The stock market presents thousands of data points every day. Many stocks move based on headlines, temporary sentiment shifts, or speculation that has little to do with long-term fundamentals. Finding companies in 2026 with real value requires more than instinct. It takes a METHOD that can interpret both financial reports and market behavior with accuracy.

This is where a well-structured undervalued stock screener becomes essential. It acts like a focused radar, helping you sort through noise and uncover stocks trading below their potential. Whether you are an experienced investor or a financial advisor overseeing client portfolios, a reliable undervalued stock screener brings discipline and clarity to your research process.

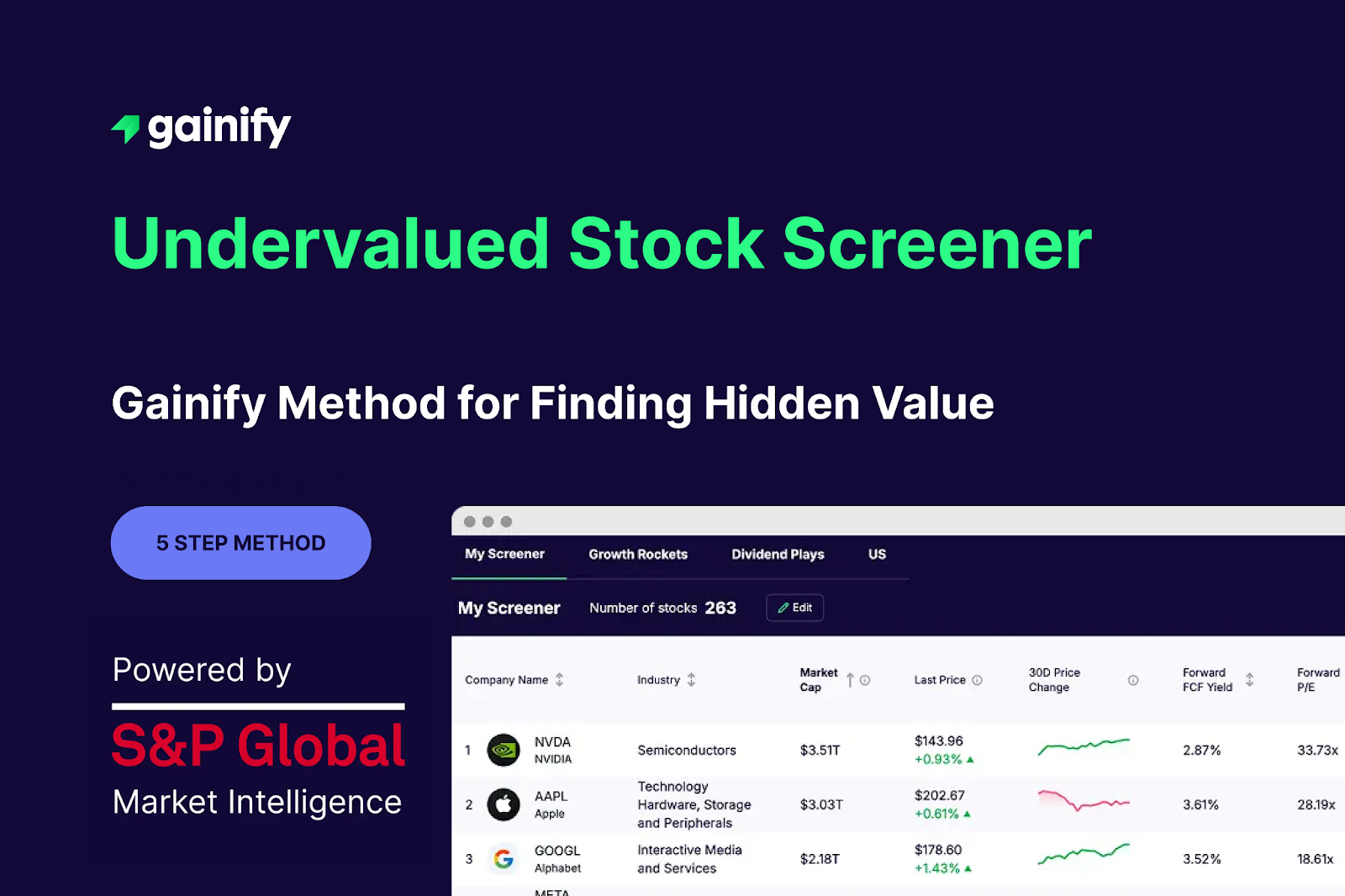

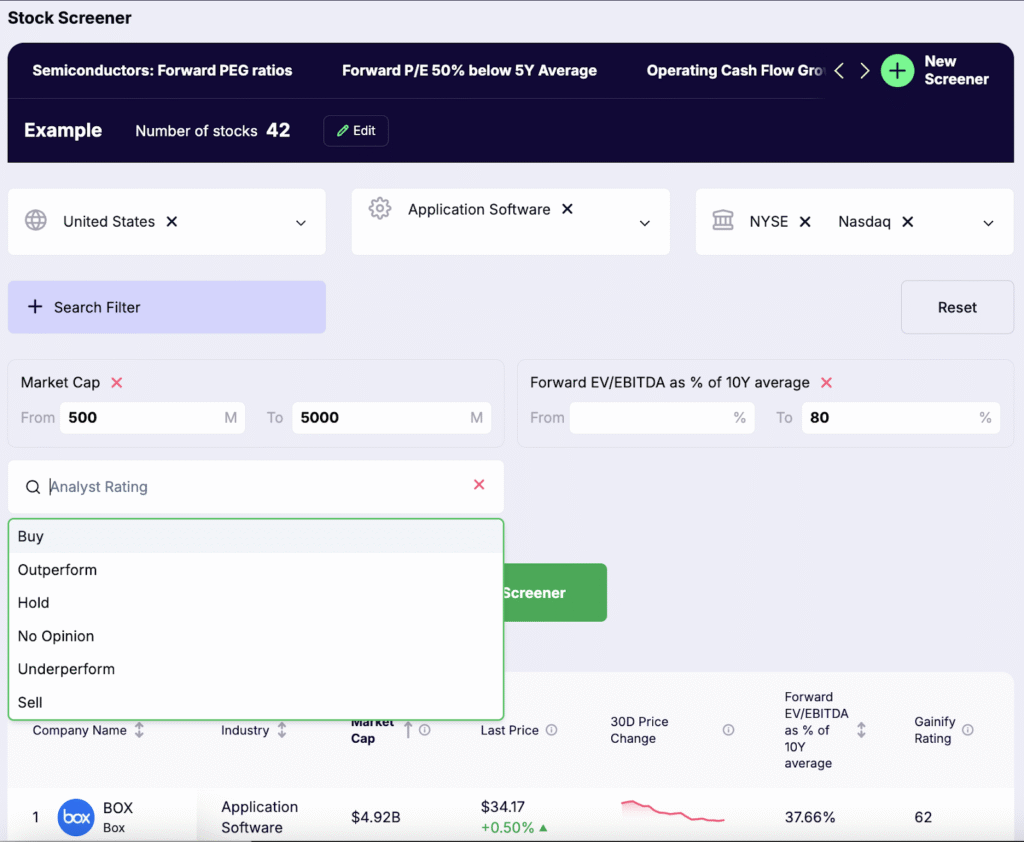

In this guide, you will learn how to build an effective screener using the Gainify platform.

Gainify provides one of the most advanced filter systems available, combining a wide set of forward-looking and historical metrics. These include valuation, earnings growth, cash flow, sentiment, operational quality, and many more. You will also see how to customize the query, select industries, and identify FUNDAMENTALLY STRONG companies with long-term potential.

From screen creation to sector-specific targeting, this approach will help you find Undervalued Growth Stocks with the same framework used by institutional analysts and experienced private investors.

Why Gainify?

Gainify is built to give investors a clear and structured way to find stocks with meaningful upside. It brings together reliable data, powerful screening tools, and a user-friendly experience that helps you make decisions with confidence.

The screener uses institutional-grade data from S&P Global, offering access to over 500 filters across key financial areas. These include metrics from the income statement, balance sheet, cash flow, dividends, and both trailing and forward valuation. You can analyze companies based on market capitalization, earnings growth, valuation multiples, and many more.

