The best dividend tracker for you in 2026 depends on your specific needs. In this blog we compare Gainify with Seeking Alpha, DivTracker, and 9 more dividend tracking apps.

If you’re seeking portfolio tracking and tax calculations, Sharesight excels. But if you’re a safety-first investor, Simply Safe Dividends‘ 97% accuracy in predicting cuts is a persuasive reason to sign up.

However, if you’re looking for the best dividend research platform, Gainify stands apart with 30+ dividend screening parameters, AI-powered dividend stock analysis, and 3-year forward projections.

Why Most Investors Miss Dividend Opportunities

Many individual (retail) investors still track dividends manually – all while stocks in the S&P 500 pay out hundreds of billions of dollars in dividends. Dividend investing is one niche where investors’ stock research strategies have been slow to evolve.

With so much opportunity available, manual dividend tracking means you’re bound to miss some of the hottest dividend stocks. You’ll be blind to opportunities unless you hear about them on CNBC or Bloomberg, and without the right tools you’ll still struggle to analyze even the small subset of dividend stocks you are alerted to.

You simply don’t have time to uncover and research so many stocks. That’s where Gainify and the other tools we analyze in this blog come in.

The Revolution in Dividend Research

What if you could instantly analyze 30+ dividend metrics across thousands of stocks with a simple question like “Show me the safest 5% yielding dividend stocks in healthcare?

Or create custom dividend tracking filters so you’re always up to date with which stocks offer the best dividend opportunities right now.

You can do all that and more with Gainify – featuring AI stock analysis (including dividend research), custom stock screeners for dividend and other opportunities, and pre-built screeners so you can find your next dividend opportunity in minutes.

If you’re an active dividend investor, this approach is likely to save you hours each week.

Why Traditional Dividend Tracking Falls Short

As an investor looking to track dividends, you have several options, each with their own strengths and limitations:

- Expensive platforms like Simply Safe Dividends ($468/year with no monthly plans) offer safety scores and portfolio sync but focus only on 1,000 U.S. stocks

- Basic apps like DivTracker ($19.99-$49.99/year) provide portfolio tracking and limited dividend metrics but lack comprehensive research capabilities

- Free tools from Yahoo Finance are available but actually require Silver ($239.40/yr) or Gold ($479.40/yr) plans to access key dividend metrics like payout ratios and dividend scores

- Community platforms like Seeking Alpha ($299/year paid annually) have some community dividend reports but require Premium subscriptions for detailed Dividend Grades and quant ratings

What you really need for deep research though is a platform offering:

✓ Comprehensive dividend screening (not just 5-10 basic metrics)

✓ Forward-looking analysis and projections

✓ AI-powered discovery of opportunities

✓ Real-time safety monitoring

✓ Institutional-quality data

✓ Affordable pricing

We analyzed 11 dividend research and tracking platforms to help you find the best fit for your investing strategy.

This comprehensive analysis will help you choose the perfect dividend tracker for your investment style, maximize dividend income through better analysis tools, and understand which features actually matter.

Gainify: Automate Your Dividend Tracking

With Gainify’s comprehensive platform, you can transform your dividend investing from manual tracking to automated dividend discovery and insights.

