When learning about stock market investing, beginner investors often encounter two broad strategies: long-term investing and short-term investing. Long-term investing typically means buying and holding assets for several years or even decades, aiming to build wealth gradually. Short-term investing, on the other hand, involves holding investments for a shorter period (anywhere from days or months up to a couple of years) to try and earn quick returns.

Both approaches can be part of a stock market strategy, but they differ significantly in terms of time horizon, risk, and potential rewards. This friendly guide will define long-term vs. short-term investing, compare their key differences, and help you understand which style might suit you best as a beginner investor.

Long-Term vs Short-Term Investing: Key Differences

Long-term and short-term investing differ mainly in investment horizon and approach. Long-term investors generally plan to hold their investments for 5+ years, while short-term investors focus on periods of 3 years or less. Long-term investing often aligns with big goals like retirement or college savings, whereas short-term investing might target nearer-term goals or quick stock market gains. To clarify these differences, here’s a comparison table of key factors:

Aspect | Long-Term Investing | Short-Term Investing |

Time Horizon | Typically 5, 10 or more years – investments held over the long run, often decades. Allows more time for assets to grow and recover from market dips. | Typically under 1–3 years – investments held for a short period, from days to a few months or years. Geared toward quick goals or fast results. |

Strategy | Generally buy-and-hold strategy. Focuses on quality stocks or index funds, compounding returns over time. Involves patience and fewer trades. | Generally active trading or timing strategy. May involve frequent buying and selling (e.g. day trading or swing trading) to capitalize on short-term price movements. More frequent monitoring of the market is needed. |

Risk & Volatility | Can tolerate short-term market volatility since there’s time to recover. Long-term investors often ride out downturns, accepting interim ups and downs for potentially higher long-run gains. | Often higher short-term risk if investing in volatile stocks – prices can swing quickly in days or weeks. Quick trades can lead to sudden losses. |

Typical Returns | Historically, long-term stock investors have seen strong average returns (the stock market has returned ~10% per year on average over the last century). Compounding can significantly grow wealth over many years. | Highly variable returns. Short-term traders might see quick capital gains, but they could also face quick losses. It’s challenging to consistently beat long-term market returns after fees and taxes. Many short-term traders do not outperform a simple long-term strategy, and frequent trading means smaller gains can be wiped out by occasional big losses. |

Tax Implications | Favorable long-term capital gains tax if stocks are held >1 year. In many jurisdictions, profits on long-term investments are taxed at a lower rate than short-term gains. Fewer transactions also mean fewer taxable events in the long run. | Higher taxes on short-term capital gains. Profits from stocks held less than a year are usually taxed as ordinary income (often a much higher rate). Frequent trading can trigger taxes each year, which can eat into net returns. |

Examples of Long-Term vs. Short-Term Investment Strategies

To further illustrate, consider how a beginner might approach the stock market with each style:

- Long-Term Investing Example: You decide to invest in an S&P 500 index fund and some well-established blue-chip stocks such as Apple (AAPL) or Alphabet (GOOGL), planning to hold them for 10+ years. Over time, you reinvest dividends and add money regularly. This buy-and-hold strategy lets you benefit from the overall growth of the market and compound interest. For instance, if you buy shares of a solid company or index fund and hold on, you’re looking to let the value appreciate gradually and ride out any interim market fluctuations. This is ideal for goals like building a retirement nest egg or saving for a future home – you’re patient and focused on the long run.

- Short-Term Investing Example: You set aside a smaller portion of money to actively trade stocks. For example, you might practice swing trading – buying a stock that you believe is undervalued after a recent dip, with the intent to sell it a few weeks or months later at a higher price. Alternatively, you might try day trading a volatile tech stock, buying in the morning and selling by the afternoon to capture a quick profit. These short-term strategies aim to take advantage of rapid price changes. As a result, they require closely following market news, using charts or technical analysis, and making swift decisions. The goal is to earn quick capital gains, such as profiting from an earnings report bump or a short-term market trend, rather than waiting years. Please note: Short-term trading is generally discouraged for beginner investors due to its high risk and complexity.

Pros and Cons of Long-Term Investing

Long-term investing means buying and holding investments, usually stocks or funds, for several years or even decades. It is a strategy built on patience, discipline, and the belief that markets grow over time. While it may not deliver quick wins, long-term investing can lead to steady wealth accumulation, especially for those focused on retirement or future financial or investment goals. Below, we break down the key advantages and challenges of this approach to help you decide if it suits your investing style.

Pros of Long-Term Investing:

- Power of Compounding: Given enough time, earnings can generate their own earnings. Reinvested dividends and growth can snowball into much larger returns over decades. Long-term investing harnesses compound interest to build wealth exponentially.

