We’re living in the golden age of retail investing. Institutional-grade Wall Street data and AI stock analysis tools are no longer restricted to hedge funds with billions in assets under management.

Right up until the early 2000s retail investors were stuck with outdated information obtained by flipping through the Wall Street Journal or through quarterly reports sent via mail.

Prospects were a little better post dot-com boom – stock data and analyst reports became more readily available to the general public – however retail investors were still at a huge disadvantage compared to their institutional counterparts.

Having access to stock market data is only one piece of the puzzle – the other is having the analytical tools and dashboards to research and compare stocks to make informed, confident investing decisions.

Fast forward to today and stock market data is available in real time – all plugged into a range of stock research apps to suit numerous stock analysis strategies & preferences.

As discussed in our 7 AI Tools for Investing guide, the advent of powerful AI tools, especially large language models (LLMs) emerging in the wake of OpenAI’s ChatGPT, has resulted in a significant levelling of the playing field –finally enabling retail investors to research & compare hundreds of stocks and gain informative insights in a matter of minutes.

This level of access to data, AI stock analysis tools, and insights is unprecedented.

However, the democratization of access to Wall Street data & powerful AI tools for investing has led to an explosion of tools & platforms claiming to help you beat the stock market. Some stock research apps deliver, while others fail to provide the insights and confidence promised.

In this comprehensive guide we will examine the top 9 stock research apps available to retail investors in 2026.

You’ll learn about their features, strengths, limitations, and ideal use cases. Platforms covered include Gainify, Yahoo Finance, Simply Wall St, TIKR, Fiscal.ai, Koyfin, Finviz, Alpha Spread, and Magnifi.

Whether your focus is on long-term investing founded in fundamental analysis, or short-term trading triggered by technical analysis & trading signals – you’ll find a stock research app suited to your investing style.

What Makes the Best Stock Research App in 2026

If you’re seeking an edge in the stock market in 2026, you need a stock research app that will help you navigate the increasing complexity and informational density of today’s fast-paced stock markets.

Key criteria to base your selection on are AI-powered research capabilities, the quality and transparency of data sources, trusted analyst estimates, and availability of forward-looking metrics versus just historical price data.

AI-Powered Research Capabilities

Previously retail investors suffered from a lack of available stock data. But today, the opposite is true. You’ll have access to more data than you can process. Although it’s a catch 22. More data brings more analysis, more confusion. You don’t need just data, you need intelligent interpretation of that data. AI tools built into stock research apps can analyze earnings calls, summarize complex filings, compare stocks, analyze industries, and more.

Many stock analysis platforms today offer AI capabilities – however you should be wary because many do not disclose how or for what purpose this AI was actually created. They may be using AI chatbots such as chatGPT that are not explicitly created for investors. Such AI tools are prone to hallucinate and may not be connected to real-time Wall Street data. You need an AI stock research assistant connected to a reliable real-time data source, and that is trained specifically for investment research.

Quality and Transparency of Data Sources

Whether you’re utilizing AI stock analysis or not – the quality of data you have access to will heavily impact your investing success. Trading based on old signals or information is not an option. Unfortunately, many stock research apps do not disclose where they actually get their data. It could be hours or even days old by the time you view it on their platform. Seek a stock research app that clearly states their data provider, and uses a reputable source such as S&P Global Intelligence. For confident investing you need data that is accurate, comprehensive, and current.

Forward-Looking Metrics and Historical Context

Some platforms will provide deep historical price action data, but lack forward looking insights & estimates. While historical data and context is important, you need insights into future trajectory to build a winning portfolio. Seek a stock research platform that provides forward looking estimates to inform your decisions – forecasts should include metrics like valuation, revenue, EBIT, EPS, CAPEX, and other key indicators of future stock performance.