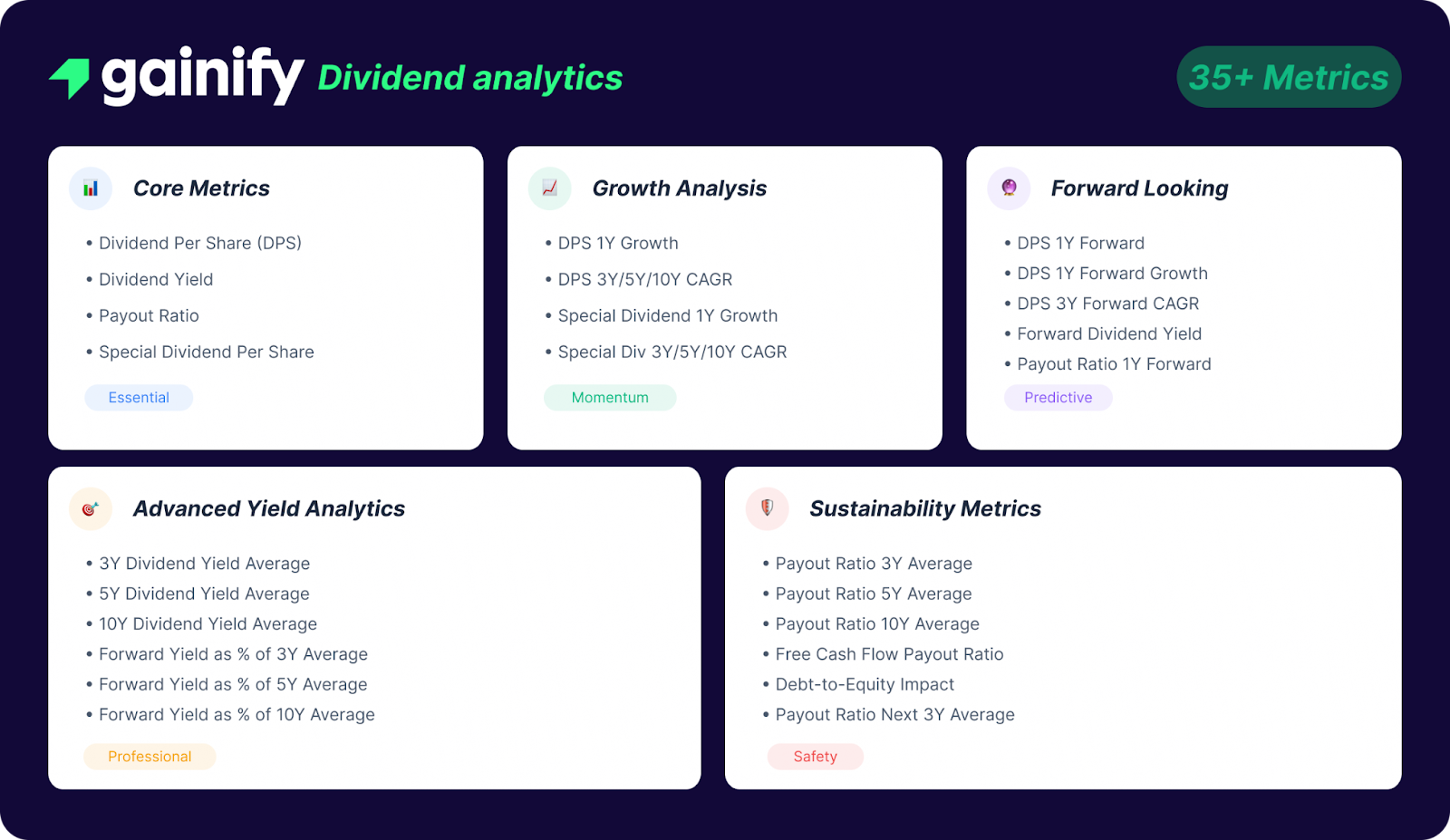

Dividend Screening

Gainify provides institutional-grade dividend analysis through 30+ specialized parameters, covering core metrics, growth analysis, forward estimations, yield analysis, and more.

Let’s say you want to find: “Dividend stocks yielding 3-5% with 10+ years of consecutive increases, payout ratios under 60%, and projected dividend growth above 7% annually.

With traditional platforms you’d need to manually filter through multiple screens, perhaps even export to excel and calculate the projections yourself.

But with Gainify you can create a single custom screener, add in some custom charts, and know your next investing move in minutes.

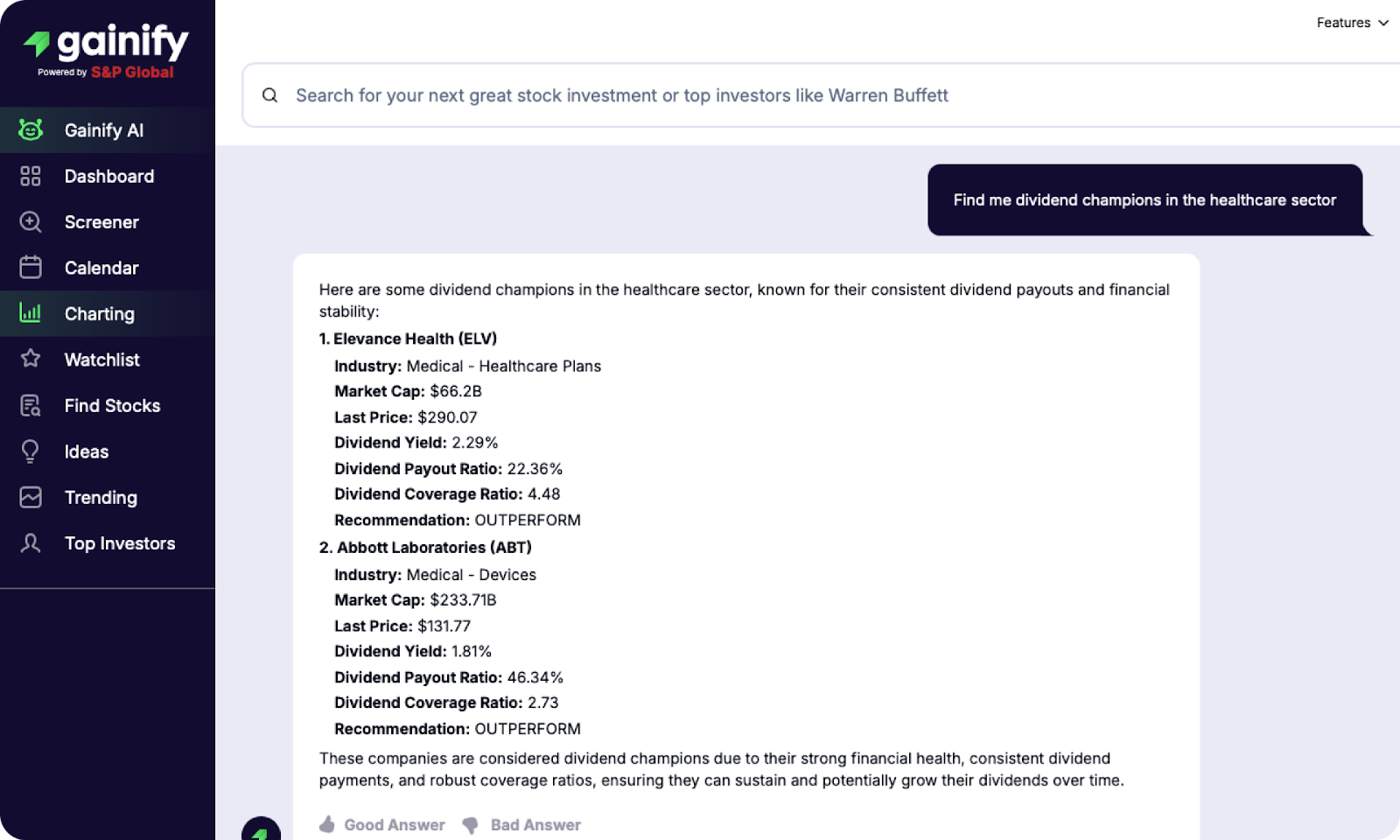

AI-Powered Dividend Discovery

Beyond custom screeners, you can also use Gainify AI to uncover dividend investing opportunities in seconds.

