When it comes to choosing which sources to trust for your portfolio building insights, you need absolute certainty and trust in the platform. If you’re trying to decide whether CNBC Investing Club delivers real value, you’re looking to answer a $399 question that could significantly impact your investment returns.

Many investors feel frustrated by generic stock advice – the kind of advice that is easy to dish out but adds little real value to your own stock research processes or portfolios.

Platforms or newsletters want you to pay top dollar for a few stock picks a month, and you’re unsure if that’s worthwhile.

The financial media landscape has ballooned with options – everyone is promising exclusive insights but only a few platforms deliver results.

CNBC Investing Club (one of many players in the financial news and stock recommendation industry) gives you access to Jim Cramer’s Charitable Trust portfolio.

Included in the package, you get real-time trade alerts 45 minutes before execution, and behind-the-scenes market analysis from the Mad Money host (Cramer) himself.

But should you build your portfolio based on CNBC Investing Club stock picks?

This review examines Jim Cramer’s actual track record. We break down exactly what you get for $399 of your hard-earned cash. You’ll also discover why AI-powered research platforms might deliver better results for your investment research needs.

Key Takeaways

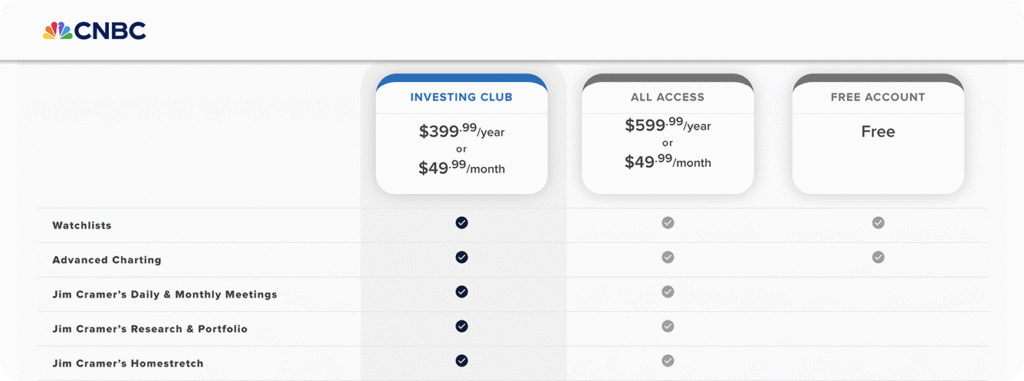

For $399/year, you get access to Jim Cramer’s charitable trust portfolio, real-time trade alerts, daily morning meetings, and monthly interactive calls with market analysis.

However, independent research from Wharton School found Cramer’s long-term returns (3.38% annually) trailed the S&P 500 (5.59%) over 17+ years, though recent shorter-term performance has shown improvement.

CNBC Investing Club is best suited for:

- Investors who value expert curation and market commentary

- Those with limited time for independent research

- Fans of Jim Cramer’s investing approach and Mad Money insights

- Portfolios focused on US large-cap stocks

However, if you wish to conduct independent research with screening tools, need analysis across global markets beyond US stocks, trade more frequently than monthly picks allow, or want to reduce costs – then modern AI-powered stock research platforms might be a better fit.

Stock Research & Analysis Approach

Each investment research platform takes a different approach to stock analysis. Methodologies used (data driven, industry insider, etc.) and research depth (simply stock picks versus detailed analysis reports) vary between services.

Understanding CNBC Investing Club’s approach will help you determine if it aligns with your research needs.

CNBC Investing Club specializes in human-curated picks. But depending on your research frequency & depth, and portfolio size – a self-led data-driven approach may be more suitable for you.

But if you trust Jim Cramer’s experience, intuition, and historical performance – then CNBC Investing Club could give your stock research process the edge it needs.

CNBC Investing Club’s Approach

If you prefer expert-curated selections over independent analysis, CNBC delivers you personality-driven insights from a Wall Street veteran.

CNBC Investing Club centers around Jim Cramer’s personal stock selection process and his charitable trust portfolio (about 36 stocks.)

The platform delivers 2-5 stock recommendations monthly. It’s not a huge amount, but in line with many financial newsletters within a similar price range.

Beyond simple stock pick, you will also have access to morning meetings, monthly calls, and trade alerts before Cramer executes transactions.

While it might be nice to follow and expert like Cramer, this approach does come with limitations. You’re betting on one person’s judgment rather than systematic analysis. Technology picks dominate (nearly 20% of portfolio). This may not match your risk tolerance or timeline.

