Casino and gaming stocks remain one of the most dynamic and speculative segments of global equity markets. In recent years, the sector is split between two powerful trends:

- Traditional casino operators benefiting from post-pandemic travel recovery and integrated resort growth.

- Digital gaming and sports betting firms leveraging legalization, data analytics, and technology-driven engagement.

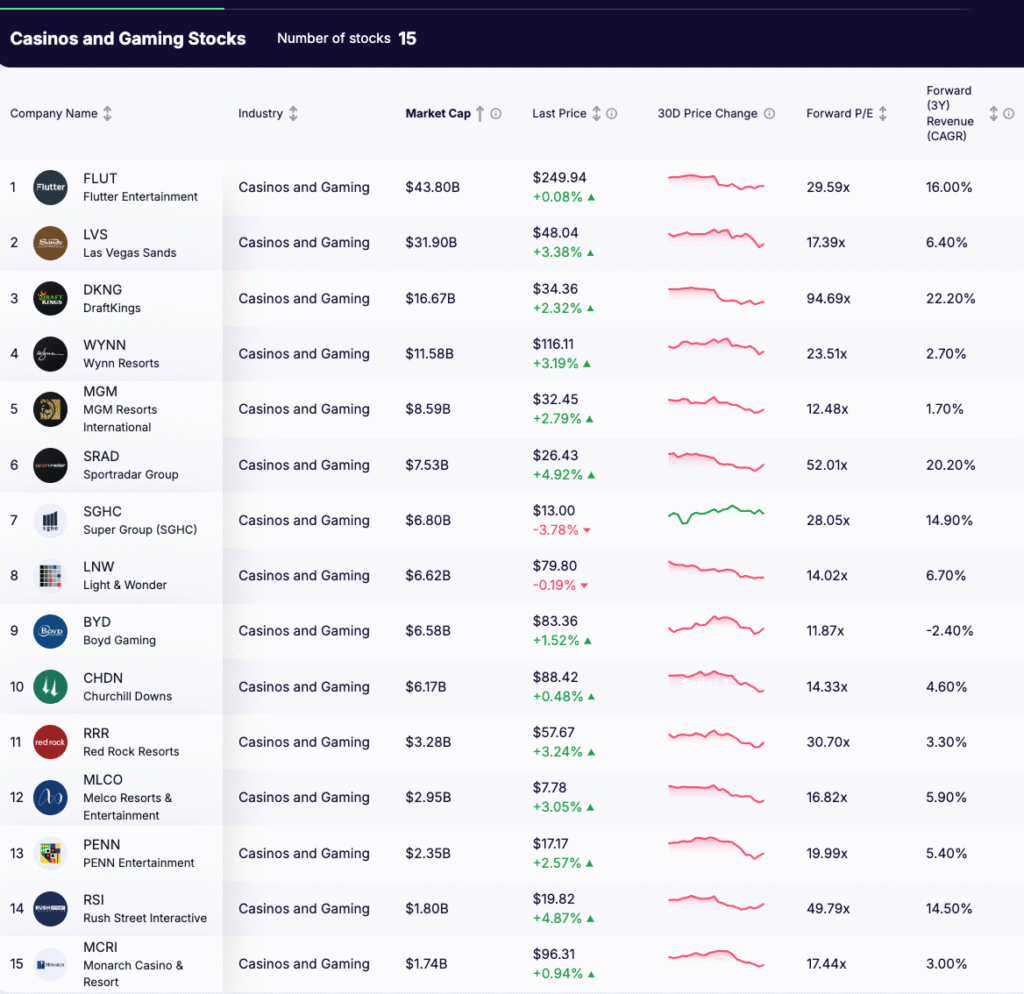

This guide explores 15 leading casino and gaming stocks, breaking down their fundamentals, strategies, and outlook based on the latest market data.

🎰 Traditional Casino Stocks: Tangible Assets, Steady Cash Flow

Casino operators own and manage large integrated resorts that bring together hotels, casinos, dining, and live entertainment. These properties often serve as major tourism hubs, attracting visitors from around the world and generating significant local economic activity.

Their performance tends to mirror the broader economy, with revenues rising when consumer confidence, tourism, and discretionary spending are strong. During downturns, reduced travel and tighter household budgets can quickly pressure margins and slow growth.

