissions free electricity, along with heat for industrial processes. These technologies are categorized into advanced water cooled reactors, non water cooled reactors, and fusion reactors.

Molten Salt Reactors (MSRs) are a prominent example of non water cooled reactors, using molten salts as a coolant or dissolving the fuel directly in the molten salt coolant. MSRs boast inherent safety features, such as a negative temperature coefficient that reduces the reaction rate as temperature increases, and operate at low pressure, minimizing the risk of coolant leaks. They can operate at higher temperatures than traditional reactors, leading to increased efficiency and the potential for producing hydrogen and other chemicals. Research is exploring new fuel cycles, such as the thorium uranium cycle, to improve fuel utilization and reduce waste production. Companies like TerraPower, Kairos Power, and Copenhagen Atomics are actively developing and manufacturing MSRs. The commercialization of MSRs is anticipated to occur in the early 2030s, though this timeline is subject to regulatory approvals and economic viability.

Fusion Reactors represent the most ambitious frontier in nuclear energy, theoretically generating energy by fusing two smaller atoms to create a larger one, releasing a massive amount of energy akin to the process that powers the sun and stars. This technology is still much further from commercial deployment compared to fission based reactors. However, significant private investment is flowing into fusion companies, with over $10 billion in cumulative equity investments, 80% of which are in U.S. based firms. The U.S. Department of Energy (DOE) has launched a “Bold Decadal Vision” to accelerate the viability of commercial fusion energy, aiming to demonstrate an operating fusion pilot plant, led by the private sector, in the 2030s. The international ITER project, under construction in France, is the largest fusion reactor project, with first plasma planned for 2033 2034 and deuterium tritium plasma operation targeted for 2039. While challenges remain in achieving sustained burning plasma and engineering for extreme conditions, the long term potential for nearly unlimited, inexpensive, and virtually waste free power is immense.

Frequently Asked Questions

Q: What is driving the renewed interest in nuclear energy?

A:The renewed interest in nuclear energy is primarily driven by two critical factors: the global imperative to achieve decarbonization goals to combat climate change and the increasing focus on energy security and independence. Nuclear power offers a reliable, carbon free baseload electricity source that can complement intermittent renewables and reduce reliance on volatile fossil fuels.

Q: How are AI data centers impacting the demand for nuclear energy?

A:AI data centers have an unprecedented and rapidly escalating demand for continuous, high density power. Nuclear energy, with its exceptionally high capacity factor and 24/7 carbon free output, is emerging as the preferred solution to meet these energy intensive needs. This creates a new, significant market for nuclear power and is accelerating the development and deployment of advanced reactors like SMRs.

Q: What are Small Modular Reactors (SMRs) and why are they important?

A: SMRs are advanced nuclear reactors that are smaller, more modular, and can be factory built and transported to site, reducing construction costs and timelines. They are important because they offer enhanced safety features, greater deployment flexibility, and can provide reliable, carbon free power for diverse applications, including remote communities and industrial facilities like data centers.

Q: What are the main risks associated with investing in nuclear energy stocks?

A:Investing in nuclear energy stocks involves several considerations, including the long term challenge of nuclear waste management, potential regulatory hurdles and lengthy licensing processes, and public perception concerns stemming from historical accidents. Additionally, the capital intensive nature of large scale nuclear projects can pose financial risks.

Q: How is the nuclear industry addressing these risks?

A:The industry is addressing these risks through various strategies. For waste, advanced reactor designs aim to reduce waste volume and toxicity, and digital technologies are improving management practices. To counter public perception, there is a focus on increased transparency, public education, and community engagement. Regulatory challenges are being addressed through government policies aimed at streamlining approval processes and providing financial incentives.

A Strategic Imperative for Tomorrow’s Energy Landscape

The nuclear energy sector is experiencing a major turning point, driven by a unique combination of global challenges and technological demands. Decarbonization and energy security continue to shape national energy policies, but a third powerful force is now accelerating the shift: the exponential growth in electricity demand from artificial intelligence.

AI data centers require uninterrupted, high-density power to operate efficiently. Traditional renewables cannot consistently meet these needs due to their intermittent nature. Nuclear energy, with its carbon-free baseload output and exceptional reliability, is emerging as the most viable solution to support the infrastructure behind AI, machine learning, and digital services.

Governments are stepping in to accelerate nuclear development. From streamlining regulations to funding advanced reactor designs and securing domestic fuel supply chains, public policy is aligning in favor of long-term nuclear expansion. Major infrastructure investments, power purchase agreements with tech giants, and national security strategies are creating a strong foundation for growth across the nuclear value chain.

Challenges remain, but innovation is rapidly addressing them. Concerns over waste, safety, and project timelines are being met with next-generation technologies, improved transparency, and new financing models. As AI drives a new industrial revolution and global climate goals intensify, nuclear power is becoming essential for both energy resilience and technological advancement.

compelling opportunity to participate in a fundamental reshaping of the global energy landscape, aligning portfolios with a future powered by reliable, clean, and secure atomic energy.