The thrill of discovering a small company before it becomes a household name draws many investors toward the small cap corner of the market. Every industry titan once traded at a modest valuation, and the next big winner could already be hiding in plain sight. In this guide on how to find small cap stocks, I will distill the core process professional analysts use to identify promising opportunities and explain how you can apply these techniques in your own portfolio.

You will learn how to define the small cap universe, build an efficient screening workflow, and apply a disciplined set of checks that separate healthy growth stories from speculative mirages. Along the way, I share the same research shortcuts, so beginners and seasoned investors alike can refine their edge.

Finding opportunity in this space also means understanding its unique risks. Many small caps operate with limited resources, unproven business models, or heavy reliance on a narrow customer base. These factors make them more vulnerable to operational missteps, market shifts, or regulatory delays. Without a margin of safety, even strong initial growth can reverse quickly.

Stick with me to the end and you will have a step-by-step blueprint you can start using today.

Let us dive straight into the research playbook.

1. Define the small cap universe

How to find small cap stocks starts with understanding what small cap actually means. The term refers to companies with a market capitalization typically ranging from 250 million to 2 billion US dollars. This is a widely accepted range used by sources like FINRA and Investopedia, but it’s not set in stone. Depending on your strategy, you might choose to go slightly broader or narrower.

Some investors focus on the lower end of this range, where potential upside might be higher but risks are also more pronounced. Others prefer to stay closer to the upper limit for more stability while still benefiting from growth dynamics. The key is consistency in how you apply your criteria so you can make accurate comparisons across the companies you’re researching.

Why begin with size at all? Companies in this market cap range often exhibit similar trading volumes, institutional interest, and financial disclosure practices. This creates a relatively level playing field when screening for opportunities. You’re not comparing a regional logistics startup with a multinational pharmaceutical giant. This way you’re comparing apples to apples.

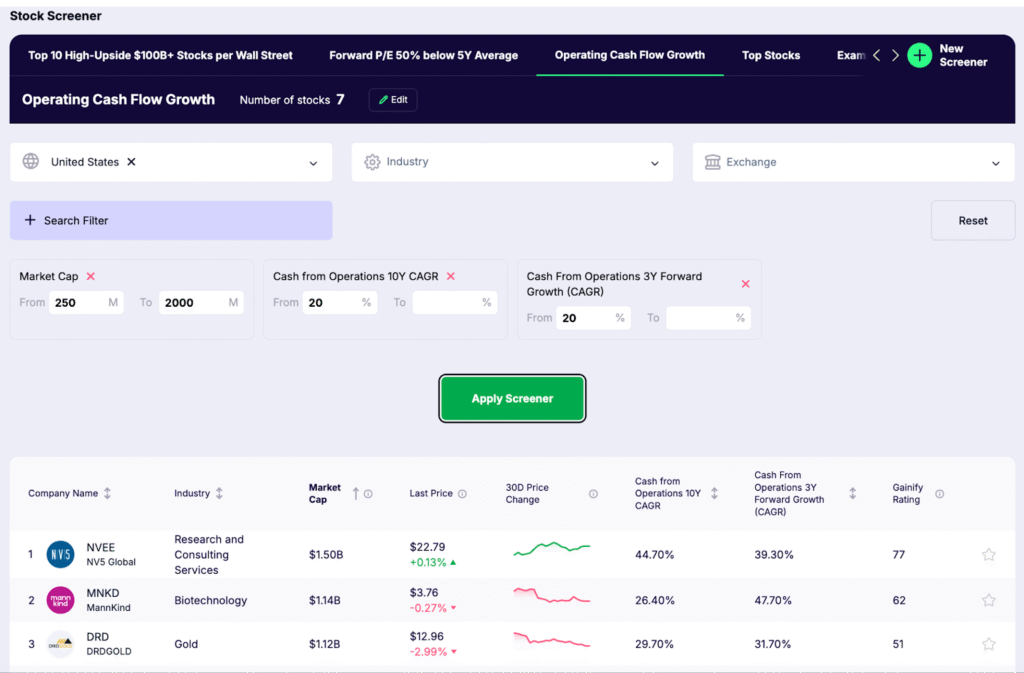

To simplify this process, consider using the Gainify.io screener. It’s designed with a practical, investor-first mindset and offers filters built around real-world small cap investing. Whether you’re hunting for revenue growth, insider ownership, or capital efficiency, Gainify lets you customize your approach with precision and clarity. It’s a powerful starting point if you’re serious about identifying high-potential small cap stocks.

