REIT stocks remain a core component of long-term real estate investing for income-focused and diversified portfolios. In 2026, the largest REIT stocks represent some of the most established and strategically important owners of income-producing real estate in the global economy. These real estate investment trusts operate across sectors such as healthcare, industrial logistics, data centers, telecommunications infrastructure, and high-quality retail.

The seven largest publicly traded REIT stocks by market capitalization offer investors exposure to durable demand drivers including demographic growth, digitalization, e-commerce expansion, and essential consumer services.

This article examines the top seven largest REIT stocks in 2026, highlighting how each company generates revenue, where growth is coming from, and which financial metrics matter most for investors evaluating real estate investment trusts in the current market environment.

Highlights

- REIT stocks remain a foundational asset class in 2026, offering investors access to income-producing real estate across multiple sectors.

- Largest REIT stocks benefit from scale and diversification, which support stable cash flows, high occupancy levels, and continued access to capital through changing market conditions.

- Leading companies such as Welltower, Prologis, American Tower, Equinix, Digital Realty, Simon Property Group, and Realty Income dominate their respective sectors, reflecting the growing importance of specialized real estate within the global economy.

- Key performance metrics including funds from operations, leverage ratios, occupancy, and same-store net operating income growth provide clearer insight into REIT stock quality than short-term share price movements.

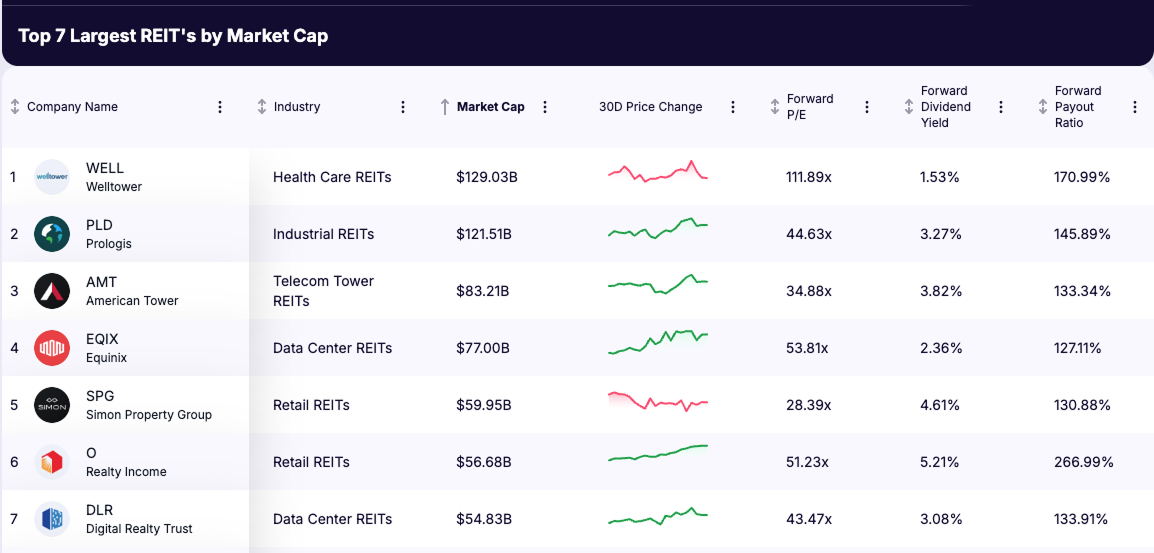

Top 7 Largest REIT Stocks in 2026

The following REIT stocks represent the largest publicly traded real estate investment trusts by market capitalization in 2026. Each company operates at scale within a specific real estate sector and plays a significant role in income generation and long-term real estate ownership.