Morning Meeting

Your day starts with the Morning Meeting. You get behind-the-scenes access with Jim Cramer and Jeff Marks. In meetings typically lasting about 10 minutes, they discuss the market’s biggest headlines, analyst calls, and holdings in the Charitable Trust.

Trade Alerts

You’ll receive Trade Alerts 45 minutes before any portfolio transactions are executed in Jim Cramer’s Charitable Trust. This includes detailed explanations for each buy or sell decision, helping you learn via osmosis.

Charitable Trust Portfolio Access

You get exclusive access to Jim Cramer’s Charitable Trust portfolio, enabling you to view current holdings, performance metrics, position weightings, and track all historical trades.

Monthly Meetings

Your membership includes Monthly Meetings that offer deeper analysis and long-term forecasts. It is in these meetings that Jim reviews market performance and its impact on the Charitable Trust.

Educational Resources

Beyond the meetings and alerts, you’ll receive regular newsletters with market analysis, access to Jim’s columns, and educational content.

The Homestretch

As part of your subscription, you’ll also get a daily wrap-up segment that reviews the day’s market action and previews what you should watch for tomorrow.

CNBC Investing Club Pros

If you have limited time and don’t want to think too much about your stock picks (preferring to trust a Wall Street insider), then CNBC Investing Club might be helpful for you.

The main benefits you gain from CNBC Investing Club include:

- Access to Jim Cramer’s live charitable trust portfolio (about 36 stocks)

- Real-time trade alerts 45 minutes before Cramer executes trades

- Daily morning meetings and monthly interactive calls with Q&A

- Behind-the-scenes analysis from the Mad Money host

CNBC Investing Club Cons

Unfortunately, the financial newsletter style “X stock picks per month” has many drawbacks.

- Reliance on one person’s judgment rather than systematic analysis

- Limited to just 2-3 stock picks per month (24-36 annually)

- No independent screening tools or analysis capabilities

- Minimal international market coverage

- Heavy concentration risk

You also lose out on autonomy. You’re fully dependent on when CNBC picks come in. You can’t trade independently.

When it comes to CNBC Investing Club in particular, performance may also be a concern. Independent research shows Cramer’s portfolio returned only 3.38% annually vs S&P 500’s 5.59% over 17+ years.

It’s also quite expensive at $399 annually (up to $599 for the All Access subscription) – especially when you only get a few dozen stock picks per year.

