The timber and lumber industry enters 2026 in a period of cautious stabilization. After several years of weak margins, slower housing activity and supply-chain challenges, conditions are beginning to settle. Cost pressure, changing construction trends and uneven regional demand are still present, but early signs point toward gradual improvement as residential building steadies and demand for sustainable materials grows.

The long-term outlook remains solid. Housing supply in North America is still well below what the market needs, which supports steady lumber demand once interest rates ease. Engineered wood continues to gain traction in commercial and mid-rise construction, and timberland owners benefit from dependable harvest economics and long-lasting land value. At the same time, mill closures and production adjustments have removed excess capacity, creating a more balanced and disciplined supply setup.

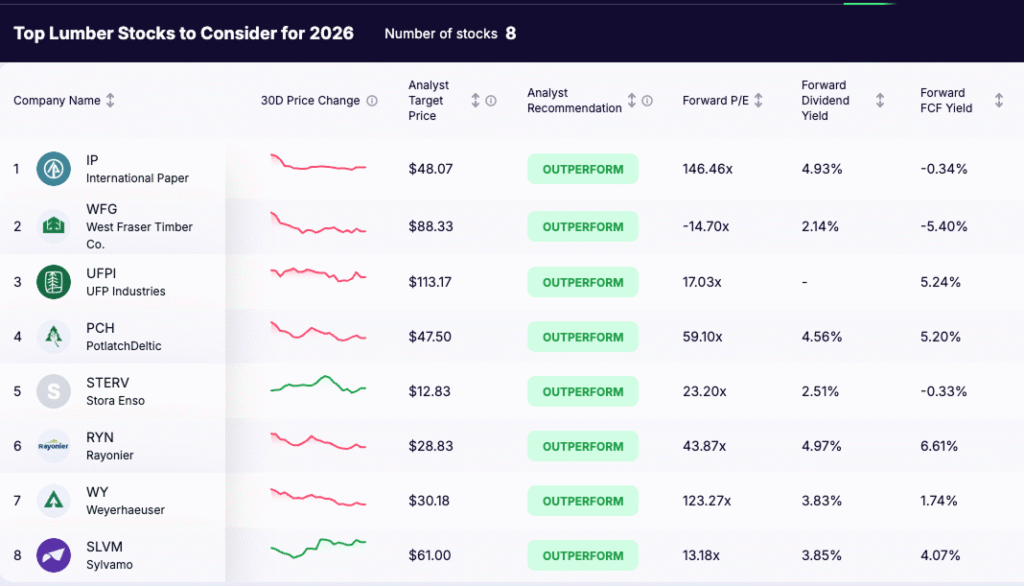

The eight timber & lumber stocks highlighted below stand out for their scale, strong assets and disciplined operations. These qualities position them to manage ongoing volatility while capturing the opportunities that will shape the next phase of growth in the lumber and timber sector.

Highlights

- Timber & lumber markets remain pressured, but early signs of demand stabilization are forming heading into 2026.

- Timberland-backed companies continue to provide defensive cash flow and long-term asset stability.

- The eight lumber stocks below offer a mix of cyclical upside, integrated operations and diversified wood-products exposure.