Rank | Company | Ticker | Type of REIT | Market Cap | Total Assets | Net Debt / EBITDA | Occupancy / Utilization | Same-Store NOI Growth |

|---|---|---|---|---|---|---|---|---|

1 | Welltower | WELL | $129.03B | $59.50B | 3.9x | >90% | +14.5% | |

2 | Prologis | PLD | $121.51B | $98.72B | 5.6x | ~95% | +4.5% | |

3 | American Tower | AMT | Telecom Tower REIT | $83.2B | $63.89B | 6.3x | High | +5.0% |

4 | Equinix | EQIX | $77.00B | $38.06B | 4.4x | >90% | +7–8% | |

5 | Simon Property Group | SPG | $59.95B | $33.60B | 5.76x | >95% | +5% | |

6 | Realty Income | O | Net-Lease Retail REIT REIT | $56.68B | $71.30B | 5.6x | >98% | +2–3% |

7 | Digital Realty | DLR | Data Center REIT | $54.83B | $48.73B | 6.50x | >80% | +3–4% |

Sources: Company filings, Q3 2025 earnings releases, and public investor presentations.

Overview of the 7 Largest REIT Stocks

1. Welltower Inc. (WELL) – Largest Health-Care REIT Stock

Market Capitalization: $129 billion

Overview: Welltower (NYSE: WELL) is the largest healthcare REIT stock in the public markets, with a diversified portfolio of senior housing, post-acute care, and outpatient medical properties across the United States, the United Kingdom, and Canada. The company’s real estate investment trust model emphasizes operating performance, scale, and capital flexibility, positioning Welltower as a core holding among healthcare-focused REIT stocks. Long-term demand is supported by aging population trends, limited new supply, and rising utilization of senior housing and medical facilities.

Operating Performance (Q2 2025)

- Same-store NOI growth: 14.5% year over year, led by 20.3% growth in the Seniors Housing Operating portfolio

- Normalized FFO: $1.34 per diluted share, up 20.7% year over year

- Occupancy growth: approximately 400 basis points year over year across senior housing operations

- Revenue per occupied room: increased 4.8% year over year

- Same-store margin expansion: 260 basis points, as revenue growth outpaced expense inflation

These results highlight improving occupancy, stronger pricing, and increasing operating leverage across Welltower’s healthcare real estate portfolio.

Balance Sheet Strength and Capital Allocation

Welltower maintains one of the strongest balance sheets among large healthcare REIT stocks.

- Net debt to adjusted EBITDA: 2.36x

- Net debt to enterprise value: 7.6%

- Available liquidity: approximately $11.9 billion

During the quarter, the company completed $1.9 billion in investments, primarily focused on senior housing acquisitions and development funding. Subsequent to quarter end, Welltower announced $23 billion in transactions closed or under contract, including large senior housing acquisitions in the U.S. and U.K. and planned outpatient medical property dispositions. These actions reflect active capital recycling aimed at upgrading portfolio quality and improving long-term returns.

Investment Thesis: Welltower’s thesis is increasingly defined by operating leverage, balance sheet flexibility, and disciplined capital recycling. The company is benefiting from accelerating senior housing demand while maintaining pricing power and improving margins. Large-scale acquisitions and dispositions are being used to upgrade portfolio quality and redeploy capital into higher-growth assets, while low leverage preserves optionality through cycles. Management’s long-term executive alignment program further reinforces a focus on sustained per-share growth rather than short-term financial engineering.

Key challenges remain, including labor cost pressures and regulatory complexity within healthcare services, but current trends suggest Welltower is positioned to compound cash flows and dividends as occupancy normalizes and demographic tailwinds strengthen into 2026 and beyond.

2. Prologis (PLD) – Largest Industrial REIT Stock

Market Capitalization: $121.5 billion

Overview: Prologis (NYSE: PLD) is the largest industrial REIT stock globally, focused on the ownership, operation, and development of logistics and warehouse real estate. The company’s portfolio includes distribution centers and fulfillment hubs across North America, Europe, and Asia. These assets are strategically located near major ports, transportation corridors, and population centers, allowing tenants to efficiently move goods through global supply chains. Prologis benefits from long-term structural trends including e-commerce growth, supply-chain modernization, and the reshoring of manufacturing and inventory.

Operating Performance (Q3 2025)

Prologis reported resilient operating performance for the fourth quarter of 2025, supported by high occupancy levels and continued leasing demand across its global industrial portfolio.

