Renewable energy stocks enter 2026 at a critical transition point, where long-term decarbonization tailwinds remain firmly intact, but near-term performance is increasingly shaped by execution, capital discipline, and policy complexity.

Deloitte’s 2026 Renewable Energy Industry Outlook highlights a sector evolving from rapid capacity build-out toward a more mature phase focused on operational resilience, supply chain optimization, and return on invested capital, particularly as developers and utilities adjust to shifting incentive structures and grid constraints.

While macro and regulatory uncertainty weighed on sentiment through much of 2025, underlying demand for clean power continues to accelerate. Renewables remain the dominant source of new generation capacity globally, led by solar, wind, and energy storage. Companies with diversified asset bases, disciplined capital allocation frameworks, and the ability to navigate regional regulatory regimes are best positioned to translate deployment momentum into sustainable earnings growth.

Market performance reflects this recalibration rather than a breakdown in fundamentals. The iShares Global Clean Energy ETF is up 43.2% year-to-date, yet remains down 41.5% on a five-year basis, highlighting the scale of the prior valuation reset even as sentiment begins to recover. This divergence points to a more selective investment environment, where broad thematic exposure is giving way to company-specific analysis and differentiated risk-reward profiles.

As renewable energy shifts from a growth narrative to an infrastructure-led investment class, the focus moves decisively toward cash flow durability, balance sheet strength, and long-term asset visibility. The top 8 renewable energy stocks to consider below represent market leaders and disciplined operators best positioned to navigate and shape the sector’s next phase.

Key Highlights

- Renewable energy equities are entering a more selective phase, where cash flow durability, capital discipline, and contract quality increasingly matter more than headline capacity growth.

- Market leaders across utilities, contracted power generators, and equipment manufacturers are better positioned to benefit from the sector’s recovery, while weaker balance sheets remain under pressure.

- The top 8 renewable energy stocks to consider, including NextEra Energy, Brookfield Renewable, First Solar, Enphase Energy, Vestas, Ørsted, Clearway Energy, and Ormat Technologies, reflect this shift toward scale, resilience, and long-term visibility.