2. Use a Smart Stock Screener to Filter Opportunities

No matter your experience level, the right screener is where intelligent small cap investing begins. With thousands of publicly traded companies out there, learning how to find small cap stocks starts by narrowing the field with filters that actually matter.

To simplify this process, consider using the Gainify.io screener. It’s designed with a practical, investor-first mindset and offers filters built around real-world small cap investing.

Whether you’re hunting for revenue growth, insider ownership, or capital efficiency, Gainify lets you customize your approach with precision and clarity. It’s a powerful starting point if you’re serious about identifying high-potential small cap stocks.

Start by setting a market capitalization filter in the range of 250 million to 2 billion US dollars, as defined earlier. Then layer on criteria to ensure the companies you’re seeing are both accessible and worth evaluating:

- Minimum average daily trading volume of 500,000 shares – ensures there’s enough liquidity to enter and exit positions with minimal price impact.

- Year-over-year revenue growth above 10% – highlights companies actively scaling their businesses.

- Positive free cash flow – suggests the company is not just growing, but doing so sustainably.

- Insider ownership over 5–10% – a strong indicator that leadership is financially aligned with shareholders.

These filters don’t just reduce noise. They signal a company is passing through fundamental gates that matter to professional analysts. Once you’ve fine-tuned your screener, you’re ready to shift from filtering to building something actionable.

