Few sectors shape modern life as profoundly as pharmaceuticals. From extending human longevity to transforming chronic disease into manageable conditions, the companies at the top of the global pharma hierarchy drive the innovations that define contemporary medicine. These firms operate at enormous scale, manage some of the world’s most valuable intellectual property portfolios and generate the cash flows needed to sustain multi-billion-dollar R&D pipelines year after year.

In 2025, the pharmaceutical landscape is undergoing a decisive shift. Obesity and metabolic disease have become new megacap therapeutic markets. Oncology continues to lead drug spending worldwide. Immunology, vaccines and neuroscience are entering periods of accelerated innovation. Meanwhile, regulatory frameworks, pricing pressure and demographic tailwinds are reshaping long-term competitive positioning. Against this backdrop, the largest pharmaceutical companies are the ones best placed to convert scientific breakthroughs into durable commercial franchises.

These companies matter because they combine three things investors seldom find in a single sector:

• structural, non-cyclical demand

• high cash generation and strong balance sheets

• defensible moats built on patents, data, scale and global distribution

And that is why it matters to know the 10 largest pharmaceutical stocks by market cap, what they do and how they shape the future of global healthcare.

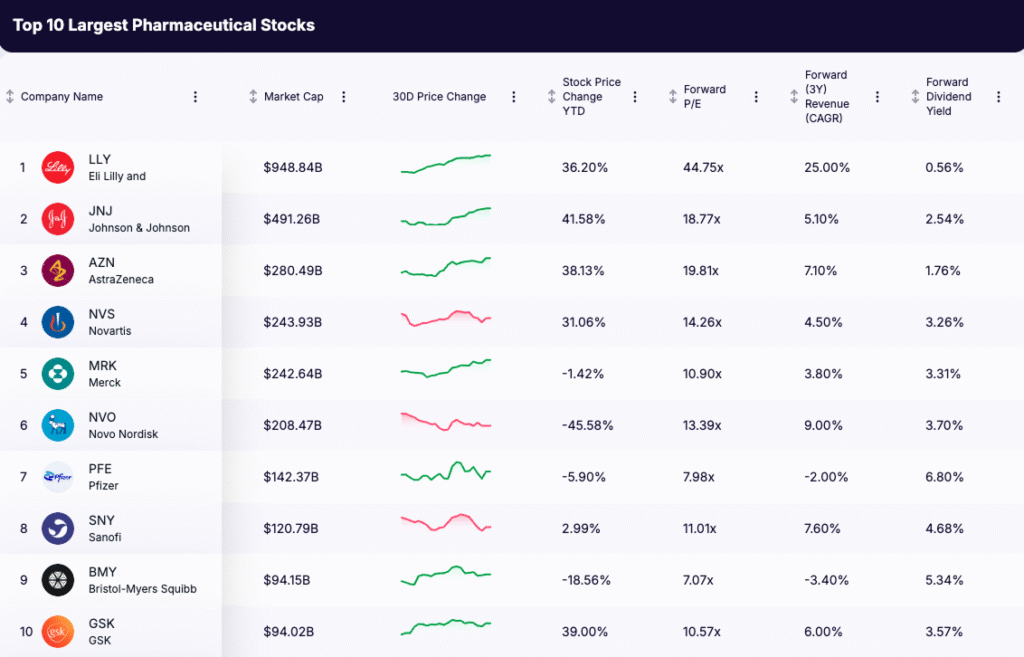

Top 10 Largest Pharmaceutical Stocks by Market Cap

Before we examine each company individually, it is worth understanding why these names stand apart. These firms control the most valuable portfolios in the industry, dominate prescription sales across major therapeutic categories and possess the scale to fund long-duration R&D programs that smaller competitors cannot match.

They are the companies attracting the most institutional capital. They are the core of every global healthcare portfolio. And they are the firms most likely to shape the next decade of medical innovation.

Below is the list of the Top 10 Largest Pharmaceutical Stocks by Market Cap in 2025.

To discover similar stocks, open the Gainify stock screener and select ‘Pharmaceuticals’ from the Industry filter.