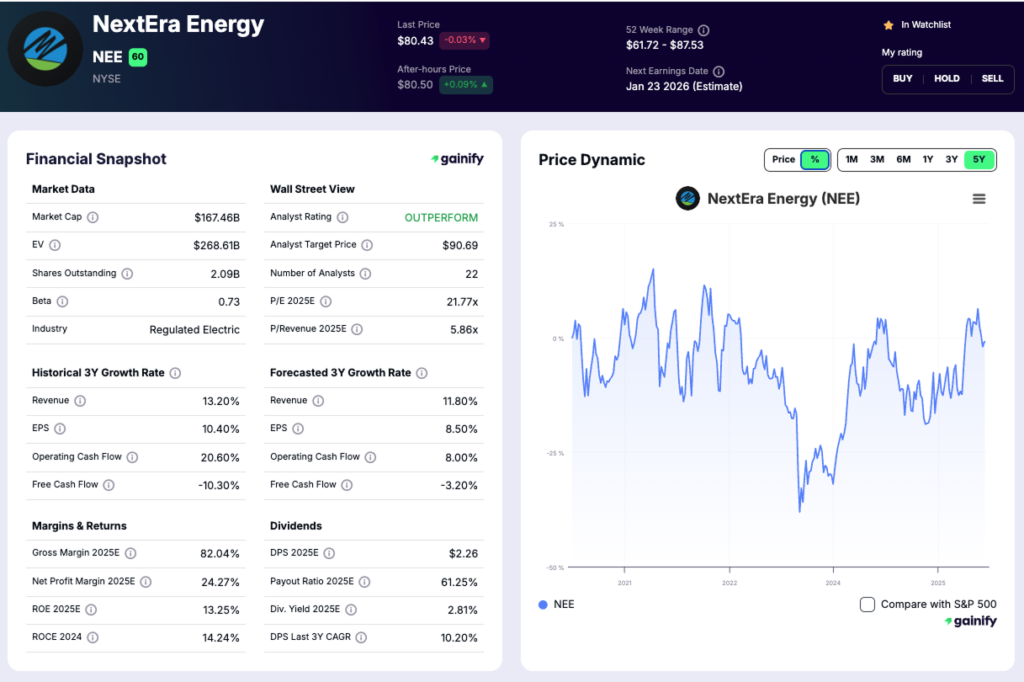

1. NextEra Energy (NYSE: NEE)

Market cap: $167.46B

Forward P/E: 21.77x

Forward 3Y revenue CAGR: 11.80%

Business overview

NextEra Energy is the largest renewable power producer in North America and one of the most defensively positioned energy platforms globally. The company operates through two complementary segments: Florida Power & Light, the largest regulated electric utility in the U.S., and NextEra Energy Resources, a leading developer and operator of wind, solar, and energy storage assets. This structure allows NextEra to pair stable, regulated earnings with long-duration contracted renewable growth.

Investment thesis

NextEra’s investment appeal is built on earnings visibility and scale. Florida Power & Light provides a predictable regulated base, supported by a growing rate base and constructive regulatory environment. On the renewable side, NextEra Energy Resources maintains one of the deepest development pipelines in the industry, with a contracted renewables and storage backlog of 29.6 GW, providing multi-year cash flow visibility. Management continues to target 6%–8% adjusted EPS growth through 2027, reinforcing confidence in the durability of the model. Importantly, growth is largely backed by long-term power purchase agreements, limiting merchant exposure and insulating returns from short-term power price volatility.

Key risks

- Regulatory exposure: regulatory changes that impact allowed returns at Florida Power & Light could affect earnings visibility and long-term capital recovery, particularly if regulatory frameworks or political priorities shift over time.

- Capital execution: execution risk tied to large-scale capital investment programs remains elevated, as project delays, permitting challenges, or cost overruns could pressure near-term returns and slow earnings progression.

- Rate sensitivity: sensitivity to interest rates given the long-duration nature of utility and renewable assets may weigh on valuation multiples and increase the cost of financing future capital deployment.

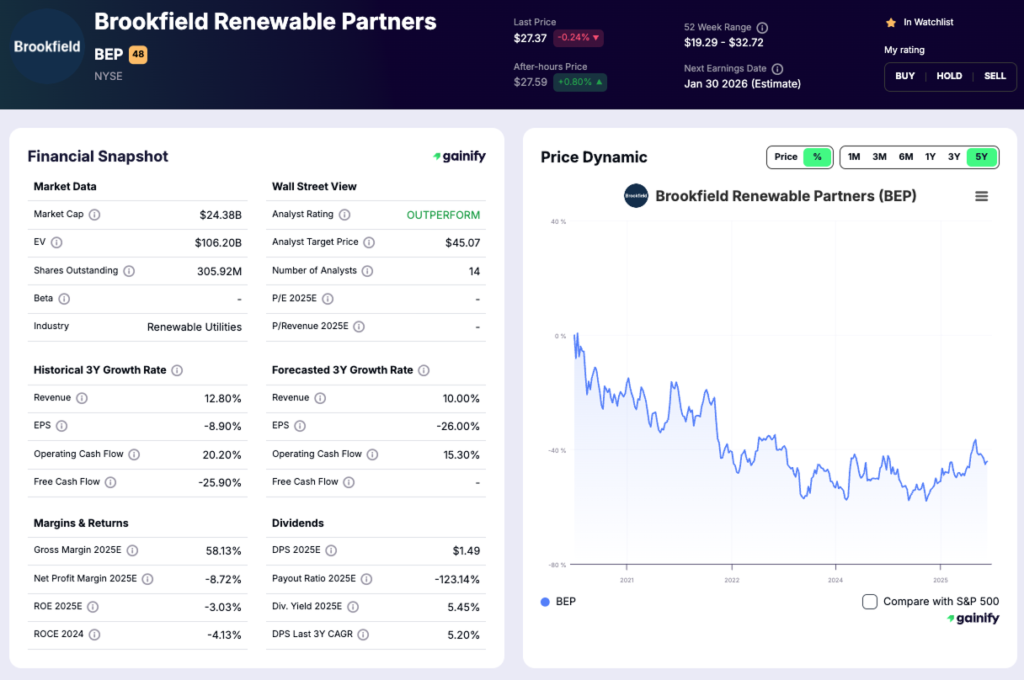

2. Brookfield Renewable Partners (NYSE: BEP)

Market cap: $17.82B

Forward P/E: -22.67x

Analyst target upside: 64.72%

Business overview

Brookfield Renewable Partners is a global owner and operator of renewable power assets across hydroelectric, wind, solar, and energy storage. The platform spans multiple continents and technologies, with a focus on long-life assets supported by contracted or regulated cash flows. Unlike single-technology peers, BEP is structured as a diversified renewable infrastructure business designed to compound value through development, acquisitions, and active asset recycling.