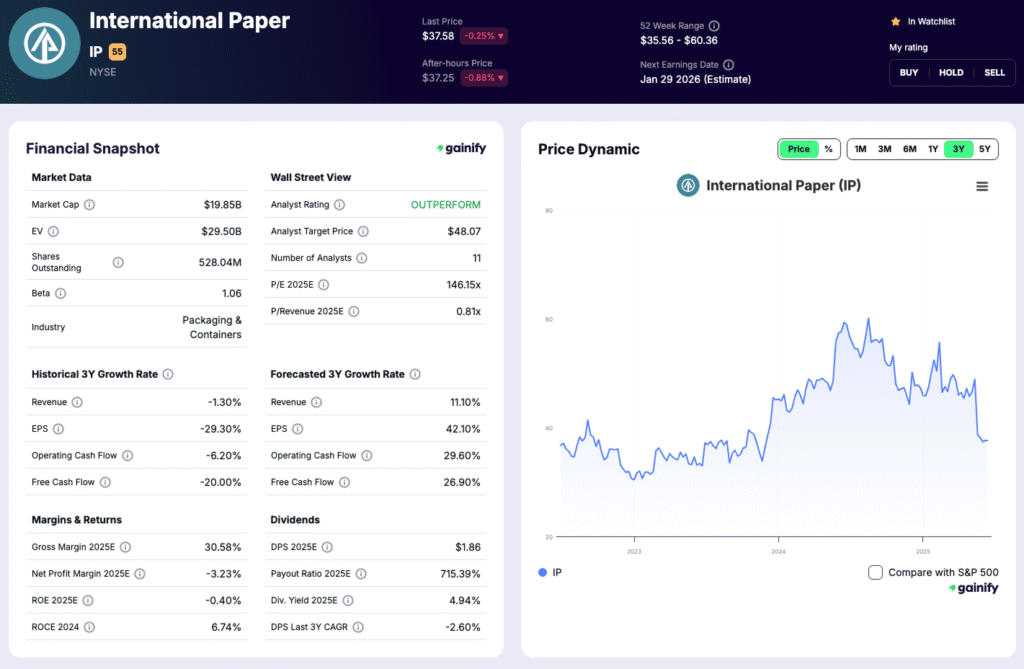

1. International Paper (IP)

Analyst target price: $48.07

Forward P/E: 146.46x

Forward dividend yield: 4.93%

Overview

International Paper is one of the largest global producers of pulp, containerboard and fiber-based packaging. While not a pure lumber name, its broad fiber network and mill footprint provide exposure to a wide segment of the wood-products value chain. The company continues to streamline operations, simplify its portfolio and advance a multi-year transformation aimed at improving margins and strengthening long-term competitiveness.

Recent Developments

- North America Packaging delivered sequential EBITDA improvement, driven by better pricing, stronger mix and steady volumes.

- Market conditions for containerboard and pulp remained soft, pressuring margins.

- Energy and input costs increased, while mill outages also weighed on results.

- The company advanced the divestiture of its Global Cellulose Fibers business, simplifying operations.

- Cost-reduction and commercial initiatives showed early progress across several facilities.

Investment Thesis

International Paper offers diversified fiber exposure during a transitional period for global packaging markets. Its transformation program is showing clear traction, with stronger margins in key businesses, improved commercial execution and a more efficient operating structure. As industry conditions stabilize, the company is positioned for better cash generation and earnings recovery. Its dividend adds stability and supports total-return potential.

Key Risks

Exposure to containerboard and pulp pricing, volatile input costs, execution risk tied to mill rationalization and a slow industrial recovery. Oversupply in containerboard may extend the timeline for sustained margin expansion.