Modern AI-Powered Alternative

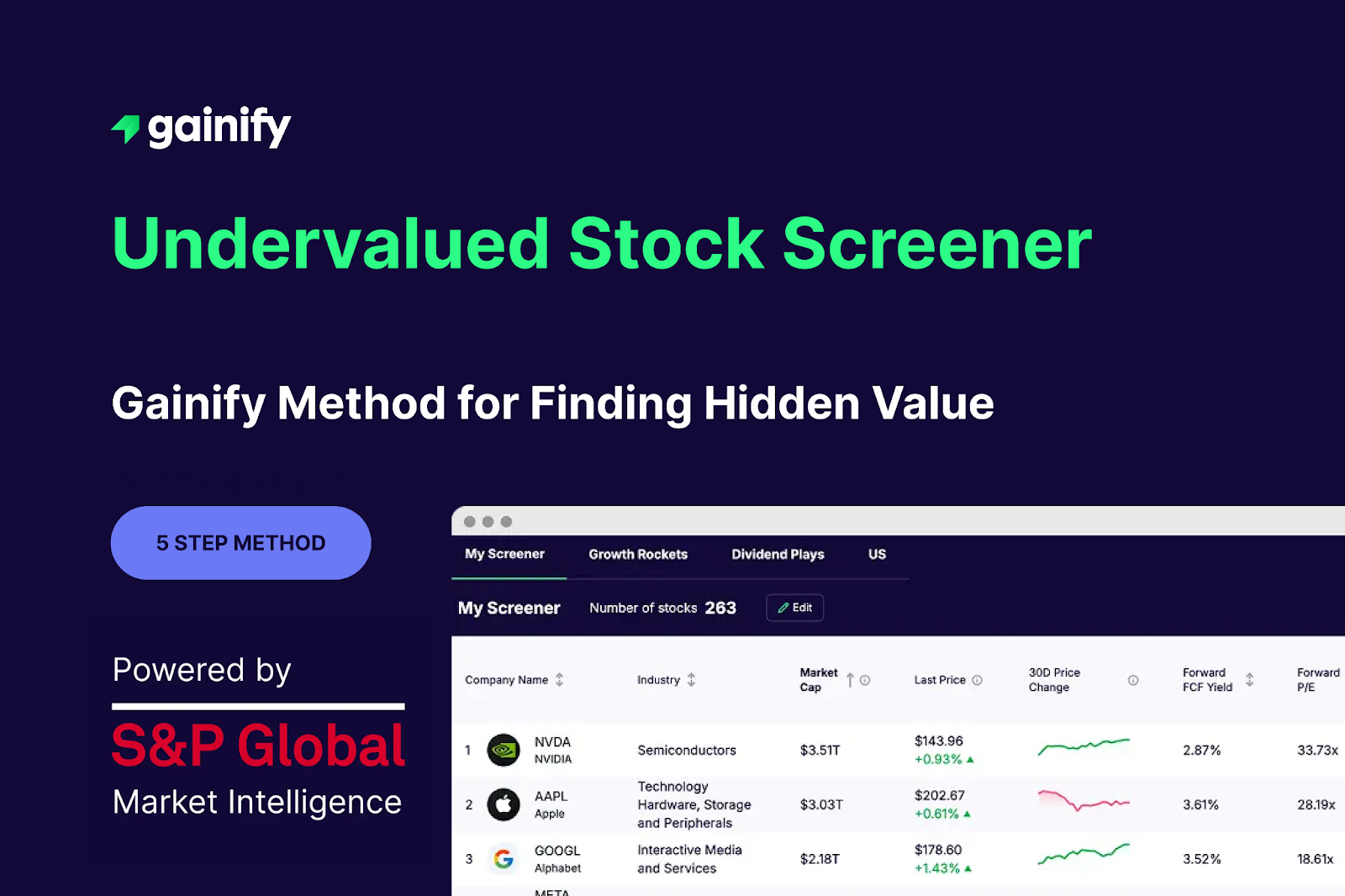

If you don’t want to be locked into a few stock picks per month from Cramer, Gainify is a strong alternative.

Gainify gives you:

- 30,000+ global stocks

- Unlimited stock research (paid plans)

- Institutional-grade data from S&P Global Intelligence

- Advanced screening capabilities with 500+ metrics for filtering

- Top investor tracking so you can learn from dozens of Wall Street legends

It’s a far cry from the limited handful of monthly stock picks from Cramer and CNBC each month and at a fraction of the cost, starting at just $95.88 annually.

You can readily analyze any stock instead of waiting for monthly pick – real-time, data-driven analysis enables you to build your portfolio on your terms.

Time to Insight

Opportunities come and go fast in today’s markets. A rally may only last a week or two. If you miss it, you’re left having to find another stock to invest in – which takes time and effort.

If you’re always waiting for a few stock picks from a weekly or monthly newsletter, you’re going to miss out on many of the stock market’s top opportunities.

CNBC Investing Club Research Timeline

With CNBC Investing Club, your research follows Cramer’s schedule. You receive 2-3 stock picks monthly (meaning you might wait weeks between relevant recommendations.)

If you trade frequently, or want to build a portfolio larger than a few dozen stocks, then CNBC Investing Club likely won’t suit your needs.

Morning meetings happen daily, however these focus on existing portfolio holdings rather than new opportunities. Monthly calls offer deeper analysis, but these center on predetermined stocks – not necessarily the ones you’re most interested in.

AI-Powered Research Speed

Gainify’s AI gives you instant analysis on 25,000+ stocks. No waiting for scheduled content from CNBC.

You can ask specific questions like “What are Tesla’s competitive advantages in the EV market?” to deep dive into the aspects of a stock (and its performance) that interest you most.

AI-powered earnings analysis gives you immediate insights after quarterly reports. You’ll benefit from detailed summaries of key drivers, headwinds, and potential catalysts that could impact a stock.

Combine that with pre-built & customizable stock screeners, and top investor tracking – plus a full-suite of institutional quality stock analysis tools – and you have everything you need to build a winning portfolio on your terms.

Data Coverage and Depth

Data is everything when it comes to stock analysis. You need a broad range of data, without error, and as close to real-time as possible.

CNBC Investing Club Coverage Limitations

CNBC Investing Club works best if you focus on US large-cap stocks and want expert curation or if you prefer concentrated portfolios over broad market coverage.