1. Eli Lilly (LLY)

Anchor GLP-1 franchise with broad pipeline optionality

Key Financials

Market cap: $948.8B

Forward P/E: 44.75x

Forward 3Y revenue CAGR: 25.00%

Forward dividend yield: 0.56%

Business profile and key products

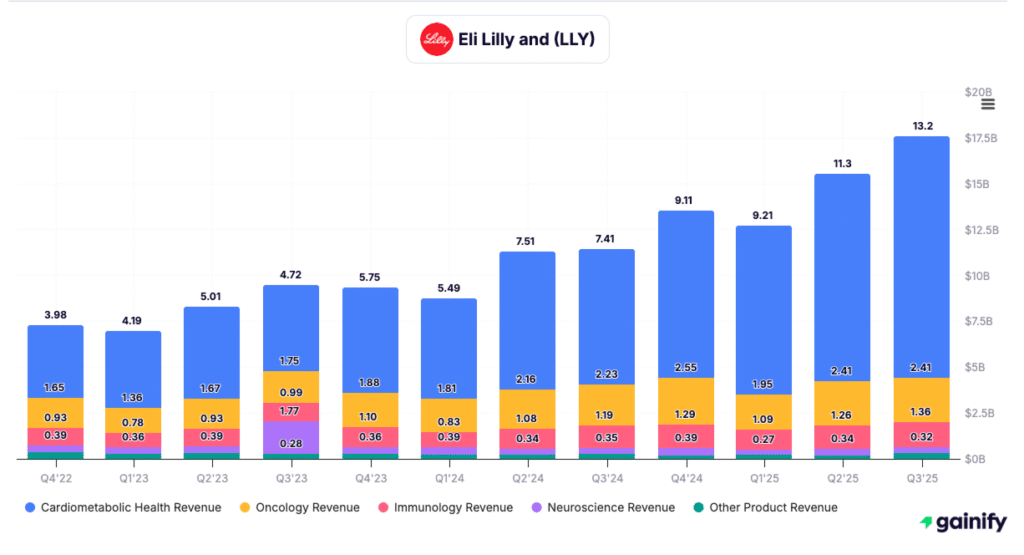

Lilly is positioned around diabetes, obesity and oncology with additional presence in immunology and neuroscience. Its GLP-1 portfolio drives the majority of growth, led by Mounjaro for type 2 diabetes and Zepbound for obesity. Additional contributors include Verzenio in oncology, Ebglyss in psoriasis, Omvoh in ulcerative colitis, Jaypirca in hematology and Kisunla in Alzheimer’s disease.

Recent developments

Key product revenue surged across Q2 and Q3 2025. GLP-1 demand drove U.S. growth above 35% year on year, and global revenue from strategic products exceeded 13 billion dollars per quarter. Manufacturing scale remains the limiting factor rather than demand.

Investment view

Lilly is the clearest large-cap expression of the obesity and cardiometabolic theme, with strong exclusivity on tirzepatide and a broad next-wave pipeline. Growth visibility is higher than peers, but valuation already reflects strong expectations.

Key risks

Pricing pressure for GLP-1 products, safety or tolerability signals in obesity use, manufacturing ramp challenges, and development risk across Alzheimer’s and other pipeline assets.

2. Johnson & Johnson (JNJ)

Diversified healthcare compounder with strengthened innovative-medicine focus

Key Financials

Market cap: $491.3B

Forward P/E: 18.77x

Forward 3Y revenue CAGR: 5.10%

Forward dividend yield: 2.54%

Business profile and key products

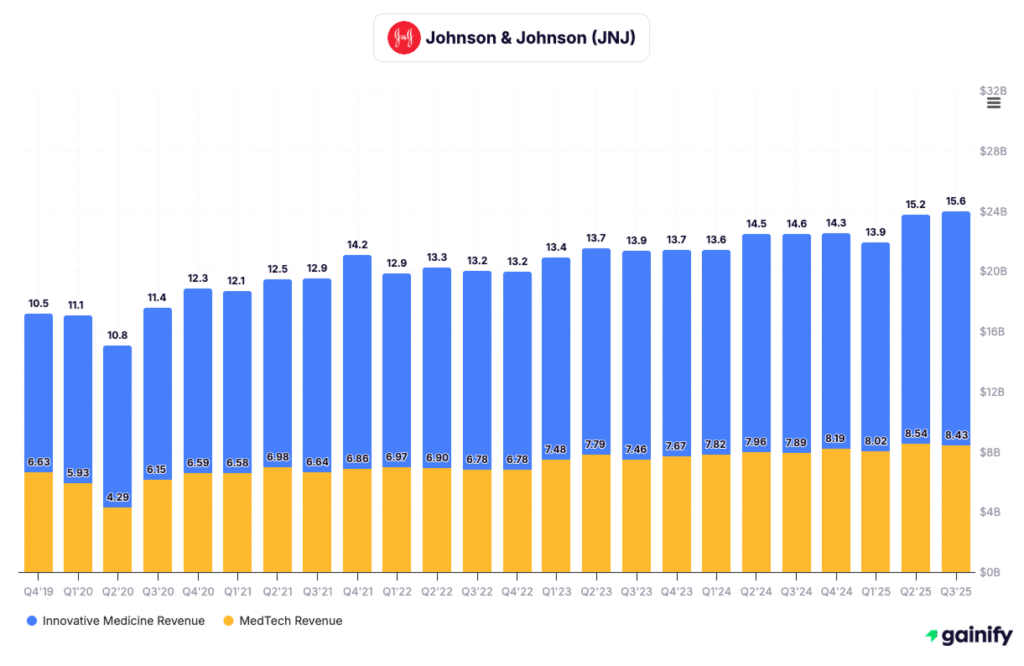

After separating its consumer-health unit, Johnson & Johnson now operates across two segments: Innovative Medicine and MedTech.

