Defense has moved firmly to the centre of Europe’s political and economic agenda. Since Russia’s invasion of Ukraine in 2022, European nations have accelerated military spending at a pace not seen since the Cold War, and that momentum has intensified further heading into 2026.

NATO members are no longer debating whether to hit the 2% guideline, which many have already surpassed, and some are preparing to spend between 4% and 5% of GDP within the next two years. Poland continues to lead, with defense expenditure exceeding 4.5% of GDP in 2025 and formal commitments to remain near that level through 2027. Several frontline and northern European countries, including the Baltic states and Finland, are now planning sustained spending well above 3%.

The numbers confirm a structural shift. EU Member States collectively spent approximately €240 billion on defense in 2022, rising to €279 billion in 2023, €326 billion in 2024, and are estimated to have exceeded €360 billion in 2025, pushing defense spending above 2.1% of EU GDP for the first time in decades. Among the 23 EU countries that are also NATO members, defense outlays are now firmly above 2% on average, with forecasts pointing toward continued increases into 2026 and beyond.

Germany remains central to this transformation. After allocating €90.6 billion (2.12% of GDP) in 2024, Berlin activated both its €100 billion special defense fund and, in 2025, approved a €500 billion multi-year package covering defense, infrastructure, and industrial capacity. In 2026, Germany has shifted from one-off emergency funding toward permanent increases in baseline defense budgets, with procurement timelines extending well into the 2030s. France has followed a similar path, maintaining spending above 2% of GDP and reaffirming plans to move toward 3–3.5% as part of its updated military programming law.

This surge is not only about replenishing weapons and ammunition sent to Ukraine. Europe is rearming and modernising across the board: building integrated air and missile defense networks, scaling up drone and unmanned systems, strengthening naval fleets, and investing heavily in cyberdefense and secure communications.

For decades, European countries leaned heavily on U.S. suppliers and non-EU defense industries. That dependence is now seen as a strategic weakness, and EU policymakers are pushing hard to foster local champions through initiatives like Readiness 2030.

For investors, this creates a rare alignment of political will, government funding, and industrial momentum. Defense stocks have been among the strongest performers in European markets since 2022, and analysts expect large backlogs and long procurement cycles to support revenues well into the 2030s. Exchange-traded funds focused on defense and aerospace have attracted inflows as global investors seek exposure to this strategic sector.

Defense, however, is not a simple growth story. Contracts are large and long-term, but they depend on political decisions, budgetary approvals, and industrial capacity. Execution risks, cost overruns, and regulatory hurdles remain part of the landscape. Investors must understand each company’s core strengths, market position, and product portfolio.

This guide reviews the nine European defense stocks that dominate investor attention in 2025: Rheinmetall (RHM.DE), BAE Systems (BAES.L), Leonardo (LDO.MI), Thales (HO.PA), Safran (SAF.PA), Rolls-Royce Holdings (RR.L), Indra (IDR.MC), Dassault Aviation (AM.PA), and Saab (SAAB-B.ST). For each, we outline what the company does, why it could grow, and which key products and programs matter most.

