Today’s stock market is difficult to follow even for the professional investor. If you’re a retail investor, even harder. The limited time you have to research stocks is in a constant struggle with endless news (and rumors), streams of stock price and economic data, changing geopolitical factors, and more.

If you want to stay informed and make confident investment decisions in the information age, you need a strong investing-specific AI tool to help you. With the right AI stock analysis chatbot you’ll be able to analyze securities, understand market trends, identify opportunities, and make investment decisions in minutes rather than hours.

But which platforms deliver the most value in 2026’s complex stock market?

Top platforms today include Gainify and Fiscal.ai (formerly FinChat) – both utilizing investing-specific AI connected to real-time Wall Street data from gold standard provider S&P Global Intelligence. A combination that gives you AI insights you can trust for more confident investing.

Other platforms like GuruFocus, Magnifi, TradeUI, Alpha Spread, and HoopsAI – while providing AI tools – are not clear on whether the systems they give you access to are general purpose or investing-specific AI. They also are not clear about where they obtain their stock data from or how up to date it is.

In this guide, we’ll explore the evolution of AI for investing, reveal the AI capabilities of today’s top stock research platforms, and give you practical guidance on how to integrate AI-driven stock analysis tools into your research process.

The Evolution of AI Tools for Investing: Rule-Based Systems to Generative Intelligence

In the early 1970’s rule-based systems emerged as the first attempt to automate routine aspects of stock trading. “If-then” style logic operated on predefined conditions like price thresholds or moving averages to provide trading signals. While such systems are rudimentary by today’s standards, they represented the first step toward computational finance.

By the late 1980s and into the early 1990s, mathematicians had systematised quantitative trading. Algorithmic approaches were proven by the likes of James Simons (Renaissance Technologies), opening up the floodgates on what would be a race for more sophisticated, accurate, and computationally intensive solutions.

High frequency trading firms emerged in the early 2000s, boasting algorithms capable of executing thousands of trades per second. The race for bigger, faster, more intelligent HFT systems continued, boosted further by the emergence of Natural Language Processing systems which enabled analysis of news articles, earnings call transcripts, social media posts, and more.

But these capabilities were reserved for those trading professionally. Wall Street analysts and traders backed by big institutional budgets. Retail traders were left behind and comparatively in the dark.

Since the release of ChatGPT and other large language models (LLMs) that has all changed. Innovators and investors alike rushed to build AI chatbots and stock analysis tools to satisfy the stock research needs of retail investors.

Today, you can find free stock research platforms enable you to:

- Translate complex market dynamics into actionable insights

- Analyse earnings calls for investing insights

- Compare top industry players head to head

- Generate comprehensive research reports

- Uncover dividend opportunities

However, AI systems such as stock analysis chatbots are only as good as the data they are connected to or trained on. You can’t trust just any AI tool with your stock research. Early iterations of ChatGPT were trained on data up to several years old (and were prone to hallucination, which in simple terms means they often made things up).

When choosing an AI stock analysis tool, look for an AI system that is:

- Built by investors and trained specifically for stock research

- Connected to real time Wall Street data from a reliable source

In this article we’ll help you find an AI tool that is both built specifically for investors and backed by real time institutional-grade stock data.

1. Gainify.io: The Breakthrough Platform Democratizing Wall Street Data

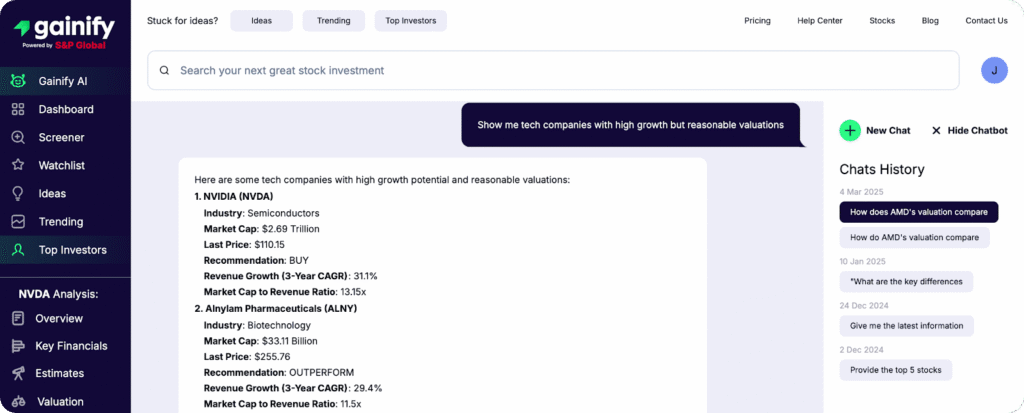

Gainify is built by investors, for investors – with an Ex Citi Analyst and M&A specialist at the helm as Chief Product Officer. Its AI powered stock research assistant and earnings call analysis tool are trained and designed to give you maximum insight for confident investing. All AI features are connected to real time Wall Street data from gold-standard stock data provider S&P Global Intelligence.