Just ask your question in plain English and you’ll get detailed answers with valuable dividend insights. All in a matter of seconds.

Try some of the following queries to get started:

- “Find me dividend champions in the healthcare sector”

- “Which REITs have the safest dividends based on FFO?”

- “Show me dividends that look undervalued based on historical yield”

- “What dividend stocks are Wall Street most bullish on?”

Gainify AI is by far the fastest way to research dividend stocks.

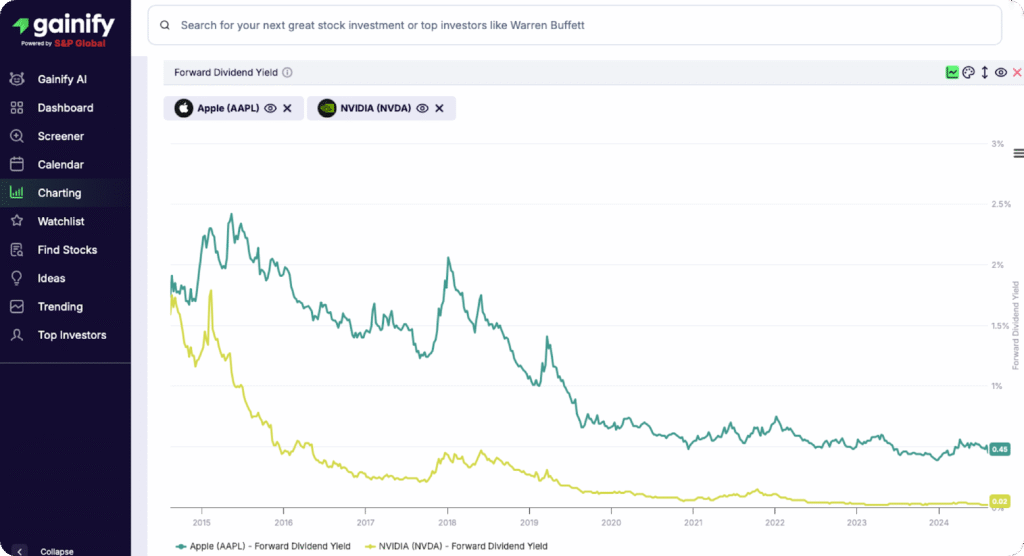

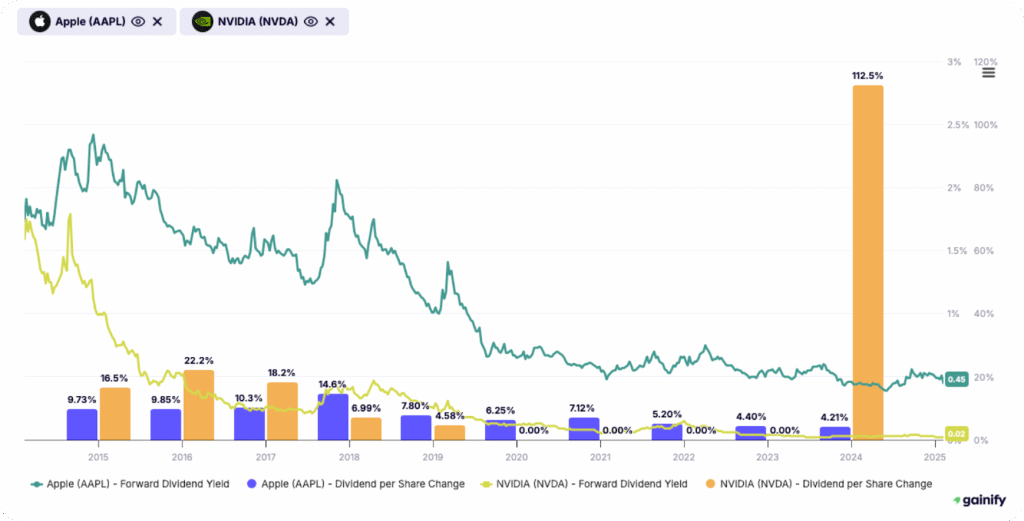

Custom Dividend Charting: Visualize Income Growth

With Gainify’s custom charts you can gain deep insights into historical trends and future trajectories for 9+ key dividend-related metrics:

- Forward DPS Projection – See expected dividends 1-3 years out

- Forward Dividend Yield – Yield trajectory based on projections

- Dividend per Share History – With growth rate overlays

- Special Dividend per Share – Identify patterns in extra payouts

- Payout Ratio Trends – Sustainability over time

- Dividend per Share Change % – Growth acceleration/deceleration

- Special Dividend Change % – Special payout patterns

- Forward 2Y Dividend Yield – Medium-term yield projection

- Forward 3Y Dividend Yield – Long-term income planning

You can plot multiple metrics on the same chart, create peer comparisons, and more.

