Graphene has long been described as a wonder material, but 2026 is shaping up to be a more pragmatic phase for graphene stocks. After years of hype-driven expectations, the sector is slowly transitioning toward real-world commercialization, niche adoption, and early revenue validation.

Investors are no longer paying for theoretical potential alone. Instead, they are rewarding companies that can scale production, integrate graphene into existing industrial processes, and demonstrate repeatable customer demand.

Graphene is a single layer of carbon atoms arranged in a hexagonal lattice, making it exceptionally strong, lightweight, conductive, and versatile. These properties enable applications across batteries, construction materials, coatings, electronics, filtration, and advanced manufacturing.

Despite its promise, graphene adoption has been uneven. Many graphene stocks remain small-cap or micro-cap stocks, reflecting both early-stage economics and execution risk. However, the dispersion within the group is widening. Some players are building credible commercial pipelines, while others remain stuck in pilot programs.

Key Takeaways for Graphene Stocks in 2026

- Market transition: graphene markets are moving from lab-scale experimentation to targeted industrial adoption

- Commercial focus: revenue visibility and production scalability now outweigh headline partnerships

- Valuation reset: several graphene companies trade at depressed levels after multi-year drawdowns

- Demand drivers: concrete, energy storage, coatings, and filtration are emerging as near-term end markets

- Capital discipline: balance sheet strength and capital efficiency increasingly separate leaders from laggards

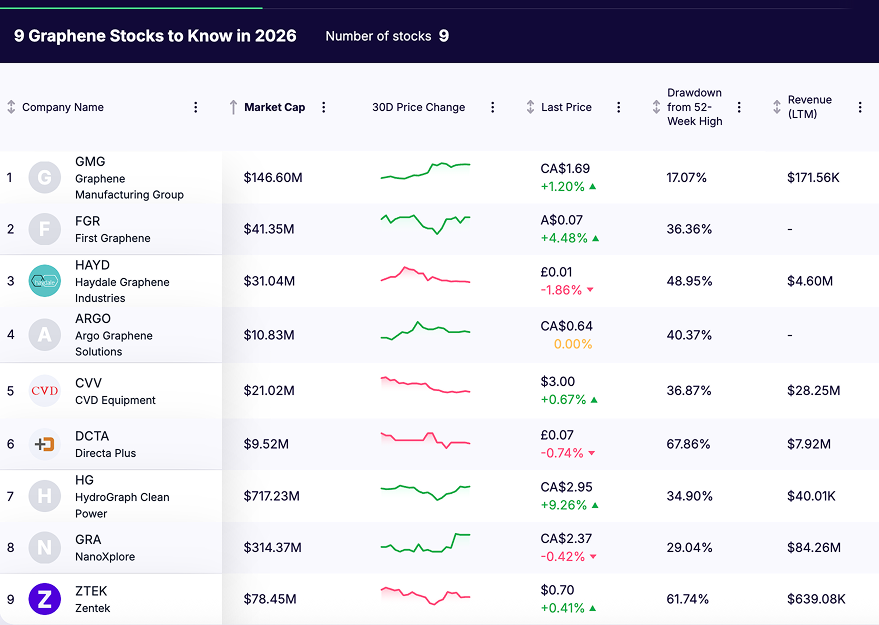

Below are nine graphene stocks to know in 2026, spanning producers, application-focused specialists, and enabling equipment providers.

1. Graphene Manufacturing Group (TSXV: GMG)

- Share price: CA$1.69

- Market capitalization: $146.60 million

Business overview

Graphene Manufacturing Group produces graphene using a proprietary plasma-based process that does not rely on mined graphite. This approach is designed to deliver high-purity graphene with lower energy intensity, positioning GMG as both a technology and sustainability-driven producer. Rather than selling graphene as a standalone commodity, the company focuses on application-led commercialization, particularly in energy efficiency, battery performance, and thermal management.