- Portfolio occupancy: approximately 95.3% across owned and managed assets

- Cash same-store NOI growth: approximately 5.7% year over year

- Leasing activity: more than 40 million square feet of leases commenced during the quarter

- Core FFO per diluted share: $1.44 for the quarter

- Net earnings per diluted share: $1.49

These results reflect sustained tenant demand, strong rental pricing power, and the essential role industrial real estate plays in modern commerce, even amid a more moderate macroeconomic environment.

Balance Sheet Strength and Capital Allocation

Prologis maintains a disciplined capital structure that supports long-term growth and development activity.

- Debt to adjusted EBITDA: approximately 5.3x

- Debt as a percentage of total market capitalization: approximately 25%

- Available liquidity: more than $7.5 billion at year-end

Management reaffirmed its outlook for continued earnings growth, supported by embedded rent escalations, development completions, and ongoing leasing activity across key logistics markets.

Investment Thesis: Prologis combines scale with enduring structural tailwinds from global trade and logistics growth. Its disciplined leverage of 5.0x EBITDA, long lease terms, and geographic diversification support stable cash flow and predictable FFO expansion. While sensitive to higher interest rates and development costs, the company’s leadership in logistics real estate positions it as a long-term core holding for investors seeking growth and stability.

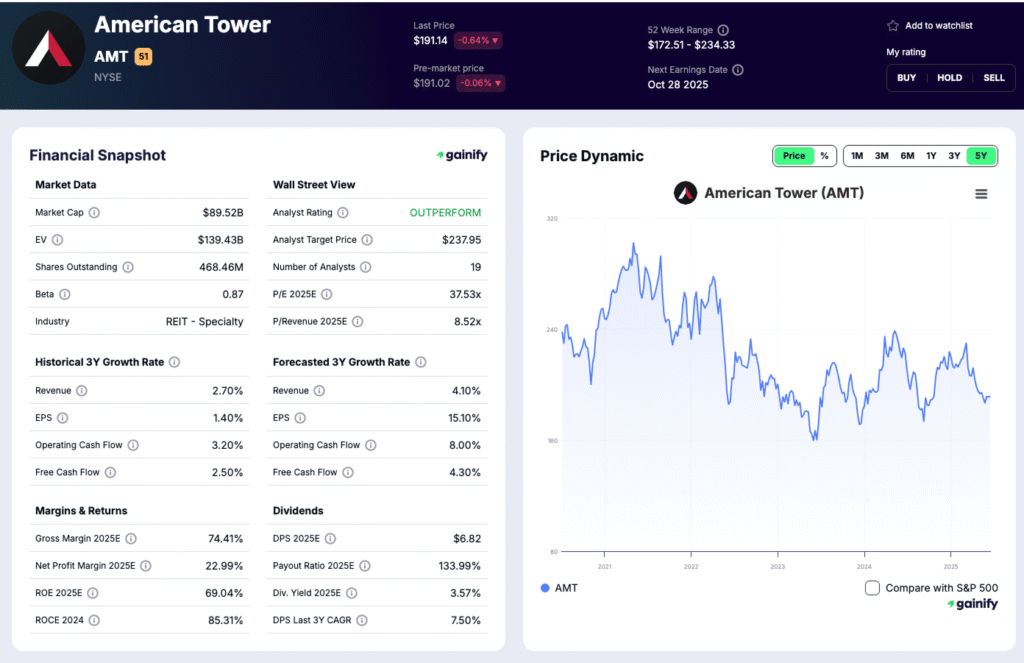

3. American Tower (AMT) – Telecom Infrastructure REIT Stock

Market Capitalization: $83.2 billion

Overview: American Tower (NYSE: AMT) is one of the world’s leading wireless communication infrastructure owners, with a global portfolio of more than 149,000 communications sites across 22 countries as of Q3 2025. The company leases tower space, distributed antenna systems, and data center capacity to mobile network operators under long-term, non-cancellable contracts. Over 96% of revenue is generated from leasing, creating highly recurring, inflation-linked cash flows supported by contractual escalators and low historical churn.

Operating Performance (Q3 2025)

American Tower delivered steady operating results during the third quarter of 2025, reflecting the resilience of its communications infrastructure platform.