Innovative Medicine is driven by a focused portfolio in oncology, immunology and neuroscience. Key assets include:

• Darzalex (multiple myeloma)

• Carvykti (BCMA CAR-T therapy)

• Erleada (prostate cancer)

• Rybrevant (EGFR exon 20 lung cancer)

• Tremfya and Simponi (immunology)

• Spravato (treatment-resistant depression)

Recent developments

Innovative Medicine delivered roughly 5% operational growth in Q3 2025, supported by continued adoption of oncology and immunology therapies. Growth was partially offset by ongoing biosimilar pressure on Stelara and softer performance from Imbruvica. J&J raised full-year guidance on the strength of key launches and steady performance in MedTech.

Investment view

JNJ offers one of the most stable risk-adjusted profiles in large-cap pharma. Its diversification, strong balance sheet and consistent dividend support defensive characteristics, while oncology, immunology and cell therapy provide multi-year growth drivers. The company’s ability to replace Stelara revenue is central to sustaining momentum.

Key risks

Upcoming patent expiries in key franchises, legal overhangs tied to legacy products and potential U.S. pricing reforms, particularly within Medicare.

3. AstraZeneca (AZN)

Oncology-led growth engine with strength across CVRM and respiratory

Key Financials

Market cap: $280.5B

Forward P/E: 19.81x

Forward 3Y revenue CAGR: 7.10%

Forward dividend yield: 1.76%

Business profile and key products

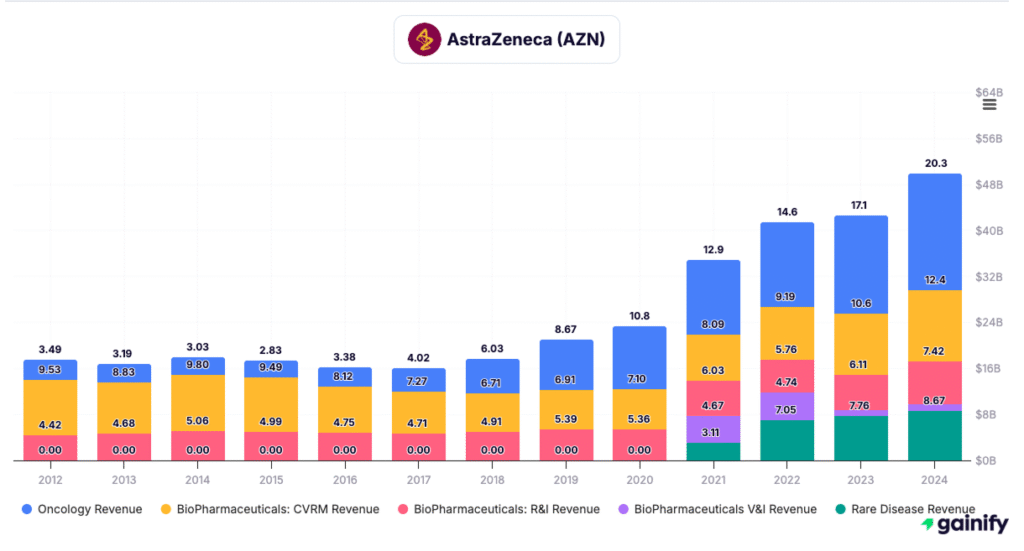

AstraZeneca is structured around three global growth engines: Oncology, Cardiovascular-Renal-Metabolism (CVRM) and Respiratory & Immunology. Oncology remains the largest contributor, led by targeted therapies Tagrisso, Lynparza, Calquence, the immunotherapy Imfinzi and the antibody-drug conjugate Enhertu (in partnership with Daiichi Sankyo). In CVRM, Farxiga continues to drive broad-based demand across diabetes, heart failure and chronic kidney disease, complemented by Brilinta in cardiovascular care. Within Respiratory & Immunology, biologics Fasenra and Tezspire anchor the franchise alongside established inhaled therapies.