CNBC Investing Club focuses on approximately 36 stocks in Cramer’s charitable trust portfolio. The portfolio is heavily concentrated in technology and large-cap names – so most stock opportunities are not covered.

Unfortunately, due to this, your analysis relies heavily on Cramer’s interpretation. At best, you can use a platform like Gainify in parallel to 1) research the Cramer stock picks yourself 2) broaden your market perspectives across global stocks.

Sure, Cramer does have a lot of market experience – but you would be well served by checking:

- Gainify’s Analyst Estimates to capture broader market sentiment

- Gainiify’s proprietary 5-point rating system to uncover company fundamentals and growth potential

Cramer’s insights offer valuable context, but don’t limit yourself to one perspective on each holding.

Expanding Your Reach with Gainify

With Gaiinfy you can access 25,000+ global stocks, filter them with stock screeners covering 500+ key mеtrics, and analyze each stock in depth. You’ll never miss an opportunity again.

Analyst estimates give you consensus price targets and recommendations from major investment banks. Supplied by S&P Global Intelligence, this is the same data driving institutional decisions every day.

When analysts upgrade or downgrade a stock, you know immediately. You’ll also be able to utilize Gainify’s deep history of analyst estimate trends – up to 10 years – to uncover long-term patterns.

Gainify Ratings for each stock give you an instant assessment of each stock’s investment potential.

The Gainify Rating covers 5 critical elements of a company’s past and projected performance:

- Outlook gives you insights into a company’s future potential – helping you identify companies positioned for strong future performance.

- Valuation shows you whether you’re paying a fair price relative to earnings, cash flow, and book value. Avoid overpaying for growth or missing undervalued opportunities.

- Health helps you assess a company’s financial stability and void companies that might struggle in downturns or face solvency issues.

- Performance shows you which companies have consistently delivered for shareholders (and which might be less consistent, or one-hit wonders.)

- Momentum helps you gauge market sentiment and price trends that could impact your near-term returns.

Rather than relying on individual analyst opinions, Gainify combines fundamental analysis, custom charting, and sentiment analysis using multiple data sources.

You will be hard pressed to find another platform providing the data depth and breadth offered by Gainify.

User Experience and Information Processing

Effective investment research requires information presented in formats that facilitate quick decision-making rather than lengthy content consumption.

CNBC Investing Club Interface Challenges

With CNBC Investing Club, information is delivered to you through text-heavy articles and video content. It’s like watching a TV show or reading a newspaper.

You’ll watch 30-60 minute morning meetings and monthly calls, taking notes on points relevant to your portfolio.

If you enjoy Cramer’s personality and have time for video content, this format works for your style.

However, one downside is that you’ll need to watch entire segments or read through full articles, hoping to find the nuggets relevant to your decisions.

30-60 minutes each day is quite a lot of time. You would be able to achieve much broader and deeper analysis using Gainify with just 15 minutes or less a day.

Modern Research Platform Advantages

With Gainify, instead of consuming hours of content hoping for relevant insights, you get direct answers to your specific investing questions in seconds.

Log into Gainify anytime, from anywhere, and get actionable investment insights for your portfolio in as little as a few minutes.

The Gainify interface is big on visual presentation. If you prefer graphs and charts over text-heavy reports, then you will love Gainify.

One of the best examples of Gainify’s dedication to providing the best visualizations in the industry is customized charting.

Customized charts let you overlay multiple indicators, compare stocks side-by-side, and zoom in and out of timeframes with a click.

Compare Tesla’s top competitors side by side on one chart, or deep dive into the Semiconductor industries’ top players.

Price vs. Value Analysis

Understanding total cost versus alternatives helps determine whether CNBC Investing Club provides sufficient returns. Investing platform subscriptions can eat up a significant portion of your portfolio returns, so you need to justify the investment.

CNBC Investing Club Pricing Breakdown

A standard subscription costs $399 annually or $49.99 monthly. This pricing places it in the mid-tier among investment research services.

If you have a portfolio of $500,000 or more then this won’t eat into your returns too much. You may even have multiple such subscriptions.

However, if you’re just starting out or have built a smaller foundational portfolio – $399 per year for only a few stock picks (24-36 annually) will make a big dent in your total returns.

Alternative Value Propositions

When comparing research capacity to cost ratios, modern AI-powered platforms offer more analytical capability at similar or lower price points than traditional subscription services.

Gainify’s $7.99/mo annual subscription (Investor plan) offers unlimited analysis across 30,000+ stocks. You get screening tools, top investor tracking, Gainify AI, plus real-time market data from S&P Global Market Intelligence.