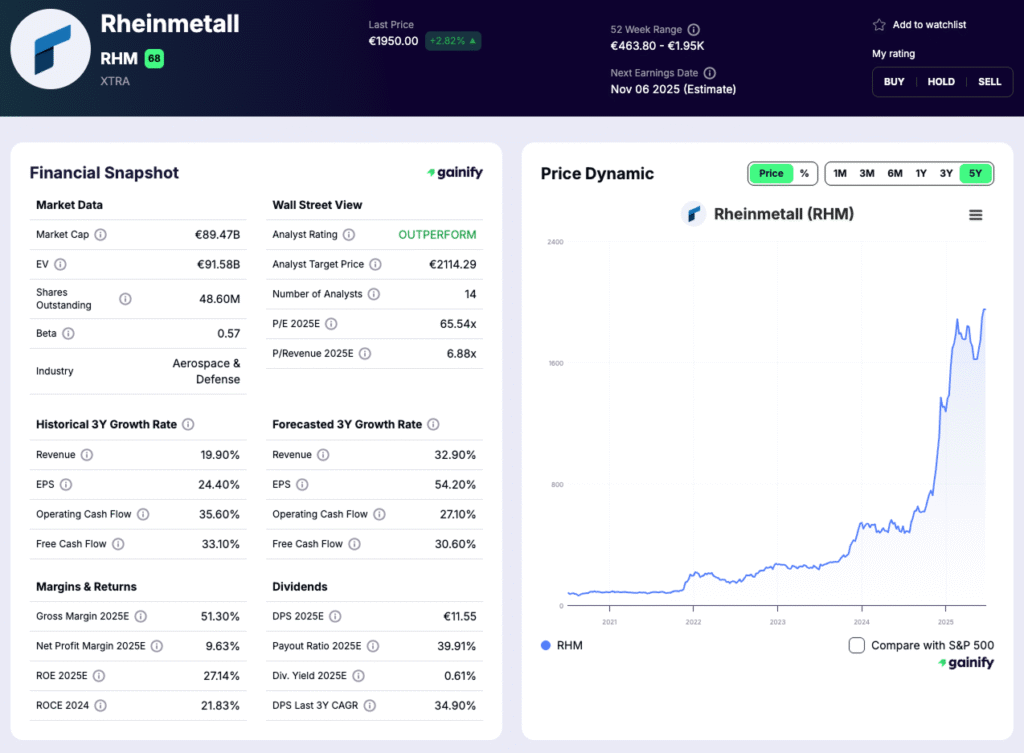

1. Rheinmetall (XTRA: RHM)

What It Does

Germany’s largest defense company, producing ammunition, armoured vehicles, air defense, and naval systems.