- Total revenue: $2.72 billion, up 3.7% year over year, or 4.4% on a constant-currency basis

- Organic tenant billings growth: 5.1%

- Adjusted EBITDA margin: approximately 67%

- Net debt to EBITDA: 4.9x

Performance was driven by contractual rent escalators, new tenant amendments, and disciplined cost management. Portfolio optimization initiatives contributed to margin expansion, while lower leverage compared with prior periods improved balance sheet flexibility heading into 2026.

Investment Thesis: American Tower offers exposure to mission-critical digital infrastructure with highly visible, inflation-protected cash flows. Its global diversification and long-term lease structure provide resilience across economic cycles, while multi-tenant tower economics support strong incremental margins. Analysts continue to view American Tower as a core compounder within the REIT universe, supported by durable demand for mobile data and ongoing network densification.

Key challenges include interest rate sensitivity, foreign currency volatility, and potential shifts in carrier capital spending. However, the essential nature of its assets, strong tenant relationships, and improving leverage profile underpin a stable long-term outlook for earnings and dividend growth.

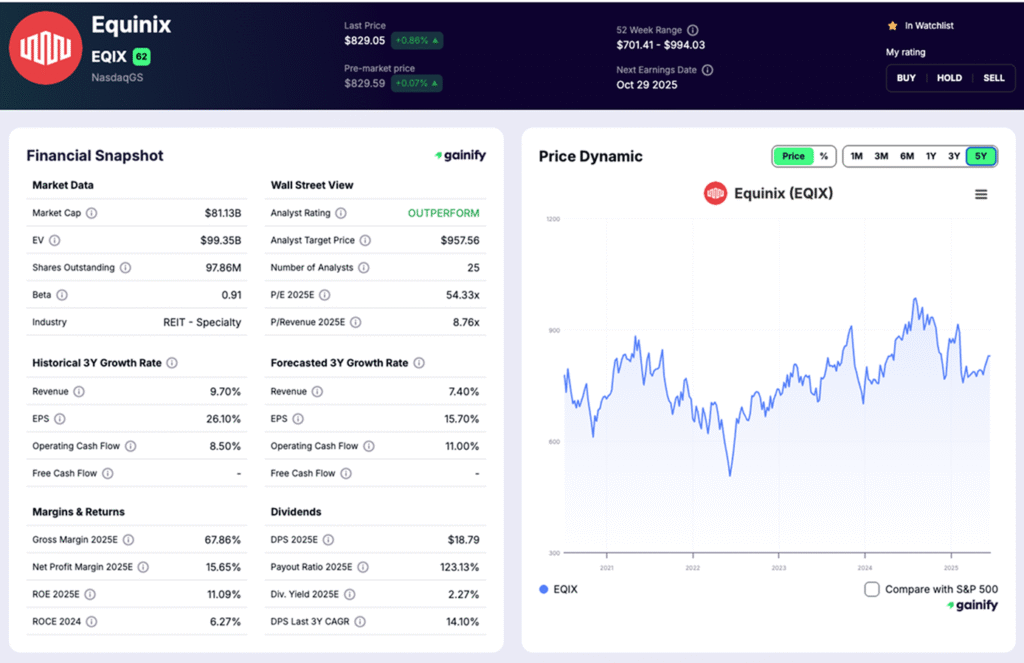

4. Equinix (EQIX) – Data Center REIT Stock

Market Capitalization: $77.0 billion

Overview: Equinix (NASDAQ: EQIX) is the world’s leading provider of interconnected data centers, operating 273 facilities across 77 metros and 36 countries. Its platform serves hyperscale cloud providers, network operators, and enterprises that require secure, low-latency connectivity between clouds, networks, and digital ecosystems. Equinix sits at the core of global cloud, AI, and hybrid IT infrastructure, with its value driven by interconnection density, long contract durations, and recurring revenue. As of Q3 2025, owned assets generate 69% of recurring revenues, providing long-term control and cash flow visibility.