What sets Gainify apart is its ability to combine both current performance and forward-looking estimates. Filters such as the P/E ratio, free cash flow yield, Price / Earnings to Growth (P/E/G), and ROCE work alongside metrics like analyst upside, earnings growth rates, and revenue trends. This approach helps you identify companies that are not only priced attractively but also show signs of strong future performance.

The platform allows you to begin creating screens that reflect your investment strategy. You can narrow your search by industry, region, or size, including companies with differing market capitalizations. For those seeking more control, Gainify supports custom query creation, so you can define and apply complex combinations of filters in a simple and repeatable way.

Results are displayed in a clean larger table view, allowing for quick comparisons across all major financial ratios. You can sort by the financial ratio of your choice.

Gainify is designed for investors who value structure, precision, and reliable data when evaluating potential investments. It offers a comprehensive foundation for making informed, long-term decisions based on both what a company has done and what it is expected to deliver.

How to Create a Custom Stock Screener for Undervalued Stocks on Gainify

Step 1 – Define Your Screening Objective

What type of undervaluation are you targeting?

Before building any filters, clarify your goal. Examples:

- Deep Value: Severely underpriced stocks based on core ratios (P/E, EV/EBITDA)

- GARP (Growth At a Reasonable Price): Undervalued and growing fast (e.g. PEG < 1)

- Turnaround: Operational recovery, not yet priced in

- High-quality Compounders: Modestly undervalued, but consistently profitable

🎯 Example Objective:

“Identify mid-cap growth stocks trading below historical valuation norms, with improving profitability and rising investor confidence.”