Catalysts / Why It Could Grow

- Strong demand for ammunition and artillery shells across NATO

- Beneficiary of Germany’s €500 billion multi-year package

- Expansion into naval systems and shipbuilding assets

- EU political support for local production

Key Products / Programs

- Leopard 2 and KF51 Panther tanks

- Boxer armoured vehicle

- Skynex air defense system

- Ammunition factories across Europe

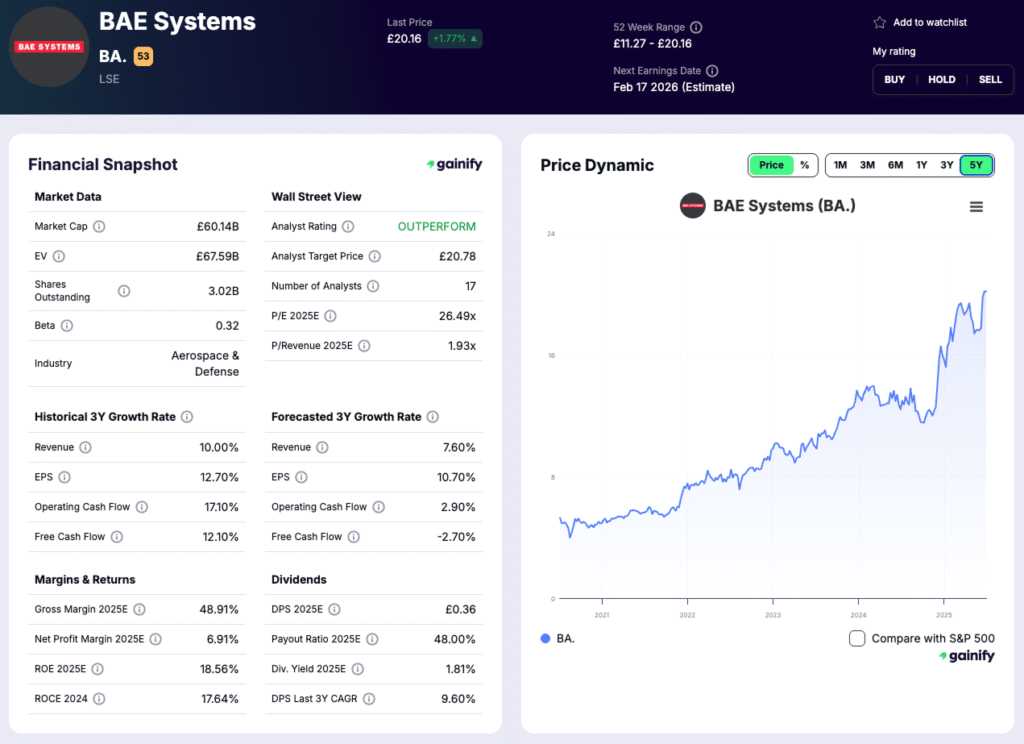

2. BAE Systems (LSE: BA.)

What It Does

UK’s biggest defense company, active in naval ships, submarines, aircraft, and intelligence systems.

Catalysts / Why It Could Grow

- Modernisation of UK armed forces

- Global Combat Air Programme (GCAP) with Italy and Japan

- Rising demand for cyberdefense

- Strong export markets in Asia and the Middle East

Key Products / Programs

- Eurofighter Typhoon and GCAP fighter

- Astute-class submarines

- Type 26 and 31 frigates

- Electronic warfare platforms

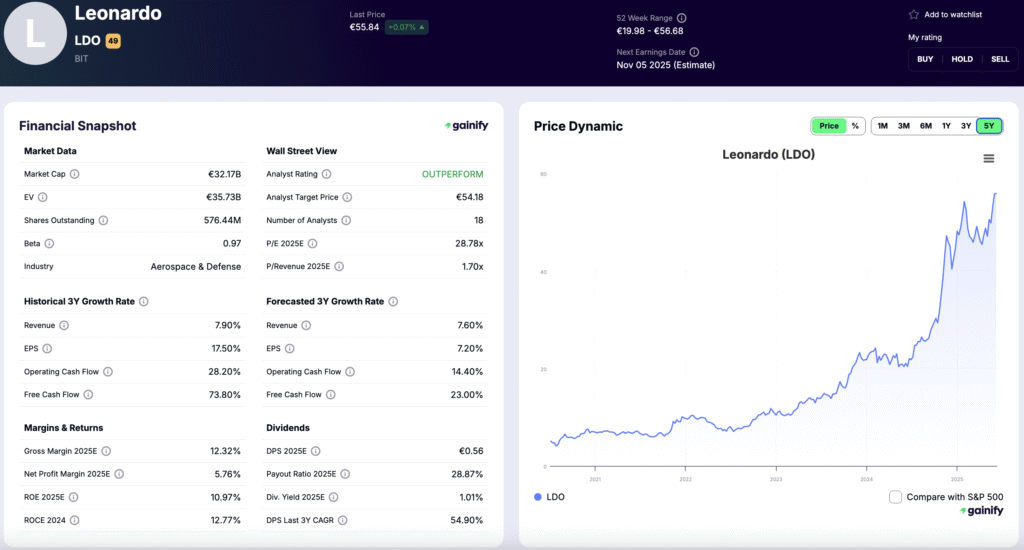

3. Leonardo (BIT: LDO)

What It Does

Italy’s leading aerospace and defense group, partly state-owned.

