A closer look at the leading defense companies benefiting from record military spending, global rearmament, and rising geopolitical tensions.

Defense stocks were some of the hottest trades of 2025 as global military budgets surge to levels unseen in decades. Especially in the last six months, markets have watched billions pour into missile systems, advanced fighter jets, and next-generation defense technology.

In early 2026, the Trump administration proposed what would be the largest defense budget in U.S. history, with total spending for FY2027 approaching $1.5 trillion, following an already elevated FY2026 request above $1.0 trillion. While budget negotiations and continuing resolutions have pushed final approvals into early 2026, expectations remain that much of the proposed increase, particularly for air, missile, and space capabilities, will ultimately pass.

Across Europe, rearmament continues at full speed. Germany, the United Kingdom, and France are expanding multi-year defense plans, while several NATO members, including Poland, Lithuania, and Estonia, have pledged to allocate up to 5 percent of GDP to defense.

As investors rotate back into industrials and real assets, defense has emerged as one of the few sectors combining growth visibility, geopolitical relevance, and shareholder returns. At the same time, President Trump has publicly discussed the possibility of limiting dividends or buybacks for defense contractors receiving large increases in federal funding, arguing that more capital should be reinvested into production capacity and readiness. While no formal policy has been proposed or enacted, the comments have introduced an additional factor for income-focused investors to watch.

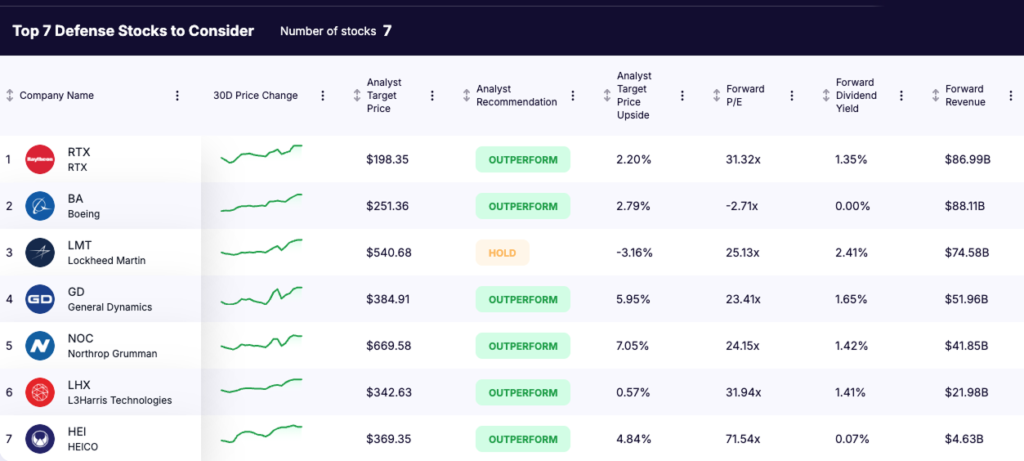

Below, we break down the top 7 defense stocks to watch right now, each offering exposure to a different corner of this global rearmament cycle.

Key Highlights

1. Global Spending Boom: defense budgets across the U.S., Europe, and Asia are surging, fueling multi-year growth for major contractors.

2. Strong Profits and Dividends: industry leaders like Lockheed Martin and RTX deliver steady cash flow and rising dividends, while HEICO and L3Harris add high-tech exposure.

3. Room for Upside: analysts still see 7–13% upside as order backlogs expand and long-term contracts support earnings.

1. Raytheon Technologies (RTX)

Market Cap: $260.2B | Forward P/E: 31.2x | Dividend Yield: 1.35% | Analyst Upside: +1.35%

What it does: RTX is one of the world’s largest defense and aerospace conglomerates. It operates through three major segments: Pratt & Whitney, which builds jet engines; Collins Aerospace, which provides avionics and aircraft systems; and Raytheon Missiles & Defense, known for systems such as Patriot and AMRAAM.