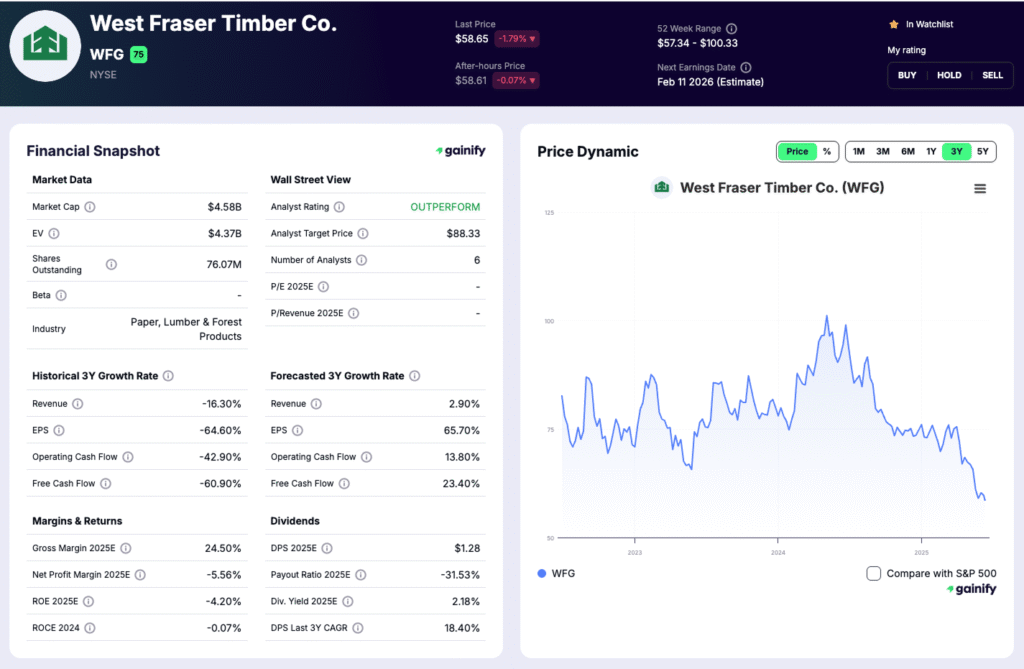

2. West Fraser Timber (WFG)

Analyst target price: $88.33

Forward P/E: -14.70x

Forward dividend yield: 2.14%

West Fraser Timber is one of the largest and most diversified lumber producers globally. Its footprint includes sawmills, OSB facilities and engineered-wood operations across Canada, the United States and Europe. The company continues to optimize its portfolio, streamline assets and shift production toward regions with lower operating costs and more stable fiber availability. These adjustments support long-term competitiveness and operational resilience.

Recent Developments

- Lumber and OSB markets remain soft, pressuring near-term pricing.

- Efficiency improvements and cost discipline helped offset weaker market conditions.

- Mill configurations were adjusted to direct production toward higher-margin assets.

- Capital spending remained focused on modernization and productivity gains.

- Management highlighted continued progress on footprint reshaping to improve long-run returns.

Investment Thesis

WFG offers high leverage to a recovery in housing, lumber pricing and repair-and-remodel demand. Its broad geographic mix, efficient mills and strong balance sheet support significant upside once markets normalize. The company’s disciplined approach to capital allocation and asset optimization adds further value through the cycle.

Key Risks

Exposure to lumber-price volatility, fiber-supply uncertainty and shifts in trade policy affecting cross-border wood flows.

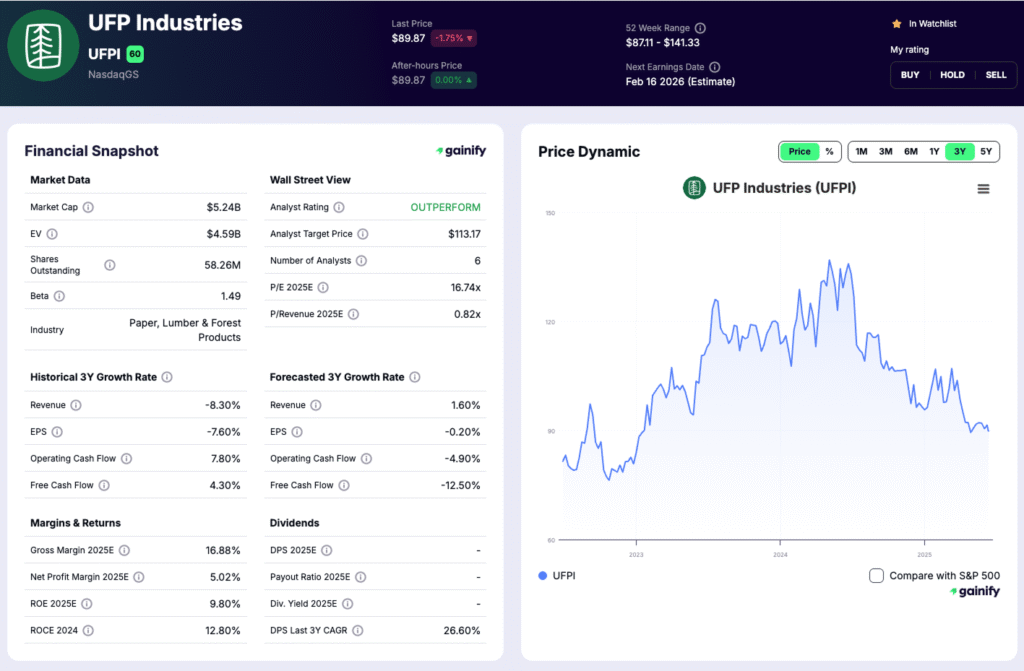

3. UFP Industries (UFPI)

Analyst target price: $113.17

Forward P/E: 17.03x

Forward FCF yield: 5.24%

Overview

UFP Industries is a diversified wood-products manufacturer serving retail, industrial and construction markets. Its flexible operating model and broad product range allow it to respond quickly to changes in demand, while its long history of disciplined capital deployment supports consistent profitability. The company benefits from a less volatile earnings profile than pure lumber producers due to its value-added product mix and strong customer relationships across multiple end markets.