Catalysts / Why It Could Grow

- Large export backlog

- Participation in GCAP and NATO projects

- Growing role in drones and UAVs

- Opportunities for restructuring and margin improvement

- Strengthened role in space via Thales Alenia Space joint venture

Key Products / Programs

- AW101 and AW139 helicopters

- M-346 trainer aircraft

- Radars, avionics, electronics

- Space systems through the Thales Alenia Space JV

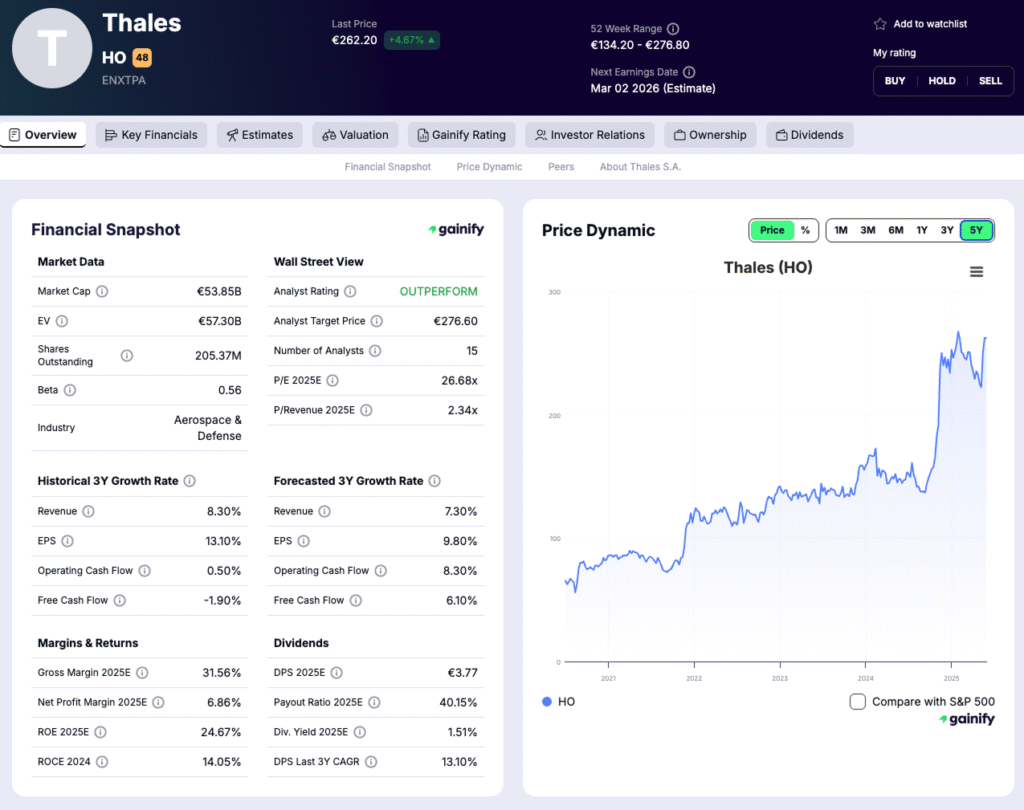

4. Thales (ENXTPA: HO)

What It Does

French defense group specialising in electronics, air defense, radars, avionics, satellites, and cybersecurity.

Catalysts / Why It Could Grow

- Strong demand for European-made air defense

- Cybersecurity and secure communications

- Long-term French and NATO contracts

- Diversification into civil tech and space

Key Products / Programs

- SAMP/T air defence (joint program with MBDA)