GMG’s strategy emphasizes integrating graphene into end products and systems where performance improvements can be clearly quantified, reducing reliance on speculative or experimental use cases.

Investment thesis

GMG’s core differentiator is its vertically integrated model, combining in-house graphene production with downstream application development. This allows tighter quality control, faster product iteration, and closer collaboration with customers compared with pure-play material suppliers. The company’s focus on batteries and thermal solutions targets markets where incremental performance gains can justify adoption and pricing.

As graphene adoption shifts toward targeted industrial use, GMG is positioned to benefit from customers seeking repeatable performance improvements rather than raw material exposure.

Financial context

According to the most recent disclosures, GMG generated $171,560 in trailing twelve-month revenue, reflecting early-stage commercialization rather than scale production. The company maintains a strong cash position relative to its revenue base, providing runway to advance pilot projects, customer trials, and initial commercial deployments. GMG remains firmly in an investment phase, prioritizing market entry and validation over near-term profitability.

Key risks

- Early revenue stage, with limited current sales scale

- Commercial adoption risk, as customer trials may take longer to convert into recurring contracts

- Ongoing cash burn, driven by R&D, production scaling, and business development

- Execution risk, as success depends on translating technical advantages into consistent commercial demand

2. First Graphene (ASX: FGR)

- Share price: A$0.07

- Market capitalization: $41.35 million

Business overview

First Graphene is a graphene producer and application-focused materials company best known for its PureGRAPH range of graphene nanoplatelets. The company’s strategy centers on supplying consistent, high-quality graphene additives that can be incorporated into existing industrial materials, particularly in construction, composites, and advanced manufacturing.

Unlike companies pursuing bespoke or experimental applications, First Graphene emphasizes scalability and regulatory readiness, positioning graphene as a performance-enhancing input rather than a disruptive replacement material. Concrete and cement additives remain a core focus, reflecting the potential for large-volume demand even at low graphene inclusion rates.

Investment thesis

First Graphene’s investment case rests on its pragmatic commercialization approach. By targeting industries with established supply chains and clear performance metrics, the company aims to shorten adoption timelines and reduce customer friction. Construction materials, in particular, offer a credible path to scale given the size of the end market and the economic incentive to improve strength and durability while lowering material usage.

As graphene adoption moves toward industrial validation rather than experimentation, First Graphene’s emphasis on product consistency and real-world testing may prove more durable than headline-driven partnerships.

Financial context

First Graphene remains in the early stages of revenue generation, reflecting the long adoption cycles typical of construction and industrial materials. The company operates a commercial-scale graphene production facility, giving it the capacity to support customer trials and early orders without immediate capital expansion. Financial performance continues to be shaped by customer qualification timelines rather than demand constraints.

Key risks

- Slow customer conversion, particularly in construction and infrastructure markets

- Revenue concentration risk if early adopters delay or reduce orders

- Pricing pressure as alternative graphene suppliers enter industrial segments

- Funding and cash management risk during extended commercialization cycles

3. Haydale Graphene Industries (LSE: HAYD)

- Share price: £0.01

- Market capitalization: $31.04 million

Business overview

Haydale Graphene Industries is a functional advanced materials company that focuses on functionalized graphene and related nanomaterials. Rather than positioning itself as a raw graphene supplier, Haydale emphasizes tailored solutions and composites, particularly in coatings, inks, adhesives, and performance materials that benefit from enhanced conductivity, strength, or chemical interaction.

The company works closely with industrial and engineering partners to integrate graphene into customer products, helping address real performance challenges rather than selling graphene as a standalone material. This application-centric strategy aims to bridge the gap between experimental use cases and true commercial adoption.

Investment thesis

Haydale’s value proposition lies in its application development model, which seeks to deepen customer relationships and shorten the path from proof-of-concept to volume sales. By focusing on end markets such as advanced coatings, functional additives, and industrial composites, the company aims to capture revenue from performance enhancements that can be objectively measured.