Recent Developments

- Performance remained steadier than peers due to diversified demand exposure.

- Retail and industrial segments showed resilience despite softer lumber pricing.

- Free-cash-flow generation continued to strengthen.

- Cost management and operational efficiency supported margins.

- Management highlighted continued investment in automation and capacity upgrades.

Investment Thesis

UFPI offers a stable and dependable approach to wood-products manufacturing. Its diversified business mix reduces exposure to lumber price swings, while an asset-light model supports strong return on capital. The company is well positioned to benefit as consumer spending, industrial shipments and construction demand gradually improve.

Key Risks

Weakness in consumer discretionary spending, industrial activity slowdowns and fluctuations in raw-material costs.

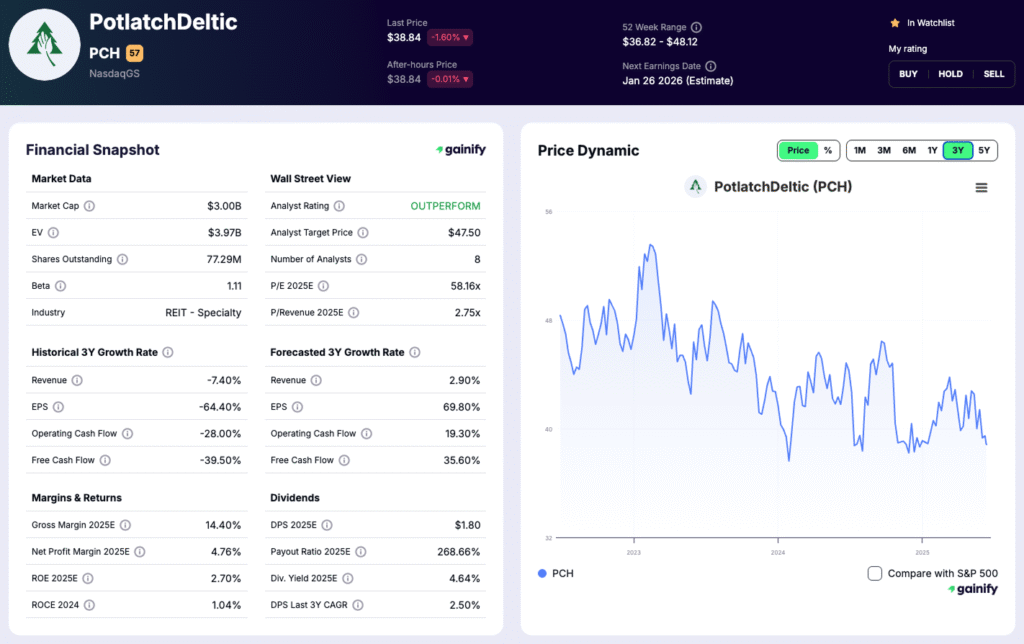

4. PotlatchDeltic (PCH)

Analyst target price: $47.50

Forward P/E: 59.10x

Forward dividend yield: 4.56%

Overview

PotlatchDeltic is a timber-focused REIT with a vertically integrated structure spanning timberlands, sawmills and rural real estate. More than 80 percent of its asset base is tied to timberlands, giving the company steady harvest economics and long-duration land value. Its operations in the U.S. South and Northwest provide geographic diversification and a mix of higher-yielding and higher-growth timber markets.

Recent Developments

- Timberlands remained the most stable segment, supported by disciplined harvest planning and steady stumpage demand.

- Q3 EBITDDA was $89 million, reflecting solid timber performance despite soft lumber pricing.

- Real estate contributed meaningfully to quarterly results, helped by strong rural land sales activity.

Investment Thesis

PCH offers dependable exposure to long-term timberland value with a balanced operating model that cushions commodity swings. Timberlands provide recurring cash flow, while the real estate segment adds high-margin upside in favorable markets. The company maintains strong liquidity and a competitive dividend, creating an attractive risk-adjusted return profile. As lumber pricing gradually improves and rural land demand remains healthy, earnings visibility should strengthen.

Key Risks

Weather-related harvest disruptions, continued softness in lumber markets and variability in real-estate transaction timing.