- Proven Historical Performance: The stock market has trended upward over long periods. By staying invested through the ups and downs, you improve the chances of a positive overall return. In fact, “time in the market” often beats “timing the market” – the longer you stay invested, the more likely you are to see growth. Long-term investors historically have benefited from the market’s ~10% average annual returns.

- Less Stress & Effort: You don’t need to watch the market constantly. Long-term investors can take a more passive investing approach, checking in periodically rather than monitoring daily price swings. This makes it easier for someone with a full-time job or who doesn’t want high-frequency trading stress.

- Lower Costs & Taxes: Fewer buy/sell transactions mean you pay less in trading fees or commissions. Plus, holding investments for over a year often qualifies for lower long-term capital gains tax rates, which can significantly boost net returns.

Cons of Long-Term Investing:

- Requires Patience: It can be psychologically hard to stay committed for years. You won’t see big results overnight, and watching your portfolio during a downturn can be unnerving if you’re not mentally prepared for the long game.

- Money Is Tied Up: Because the investment goal is future growth, the money you invest isn’t readily available for short-term needs or emergencies. You have to be comfortable not touching those funds for a long period.

- Possibility of Long Wait for Goals: If you have multiple goals, some long-term investments (like retirement funds) won’t help you with nearer-term needs (like buying a car next year). Long-term investing addresses long-range investment goals, so it’s not a quick solution for any immediate financial objectives.

- Market Risk Still Exists: While you can ride out volatility, there’s no guarantee a particular stock will succeed in the long run. Companies can decline or even go bankrupt. Diversification (spreading investments across many stocks or funds) helps manage this risk, but long-term investing doesn’t eliminate risk.

Pros and Cons of Short-Term Investing

Short-term investing, often called trading, involves buying and selling assets within a relatively brief period such as days, weeks, or a few months. This strategy focuses on taking advantage of quick price movements rather than waiting for long-term growth. While it offers the potential for fast returns and flexibility, it also requires more time, attention, and risk management. Below is a breakdown of the key benefits and drawbacks to help you decide whether short-term investing fits your goals and comfort with risk.

Pros of Short-Term Investing:

- Quick Potential Profits: Short-term investing (or trading) offers the possibility of making money fast. If you correctly predict a stock’s short-term move, you could see gains in days or weeks instead of years. This agility can be appealing if you spot timely opportunities – for example, buying a stock right before a favorable product launch and selling shortly after the price jumps.

- Liquidity and Flexibility: Since positions are not held for long, your money isn’t locked up. You can quickly convert investments back to cash. This can be useful if you might need funds soon or want the flexibility to jump in and out of different assets frequently.

- Excitement and Learning: Some people enjoy the active engagement of short-term trading. It can be exciting and educational – you learn a lot about how the market moves in the short run, and each trade provides feedback.

- Opportunistic Capital Gains in Any Market: Short-term traders can potentially profit in any market condition – even when overall markets are flat or down, there are usually individual stocks moving that a trader could target. This style isn’t necessarily tied to the market’s long-term upward trend; a skilled short-term investor can seek gains from volatility, news events, or market swings.

Cons of Short-Term Investing:

- Higher Risk and Volatility: Short-term stock trading is inherently risky. Prices can swing unpredictably in the short term, and there’s a real chance of significant capital losses. A bad earnings report or unexpected news can make a stock plunge before you have time to react. Without the cushion of time, there’s little opportunity to recover from a downturn – which means short-term investors often face a higher risk of losing money. In fact, many new day traders find it’s as likely to lose money as to make money in the short run.

- Stress and Time-Consumption: Constantly watching the market and making frequent trades can be stressful and time-intensive. Short-term investments often require active management, meaning you need to dedicate time each day to research, monitor price charts, and execute trades. This can feel like a part-time (or even full-time) job and may not be feasible or desirable for many beginners.

- Transaction Costs: Frequent buying and selling racks up transaction costs (like brokerage fees or bid-ask spreads). Over time, these costs eat into your profits. Even with low-cost brokers, high turnover can still reduce overall returns.

- Tax Inefficiency: As mentioned, profits from short-term trades don’t get the favorable tax treatment that long-term holdings do. Short-term gains are taxed at higher ordinary income rates, which can significantly reduce what you keep. If you trade often and make profits, you could face a hefty tax bill at year-end.

Which Investing Style Is Right for You?

