In today’s stock market, where uncertainty and sharp drawdowns have become more common, high-yield dividend stocks continue to stand out as one of the most dependable ways to generate returns. Unlike pure growth stocks that rely on rising valuations or rapid earnings expansion, dividend-paying companies reward shareholders with consistent cash payments. These payouts can provide peace of mind, especially during periods of market volatility, because they deliver value regardless of short-term price changes. For many investors, this stream of income is an essential tool for building passive income and reducing overall stock market risk.

In this article, we will concentrate on dividend-paying stocks with market capitalizations above $100 billion. These firms are among the most established names in global finance, and many of them trade on the New York Stock Exchange or NASDAQ while also being included in the S&P 500 index. Their size and stability give them a clear advantage over smaller firms when it comes to dividend durability. Industries such as oil and gas, pharmaceuticals, banking, and telecom dominate this list, as they generate the kind of large and recurring cash flows needed to support high dividend payouts year after year.

But investors cannot rely on yield alone. A high dividend yield can signal that a stock is undervalued and financially strong, or it may suggest the market believes the payout is unsustainable. The difference lies in the details. To evaluate whether a dividend is safe, investors need to consider three critical factors: payout ratios, free cash flow coverage, and dividend growth trends. Companies with manageable payout ratios, reliable cash generation, and a history of raising dividends tend to be stronger long-term bets. On the other hand, companies with stretched financials may be forced to cut dividends, even if the headline yield looks attractive today.

This article focuses on the Top 20 high-yield dividend stocks in 2026 with market caps above $100 billion. These stocks represent a mix of traditional high-dividend payers and companies that combine solid current yields with room for future growth. Along the way, we will break down each company’s dividend yield, payout ratio, and sector positioning, while also placing them on a risk and reward scale to help both conservative investors and growth-oriented investors understand where each stock fits within a diversified investment portfolio.

The goal is to go beyond the surface. By looking not only at yields but also at the fundamental value behind them, investors can separate the truly reliable dividend-paying stocks from those that may not deliver in the long run.

What Dividend Yield Really Means

Dividend yield measures how much cash a company returns to shareholders each year relative to its stock price. The formula is straightforward:

Dividend Yield = Annual Dividend per Share ÷ Current Share Price

For example, if Bank of America (BAC) trades at $50 and is expected to pay an annual dividend of $1.08 per share annually, the dividend yield is 2.18%. In other words, for every $100 invested, you would receive $2.18 per year in dividends, assuming the company maintains its payout.

While this looks simple on paper, dividend yield should never be viewed in isolation. A high yield can be attractive, but it does not always mean the dividend is safe. A company showing a 7% yield, but facing weak earnings or declining cash flow could be at risk of cutting its payout. On the other hand, a stock yielding 3.5% but consistently raising dividends (like many dividend aristocrats) may prove far more rewarding over time.

It is also important to track the ex-dividend date, which marks the deadline to be eligible for the next payment. Understanding these dates helps investors properly time purchases and better anticipate cash flow from their dividend-paying stocks.

Dividend Durability: Growth, Payout Ratios, and Cash Flow

The most attractive high-yield investments are not simply the ones that offer the highest dividends today. What truly matters is whether those dividends can be sustained and increased over time. This ability, often called dividend durability, is shaped by three key factors:

1. Dividend Growth (DPS and EPS trends)

A reliable dividend stock is one that can raise payments steadily year after year. Companies like Johnson & Johnson or PepsiCo have demonstrated this consistency by increasing dividends even through challenging markets. Rising dividends usually reflect strong earnings per share (EPS) growth and disciplined management, giving investors confidence that payouts will continue to rise in the future.

2. Payout Ratios and Cash Coverage

Dividend yields are only as safe as the cash flows supporting them. A healthy payout ratio shows that a company is distributing dividends at a level it can afford. When a payout ratio climbs too high or exceeds free cash flow, future dividends may be at risk. This risk is especially relevant in capital-intensive industries such as oil and gas, where earnings and cash flows can fluctuate with commodity prices.

3. Balance Sheet Strength and Industry Position

Dividends are more durable when backed by strong financial foundations and competitive advantages. Companies with wide economic moats, dependable recurring revenues, or proven track record are far better positioned to withstand downturns.