For investors, Haydale represents exposure to graphene’s value-added application layer rather than the commoditized raw material market. Its solution-oriented approach may resonate with industrial buyers who prioritize measurable performance benefits.

Financial context

Haydale’s revenue reflects the early stage of industrial adoption for many graphene applications. The company reported approximately £3.7 million in last reported revenue, with growth driven by strategic customer engagements and pilot programs. While still modest relative to peers with broader diversification, this performance underscores emerging traction in specific industrial niches.

Key risks

- Revenue concentration risk, with meaningful sales tied to a limited number of industrial partners

- Commercial scaling risk, as pilot programs may take time to convert into stable, recurring revenue

- Cost and operational leverage, which may pressure margins during expansion

- Competitive pressure from other functional materials and graphene suppliers

4. Argo Graphene Solutions (CNSX: ARGO)

- Share price: CA$0.64

- Market capitalization: $10.83 million

Business overview

Argo Graphene Solutions focuses on integrating graphene into industrial materials, with an emphasis on construction-related applications such as concrete additives, protective coatings, and performance composites. Rather than positioning graphene as a standalone product, Argo targets use cases where small graphene inclusion rates can deliver measurable improvements in strength, durability, and longevity.

The company’s strategy is oriented toward practical deployment. By working within established industrial supply chains, Argo aims to lower adoption barriers and align graphene use with existing manufacturing processes and customer requirements.

Investment thesis

Argo’s investment case is based on focus and specificity. By narrowing its attention to a limited set of industrial applications, the company avoids the execution risk associated with broad platform strategies. Construction and infrastructure materials offer a compelling entry point due to their scale and the economic value of incremental performance gains.

At its current size, Argo represents a high-risk, early-stage graphene opportunity where valuation is more sensitive to initial commercial validation than long-term market dominance. Any progress toward repeatable customer orders could have an outsized impact on investor perception.

Financial context

Argo remains in the pre-scale commercialization phase, with minimal reported revenue as it prioritizes customer trials, testing, and qualification. This stage reflects the long adoption cycles typical in construction and infrastructure markets, where performance verification and regulatory acceptance are prerequisites to broader uptake.

The company’s financial profile underscores both its optionality and its dependence on successful conversion from trials to revenue-generating contracts.

Key risks

- Limited current revenue, reflecting early commercialization

- Customer conversion risk, as trials may not lead to recurring orders

- Funding and liquidity constraints, given the company’s micro-cap profile

- Competitive alternatives, including other graphene suppliers and non-graphene material solutions

5. CVD Equipment Corporation (NASDAQ: CVV)

- Share price: $4.42

- Market capitalization: $21.09 million

Business overview

CVD Equipment Corporation is an enabling technology provider rather than a direct graphene producer. The company designs and manufactures chemical vapor deposition and advanced materials processing equipment used in the production of graphene, carbon nanotubes, silicon carbide, and other high-performance materials.

Its systems are used by industrial customers, research institutions, and pilot-scale manufacturers that require precise control over material growth, purity, and repeatability. This positions CVD Equipment as an indirect beneficiary of graphene adoption, regardless of which specific graphene producer ultimately scales.

Investment thesis

CVD Equipment offers infrastructure exposure to graphene and advanced materials, rather than application or commodity risk. As graphene moves from laboratory research to pilot production and early commercialization, demand for specialized deposition and processing equipment becomes more relevant.

The company’s diversified end markets reduce dependence on any single material or customer. For investors, this creates a different risk profile compared with graphene pure plays, with revenue tied to capital spending cycles rather than product adoption curves.

Financial context

According to the most recent company presentation, CVD Equipment generated approximately $28 million in trailing twelve-month revenue, supported by a mix of equipment sales and aftermarket services. The company maintains a net cash balance and no long-term debt, providing financial flexibility during cyclical fluctuations in customer capital spending.