Gainify.io– The Best Stock Research App for AI-Powered Analysis

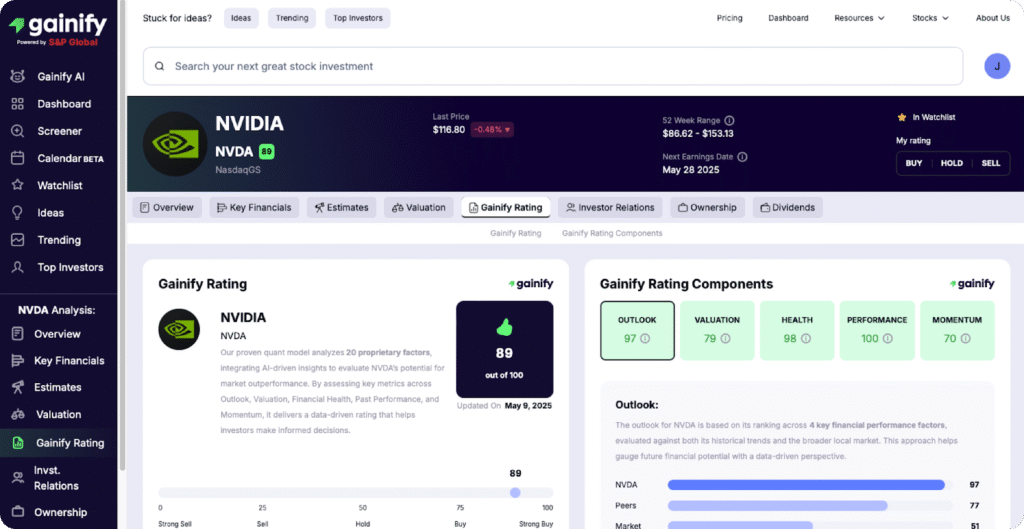

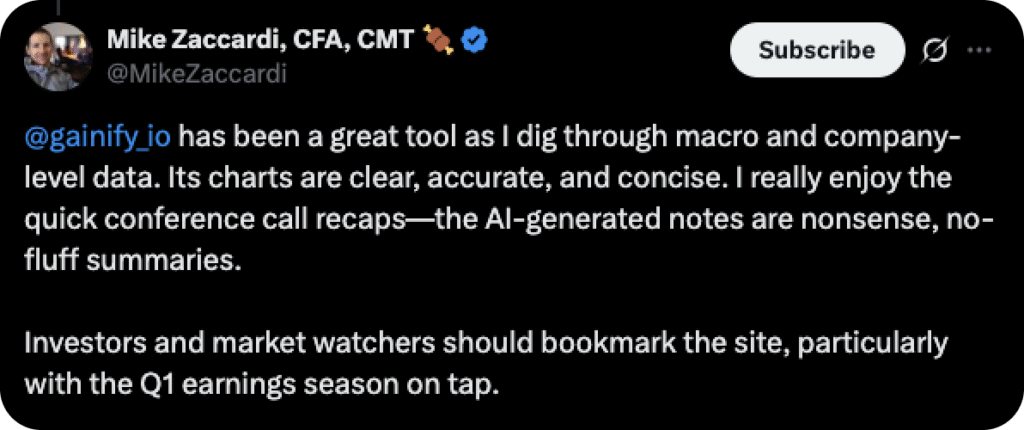

Gainify is the leading AI-powered stock research app available to retail investors in 2026. Unlike platforms that focus solely on technical analysis, it provides deep fundamental insights to help you find quality companies with confidence.

With Gainify you’ll have access to custom stock screeners with 1000+ filters, your own AI stock analysis assistant, the proprietary 5-point Gainify view, top investor & congress tracking, and more – all connected to premium real-time S&P Global Intelligence Wall Street data and the world’s largest database of analyst estimates for retail investors.

It doesn’t have a mobile app yet. But its website app is fully responsive – which means it will adjust to your specific device. You can access Gainify’s powerful stock research app on desktop, mobile, and tablet devices.

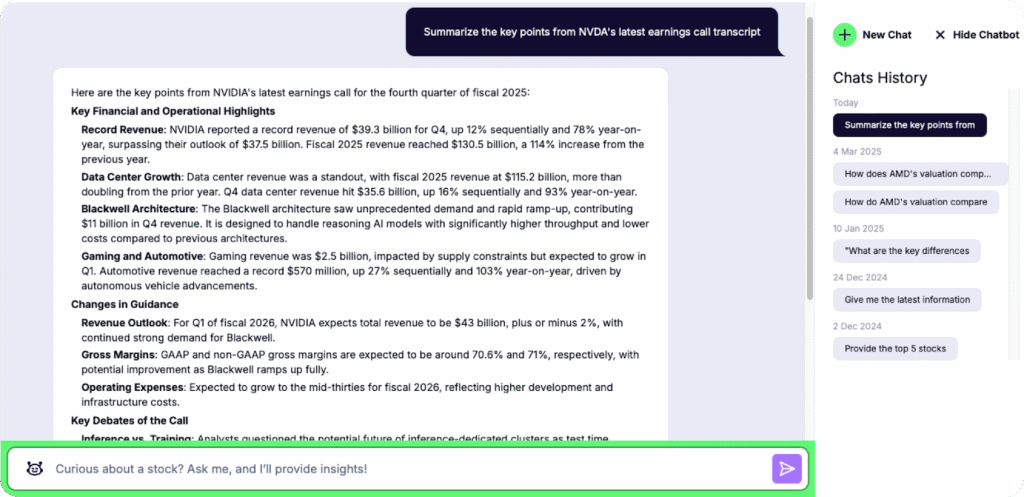

AI Stock Analysis Built for Investors

Gainify doesn’t give you a generic AI bot trained on years-old data. Gainify AI provides an AI stock analyst trained specifically for investing research, with access to real time Wall Street data.

Gainify’s AI assistant can:

- Answer your most important stock research questions

- Compare top competitors in an industry

- Uncover top dividend paying stocks

- Deep dive into individual stocks

- Summarize earnings calls

Some example questions you can ask Gainify AI include 1) Industry analysis: “Who are the top players in the semiconductor industry and which presents as the best investment right now?” 2) Stock deep dive: “What is the Gainify view on NVDA?” 3) Dividend hunting: “Which stocks offer the largest dividends right now?” 4) Fundamental analysis: “Explore Verizon’s fundamentals with a focus on EPS, revenue, and net income.” 5) Earnings call signals: “Analyze Apple’s latest earnings call for investing signals.”

You can trust Gainify AI for up to date information, critical investing insights, and comprehensive analysis. Try it free to uncover quality companies in minutes.

