For decades, U.S. investors have focused primarily on domestic equities because of the size, liquidity, and innovation-driven growth of the American stock market. Yet beyond Wall Street lies a vast landscape of opportunities in Europe. The region is home to some of the world’s most established multinational companies and fastest-growing industries. From luxury goods in France to pharmaceuticals in Switzerland and engineering giants in Germany, European stocks give investors exposure to global leaders with strong track records and distinct advantages compared to their American counterparts.

Investing in European equities provides powerful diversification. U.S. stocks dominate many portfolios, but concentrating too heavily in one region exposes investors to risks tied to localized downturns, monetary policy changes, or sector bubbles. By adding exposure to Europe, investors can access different economies and industries while benefiting from variations in interest rate cycles, regulatory frameworks, and consumer behavior. For anyone seeking balance, European stocks can help reduce volatility and introduce new growth and income sources.

Valuation is another reason to look abroad. At various points in the last decade, European markets have traded at significant discounts compared to U.S. equities, even when adjusted for differences in growth prospects. For income-oriented investors, Europe is also known for strong dividend traditions. Many European blue chips maintain high payout ratios and stable dividend policies, offering attractive income streams that complement the growth-oriented nature of U.S. tech-heavy markets.

International investing does come with challenges. Currency fluctuations, differing accounting standards, and foreign regulations can complicate decision-making. Tax implications, such as withholding taxes on dividends, must also be considered. The good news is that these hurdles can be managed with the right strategy, particularly through American Depositary Receipts (ADRs), which allow U.S. investors to buy foreign stocks directly on domestic exchanges in U.S. dollars.

This guide covers everything you need to know about investing in European stocks. You will learn why they matter, how ADRs work, which companies are the most popular and accessible, what risks to watch out for, and the steps to build an internationally diversified portfolio. Whether you are new to international investing or a seasoned market participant, this article will give you the foundation to confidently invest in European equities.

Why Invest in European Stocks

European equities give investors unique opportunities. They provide exposure to global leaders in industries that are either underrepresented or structured differently compared to the U.S. For example, the luxury goods sector is dominated by European giants like LVMH, Kering, and Hermès, while industrial automation and engineering are led by Siemens and ABB. These companies have global footprints but remain rooted in European innovation and regulation.

Geographic diversification is a key advantage. By holding European stocks, investors reduce the risk of being overly concentrated in U.S. markets. If the American economy slows or U.S. monetary policy tightens, European companies may benefit from different economic cycles, interest rate paths, or consumer demand trends. This regional diversification often smooths overall portfolio performance.

European companies are often dividend powerhouses. Many firms distribute a significant portion of profits to shareholders. Yields of 3 to 6 percent are common among blue-chip companies in sectors like banking, energy, and consumer staples. For investors seeking income, this can be a compelling reason to look across the Atlantic.

Valuation differences create opportunity. Historically, European equities have traded at lower price-to-earnings ratios than their U.S. counterparts. This discount sometimes reflects slower economic growth, but it also presents value opportunities when high-quality companies are mispriced relative to their long-term earnings potential. Value-oriented investors often look to Europe for bargains.

Currency exposure adds another layer of diversification. By holding assets denominated in euros, British pounds, or Swiss francs, investors diversify away from the U.S. dollar. While currency fluctuations can add volatility in the short term, they also provide long-term protection if the dollar weakens.

Ways to Access European Stocks

There are several methods for investors to gain exposure to European equities, each with its own benefits and trade-offs.

1. Direct Investing in Local Exchanges

Buying shares directly on European stock exchanges such as the London Stock Exchange, Euronext Paris, or Deutsche Börse provides the most authentic exposure to international equities. This route gives investors access to the full breadth of listed companies, from mega-cap multinational corporations to smaller regional firms that may not be available in U.S. markets.

Many U.S. brokerages, including Interactive Brokers and Charles Schwab, provide access to these national exchanges. However, investors must be prepared to exchange U.S. dollars into euros, pounds, or other local currencies in order to execute trades. This introduces an extra layer of complexity, as returns will be affected not only by stock performance but also by currency fluctuations.

There are also practical considerations: transaction costs, foreign exchange fees, and settlement times can be higher or slower compared to domestic stocks. In addition, investors must understand local trading rules and regulatory requirements that may differ from those in the U.S.

