In times of economic uncertainty and market volatility, many investors ask:

Is gold a good investment?

The simple answer is yes, but it depends on your financial goals and risk profile.

Gold has long been considered a safe-haven asset and a reliable hedge against inflation. From ancient civilizations using it as a medium of exchange to modern investors viewing it as a store of value, the historical significance of gold is undeniable.

However, before you add gold to your investment portfolio, it’s critical to understand the different forms of gold investments and how they align with your investment goals. Consulting with a financial advisor can help you assess whether a portfolio in gold fits your overall financial plan and whether it offers the right diversification benefit for your risk tolerance.

Why Consider Gold?

- Inflation Hedge: Gold serves as an effective inflation hedge, helping preserve purchasing power when central banks enact loose monetary policies or during periods of currency fluctuations.

- Portfolio Diversification: Adding gold provides a diversification benefit, reducing dependence on traditional stocks and bonds.

- Tangible Asset: Unlike digital or paper money, gold is a physical asset that holds intrinsic value.

- Liquidity: Gold is a highly liquid asset, easily traded worldwide through gold dealers, online dealers, and reputable platforms.

- Historical Performance: The performance of gold often improves during market crashes and times of high investor demand for safe assets.

How to Buy Gold

When considering investment options in gold, it’s crucial to understand that there is no universal strategy. The right approach depends on your financial goals, risk tolerance, and whether you prefer to own physical gold or gain exposure to gold through financial instruments. Each method comes with unique benefits, risks, and costs.

1. Physical Gold Investments

Forms:

- Gold Coins: Popular options include the American Eagle, Canadian Maple Leaf, and South African Krugerrand.

- Gold Bars and Bullion Bars: Typically available in weights from 1 gram to 1 kilogram.

- Gold Jewelry: While it has aesthetic purposes, it’s not typically recommended for investment due to high markups and lower resale value.

Pros:

- Acts as a tangible asset with intrinsic value.

- No Counterparty Risk. You own the asset outright.

- Historically viewed as a safe-haven asset during economic uncertainty.

Cons:

- Requires secure storage (e.g., a bank safe deposit box or professional gold vault service).

- Involves storage costs, insurance expenses, and sometimes high dealer markups.

- Difficult to verify gold content without specialized equipment when buying from non-certified dealers.

- May incur additional Capital Gains Tax when sold.

2. Gold ETFs and Mutual Funds

Options:

- Gold ETFs like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) offer direct exposure to gold prices without the hassle of storing physical metals.

- Mutual Funds specializing in gold often include a mix of gold mining stocks and related precious metals holdings.

Pros:

- Highly liquid and easily traded on major stock exchanges.

- Avoids the challenges of securing and insuring physical gold.

- Provides exposure to gold price movements with low minimum investment requirements.

Cons:

- Subject to management fees and transaction costs.

- Some ETFs may involve counterparty risk if not fully backed by physical gold (important to verify if the fund holds allocated or unallocated gold).

- Does not provide ownership of a tangible asset.

3. Gold Mining Stocks and Gold Mutual Funds

Options:

- Investing in companies such as Newmont Corporation (NEM) or Barrick Gold (GOLD) allows investors to benefit from the performance of gold mining companies.

Pros:

- Potential for higher capital gains and dividend income.

- Can outperform the price of gold due to operational efficiencies and discoveries.

Risks:

- Highly sensitive to stock market volatility and individual company performance.

- Influenced by political events, labor disputes, and changing government policies in mining regions.

- Exposure to operational and management risks specific to each company.

4. Digital Gold

Description:

This modern investment approach allows you to purchase fractional amounts of gold via online platforms or apps. Companies store the corresponding physical gold in secure vaults, and you hold a digital certificate of ownership.

Pros:

- Convenient and accessible for small-scale investors.

- No need to worry about physical storage or security.

Caution:

- Be cautious of Counterparty Risk. Verify that the platform is regulated and transparent about its storage policies.

- Ensure that the digital holdings are backed by allocated and audited physical gold.

- Carefully review all transaction fees, potential hidden costs, and tax implications.

