A price target is an equity analyst’s estimate of where a stock could trade over a defined period, most commonly the next 12 months. It reflects the analyst’s view of a company’s future performance translated into a single price.

At a basic level, a price target answers a simple question: what does the stock look like if the business performs as expected? Analysts start by estimating how fast a company can grow, how profitable it can be, and how much it needs to reinvest to sustain that growth. Those expectations are then expressed through a valuation method to arrive at a price that reflects that outlook.

For investors, price targets are useful as a reference point. They show what assumptions sit behind a forecast and how optimistic or conservative an analyst may be relative to the current market price. This article explains what price targets mean, how they are used, and how to interpret them responsibly as part of a broader investment process.

Price Targets Explained in 30 Seconds

- What it is: A price target is an analyst’s estimate of where a stock could trade over the next 12 months.

- Who sets it: Equity research analysts at banks, asset managers, and research firms.

- How it’s built: Based on assumptions about growth, profitability, and valuation, summarized into a single price.

- What it tells you: The analyst’s view of upside or downside relative to today’s price.

- How to use it: As context for expectations, not as a prediction or a trading signal.

What Is a Price Target?

A price target is an equity analyst’s estimate of where a stock could trade over a specific time horizon, most often the next 12 months. It represents the analyst’s view of a company’s future value based on expected financial performance and valuation assumptions.

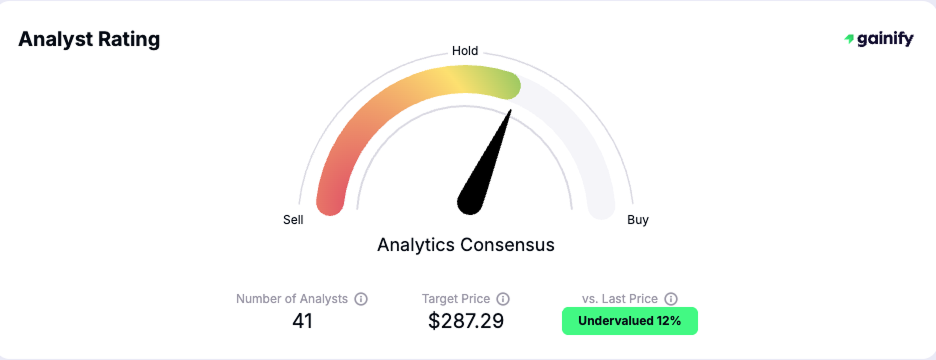

Price targets are typically issued alongside a buy, hold, or sell rating and are updated as new information becomes available, such as earnings results, changes in guidance, or shifts in market conditions. When multiple analysts cover the same stock, their individual targets are often averaged into a consensus price target, which reflects overall market sentiment.

Price targets are not forecasts of exact future prices. Instead, they provide a reference point that helps investors understand how optimistic or conservative an analyst’s assumptions are relative to the current market price.

How Is a Price Target Calculated?

Analysts rely on a range of tools and data to determine a price target, including financial statements, revenue projections, industry outlook, asset allocation trends, and macroeconomic indicators.

Step 1: Forecast the Business

Analysts begin by forming expectations about how the business will perform over the next year. This usually includes:

- Revenue growth, based on demand, pricing, and market share

- Profitability, reflected in gross and operating margins

- Operating costs, such as research, marketing, and administrative expenses

- Investment needs, including capital expenditures and working capital

These assumptions determine future earnings or free cash flow, which form the foundation of the valuation.

Step 2: Apply a Valuation Framework

Once financial performance is projected, analysts translate those expectations into a price using one or more valuation approaches:

- Discounted Cash Flow (DCF): Uses projected cash flows and a discount rate to estimate present value

- Comparable Company Analysis: Compares valuation multiples of similar public companies

- Dividend Discount Model (DDM): Values dividend-paying stocks using expected dividend streams

- Sum-of-the-Parts (SOTP): Breaks down a diversified company into components and values each separately

Step 3: Set the Target Price

The final price target reflects the analyst’s base-case scenario, assuming the company performs in line with expectations and the market assigns a reasonable valuation. Analysts may also consider downside and upside cases internally, even if only one target is published.

Example: How to Interpret a Price Target

As of Jan 2026, Apple Inc. (NASDAQ: AAPL) trades at $255.41, while the consensus 12-month price target stands at $287.29. This suggests a potential upside of approximately 12%.

When many analysts arrive at similar price targets, it can signal a strong consensus about a company’s fundamentals and growth prospects. However, when targets vary significantly, it often reflects divergent views on future earnings, risk exposure, or market conditions.

Why Price Targets Matter to Investors

Price targets are critical tools for evaluating stock opportunities, especially during market volatility. They help investors of all profiles, including aggressive investors, institutional investors, and pension funds, assess the return potential and level of risk in a particular investment.

- Decision-Making Context: Price targets provide a forward-looking reference that helps investors frame potential upside or downside relative to the current market price. They are commonly used to prioritize research and align expectations with individual investment goals and risk tolerance.