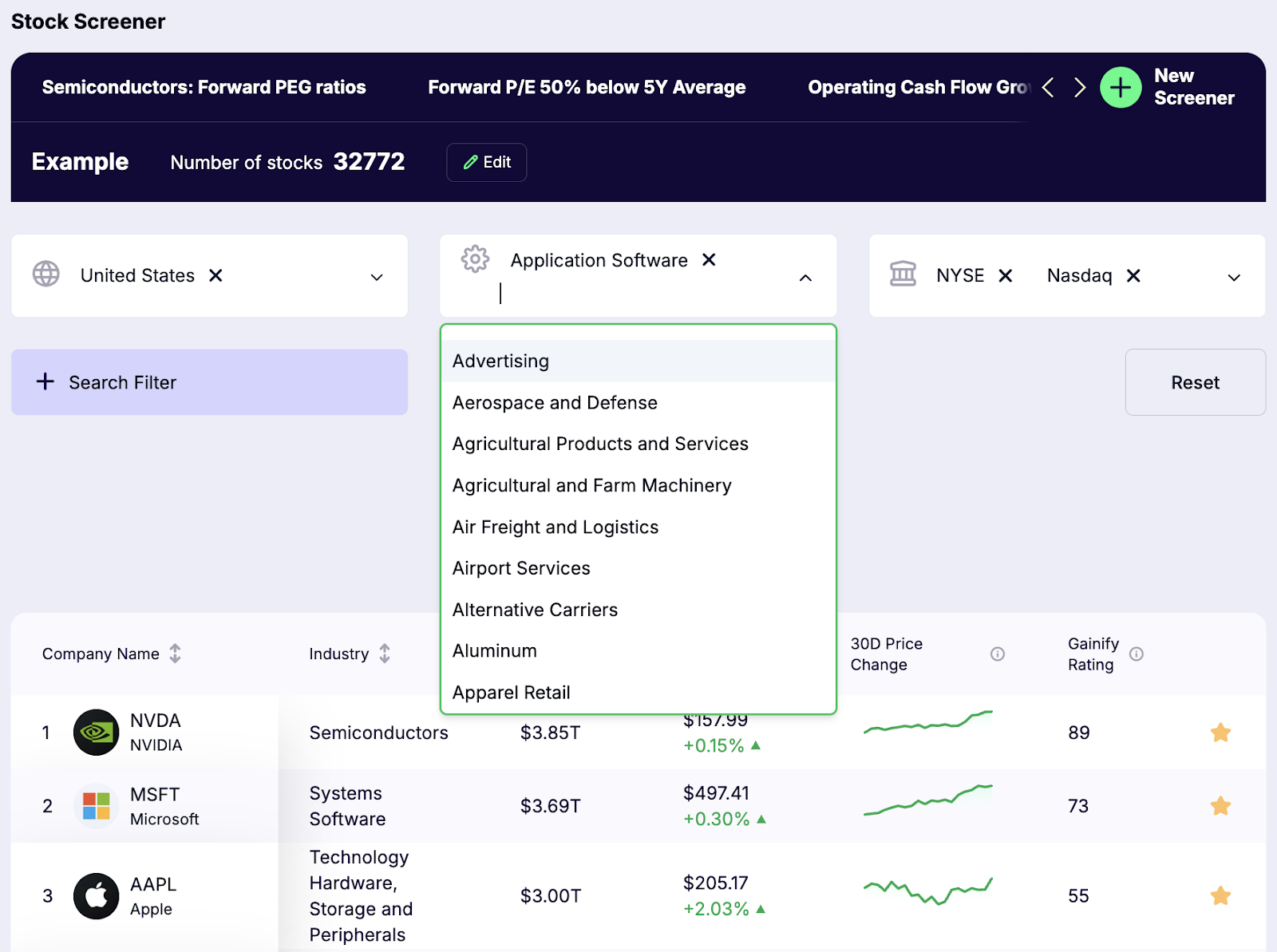

Step 2 – Set Your Investable Universe

Narrow the search space to increase relevance.

In Gainify:

- Select Country & Exchange

- Examples: India / NSE, US / NASDAQ, Germany / Xetra

- Market Cap Filter

- Micro (< $500M), Mid ($500M-$5B), Large (> $10B)

- Sector or Theme (optional)

- Focus: Automakers, Regional Banks, Semiconductors, etc.

- You can mix sectors – e.g., Advertising + Software Applications

Pro Tip: If your idea is thematic (like “Semiconductors”), limit your universe early to stay focused.

Step 3 – Apply Core Fundamental Filters

This is where you define what “undervalued” means.

Use a combination of valuation, growth, and efficiency filters. Below are the key building blocks:

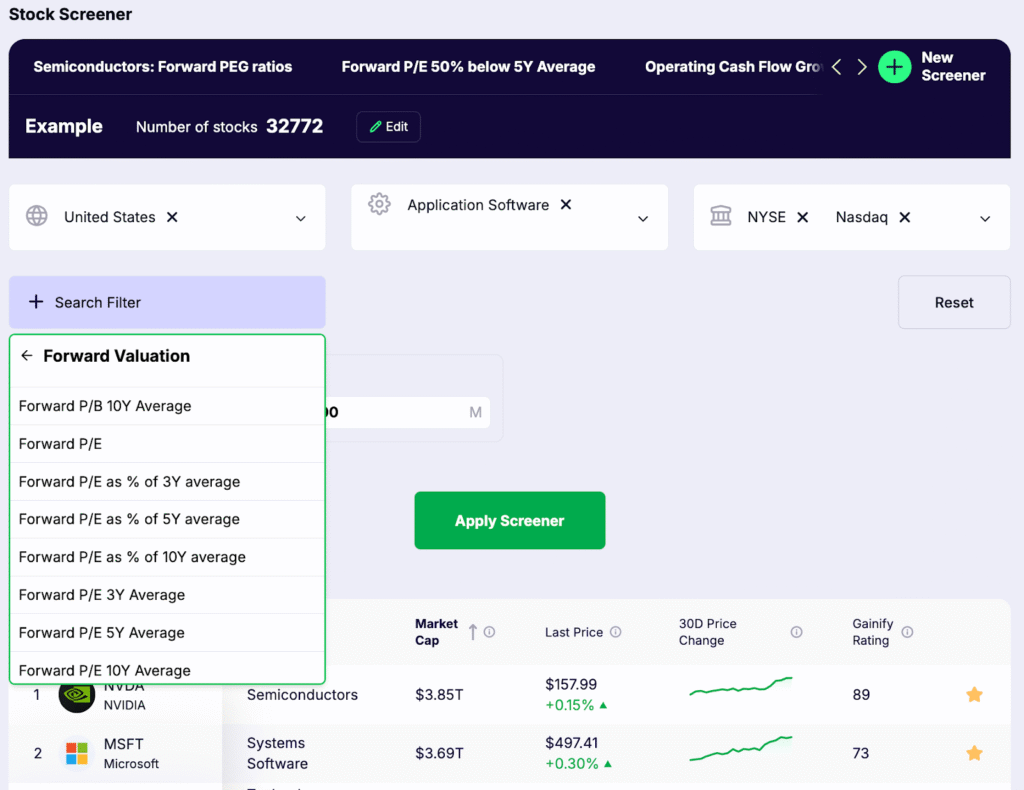

A. Valuation in Context

Instead of fixed cutoffs, compare against the company’s own historical valuation:

- P/E Ratio – below 5-year or 10-year mean

- EV/EBITDA – below 5-year or 10-year mean

- Price-to-Book – especially for asset-heavy sectors (e.g. banks)

Rule of thumb: Stock trading ≥ 20% below its own 5-year average = potential undervaluation

B. Growth & Profitability

You want cheap stocks that are still growing or becoming more efficient.

- 5-Year EPS Growth > Market Median

- PEG < 1 – high growth, low valuation

- ROCE > 12% – capital-efficient companies generating returns above the sector average

- Positive or rising Free Cash Flow Yield

Pro Tip: Evaluate these valuation multiples by comparing them to the company’s own historical norms. Static cutoffs miss nuance, so focus on how the current valuation ranks within the company’s typical range. Gainify offers 3-year, 5-year, and 10-year forward comparisons that help you identify when a stock is priced meaningfully below its usual levels.

Step 4 – Add Sentiment & Analyst Confirmation

Now check if others are starting to notice the opportunity.

These signals don’t drive the screen, they could validate it.

- Analyst Target Upside ≥ 10%

→ Confirms potential for re-rating - At least 3 Strong Buy Ratings

→ Analyst confidence in fundamentals - Insider Buying (past 90 days)

→ Management sees value - Institutional Inflows

→ Growing investor attention

Rule of thumb: Use these to prioritize opportunities with both value and momentum tailwinds.

Step 5 – Save, Review, and Monitor

Make your screener actionable and dynamic.

A. Save Your Screener

- So you can reuse and tweak it over time

- Run the same logic across sectors or countries

B. Manually Review Top Results

- Check the top 10-20 stocks

- Are they consistent with your strategy?

- Any red flags that your filters missed?

C. Refresh Every Quarter

Markets change. Revisit your screener regularly:

- Adjust thresholds (e.g., valuation ranges, growth %)

- Shift sectors based on macro trends

- Add/remove filters as needed

Pro Tip: Your screener is a strategy tool. Treat it as a living process.

A Smarter Way to Read “Cheap”

Low valuation ratios like a P/E of 10 or a Price-to-Book below 1 may suggest a stock is attractively priced, but these numbers alone are not enough to justify an investment. Many companies trade at low multiples because of weak fundamentals, poor industry conditions, or long-term decline.

Before making a decision based on a screener result, it is important to look deeper into the business. Key questions to consider include:

- Does the company continue to deliver real value to its customers?

- Is its earnings growth supported by operational strength rather than one-off events?

- Does it have any competitive advantage that is difficult for others to replicate?

- Is the industry facing long-term headwinds that could limit future returns?

These qualitative factors help determine whether the low valuation reflects temporary mispricing or structural problems. Strong screeners identify candidates, but sound decisions come from further analysis.

This approach is used by practitioners like Riyas MA, who recommend combining financial metrics with business insight when selecting undervalued growth stocks. The numbers are a starting point, not the full story.

Final Thought

A custom stock screener is most effective when built on a clear and repeatable structure. Gainify gives you the flexibility to combine key financial filters with targeted selection, helping you focus on companies that are priced attractively and show fundamental strength.

The goal is to identify stocks that are not just statistically cheap but supported by real business performance. With regular review and thoughtful adjustments, your screener can become a core part of your investment process.

Quick Summary: Screener Setup

- Step 1: Define your objective

Decide what kind of undervaluation you want to find (deep value, GARP, turnaround, etc.) - Step 2: Set your universe

Choose the country, exchange, market cap range, and sector focus - Step 3: Apply fundamental filters

Use valuation, growth, and efficiency metrics based on company history - Step 4: Add confirmation signals

Include analyst upside, insider activity, and institutional flows - Step 5: Save, review, and monitor

Store your screener, check top results regularly, and adjust filters over time

A well-designed screener helps you stay focused, consistent, and data-driven in identifying opportunities with long-term potential.