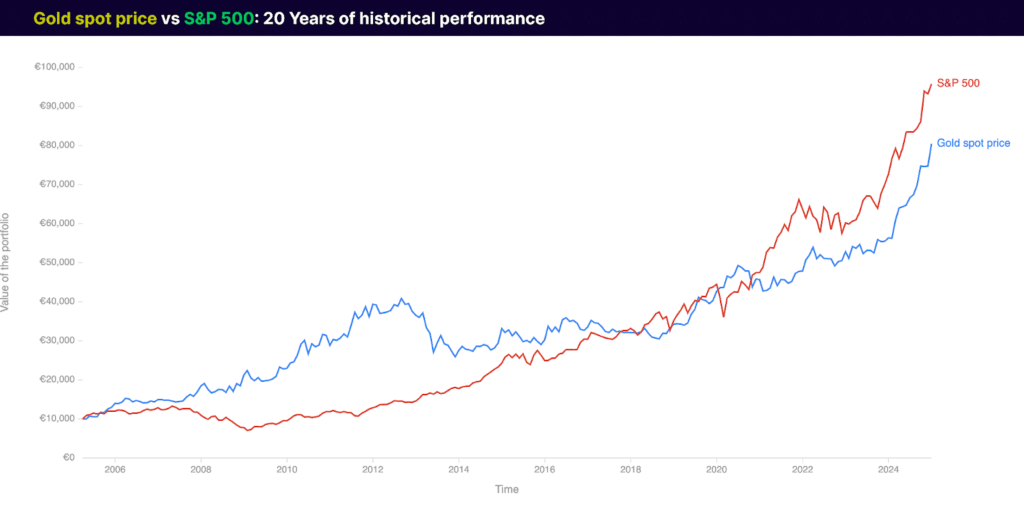

Gold Performance vs. S&P 500

Over the years, the price of gold has moved in cycles, often counter to the stock market.

- Long-Term Comparison:

- Over the past 20 years, gold has delivered average annual returns of around 8%, acting as a potential hedge during crises.

- In contrast, the S&P 500 averaged around 10% to 12% annually, including dividends.

- During Market Crashes:

- In the 2008 financial crisis, the price of gold went up by approximately 5%, while the S&P 500 dropped over 38%.

- In 2020, during the COVID-19 market shock, the price of gold tends to surge, hitting historic highs.

Key Insight: Gold is not typically a growth asset but is highly effective for wealth preservation during times of Geopolitical events, high inflation, and market volatility.

Disadvantages of Investing in Gold

While gold has its merits, it is not without significant drawbacks:

- No Passive Income: Unlike dividend-paying stocks or rental properties, gold doesn’t generate an income stream. You only profit from price appreciation.

- Storage and Transaction Costs: Physical gold requires secure storage and often incurs insurance costs. Purchasing through a pawn shop or local gold dealers may also involve high sales pitches and premiums.

- Price Volatility: The gold market experiences price swings based on central bank policies, political events, and speculative trading.

- Opportunity Cost: Funds invested in gold are not earning dollars in dividends or being deployed in productive assets with higher long-term growth potential.

Frequently Asked Questions About Gold Investing

1. Is Gold a Good Long-Term Investment?

Gold works best as a portfolio diversifier rather than a primary investment. While it can provide financial security during crises, it often underperforms during economic booms.

2. How Should I Store Physical Gold?

Options include a safe deposit box, professional gold vault services, or certified home safes. Keep in mind the importance of secure storage and insurance.

3. Are There Tax Implications?

Yes, selling gold may trigger Capital Gains Tax, and certain investments may be subject to the long-term capital gains rate. Always consult a licensed investment adviser or financial advisor for personalized investment advice.

Final Thoughts: Should You Add Gold to Your Portfolio?

If you want to hedge against inflation and create a more diversified portfolio, adding a moderate portfolio in gold can provide valuable protection against market uncertainty. However, gold should not replace growth assets or productive and non-productive assets that offer long-term wealth-building potential.

Pro Tip: For new investors, starting with gold ETFs or gold-backed paper assets offers diversified exposure without the complexities of physical metals. As your experience grows, you can explore owning physical gold bullion, gold bars, or even investing in stocks of gold mining companies for higher potential returns.