Top 8 Traditional Casino Stocks

Company | Ticker | Market Cap (USD) | 30D Price Change | Forward P/E | 3Y Revenue CAGR | Focus Area |

$31.9B | -6.33% | 18.58x | 6.4% | Macau, Singapore Resorts | ||

$11.6B | -6.15% | 25.10x | 2.7% | Luxury Casinos, Macau | ||

$8.6B | +0.94% | 12.44x | 1.7% | Integrated Resorts, Online Gaming | ||

$6.6B | +0.70% | 11.79x | -2.4% | Regional U.S. Casinos | ||

$6.2B | -2.24% | 14.66x | 4.6% | Horse Racing, Online Wagering | ||

$3.3B | +0.23% | 30.62x | 3.3% | Locals Casinos, Las Vegas | ||

$2.95B | -7.55% | 17.31x | 5.9% | Macau, Asian Gaming | ||

$1.74B | -1.39% | 17.69x | 3.0% | Regional Casinos, Colorado & Reno |

Below are the top eight traditional casino stocks that represent this segment of the market.

1. Las Vegas Sands (LVS) — $31.9B Market Cap

- Market Cap: $31.9B

- Forward P/E: 18.58x

- 3Y Revenue CAGR: 6.4%

Overview:

Las Vegas Sands is one of the largest integrated resort operators globally, with its main revenue coming from Macau and Singapore. After selling its Las Vegas assets, LVS doubled down on Asia, focusing on the Marina Bay Sands and Cotai Strip operations.

Investor Insight:

A pure play on Asia’s tourism recovery. The recent price dip may offer value if China’s outbound travel accelerates in 2026. Watch for regulatory clarity from Macau’s gaming authorities.

2. Wynn Resorts (WYNN) — $11.6B Market Cap

- Forward P/E: 25.10x

- 3Y CAGR: 2.7%

Overview:

Wynn is synonymous with luxury resorts and premium gaming. Its revenues are heavily exposed to Macau, with secondary operations in Las Vegas and the upcoming UAE expansion project.

Investor Insight:

WYNN trades at a premium valuation due to its brand and property quality, but faces short-term headwinds from slower Macau growth. Long-term, Wynn’s diversification into the Middle East could prove transformative.

3. MGM Resorts International (MGM) — $8.6B Market Cap

- Forward P/E: 12.44x

- 3Y CAGR: 1.7%

Overview:

MGM blends physical resorts with digital presence through BetMGM, its joint venture with Entain. The firm operates major properties on the Las Vegas Strip and in Asia (MGM China).

Investor Insight:

Attractive for investors seeking both stable cash flows and online exposure. Moderate valuation and healthy fundamentals make it a defensive yet forward-looking play in this space.

4. Boyd Gaming (BYD) — $6.6B Market Cap

- Forward P/E: 11.79x

- 3Y CAGR: -2.4%

Overview:

Boyd Gaming focuses on regional U.S. casinos — minimizing reliance on tourism-heavy markets. Its footprint includes properties across Nevada, Louisiana, and the Midwest.

Investor Insight:

Lower growth but stable margins. Ideal for income-focused investors who prefer consistent domestic earnings over global volatility.

5. Churchill Downs (CHDN) — $6.2B Market Cap

- Forward P/E: 14.66x

- 3Y CAGR: 4.6%

Overview:

Best known for the Kentucky Derby, Churchill Downs has expanded into online horse racing and gaming platforms. It’s a unique blend of legacy sports and modern gambling.

Investor Insight:

Solid fundamentals with cultural cachet. Limited international risk makes CHDN a balanced mid-cap exposure to U.S. gaming.

6. Red Rock Resorts (RRR) — $3.3B Market Cap

- Forward P/E: 30.62x

- 3Y CAGR: 3.3%

Overview:

Red Rock focuses on locals casinos in Las Vegas rather than high-tourist venues, which helps during downturns. Its Station Casinos brand targets Nevada residents.

Investor Insight:

High valuation but low cyclicality. RRR is a stable, niche operator with a loyal regional customer base.

7. Melco Resorts & Entertainment (MLCO) — $2.95B Market Cap

- Forward P/E: 17.31x

- 3Y CAGR: 5.9%

Overview:

Melco operates luxury properties like City of Dreams Macau and Studio City. Its fortunes closely follow Macau’s policy and Chinese consumer sentiment.