Try the following workflow for your dividend research:

- Plot 10-year dividend per share with growth rate

- Overlay payout ratio to see expansion room

- Add forward projections based on analyst estimates

- Compare to sector dividend leaders

Uncover Future Stock Performance Projections

Gainify separates itself from competitors because while others show you historical dividends, Gainify projects future performance.

The world’s largest database of analyst estimates available to retail investors covers:

- Forward dividend yield

- Forward EV/EBITDA

- Forward PEG

- Forward DPS

- Forward P/E

And much more!

You’ll also have access to Gainify’s proprietary metrics, which show you which dividends may be at risk, help you identify stocks with accelerating dividend growth, and identify momentum.

The proprietary Gainify score gives you insights into:

- Outlook – Growth and future prospects assessment

- Valuation – Price attractiveness relative to intrinsic value

- Health – Financial strength and stability metrics

- Performance – Historical execution and returns

- Momentum – Recent trends and market sentiment

Gainify Advantages

Gainify brings you institutional-grade dividend analysis capabilities and data that were previously only available to Wall Street professionals.

Here’s what sets Gainify apart:

- 30+ dividend screening parameters (vs. 5-15 for competitors)

- AI assistant that understands complex dividend queries

- Forward dividend projections up to 3 years out

- Special dividend tracking with growth analysis

- Dividend Champions section with pre-screened opportunities

- Custom dividend charting with 9+ visualization options

- Institutional S&P Global data at retail prices

With this comprehensive set of features, Gainify delivers more dividend analysis power than platforms costing 10-40x more.

Getting Started with Gainify

Gainify gives you an integrated stock research ecosystem where each component enhances the others:

- Start with AI Discovery → “Find me safe 4%+ yields”

- Deep Dive with Screening → Apply 30+ parameters to refine

- Analyze with Charts → Visualize growth and sustainability

- Project with Forward Analytics → Model future income

At $7.99/month for the Investor plan, Gainify costs less than a single dividend payment from many stocks!

Other Ways You Can Research and Track Dividends

While Gainify offers some of the most comprehensive dividend-related metrics – some that are hard to find even on dedicated dividend tracking platforms – it does lack some key features such as brokerage sync and dividend portfolio tracking.

The optimal dividend investing likely to bring you the best results is likely a combination of Gainify (for research) and a dividend tracking platform with brokerage sync and tax calculations.

Listed below, you will find 11 dedicated dividend investing platforms suited for a range of needs and strategies.

1. Seeking Alpha – Best for Community Insights, Weak on Dividend Analytics

Seeking Alpha provides you with proprietary Quant Ratings and Dividend Grades designed to predict dividend safety and growth.

Dividend grades are updated once daily, and cover Dividend Safety, Dividend Growth, Dividend Yield, and Dividend Consistency.

Owning stocks with higher Dividend Grades can help you avoid dividend cuts.

Quant Ratings enable you to dive a little deeper into individual stocks, providing insights into value, growth, profitability, momentum, and earnings revisions.

These two tools alone give you a solid idea of a stock’s dividend strength. But there are some Seeking Alpha limitations you should be aware of:

- Detailed Dividend Grades and quant ratings require a Premium subscription (whereas Gainify free users can access all dividend-related features)

- The quant ratings and dividend grades largely focus on U.S. stocks (if you’re an international investor it may not be for you)

Paid plans are quite accessibly priced, at $299/year. But unfortunately monthly plans are not available – so you will have to pay for a full year upfront.

2. Simply Safe Dividends – Best Dividend Safety Scores with 97% Accuracy

Simply safe dividends offer ‘boring and conservative’ (their words) dividend investing solutions.

If you’re seeking a safety first investment philosophy, Simply Safe Dividends will likely fit your risk tolerance level.

One advantage is that you can sync (or manually enter) your portfolio to track what you own and monitor when you can expect dividend payments from your portfolio companies.

You can feel relatively confident following Simply Safe Dividends’ “Safety Scores” (a rating from 0-100) to guide your investing. Their public track record shows they can help you avoid 97% of dividend cuts.

However, it is quite expensive at $468 per year, and there are no monthly plans available – you need to pay for a full year upfront.

You’ll also find the platform lacks international stocks. The focus is exclusively on 1,000 U.S. listed dividend stocks.

If you prefer to invest globally, Gainify provides a better range (over 25,000) of truly international stocks.

3. Morningstar – Premium Dividend Newsletter with High Price Tag

Morningstar’s “Dividend Investor” newsletter aims to help you stay up to date with the latest in dividend investing.

However, unfortunately Morningstar is another expensive dividend tracking tool.

To get the full dividend investing experience you will need to purchase a Morningstar Investor subscription ($249/year) AND the separate Dividend newsletter ($239/year).

So the full package will set you back $488 a year. There are no monthly plans available.

A Morningstar Investor subscription enables you to screen & research stocks, and track your portfolio. It also includes allocation and risk metrics to help you balance your investments.

The Dividend Investor newsletter gives you:

- Portfolio recommendations from dividend specialists

- Analysis of dividend sustainability and growth potential

Beware that some users complained of Morningstar’s dividend information being wrong from April 2022 until at least May 2024 (the latest update provided).