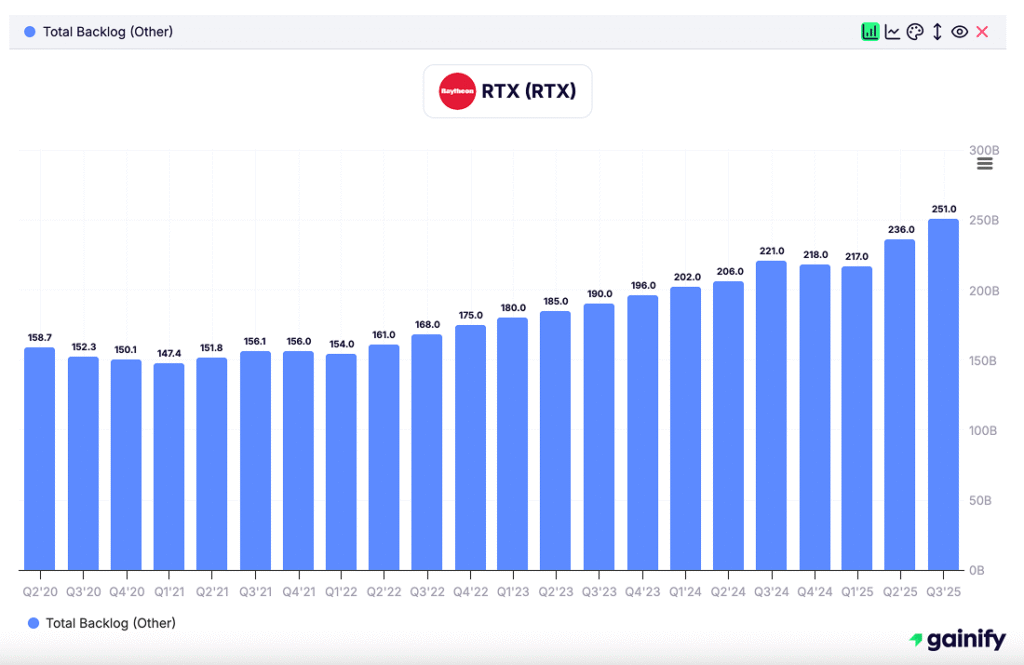

Why it matters now: Global demand for missile defense, radar systems, and engine upgrades continues to accelerate as NATO members rebuild inventories and modernize their fleets. RTX recently secured a $1.7 billion U.S. Army radar contract for its LTAMDS system, with deployment planned for U.S. and Polish forces. The company reported 13 % organic sales growth in Q3 2025 and raised its full-year outlook, supported by a record $251 billion backlog, including $103 billion in defense orders. This combination of strong defense demand and commercial aerospace recovery makes RTX a balanced play on global rearmament.

2. Boeing (BA)

Market Cap: $185.9B | Forward P/E: N/A | Analyst Upside: +2.8%

What it does: Boeing’s Defense, Space & Security division produces some of the world’s most advanced military platforms, including the KC-46 Pegasus aerial refueler, F/A-18 Super Hornet fighter jet, and P-8 Poseidon maritime patrol aircraft. The company is also active in satellite systems, missile components, and space launch technologies.

Why it matters now: Boeing’s defense arm has entered a new growth phase in 2025, supported by several major international contracts. In October 2025, the company won a multibillion-dollar order for its F-15EX fighter jets from the U.S. Air Force and allied nations, alongside expanded F-25 next-generation aircraft development work. It also secured a $2.7 billion deal to supply more than 3,000 PAC-3 missile seekers for global air defense systems. While production challenges and strike disruptions remain a near-term risk, Boeing’s growing defense backlog and strategic focus on next-gen aircraft position it for a sustained recovery, with analysts projecting strong upside into 2026.

3. Lockheed Martin (LMT)

Market Cap: $129.2B | Forward P/E: 25.1x | Dividend Yield: 2.4% | Analyst Upside: +8.5%

What it does: Lockheed Martin is the world’s largest pure-play defense contractor and a key supplier to the U.S. and allied militaries. Its flagship programs include the F-35 Lightning II stealth fighter, Black Hawk helicopters, Aegis Combat Systems, HIMARS rocket launchers, and a range of advanced missile technologies such as the Patriot PAC-3 and Javelin systems.

Why it matters now: In 2026, Lockheed continues to dominate global defense procurement with record demand for the F-35 across Europe and Asia, including expanded orders from Poland, Japan, and Finland. The company’s backlog surpassed $170 billion in Q3 2025, reflecting long-term visibility from multi-year NATO and U.S. modernization programs. Recent contract extensions for missile systems and hypersonic development underscore Lockheed’s central role in next-generation deterrence strategy. Supported by stable cash flow and a consistent dividend track record, it remains a core holding for investors seeking exposure to sustained global defense spending.

4. General Dynamics (GD)

Market Cap: $98.0B | Forward P/E: 23.4x | Dividend Yield: 1.7% | Analyst Upside: +9.4%

What it does: General Dynamics is one of the most diversified defense and aerospace companies in the world. Its portfolio includes Abrams main battle tanks, Stryker armored vehicles, Columbia-class and Virginia-class nuclear submarines, and Gulfstream business jets. The company operates through four key segments: Aerospace, Marine Systems, Combat Systems, and Technologies, giving it exposure across both military and commercial markets.