In short, dividend durability comes from more than just today’s yield. It is the combination of growth, coverage, and financial strength that separates the stocks likely to deliver lasting income from those vulnerable to cuts.

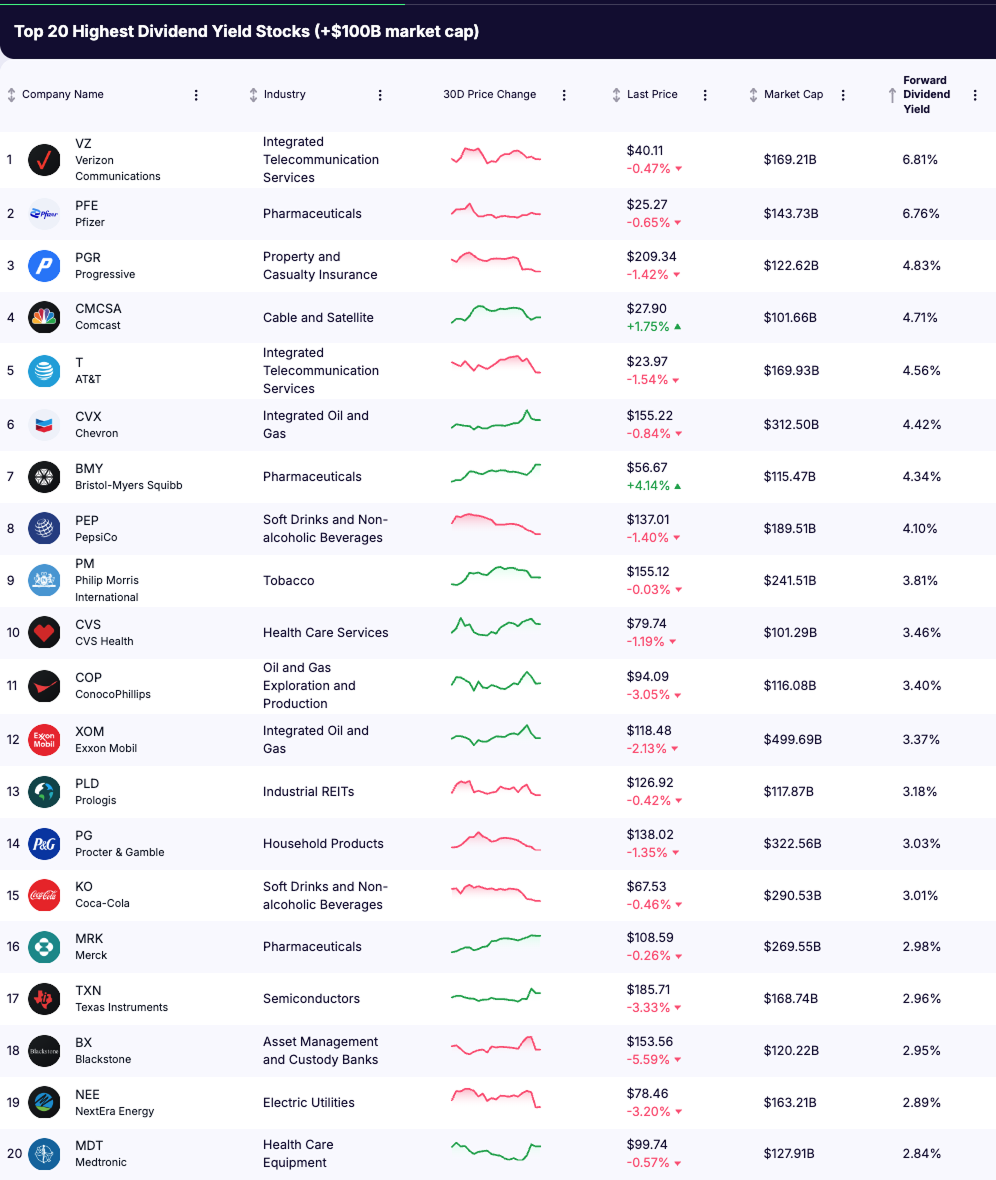

Top 20 High-Yield Dividend Stocks ($100B+ Market Cap, 2026)

Below is the full list of the highest dividend-paying mega-cap stocks in Jan 2026. Each of these companies has a market capitalization above $100 billion and offers one of the strongest forward dividend yields, making them potential candidates for income-focused investment strategies.