3. Create a Focused Watchlist That Works for You

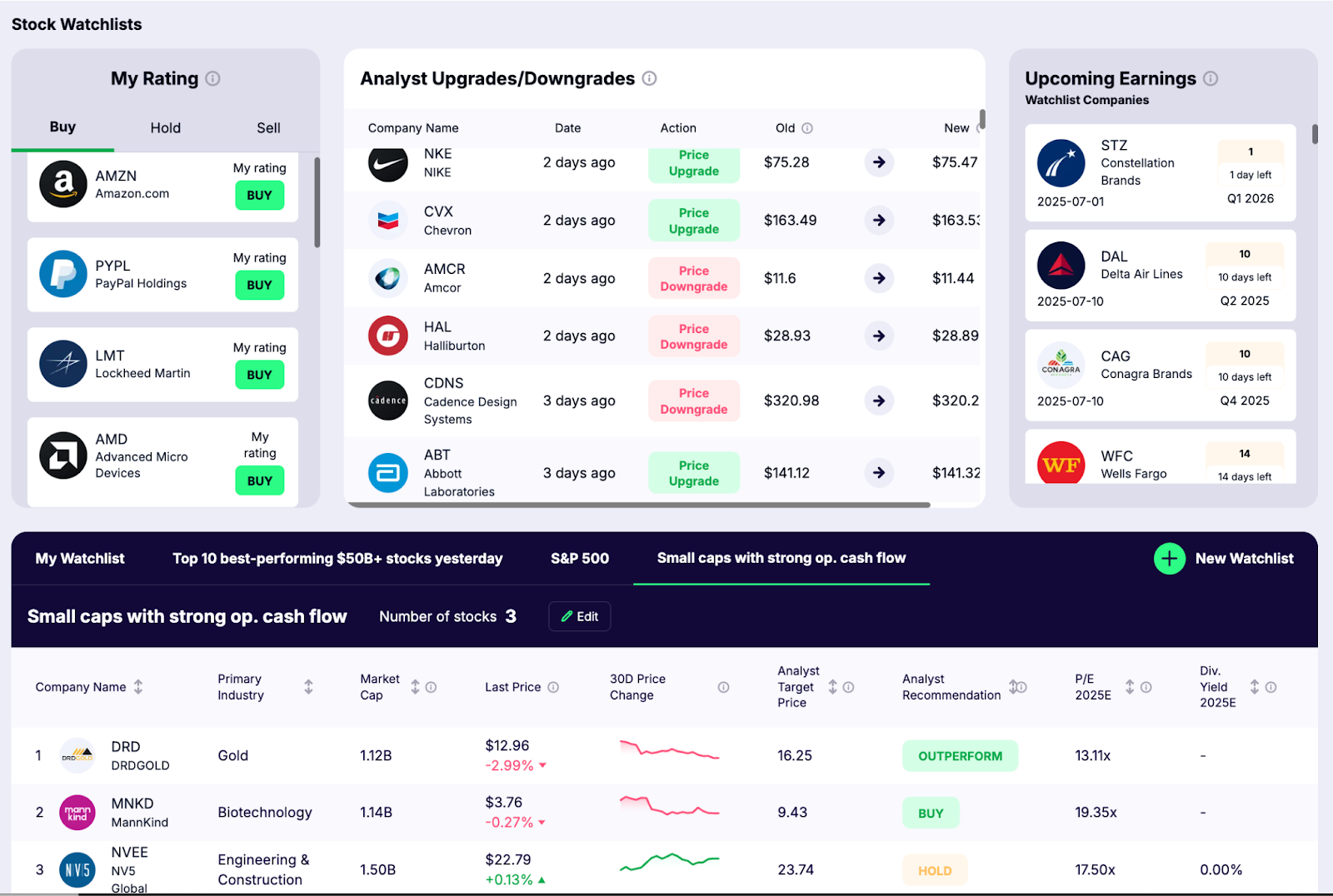

Once you’ve applied your screening criteria, the next step in finding small cap stocks is to create a watchlist of companies that truly stand out. The goal here isn’t to chase what’s trending or volatile. It’s to track businesses that consistently meet your benchmarks for quality, growth, and liquidity, even if the market hasn’t recognized them yet.

This is where the Gainify.io Watchlist becomes a valuable tool. With a single click, you can transfer screened stocks into a live dashboard that monitors key financial metrics, technical signals, insider trades, earnings dates, and valuation trends in one place. It’s not a static list. It evolves as the company evolves.

Think of your watchlist not as a shopping cart, but as your research lab. It lets you stay close to promising companies without rushing into a position. You can observe how they behave across quarters, how they respond to earnings surprises, or how insider activity shifts during key events. When a name hits a technical or fundamental inflection point, you’re prepared to act, not guessing or reacting emotionally.

Over time, this curated list becomes a reflection of your personal investing thesis. You’ll refine it as macro conditions change, sectors rotate, and new opportunities surface. Some companies will graduate from the list into your portfolio. Others will fall off if the narrative breaks or the fundamentals weaken.

Your objective is not to own dozens of names. It’s to track a high-conviction subset that has passed through a layered process: screen, verify, monitor. When combined with smart tools and deliberate selection, your watchlist becomes one of the most powerful assets in your investment process.

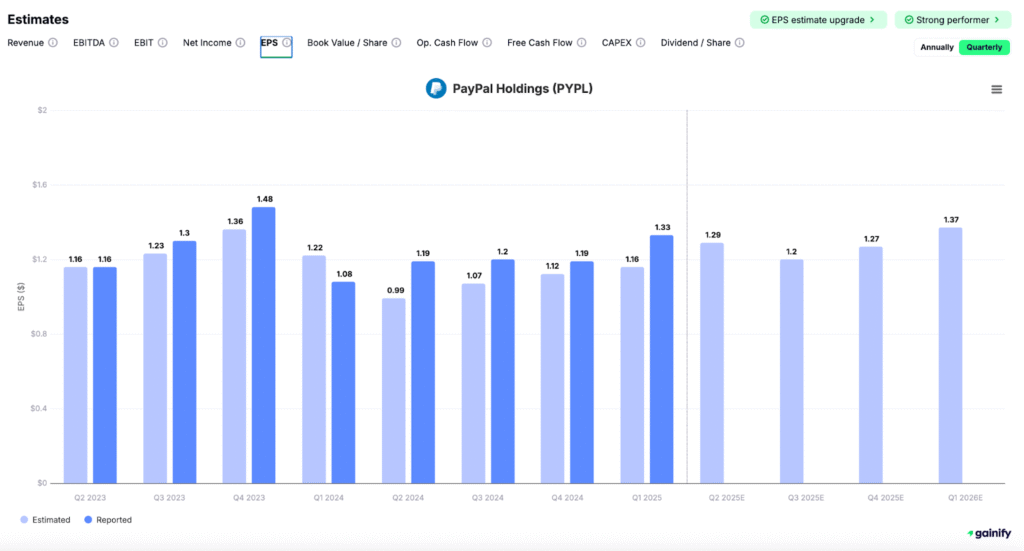

4. Review What Wall Street Analysts Expect

A vital step in how to find small cap stocks is to understand the consensus view that professional analysts publish. Their reports reveal what earnings, revenue, and price moves the market already anticipates. Small caps attract far fewer analysts than large caps, often one-quarter as many, which means each opinion can move the share price more than it would for a blue-chip name.

Why consensus matters

- Benchmark for surprises

If your own research points to earnings that differ from the consensus, the gap may signal upside or downside that is not yet priced in. - Market mood barometer

Up-to-date targets and ratings help you judge whether sentiment is warming or cooling. - Risk filter

Analyst notes often flag legal, competitive, or funding issues before they appear in headlines.