While revenue can be lumpy due to the project-based nature of equipment sales, the balance sheet strength differentiates CVD Equipment from many early-stage graphene companies.

Key risks

- Capital expenditure cyclicality, which can delay customer orders

- Revenue volatility, as equipment sales are project driven

- Customer concentration risk, particularly among industrial and research buyers

- Competition from larger, better-capitalized equipment manufacturers

6. Directa Plus (LSE: DCTA)

- Share price: €0.11

- Market capitalization: $10.03 million

Business overview

Directa Plus is a graphene technology company focused on functional graphene applications that improve performance in consumer and industrial products. The company’s core offerings include graphene-enhanced products for textiles, environmental remediation, elastomers, and industrial filtration. Its flagship product line, known as G+, is designed to deliver conductivity, durability, and barrier improvements when integrated into existing material systems.

Unlike raw graphene materials businesses, Directa Plus positions itself as a solutions provider, selling finished or semi-finished graphene-enhanced materials that target clear performance benefits. This end-market focus differentiates Directa Plus from producers that have struggled to translate the material into commercially adopted products.

Investment thesis

Directa Plus’s value proposition is grounded in product integration and measurable performance gains rather than speculative future markets. The company’s graphene enhancements are selected for applications where enhanced durability, conductivity, or environmental performance can command pricing premiums or open new product categories.

For investors, Directa Plus represents a use-case-centric exposure to graphene adoption, where success depends on product performance, recurring revenue from repeat customers, and the company’s ability to scale manufacturing in line with orders.

Financial context

Directa Plus has recorded revenue growth, driven by increasing uptake of G+ materials in polymers, textiles, and environmental applications. In the latest reporting period, the company posted €3.9 million in revenue, with contribution margins above 50 percent, indicating strong pricing power and operational leverage relative to revenue. This solid margin profile distinguishes Directa Plus from many earlier-stage graphene plays that have yet to demonstrate consistent profitability.

Key risks

- Early revenue stage relative to global peers

- Commercial timing risk, as broader adoption may take longer than anticipated

- Capital constraints given its micro-cap status

- Competitive pressure from alternative advanced materials and graphene suppliers

7. HydroGraph Clean Power (CNSX: HG)

- Share price: $3.74

- Market capitalization: $716.97 million

Business overview

HydroGraph Clean Power is a graphene technology developer focused on producing high-purity graphene using a patented detonation synthesis process. The company’s core emphasis is on delivering consistent, scalable graphene suitable for energy, electronic, industrial, and performance material applications.

Unlike many graphene companies that rely on traditional exfoliation or chemical reduction, HydroGraph’s proprietary synthesis process is designed to produce ultra-high-quality graphene with minimal contaminants, which can improve performance in applications requiring strict material specifications, such as energy storage and advanced composites.

Investment thesis

HydroGraph’s value proposition centers on its technology platform and material quality. High-purity graphene can command higher pricing and unlock performance advantages in energy storage (such as supercapacitors and batteries), thermal management, and advanced composites for industrial customers. The company’s technological differentiation and scalable synthesis process position it to capture adoption in higher-end industrial use cases rather than basic raw material markets alone.

For investors, HydroGraph represents a technology-led graphene exposure that banks on material quality and application specificity, rather than commodity pricing pressure. If the company successfully transitions from development to repeatable commercial engagement, valuation could reflect not just optionality but tangible application traction.

Financial context

HydroGraph is still in the early commercialization stage, with minimal revenue reported relative to its valuation. Its market capitalization is one of the largest among pure-play graphene stocks, indicating that a significant portion of investor value is tied to future growth expectations and the market’s belief in the long-term relevance of its proprietary synthesis technology.

The company’s financial position and cash reserves remain key variables; maintaining sufficient runway to support product qualification and customer adoption will be essential to unlocking long-term shareholder value.