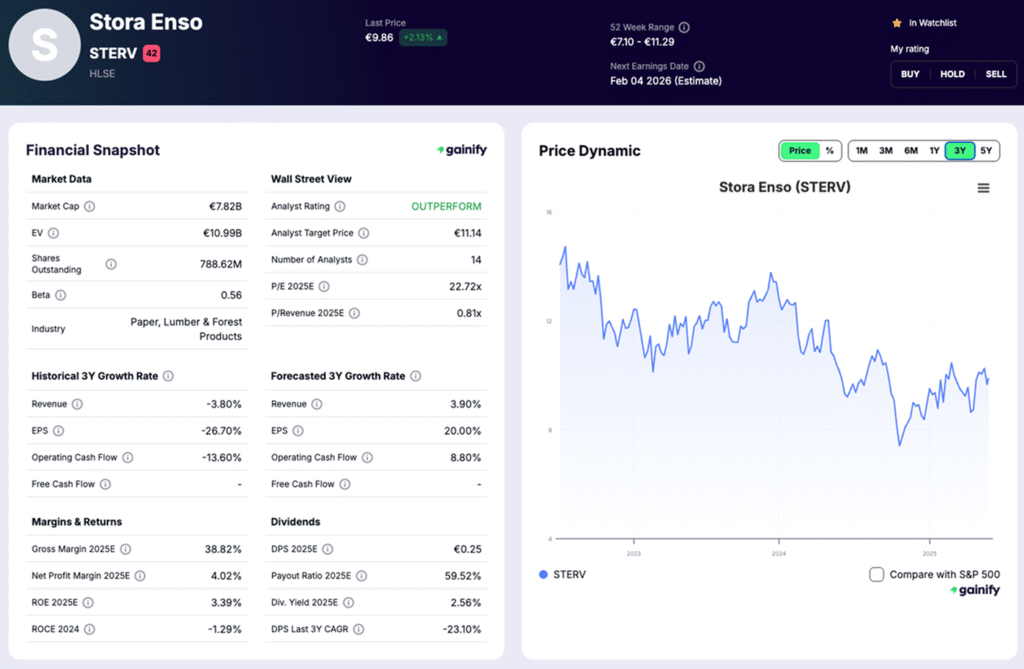

5. Stora Enso (STERV)

Analyst target price: $12.83

Forward P/E: 23.20x

Forward dividend yield: 2.51%

Overview

Stora Enso is one of Europe’s leading wood-products and biomaterials companies, supplying engineered wood, pulp, packaging and renewable materials into both construction and industrial markets. Its portfolio positions the company at the centre of Europe’s shift toward low-carbon building and sustainable packaging. Stora Enso continues to streamline operations, focus on higher-margin segments and scale its engineered-wood capabilities in markets where demand is structurally expanding.

Recent Developments

- Q3 net sales reached EUR 2.1 billion, reflecting mixed conditions across packaging and wood products.

- EBIT improved sequentially, supported by restructuring benefits and cost savings.

- Wood products remained pressured by softer European construction, although demand for engineered solutions held up better.

Investment Thesis

Stora Enso provides direct exposure to Europe’s transition toward renewable materials and the adoption of engineered wood in mid-rise and commercial construction. Its cost-reduction program, portfolio reshaping and focus on value-added products position the company for improved margins once regional demand firms. The company’s scale, innovation pipeline and strategic emphasis on sustainable materials support a long-term growth opportunity tied to decarbonization trends.

Key Risks

Soft European construction markets, energy-cost volatility and regional economic sensitivity affecting packaging and wood-product demand.