Recent developments

First-half 2025 results showed steady top-line growth, led by accelerated adoption of oncology therapies across multiple tumor types. Data presented at major oncology congresses strengthened the company’s position in breast and gastric cancer, particularly through ongoing Enhertu and SERENA program updates. Management reaffirmed its outlook for continued revenue expansion and reiterated its medium-term target of double-digit earnings growth.

Investment view

AstraZeneca offers a diversified pipeline and a well-balanced commercial portfolio with a high concentration of products in growth phases rather than late-cycle decline. Its leadership in oncology, expanding ADC franchise and durable CVRM base support one of the strongest multi-year growth profiles among large-cap pharmaceutical companies.

Key risks

Competition across key oncology categories, class-wide pricing pressure for SGLT2 therapies and the execution complexity of a large late-stage development program.

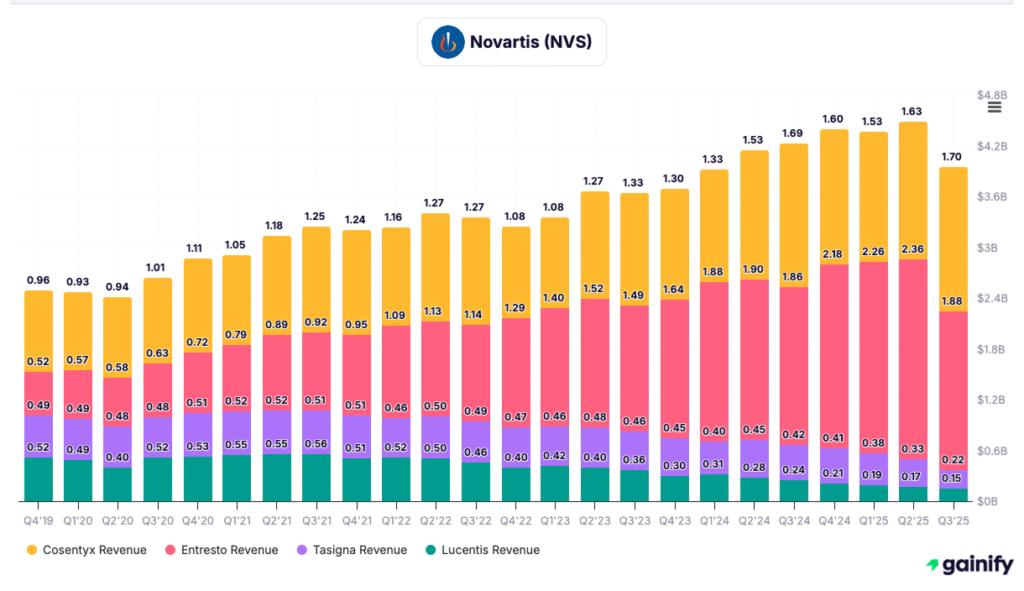

4. Novartis (NVS)

Pure-play innovative medicines with a focused growth portfolio

Key Financials

Market cap: $243.9B

Forward P/E: 14.26x

Forward 3Y revenue CAGR: 4.50%

Forward dividend yield: 3.26%

Business profile and key products

Following the separation of Sandoz, Novartis now operates as a focused, pure-play innovative medicines company. Its growth is anchored by a diversified set of mid-cycle blockbusters spanning major therapeutic areas. In cardiology, Entresto remains a foundational product with broad global adoption. Oncology growth is driven by Kisqali in breast cancer, Pluvicto in prostate cancer and Scemblix in chronic myeloid leukemia. In neuroscience, Kesimpta continues to expand in multiple sclerosis. Leqvio contributes to the company’s longer-term strategy in lipid management with an infrequent dosing profile that supports adherence.

Recent developments

Second-quarter 2025 results showed strong double-digit revenue growth supported by continued uptake of Kisqali and Kesimpta, each growing above 40% year over year. Entresto maintained durable momentum and remains one of the company’s largest global products. Margin performance improved with operating leverage, and management increased peak-sales expectations across several key assets, underscoring confidence in the portfolio’s trajectory.

Investment view

Novartis benefits from a balanced mix of high-growth assets in oncology and neuroscience, paired with durable cardiovascular revenue. Its mid-cycle product concentration reduces reliance on any single therapy, while disciplined capital allocation and a cleaner operating profile post–Sandoz support consistent earnings and cash generation. Valuation remains reasonable relative to its growth outlook.

Key risks

Regulatory outcomes for radioligand therapies, competitive dynamics in oncology, patent expiries later in the decade and execution risk around business development initiatives.