Investment thesis

BEP’s investment case into 2026 is defined by cash flow durability and capital flexibility rather than near-term earnings optics. The partnership controls a large, diversified asset base with long-dated contracts and inflation-linked revenue characteristics, providing stability through power cycles. Management continues to emphasize internally funded growth, supported by $4.7B of available liquidity and a targeted 10%+ growth in funds from operations per unit, alongside mid-single-digit distribution growth.

The negative forward P/E reflects accounting distortions common to asset-heavy partnerships, including depreciation and financing effects, rather than deterioration in underlying economics. For long-term investors, the relevant question is whether BEP can continue compounding per-unit cash flows while maintaining distribution coverage. The current valuation implies skepticism around that outcome, despite a balance sheet and development pipeline that remain well-positioned to execute through a higher-rate environment.

Key risks

- Structural complexity: the partnership structure and reliance on non-GAAP cash flow metrics can obscure underlying performance and contribute to valuation discounts during periods of market stress.

- Capital market dependence: although liquidity is currently strong, BEP’s growth model depends on access to debt markets and asset monetization opportunities. Prolonged capital market disruption could slow deployment and recycling activity.

- Geographic and currency exposure: global diversification reduces single-market risk but introduces foreign exchange volatility and exposure to varying regulatory regimes, which can affect reported results and near-term cash flows.

- Execution discipline: value creation depends on disciplined underwriting, cost control, and timing across acquisitions, developments, and asset sales. Missteps at scale can have an outsized impact on returns.