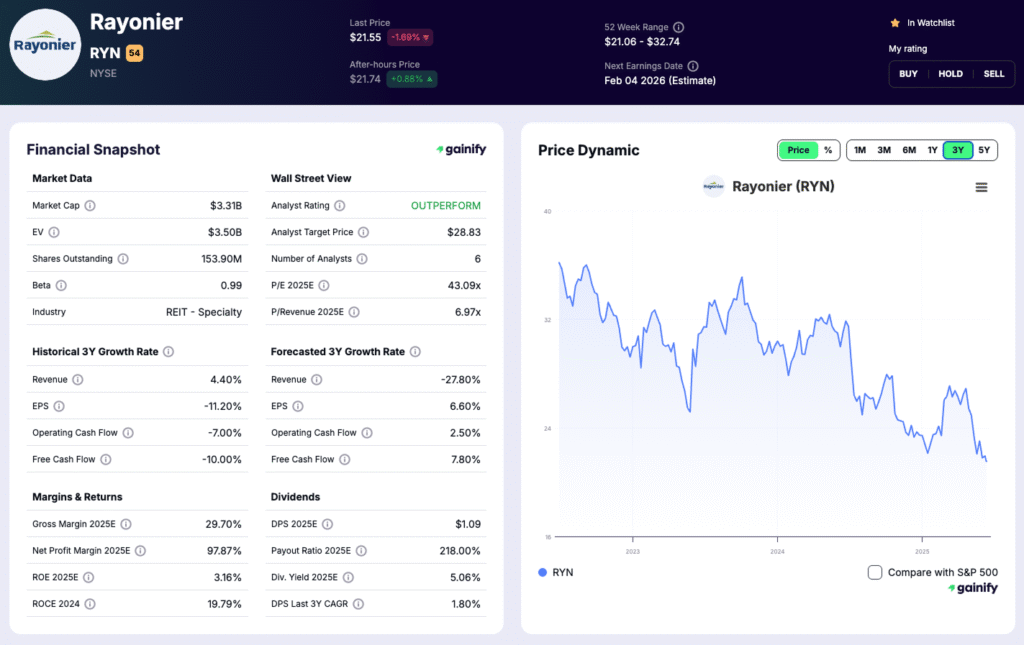

6. Rayonier (RYN)

Analyst target price: $28.83

Forward P/E: 43.87x

Forward dividend yield: 4.97%

Overview

Rayonier is a pure-play timber REIT with a high-quality land base spanning the U.S. South, Pacific Northwest and New Zealand. Its portfolio is heavily weighted toward Southern timberlands, which provide stable stumpage economics and some of the most competitive harvest costs in North America. The company’s strategy centers on long-duration timber value, recurring harvest income and selective higher-margin land sales.

Recent Developments

- Timber volumes in the U.S. South remained steady, supported by resilient pulpwood and sawtimber demand.

- Management highlighted stable quarterly adjusted EBITDA, with timber segments generating the majority of earnings.

- Real estate activity contributed incremental income through targeted rural land sales, improving cash flow for the period.

Investment Thesis

Rayonier offers a defensive way to invest in timberland assets with low volatility and consistent dividend support. Its U.S. South footprint delivers attractive harvest economics and reliable year-round operations, while New Zealand timberlands add export exposure to Asian demand. The company’s steady harvest profile, selective land monetization and conservative balance sheet create a durable, income-oriented return stream. As lumber markets recover and export volumes strengthen, RYN should benefit from gradually improving stumpage pricing and enhanced cash generation.

Key Risks

Weather-driven harvest variability, slower export demand from Asia and regional pricing pressure in the Pacific Northwest.