Operating Performance (Q3 2025)

- Total revenue: $2.16 billion, up 7% year over year on a constant currency basis

- Same-store revenue growth: 4% year over year on a constant currency basis

- Adjusted EBITDA margin: approximately 49%

- Interconnection revenue growth: 8% year over year on a normalized and constant currency basis

- Portfolio utilization: 78% globally across stabilized, expansion, and new assets

- Net debt to EBITDA: 3.6x, reflecting conservative leverage and balance sheet strength

Interconnection momentum remained strong, with total interconnections reaching 499,400, up 7,100 sequentially, while stabilized assets delivered a 70% cash gross margin and a 26% return on invested capital on a constant currency basis. These results underscore Equinix’s ability to grow earnings while maintaining capital discipline.

Investment Thesis: Equinix combines high-quality assets, global reach, and exposure to powerful digitalization trends. Low leverage provides flexibility for new developments and acquisitions. While it trades at a valuation premium, the company’s strategic position in global digital infrastructure offers investors access to long-term growth themes such as cloud computing, AI adoption, and data connectivity. For those prioritizing steady expansion over high yield, Equinix remains one of the most attractive growth-oriented REITs.

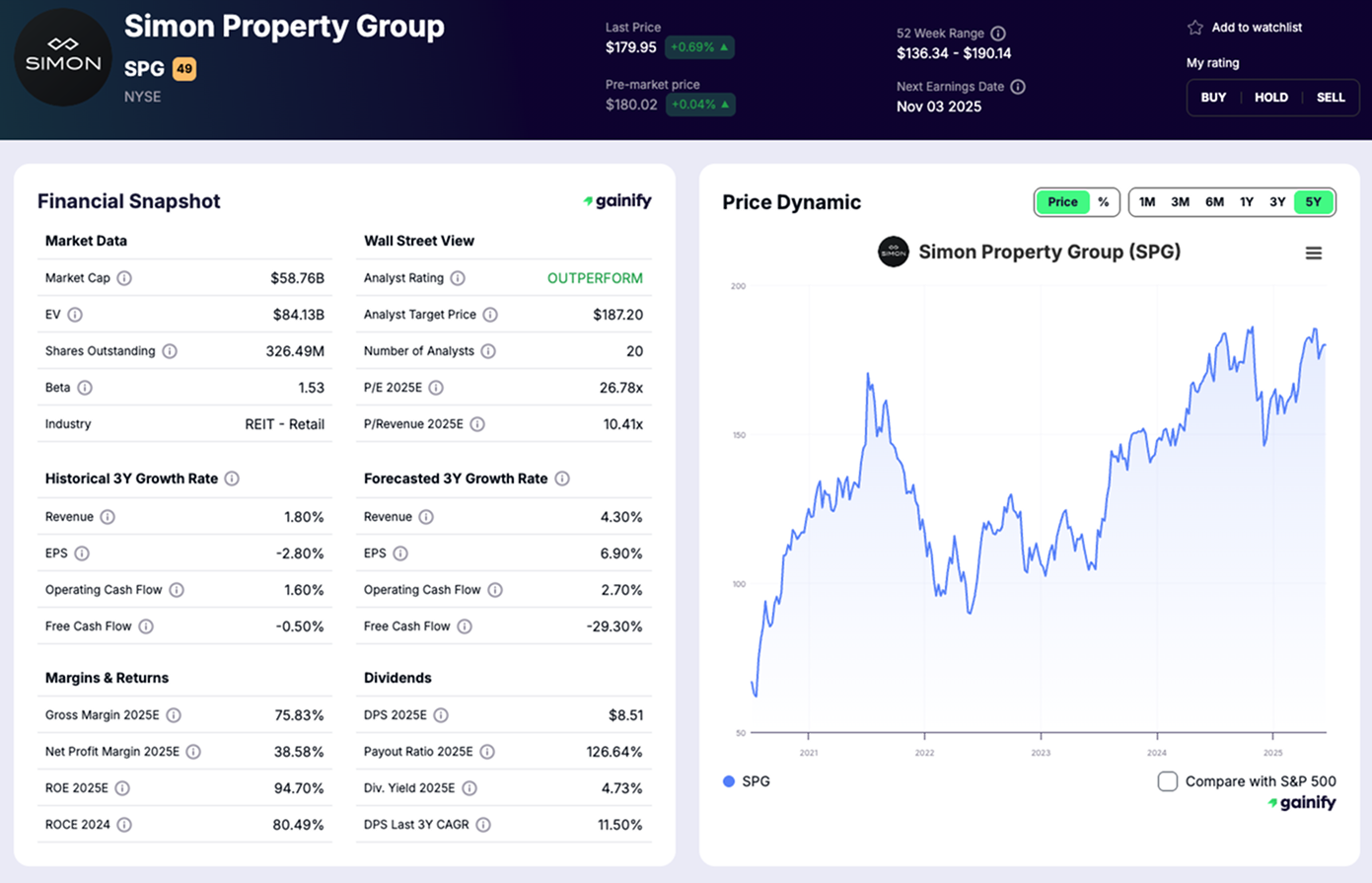

5. Simon Property Group (SPG) – Largest Retail REIT Stock

Market Capitalization: $60.0 billion

Overview: Simon Property Group (NYSE: SPG) is the largest owner and operator of premium retail real estate in the United States, with a portfolio that includes top-tier shopping malls, outlet centers, and mixed-use properties. The company focuses on high-end, well-located assets that attract strong tenant demand and consistent consumer traffic. In recent years, Simon has strategically redeveloped many of its properties into lifestyle destinations that combine retail, dining, entertainment, and residential spaces, helping to offset broader retail headwinds.

Operating Performance (Q3 2025)

- Portfolio occupancy: 96.4 percent, up from 96.2 percent a year earlier

- Base rent per square foot: up 2.5 percent year over year

- Tenant sales and foot traffic: remained strong across flagship properties, with trailing twelve-month sales of $742 per square foot

- Funds from operations (FFO) per share: $3.25, up 14.4 percent year over year