Rank | Company | Ticker | Industry | Market Cap ($B) | Forward Dividend Yield | Payout Ratio (1Y Forward) | Dividend Per Share Growth (3Y CAGR) |

|---|---|---|---|---|---|---|---|

1 | Telecom | 169.21 | 6.81% | 58.27% | 1.70% | ||

2 | Pharmaceuticals | 143.73 | 6.76% | 54.68% | 1.50% | ||

3 | PGR | Insurance | 122.62 | 4.83% | 56.35% | 1.70% | |

4 | CMCSA | Cable & Satellite | 101.66 | 4.71% | 31.19% | 6.00% | |

5 | T | Telecom | 169.93 | 4.56% | 53.87% | 0.10% | |

6 | CVX | Oil & Gas | 312.50 | 4.42% | 93.85% | 4.80% | |

7 | BMY | Pharmaceuticals | 115.47 | 4.34% | 37.71% | 2.60% | |

8 | PEP | Beverages | 189.51 | 4.10% | 69.19% | 5.30% | |

9 | PM | Tobacco | 241.51 | 3.81% | 78.38% | 6.20% | |

10 | CVS | Health Care Services | 101.29 | 3.46% | 41.43% | 4.20% | |

11 | Oil & Gas E&P | 116.08 | 3.40% | 49.23% | 3.70% | ||

12 | Oil & Gas | 499.69 | 3.37% | 57.57% | 3.80% | ||

13 | Prologis | PLD | Industrial REITs | 117.87 | 3.18% | 153.11% | 5.10% |

14 | Procter & Gamble | PG | Household Products | 322.56 | 3.03% | 60.77% | 4.30% |

15 | Beverages | 290.53 | 3.01% | 67.91% | 4.90% | ||

16 | Pharmaceuticals | 269.55 | 2.98% | 36.07% | 4.60% | ||

17 | Semiconductors | 168.74 | 2.96% | 98.89% | 3.90% | ||

18 | Blackstone | BX | Asset Management | 120.22 | 2.95% | 85.37% | 18.40% |

19 | Utilities | 163.21 | 2.89% | 61.29% | 8.70% | ||

20 | Health Care Equipment | 127.91 | 2.84% | 50.82% | 1.10% |

Key Observations

1. Healthcare provides steady income

Healthcare names like Pfizer, Merck, Bristol-Myers Squibb, CVS Health, and Medtronic highlight why the sector is favored by dividend investors. Demand for drugs, treatments, and healthcare services is relatively stable across economic cycles, supporting consistent payouts with lower volatility than more cyclical industries.

2. Energy companies remain powerful payers

Chevron, Exxon Mobil, and ConocoPhillips remain among the most powerful dividend payers in the mega-cap space. Strong operating cash flows enable attractive yields, though dividends in this sector remain sensitive to fluctuations in oil and gas prices.

3. Consumer staples balance yield with durability

Companies such as PepsiCo, Coca-Cola, and Procter & Gamble offer dependable dividends backed by global brands and resilient demand. Their ability to generate steady cash flow allows them to maintain and gradually grow payouts over time.

4. High yields require closer scrutiny

Stocks like Verizon, AT&T, and Prologis stand out for their elevated dividend yields, but higher payout ratios raise questions around long-term sustainability. Investors should assess cash flow coverage and balance-sheet strength before prioritizing yield alone.

5. Financials and alternatives add diversification

Progressive and Blackstone provide diversification beyond traditional dividend sectors. Blackstone, in particular, shows strong dividend growth potential, though its payouts can be more variable and tied to market conditions.

Conclusion

The Top 20 dividend-paying mega-cap stocks of 2026 show the wide range of options available to income-focused investors. These companies are large, established, and capable of generating meaningful shareholder returns.

The key lesson is that headline yield is only the starting point. The most reliable dividend payers combine strong current income with sensible payout ratios, solid cash flow, and a history of steady increases.

For investors, the best approach is to balance high-yield stocks that provide income today with companies that have the ability to grow dividends over time. This combination can create a portfolio that delivers steady cash flow now while also compounding wealth for the future.