Whether you’re a new investor or an experienced portfolio manager, building a diversified investment portfolio is a timeless principle that protects capital and enables long-term growth. Instead of putting all your investment dollars into a single security or market segment, a diversified portfolio spreads risk by allocating assets across various geographies, industries, and investment types. This strategy not only helps mitigate downside risk during economic downturns but also positions you to benefit from growth cycles across global markets.

The idea isn’t new. It’s a core tenet of modern portfolio theory, embraced by legendary institutional investors such as David Swensen (Yale Endowment), Ray Dalio (Bridgewater Associates), and Warren Buffett (Berkshire Hathaway). Leading financial advisors also rely on this approach to manage risk and align portfolios with long-term financial goals.

A diversified portfolio example typically includes a thoughtful mix of asset classes – such as equities, bonds, real estate, and alternative investments – carefully balanced to match an investor’s risk profile and financial goals. It may also include domestic and international holdings, across different market capitalizations and sectors.

In this article, we’ll explore what a truly diversified portfolio looks like, including real-world asset allocation examples, age-based strategies, and a comparison of different investment vehicles. Whether you’re aiming for capital preservation, steady income, or long-term growth, this guide will help you build a portfolio with purpose.

The Goal of Diversification

The goal of diversification is not to maximize returns in the short term, but to optimize risk-adjusted returns over time. By including a variety of investments with different risk levels, investors reduce exposure to unsystematic risk from any single stock, individual company, or market segment.

This principle allows you to hedge against factors like inflation risk, market risk, political instability, or the impact of market volatility in specific sectors like technology stocks or airline stocks.

Key benefits of diversification include:

- Smoother returns over time by spreading exposure across asset classes

- Protection during economic downturns or sector-specific declines

- Access to a wider range of investment opportunities including international stocks, real estate, and alternative asset classes

- Improved risk-adjusted performance, allowing you to pursue solid returns without unnecessary volatility