It’s hard to beat Gainify on value. Very few alternatives even come close. You can even use it for free (on the free forever plan, no credit card required).

Performance Analysis and Track Record

You may have heard a lot about the man behind CNBC Investing Club – Jim Cramer. Or you may have seen him on television. But have you analyzed his historical portfolio performance?

Jim Cramer’s Documented Performance

Luckily, there is a good deal of information available about Cramer’s historical stock picking performance.

Wharton School research covering 17+ years (August 2001-March 2016) of Jim Cramer’s Action Alerts PLUS portfolio shows an annualized return of 3.38% versus the S&P 500 total return index’s 5.59% during the same period.

The comprehensive academic study found higher volatility with lower returns. Cramer’s portfolio had a standard deviation of 18.78% compared to the S&P 500’s 17.92%. His portfolio generated a Sharpe ratio of just 0.11 versus the index’s 0.24.

That’s not great when you could get a better return from an index fund, without having to pay up $399-599/year in subscription fees.

Recent performance claims improvement with CNBC promoting charitable trust outperformance over shorter timeframes.

But this selective timeframe reporting may not represent sustainable outperformance. Longer-term academic evidence is a more reliable assessment of performance.

Performance Context and Limitations

The charitable trust structure creates cash drag as dividends are collected for donation rather than being actively invested. This potentially hampers performance.

Concentration risk is significant. The portfolio has a heavy focus on technology stocks (20% of portfolio.) While tech has outperformed in recent years, holding up entire indices, the strategy is vulnerable to sector-specific downturns.

As always, past outperformance does not predict future results. When evaluating any stock pick newsletter or subscription, don’t get pulled in by the cherry picked statistics.

Consider longer-term performance and seek independent third-party reviews before making your decision.

Modern alternatives remove individual manager risk by using systematic, data-driven approaches. You won’t depend on single-person judgment calls or personality-driven selection processes – instead, you have full control over your research process and portfolio.

Features and Service Comparison

Understanding what you actually receive for your subscription helps evaluate whether CNBC Investing Club meets your research needs.

CNBC Investing Club Feature Set

Core features include:

- Monthly interactive calls with Q&A

- Daily morning meetings (30-60 minutes)

- Educational content and market commentary

- Access to charitable trust portfolio holdings

- 2-3 stock picks monthly with detailed analysis

- Real-time trade alerts 45 minutes before execution

However, unfortunately the service provides no independent screening tools, limited international coverage, and no ability to analyze stocks outside the predetermined selection.

AI-Powered Research Capabilities

Gainify offers research tools, putting the power in hands. When you sign up for any Gainify plan you will have access to:

- Custom watchlists and alerts

- Detailed earnings call summaries

- Instant AI analysis of 25,000+ stocks

- Institutional-grade data from S&P Global

- Advanced screening across 500+ metrics

- Top investor portfolio tracking for dozens of Wall Street pros

With unrestricted access to stock market data, you can analyze any stock, sector, or market trend without waiting for predetermined content or hoping your interests align with CNBC’s focus areas.

The platform scales with your needs – from beginner-friendly AI explanations to advanced metrics, charting, and screening for experienced investors.

CNBC Investing Club Alternatives

CNBC’s Investing Club gives you Jim Cramer’s market insights and portfolio picks. But today, you have access to more comprehensive and cost-effective alternatives – that deliver better value and broader research capabilities.

AI-Powered Analysis Platforms like Gainify offer you automated custom stock screening, custom stock charting, and on-demand AI analysis covering global markets with institutional-grade data sources for as little as $7.99/month.

If you prefer curated stock recommendations, rather than your own independent analysis, explore our best financial newsletters guide. Your options range from free daily briefings like Morning Brew to premium services from Motley Fool.

If you’re an audio learner, tap into free, high-quality investment podcasts. Our comprehensive best investing podcasts guide covers over 20 shows including:

- The Technology Brothers Podcast for tech stock analysis

- We Study Billionaires for value investing insights

- Chat with Traders for active trading strategies

- Bitcoin Fundamentals for crypto coverage

- BAHNSEN for dividend investing

Key Takeaways: Choosing Your Investment Research Platform

CNBC Investing Club works best if you:

- Prefer expert-curated selections over independent analysis

- Have limited time for research and want predetermined picks

- Value personality-driven insights and market commentary

- Don’t mind waiting for monthly recommendations

- Focus primarily on US large-cap stocks

Modern alternatives like Gainify are better suited. You will get access to:

- Top investor portfolio tracking. See what Wall Street’s best are buying and selling, their portfolio composition, and who is performing best right now.