- Net debt to EBITDA: approximately 5.4x

These metrics highlight resilient operating performance, supported by solid tenant retention, premium locations, and ongoing redevelopment success in converting traditional malls into multi-purpose destinations.

Investment Thesis: Simon Property Group offers investors a high-quality cyclical opportunity in retail real estate. The company’s strong balance sheet, stable occupancy, and consistent dividend yield provide a dependable income stream, even through market volatility. While near-term growth in net operating income is modest, continued portfolio reinvestment and premium asset positioning support long-term value creation. Simon’s scale and financial flexibility make it one of the most durable names in the retail REIT sector.

6. Realty Income (O) – Net-Lease Retail REIT Stock

Market Capitalization: $57.0 billion

Overview: Realty Income (NYSE: O) is one of the most recognized names in the net-lease real estate sector, known as “The Monthly Dividend Company” for its consistent and reliable income distributions. The firm owns more than 15,000 single-tenant commercial properties across the United States and Europe, leased primarily to essential service, retail, and industrial tenants under long-term net leases. This structure shifts most operating expenses to tenants, providing Realty Income with stable, predictable rental income and low operational risk.

Operating Performance (Q3 2025)

- Portfolio occupancy: 98.7 percent, among the highest levels in the REIT sector

- Same-store rent growth: approximately 1.0 percent year over year

- Acquisitions: approximately $1.4 billion of property investments during the quarter

- Net debt to EBITDA: approximately 5.4x, reflecting a conservative capital structure

- Dividend: continued monthly payments with a 4.9 percent annualized yield

These results demonstrate exceptional portfolio stability and steady growth, supported by high-quality tenants, disciplined acquisitions, and a conservative balance sheet.

Investment Thesis: Realty Income remains a cornerstone holding for income-focused investors, offering reliable dividends and low volatility through economic cycles. Its focus on essential tenants, long-term leases, and prudent financial management ensures consistent cash flow generation. While growth is gradual, the company’s scale, diversification, and 30-year track record of dividend increases make it one of the most dependable REITs in the market.