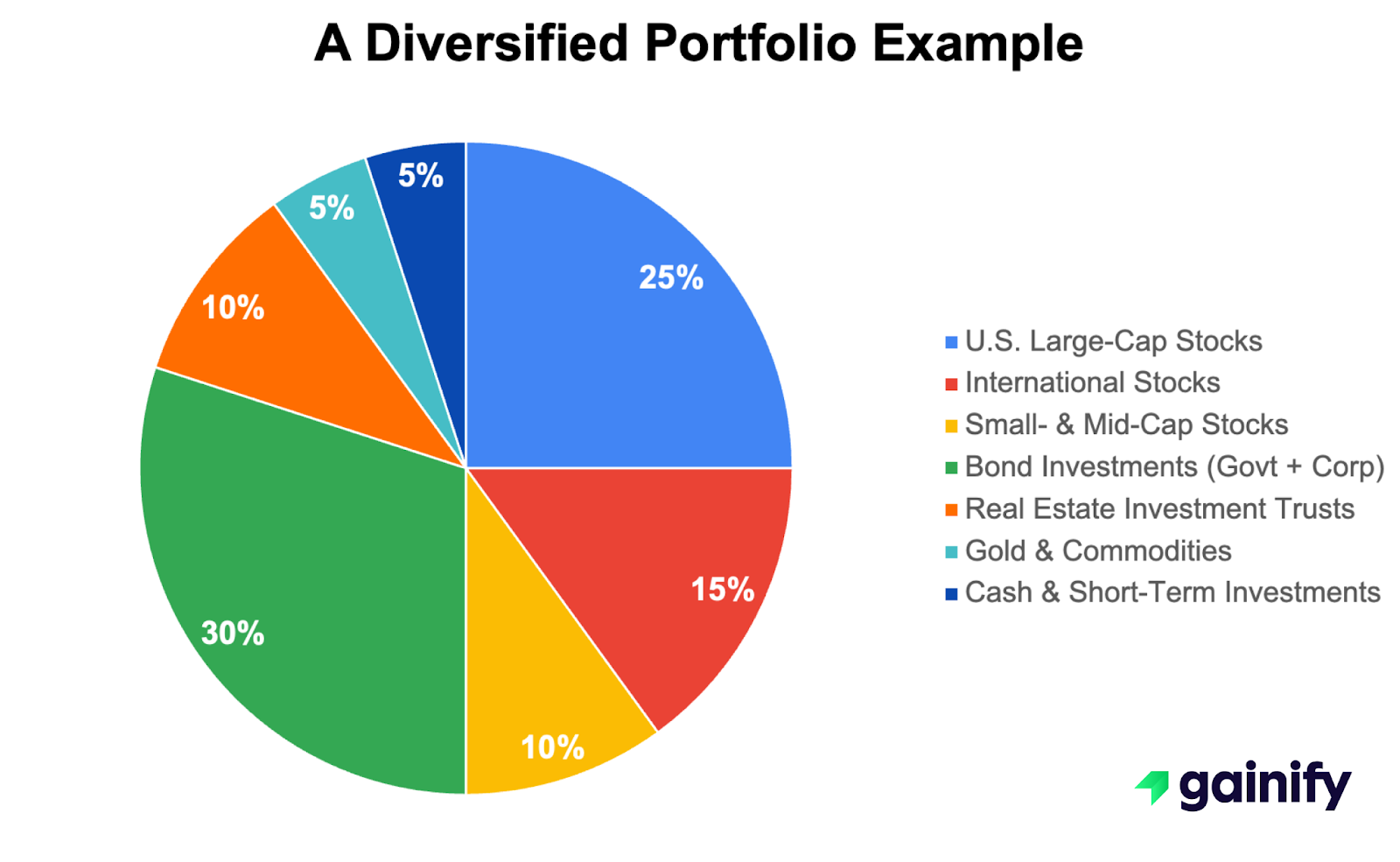

What True Diversification Looks Like (Example Portfolio)

A well-constructed diversified portfolio includes a broad mix of investments, often tailored to your risk tolerance levels, investment objectives, and financial circumstances.

Model Allocation (for Moderate Risk Tolerance)

Asset Class | Allocation | Role in Portfolio |

U.S. Large-Cap Stocks | 25% | Growth engine, exposure to blue-chip stocks, consistent returns |

International Stocks | 15% | Geographic diversification, non-U.S. companies exposure |

Small- & Mid-Cap Stocks | 10% | High growth opportunities, higher risk/reward profile |

Bond Investments (Govt + Corp) | 30% | Fixed-income exposure, reduce portfolio risk |

Real Estate Investment Trusts | 10% | Alternative asset class, hedge against inflation |

Gold & Commodities | 5% | Protection during economic downturns, diversifier |

Cash & Short-Term Investments | 5% | Liquidity buffer, portfolio ballast |

This diversified approach spans all major asset classes, balancing potential returns with a manageable level of risk.

Age-Based Diversification Strategies

A well-structured investment plan changes with time. Here are examples of age-based portfolio models:

Age 30-40: Growth-Focused

- 70% Stocks (Domestic + International)

- 20% Bonds (Mix of Government, Municipal & Corporate bonds)

- 10% Real Estate / Alternatives

Objective: Build a long-term nest egg. Favor growth stocks, small-cap stocks, and technology stocks.

Age 40-60: Balanced Investment Approach

- 50% Stocks (Including dividend-paying stocks such as healthcare stocks)

- 35% Bonds (Add long-term bond exposure)

- 10% Real Estate / Commodities

- 5% Cash or Short-Term Investments

Objective: Maintain growth while reducing risk. Focus on moderate returns, bond allocation, and some safer investments.

Age 60+: Conservative Investors

- 30% Stocks (Mainly consist of large-cap blue-chip portfolio)

- 50% Bonds (40% long-term bonds, 10% intermediate-term bonds)

- 10% REITs / Gold

- 10% Cash / Money Markets

Objective: Preserve capital, maintain a steady income stream, minimize portfolio volatility.

Investment Vehicles That Offer Diversification

Investors can access broad diversification through a variety of investment vehicles designed to spread risk and streamline portfolio management. These tools offer exposure to a wide range of asset classes, geographies, and sectors without the need to handpick individual securities.

- Mutual Funds and Exchange-Traded Funds (ETFs): These pooled investment vehicles allow investors to buy into a collection of stocks, bonds, or other securities. Many mutual funds and ETFs focus on broad market indexes such as the S&P 500 or MSCI World Index, providing instant diversification across hundreds or even thousands of companies. Some are sector-specific, offering targeted exposure to areas like technology, healthcare, or consumer staples.

- Target-Date Funds: Popular in retirement accounts, these funds automatically adjust the asset allocation based on a specific retirement date. Younger investors are typically allocated more heavily to equities, with the fund gradually shifting toward bonds and other safer investments as the target date approaches. This is a hands-off, age-appropriate solution for long-term planning.