The Morningstar platform is also rated at just 1.6 stars (out of 5) by users on popular review platform Trustpilot.

4. DivTracker – Best Budget Dividend Portfolio Tracker

DivTracker has a clean interface to help you track your dividend composition, upcoming payouts, and changes.

The platform does support multiple portfolios, but you may need to update your portfolio information manually as brokerage sync is only available for US users of the Ultimate (most expensive) plan.

Having detailed data & personalized insights about your dividend portfolio is bound to make achieving your financial goals easier.

The platform focuses mostly on dividend information – specifically 6 dividend metrics (yield, payment, growth rate, etc.)

You may appreciate this clear focus on dividend metrics, or you may feel limited in your research abilities.

It depends on your investment strategy and research needs.

While DivTracker does lack a lot of features, it’s also much cheaper than many dividend tracking alternatives. You can access the platform for just $19.99/year (or $49.99/year for the Ultimate plan).

5. Sharesight – Best Dividend Tracker with Tax Reporting & Capital Gains

If you need capital gains tracking and tax reporting built into your dividend tracking tool then Sharesight may be the platform for you.

You can also track your reinvested dividends, and how they impact your portfolio’s performance.

Unlike other platforms in this comparison (Simply Safe Dividends and DivTracker), Sharesight offers strong global coverage. You’ll have access to dividend analysis for over 700,000 stocks, ETFs, and funds.

Its extensive partner network means you can connect a wide range of brokers and apps (200 of them to be precise).

Rated 4.1 (out of 5) stars on Trustpilot, versus Morningstar’s very low 1.6 star rating – users are quite satisfied with Sharesight’s range of features and performance.

Plans are available for between $9.33–$31/month.

6. Track Your Dividends – Best Free Dividend Tracker with DRIP Calculations

If you’re budget conscious then Track Your Dividends will likely fit your requirements.

Its free tier allows for one linked account, and provides both diversification analysis and future value projections.

But if you want detailed stock analysis, dividend screeners, personal watchlists, and unlimited linked accounts – you will need the $9.99/month Premium plan.

Track Your Dividends provides the bare bones you need to build a simple dividend investing strategy.

You’ll be able to track:

- Upcoming dividends

- Portfolio diversification

- Dividend Reinvestment Plans (DRIPs)

7. Stock Rover – Best Dividend Screener for North American Stocks

Its focus is solely on North American stocks, so like many other apps in this comparison, it lacks a global focus.

However, Stock Rover does cover more stocks than some other platforms in this comparison. You’ll gain insights into 8,500+ North American stocks as well as 40,000 funds and 4,000 ETFs.

Although Stock Rover is less focused on dividend investing than other apps in this blog.

The platform contains a huge range of features for all types of investors. At the same time, it matches most dividend focused platforms in terms of its dividend-specific features.

But it does lack some dividend investing features such as Dividend Reinvestment Plan calculations (as found in Track Your Dividends) and capital gains & tax tracking (as in Sharesight).

However you will still find:

- Pre-built and custom dividend screeners

- Dividend yield, growth, and coverage

- Dividends per share

- Peer analysis

- Trailing yield

There is also a Future Income Tool which helps you forecast your dividend payments on a monthly, quarterly, or yearly basis.

Once you’ve built your portfolio, you’ll get a detailed breakdown (thanks to brokerage sync!) covering:

- Current dividend yield for each holding

- Expected yearly dividends in dollar amounts

- Dividend weighting within your overall portfolio

- Cost basis yield showing your yield on original investment

If investing for retirement is one of your main goals, you’ll appreciate the ability to track mutual funds and ETFs in retirement accounts at brokers like Vanguard and Fidelity.

You will find Stock Rover’s pricing quite accessible, with plans ranging from just $7.99–$27.99/mo.

But to get their research reports you will have to pay an additional $49.99/year – on top of your existing plan.

8. Yahoo Finance – Popular Free Tool but Expensive Subscription for Dividend Features

Chances are you’ve already heard of or even used Yahoo Finance. It’s one of the largest and most accessible databases of stock information available to retail investors.

Not to mention you can access much of the information for free.

But you may not be aware of Yahoo Finance’s full capabilities, especially as it comes to dividend investing.

With Yahoo Finance you can:

- Filter stocks based on various criteria (including dividend-related metrics like dividend yield, payout ratio, and growth rate)

- Uncover forward and trailing annual dividend rates and yields for stocks

- Monitor dividend payments and analyze your portfolio’s performance

Yahoo Finance also provides comprehensive company fundamentals data – allowing you to analyze a company’s financial health, including its dividend payout history.

Once you’ve found a dividend stock that interests you, you’ll be able to dive deeper into financial statements (income statements, balance sheets, and cash flow statements), earnings per share, cash flow, and revenue growth.

However many of the dividend-related features are limited to the Silver ($239.40/yr) and Gold ($479.40/yr) plans.

Free and Bronze ($95.40/yr) plans lack any dividend score, dividend payout ratio, dividend share, coverage ratio, and other key data.

9. Dividend.com – DARS Rating System for Dividend Stock Analysis

Dividend.com has been focused on bringing you the latest dividend research and information since 2008.

Many dividend-focused platforms have a proprietary dividend rating methodology, and Dividend.com is no different.