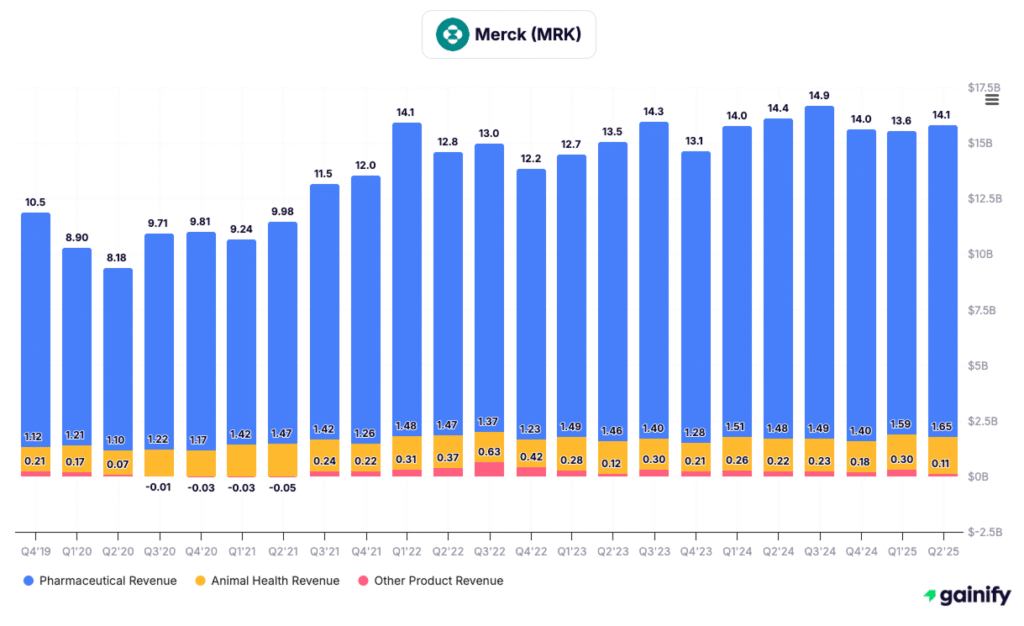

5. Merck & Co. (MRK)

Keytruda-driven cash engine with expanding cardio and vaccine exposure

Key Financials

Market cap: $242.6B

Forward P/E: 10.90x

Forward 3Y revenue CAGR: 3.80%

Forward dividend yield: 3.31%

Business profile and key products

Merck’s portfolio is anchored by Keytruda, the leading PD-1 immunotherapy and the company’s primary growth driver across multiple oncology indications. Beyond oncology, Merck maintains meaningful scale in vaccines through Gardasil, which remains a top global vaccine franchise. Additional contributors include cardiometabolic medicines, hospital acute-care therapies and a sizable animal health division that provides steady, recurring revenue. The company continues to invest in expanding Keytruda into earlier-stage cancer settings and advancing next-generation immuno-oncology and cardiometabolic assets.

Recent developments

Third-quarter 2025 results exceeded expectations, with Keytruda growing approximately 10% year on year to more than 8 billion dollars in quarterly revenue. Softer demand for Gardasil in China partially offset performance, but overall operational growth remained solid. Merck reaffirmed its full-year outlook and highlighted progress across late-stage oncology studies aimed at expanding Keytruda’s use in adjuvant and neoadjuvant settings. The company also advanced multiple cardiovascular and immunology programs intended to diversify long-term revenue.

Investment view

Merck offers a strong combination of defensive earnings, high cash flow generation and one of the most important assets in global oncology. While Keytruda concentration is high, its breadth of indications, continued expansion into earlier treatment lines and long patent runway support a stable medium-term outlook. The company’s balance sheet, dividend profile and clinical pipeline provide additional stability.

Key risks

High reliance on a single asset, eventual biosimilar competition for Keytruda early in the next decade, exposure to U.S. drug pricing reforms and execution risk in diversifying the portfolio beyond oncology.