With Gainify AI you’ll be able to:

- Analyse stocks: Get investing insights you can rely on whether you’re seeking to deep dive into an individual stock, compare competitors, or create industry reports.

- Summarize earnings calls: Save hours of manual research by summarizing earnings calls to uncover key strategic insights, performance indicators, and forward guidance. Earnings calls often hold insights critical for a stock’s future trajectory.

- Access analyst estimates: Gainify AI can give you insights from the world’s largest database of analyst estimates for retail investors. This includes historical context (how estimates have evolved in the past) and 3-year forward projections for key metrics like EPS, revenue, and EBITDA.

- Access Gainify’s proprietary metrics: Unique composite indicators focus on uncovering a stock’s future value. Gain unprecedented insights into a stock’s Performance, Momentum, Valuation, Outlook, and Health.

All Gainify AI features are available to free users. Paid plans can be purchased to increase usage of Gainify’s investor specific AI chatbot to 500 monthly queries for just $26.99/mo – more than enough to dominate a specific industry or investment strategy.

Try it out for yourself – sign up for a free plan now and ask Gainify AI:

- Company deep dive: “What is Gainify’s view on Microsoft? Break down its growth drivers, competitive position, and valuation compared to peers.”

- Sector analysis: “Which AI stocks have the strongest balance sheets and most reasonable valuations?

- Valuation and proprietary Gainify metrics: What is NVIDIA’s current Performance, Momentum, Valuation, Outlook, and Health ratings?

- Dividend hunting: “Which stocks have the strongest dividend yields in the healthcare sector.”

- Head to head comparison: “Compare Visa and Mastercard head-to-head.”

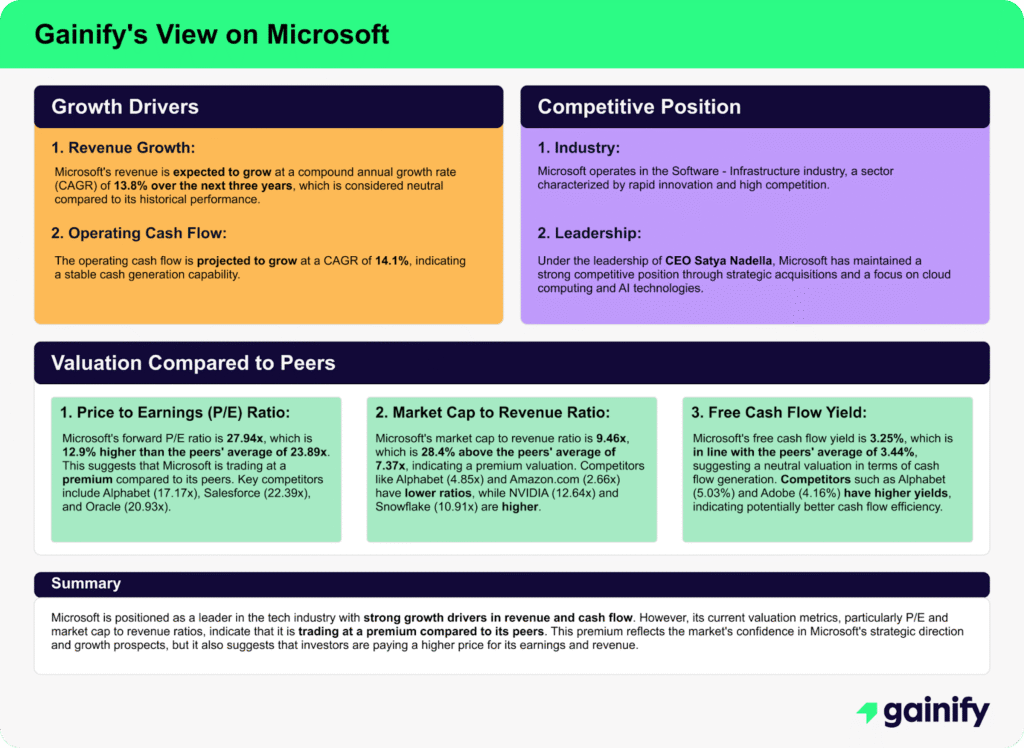

See an example below showing a company deep dive on Microsoft using Gainify AI. Gainify identified that Microsoft was trading at a premium to peers, but still expected to grow at a strong compound annual growth rate – suggesting investors may feel confident in Microsoft’s long term strategy and trajectory.