You’ll have access to DARS (Dividend Advantage Rating System), which rates dividends from 1-5 stars. The metric is based on:

- Yield attractiveness

- Dividend reliability

- Dividend uptrend

- Relative strength

- Earnings growth

However it may not beat Simply Safe Dividend’s strong accuracy in predicting dividend cuts.

While a free plan is available, the features you can access are quite limited. For example, as a free user you will only get two monthly “reveals” of DARS ratings.

You’ll also find comprehensive DRIP guides and foreign dividend tax treaty explanations – providing you niche dividend investing tools found in some, but not all, dividend-focused platforms.

However, like many dividend investing platforms, Dividend.com is focused on U.S. stocks. If you’re seeking opportunities on the London or Tokyo exchanges, you’ll need another platform.

The cost of a premium plan ($149) must be paid upfront annually.

10. The Dividend Tracker – Best Dividend Tracker with Crypto Support

If you’re focused on crypto investing, then this may be the platform for you. The Dividend Tracker enables you to track (not trade!) over 2800 cryptocurrency tickers.

Currently, crypto ticker support is limited to USD pairs, such as BTC-USD, ETH-USD, and XRP-USD.

With The Dividend Tracker you will have access to all the typical dividend investing tools, such as:

- Automated portfolio tracking

- Dividend income projections

- Dividend calendars

- Real-time alerts

- Analytical tools

The platform has a slightly more international focus than many others analyzed in this article.

Many competitors only cover U.S. stocks, or at best, North American stocks.

The Dividend Tracker enables you to trade over 15 exchanges and manage holdings in over 25 currencies – covering Canadian, U.S. and UK stocks.

Getting your portfolio data into the platform is quite easy with over 500 broker integrations. However these are only available to you if you’re on the Premium plan ($8.99/mo) or higher.

It’s worth noting that the automatic portfolios feature (brokerage sync) is not necessarily “real time”.

Unfortunately, you’ll only be able to access the ‘automatic portfolio’ functionality if you are in the U.S.

How often your portfolio is updated within The Dividend Tracker depends on your broker. Updates may be delayed by 24-72 hours.

The same is true for Dividend Grades – which will only be available to you on the Premium and Pro ($16.99/mo) plans.

The free tier is quite limited. You’ll only be able to manage a single portfolio, composed of 10 stocks.

11. Digrin – Best for Cheap Interactive Brokers

With Digrin you will be able to import your portfolio data via CSV, making it easy to get set up if you use a broker such as Fidelity, Trading212, Robinhood, and eToro.

But this should not be mistaken for a direct broker integration. Digrin’s only true broker integration is that with Interactive Brokers – with it you’ll benefit from automatic transaction synchronization.

Digrin contains many of the features expected within a dividend tracking platform, including:

- Automatic dividend reinvestment (DRIP) calculations

- Estimation tools for both capital gains and dividend taxes

- Dividend calendar (paid dividends, announced payouts, and projected future income)

You won’t break the bank with Digrin, with premium features available at just €7.99/month.

Which Dividend Tracker Is Right for You?

Choosing the right dividend tracker depends on your specific needs, investing style, and budget.

But some dividend tracking and analysis tools stand out among the rest.

For Comprehensive Global Dividend Data: Gainify

If you’re serious about dividend investing and want the most comprehensive toolset, Gainify is the clear winner.

The combination of 30+ dividend metrics, AI-powered analysis, and forward projections for just $10.99/month offers unmatched value.

Gainify gives you access to comprehensive coverage of 25,000+ global stocks.

However, while Gainify has proprietary metrics (the Gainify Rating) covering a stock’s Outlook, Valuation, Health, Performance, and Momentum, it does lack a dedicated dividend rating.

With that being said, you are given all the tools you need to understand if a company is a strong dividend payer, analyze their payout track record, and see if the stock is on a dividend growth streak.

For Tax-Focused Investors: Sharesight

If tax reporting and capital gains tracking are important to you, Sharesight will likely be the best fit for you.

While other platforms do offer tax and capital gains features, Sharesight is the best developed (and top-rated) among these platforms.

For Ultra-Conservative Investors: Simply Safe Dividends

If avoiding dividend cuts is your absolute priority, it will be hard for you to look past Simply Safe Dividends’ 97% accuracy rate in predicting cuts.

This track record alone may be worth the $41.58/month cost, which is more expensive than many platforms covered in this analysis.

For Community-Driven Research: Seeking Alpha

If you value community insights and crowdsourced research alongside dividend data, Seeking Alpha has the best community trading coverage.

How You Can Use Dividend Trackers

How you use dividend trackers will depend on your investing goals and strategy. Common investor types interested in dividend investing are retirement-focused investors, financial independence retire early (FIRE) investors, and growth-oriented investors.

Income-Focused Retirees

If you’re currently retired and seeking dividend income to supplement your lifestyle, or planning for retirement and seeking additional income, then you will prioritize consistent, reliable income streams over growth.

Your focus may be on using dividend trackers to:

- Monitor payment schedules: Track exact payment dates to manage monthly cash flow

- Assess dividend safety: Focus on payout ratios and coverage metrics to avoid cuts

- Calculate Total Income: Project annual and monthly income from their entire portfolio

- Track dividend increases: Monitor companies that consistently raise dividends to combat inflation

- Diversify income sources: Ensure dividends come from multiple sectors to reduce risk

You should focus on: Current yield, payment consistency, payout ratio, dividend coverage, and sector diversification.