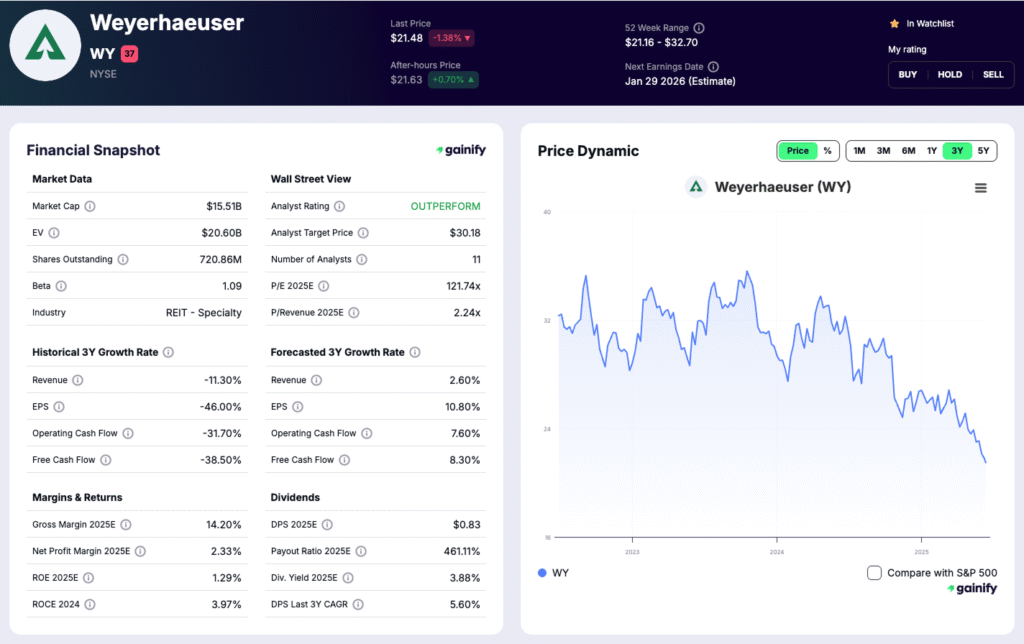

7. Weyerhaeuser (WY)

Analyst target price: $30.18

Forward P/E: 123.27x

Forward dividend yield: 3.83%

Overview

Weyerhaeuser is the largest timber REIT in North America, with a portfolio spanning high-quality Southern, Western and Northern timberlands. Its scale, integrated structure and disciplined capital allocation give the company one of the most balanced cash-flow profiles in the sector. WY benefits from recurring harvest income, exposure to lumber pricing, and a real-estate platform that monetizes higher-and-better-use land, creating a durable blend of steady and cyclical earnings.

Recent Developments

- Portfolio optimization advanced meaningfully, including $364 million of Southern and Western timberland acquisitions closed in Q3

- Real Estate, Energy & Natural Resources full-year adjusted EBITDA is now expected to reach ~$390 million, an increase from prior guidance

- Wood Products saw softer pricing, with average sales realizations for lumber trending $10–$20/MBF lower than Q3 levels

Investment Thesis

Weyerhaeuser offers one of the most resilient timberland cash-flow models in public markets. Timberlands provide stable year-round harvest economics, while the real-estate business adds high-margin optionality tied to land value. WY’s scale allows for efficient capital recycling, and its dividend framework targets returning 75–80 percent of annual funds available for distribution. As lumber markets normalize and Southern stumpage demand remains firm, earnings visibility should improve across both timber and wood-products segments. The company’s active portfolio management further enhances long-term land quality and cash-flow durability.

Key Risks

Lumber-price volatility, export-market sensitivity (Japan and China) and weather-driven harvest variability across Southern and Western regions.

