Long-term investing is about finding companies that can keep creating value year after year. The best long-term stocks are not the ones that surge for a moment but the ones that build steadily, adapt to change, and grow through different market cycles.

These companies combine consistent growth, strong cash generation, and thoughtful capital allocation. They create value through time rather than through short bursts of momentum.

Short-term market moves often reflect emotion, but long-term success comes from fundamentals.

To understand what that looks like in practice, it helps to study the companies that have already done it. The top 10 performers of the past decade provide a clear example of how durability, innovation, and disciplined execution can translate into extraordinary returns.

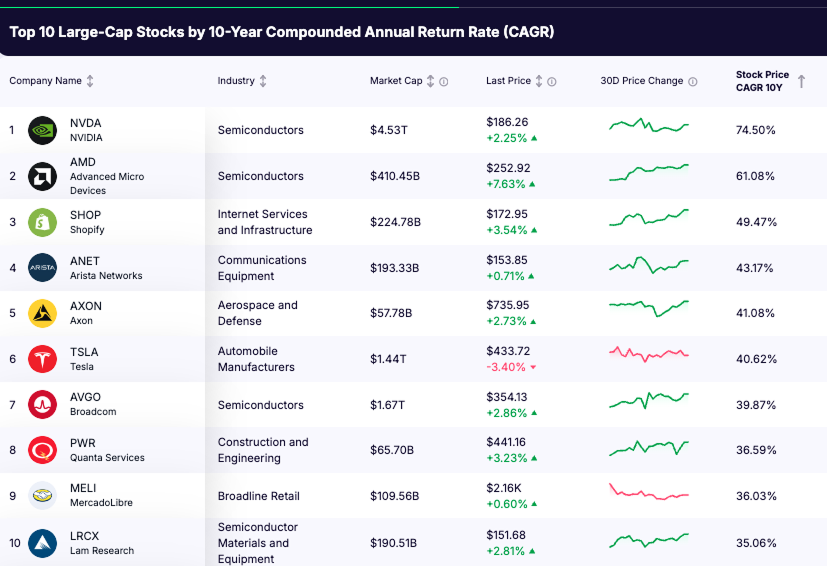

Top 10 Best-Performing Large-Cap Stocks of the Past Decade

The table highlights the large-cap companies that delivered the highest compounded annual returns over the past 10 years.

Highlights

- The ranking is based on 10-year compounded annual growth rate (CAGR) in stock price, excluding dividends.

- Only companies which have a market capitalization above $50 billion were considered.

- The top performers generated annualized returns from 35 percent to over 70 percent, far outpacing global equity benchmarks.

- Semiconductors dominate, led by NVIDIA (74.5%), AMD (61.1%), Arista Networks (43.2%) and Broadcom (39.9%), reflecting the structural rise of AI, data centers, and digital infrastructure.

Understanding What Makes a Great Long-Term Stock

Great long-term performers rarely succeed by chance. They combine durable business models, consistent growth, strong cash generation, and management that allocates capital with discipline. Below is a detailed framework for assessing what drives true long-term compounding.

1. Business Quality and Competitive Advantage

The foundation of long-term success lies in business quality. High-quality companies sustain returns well above their cost of capital and defend profitability through competitive advantages that are difficult to replicate.

What to look for:

- Return on invested capital (ROIC) consistently above the cost of capital.

- Stable or rising gross margins that signal pricing power.

- Clear competitive moats such as scale efficiency, brand strength, network effects, or proprietary technology.

Practical check: ROIC at least 5 percentage points above the company’s weighted average cost of capital (WACC), and gross margins that are stable or improving over the last five years.

2. Growth Runway and Market Duration

Even the best companies struggle to compound without room to grow. Long-term winners operate in markets that expand over time and find new ways to capture demand through innovation.

What to look for:

- A large and growing total addressable market supported by structural trends (for example, digitization, electrification, or healthcare innovation).

- A clear record of product development and expansion into adjacent markets or geographies.

- A pipeline of innovation that extends the company’s growth cycle.

Practical check: Evidence that revenue can grow sustainably above GDP over the next decade based on tangible market drivers rather than short-term cycles.

3. Cash Flow Quality and Balance Sheet Strength

Earnings tell part of the story, but long-term compounding depends on how effectively a company turns profits into cash and grows that cash generation over time. Free cash flow (FCF) is what ultimately supports reinvestment, debt reduction, dividends, and buybacks.

Look for:

- Sustained growth in free cash flow per share, not just one-time spikes.

- Free cash flow conversion above 80 percent of net income across multiple years.

- Reinvestment discipline, where growing cash flow is allocated to projects with attractive returns rather than wasted on acquisitions or buybacks at peak valuations.

- A strong balance sheet that provides optionality such as the ability to invest through downturns rather than react defensively.

Practical check: Free cash flow growth matching or exceeding revenue growth over the last five years, net debt to EBITDA below 2.0x, and interest coverage consistently above 6x.

4. Reinvestment and Capital Allocation

What a company does with its cash often determines how fast it compounds. Effective capital allocation balances organic growth, acquisitions, and shareholder returns without overreaching.

What to look for:

- Reinvestment in projects or segments that earn above-average returns.

- A clear hierarchy for using cash: reinvestment first, dividends and buybacks next.

- Acquisitions that strengthen existing capabilities rather than dilute focus.

Practical check: Capex and R&D levels aligned with growth strategy, consistent return on incremental invested capital (ROIC), and buybacks executed when valuations are reasonable.

5. Leadership, Culture, and Governance

Management quality and company culture are often underestimated drivers of long-term success. Alignment between leadership and shareholders fosters consistent execution and accountability.

What to look for:

- Insider ownership or incentive plans tied to long-term value creation.