- Ground Master radar family

- Avionics for military aircraft

- Cyber and secure communications platforms

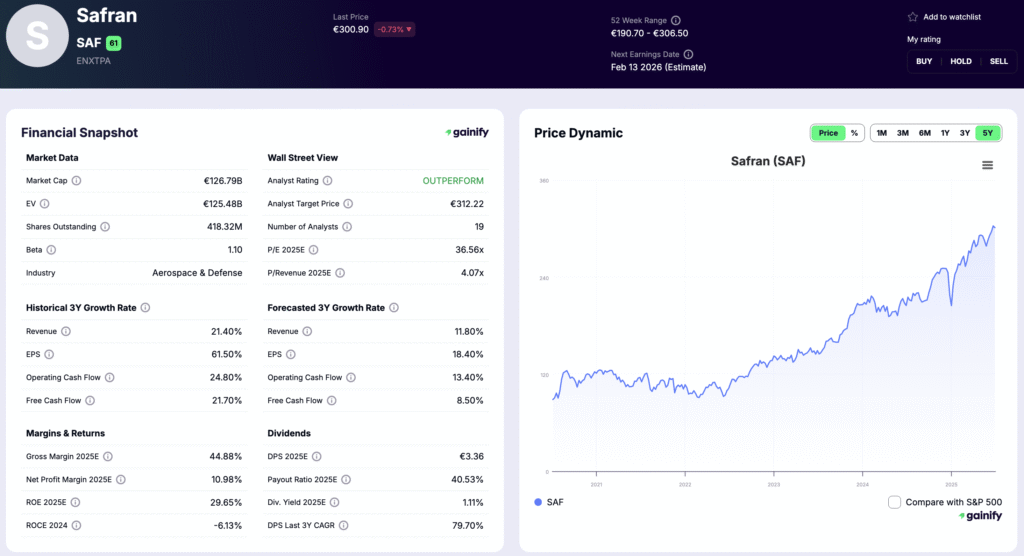

5. Safran (EXNTPA: SAF)

What It Does

French aerospace and defense firm, producing aircraft engines, avionics, and propulsion systems.

Catalysts / Why It Could Grow

- High demand for engine upgrades and maintenance

- Expanding defense electronics

- Integration in EU and NATO projects

- Carbon regulations driving propulsion efficiency demand

Key Products / Programs

- M88 engine for Rafale fighter

- Optronics, avionics, and navigation systems

- Drone propulsion systems and related electronics

- Drone propulsion systems

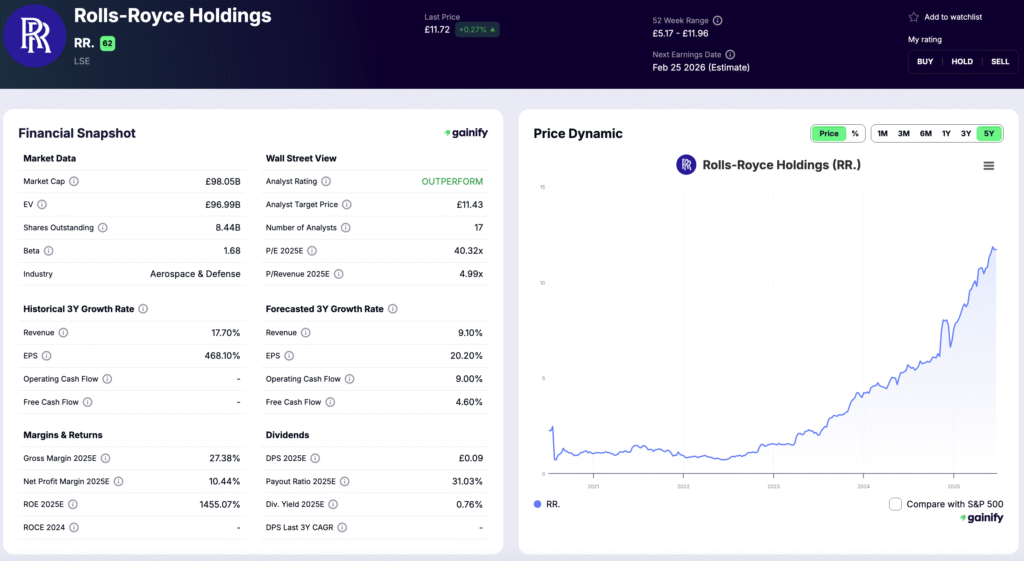

6. Rolls-Royce Holdings (LSE: RR.)

What It Does

UK-based engine maker with a major defense division.