- Valuation Benchmarking: By comparing a price target with the current share price, investors can assess whether a stock is viewed as undervalued, fairly valued, or stretched relative to projected fundamentals and sector norms.

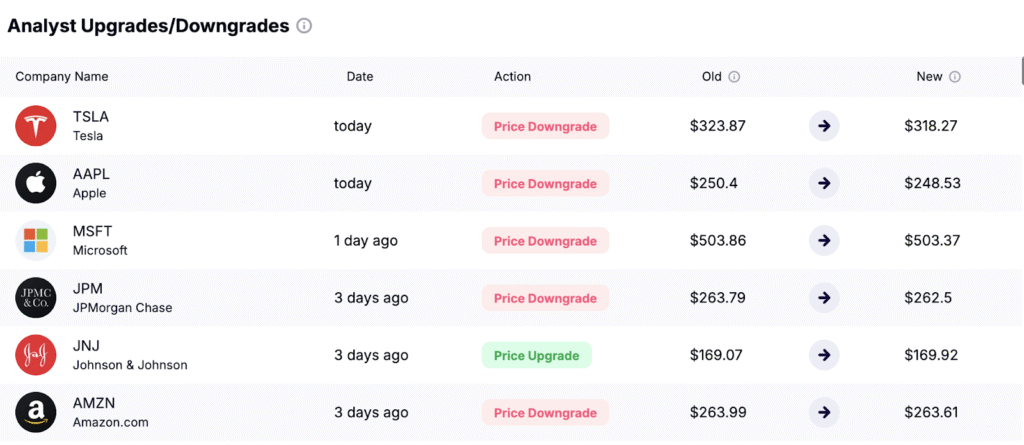

- Signal From Revisions: Changes in price targets often carry more information than the absolute number. Upward or downward revisions typically reflect updated assumptions around earnings, margins, growth, or valuation, offering insight into shifts in analyst conviction.

- Market Sensitivity: Price target updates from widely followed analysts can influence short-term trading activity, particularly for large-cap or index-heavy stocks where institutional participation is high.

- Comparative Analysis: Consensus price targets allow investors to compare expectations across companies within the same industry, helping identify where market optimism or skepticism is most concentrated.

These metrics support accountability to investors and are integrated into the investment process by hedge funds, mutual funds, and other investment companies seeking to deliver consistent investment success. They also play a role in understanding secondary market dynamics and sector positioning.

Limitations of Price Targets

Despite their popularity and influence, price targets have meaningful limitations that investors should consider:Despite their popularity and influence, price targets have meaningful limitations that investors should consider:

- Subjective Inputs: Price targets rely heavily on assumptions made by analysts, including revenue projections, margin expectations, and valuation multiples. These assumptions can vary widely between firms.

- Market Volatility: External shocks such as geopolitical conflicts, policy changes, or surprise economic data can quickly invalidate even the most well-reasoned price target.

- Short-Term Focus: Usually limited to a 12-month projection period, which may misalign with benefit plans or long-term strategies

- Conflicting Views: Multiple analysts can have dramatically different price targets for the same stock, often driven by different methodologies, sector views, or risk appetites.

- Not Always Updated Timely: Stale price targets may not reflect recent shifts in market accounting, company performance, or geopolitical factors

- Psychological Anchoring: Investors can become anchored to a specific target and overlook deteriorating fundamentals if the number remains unchanged.

Always consider the full range of analyst estimates and the rationale behind each projection. Use price targets as one of many inputs (not a standalone indicator) when making investment decisions.

Where to Find Price Targets

Each major brokerage or investment bank typically has its own team of equity analysts who assign individual price targets to the stocks they cover. These estimates are based on internal research models, sector expertise, and economic forecasts. When several analysts cover the same stock, a consensus price target (an average of all available projections) is commonly used to gauge broad sentiment.

In addition to traditional sources, modern equity research platforms make it easier than ever to access and interpret price targets from across the market.

You can find individual and consensus price targets on:

- Brokerage platforms (e.g., Fidelity, Schwab, E*TRADE)

- Financial media (e.g., CNBC, Bloomberg, MarketWatch)

- Research aggregators (e.g., Yahoo Finance, TipRanks, Seeking Alpha)

- Equity research services (e.g., Gainify, Fiscal.ai, Simply Wall St)

- Analyst reports issued by investment banks and institutional research teams

Final Thoughts

A price target is a valuable reference point, but not a guarantee. It reflects an analyst’s informed projection based on their financial modeling, assumptions, and market outlook. While it can help shape expectations, it should always be viewed within the broader context of investment analysis.

Consensus price targets, in particular, can offer useful insight into collective analyst sentiment. When multiple professionals converge around a similar forecast, it often signals confidence in a stock’s direction. Conversely, large disparities between analyst targets may reflect uncertainty or disagreement about a company’s outlook.

Ultimately, price targets should be treated as one tool among many. Combine them with fundamentals, technicals, macro trends, and your own risk profile to make fully informed investment decisions.