Key risks

- Limited current revenue, with much of the investment thesis tied to future commercialization

- Execution risk in scaling production and qualifying materials for high-end applications

- Valuation sensitivity, as a large portion of market cap reflects expectation rather than earnings

- Competitive pressure from other high-quality graphene producers and alternative advanced materials

8. NanoXplore (TSX: GRA)

- Share price: CA$1.06

- Market capitalization: $314.44 million

Business overview

NanoXplore is one of the largest graphene producers globally with a vertically integrated production model and a focus on embedding graphene into existing industrial supply chains. Unlike some pure-play explorers, NanoXplore operates commercial-scale manufacturing and supplies graphene-enhanced materials into plastics, polymers, composites, and transportation markets.

The company’s strategy emphasizes practical performance enhancement, embedding graphene into materials to improve mechanical strength, durability, conductivity, and thermal performance. NanoXplore’s product lineup includes graphene-enhanced masterbatches and additives designed for real-world industrial customers rather than speculative or early-stage applications.

Investment thesis

NanoXplore stands out for its scale, commercialization progress, and diversified application base. With meaningful annual revenue relative to many graphene peers, the company transitions graphene from niche experimentation to tangible use cases with recurring demand. Its upstream production and downstream product sales capture value across the materials value chain, positioning NanoXplore as a more mature and operationally relevant exposure to the graphene economy.

For investors, NanoXplore offers a blend of scale and execution, where continued customer adoption in high-volume markets like automotive, industrial plastics, and transportation materials could drive sustainable revenue growth.

Financial context

NanoXplore’s revenue base is one of the largest among graphene-focused equities, with annual sales substantially higher than most pure plays. This revenue scale reflects ongoing commercial activity and real-world product integration. Its cost structure and production footprint also provide operating leverage as adoption increases.

The company’s financial profile suggests that commercial traction is underway, reducing the reliance on future hope-value alone and making revenue performance a more significant component of valuation.

Key risks

- Margin pressure in industrial commodity applications

- Slower growth than speculative peers if adoption lags expectations

- Competitive substitution by other advanced materials or graphene suppliers

- Capital intensity if additional production capacity is required before demand justifies expansion

9. Zentek (TSXV: ZEN)

- Share price: $1.14

- Market capitalization: $78.15 million

Business overview

Zentek is a graphene technology company focused on specialized applications in coatings, filtration, and performance materials, with an emphasis on areas where graphene’s unique properties can deliver measurable functional benefits. The company’s product portfolio includes graphene-enhanced coatings for corrosion resistance, antimicrobial finishes, air and water filtration media, and energy-related solutions.

Unlike pure material miners, Zentek positions itself as a solutions provider, working to embed graphene into higher-value niche products with clearer commercial pathways and customer demand. Its efforts reflect a broader shift in the graphene sector toward practical industrial integration rather than exploratory nanomaterial experiments.

Investment thesis

Zentek’s appeal lies in its diversified application focus and early traction in non-cyclic end markets such as environmental filtration and performance coatings. These arenas offer repeatable demand patterns, which can reduce reliance on large-scale adoption cycles typical of industrial materials markets. By prioritizing segments where performance gains translate directly into economic or regulatory advantages, Zentek aims to carve out a more defensible niche within the graphene ecosystem.

For investors, Zentek represents a pragmatic exposure to graphene commercialization where the success pivot is early revenue validation and customer adoption in specialized products rather than commodity supply.

Financial context

Zentek’s reported revenue remains modest, reflecting its early commercialization stage, but revenue dynamics are beginning to shift as recurring contracts and product placements increase. Its market cap is higher than many micro-cap graphene peers, suggesting that investors are pricing in growth optionality around diversified applications rather than near-term earnings.

This financial profile distinguishes Zentek from raw feedstock plays and aligns it more closely with application-first equities that leverage graphene’s performance attributes in defined industrial solutions.

Key risks

- Revenue concentration risk, given early-stage commercial adoption

- Slow scaling, if product integration timelines extend longer than expected

- Competition from both graphene and non-graphene performance materials

- Cash flow sensitivity, typical of early commercial deployment phases

What Is Graphene?