2. American Depositary Receipts (ADRs)

As detailed earlier, ADRs provide a convenient bridge between U.S. investors and European companies. They allow you to buy shares of foreign businesses in the same way you would purchase domestic stocks, removing many of the hurdles typically associated with international investing.

ADRs trade in U.S. dollars, settle under American market rules, and are available through standard brokerages such as Fidelity, Schwab, or TD Ameritrade. You do not need to open a foreign trading account, convert cash into euros or pounds, or worry about the mechanics of trading on national exchanges like Frankfurt or Paris. This simplicity makes ADRs the most common method for retail investors who want direct exposure to European blue chips.

The structure is straightforward: a U.S. depository bank issues shares that represent ownership of a foreign company’s stock. These ADRs may represent a single share, multiple shares, or even a fraction of one. Dividends, when paid, are converted from the local currency into U.S. dollars and deposited into your brokerage account. This ensures investors avoid the complexities of foreign exchange conversion themselves.

3. Exchange-Traded Funds (ETFs) and Mutual Funds

ETFs and mutual funds are ideal for investors who prefer broad diversification without the need to pick individual European stocks. These pooled investment vehicles provide exposure to a wide basket of companies across the continent, helping reduce single-company risk. They are cost-effective, easy to trade through most U.S. brokerages, and suitable for both casual investors who want simple solutions and more experienced investors looking to complement a portfolio of stocks.

ETFs, in particular, offer intraday trading flexibility. Like domestic stocks, they can be bought and sold throughout the day at market prices. Mutual funds, by contrast, are priced once daily at net asset value (NAV). The choice between them depends on your investment objectives, trading style, and whether you value intraday liquidity or are comfortable with end-of-day pricing.

Examples of European-focused ETFs:

- Vanguard FTSE Europe ETF (VGK): Tracks large- and mid-cap companies across developed European markets. One of the most popular funds for broad exposure across multiple geographical regions.

- iShares MSCI Eurozone ETF (EZU): Focuses specifically on companies in the Eurozone, excluding the UK and Switzerland. Useful for investors who want euro-only exposure.

- SPDR EURO STOXX 50 ETF (FEZ): Tracks 50 of the largest and most liquid blue-chip companies in the Eurozone. Provides concentrated exposure to leading multinational corporations.

- iShares MSCI United Kingdom ETF (EWU): Gives investors access to UK companies, offering a way to capture growth in markets centered around the London Stock Exchange.

Examples of mutual funds with European exposure:

- Fidelity Europe Fund (FIEUX): Actively managed with a long-term focus on capital appreciation in European equities. A good fit for investors who want professional management and research support.

- T. Rowe Price European Stock Fund (PRESX): Invests across Europe using a balanced mix of growth and value strategies. Designed for investors seeking a diversified, actively managed portfolio of European companies.

Advantages of ETFs and mutual funds:

- Diversification across dozens or even hundreds of companies, reducing exposure to any single firm.

- Lower research burden compared to selecting and monitoring individual stocks via ADRs or local exchanges.

- Liquidity and transparency, especially for large ETFs, with daily holdings disclosure and straightforward pricing.

- Accessible through most U.S. trading platforms, without the need to handle currency conversions directly.

Drawbacks to consider:

- Management fees reduce net returns slightly. Even low-cost passive index funds charge small expense ratios.

- Less control over individual stock selection. You own the entire index or portfolio, including underperforming companies.

- Potential overlap with domestic holdings. Some multinational corporations in Europe already trade in the U.S. via ADRs, meaning exposure can double up unintentionally.

Understanding ADRs in Depth

ADRs remain the most popular gateway for U.S. investors who want to buy European companies. To fully appreciate them, it is important to understand their mechanics, types, advantages, and limitations.

Mechanics of ADRs:

- A U.S. depositary bank (such as JPMorgan, Citi, or BNY Mellon) holds shares of the European company in custody.

- The bank then issues ADRs in the U.S., with each ADR representing a specific number of underlying shares.

- These ADRs are listed on U.S. exchanges like the NYSE or Nasdaq, or they may trade over-the-counter.

- Investors buy and sell ADRs in U.S. dollars, with dividends also paid in dollars after currency conversion.

ADR levels explained in detail:

- Level 1 ADRs are the simplest and cheapest for foreign companies to establish. They trade OTC and require minimal SEC disclosure. However, liquidity may be low and information less transparent.