Other tools you will find within Gainify’s breakthrough stock research platform are top investor tracking (Wall Street’s biggest names and Congress insiders), customizable stock screeners with hundreds of filters, pre-built strategy screeners for instant insights, a dedicated earnings calendar, and more.

Strength of AI capabilities

Strong. Gainify leads the way in purpose built AI stock research tools for retail investors.

Data source

S&P Global Intelligence real time stock market data for the world’s top 33,000 stocks.

Pricing

Gainify offers three pricing tiers for you to choose from based on how often you want to research and trade.

- Starter (FREE): Full access to all core features with 10 AI queries/month, 1 year of analyst estimates history, and 1 year of forward valuation data.

- Investor ($10.99/month or $7.99/month annually): Includes the Gainify Rating, 50 AI queries/month, 3 years of analyst estimates, and 10 years of historical data.

- Gainer Pro ($36.99/month or $26.99/month annually): Provides 500 AI queries/month, comprehensive Gainify Rating, 3 years of forward estimates, and 15 years of historical data.

2. Magnifi: The Conversational AI Investment Assistant

Magnifi’s AI tools are built to help you find stocks to invest in and manage your portfolio. You can interact with Magnifi to ask investment questions, analyze your portfolio, compare stocks, and make buy/sell orders.

It can help you create personalized investing plans based on specific goals such as retirement, buying a house, saving for college, or building an emergency fund for a rainy day.

You can connect multiple brokerage accounts (including Robinhood, E*TRADE, and Schwab) to gain insights across all your holdings. You’ll also be able to execute trades from within the platform, without commission fees.

Recommendations made by Magnifi are tailored to your preferences, risk tolerance, and investing style.

Strength of AI capabilities

Moderate. Magnifi does have some AI query capabilities that will answer your important investing questions.

Data source

Unknown.

Pricing

Try the platform out with a limited free trial (credit card required), or pay up to $168 per year for continued access.

3. TradeUI: AI-Powered Trading Signals and Technical Analysis

If you’re an active trader seeking shorter term strategies to make a quick profit and move on to the next stock, then TradingUI might suit your investment style.

TradeUI’s AI is capable of:

- Recognizing technical analysis patterns

- Defining potential entry/exit points

- Generating short term price predictions

As you can see, it’s most suitable for investors who align with day trading or swing trading strategies.

Strength of AI capabilities

Moderate. While TradeUI has some AI technical analysis & sentiment analysis capabilities, it lacks broader AI features that enable you to customize your stock research.

❌ No AI chatbot

❌ No AI industry analysis

❌ No AI competitor comparisons

Data source

Unknown.

Pricing

You’ll be able to test the platform free for two weeks, but continued access and pro features will cost you up to $115/month, making TradeUI one of the more expensive stock research tools in this comparison.

4. HoopsAI: AI-Generated Investment Ideas and Screening

When you sign up for HoopsAI, you’ll be asked about your risk tolerance, investment horizon, financial proficiency, and asset classes & industries of interest. HoopsAI uses this information to provide tailored investment suggestions. However, you may find, as we did, that suggested stocks often fall outside your industry of interest.

Once you’ve fund a stock you are interested in, HoopsAI uses AI to generate an overview containing information about:

- Performance streak

- Balance sheet

- Key ratios

- Dividends

- Earnings

There are some pre-built strategies available to get you started, and you can filter these by risk level, investment horizon, and returns.

Strength of AI capabilities

Low. While HoopsAI seems to generate an AI summary for each stock, there is no AI chatbot that enables you to conduct deeper analysis.

❌ No AI chatbot

❌ No AI industry analysis

❌ No AI competitor comparisons

Data source

Unknown.

Pricing

HoopsAI seems to be in an open beta phase. There are no paid plan options available, but you can access the platform and most of its features for free (the broker integration feature seems to still be in development).