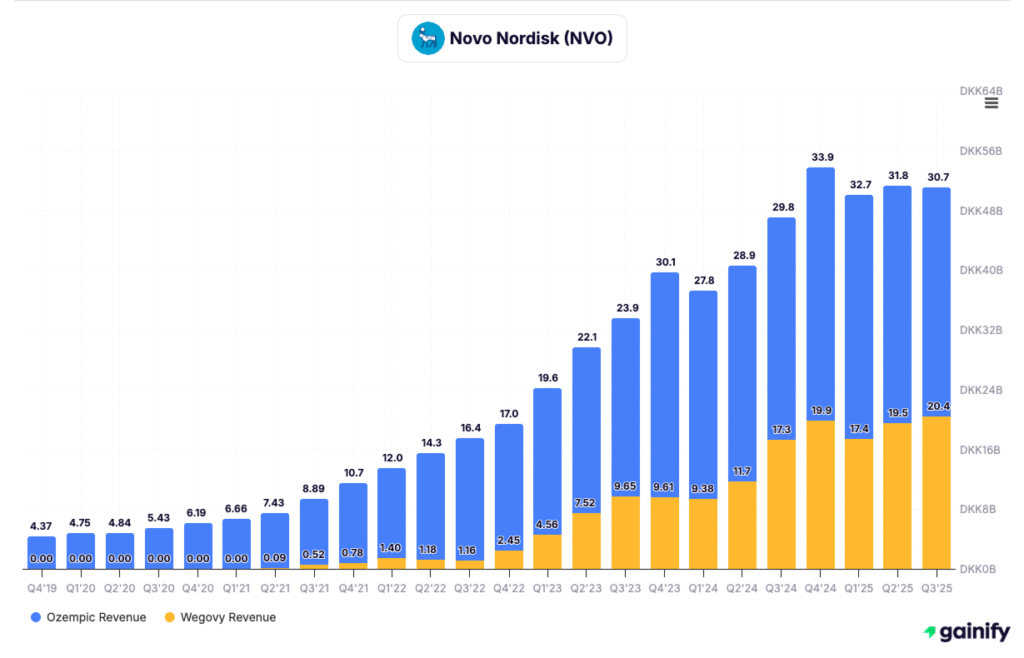

6. Novo Nordisk (NVO)

Diabetes and obesity leader managing rising GLP-1 competition

Key Financials

Market cap: $208.5B

Forward P/E: 13.39x

Forward 3Y revenue CAGR: 9.00%

Forward dividend yield: 3.70%

Business profile and key products

Novo Nordisk is a global leader in diabetes and obesity care, with a portfolio anchored by its GLP-1 franchise. Ozempic remains the company’s largest product, driving sustained global demand in type 2 diabetes. Wegovy, the once-weekly obesity treatment, is scaling rapidly and has become the company’s second major growth engine. These products sit alongside Rybelsus, the oral semaglutide formulation, modern insulin analogues and a focused portfolio in rare endocrine disorders. Together, they position Novo as one of the dominant players in metabolic disease.

Recent developments

Novo Nordisk’s growth continues to be driven by accelerating global adoption of GLP-1 therapies across both diabetes and obesity. Ozempic has maintained strong, consistent demand with broad international uptake, while Wegovy has expanded rapidly since 2023 as manufacturing constraints eased and obesity reimbursement improved in key markets. Together, these products now account for the majority of Novo’s growth, reflecting sustained momentum across metabolic care.

Operationally, the company is scaling production capacity to meet long-term demand, including major investments in active pharmaceutical ingredient and fill-finish facilities. Management also launched a company-wide restructuring program aimed at improving efficiency and aligning resources with its metabolic portfolio strategy. In parallel, Novo agreed to acquire Akero Therapeutics, adding a Phase 3 MASH program that broadens its presence in liver and metabolic disease and complements the GLP-1 franchise.

Investment view

Novo remains one of the central players in the GLP-1 category. Demand visibility for Ozempic and Wegovy is high, supported by expanding obesity reimbursement and broader metabolic indications. The company is proactively diversifying its portfolio through internal R&D and acquisitions, though competitive pressure from Eli Lilly has increased. Despite near-term volatility, the long-term addressable market for obesity and cardiometabolic disease supports a strong strategic position.

Key risks

Heightened GLP-1 competition, pricing pressure across major markets, supply-chain and manufacturing constraints, and execution risks tied to restructuring and new pipeline integration.