Graphene is a single atomic layer of carbon atoms arranged in a two-dimensional hexagonal lattice. It is the thinnest material ever isolated, yet also one of the strongest and most versatile known to science. Despite being just one atom thick, graphene exhibits exceptional strength, electrical conductivity, thermal conductivity, and flexibility.

What makes graphene unique is not one standout property, but the combination of properties it delivers simultaneously. This allows graphene to enhance the performance of other materials without adding significant weight, thickness, or complexity.

In practical terms, graphene acts as a performance amplifier when added in small quantities to existing products.

Why Graphene Is Different

Graphene’s commercial potential stems from a rare convergence of physical characteristics:

- Extreme strength: Over 200 times stronger than steel by weight

- Exceptional conductivity: Superior electrical and thermal performance

- Ultra-lightweight: Adds strength without mass

- Flexible and durable: Can bend and stretch without breaking

- High surface area: Enables efficient chemical interaction and energy storage

These properties allow graphene to solve problems that traditional materials cannot, particularly where strength, conductivity, and weight must be optimized simultaneously.

How Graphene Is Used Today

While graphene was initially confined to laboratories, several applications are now progressing into early commercial deployment.

Energy Storage and Batteries

Graphene improves charge transport and surface area in batteries and supercapacitors. This can result in faster charging, higher power density, and longer cycle life, making it attractive for energy storage and mobility applications.

Construction and Concrete

Incorporating graphene into cement and concrete can significantly increase compressive strength, durability, and crack resistance. This allows less material to be used for the same structural performance, reducing costs and carbon intensity.

Composites and Advanced Materials

Graphene enhances plastics, polymers, and composites by improving mechanical strength, heat resistance, and durability. These benefits are being explored in automotive parts, industrial equipment, and aerospace components.

Electronics, Sensors, and Thermal Management

Because graphene conducts electricity and heat so efficiently, it is used in sensors, conductive coatings, flexible electronics, and thermal interface materials. These applications benefit from graphene’s thinness and responsiveness.

Filtration and Environmental Applications

Graphene-based membranes enable highly efficient water purification, air filtration, and chemical separation. Their strength and selectivity allow filtration at the molecular level with lower energy requirements.

Health and Biomedical Applications

Graphene is being evaluated for antimicrobial coatings, biosensors, and medical filtration systems. Its electrical sensitivity and surface chemistry are valuable, though regulatory approval remains a critical hurdle.

Why Graphene Adoption Is Accelerating Now

Graphene adoption was slow in its early years due to production challenges, inconsistent quality, and integration difficulties. That phase is now giving way to a more focused commercialization cycle.

Key changes driving adoption:

- Improved manufacturing consistency

- Better understanding of where graphene adds economic value

- Shift toward targeted industrial use cases rather than broad experimentation

As a result, graphene is increasingly used where it can demonstrably improve performance or reduce cost, not simply where it is novel.

Why Graphene Matters for Investors

For investors, graphene represents a materials transition rather than a single product cycle. The opportunity lies not in graphene itself, but in companies that can:

- Produce graphene reliably at scale

- Integrate it into existing supply chains

- Deliver measurable performance improvements

- Convert trials into recurring revenue

As the sector matures, execution and commercialization discipline are becoming more important than scientific promise. This is why dispersion among graphene stocks is widening and why selectivity matters heading into 2026.

Final Thoughts

Graphene stocks remain a high-risk, high-dispersion segment of the market heading into 2026. While the material’s properties are no longer in question, the path to widespread adoption is proving slower and more selective than early forecasts suggested. Investors should focus less on broad narratives and more on specific use cases, customer traction, and financial discipline.

Among graphene stocks, companies with scalable production, clear end markets, and improving revenue visibility are best positioned to benefit as graphene gradually transitions from promise to product.