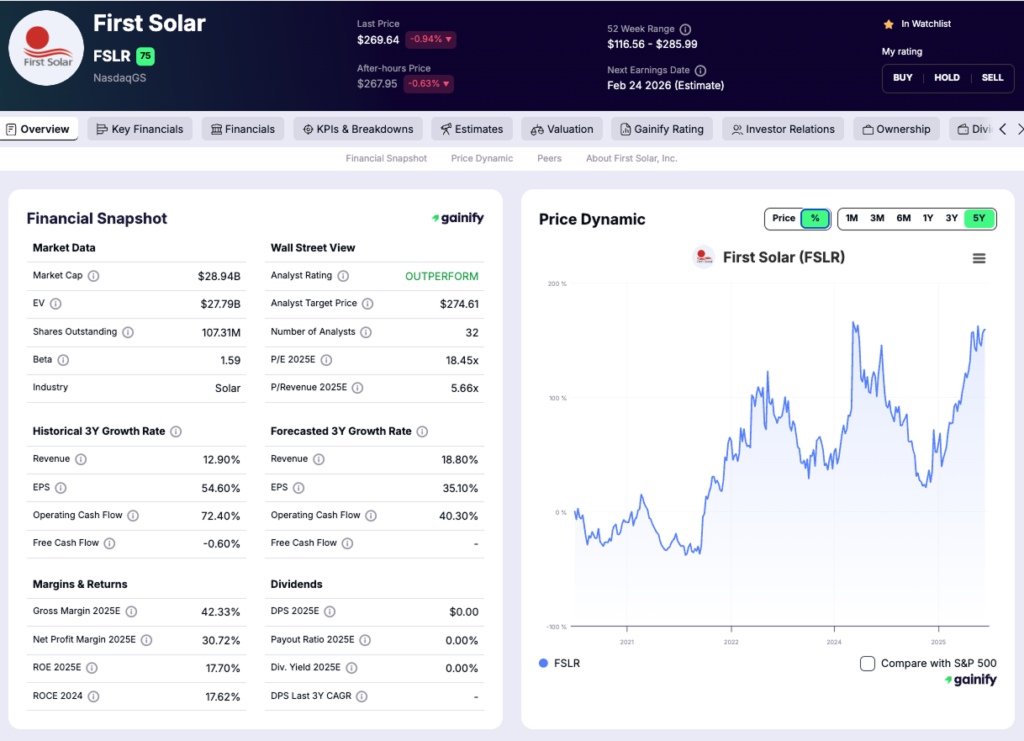

3. First Solar (NASDAQ: FSLR)

Market cap: $28.94B

Forward P/E: 18.45x

Forward 3Y revenue CAGR: 18.80%

Business overview

First Solar is the leading U.S.-based utility-scale solar manufacturer, differentiated by its proprietary cadmium telluride (CdTe) thin-film technology. Unlike most solar peers, First Solar does not compete in commoditized residential or rooftop markets. Instead, it focuses exclusively on large-scale utility and commercial projects, primarily in North America and India, with a vertically integrated manufacturing footprint increasingly centered in the U.S.

Investment thesis

First Solar’s appeal into 2026 is rooted in visibility and domestic advantage. As of Q3 2025, the company reported a bookings backlog of 54.5 GW extending through 2030, providing rare multi-year revenue clarity in the solar manufacturing space. This backlog is complemented by strong financial positioning, with $1.5B in net cash on the balance sheet, offering flexibility to fund capacity expansion and absorb short-term volatility.

Operationally, First Solar continues to scale U.S. manufacturing, with new facilities coming online to support domestic content requirements and benefit from production-linked incentives. The company sold 5.3 GW of modules in Q3 alone, reinforcing its ability to convert backlog into delivered revenue. Combined with a differentiated technology stack, tariff insulation, and long-term customer contracts, First Solar is positioned as a structural beneficiary of utility-scale solar deployment rather than a cyclical module supplier.

Key risks

- Policy dependence: First Solar’s economics are influenced by trade policy, tariffs, and clean energy incentives. Changes to domestic manufacturing credits, trade enforcement, or renewable support mechanisms could impact margins and demand visibility.

- Manufacturing execution: the company is expanding and ramping new production facilities. Delays, yield challenges, or cost overruns during capacity expansion could affect near-term profitability and shipment volumes.

- Customer concentration: utility-scale projects are lumpy by nature and often involve a limited number of large counterparties. Contract cancellations, deferrals, or customer financing issues could introduce earnings volatility.

- Technology competition: while CdTe offers differentiation, continued efficiency improvements from crystalline silicon technologies could pressure pricing or narrow performance advantages over time.