Where to find reliable data

The Gainify.io platform aggregates earnings forecasts, price targets, and ratings into one clean view. You can sort your watchlist by the size of the estimate revision or by shifts in buy-hold-sell ratios. This keeps your focus on names where expectations are changing fastest.

How to use analyst insight wisely

- Compare projections to company guidance posted in recent filings.

- Scan the range, not only the average. A wide spread between the highest and lowest target hints at uncertainty that deserves extra diligence.

- Track revisions over time. Upward estimate trends often precede positive price momentum, while rapid downward moves can warn of trouble.

Remember, analyst opinions are reference points, not marching orders. Blend them with your own screening, fundamental checks, and watchlist alerts. By knowing what Wall Street already expects, you improve your odds of spotting overlooked winners or sidestepping costly surprises.

5. Evaluate Fundamentals the Expert Way

The next key step in finding attractive small cap stocks is evaluating whether each company on your watchlist has the financial strength to support real, lasting growth. This part of the process helps you avoid businesses that look exciting on the surface but are weak underneath.

You’re not just checking boxes. You’re verifying whether a company is growing efficiently, generating real cash, and operating with enough flexibility to withstand pressure.

A. Growth is only as good as its quality

When evaluating small cap companies, focus on growth that is steady and backed by real user or customer behavior. A rising revenue figure matters, but it is more meaningful when it reflects growing demand that can be measured in actual business performance.

Two areas to look at closely:

- Revenue growth over a 3- to 5-year period. This helps you see whether the company is attracting more business over time, not simply benefiting from short-term events.

- Key performance indicators (KPIs). These can include metrics like active users, transaction volume, subscriber counts, or customer retention, depending on the business model.

For example, a company offering a digital product should show user growth that aligns with its revenue increase. If user numbers are flat, but revenue is rising, that might suggest pricing changes rather than product momentum. A healthy business typically shows growth in both usage and revenue together.

Companies that demonstrate this kind of alignment between their financial results and core KPIs tend to be more stable and better positioned for long-term success. Look for businesses that can explain clearly how their revenue is connected to actual usage and value delivered.

B. Margins reveal how well the business is run

Margins reflect how effectively a company turns its strategy into real financial results. They help you understand whether the business can generate profits while maintaining control over its costs.

Two key margin levels to monitor:

- Gross margin. This shows how much money the company keeps after covering the direct costs of producing its product or service. Strong gross margins often indicate pricing power and well-managed production or delivery costs.

- Operating margin. This shows how efficiently the business runs after accounting for day-to-day expenses like salaries, marketing, and infrastructure. A healthy operating margin suggests disciplined management and a clear cost structure.

For small cap companies, margins are especially important because they often have fewer financial resources. When gross and operating margins are steady or improving, it signals that the company is not only growing but doing so in a controlled, sustainable way.

Evaluating margin trends over time can also help you understand how a business handles scale. Some companies improve margins as they grow, while others face pressure if rising revenue comes with rising costs. Look for businesses that show progress in both margin levels and operational consistency.

C. Cash flow separates the real from the risky

Earnings can be affected by accounting choices, but cash flow shows whether the company is actually bringing in more money than it spends. For small cap companies, this is a critical test of business health.

Start by looking at cash flow from operations (CFO). This figure shows how much cash the company generates from its core business activities. It reflects whether the product or service is truly generating value in the market. A consistently positive CFO indicates that the company’s main operations are supporting the business without relying on financing or asset sales.

Next, examine free cash flow (FCF). This is the amount of cash left after the company has covered both its operating costs and capital investments. Free cash flow is what remains to pay down debt, invest in future growth, or return value to shareholders.

A company with positive and growing free cash flow is in a stronger position to expand without depending on outside funding. It also gives management flexibility to make long-term decisions without financial pressure.

When reviewing small cap stocks, prioritize those that show strength in both cash flow from operations and free cash flow. These companies are more likely to support their growth with internally generated resources, which is a strong foundation for long-term value.

D. A strong balance sheet supports long-term stability

The balance sheet shows how well a company can handle financial pressure. For small cap stocks, where access to capital can be limited, a healthy balance sheet often makes the difference between surviving a setback and falling apart.