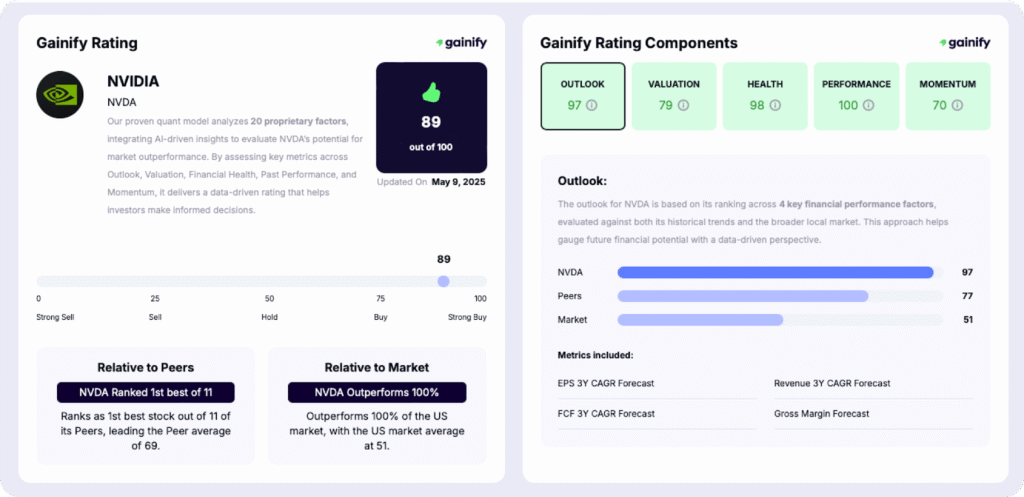

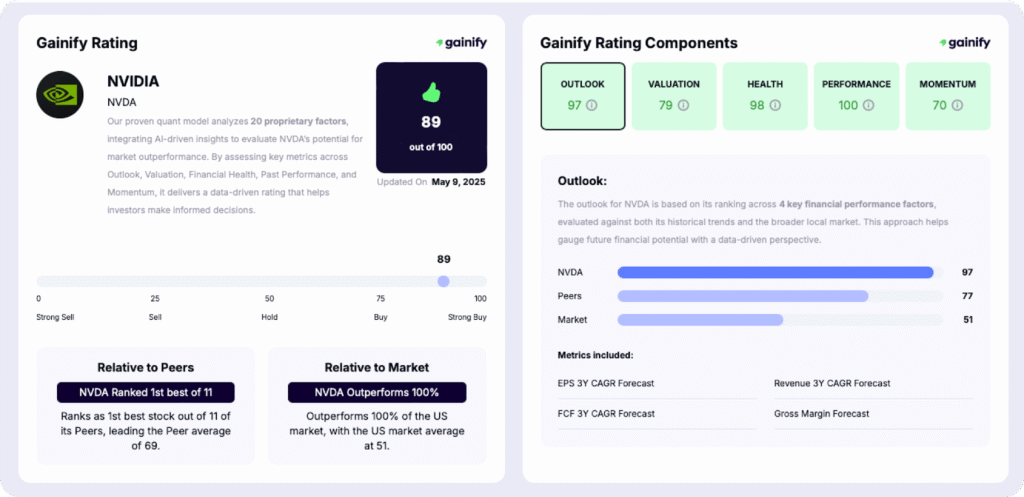

Proprietary Metrics and Scoring

One of your biggest advantages in the stock market will come from Gainify’s proprietary metrics – combined to form the Gainify Rating. Access a 5-point scoring system to quickly understand a stock’s overall attractiveness compared to both industry peers and the broader stock market.

Gainify’s proprietary 5-point metrics cover:

- Valuation: A stock’s current value analysed through metrics such as P/E, FCF yield, and dividend yield.

- Outlook: A company’s growth potential based on projected revenue and EPS growth versus peers.

- Health: An assessment of debt and liquidity metrics to uncover a stock’s financial stability.

- Performance: An analysis of management’s ability to deliver consistent future growth.

- Momentum: A stock’s current market strength assessed through price movement indicators.

The Gainify Rating will be a key tool in helping you uncover hidden investment opportunities, and giving you more confidence in your investment decisions.

You’ll also have access to forward-looking analyst estimates, giving you insights into how stocks are expected to perform on EPS, valuation, EBIT, revenue, net income, and more.

Top Investor and Congress Tracking

If you’re seeking trading inspiration there’s no better place to look than Gainify’s top investor & congress tracking. Comprehensive analysis of top investor’s portfolios and recent trading activity enables you to:

- Compare portfolios head-to-head: Compare investors’ portfolios to find top performers.

- Copy winning portfolios: Fork top investors’ strategies to your own watchlist with a single click.

- Track Congressional trading: See what those with unique stock information, market access, and insight are buying & selling.

Get alerts for every trade made by investing figures such as Warren Buffet (Berkshire Hathaway), Leon Cooperman (Omega Advisors), Chase Coleman (Tiger Global Management), Ray Dalio (Bridgewater Advisors), Stephen Mendel (Lone Pine Capital), James Simons (Renaissance Technologies), and more.

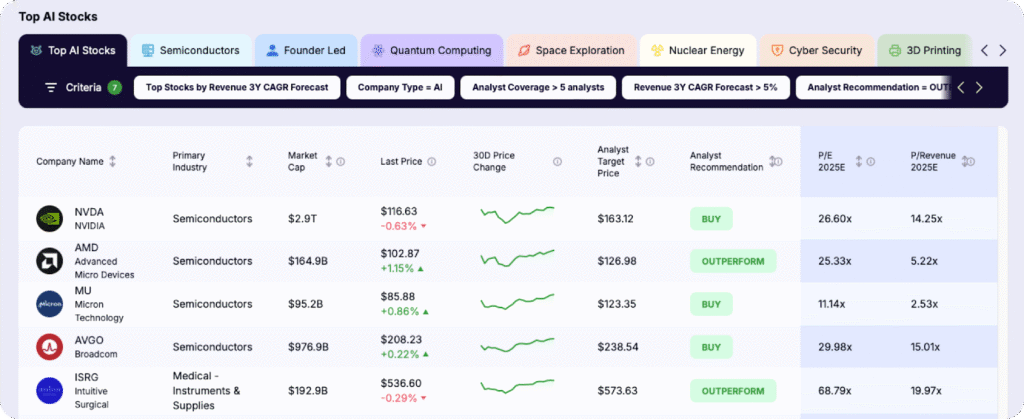

Smart Stock Screening

Within Gainify’s user-friendly and streamlined stock research app you’ll find two types of stock screeners. The first are pre-built screeners for stock ideas. The second are fully-customizable screeners covering a range of exchanges and industries.