Catalysts / Why It Could Grow

- Rising demand for military engines and naval propulsion

- Contracts in nuclear submarine propulsion

- Defense spending on propulsion for drones and advanced aircraft

- Restructuring has strengthened financials

Key Products / Programs

- EJ200 engine for Eurofighter Typhoon

- Naval propulsion systems

- Nuclear propulsion plants for submarines

- Dual-use civil aviation engines

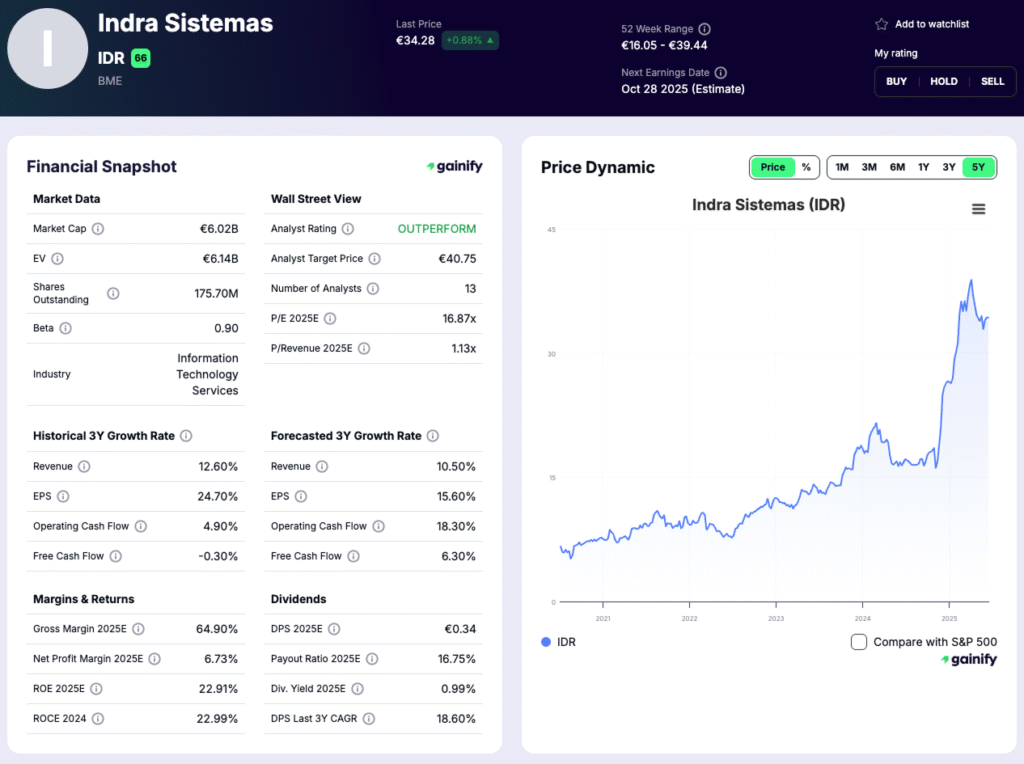

7. Indra (BME: IDR)

What It Does

Spain’s main defense and technology group, focused on electronics, radar, cybersecurity, and border security.