- Clear, transparent reporting and a stable strategic direction.

- A culture that prioritizes innovation, execution, and prudent risk-taking.

Practical check: Executive compensation that rewards multi-year performance metrics and return-based outcomes, not short-term targets.

6. Valuation and Expectations

Even the best business can disappoint if investors overpay. The price you pay determines how much of future success is already priced in. Long-term investors seek quality companies at valuations supported by realistic assumptions.

What to look for:

- A valuation that reflects achievable growth and profitability.

- A margin of safety under conservative scenarios.

- A balanced view between company potential and market expectations.

Practical check: Use a reverse discounted cash flow (DCF) model to test what level of growth the market is already pricing in and whether those assumptions are reasonable.

Common Pitfalls in Long-Term Investing

Even experienced investors can fall into traps that undermine long-term performance. Sustainable compounding requires discipline, perspective, and a willingness to question assumptions.

Below are some of the most frequent pitfalls and how to avoid them.

⛔ Chasing Short-Term Performance

A common mistake is buying companies based on recent momentum or quarterly results rather than long-term fundamentals. Short-term outperformance often reflects sentiment, not durability.

High returns in a short window can be driven by temporary factors such as commodity cycles, interest rate changes, or speculative enthusiasm. When those forces reverse, so do valuations.

How to avoid it: Focus on the drivers of earnings and cash flow five to ten years out, not just last quarter’s growth. Ask whether the business model can sustain returns across multiple cycles.

⛔ Ignoring Cash Flow Quality

Headline revenue growth can look impressive, but growth without cash flow is rarely sustainable. Some companies expand aggressively by sacrificing margins or relying on external financing.

Eventually, weak cash conversion exposes fragility when capital costs rise or demand slows.

How to avoid it: Track free cash flow alongside earnings. Strong long-term compounders show consistent cash generation that supports reinvestment and shareholder returns, not just top-line growth.

⛔ Overpaying for Narratives

Valuations often stretch when markets reward compelling stories rather than tangible results. Growth themes such as AI, green energy, or e-commerce can justify optimism, but paying any price for potential creates poor long-term outcomes.

Even great businesses can deliver disappointing returns if the entry valuation assumes perfection.

How to avoid it: Separate the quality of a company from the price of its stock. Use scenario analysis or reverse-DCF models to test what level of growth is already embedded in the share price.

⛔ Failing to Revisit the Investment Thesis

Industries evolve, competition intensifies, and business models mature. What was once a growth story can become a slow-growth utility. Long-term investing is not the same as set-and-forget investing.

Investors who fail to update their view risk holding companies that no longer meet their original rationale.

How to avoid it: Reassess your core holdings periodically. Monitor whether the factors that made a company attractive (profitability, reinvestment opportunities, or competitive advantages) remain intact. Long-term investing means staying patient but also staying informed.

⛔ Underestimating Capital Allocation Risk

Management discipline can change over time. Companies that once deployed capital wisely may later chase acquisitions, dilute shareholders, or prioritize short-term financial engineering. Poor capital allocation can quietly erode years of compounding.

How to avoid it: Watch for shifts in behavior such as large, unrelated acquisitions, excessive buybacks at peak valuations, or dividend policies unsupported by free cash flow. Alignment between management incentives and shareholder interests is a key safeguard.

⛔ Neglecting the Impact of Cycles and Leverage

Strong businesses can still be poor long-term investments if their results depend too heavily on cyclical peaks or cheap financing. When demand falls or rates rise, leverage can magnify downside risks.

How to avoid it: Evaluate how the business performs in both up and down cycles. Look for moderate leverage, recurring revenue streams, and flexible cost structures that allow adaptation in changing environments.

The Traits of Long-Term Compounders

The strongest long-term stocks share one core feature: they can reinvest profits at high returns while maintaining financial strength and steady growth through changing market conditions. These companies compound value because their business models generate cash that can be redeployed year after year.

Below are the key traits that define enduring compounders and why each one matters for long-term performance.

Framework for Identifying Long-Term Compounders

Key Factor | What It Represents | What to Look For |

Business Quality and Competitive Advantage | The company’s ability to sustain profitability above its cost of capital and defend its market position. | ROIC consistently above WACC; stable or rising margins; durable moats such as scale, brand strength, or proprietary technology. |

Growth Runway and Market Duration | The long-term potential for revenue and earnings expansion. | Large and growing addressable market; consistent innovation; product or geographic expansion; long-term structural demand drivers. |

Cash Flow Growth and Balance Sheet Strength | The company’s capacity to generate and grow free cash flow while maintaining financial flexibility. | Sustained FCF per share growth; conversion above 80% of net income; moderate leverage (Net debt/EBITDA < 2x); interest coverage > 6x. |

Reinvestment and Capital Allocation | How effectively management reinvests capital to enhance future returns. | Reinvestment in high-ROIC projects; disciplined M&A; balanced approach to dividends and buybacks; consistent incremental ROIC. |

Leadership, Culture, and Governance | The quality, alignment, and integrity of management and organizational culture. | Insider ownership; long-term incentive structures; transparent reporting; culture that values innovation and accountability. |

Valuation and Expectations | The relationship between a company’s fundamentals and its market price. | Reasonable valuation based on achievable growth; clear margin of safety; realistic assumptions in market expectations. |

Final Takeaway

The best long-term stocks are rarely those with the highest short-term gains. They are companies that build competitive advantages, generate strong free cash flow, and reinvest efficiently over many years.

History shows that consistency often beats excitement. Investors who focus on quality, discipline, and time in the market tend to outperform those chasing trends.

Patience remains the most underrated advantage in long-term investing.

Disclaimer: The following analysis is for informational and educational purposes only. It does not include investment recommendations. Past performance does not guarantee future results.