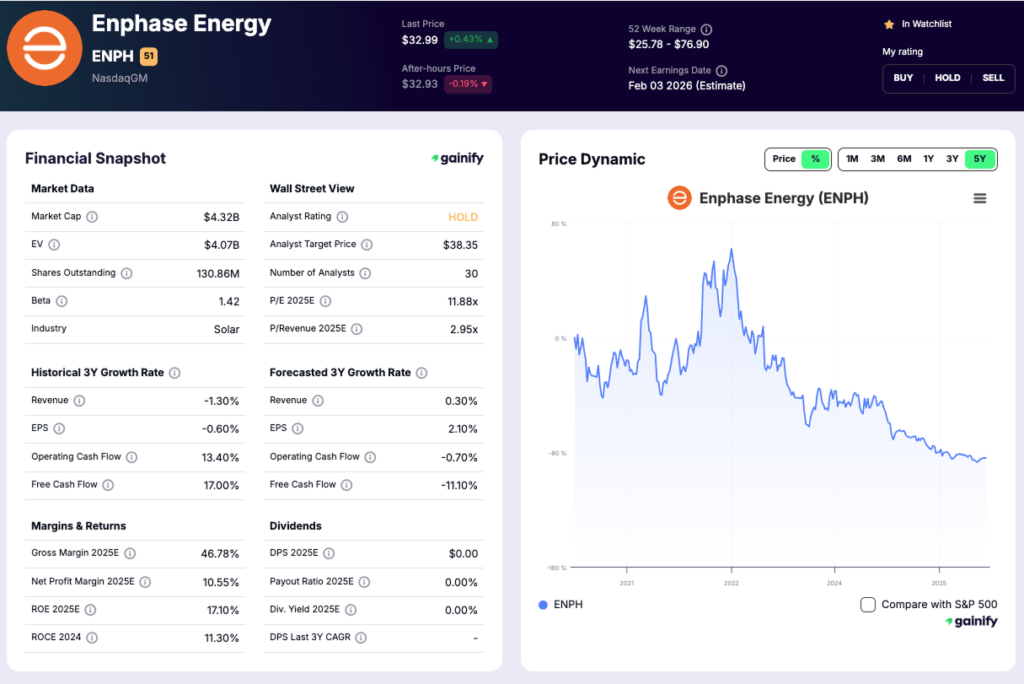

4. Enphase Energy (NASDAQ: ENPH)

Market cap: $4.32B

Forward P/E: 11.88x

Forward 3Y revenue CAGR: 0.30%

Business overview

Enphase Energy is a global leader in solar microinverters and home energy systems, with a differentiated technology stack spanning power electronics, software, energy storage, and home energy management. Unlike traditional inverter manufacturers, Enphase’s distributed architecture converts power at the panel level, improving system reliability, safety, and lifetime performance. The company has expanded beyond solar into batteries, EV charging, and AI-enabled energy management, positioning itself as a full home energy platform rather than a single-product supplier.

Investment thesis

Enphase’s investment case is anchored in resilience and optionality rather than near-term growth. The company shipped approximately 84.8 million microinverters, representing 30.21 GW of deployed capacity across more than 5.0 million systems in over 160 countries, underscoring its scale and installed base advantage. Financially, Enphase generated $1.3B in revenue and $513.7M in operating cash flow in 2024, reflecting a capital-light model with strong cash conversion despite cyclical end-market softness. As residential solar demand normalizes, Enphase stands to benefit disproportionately from higher attach rates of batteries, EV chargers, and energy management software, increasing revenue per home without requiring a rebound to peak installation volumes.

Key risks

- Demand cyclicality: Residential solar installations remain sensitive to interest rates, utility pricing, and incentive structures, particularly in core U.S. and European markets.

- Competitive pressure: Pricing and innovation risk from alternative inverter architectures and low-cost competitors could pressure margins during periods of volume recovery.

- Execution complexity: Expanding into batteries, EV charging, and AI-driven energy management increases product and supply-chain complexity, raising execution and integration risk over time.

5. Vestas Wind Systems (CPSE: VWS)

Market cap: $26.66B

Forward P/E: 31.15x

Forward 3Y revenue CAGR: 14.00%

Business overview

Vestas is the world’s largest manufacturer of wind turbines, with a global footprint spanning onshore and offshore wind markets. Beyond equipment sales, the company operates a sizable and growing service business, which provides long-duration contracts tied to its installed base. This combination positions Vestas as both a cyclical equipment supplier and a long-term infrastructure service provider within global wind energy.

Investment thesis

Vestas is emerging from a multi-year margin reset with improving operational momentum. In Q3 2025, the company generated revenue of EUR 5.3B and delivered an EBIT margin of 7.8%, reflecting stronger onshore execution and lower warranty costs. Order intake reached 4.6 GW during the quarter, while the Power Solutions backlog expanded to EUR 31.6B, providing multi-year revenue visibility. Importantly, the service segment now covers 159 GW under active contracts with an average duration of 11 years, supporting more stable cash flows as turbine installations scale globally. The combination of backlog growth, execution improvements, and recurring service revenue underpins a more resilient earnings profile heading into 2026.

Key risks

- Cost exposure: manufacturing ramp-ups and commodity input volatility can pressure margins, particularly during periods of rapid capacity expansion.

- Project execution: delays in permitting, grid connections, or customer-led project timelines can impact revenue recognition and working capital dynamics.

- Market cyclicality: demand for wind turbines remains sensitive to policy frameworks, auction structures, and regional subsidy changes, which can drive order volatility across markets.