- Pre-built “Ideas” screeners: Immediately discover stocks in key themes like AI, quantum computing, space exploration, cash cows, dividend champions, and value opportunities

- Custom stock screener: Build personalized screeners using over 1000+ filters across market data, fundamentals, forward estimates, and valuation multiples

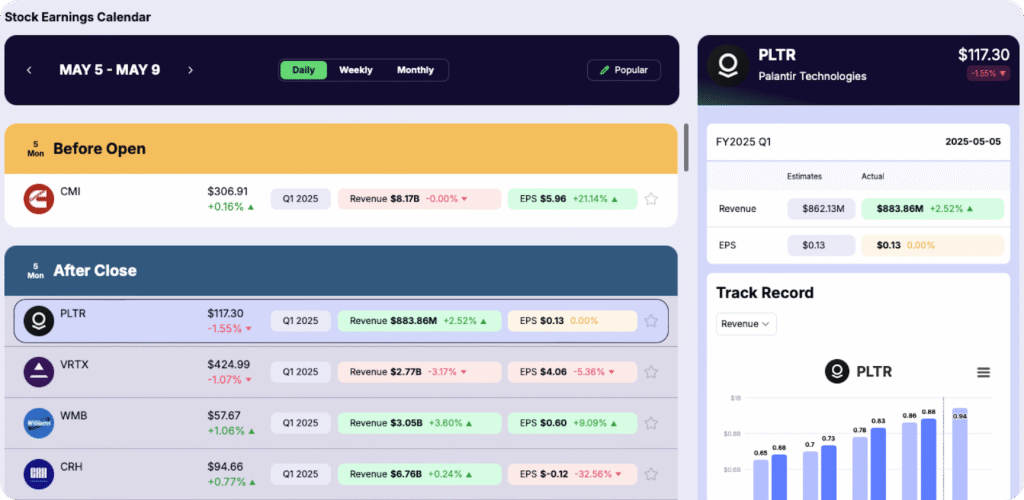

Earnings Calendar

Make earnings season actionable. Earnings announcements are some of the most critical moments for stock price movements. Gainify’s complete earnings intelligence system gives you comprehensive coverage of historical earnings call transcripts and upcoming earnings calls. You’ll gain historical context, insights into analyst expectations, and the ability to quickly identify growth or contraction indicators.

- AI summaries: A concise, AI-generated summary highlighting recent results, key themes, and what to watch next for each company.

- Custom filters: Filter earnings by market cap, trending tickers, or your own watchlist.

- Instant stock snapshots: Quickly view next earnings date, revenue & EPS track record, current quarter estimates, and estimate revisions for each ticker.

Plan your stock research around critical market events with an earnings calendar that organizes companies by reporting time (before open/after close) and date.

Use Gainify AI to analyze earnings call transcripts in-depth with queries like “What insights can we gain from Apple’s latest earnings call?” or “Analyze Tesla’s latest earnings call and highlight key strategic shifts in comparison to previous earnings call transcripts.”

Advantages

Gainify democratizes access to Wall Street data and advanced AI stock analysis built specifically for investors. Institutional-grade financial information is now at your fingertips in an intuitive stock research app.

✅ Comprehensive top investor and Congress tracking

✅ Intuitive interface with clear, actionable data visualizations

✅ AI-powered analysis connected to real-time S&P Global data

✅ Free access to core premium features including AI stock analysis

✅ S&P Global Market Intelligence as a transparent, trusted data source

✅ Expert-validated valuations with historical context and forward projections

Limitations

While Gainify offers comprehensive stock research capabilities, there is currently no direct broker integration for executing trades.

Pricing

Gainify stands out for offering exceptional value across all pricing tiers:

- Starter (FREE forever): Access all core features, 10 AI queries per month, 1 year of analyst estimates, and watchlist management. No credit card required.

- Investor Plan ($10.99/month or $7.99/month billed annually): Unlock the Gainify Rating, 50 AI queries/month, 3 years of analyst estimates, 10 years of forward valuation data, and priority support.

- Gainer Pro ($36.99/month or $26.99/month billed annually): Get 500 AI queries/month, 3 years of analyst estimates, 15 years of forward valuation data, and VIP priority support.

Yahoo Finance: The Popular Free Option with Premium Limitations

If you’re looking for a free source of comprehensive global stock data then Yahoo Finance may be suitable for you. It has a web app for desktop browsing, and mobile apps for iPhone & Android.

However, if your stock research process requires premium features like advanced charting, Morningstar estimates, and data export (up to 4 decades of stock data history) – a paid plan will be more suitable. You will gain some technical analysis & charting features (50+ technical patterns) that you won’t find on Gainify, which focuses more on fundamental analysis and uncovering a stock’s true intrinsic value.

For a more detailed comparison, read our complete Gainify vs Yahoo Finance analysis, where we break down the key differences.

One advantage of Yahoo Finance is that it provides data for not only stocks, but also ETFs, Crypto, Bonds, Mutual Funds, and more.

All in all, Yahoo Finance’s technical tools can help you with basic market tracking, but for AI-powered stock analysis, you’ll need to look elsewhere.