5. Fiscal.ai (formerly FinChat): The KPI and Segment Data Specialist

Fiscal.ai, like Gainify, is connected to S&P Global Intelligence data. So you can trust that the insights you’re getting are based on comprehensive stock data from one of the industry’s most reputable sources.

You’ll be able to query Fiscal.ai AI assistant in very much the same way as you can with Gainify AI. As a welcome surprise, Fiscal.ai will include charts and embed earnings calls in the output, making for an interactive chat experience.

You may also find that Fiscal.ai has more granular data – especially when it comes to segments and KPIs. This means that if you ask about Microsoft’s revenue data, instead of getting revenue for the company as a whole, Fiscal.ai will actually show you how each main business unit contributed to Microsoft’s overall revenue (I.e. Azure, Gaming, LinkedIn, Dynamics 365, etc.)

Fiscal.ai copilot also links to sources within its chat, so you can see exactly where an insight came from.

Strength of AI capabilities

Strong. Its AI chatbot answers your important investing questions and can include embedded interactive elements or charts.

Data source

S&P Global Intelligence.

Pricing

Fiscal.ai free tier gives you access to 5 years of financial data and 2 years of Segments & KPIs. Deeper data history is available on paid plans, which cost up to $79/month.

6. Alpha Spread: Useful Tools for Value Investors

Alpha Spread is purpose built to support value investors. If uncovering intrinsic value and replicating the investment strategies utilized by the likes of Warren Buffett and Ray Dalio is your goal, then Alpha Spread will be a welcome addition to your stock research process.

With Alpha Spread you’ll be able to:

- View the bull and bear case for a stock to gain contrasting perspectives

- Access pre-built value screeners for “Sensibly Priced Quality”, “Significantly Undervalued”, and more

- Utilize intrinsic value calculations with automated DCF (Discounted Cash Flow) valuation and relative valuation models

Alpha Spread’s AI capabilities include AI summaries and competitor comparisons (including handy comparison tables), with the inclusion of useful charts within the AI chatbot’s output to help you visualise key metrics.

The chatbot also provides contextual next question suggestions to help you quickly deep dive into a specific aspect or explore new angles. Fiscal.ai also provides next question suggestions but we found these to lack context – they were generic and not relevant to the specific chat topic.

For example, in a chat about Microsoft’s performance Alpha Spread’s AI chatbot suggested our next follow up question should be “What is Microsoft’s competitive advantage over its rivals?”, whereas Fiscal.ai suggested questions like “What is fundamental analysis?”.

Strength of AI capabilities

Strong. Its AI chatbot provides comprehensive answers, includes charts, and provides contextual suggestions for the next question(s) you may wish to ask.

Data source

Unknown. Unlike platforms like Gainify that clearly specify S&P Global Intelligence as their data provider, AlphaSpread doesn’t explicitly state its data sources.

Pricing

There is a free plan available that limits you to researching 3 stocks per week. A paid plan will cost you $20/mo.

7. GuruFocus: The Guru-Tracking Value Platform

Like AlphaSpread, GuruFocus has a strong emphasis on value investing. It does have a lot more features than AlphaSpread though, including: top investor tracking (especially value investors), screeners, insider trade tracking, and an excel spreadsheet plugin for custom analysis.

You can ask GuruFocus’ AI to:

- Teach you how to use GuruFocus tools like the excel spreadsheet add-on

- Create stock screeners for you and list stocks meeting specific criteria

- Reveal the sector allocations of top investor’s portfolios

- Deep dive into a specific stock’s valuation and outlook

If you request a list of stocks (via a stock screener) or portfolio sector allocations, GuruFocus’ AI will format the output in a neat and easy to read table. Embedded stock screener results are even interactive, enabling you to refine your criteria via an in-chat widget.

Strength of AI capabilities

Strong. Its AI chatbot provides comprehensive answers, includes charts, and provides contextual suggestions for the next question(s) you may wish to ask.

Data source

Unknown. GuruFocus does not state explicitly where it gets data. The platform does however serve as a data provider itself, meaning GuruFocus sells access to its data via API.

Pricing

GuruFocus is the most expensive platform in this comparison. Basic access to US stock data can be had for as $199/year. However, global stock data could cost you as much as $5,120/year (you need to pay more for each additional region).

Which AI Investing Tool Is Right for You?

Some stock research platforms may boast about their AI tool performing well on benchmark tests. Such tests are designed to make direct comparison between AI chatbots easier. However, performing well on a benchmark (which runs a limited range of specified tests) doesn’t ensure that an AI chatbot will satisfy your specific investment research process.

