Dividend-paying stocks play a central role in many portfolios. They deliver steady income, add stability, and can be a powerful tool for building long-term wealth.

For retirees, dividends often provide reliable cash flow. For younger investors, reinvesting them can accelerate compounding and boost total returns.

But how can you tell if a dividend is truly attractive and sustainable? The answer lies in one key metric: dividend yield. It helps investors measure income return and compare opportunities across companies and sectors.

What Is Dividend Yield?

Dividend yield measures how much a company pays out in dividends each year relative to its share price.

👉 In simple words: Dividend yield shows how much cash you earn back in dividends for every dollar you invest in a stock.

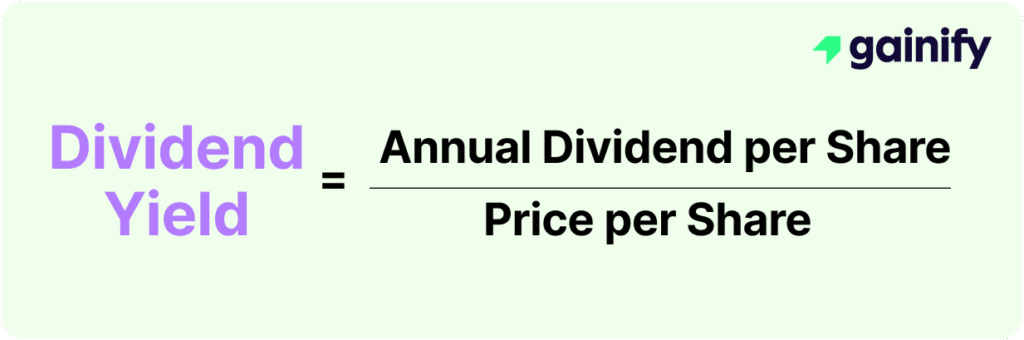

Formula:

Dividend Yield = Annual Dividend per Share ÷ Price per Share

📌 Example: If a stock trades at $100 and pays an annual dividend of $4 per share, its dividend yield is 4%.

Why Dividend Yield Matters

Dividend yield is one of the most important indicators for income-focused investors. It provides insights into both a company’s payout strategy and its financial health. Key reasons it matters include:

- Income return: Shows the cash flow you receive simply by holding the stock.

- Comparison tool: Allows quick comparison of income potential across sectors, industries, and companies.

- Valuation signal: Extremely high yields may indicate risk or distress. Consistent moderate yields often suggest stability.

- Capital efficiency: Highlights how effectively a company balances rewarding shareholders with reinvesting for growth.

- Portfolio strategy: Helps investors match stock selection with goals, such as steady income for retirees or reinvestment potential for long-term growth.

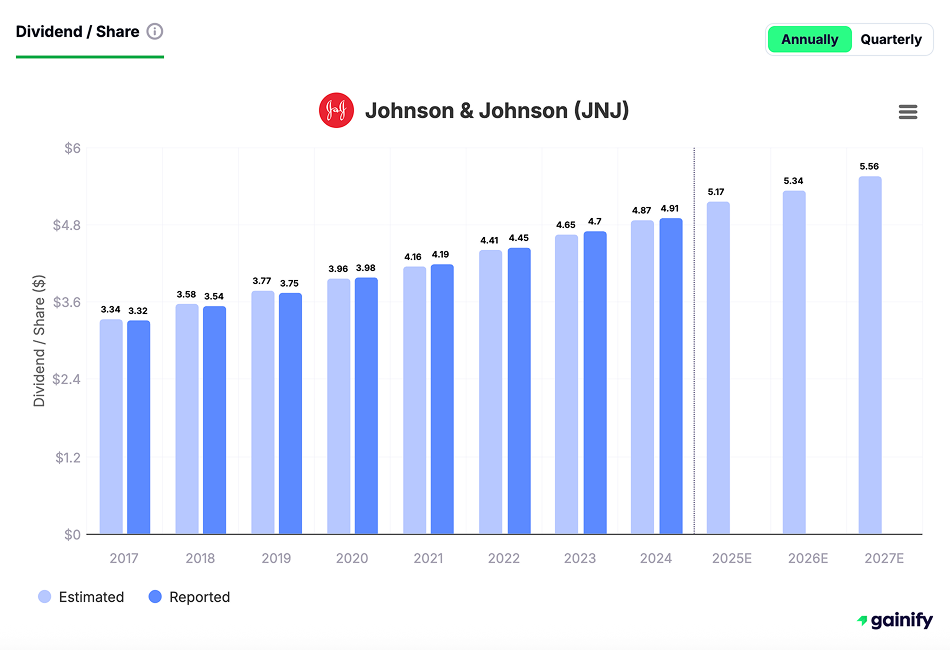

A Real-World Example: Johnson & Johnson (JNJ)

Let’s look at Johnson & Johnson ($JNJ), a healthcare giant known for its long dividend history.

- Current share price (Jan 2026): ~$204

- Annual dividend per share: ~$5.17

- Dividend yield: 2.53%

This means if you invested $204 in one share of JNJ, you would expect about $5.17 per year in dividends, or a 2.53% return from income alone.

JNJ is also a Dividend Aristocrat, having increased its dividend for more than 60 consecutive years. That consistency makes its yield not only attractive but also highly reliable compared to many other companies.

What Is a “Good” Dividend Yield?

There is no single definition of “good.” Dividend yield must always be viewed in context:

- By industry: Utilities, telecoms, and REITs typically offer higher yields. Technology and biotech often pay little or none.

- By stability: A reliable 3% yield from a strong company such as JNJ may be safer than a 9% yield from a struggling firm.

By investor goals: Income-focused investors may prefer higher yields. Growth-oriented investors might accept lower or no yield if profits are reinvested into expansion.

As a rough guide in the U.S. market, yields between 2% and 5% are often considered both sustainable and attractive.

Things to Consider Beyond Yield

Dividend yield is only one part of the picture. A high yield may look attractive, but without context it can be misleading. Investors should also consider:

- Payout ratio: Shows the share of earnings paid out as dividends. A moderate ratio often signals balance between rewarding shareholders and reinvesting for growth. Excessively high payouts can strain resources and increase the risk of cuts.

- Dividend growth: A track record of steady increases points to management confidence and long-term stability. Irregular payments or past cuts may reveal underlying business challenges.

- Cash flow coverage: Dividends are ultimately paid from cash, not accounting profits. Strong operating cash flow relative to dividend obligations is a key indicator of sustainability. Weak coverage raises the risk of reductions.

- Balance sheet strength: Companies with healthy cash reserves, low debt, and robust liquidity are more likely to maintain dividends through downturns.

- Market conditions: Yields rise when stock prices fall. This can create opportunity if fundamentals are sound, but it can also signal financial stress or loss of investor confidence.

- Business model and industry: Defensive sectors such as utilities or consumer staples tend to sustain dividends more easily. Cyclical sectors often struggle during downturns.

Key Takeaways

- Dividend yield = annual dividend ÷ share price.

- It tells you the income return you earn from a stock.

- A higher yield is not always better. Stability and sustainability are crucial.

- Real-world example: JNJ currently offers ~2.74% yield and decades of consistent growth.

- Reinvesting dividends can amplify returns through compounding.

📌 Bottom line: Dividend yield is a simple but powerful tool. It connects income, valuation, and investor goals, helping you spot opportunities and avoid traps. Used with other fundamentals, it can guide you toward building a portfolio that balances income and long-term wealth creation.