- Instant answers to complex investment questions with Gainify’s breakthrough AI connected to real-time Wall Street data.

- The world’s largest database of analyst estimates with historical trend tracking and future projections.

- Sophisticated custom and pre-built stock screeners so you can uncover top stocks no matter your investing criteria – no need to rely on CNBCs picks, find what interests you!

Gainify: The Complete Stock Research Platform for Modern Investors

CNBC Investing Club is a typical example of traditional investment advice models. You pay a monthly fee and get a few stock picks, heavily relying on the expertise of the names researching stocks for you.

Gainify is a glimpse into the future of investment research. AI-powered analysis, highly customized screeners, and top investor tracking give you unprecedented stock analysis capabilities – all powered by the same institutional grade data used by Wall Street

Three key advantages make 2026 important for reconsidering traditional subscription services.

Real-time AI analysis means you never have to wait for insights again. Research and trade on your terms. When and where you want.

Market coverage across 25,000+ stocks ensures you never miss opportunities due to limited analyst coverage or selection bias.

Cost-effective platforms offer more analytical capability per dollar compared to traditional services.

Your New Superior Research Workflow with Gainify

Getting started with Gainify is simple. Start with Gainify AI, pre-built screeners, and trending stocks to find your first opportunities.

Then explore top investor tracking to examine Wall Street’s best performing portfolios in detail.

Add stocks of interest to your watchlist, and stay up to date with upcoming major events using the earnings call calendar.

When you’re ready – explore customized stock screening and use 500+ filters to help you find stocks meeting your investing criteria. Plot competitors side by side with custom charting and dive deep into historical trends, current metrics, and future growth projections.

If you’re serious about growing your portfolio in 2026, the choice is clear. Embrace AI-powered research tools that scale with your needs rather than traditional subscription models designed for passive content consumption.

Frequently Asked Questions (FAQ)

What is CNBC Investing Club and how much does it cost?

CNBC Investing Club is Jim Cramer’s subscription service offering access to his charitable trust portfolio picks, trade alerts, daily meetings, and market commentary. It costs $399 annually or $49.99 monthly, occasionally offering promotional discounts for new subscribers.

Does Jim Cramer actually beat the market?

According to Wharton School research covering 17+ years of data, Jim Cramer’s Action Alerts PLUS portfolio achieved 3.38% annualized returns versus 5.59% for the S&P 500 total return index. The study found higher volatility and lower risk-adjusted returns compared to the market.

How many stock picks do you get with CNBC Investing Club?

Subscribers receive 2-3 stock recommendations per month (24-36 annually) along with daily morning meetings, monthly interactive calls, and trade alerts 45 minutes before Cramer executes transactions in his charitable trust portfolio.

Can you cancel CNBC Investing Club subscription?

Yes, you can cancel your CNBC Investing Club subscription anytime. Monthly subscribers can cancel before the next billing cycle, while annual subscribers typically receive prorated refunds depending on the terms of service.

What’s the difference between CNBC Investing Club and Gainify?

CNBC Investing Club offers 24-36 predetermined stock picks annually from Jim Cramer for $399 (up to $599 for the All Access subscription). Gainify provides unlimited AI-powered analysis across 30,000+ stocks starting at $7.99/month. Gainify offers real-time insights, advanced screening, and comprehensive market coverage versus CNBC’s limited, Cramer-dependent approach.

Is Jim Cramer’s charitable trust the same as CNBC Investing Club?

Yes, CNBC Investing Club subscribers access Jim Cramer’s charitable trust portfolio (Action Alerts PLUS). The trust was established in 2005 when Mad Money launched, converting his original portfolio to donate dividends and distributions to charity.

Does CNBC Investing Club offer international stock coverage?

No, CNBC Investing Club focuses primarily on US large-cap stocks with minimal international market coverage. The service concentrates on about 36 stocks in Cramer’s charitable trust portfolio, with heavy weighting in technology companies.

What tools does CNBC Investing Club provide for research?

CNBC Investing Club provides daily morning meetings, monthly calls, educational content, and trade alerts, but lacks independent screening tools, advanced analytics, or the ability to analyze stocks outside Cramer’s predetermined selections. Research is limited to commentary on existing portfolio holdings.