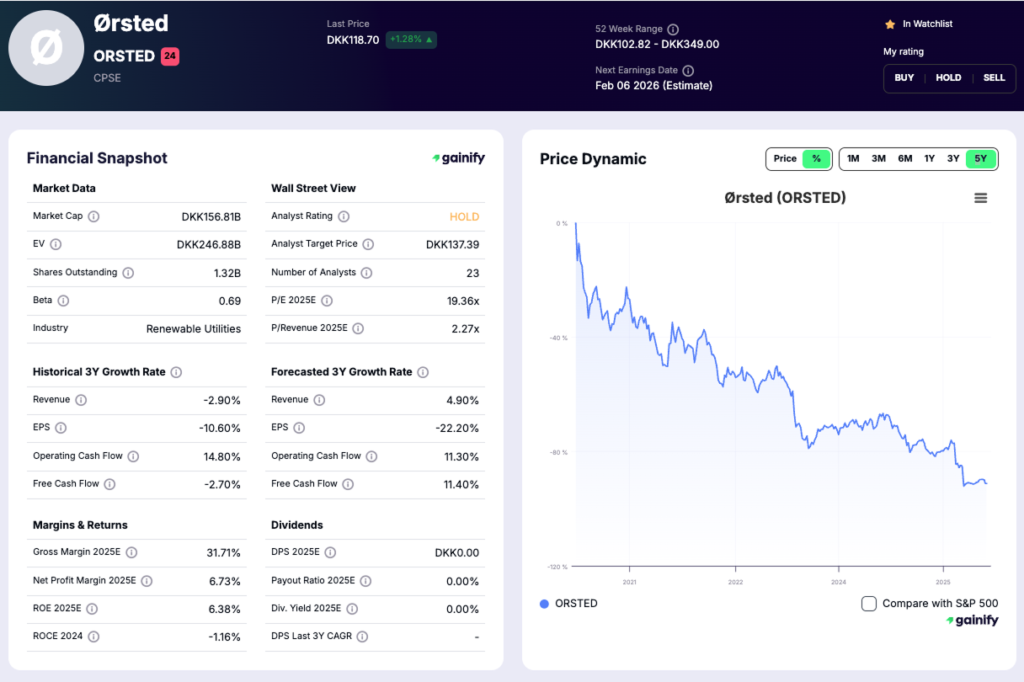

6. Ørsted (CPSE: ORSTED)

Market cap: $24.72B

Forward P/E: 19.36x

Forward 3Y revenue CAGR: 9.40%

Business overview

Ørsted is the global leader in offshore wind, with a fully integrated model spanning development, construction, and operations across Europe, the U.S., and Asia-Pacific. The company operates a predominantly contracted portfolio with a renewable share of generation at 99%, positioning it as one of the purest large-scale renewable platforms globally. Its scale, technical expertise, and early-mover advantage in offshore wind remain difficult to replicate.

Investment thesis

Ørsted is transitioning from a period of balance sheet stress and project repricing into an execution-led recovery phase. The company is currently delivering an 8.1 GW offshore construction portfolio, which management expects to contribute DKK 11–12 bn in annual EBITDA once fully operational.

At the same time, Ørsted has taken decisive actions to stabilize its capital structure, including a completed rights issue and the divestment of a 50% stake in Hornsea 3, a transaction valued at DKK 39 bn, while remaining EBITDA-neutral over the project lifecycle.

Operationally, performance is improving. Offshore availability reached 93% in 9M 2025, while installed renewable capacity stood at 18.5 GW as of September 2025, with 27.4 GW including projects under construction and at final investment decision. These figures underline both near-term cash flow visibility and long-duration growth embedded in the pipeline. With capital discipline tightening and offshore wind economics resetting at more attractive risk-adjusted returns, Ørsted offers asymmetric upside if execution normalizes and policy stability holds.

Key risks

- Project execution complexity: offshore wind construction remains exposed to weather disruptions, supply chain constraints, and contractor performance, which can pressure timelines and costs on multi-gigawatt projects.

- Policy and tariff exposure: changes in U.S. and European tariff regimes, grid connection rules, or subsidy frameworks can materially impact project economics, as evidenced by recent impairment volatility.

- Balance sheet sensitivity: despite capital actions, net interest-bearing debt of DKK 83.2 bn and an FFO to adjusted net debt ratio of 13.9% leave limited room for error if cash flow ramps are delayed or financing costs rise further.