- Real Estate Investment Trusts (REITs): REITs offer exposure to the real estate sector without requiring direct property ownership. They invest in income-generating properties such as commercial buildings, apartments, or healthcare facilities, and typically offer consistent dividend payments. They also serve as a hedge against inflation.

- Fund-of-Funds: These investments hold a mix of other mutual funds or ETFs, adding an additional layer of diversification. They are ideal for investors seeking broad exposure with minimal involvement.

- Alternative Asset Funds: For those looking to include commodities, hedge funds, private equity, or infrastructure into their portfolios, there are specialized funds that provide access to these non-traditional assets.

Each of these vehicles comes with varying levels of risk, expense ratios, and management involvement. Understanding your risk tolerance, investment horizon, and financial objectives is critical when selecting the right mix. When used wisely, these vehicles can offer effective diversification while aligning with your overall investment strategy.

How to Build a Diversified Portfolio (Step-by-Step)

1. Start with Core Exposure

Begin by establishing a solid foundation using broad market index funds. For U.S. equities, consider VTI (Total Stock Market ETF), and for international exposure, look at VXUS (Total International Stock ETF). These offer low-cost access to hundreds of companies across various sectors and geographies.

2. Add Bonds Intentionally

Incorporate fixed-income securities to manage volatility and generate income. Use a mix of durations and credit qualities. For example, IEF provides exposure to intermediate-term U.S. Treasuries, while BND offers a broad basket of investment-grade bonds.

3. Include Alternatives

Diversify further with non-traditional assets that tend to behave differently from stocks and bonds. This can include gold (GLD), commodities (PDBC), and real estate through REITs like VNQ. These help reduce overall portfolio correlation and provide inflation protection.

4. Keep Some Cash

Holding cash isn’t a sign of indecision—it’s strategic. Cash offers liquidity, serves as a buffer during volatility, and provides flexibility to act on new opportunities.

5. Rebalance Periodically

Review and adjust your portfolio at least once a year. Trim back outperforming assets and add to lagging ones to maintain your intended asset allocation. This disciplined approach supports risk management and long-term returns.

By following these steps, you can construct a well-diversified portfolio tailored to your investment goals and risk tolerance.

The Contrarian View: Is Diversification Always Better?

While diversification is a cornerstone of traditional investing, some experienced investors challenge its universal application. Legendary investors like Warren Buffett have famously remarked that diversification is protection against ignorance. In other words, when you truly understand a business, concentration might outperform diversification.

Aggressive or advanced investors often argue that over-diversification – owning too many overlapping positions – can dilute potential returns. This is especially true when investment decisions are driven by fear of volatility rather than a clear financial strategy. Simply holding a large number of funds or securities does not guarantee effective diversification, especially if those assets move in correlation with one another under similar economic conditions.

Another valid critique is that diversification can mute gains in a rising market. Investors who identified high-performing sectors such as technology, AI, or energy early on may have missed out on exceptional returns if they were too diversified across slower-growth industries like utilities or consumer staples.

The key is intentionality. A contrarian, concentrated strategy can work – but only when rooted in deep research, conviction, and tolerance for volatility.

Rule of thumb: Every asset in your portfolio should serve a distinct purpose and contribute uniquely to your overall investment goals. If it doesn’t improve your risk-return profile or enhance diversification across geographies, sectors, or asset classes, it may be worth reconsidering.

What to Consider Before Diversifying

- Investment goals: Are you targeting income, growth, or preservation?

- Risk profile: Do you have a moderate risk tolerance or are you seeking high-risk investment?

- Market conditions: Is the current economic climate favorable for bonds or stocks?

- Time horizon: Longer horizons allow for more risky investments with higher potential returns.

Final Thoughts: Building Your Portfolio with Purpose

A successful investment strategy blends broad diversification, risk awareness, and long-term discipline. By leveraging a variety of investment options, including various types of bonds, international assets, and alternative asset classes, you can build resilience against market volatility and economic downturns.

Your portfolio should evolve alongside your personal circumstances, market shifts, and financial goals. Regular reviews of your asset mix, ideally supported by a trusted financial advisor, help ensure that your investment strategy remains aligned with your risk tolerance and investment horizon.

It’s important to remember that no single investment guarantees success. However, a thoughtful asset allocation strategy, rooted in sound investment philosophies and tailored to your stage of life, can help your investment dollars grow steadily over time.

Diversification isn’t just an investment technique. It’s a form of consumer protection for your financial future. It empowers you to weather unpredictable markets while staying on track to achieve your long-term objectives.