Why it matters now: General Dynamics continues to benefit from the U.S. Navy’s aggressive modernization program and Europe’s renewed demand for armored vehicles. The company recently secured additional orders for Virginia-class submarines and expanded Abrams tank upgrades for NATO allies, including Poland and Romania. Gulfstream’s jet deliveries are also rebounding as global corporate travel recovers. With a strong backlog exceeding $95 billion and stable free cash flow, GD offers a balanced blend of growth and income potential, making it a core holding for investors seeking diversified exposure to the global defense cycle.

5. Northrop Grumman (NOC)

Market Cap: $89.3B | Forward P/E: 24.2x | Dividend Yield: 1.4% | Analyst Upside: +11.8%

What it does: Northrop Grumman is a leading U.S. defense contractor specializing in advanced aerospace, nuclear deterrence, and space systems. The company develops the B-21 Raider stealth bomber, the Sentinel (GBSD) intercontinental ballistic missile program, and critical space-based defense and communications technologies. It also provides key components for missile warning, command, and control networks used across U.S. and allied defense systems.

Why it matters now: As the U.S. government ramps up its nuclear modernization and space defense initiatives, Northrop Grumman sits at the center of multi-decade strategic programs extending well into the 2040s. In 2025, the company entered the final testing phase of the B-21 Raider, with the first deliveries expected in 2026, and secured new funding for the Sentinel ICBM system under the FY2026 defense budget proposal. With a $90 billion backlog and rising demand for space-based surveillance capabilities, Northrop’s long-term growth outlook remains strong. Analysts project solid double-digit upside as recurring defense-tech contracts continue to expand.

6. L3Harris Technologies (LHX)

Market Cap: $63.8B | Forward P/E: 32.0x | Dividend Yield: 1.4% | Analyst Upside: +13.4%

What it does: L3Harris Technologies is a major U.S. defense contractor specializing in tactical communications, intelligence, surveillance, and electronic warfare systems. The company provides mission-critical technologies that enable secure battlefield connectivity, real-time situational awareness, and cyber defense. Its product range includes advanced radios, ISR (intelligence, surveillance, and reconnaissance) platforms, and space-based communication payloads used by the U.S. Department of Defense and allied militaries.

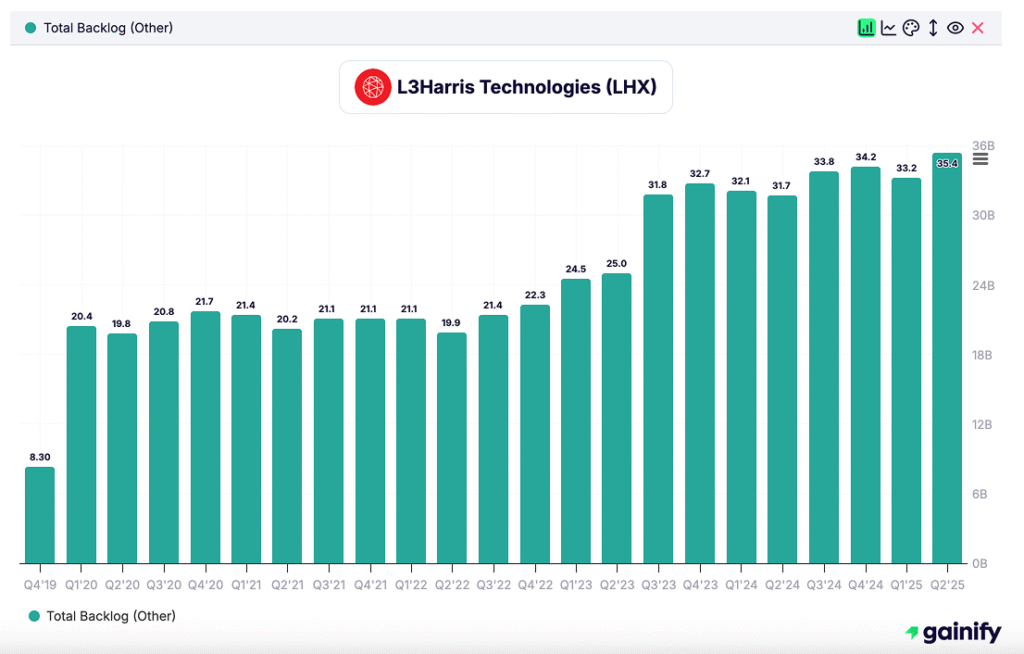

Why it matters now: As modern warfare becomes increasingly digital and data-driven, L3Harris has emerged as a leader in secure communication and electronic defense systems. In 2025, the company secured key contracts tied to next-generation battlefield networks and satellite communication programs, including work for the U.S. Space Development Agency. Its acquisition of Aerojet Rocketdyne has expanded its reach into propulsion and missile technologies. With growing global demand for cyber resilience, space-based communications, and AI-enabled command systems, L3Harris is well positioned for steady growth and improving profitability.