Key Features and Capabilities

- Real-time quotes and basic charting

- News aggregation and market updates

- Basic screeners and watchlists

- Premium tier offerings

Limitations Compared to Gainify

- Limited forward-looking data

- Basic AI capabilities

- Paywalled advanced features

- Ad-heavy experience on free tier

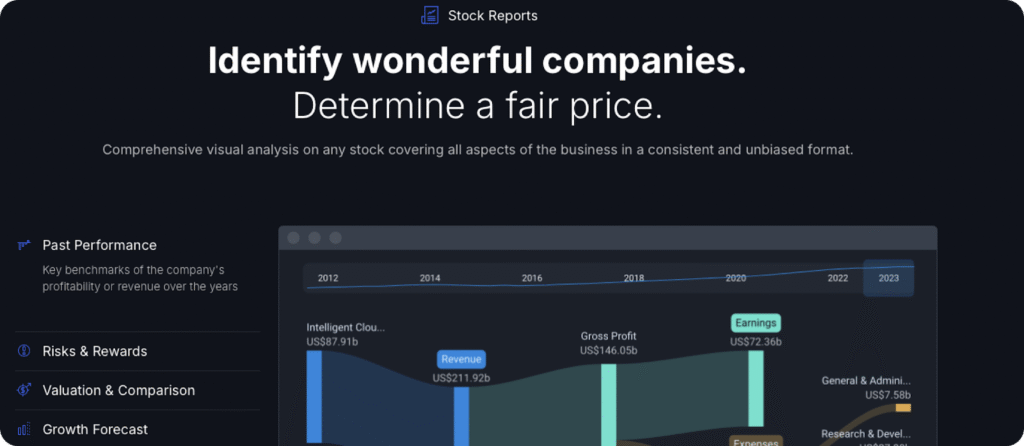

Simply Wall St: The Visual Fundamental Analysis Platform

Simply Wall St is one of the top stock research apps for retail investors. It will cover most of your fundamental stock analysis needs. Even providing a proprietary snowflake analysis to quickly understand a stock’s strengths and weaknesses.

In many ways, Simply Wall St and Gainify are very similar. Both focus on fundamental analysis and help you uncover a stock’s intrinsic value.

However, besides Gainify’s advantage in proprietary metrics, there are some key differences in how each platform approaches fundamental analysis. Our in-depth Gainify vs Simply Wall St comparison explores in more detail.

Unfortunately, you won’t be able to analyze stocks at scale, conduct competitor comparisons or stock deep dives, and gain quick insights using AI stock analysis – because unlike Gainify, Simply Wall St does not yet offer AI tools to enhance your stock research processes.

If you want to understand metrics like P/E ratio and PEG ratio, Simply Wall St’s visual tools can help. But if you’re an investor with time constraints due to work, study, or family – you will want access to quick AI insights you can trust, rather than analyzing stocks manually yourself.

One advantage of Simply Wall St is that you will be able to access brokerage sync (paid plans only). However, unfortunately paid plans are only available on an annual basis (no option to pay monthly) so it can be quite expensive upfront.

In addition to Simply Wall St’s desktop app, you will have access to mobile apps for iPhone and Android, as well as a Chrome extension.

The Chrome extension makes it easy to get stock information for the companies you are reading about in the news, on platforms like Bloomberg for example. However, it’s only available for US, UK and AU primary markets at the moment.

Key Features and Strengths

- Visual representation of fundamental data

- Management and insider transaction tracking

- Broker account integration

- Global market coverage

Drawbacks Compared to Gainify

- Annual-only subscription model

- Limited AI capabilities

- Lack of forward-looking valuation tools

- Gap in top investor tracking

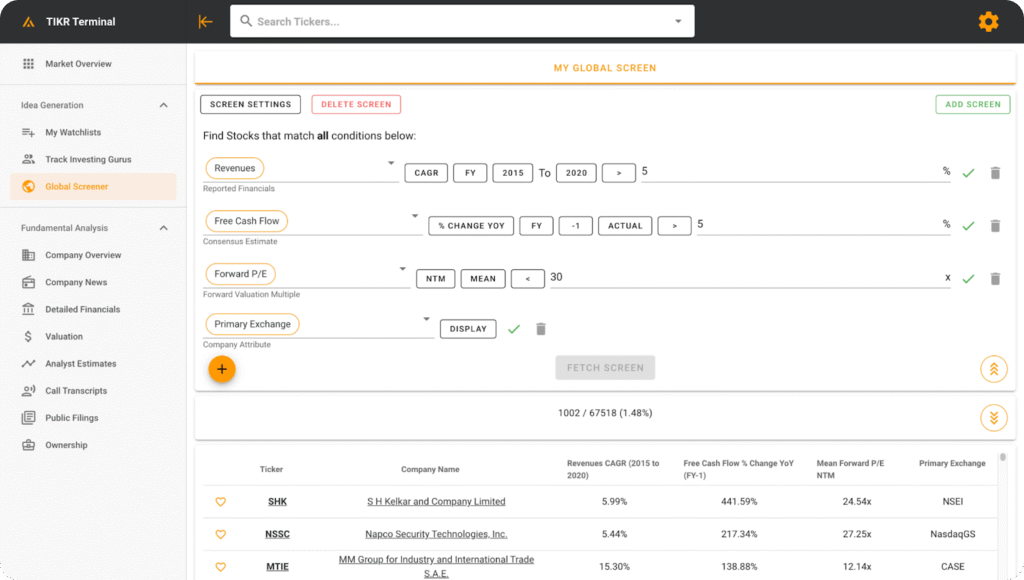

TIKR: The Bloomberg-Style Terminal for Retail Investors

For those transitioning from institutional-tier platforms like FactSet or Capital IQ, TIKR may be a suitable stock research app for retail investor trading.