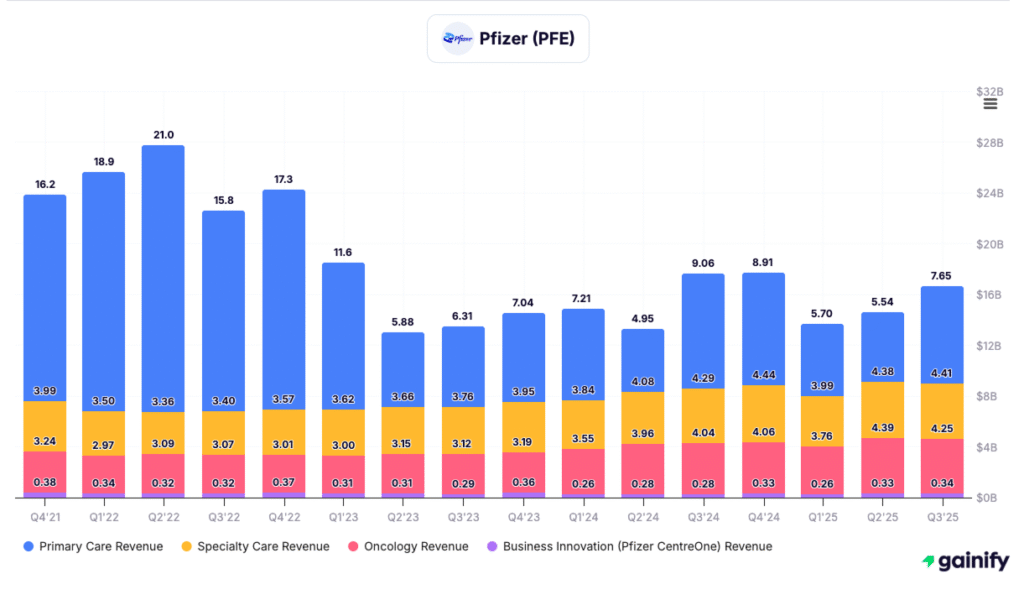

7. Pfizer (PFE)

Turnaround strategy shifting from pandemic revenue to next-generation launches

Key Financials

Market cap: $142.4B

Forward P/E: 7.98x

Forward 3Y revenue CAGR: -2.00%

Forward dividend yield: 6.80%

Business profile and key products

Pfizer is transitioning from its pandemic-era revenue peak toward a more diversified portfolio centered on cardiometabolic disease, oncology, vaccines and rare conditions. Key contributors include Vyndaqel for ATTR cardiomyopathy, the Prevnar pneumococcal vaccine franchise, oncology agent Padcev (through Seagen) and co-promoted anticoagulant Eliquis. Covid products Comirnaty and Paxlovid remain meaningful but continue to normalize as global demand recedes.

Recent developments

Pfizer’s recent updates show early signs of stabilization as non-Covid products regain momentum. Growth in Vyndaqel and increased uptake of newer launches supported improving operational trends through 2025. The integration of Seagen continues to expand Pfizer’s oncology footprint, adding multiple approved therapies and a deep ADC pipeline. Management raised full-year EPS guidance, reflecting cost discipline and better-than-expected performance across select therapeutic areas, even as total revenue remains below pandemic-era levels.

Investment view

Pfizer screens as a high-yield, low-multiple turnaround with meaningful optionality. The company holds one of the largest late-stage pipelines in the industry and is positioned to unlock incremental value as recent launches scale and oncology contribution increases. Cash flow remains strong even at lower Covid volumes, providing flexibility for debt reduction, dividends and targeted business development.

Key risks

Execution risk around new product launches, integration of Seagen’s oncology portfolio, continued normalization in Covid revenues, exposure to U.S. pricing reforms including the inflation Reduction Act and the need to offset upcoming patent expiries.

8. Sanofi (SNY)

Immunology and vaccines platform with strengthened growth momentum

Key Financials

Market cap: $120.8B

Forward P/E: 11.01x

Forward 3Y revenue CAGR: 7.60%

Forward dividend yield: 4.68%

Business profile and key products

Sanofi’s growth is driven by its Specialty Care and Vaccines franchises, with immunology continuing to be the central engine. Dupixent remains the company’s most important asset, with broad indications across atopic dermatitis, asthma and COPD. Additional specialty-care contributors include Altuviiio for hemophilia and Aubagio and Tzield in immunology and autoimmune disease. In vaccines, Sanofi maintains global scale with products across influenza, meningitis, pediatric disease and RSV prevention, including the fast-growing Beyfortus antibody.

Recent developments

Sanofi delivered solid growth through 2025, driven primarily by sustained double-digit expansion of Dupixent and strong uptake of newly launched vaccines and specialty medicines. Management continued to execute on a multi-year efficiency program, reinvesting savings into priority R&D areas while returning capital via share repurchases. The company reaffirmed its focus on immunology, vaccines and first-in-class or best-in-class biologics, positioning the pipeline for more predictable long-term growth.

Investment view

Sanofi offers a balanced profile of growth and income. Dupixent provides durable, high-margin cash flow with still-expanding indications, while vaccines add recurring revenue and global diversification. The company’s disciplined cost structure, improved R&D focus and consistent shareholder returns support a more stable medium-term outlook relative to many European peers.

Key risks

High dependence on Dupixent, variable vaccine demand across geographies, pricing and access pressure in immunology and the challenge of scaling newer specialty-care assets quickly enough to diversify revenue contribution.