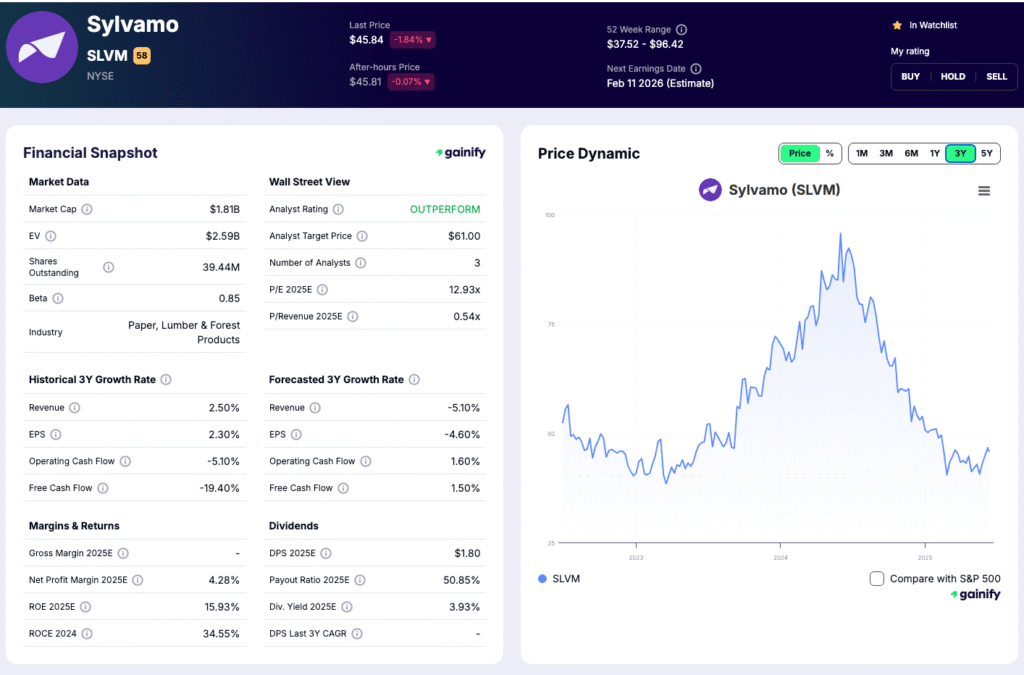

8. Sylvamo (SLVM)

Analyst target price: $61.00

Forward P/E: 13.18x

Forward dividend yield: 3.85%

Overview

Sylvamo is a global producer of uncoated freesheet paper with mills in North America, Latin America and Europe. The company positions itself as a low-cost operator focused on efficient mill performance, disciplined capital allocation and strong cash generation. Sylvamo’s geographic mix provides a natural hedge across regional demand patterns, while its Brazilian forestlands supply high-quality fiber and long-term strategic advantage. The company continues to emphasize simplicity, cost leadership and consistent operational execution.

Recent Developments

- Q3 adjusted EBITDA reached $193 million with a 20 percent margin, reflecting stronger pricing and improved mix.

- Free cash flow strengthened, supported by solid operating performance and disciplined working-capital management.

- Brazilian forestlands were recently appraised at approximately BRL 5 billion, underscoring the value of Sylvamo’s integrated fiber base.

Investment Thesis

Sylvamo offers stable exposure to global paper demand with a business model built around cost efficiency and reliable cash flow. Its mills are located in advantageous regions, and management continues to optimize product mix and margins. The combination of strong free-cash-flow generation, valuable forest assets in Brazil and disciplined capital allocation supports the company’s long-term value-compounding potential. As demand remains resilient and mill performance improves, Sylvamo stands out as a steady, cash-focused operator within the broader wood-products ecosystem.

Key Risks

Exposure to pulp and energy cost volatility, shifts in global paper consumption and regional supply-demand imbalances.

2026 Outlook for Timber and Lumber

The 2026 outlook for lumber and timber reflects a sector moving from contraction toward gradual stabilization. Several structural forces shape the year ahead:

- Construction Recovery

Demand linked to residential building is expected to improve as financing conditions gradually normalize. This supports a steadier baseline for lumber consumption and creates room for selective price recovery. - Shift Toward Low-Carbon Materials

Timber is gaining strategic importance in sustainable construction. Mass-timber technologies, engineered-wood systems and renewable materials provide structural momentum as regulators and developers seek lower-emission building solutions. - Higher Supply-Chain Discipline

Mill closures, production adjustments and tighter forest-management rules reduced excess supply. The sector now operates with more control over output, which improves pricing dynamics once demand strengthens. - Exposure to Climate-Driven Variability

Wildfires, storms and pest-related disruptions create cost volatility and potential supply imbalance. Companies with diversified timber bases and strong insurance frameworks are better protected. - Regulatory Sensitivity

Emerging forestry regulations, harvest-limit requirements and sustainability reporting standards can influence operating costs and export patterns. Vertically integrated companies tend to manage these shifts more effectively.

Overall, lumber and timber companies that combine disciplined capacity management with strong land portfolios and efficient manufacturing will be positioned for the most durable performance in 2026.

Final Take: The Strongest Names in Lumber Heading into 2026

International Paper, West Fraser Timber, UFP Industries, PotlatchDeltic, Stora Enso, Rayonier, Weyerhaeuser and Sylvamo represent the strongest mix of timberland value, operational depth and through-cycle resilience. Together they provide investors with exposure that balances income stability, asset-backed security and cyclical upside potential.

Each company offers a distinct investment profile:

- International Paper provides broad exposure to fiber and packaging with an income-oriented profile.

- West Fraser Timber offers high operating leverage to a lumber-price and housing recovery.

- UFP Industries combines diversification with consistent profitability and cash discipline.

- PotlatchDeltic and Rayonier deliver long-duration timberland value and predictable dividends.

- Stora Enso gives access to Europe’s renewable-material transition and engineered-wood innovation.

- Weyerhaeuser brings unmatched scale and diversified timber-real-estate capabilities.

- Sylvamo offers stable fiber-linked earnings and discounted cash-flow potential.

For investors seeking a mixture of stability and cyclical opportunity, these names form the core of the lumber and timber sector heading into 2026.