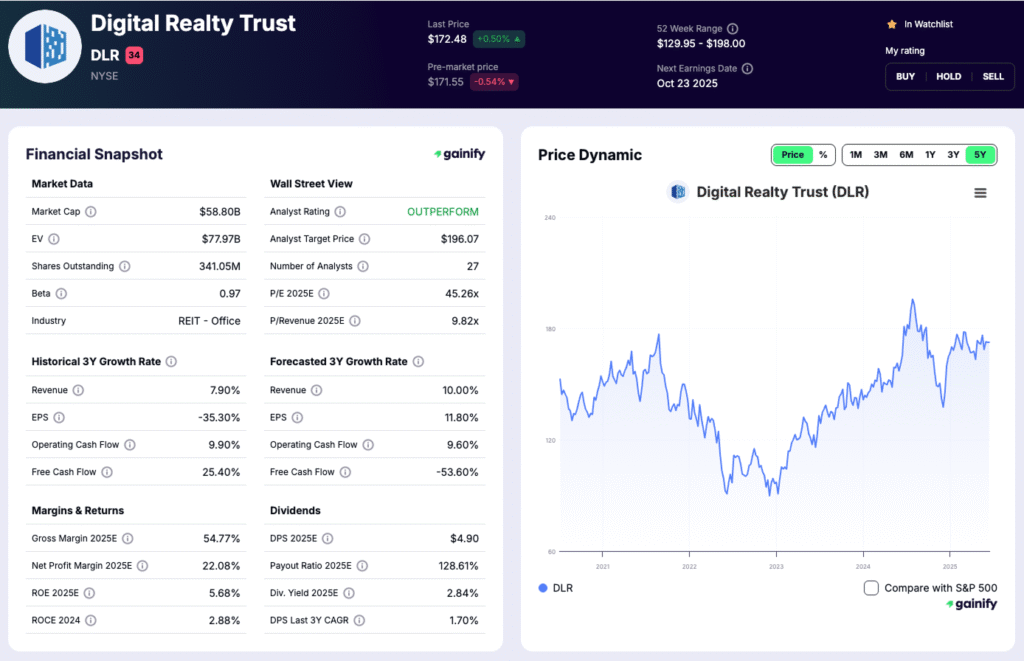

7. Digital Realty (DLR) – Data Center REIT Stock

Market Capitalization: $54.8 billion

Overview: Digital Realty (NYSE: DLR) is a global leader in data center ownership and operation, managing more than 300 facilities across North America, Europe, Asia, and Latin America. The company provides secure, large-scale space for cloud service providers, hyperscale clients, and enterprise customers. Digital Realty’s business is centered on delivering reliable, high-capacity environments for data storage, networking, and computing. It benefits from the same structural tailwinds driving digital transformation, AI growth, and rising cloud adoption.

Operating Performance (Q3 2025)

- Total revenue (quarter): $2.32 billion, up 9% year over year on a constant-currency basis

- Same-capital cash NOI growth: 5.1% year over year on a constant-currency basis

- Portfolio occupancy: approximately 85%, with year-end guidance calling for a further 100–200 basis point increase

- Cash rental rate increases on renewal leases: between 5.75% and 6.25%

- Adjusted EBITDA margin: approximately 55%

- Net debt to EBITDA: 4.9x

Demand remained strong across both hyperscale and smaller 0–1 MW deployments, with total bookings of $202 million at full share in Q3. More than 85% of backlog is expected to commence through 2026, providing strong forward revenue visibility.

Investment Thesis: Digital Realty provides investors with a value-oriented alternative to Equinix, offering exposure to global data infrastructure at lower valuation multiples. Management remains focused on balance sheet improvement through debt reduction and refinancing initiatives. While higher leverage and capital intensity introduce risk, ongoing digitalization and enterprise cloud migration underpin the company’s growth prospects. Over time, Digital Realty’s scale and global platform should support sustainable earnings and dividend expansion.

What Are REIT Stocks?

REIT stocks, or real estate investment trust stocks, allow investors to participate in income-producing real estate through publicly traded companies. Instead of owning property directly, investors gain exposure to professionally managed portfolios that span sectors such as healthcare, industrial logistics, data centers, retail, and communications infrastructure.