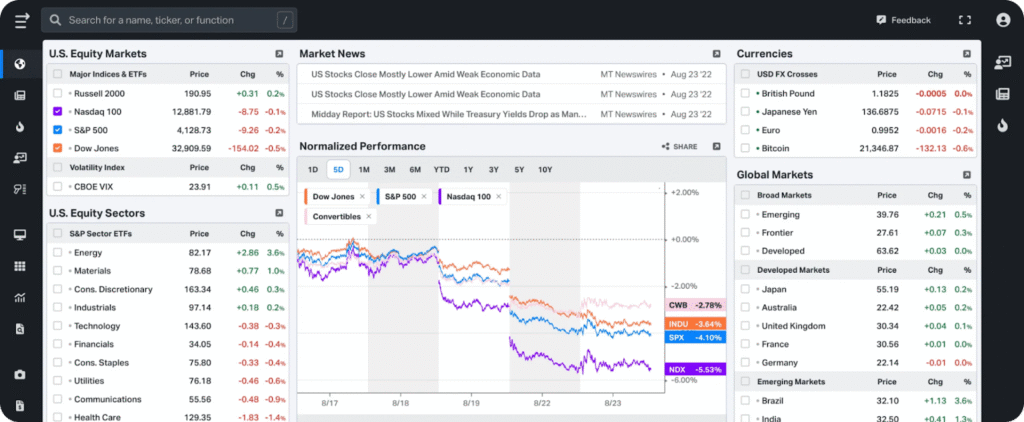

It offers institutional-grade data from S&P Global Intelligence, just like Gainify and Simply Wall St. However, data is presented in a less visual manner (no intuitive charts and graphs). Instead, TIKR replicates the terminal style interface provided by platforms like Bloomberg. For this reason you may find the TIKR platform “data heavy”.

A terminal style interface that requires reading lots of raw text and numbers combined with the lack of AI-powered analysis means your research process on TIKR will likely be slow. What can be done in a few minutes with Gainify AI could take up to 15x longer on TIKR.

If you’re considering TIKR as your stock research app of choice, read our best TIKR alternatives guide first, which compares several similar platforms.

Key Features and Capabilities

- Global stock coverage across multiple exchanges

- Financial data depth and historical context

- Reuters news integration

- Institutional holdings tracking

Shortcomings Compared to Gainify

- Text-heavy, complex interface

- Limited visualization capabilities

- Lack of AI-powered research tools

- More suited for experienced investors

Fiscal.ai: The KPI and Segment Data Specialist

Fiscal.ai – backed by S&P Global Intelligence data – may be the closest analog to Gainify available on the market today. It focuses on fundamental analysis (rather than technical analysis and charting), and also has an AI assistant.

While it lacks Gainify’s proprietary 5-point stock evaluation system, covering a stock’s outlook, health, valuation, performance, and momentum – you will find unique KPI & segment data (unique to Fiscal.ai).

These company-specific business metrics provide much deeper insights than traditional financial websites – covering KPIs such as subscriber numbers, transaction volumes, customer numbers, renewal rates. Segments break down revenue by key groups like geography and business vertical.

You can’t get segment & KPI data for all global stocks, but you’ll find this information for the entire S&P 500 and around 1500+ other companies. This data will help you directly compare competitors at a granular level – like analyzing subscriber numbers for key movie streaming platforms to compare growth in customer count.

If you’re interested in a deeper Fiscal.ai analysis & competitor comparison – view our best Fiscal.ai alternatives guide.

Standout Features and Strengths

- Granular KPI and segment data

- Company-specific business metrics

- AI copilot for market research

- Developer API access

Limitations When Compared to Gainify

- Feature restrictions on lower pricing tiers

- More complex learning curve

- Limited mobile functionality

- Less robust investor tracking capabilities

Koyfin: The All-Purpose Research Swiss Army Knife

Koyfin’s standout feature is its multi-asset class coverage. You’ll be able to research not only stocks, but also bonds, ETFs, commodities, and currencies.

If your stock research process combines both fundamental and technical analysis (charting and finding patterns) – Koyfin offers tools for each strategy.

The Koyfin app interface is similar to the terminal style of TIKR, but with more graphs and charting options. A middle ground between a pure terminal style interface and the intuitive charts and graphs provided by Gainify and Simply Wall St.

Key Features and Capabilities

- Customizable dashboards and data visualization

- Multi-asset coverage (stocks, bonds, ETFs, etc.)

- Macro economic data integration

- Advisor-specific tools and portfolio management

Drawbacks Compared to Gainify

- Steeper learning curve

- Higher pricing tiers

- Limited AI capabilities

- Complex interface for beginners

Finviz: The Technical Analysis and Visualization Platform

Finviz excels at technical pattern recognition and visual market mapping. One limitation to note, however, is Finviz’s focus on US markets. If you’re seeking global stock data – like that provided by Gainify, Simply Wall St., and Fiscal.ai – then you will need to look elsewhere.

The platform’s greatest limitation though, is its lack of AI analysis tools. FinViz is one of the more visually challenging stock research apps. It’s full of text and numbers, and gaining valuable insights can be difficult. Not being able to have AI parse all this complex data will make your stock research process time consuming and tiresome.

But FinViz is not without its strengths. If advanced technical charting or the ability to backtest strategies are important to you – then FinViz will satisfy your needs better than any other platform in this article.

For a deeper look into FinViz and its capabilities, see our detailed Gainify vs Finviz comparison.