7. Clearway Energy (NYSE: CWEN)

Market cap: $3.90B

Forward P/E: 17.65x

Forward 3Y revenue CAGR: 8.70%

Business overview

Clearway Energy is a U.S.-focused owner of contracted clean power assets, with a portfolio spanning wind, utility-scale solar, battery storage, and flexible generation. The company operates a diversified fleet across core power markets, supported by long-term power purchase agreements that provide predictable and inflation-resilient cash flows. Clearway’s structure emphasizes stability, gradual growth, and disciplined capital allocation rather than merchant exposure.

Investment thesis

Clearway’s appeal lies in the visibility of its cash generation and the clarity of its growth framework. The company operates approximately 12 GW of net capacity under long-term contracts, anchoring revenue stability across economic cycles. Management has reaffirmed a target of $2.70 in CAFD per share by 2027, supported by fully identified investment opportunities rather than speculative development. Beyond that, the sponsor-backed development pipeline exceeds 10 GW of late-stage projects, providing a clear runway for incremental growth through acquisitions and repowering. Together, these factors position Clearway as a lower-volatility renewable infrastructure compounder heading into 2026.

Key risks

- Contract concentration: a significant portion of cash flow is tied to long-term PPAs, creating exposure to counterparty credit quality and renewal terms over time.

- Capital intensity: the growth strategy relies on continued access to debt and equity markets to fund acquisitions and asset optimization, which may become more constrained in adverse capital market conditions.

- Operational variability: renewable generation remains exposed to weather and resource variability, which can affect short-term cash flows despite portfolio

8. Ormat Technologies (NYSE: ORA)

Market cap: $6.86B

Forward P/E: 51.88x

Forward 3Y revenue CAGR: 10.90%

Business overview

Ormat Technologies is a global leader in geothermal power and energy storage, with vertically integrated capabilities spanning resource development, plant construction, and long-term operation. Its geothermal portfolio provides baseload renewable generation, while energy storage has emerged as a fast-growing complementary segment, expanding Ormat’s relevance beyond traditional renewables into grid balancing and capacity solutions.

Investment thesis

Ormat’s investment case is built around long-duration, contracted assets with visible growth. In Q3 2025, the company generated $249.7M in revenue, reflecting a 17.9% year-over-year increase, driven primarily by strength in its Product and Energy Storage segments. Adjusted EBITDA reached $138.4M in the quarter, underscoring operating leverage even as the company continues to invest heavily in growth. Looking forward, Ormat’s development pipeline supports a multi-year expansion path, with approximately 200 MW under development in electricity generation and 325 MW / 1,180 MWh in energy storage projects, positioning the company to compound cash flows as new capacity comes online.

Key risks

- Project execution risk: geothermal and storage developments are capital intensive and technically complex, exposing Ormat to construction delays, cost overruns, or permitting challenges that could pressure returns.

- Commodity and pricing exposure: while much of Ormat’s output is contracted, portions of the portfolio remain sensitive to power price fluctuations and regional market dynamics.

- Capital intensity and leverage: sustained growth requires ongoing capital deployment, and maintaining balance sheet flexibility while funding expansion remains a critical discipline for management.