Catalysts / Why It Could Grow

- Spanish government procurement programs

- EU-wide defense collaborations

- Growth in AI, surveillance, and cybersecurity

- Potential expansion of exports

Key Products / Programs

- Radar and air traffic management systems

- Cybersecurity platforms

- C4ISR systems

- Border surveillance

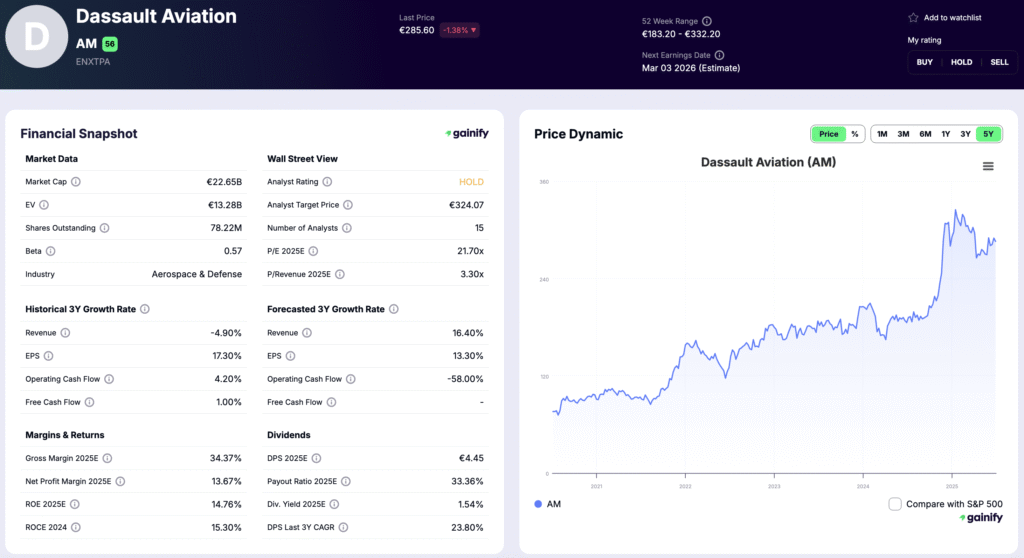

8. Dassault Aviation (ENXTPA: AM)

What It Does

French aerospace company best known for the Rafale fighter jet and Falcon business jets.

Catalysts / Why It Could Grow

- Strong Rafale export orders from countries such as India, Egypt, and Greece

- Long-term support contracts for Rafale fleets

- Participation in the Future Combat Air System (FCAS) programme

- Dual exposure to civil business jets and military aircraft

Key Products / Programs

- Rafale multirole fighter jet

- Falcon business jets

- Future Combat Air System (FCAS) with Airbus and Indra

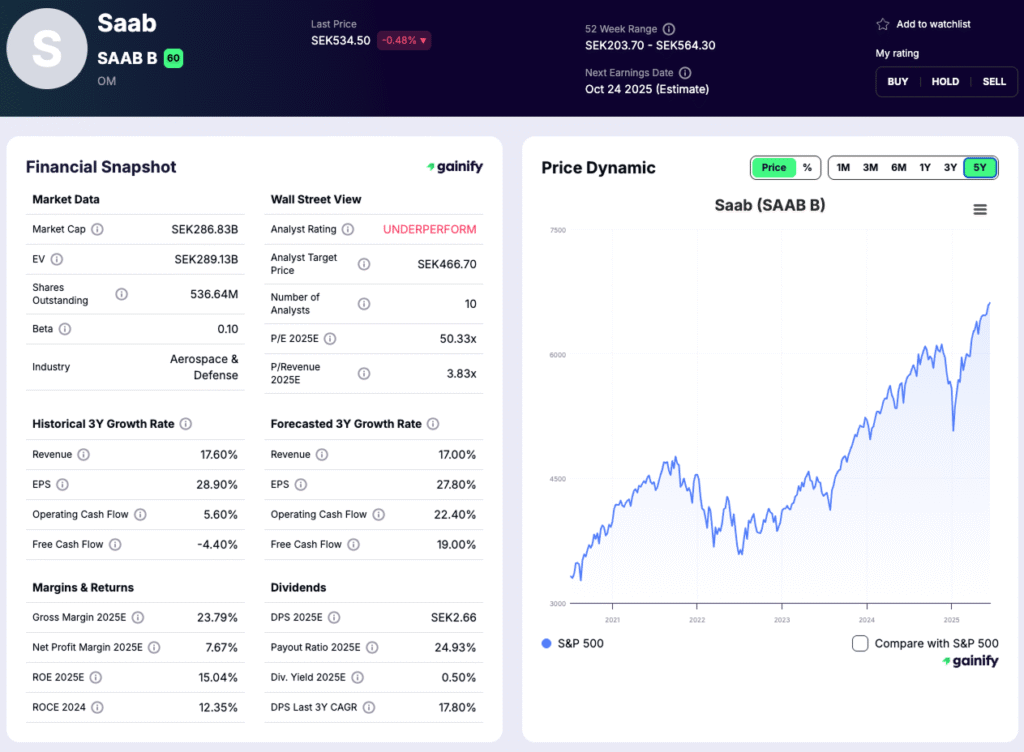

9. Saab (OM: SAAB B)

What It Does

Swedish defense and aerospace company producing aircraft, submarines, radars, and missile systems.