Key Features and Strengths

- Stock screener with technical indicators

- Visual market maps and sector performance

- Technical charting capabilities

- Insider trading information

Shortcomings When Compared to Gainify

- Limited fundamental analysis tools

- Lack of AI-powered insights

- US market focus

- Less robust forward-looking data

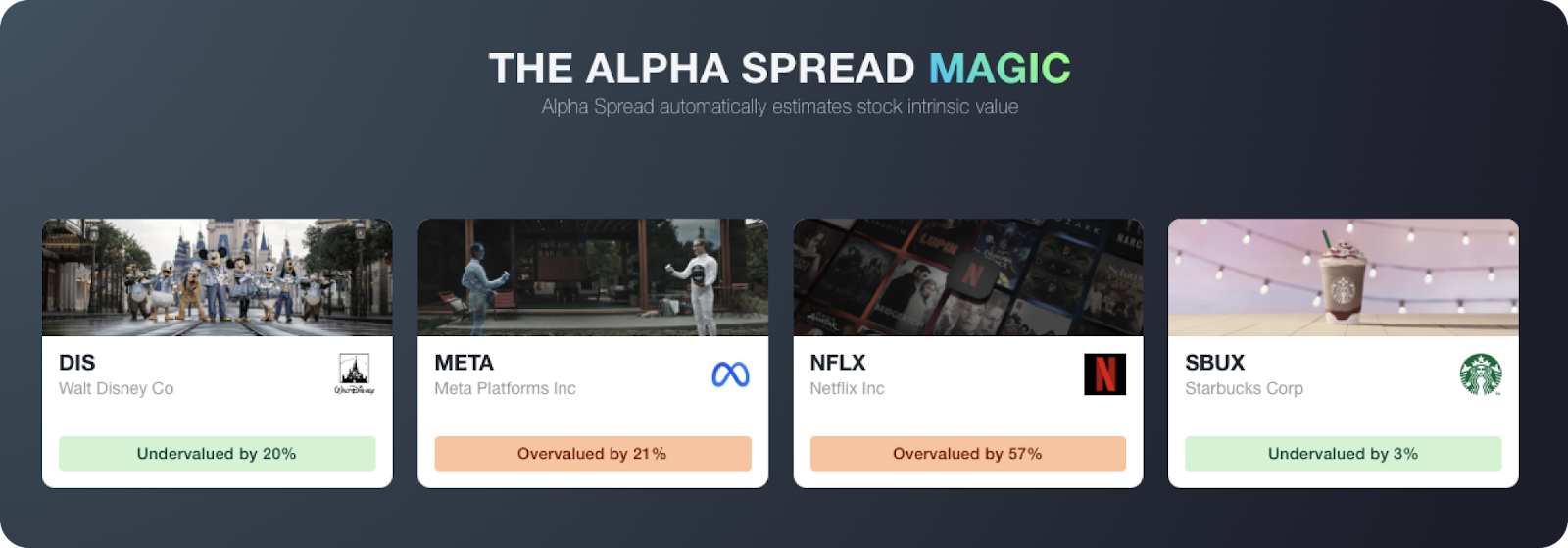

Alpha Spread: The Value Investor’s Tool

AlphaSpread stands out for its strong focus on value investing principles. While the app does not have proprietary metrics like Gainify or segment and KPI data like Fiscal.ai – Alpha Spread does you pre-built value investing-focused screeners like “sensibly priced quality”, “significantly undervalued”, “magic formula” (created by value investor Joel Greenblatt), and more.

In addition to a range of intuitive graphs and charts – similar to those offered by Gainify and Simply Wall St. – you’ll be able to view a stock’s economic moat analysis, latest insider transactions, and earnings call summaries.

Like Gainify and Fiscal.ai, Alpha Spread also has an AI chatbot to speed up your stock research process.

Unfortunately though, Alpha Spread does not disclose its data source, and it’s not apparent if data provided is real time or not. Gainify on the other hand explicitly uses S&P Global Intelligence data – the gold standard for Wall Street-grade stock research apps – so you know you can trust insights from the platform and its AI tools.

For a full analysis of similar platforms, read our Alpha Spread alternatives guide comparing options for value investors.

Key Features and Strengths

- Pre-built value investing screeners

- Bull and bear case analysis

- Economic moat evaluation

- AI chatbot for investment research

Limitations Compared to Gainify

- Uncertainty about data sources

- Limited stock coverage

- Restrictive free plan

- Fewer proprietary metrics

Magnifi: AI Investment Planner

Designed to help you find stocks and manage your entire portfolio, Magnifi is your AI-powered investment companion. It creates personalized investment plans based on specific goals like retirement, home purchase, college savings, or emergency funds.

You’ll be able to ask Magnifi questions about investments, analyze your current holdings, and compare stocks side-by-side.

But Magnifi’s standout feature is that unlike most research platforms that stop at analysis, it enables you to execute commission-free trades directly within the app.

Connect multiple brokerage accounts including Robinhood, E*TRADE, and Schwab to gain insights across all your holdings.

If you’re seeking a platform that combines basic research with portfolio management and trade execution, Magnifi may be worth exploring.

Key Features and Strengths

- Conversational AI interface for investment questions

- Multi-broker account integration

- Commission-free trading capabilities

- Goal-based investment planning

- Portfolio analysis and monitoring

Shortcomings Compared to Gainify

- Moderate AI capabilities focused more on basic queries than deep analysis

- Data source transparency is limited

- Less comprehensive fundamental analysis tools

- More focused on portfolio management than in-depth research

Final Thoughts: Choosing the Right Stock Research App for You

Investors today have access to more powerful tools than ever before. Democratization of Wall Street data combined with breakthrough AI for stock analysis, has fundamentally transformed how you as a retail investor can find quality companies to invest in.

The best stock research app isn’t necessarily the one with the most bells and whistles. Different investors may prioritize features differently based on their goals, whether it’s tracking dividend stocks or growth opportunities. Your investment strategy – whether long-term or short-term– should guide your choice.

- Technical traders and chartists require advanced charting, pattern recognition, technical indicators, real-time data, and historical price analysis. If this is you, Finviz, and Yahoo Finance Premium will be compelling options.

- Long-term fundamental investors should seek forward analyst estimates, historical financial trends, competitive analysis, and a focus on intrinsic value. Gainify, Simply Wall St, and Alpha Spread are all suitable if this is your investment style.