- Level 2 ADRs are listed on major exchanges. They must comply with SEC reporting requirements, including annual reports and reconciliation of financials to U.S. standards. Investors gain better transparency and liquidity, but the company cannot raise capital in U.S. markets.

- Level 3 ADRs are the highest level. They allow the company to list shares on U.S. exchanges, raise capital through new share offerings, and require full SEC compliance. These ADRs provide the most robust investor protections.

Sponsored vs. Unsponsored ADRs:

- Sponsored ADRs involve active cooperation with the foreign company, often ensuring accurate disclosures and reliable dividend payments.

- Unsponsored ADRs are created by a bank without the company’s involvement. They are typically OTC, may have multiple banks issuing them, and can be less reliable in terms of reporting and consistency.

Advantages of ADRs:

- Simplicity: Trade in U.S. dollars through regular brokerage accounts.

- Accessibility: Available on familiar exchanges like NYSE or Nasdaq.

- Dividends: Paid in U.S. dollars, with the custodian bank handling conversions.

- Transparency: Sponsored ADRs provide financial disclosures that comply with U.S. standards.

Disadvantages of ADRs:

- Fees: Annual ADR fees, usually deducted from dividends, reduce returns.

- Liquidity: Some ADRs trade infrequently, creating wider bid-ask spreads.

- Limited selection: Only a portion of European companies issue ADRs.

- Currency exposure: Even though ADRs trade in U.S. dollars, the underlying value depends on foreign currency performance.

In essence, ADRs combine the familiarity of U.S. trading with the opportunity to access European companies. They are not perfect, but for most retail investors, they remain the easiest and most practical route into European equity markets.

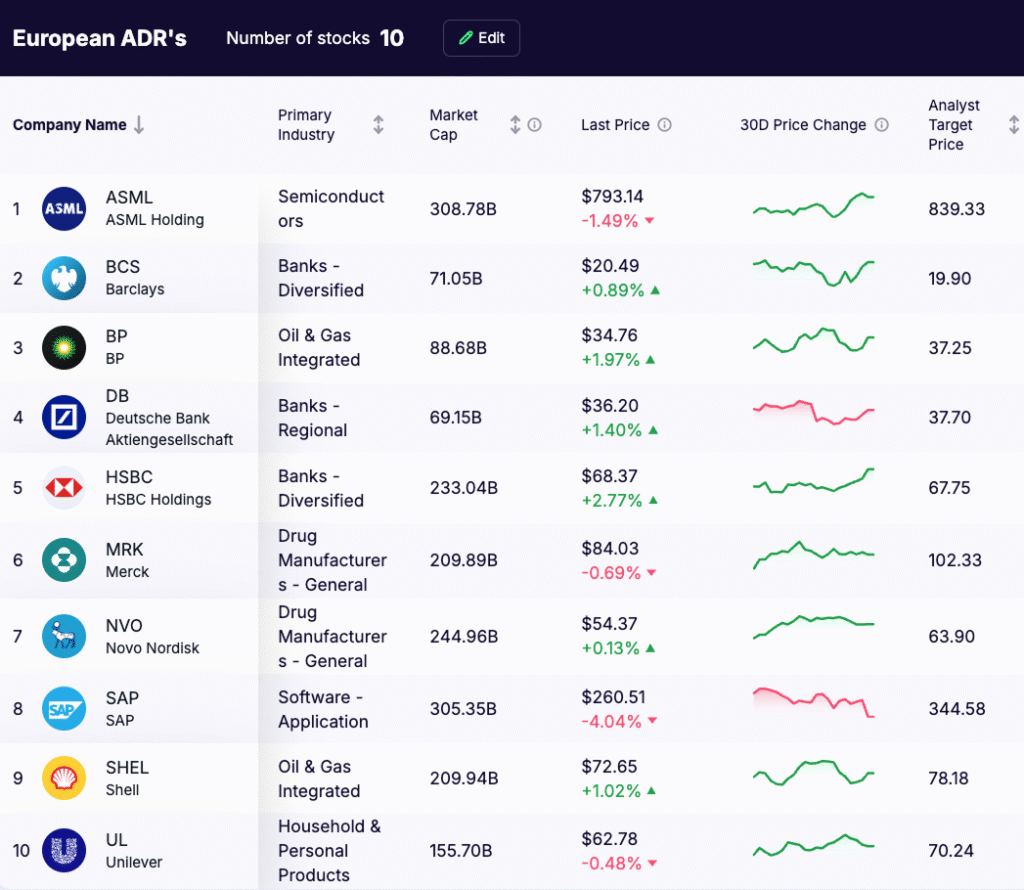

Popular European ADRs

Many of Europe’s most famous companies are accessible to U.S. investors through ADRs. These stocks represent global leaders across diverse industries, from pharmaceuticals to luxury goods. Below are some of the most widely traded ADRs:

- Nestlé (NSRGY) – Based in Switzerland, Nestlé is the world’s largest food and beverage company, owning brands like Nescafé, KitKat, and Gerber. It is a dividend-paying giant with a long history of stable growth.

- Novartis (NVS) – A Swiss pharmaceutical leader known for innovative drug development and global reach. The ADR is actively traded on the NYSE.

- Unilever (UL) – A consumer goods powerhouse with brands like Dove, Hellmann’s, and Ben & Jerry’s. Unilever’s ADR offers exposure to stable cash flows from everyday essentials.

- BP (BP) – The British energy giant has been a core player in oil and gas for decades. Its ADR offers U.S. investors access to one of Europe’s largest energy companies.

- Royal Dutch Shell (SHEL) – A global energy leader, Shell has shifted some focus to renewables and energy transition. It remains one of the largest dividend payers in the world.

- SAP (SAP) – Germany’s largest software company and a global leader in enterprise applications and cloud services. SAP’s ADR is actively traded on U.S. markets.

- Siemens (SIEGY) – A German industrial conglomerate specializing in automation, infrastructure, and healthcare technology. Siemens is a bellwether for Europe’s industrial strength.

- ASML (ASML) – Based in the Netherlands, ASML is the only company in the world capable of producing extreme ultraviolet lithography machines, which are essential for advanced semiconductor manufacturing.

- LVMH (LVMUY) – The French luxury conglomerate owns brands like Louis Vuitton, Moët & Chandon, and Sephora. It dominates the global luxury sector.

- Allianz (ALIZY) – A German insurance and asset management firm with global operations. Known for stability and strong dividend payouts.

These ADRs are among the most liquid and widely followed by analysts, making them a practical entry point for U.S. investors looking to add European exposure.

Risks and Costs of Investing in European Stocks

Currency risk is unavoidable. Even if you invest through ADRs, the underlying shares trade in foreign currencies. If the euro or pound weakens against the U.S. dollar, the value of your ADRs will decline, even if the local share price remains stable. Conversely, a strengthening foreign currency can boost returns.

Accounting and regulatory differences matter. Most European companies report under International Financial Reporting Standards (IFRS), not U.S. GAAP. While broadly similar, there are differences in revenue recognition, depreciation, and reporting style. For ADRs, sponsored programs must reconcile disclosures to meet SEC requirements, but unsponsored ADRs may provide less detail.

Dividend taxation can reduce returns. European countries often impose withholding taxes on dividends paid to foreign investors. The rate varies by country (e.g., Switzerland typically withholds 35%, while the UK does not withhold for U.S. investors). Tax treaties can reduce these rates, but you must ensure your broker files the correct paperwork.

ADR fees are often overlooked. Depositary banks charge annual custody fees, usually ranging from $0.01 to $0.05 per share. These are typically deducted from dividends but can also appear as charges in your brokerage account.

Liquidity may be an issue for smaller ADRs. While companies like Nestlé or SAP trade actively, smaller ADRs can have wide bid-ask spreads. This means you may pay more to buy or receive less when selling.

Political and economic risks also matter. Europe has faced unique challenges in recent decades, including Brexit, the Eurozone debt crisis, and energy shocks tied to geopolitics. Regional regulations, such as strict environmental standards, can impact certain industries more heavily than in the U.S.

In summary, investing in European stocks offers diversification and opportunity, but it is critical to factor in additional costs and risks that differ from U.S. markets.

Practical Steps to Buy European Stocks

Step 1: Choose the right brokerage. Not all U.S. brokers provide access to international markets. Most major brokers such as Fidelity, Schwab, TD Ameritrade, and Interactive Brokers allow investors to trade ADRs. For direct listings on European exchanges, Interactive Brokers is often the most comprehensive option.