Focus on two key areas:

- Solvency. This reflects the company’s ability to meet long-term obligations. A common metric to assess solvency is net debt to EBITDA. This compares total debt, minus cash, to earnings before interest, taxes, depreciation, and amortization. A lower ratio suggests the company is not overextended and can cover its debt with operating profits. For many sectors, a net debt to EBITDA ratio below 3 is considered a sign of good financial control.

- Liquidity. This shows how easily the company can meet short-term needs. The current ratio, which compares current assets to current liabilities, is often used to evaluate liquidity. A ratio above 1.5 is generally viewed as healthy, meaning the company has enough resources to cover upcoming obligations.

A solid balance sheet gives management room to invest, adapt, and navigate slower periods without needing emergency funding. When analyzing small caps, seek out those with both the solvency to handle long-term commitments and the liquidity to stay flexible day to day.

D. Use a full checklist when you’re ready

The earlier sections covered essential fundamentals, including growth, margins, cash flow, and balance sheet strength. To complete your analysis, it helps to review a broader set of metrics that add depth and context to your findings.

These may include:

- Share dilution history – tracks whether the company frequently issues new shares, which can reduce the value of each existing share

- Inventory turnover – measures how efficiently the company sells its products, especially relevant for product-based businesses

- Capital expenditures – shows how much is being reinvested to support future growth

- Accounts receivable trends – helps you understand how quickly the company collects payment from customers

Each of these adds clarity to the company’s operational quality and financial discipline. They are especially useful when comparing small cap companies in the same industry.

You can explore a more detailed checklist of these filters and benchmarks on Gainify.io. The platform is designed to help investors evaluate small cap stocks with a complete and structured approach, without requiring a full research team.

Using a full checklist gives you confidence in your process and helps you stay consistent when making investment decisions.

6. Check liquidity and risk

Before you invest in a small cap stock, it’s important to understand how easily you can enter and exit the position. Liquidity can affect both your execution and your ability to manage risk effectively.

Begin with the bid-ask spread. This is the gap between what buyers are offering and what sellers are asking. For most small caps, a spread that stays below 2 percent of the share price is considered acceptable. Tighter spreads usually suggest healthier trading activity and lower transaction costs.

Next, look at the average daily trading volume. A volume of at least 100,000 shares per day helps ensure that there is enough interest in the stock for trades to be executed quickly and at stable prices. Thin volume can result in larger price swings, even on small orders.

It’s also helpful to review the ownership breakdown. If a company is tightly held by a few institutions or insiders, a single large seller can create significant downward pressure. This is more likely in small caps, where the public float is often limited.

Market conditions can influence these dynamics. In 2024 and early 2025, for example, small caps underperformed large caps, partly because rising financing costs made smaller companies more sensitive to capital constraints. During that period, many investors rotated into larger, more liquid names. This made liquidity checks especially important for small cap positions, as noted by sources like Morningstar and Charles Schwab.

Before you decide to invest, confirm that the stock trades actively, the spread is reasonable, and there are no clear liquidity risks. These simple checks can help you avoid situations where you are unable to react when conditions change.