9. Bristol Myers Squibb (BMY)

Transforming portfolio with rising contribution from growth assets

Key Financials

Market cap: $94.2B

Forward P/E: 7.07x

Forward 3Y revenue CAGR: -3.40%

Forward dividend yield: 5.34%

Business profile and key products

Bristol Myers Squibb is navigating a multiyear transition as revenue from legacy blockbusters, including Revlimid, declines and a newer group of therapies expands. The company’s growth portfolio includes immunotherapy Opdivo, anticoagulant Eliquis (co-promoted), anemia drug Reblozyl, cardiomyopathy therapy Camzyos and the cell therapies Breyanzi and Abecma. These assets now account for an increasingly large percentage of total company sales and represent the core of BMS’s next decade of value creation.

Recent developments

BMS delivered modest top-line growth in 2025, with the growth portfolio rising at a double-digit rate and surpassing half of total revenue. This helped offset the ongoing erosion of Revlimid and soft performance in certain mature franchises. Management raised full-year revenue guidance and continued to add to its pipeline through targeted business-development activity, including transactions aimed at strengthening oncology, neurology and inflammation portfolios.

Investment view

BMS trades at a discounted valuation due to market skepticism about its ability to fully replace declining legacy revenue. However, the company now has multiple mid- to late-stage assets with meaningful commercial potential, and a growing base of cell-therapy revenue provides differentiated exposure within oncology. For investors comfortable underwriting pipeline execution and business-development strategy, the risk-reward remains attractive relative to peers.

Key risks

Accelerating generic erosion of Revlimid, future patent expiries for Eliquis and Opdivo, clinical and regulatory uncertainty across newer assets and the need to execute efficiently on a broad pipeline to sustain long-term growth.

10. GSK (GSK)

Vaccines and HIV specialist with growing specialty-medicine presence

Key Financials

Market cap: $94.0B

Forward P/E: 10.57x

Forward 3Y revenue CAGR: 6.00%

Forward dividend yield: 3.57%

Business profile and key products

GSK operates through three primary areas: Specialty Medicines, Vaccines and General Medicines. Growth is increasingly driven by specialty medicines, led by the HIV portfolio (Dovato, Juluca), oncology therapy Jemperli and respiratory therapy Trelegy. GSK remains a global leader in vaccines, with major contributors including Shingrix for shingles, Arexvy for RSV in older adults and a broad meningitis portfolio. These franchises form a mix of durable, recurring revenue and expanding specialty-care exposure.

Recent developments

The company delivered solid performance through 2025, with quarterly revenue supported by strong uptake of Shingrix, Arexvy and meningitis vaccines, as well as continued expansion in the HIV franchise. Specialty Medicines remained the fastest-growing segment, benefiting from increased European and international demand. Management upgraded full-year sales and EPS guidance, reflecting operational strength and improved execution. GSK is also preparing for a CEO transition, with a strategic focus on strengthening its oncology and infectious-disease pipelines.

Investment view

GSK offers a balanced profile of growth, income and defensive earnings. Its leadership positions in vaccines and HIV provide stable, high-margin cash flow, while Jemperli and other specialty-medicine assets support medium-term expansion. The company’s renewed R&D discipline and emphasis on high-value biologics enhance visibility in core therapeutic areas. For investors seeking a mix of stability and selective growth catalysts, GSK remains a credible large-cap holding.

Key risks

Uncertain U.S. vaccine demand patterns, long-term HIV patent expiries, slower-than-expected scaling of oncology assets and the ongoing need to strengthen late-stage pipeline depth to sustain future growth.

Why Large-Cap Pharma Still Matters

Global pharmaceuticals remain one of the few sectors that combine structural demand growth with high cash generation and durable competitive moats. The largest companies sit at the intersection of three long-term themes:

• ageing populations and chronic disease

• innovation in oncology, immunology, metabolic and infectious disease

• expanding access to medicines in emerging markets

The ten companies below dominate global prescription sales and control many of the industry’s most valuable assets and pipelines.

Final Take: How to Use These Names

These ten companies form the backbone of global large-cap pharma and offer distinct exposure profiles:

High growth, led by obesity and oncology: LLY, AZN, NVO

Balanced growth and defensive earnings: JNJ, NVS, MRK, SNY, GSK

Value and turnaround opportunities with high yield: PFE, BMY

Underlying fundamentals are constructive. Chronic disease prevalence continues to rise, ageing populations expand addressable markets and innovation in oncology, immunology and metabolic disease is creating new multi-billion-dollar franchises.

For investors with a multi-year horizon, a selectively constructed allocation across these names provides a blend of secular growth, downside protection and income, supported by both pipeline catalysts and durable market positioning.

Disclaimer

This content is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations or an offer to buy or sell any securities. The information presented is based on publicly available data believed to be reliable, but no representation or warranty is made regarding its accuracy or completeness. Market conditions and company fundamentals may change without notice. Readers should conduct their own research or consult a qualified financial professional before making any investment decisions.