Step 2: Decide on your method of exposure. Ask yourself whether you want to own individual stocks, ADRs, or broad ETFs. ADRs are convenient for blue chips. ETFs provide instant diversification. Direct listings are best if you want exposure to companies without ADRs.

Step 3: Research your investment carefully. Review financial statements, dividend policies, and industry trends. If investing through ADRs, confirm whether they are sponsored, which level they are, and what fees apply.

Step 4: Understand dividend treatment. Find out the foreign withholding rate for dividends and whether your broker files tax treaty forms (often W-8BEN for U.S. investors). This ensures you do not overpay on taxes.

Step 5: Monitor foreign exchange impact. Even ADRs reflect the performance of the underlying currency. If the euro weakens 10% against the dollar, your returns will be affected accordingly. Consider whether you want to hedge currency risk through ETFs or derivatives.

Step 6: Build a diversified basket. Do not concentrate in one country or sector. For example, balance luxury goods (LVMH), energy (Shell, BP), pharma (Novartis), and industrials (Siemens) for broader exposure.

Step 7: Reassess regularly. European economies change, and currency trends shift. Periodic review ensures your portfolio stays aligned with your goals.

Taxes and Regulatory Considerations

Dividend withholding taxes vary by country. For example, Switzerland withholds 35% by default, but under U.S.–Swiss treaties, this can be reduced to 15% with proper documentation. France withholds 25%, while Germany withholds 26.375%. The U.K., however, does not withhold on dividends for U.S. investors.

Tax treaties can help but require action. Investors must often file forms like the W-8BEN with their broker to claim reduced withholding rates. Without this, maximum withholding will apply.

Foreign tax credits may offset double taxation. In the U.S., you may be able to claim a foreign tax credit for taxes paid abroad. This can reduce or eliminate double taxation on dividends. Consult a tax advisor for specifics.

Regulatory standards differ. European firms follow IFRS, which emphasizes principles over rules. While similar to U.S. GAAP, differences exist in areas like lease accounting, revenue recognition, and goodwill treatment. For ADRs, Level 2 and 3 programs reconcile these differences for SEC filings, but Level 1 ADRs may provide limited reporting.

Capital gains taxes are typically paid in your home country. For U.S. investors, capital gains on ADRs are taxed like any U.S. stock sale. Direct shares in Europe may carry additional complexities depending on your broker.

Always review tax implications before investing. They can significantly affect net returns, especially for dividend-focused investors.

Portfolio Strategy Tips

Diversify across sectors and countries. Europe is not a single market. Investing in France’s luxury sector, Germany’s industrials, Switzerland’s pharma, and the U.K.’s financials creates a more resilient portfolio.

Balance growth and income. Some European companies like ASML provide growth exposure in high-tech industries, while others like BP or Allianz are strong income generators. Mixing both stabilizes long-term returns.

Use ETFs for efficiency. For investors who do not want to research each company, ETFs like VGK, EZU, or FEZ offer broad exposure with low fees. Mutual funds like FIEUX or PRESX provide actively managed alternatives.

Watch currency cycles. The euro and pound can swing significantly against the dollar. Long-term investors may accept this volatility, but tactical investors sometimes hedge currency risk using specialized ETFs such as the WisdomTree Europe Hedged Equity Fund (HEDJ).

Allocate wisely. Many financial advisors suggest allocating between 10% and 25% of a portfolio to international stocks, with Europe being a large component. Adjust based on your risk tolerance and investment goals.

Rebalance periodically. Markets shift. Rebalancing ensures you do not become overweight in one sector or country due to short-term outperformance.

In short, European equities should be part of a balanced global portfolio. By combining ADRs, ETFs, and direct investments, investors can build exposure that captures both growth and income from across the Atlantic.

Final Thoughts

European stocks are a valuable addition to a diversified portfolio. They offer access to world-class companies, unique industries, attractive dividends, and currency diversification. While risks such as currency volatility, taxation, and regulatory differences exist, they can be managed with proper knowledge and planning.

ADRs remain the simplest way for U.S. investors to access European companies. For broader diversification, ETFs and mutual funds offer efficient exposure. For advanced investors, direct listings provide the deepest access but require more effort.

With careful strategy and awareness of the risks, European equities can provide both growth and stability for long-term investors.