- Growth stock hunters need pre-built or custom screeners designed to uncover breakout growth stocks. Gainify, with its screening capabilities and proprietary metrics which show how likely a stock is to continue its growth trend, is your best option here.

On top of finding a platform that fits your strategy, you should seek one that cuts your research time, and brings hard-to-uncover insights to the surface effortlessly. You don’t want to be switching between tabs, reading and comparing loads of text data. You need intuitive charts and graphs that condense complex information into actionable insights, and AI stock analysis tools to do the heavy lifting for you.

For this reason, while different platforms excel in specific niches, Gainify stands out as the best overall stock research app for retail investors in 2026, with its clean interfaces, top investor tracking, pre-built & customizable screeners, and AI assistance.

It combines the best aspects of alternative stock research apps while adding unique capabilities that aren’t available elsewhere.

You’ll avoid complex terminal-style interfaces, overwhelming data displays, and high subscription costs. Gainify’s free tier offers access to all features, including:

- Forward-looking analyst estimates

- AI stock analysis assistant

- Pre-built stock screeners

- Gainify proprietary rating

- Customizable screeners

- Top investor tracking

- Earnings calendar

However, if you are a technical trader and require advanced charting capabilities, Finviz, and Yahoo Finance Premium may be your best options. For multi-asset class coverage, you should try Koyfin or Yahoo Finance.

Try Gainify Free Today

With no financial commitment required, Gainify’s free tier offers the perfect opportunity to experience institutional-grade research tools enhanced by AI:

- Create a free account to access all core features including AI analysis

- Build your first watchlist to track stocks that interest you

- Explore the Ideas section to discover thematic investment opportunities

- Ask the AI assistant your most pressing investment questions

- Track top investor moves to see what the professionals are buying and selling

By starting with Gainify’s free tier, you can immediately elevate your research process and make more confident investment decisions

FAQs About Stock Research Platforms

What is the best free stock research app in 2026?

Gainify offers the most comprehensive free plan, providing access to core premium features including AI analysis, top investor tracking, and analyst estimates with no credit card required. Yahoo Finance also offers a solid free option with real-time quotes, basic charting, and news aggregation, though advanced features are paywalled.

How do AI-powered stock research apps work?

AI-powered stock research apps like Gainify connect specialized AI models to real-time financial data sources. These systems analyze earnings transcripts, financial statements, analyst estimates, news, and market trends to provide instant insights, answer specific investment questions, and identify patterns that might be missed in manual research. The best AI tools are specifically trained on financial data rather than using general-purpose models.

Are paid stock research platforms worth the investment?

Yes, paid stock research platforms are worth the investment for serious investors. Premium services provide access to deeper analyst estimates, forward-looking data, proprietary metrics, and advanced AI capabilities that can significantly improve decision-making. The value comes from time saved on research and potential improvements in investment returns. Many platforms offer tiered pricing to match different investor needs and budgets.

Which stock research app has the most accurate analyst estimates?

Gainify offers the most comprehensive and transparent analyst estimate database available to retail investors, pulling data directly from S&P Global Intelligence. The platform shows historical accuracy of previous estimates versus actual results, giving crucial context for evaluating current projections. Other platforms with strong analyst coverage include TIKR and FactSet, though the latter comes at institutional-level pricing.

How do I choose between technical and fundamental analysis platforms?

Your investment timeframe and strategy should guide this choice. For long-term investors focused on company value and growth, fundamental analysis platforms like Gainify provide deeper insights into financial health and future potential. Short-term traders may prefer technical platforms like TradingView with advanced charting tools. Many investors use both types, with a fundamental platform for stock selection and a technical platform for timing entry/exit points.

What features should beginners look for in a stock research app?

Beginners should prioritize platforms with intuitive interfaces, educational resources, pre-built screeners, and clear visualizations. Look for tools that explain financial metrics directly in the interface (like hover tooltips), offer AI assistance for answering questions, and provide pre-built stock ideas rather than overwhelming with complex customization options. Gainify’s clean interface and AI assistant make it particularly beginner-friendly while still offering advanced capabilities.

Can stock research apps help with international investing?

Yes, several platforms offer robust international coverage. Gainify covers 30+ global exchanges, Simply Wall St provides data on 120,000+ stocks across 90 global markets, and TIKR covers 100,000+ stocks across 92 countries. When investing internationally, look for platforms that provide local market context, currency conversion tools, and region-specific metrics to account for different reporting standards.

How much do professional-grade stock research platforms cost?

Professional-grade platforms vary widely in price. Institutional platforms like Bloomberg Terminal ($32,000/year), FactSet ($45,000/year), and S&P Capital IQ (~$16,000+/year) are beyond most individual investors’ budgets. Retail-focused platforms with professional features range from Gainify ($7.99-$26.99/month), Koyfin ($49-$199/month), and TIKR ($14.95-$39.95/month), making institutional-quality research much more accessible.

Are mobile stock research apps as powerful as desktop versions?

Most leading stock research platforms offer responsive web applications rather than dedicated mobile apps. These web apps adapt to different screen sizes but may offer slightly different experiences between desktop and mobile. Complex tasks like custom screening and detailed chart analysis often work better on desktop, while monitoring portfolios, checking alerts, and reading news are well-suited for mobile. Gainify’s clean interface works well across both environments.

Which stock research app is best for tracking insider trading?

Gainify offers the most comprehensive and user-friendly tracking of both insider trades and Congressional trading activity, with real-time alerts, portfolio comparisons, and the ability to replicate trades to your own watchlist. FinViz also provides insider transaction data with visualization tools, while GuruFocus offers detailed insider tracking but at a higher price point.