Catalysts / Why It Could Grow

- Rising demand for Gripen fighter jets from NATO-aligned countries

- Expertise in radar, electronic warfare, and submarine technologies

- Strong export prospects following Sweden’s NATO membership

- Participation in next-generation European defense programs

Key Products / Programs

- Gripen fighter aircraft

- Giraffe radar systems

- A26 Submarines for Swedish Navy

- Missile and electronic warfare systems

What Investors Should Consider

Order Backlogs and Contract Visibility

Defense companies operate on multi-year contracts that provide revenue visibility. A strong backlog indicates stability, but investors must check whether these orders are firm or still in negotiation.

Product Mix and Diversification

Some groups like Safran and Rolls-Royce balance civil and defense markets, which smooth earnings. Pure-play defense firms like Rheinmetall are more volatile but benefit more directly from higher military budgets.

Export Exposure and Government Dependency

Companies with diversified exports are less vulnerable to single-market risks. BAE Systems and Dassault Aviation have strong global customers, while Indra depends heavily on Spanish contracts.

Innovation and Technology Leverage

Future growth will come from drones, AI-enabled systems, cyberdefense, and missile defense. Firms leading in these areas, such as Thales and Saab, may see outsized growth.

Supply Chain and Industrial Capacity

With orders surging, production capacity and access to skilled labour are critical. Rheinmetall’s new ammunition plants and Leonardo’s helicopter production lines are examples of scaling to meet demand.

Valuation and Earnings Stability

Defense stocks have rallied, and some are richly priced. Investors should compare P/E ratios, margins, and cash flow stability.

Geopolitical and Regulatory Risk

Export controls, alliances, and EU procurement rules shape the industry. Contracts can be lost or delayed due to political decisions.

Risks

Despite strong tailwinds, defense remains a sector with unique risks. Investors should weigh the following carefully:

1. Budgetary Pressure and Recession Risk

- Defense is a political priority today, but economic downturns could force governments to cut or slow budgets.

- High debt levels in some countries may limit sustained growth.

2. Program Delays and Cost Overruns

- Large projects often face delays and overruns.

- These can erode profitability and lead to strained government relationships.

3. Export Restrictions and Political Risk

- Export licences can be revoked or delayed.

- EU and U.S. regulations on dual-use technologies add uncertainty.

- Heavy reliance on non-NATO markets carries additional political risk.

4. Supply Chain and Capacity Bottlenecks

- Ammunition shortages in 2022–2023 showed Europe’s limited capacity.

- Access to raw materials, skilled labour, and industrial capacity remains a constraint.

5. Valuation and Market Expectations

- After strong rallies, some defense stocks trade at premium valuations.

- Disappointments in orders or political shifts could trigger sharp corrections.

Conclusion

Europe is entering a new defense cycle that extends well beyond short-term replenishment. The continent is:

- Building long-term military capacity

- Reshaping its industrial base

- Reducing reliance on U.S. and non-EU suppliers

The leading players: Rheinmetall, BAE Systems, Leonardo, Thales, Safran, Rolls-Royce, Indra, Dassault Aviation, and Saab – each bring distinct strengths:

- Rheinmetall: armour and ammunition

- Thales & Indra: electronics and cyberdefense

- Dassault & Saab: fighter jets with strong export pipelines

- Safran & Rolls-Royce: propulsion systems

- BAE Systems: diversified global reach

For investors, the opportunity is clear but requires discipline.

- Focus on order backlogs, export exposure, R&D leadership, and supply chain capacity.

- A diversified approach across several of these names may balance growth potential with risk.

In today’s environment, where security equals economic stability, European defense stocks are no longer niche. They are core to Europe’s future and central to portfolios of investors seeking exposure to one of the defining secular trends of the 2020s.