7. Follow the Calendar to Anticipate Volatility

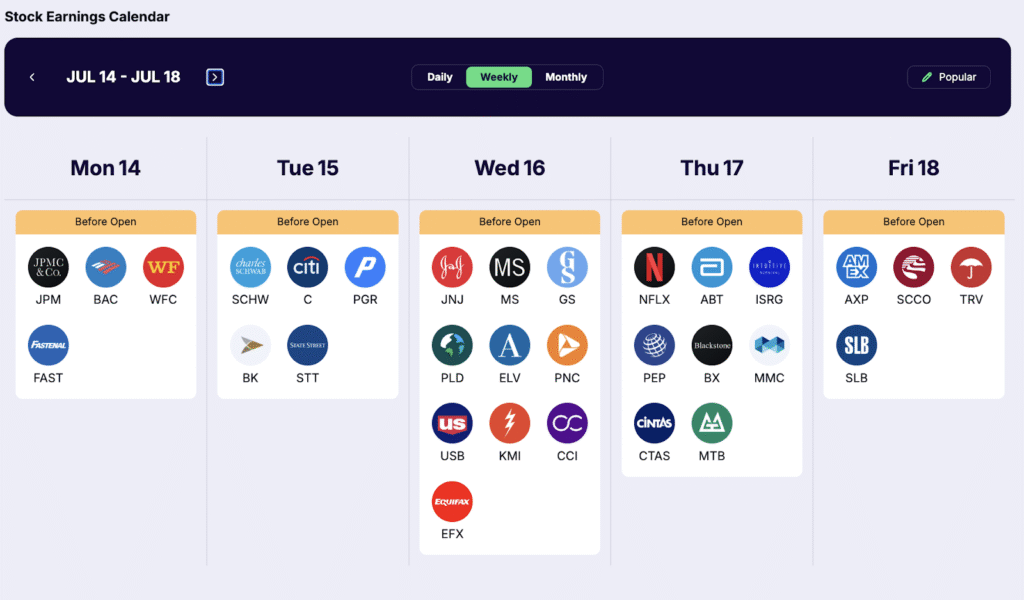

Timing matters in small cap investing. Certain dates throughout the year can trigger meaningful price movements, even in fundamentally strong companies. Being aware of these moments helps you make more informed decisions about when to enter or watch a position more closely.

Start by tracking earnings release dates. Small caps often experience larger price swings around earnings, especially when analyst coverage is limited and expectations vary. Watching how a company performs relative to its prior guidance or consensus estimates can give you useful insight into management’s credibility and the stock’s direction.

Other important events include index rebalances, where major funds adjust their holdings based on index composition. If a small cap is added or removed, this can create short-term buying or selling pressure. For recently listed companies, lock-up expirations are also key. When insiders are allowed to sell shares after the lock-up period ends, it can affect supply and price in the short term.

One of the easiest ways to stay organized is to use a watchlist calendar. The calendar on Gainify.io is one of the most advanced available. It automatically pulls in critical dates (such as earnings reports, estimates on key financials prior to the earnings release, and other key events) so you can plan your timing more effectively.

Monitoring these events does not require complex forecasting. It simply gives you the chance to observe how the market reacts before making a move. Staying aware of the calendar helps reduce surprises and gives you a more structured view of near-term risk and opportunity.

8. Understand the Risks That Come With Small Cap Investing

Investing in small cap stocks can be rewarding, but it involves a set of risks that are important to understand before taking any position. These companies are often still building their market presence and may not have the same level of financial or operational stability as larger firms.

Many small caps operate with limited resources. Some may not yet be profitable, and others may depend on a narrow customer base or a single product line. This can make them more sensitive to unexpected challenges such as cost increases, supply chain issues, or regulatory changes.

Price movements can also be more extreme. Small cap stocks typically trade with lower volume, which can result in sharper price swings even on relatively small news. This makes it more difficult to manage entries and exits without affecting the stock price.

Another common risk is related to funding. When capital markets tighten or interest rates rise, smaller companies may find it harder to raise money. Limited access to financing can slow down growth plans or force a shift in strategy that investors may not anticipate.

Information access is often more limited as well. Fewer analysts cover small cap companies, and media attention tends to be lower. Investors need to rely more heavily on primary sources such as earnings reports, SEC filings, and management commentary to form a clear view.

These risks do not mean small cap investing should be avoided. They mean it should be approached with a structured process, careful research, and an understanding that results may take time. A disciplined approach helps reduce exposure to avoidable problems and puts you in a better position to benefit from the long-term potential this segment can offer.

Key Takeaways

- Start with a defined market-cap range to stay focused on true small cap opportunities and avoid dilution from unrelated names.

- Use a structured screener to filter thousands of companies down to a short list based on growth, financial strength, and liquidity.

- Prioritize companies with real, repeatable growth drivers, supported by strong fundamentals like revenue consistency, healthy margins, and positive cash flow.

- Check liquidity, ownership, and key calendar events to avoid unnecessary volatility and improve timing on entries.

- Track your watchlist with the right tools, and update your research as new financial data and company developments emerge.

This guide is for educational purposes and is not intended as personalized financial advice. Always consider your own investment objectives and risk tolerance, and consult a licensed financial professional when needed.

Frequently asked questions

Q: What is a small cap stock in simple terms?

A: It is a publicly traded company with a market value from roughly 250 million to 2 billion dollars.

Q: Are small cap stocks riskier than large caps?

A: Yes. They often have thinner cash buffers, face more volatile revenue streams, and trade on lower volume, which can amplify price swings.

Q: Which screeners work best?

A: Most investors start with broker platforms such as Schwab or Fidelity. Advanced users prefer professional tools like Gainify, Fiscal or Capital IQ for deeper fundamental data.

Q: Should I buy a small cap ETF or individual names?

A: An ETF provides diversified exposure that reduces single company risk, while individual selection offers higher upside potential if your research proves correct.

Q: How often should I rebalance a small cap portfolio?

A: Reassess positions quarterly around earnings to verify that growth narratives remain intact and liquidity remains sufficient.