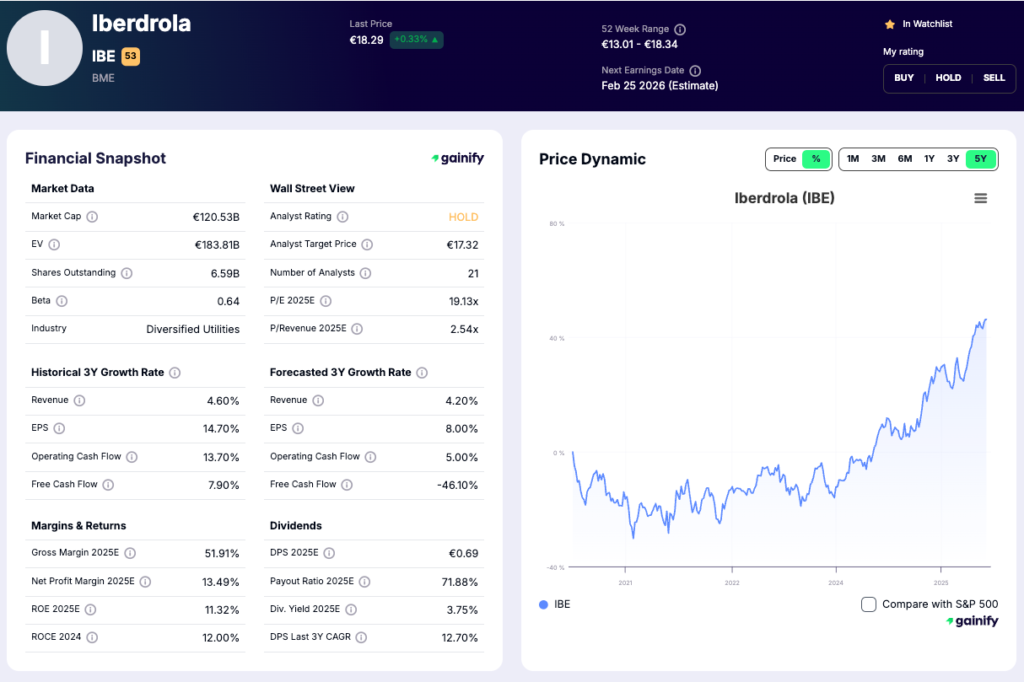

9. Iberdrola (BME: IBE)

Market cap: $141.94B

Forward P/E: 19.13x

Forward 3Y revenue CAGR: 8.80%

Business overview

Iberdrola is one of the world’s largest renewable-focused utilities, with a diversified footprint across regulated networks, renewable generation, and customer solutions in Europe, the U.S., and Latin America. The company’s strategy emphasizes grid expansion and long-duration renewable assets, positioning it as a core infrastructure provider in the global energy transition rather than a pure-play renewable developer.

Investment thesis

Iberdrola’s investment case is anchored in scale, regulatory visibility, and capital discipline. During the first nine months of 2025, the company invested EUR 9.0B, with 55% allocated to regulated networks, reinforcing earnings stability through an expanding regulated asset base. Renewable growth remains selective but substantial, with more than 2,000 MW of new renewable capacity installed over the last 12 months, supporting long-term contracted cash flows. Financial strength is evident in operating performance, with operating cash flow rising to EUR 9.75B, providing internal funding capacity for growth while limiting balance sheet strain.

Key risks

- Regulatory exposure: A significant portion of earnings depends on allowed returns across multiple jurisdictions, making results sensitive to regulatory reviews and policy changes.

- Capital intensity: Sustaining growth requires ongoing large-scale investment, increasing execution risk and exposing returns to construction timelines and cost inflation.

- Market conditions: Power price volatility and renewable subsidy frameworks can impact near-term profitability despite long-term contract coverage.

Conclusion

Renewable energy investing heading into 2026 is no longer about chasing the next wave of capacity additions. It is about durability, discipline, and differentiation. After a multi-year valuation reset, the sector is emerging leaner and more selective, with clear separation between companies that can consistently convert decarbonization demand into cash flows and those that remain structurally capital-constrained.

The renewable leaders highlighted in this article reflect that shift. Regulated utilities such as NextEra Energy and Iberdrola provide earnings visibility and balance-sheet resilience. Contracted asset owners like Brookfield Renewable and Clearway Energy offer long-duration cash flows with embedded growth. Equipment and technology providers including First Solar, Vestas, Enphase, and Ormat introduce selective upside tied to execution, cost control, and market normalization. Together, they span the full renewable value chain while emphasizing scale, contractual protection, and capital discipline.

What ultimately defines success in the next phase of renewable investing is execution over narrative. Companies that can fund growth internally, manage balance sheets conservatively, and deliver projects on time are increasingly rewarded. As renewable energy matures into an infrastructure-like asset class, these businesses are positioned not only to benefit from the energy transition, but to compound value through it.

For investors willing to be selective, 2026 offers a reset opportunity. The cycle has shifted, expectations are more grounded, and the strongest operators now stand out clearly.

Disclaimer

This article is provided for informational and educational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. The views expressed reflect analysis based on publicly available information and company disclosures at the time of writing and are subject to change without notice.

Investing in equities, including renewable energy stocks, involves risk, including the potential loss of principal. Past performance is not indicative of future results. Readers should conduct their own research and consider their individual financial circumstances, investment objectives, and risk tolerance before making any investment decisions. Where appropriate, consultation with a licensed financial advisor is recommended.