FIRE Movement Investors

If you’re a Financial Independence, Retire Early (FIRE) investor, you will want to use dividend trackers differently. Instead of focusing on payouts to cover your expenses in retirement, you will likely want to focus more on long-term income growth.

- Project your future income: Model dividend growth 10-20 years out to plan retirement timing

- Find dividend growers: Screen for companies with 5-10% annual dividend growth

- Calculate crossover point: Determine when dividend income will exceed expenses

- Optimize tax efficiency: Track qualified vs. ordinary dividends for tax planning

- Build income ladders: Structure portfolios for increasing income over time

Key metrics you should focus on include: Dividend growth rate, forward projections, yield on cost, and total return potential.

Value Investors

If you’re a value investor following in the footsteps of the likes of Warren Buffet, there are multiple aspects you should focus on. Instead of only looking at dividend potential, you will also need to consider intrinsic value and current trading price.

To uncover undervalued income opportunities, you should look for:

- High yield + value: Find stocks with attractive yields trading below intrinsic value

- Historical yield comparison: Identify when current yields exceed historical averages

- Analyze payout sustainability: Deep dive into free cash flow coverage

- Track dividend aristocrats: Monitor companies with 25+ years of increases

- Spot dividend initiations: Find companies just starting to pay dividends

Key metrics that will help you uncover value opportunities include: Price-to-book, historical yield ranges, FCF payout ratio, and dividend history.

International Dividend Investors

If you’re not satisfied investing solely in North American stocks and have an international focus, then taxes are going to be a thorn in your side.

On top of the usual dividend investing skills and best practices, you will need to pay special attention to:

- Currency impact analysis: Track how exchange rates affect dividend income

- Tax treaty information: Understand withholding taxes by country

- ADR dividend tracking: Monitor American Depositary Receipt payments

- Global yield comparison: Compare yields across different markets

- Country diversification: Balance geographic exposure for risk management

Key metrics to help you with your international portfolio include: Currency-adjusted yields, withholding tax rates, country allocation, and ADR fees.

Growth-Oriented Dividend Investors

If you’re a growth oriented investor, you don’t want just any dividend stock, you want one that is going to continue raising its dividend for a long time to come.

The holy grail of such stocks are known as Dividend Aristocrats (members of the SP500 who have raised their dividend for 25+ consecutive years).

You should look for stocks with:

- Low yield, high growth: Companies with 1-3% yields but 10%+ dividend growth

- Technology dividends: Track newer dividend payers in growth sectors

- Reinvestment opportunities: Calculate DRIP benefits for compounding

- Special dividends: Monitor companies that pay occasional special dividends

Key metrics to track for your dividend growth strategy include: Earnings growth, dividend growth rate, ROE, reinvestment returns.

Conclusion

After analyzing 11+ dividend trackers, it’s clear that you have a huge range of platforms to choose from. From simple free tools to those tax & capital gains support, and AI-enhanced stock research apps like Gainify.

For dividend research alone, Gainify stands out for its comprehensive dividend-related metrics, customized screening, and forward projections.

But if you need to track your actual live portfolio holdings and the returns it is generating (or that you can expect based on upcoming dividends), you will need to layer in a dedicated dividend tracking tool.

A dividend tracking tool gives you the ability to see actual portfolio performance in (near) real time – although many platforms that focus solely on dividend investing lack in other areas. Unless your sole investing goal is to build a dividend portfolio (you’re not interested in value or growth investing), you will likely need at least a pair of stock research and dividend tracking platforms to meet your investing requirements.

With dividend stocks distributing hundreds of billions annually, having the right tools is a strong investment in your portfolio’s performance.

Why Gainify

Whether you’re building income for retirement, seeking dividend growth, or just starting your investing journey, Gainify provides tools that were previously available only to institutional investors.

- Most comprehensive parameters (30+ vs 5-15 elsewhere)

- Only AI-powered analysis in the market

- Unique forward projections up to 3 years

- Institutional data quality at retail prices

- Integrated investment platform beyond just dividends

Ready to Transform Your Dividend Investing?

Start with Gainify’s free tier to experience the difference AI-powered analysis makes. With no credit card required and immediate access to core features, you can begin optimizing your dividend portfolio today.

Frequently Asked Questions About Dividend Tracking

What is a dividend tracker and why do I need one?

A dividend tracker is a tool or platform that helps investors monitor, analyze, and manage dividend-paying stocks in their portfolio. You need one because manually tracking dividends across multiple stocks becomes overwhelming quickly – you’ll miss payment dates, overlook opportunities, and struggle to assess dividend safety without proper tools.