7. HEICO Corp (HEI)

Market Cap: $42.3B | Forward P/E: 71.5x | Dividend Yield: 0.07% | Analyst Upside: +12.7%

What it does: HEICO Corporation designs and manufactures specialized aerospace and defense components used in aircraft, satellites, and advanced military systems. The company supplies parts and subsystems to major players such as Boeing, Lockheed Martin, and Airbus. Its aftermarket business provides replacement parts and repair solutions that generate recurring, high-margin revenue through its Flight Support Group and Electronic Technologies Group.

Why it matters now: HEICO stands out as one of the most innovative and steadily growing suppliers in the aerospace and defense industry. In 2026, demand remains strong for aircraft modernization, satellite electronics, and defense maintenance programs. The company continues to expand through targeted acquisitions of niche, high-technology manufacturers that strengthen its portfolio and improve margins. With rising global defense spending and continued growth in aviation, HEICO’s combination of recurring revenue, operational discipline, and long-term consistency makes it one of the most reliable performers among defense stocks.

Global Context: The Defense Boom of 2026

The global defense industry over the last couple of years has entered its strongest growth cycle in decades. Rising geopolitical tensions, supply shortages from ongoing conflicts, and a renewed focus on national security have turned defense spending into a strategic priority. Governments are no longer debating if they should spend more, but how fast they can expand capacity.

Europe is leading the surge. The region’s defense stocks over the last 12 months have soared this year as countries rearm at record speed. Rheinmetall has climbed nearly 200%, fueled by massive orders for ammunition and armored vehicles from Germany and Eastern Europe. Leonardo has more than doubled in value, supported by export demand for helicopters, avionics, and radar systems. BAE Systems has advanced over 60%, driven by strong demand for its fighter jets and naval programs. Several NATO members, including Poland, Lithuania and Estonia, are now committing up to 5% of GDP to defense spending, marking a historic shift from pre-2022 levels.

At the same time, U.S. defense companies are catching up. After lagging behind growth and technology stocks in 2023 and 2024, American contractors are now seeing renewed investor interest. Looking ahead, the U.S. administration is pushing for a $1.01 trillion defense budget for FY2026, a 13 percent increase from the prior year, while also signaling an even larger increase to approximately $1.5 trillion in 2027. Together, these proposals underscore a long-term commitment to military readiness and technological leadership, providing improved earnings visibility for U.S. defense contractors.

Despite recent gains, valuations tell two different stories. European defense names now trade at premium levels after a year of exceptional performance, while U.S. counterparts such as Lockheed Martin, RTX, and General Dynamics remain relatively discounted. This valuation gap could present an opportunity for investors seeking exposure to the global rearmament cycle at more attractive entry points.

In summary: Europe’s defense sector has already re-rated sharply, reflecting its position at the front line of the global security shift. The U.S. industry, supported by trillion-dollar budgets and next-generation programs, might be poised to follow, offering a compelling mix of growth potential and valuation support heading into 2026.

Bottom Line

The defense sector in 2026 remains one of the strongest and most reliable investment themes worldwide. Military budgets are expanding across every major economy, and multi-year procurement programs are locking in predictable revenue streams for the decade ahead. As governments prioritize national security, defense contractors continue to benefit from record backlogs and sustained demand for next-generation systems.

That said, investors should monitor ongoing policy discussions in the United States around potential limits on dividends or buybacks for defense contractors receiving large increases in federal funding. While no measures have been enacted, such proposals represent a potential risk to near-term shareholder returns.

These seven defense stocks combine resilience, and exposure to advanced technologies spanning aerospace, cybersecurity, and space defense. While European names have already rallied sharply on surging military budgets, U.S. giants still trade at more attractive valuations and are positioned for renewed growth as spending accelerates into 2026 and beyond.

For investors seeking a hedge against geopolitical uncertainty, defense remains one of the few sectors that rises when global risks escalate. It offers a compelling mix of stability, long-term growth, and protection in volatile markets. In an unpredictable world, the defense trade has shifted from a tactical play to a strategic cornerstone of diversified portfolios.