Every investor is different, and the choice between long-term and short-term investments should depend on your personal goals, risk tolerance, and circumstances. Here are some considerations to help you decide which style (or combination) suits you:

- Financial Goals and Timeframe: Start by identifying your goals. Are you investing for long-term goals like retirement, a child’s college fund, or building wealth over decades? If so, a long-term investing approach is usually more suitable, since it aligns with your multi-year horizon and lets you benefit from steady growth. Conversely, if you have a short-term goal (say, saving for a home down payment in two years), putting that money in stocks is risky – a market downturn could derail your plans. For short-term goals that are just a few months or years away, many experts actually recommend safer instruments (like high-yield savings, CDs, or short-term bonds) over stocks, because you want the money to be there when you need it. Only if you’re prepared to potentially lose some of it would you invest short-term in the stock market.

- Risk Tolerance: Consider how comfortable you are with risk and volatility. Long-term investing generally suits those with a lower tolerance for stress because you won’t be as rattled by daily market swings – you’re focused on the big picture. If seeing red in your investment portfolio makes you anxious, a long-term, buy-and-hold strategy in quality stocks or mutual funds is likely the better fit. Short-term investing might appeal to those with a higher risk tolerance who understand the dangers but are willing to take them for a chance at quick gains. Be honest with yourself: if losing 10% of your investment in a week would cause you to panic, short-term trading is probably not for you. Long-term investors can afford to be more patient with risk, while short-term traders need to be comfortable with rapid ups and downs.

- Skill and Knowledge: For beginners, it’s generally advised to start with long-term investing to learn the ropes of the market. Short-term trading is a skill that takes time, education, and practice to do successfully. Professional traders have sophisticated tools and years of experience, and even they often struggle to consistently beat the market. As a new investor, you might consider focusing on building a solid long-term portfolio first. If you are very interested in short-term trading, start very small – perhaps using a small portion of your money as a “learning experience” while keeping the majority in safer long-term investments. Remember, successful short-term trading requires extensive research, discipline, and a bit of luck.

- Time Commitment and Temperament: Ask yourself how much time and attention you can devote to your investments. If you have a busy life or simply don’t want to be glued to stock tickers, long-term investing is the way to go – it’s a “invest and relax” approach. You might rebalance your portfolio a few times a year and keep up with news occasionally, but it won’t consume your daily routine. On the other hand, if you enjoy the thrill of the market and can spend hours analyzing and following stocks, you may lean towards trying some short-term trades. But even then, consider keeping your core money in long-term investments, and use only a portion for active trading. This way, your short-term adventures won’t jeopardize your overall financial future.