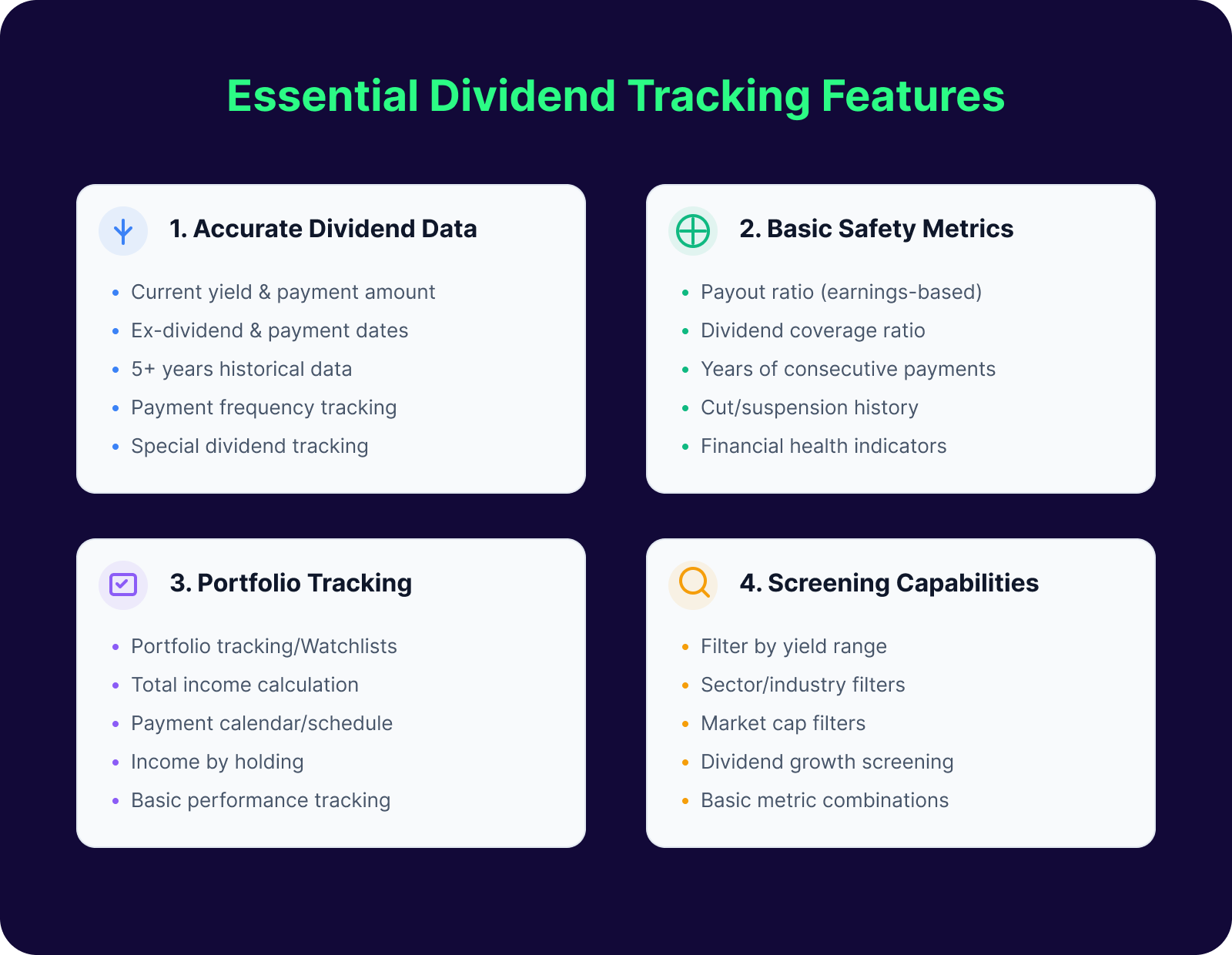

What are the most important features to look for?

The five essential features are: (1) accurate dividend payment data and history, (2) safety metrics like payout ratios, (3) portfolio income tracking, (4) dividend-specific screening tools, and (5) payment calendar/alerts.

Do I need real-time data for dividend investing?

No. Unlike day trading, dividend investing is a long-term strategy where 15-20 minute delayed quotes are perfectly adequate. Real-time data adds unnecessary cost for most dividend investors. Focus instead on comprehensive historical data and forward projections.

How important are forward dividend projections?

Very important for serious investors. While historical data shows past performance, forward projections help you model future income, identify stocks likely to increase dividends, and spot potential cuts before they happen.

Can dividend trackers help me avoid dividend cuts?

Yes, quality trackers with safety scores and payout ratio analysis may reduce your risk. Platforms like Simply Safe Dividends claim 97% accuracy in predicting cuts. However, no system is perfect – always combine tracker data with your own research.

Do dividend trackers work with international stocks?

Coverage varies significantly. Some platforms focus solely on U.S. stocks, while others like Sharesight and Gainify offer more extensive international coverage. Sharesight also helps you handle currency conversion and foreign taxes.

Can I import my existing portfolio?

Many platforms support CSV import or broker connections. However, broker sync availability varies – some platforms only support major U.S. brokers. Always check if your specific broker is supported before committing to a paid plan.

Should I start with a free or paid platform?

Start with a free platform or free trial to understand what features you actually use. As your portfolio grows and strategy becomes more sophisticated, upgrade to access advanced features like AI analysis and forward projections. You can start using Gainify free here.

Can I use multiple dividend trackers?

Of course you can. Many investors combine platforms. You can try a free or cheap tool for portfolio tracking combined with Gainify for advanced research, screening, and charting.

How do I know if a tracker’s “safety score” is reliable?

Look for platforms that publish their track record. Simply Safe Dividends, for example, publicly shares their prediction accuracy.

Is AI-powered analysis worth the extra cost?

For active investors managing multiple positions, AI can save significant time and uncover opportunities you’d miss manually. If you spend more than 5 hours monthly on dividend research, AI tools typically pay for themselves through time savings and better investment decisions.

But when you use Gainify you get top stock research features PLUS artificial intelligence all for FREE, and paid plans start at just $7.99 – so you’re actually playing LESS than you would be for other platforms without AI features.