By law, REITs must distribute at least 90 percent of their taxable income to shareholders in the form of dividends. This structure makes REIT stocks particularly attractive to investors seeking steady income alongside long-term exposure to real assets. Because REITs trade on public exchanges, they also provide liquidity and transparency that direct real estate ownership typically lacks.

Key characteristics of REIT stocks include:

- Income-focused structure: Mandatory dividend distributions support consistent income generation

- Diversified real estate exposure: Portfolios often span multiple properties, tenants, and regions

- Access to real assets: Provides exposure to real estate without the complexity of direct ownership

- Public market liquidity: Shares can be bought and sold like traditional stocks

- Scale advantages: Larger REIT stocks often benefit from lower capital costs and more stable cash flows

The largest REIT stocks combine these features with scale, sector specialization, and access to capital markets, allowing them to operate efficiently and invest through different market environments.

Why Investors Buy REIT Stocks

REIT stocks are widely used by individual and institutional investors as a way to generate income, diversify portfolios, and gain exposure to real assets. Their structure and operating model offer several advantages that make them a core allocation in many long-term investment strategies.

Common reasons investors allocate to REIT stocks include:

- Consistent dividend income: Required dividend distributions support regular income payments

- Portfolio diversification: Real estate returns often behave differently than stocks and bonds

- Inflation sensitivity: Rental income and contractual rent escalators can help offset rising prices

- Access to long-term growth: Exposure to structural trends such as logistics, healthcare, and digital infrastructure

- Liquidity and transparency: Public REIT stocks trade on major exchanges with regular financial disclosures

For many investors, REIT stocks serve as a bridge between income generation and long-term capital appreciation, particularly when held alongside traditional equities and fixed income.

The Five Metrics Every REIT Investor Should Track

Metric | Definition | Investor Insight |

Funds From Operations (FFO) | Adjusted cash earnings excluding depreciation and asset sales | Core measure of profitability and dividend sustainability |

Net Debt / EBITDA | Total leverage relative to earnings | Key measure of financial health and balance-sheet flexibility |

Occupancy Rate | Percentage of leased or revenue-producing space | Gauges tenant demand and operational strength |

Dividend Payout Ratio | Dividends ÷ FFO | Indicates sustainability of distributions |

Same-Store NOI Growth | Growth in income from existing properties | Measures organic performance excluding acquisitions |

Outlook for 2026 and Beyond

As markets move deeper into 2026, REIT performance is increasingly driven by fundamentals rather than rate speculation. While interest rates remain an important input, operating execution, balance sheet strength, and access to capital have become the primary differentiators across the sector. Valuations are no longer uniformly discounted, and investors are becoming more selective, rewarding REITs with visible cash flow growth and disciplined capital allocation.

Structural growth areas such as data centers, industrial logistics, and digital infrastructure continue to attract capital, supported by sustained demand from AI, cloud computing, e-commerce, and supply-chain optimization. At the same time, healthcare and net-lease REITs remain core portfolio anchors, offering durable income, high occupancy, and defensive characteristics amid a slower growth backdrop.

Looking ahead, the best-capitalized REITs are positioned to benefit from a more normalized transaction environment. With stronger balance sheets, improved liquidity, and clearer cost of capital, large platform operators should be able to deploy capital selectively into accretive acquisitions and development projects. For investors, 2026 is less about broad sector exposure and more about identifying REITs that can compound cash flows through disciplined execution as capital markets continue to stabilize.

Key Takeaways

- Defensive Income: Welltower (WELL) and Realty Income (O) deliver consistent cash flow and dividend stability through needs-based real estate and long-term leases.

- Secular Growth: Prologis (PLD) and Equinix (EQIX) capture structural demand from e-commerce, cloud computing, and AI-driven digital infrastructure.

- Infrastructure Stability: American Tower (AMT) and Digital Realty (DLR) provide inflation-linked, contract-based revenues backed by global data and telecom networks.

- Cyclical Rebound: Simon Property Group (SPG) offers exposure to retail recovery, underpinned by premier assets, strong balance sheet, and resilient foot traffic.