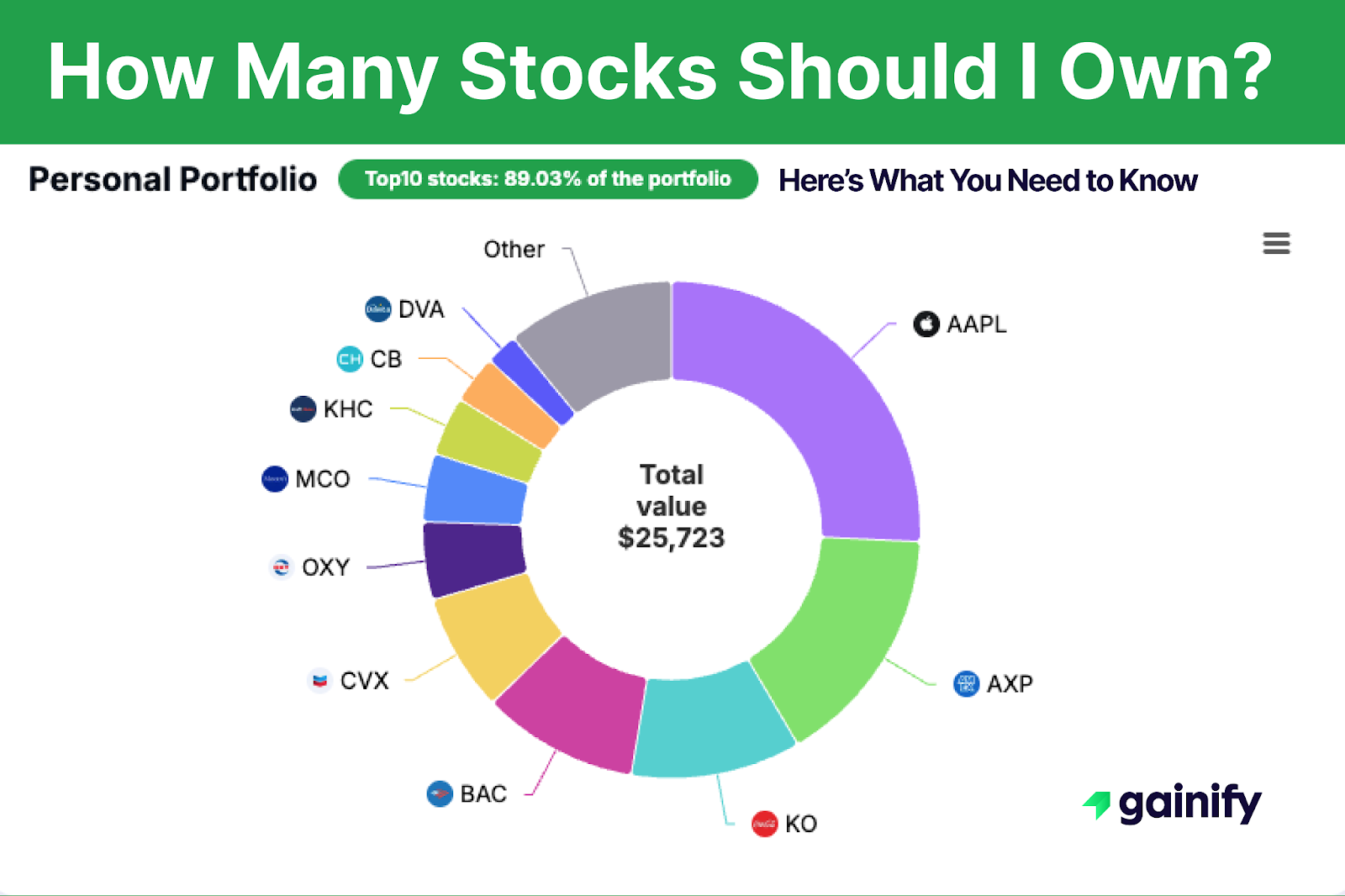

- Combining Both Strategies: It’s not an either/or choice for many investors. In fact, a mix of long-term and short-term investments can coexist. Your portfolio might have a long-term foundation (for example, index or mutual funds or blue-chip stocks for growth over years), complemented by a small portion for short-term opportunities or “fun money” trades. This balanced approach ensures you are working toward your secure long-term goals, while also allowing some tactical moves on the side. Just be sure that any short-term investments you make complement your long-term plan, not derail it. For instance, don’t gamble your retirement fund on a risky short-term investment; instead, keep those funds safely invested for the long haul, and only use separate, disposable capital for short-term plays.

Conclusion

In summary, long-term and short-term investing represent two very different paths in the stock market. Long-term investing focuses on steady growth, patience, and the power of compounding over time. It has historically rewarded disciplined investors who stay invested through market cycles and avoid emotional decision-making.

Short-term investing, on the other hand, is centered on speed, market timing, and frequent trades. While it offers the possibility of quick gains, it comes with significantly higher risks, greater stress, and a much steeper learning curve. Many new investors underestimate how difficult it is to consistently make money this way, especially after accounting for taxes, fees, and emotional pressure.

For most beginner investors, a long-term strategy built around diversified, high-quality stocks or index funds is the most reliable and low-stress way to build wealth. Short-term trading may seem exciting, but it should only be explored after gaining experience, developing a risk management framework, and understanding that losses can accumulate quickly.

The most important thing is to be honest with yourself about your financial goals, risk tolerance, and time commitment. Do not invest in anything you do not fully understand. If you choose to experiment with short-term strategies, do so cautiously and consider it a small part of your overall plan, not the foundation.

Ultimately, successful investing comes from aligning your strategy with your goals and having the discipline to stick with it. For most retail investors, long-term investing remains the most effective and proven approach to building wealth over time.

FAQ: Long-Term vs. Short-Term Investing

1. How long is “long-term” vs. “short-term” investing?

Long-term usually means holding an investment for 5+ years, often with goals like retirement. Short-term typically refers to a holding period under 3 years, sometimes just weeks or months. Think: long-term = future-focused, short-term = near-term or tactical.

2: Which is riskier?

Short-term investing is riskier. Price swings, emotional decisions, and time constraints make short-term trades harder to recover from. Long-term investing smooths out volatility and gives time for recovery, especially with a diversified portfolio.

3: Can short-term investing deliver better returns?

Occasionally, yes, but not consistently. Big short-term wins are possible, but hard to repeat. Most short-term traders underperform over time. Long-term investors benefit from steady compounding, which tends to win over decades.

Q: How are taxes different?

Long-term gains (over 1 year) are taxed at lower capital gains rates. Short-term gains (under 1 year) are taxed as regular income, which is usually higher. Frequent trading also means more taxable events.

What’s better for beginners?

Long-term investing is the best starting point. It’s lower stress, more forgiving, and helps build good habits. Beginners can explore short-term trading later, but only with proper education and small amounts they’re willing to lose.