When evaluating platform responses to these queries, consider these key dimensions:

- Response relevance: Does the platform directly address your specific question asked?

- Information depth: Does it provide you with detailed, substantive insights beyond surface-level information?

- Data transparency: Does it clarify the sources of its information?

- Personalization quality: How well does it adapt to your preferences and constraints?

- Actionability: Are the insights concrete enough to inform specific investment decisions?

- Visual presentation: How effectively does the platform visualize complex data?

- Response time: How quickly does the system generate comprehensive responses?

But even if an AI chatbot or stock analysis tool meets all these criteria – there’s one more thing you need to check. The most important criteria that any AI stock research chatbot must meet is being connected to a reputable real-time data source.

AI models trained on historical data only might provide information and insights that are no longer relevant or accurate. This can lead to flawed analysis and bad trades that lose you money.

Out of the platforms included in this comparison article, only two meet that criteria – Gainify and Fiscal.ai. Both utilize data from S&P Global Intelligence, the gold standard in institutional grade stock data.

AI tools should be used as one of several inputs in your investment decision making process. Combine them with strong fundamental analysis utilizing tools such as Gainify’s 5 proprietary metrics, analyst estimates, historical evolution of key performance indicators, etc.

Which AI stock analysis tool you choose will also depend heavily on your investing focus and research style.

If you’re more interested in fundamental analysis and uncovering intrinsic value to make long term investing plays, then a platform like Gainify will be your best choice.

However, if you’re focused on short term trading opportunities, then you might find a platform like TradeUI more suitable for its technical analysis tools.

But if you require broker integration(s) and zero commission fees for stock trades, then Magnifi stands out as the best choice for you.

Of course, you’re welcome to mix and match multiple tools to fit your needs – many are available at accessible price points, enabling you to build your ideal investment research and portfolio building stack.

Best of luck with your investing!

Frequently Asked Questions

What is the most important factor when choosing an AI investing tool?

The most important factor is the quality and recency of the data powering the AI. Tools connected to real-time Wall Street data from trusted providers like S&P Global Intelligence (such as Gainify and Fiscal.ai) provide reliable insights you can trust. Avoid platforms using unspecified data sources. Additionally, you should ensure the AI is specifically built for investment analysis – not just a general-purpose chatbot.

Can AI investing tools replace human financial advisors?

AI tools definitely enhance your investment research, but use them as a complement to your own human judgment, rather than a replacement. AI can process vast amounts of data, but it may lack broader contextual understanding. It is, after all, largely dependent on the information it has available in its dataset. It may just be that the latest news or geopolitical shifts are not factored into its analysis.

How accurate are AI platform investment recommendations?

The accuracy varies significantly based on the platform’s data sources, AI model quality, and the type of prediction being made. Platforms that analyze fundamental data, earnings estimates, and competitive positioning can provide valuable insights for longer-term investment decisions – however they cannot predict the future with 100% certainty. Verify AI recommendations against multiple sources and your own analysis.

Which AI investing platform offers the best free plan?

Gainify offers the most comprehensive free plan, providing access to all core features including its AI chatbot (10 queries/month), analyst estimates (1 year of history), forward valuation data, and top investor tracking. This gives you unprecedented access to institutional-grade data and analysis as a retail investor.

Are AI investing tools worth the subscription cost?

If you’re an active investor, the time savings and enhanced analysis capabilities may justify the subscription costs (which typically range from $10-50/month for retail investor-focused platforms). If you’re making significant investment decisions then a dedicated stock research tool is recommended to help avoid poor investing decisions and enable you to invest more confidently .

How often do these AI investing platforms update their data?

Platforms connected to professional data providers like S&P Global Intelligence (such as Gainify and Fiscal.ai) likely update their core financial data daily or in real-time for market prices. Analyst estimates are updated as they’re released, while fundamental data updates quarterly with earnings reports. Platforms that don’t disclose their data sources may have less frequent update schedules, which means the data you’re seeing (and that their AI tools are using) may be outdated.

Can I use these AI tools to analyze stocks outside the US market?

Yes, but global coverage varies by platform. Gainify focuses on the top 25,000 global stocks, while platforms like GuruFocus charge (hefty) additional fees for each global region.

Do AI stock research platforms allow me to execute trades directly?

Of the platforms reviewed in this article, only Magnifi offers direct trade execution with commission-free trading.