Investor Insight:

A high-risk, high-reward stock, which is ideal for those bullish on long-term Asian tourism. Currency and policy risks remain significant.

8. Monarch Casino & Resort (MCRI) — $1.74B Market Cap

- Forward P/E: 17.69x

- 3Y CAGR: 3.0%

Overview:

A smaller but efficient operator with properties in Reno and Colorado. Focused on regional, drive-in markets.

Investor Insight:

Conservative growth but steady profitability. Attractive to small-cap investors seeking U.S.-focused exposure.

💻 Gaming and Sports Betting Stocks: Digital Acceleration, Global Reach

These companies lead the rapidly expanding digital side of the gambling industry, spanning sports betting, iGaming, and gaming platform software. Their growth is powered by legalization, mobile technology, and advanced data analytics, which make betting more accessible and personalized for users worldwide.

Unlike traditional operators, their success depends on user acquisition, digital engagement, and market expansion rather than physical tourism or resort traffic. Below are the top seven gaming and sports betting stocks driving innovation and growth across this fast-evolving sector.

Top 7 Gaming and Sports Betting Stocks

Company | Ticker | Market Cap (USD) | 30D Price Change | Forward P/E | 3Y Revenue CAGR | Focus Area |

$43.8B | +3.12% | 29.35x | 16.1% | FanDuel, Global Sports Betting | ||

$16.7B | +2.72% | 92.18x | 22.1% | U.S. Sports Betting, iGaming | ||

$7.5B | +3.88% | 50.16x | 20.1% | Betting Data & Analytics | ||

Super Group (Betway) | $6.8B | +4.00% | 26.97x | 14.6% | Online Casino, Global Betting | |

$6.6B | +0.76% | 13.92x | 6.7% | Gaming Software & Systems | ||

$2.35B | +3.34% | 19.39x | 5.4% | Regional Casinos, ESPN Bet | ||

$1.80B | +2.94% | 48.37x | 14.5% | BetRivers, PlaySugarHouse |

Here are seven leading gaming and sports betting stocks that exemplify this rapidly growing segment of the industry.

1. Flutter Entertainment (FLUT) — $43.8B Market Cap

- Forward P/E: 29.35x

- 3Y CAGR: 16.1%

Overview:

Owner of FanDuel, PokerStars, and Betfair, Flutter leads the online gambling world. Its U.S. presence (FanDuel) dominates the sports betting market.

Investor Insight:

The clear global leader in online betting. High growth with manageable risk; a top pick for long-term exposure to the digital gambling megatrend.

2. DraftKings (DKNG) — $16.7B Market Cap

- Forward P/E: 92.18x

- 3Y CAGR: 22.1%

Overview:

DraftKings is a U.S.-based online sports betting pioneer. Its platform integrates fantasy sports, iGaming, and sportsbook services across 25+ states.

Investor Insight:

Exceptional revenue growth but lofty valuation. Ideal for aggressive investors betting on U.S. expansion and technological leadership.

3. Sportradar Group (SRAD) — $7.5B Market Cap

- Forward P/E: 50.16x

- 3Y CAGR: 20.1%

Overview:

Provides data and analytics infrastructure for sportsbooks and leagues globally. Clients include major names like the NBA and FIFA.

Investor Insight:

An indirect but critical play on digital betting’s expansion. Long-term data moat makes SRAD a valuable tech-oriented asset.

4. Super Group (SGHC) — $6.8B Market Cap

- Forward P/E: 26.97x

- 3Y CAGR: 14.6%

Overview:

Parent of Betway and Spin Casino, operating across over 20 jurisdictions. Focuses on Europe and Latin America.

Investor Insight:

Strong international diversification, though regulatory complexity adds risk. Reasonable valuation relative to peers.

5. Light & Wonder (LNW) — $6.6B Market Cap

- Forward P/E: 13.92x

- 3Y CAGR: 6.7%

Overview:

Formerly Scientific Games, LNW develops casino systems, slot machines, and online gaming software.

Investor Insight:

A hybrid hardware/software gaming firm with stable recurring revenue. Lower volatility than pure-play digital stocks.

6. Penn Entertainment (PENN) — $2.35B Market Cap

- Forward P/E: 19.39x

- 3Y CAGR: 5.4%

Overview:

Transitioning from regional casinos to digital operations via ESPN Bet and Barstool partnerships.

Investor Insight:

Rebranding and digital integration could unlock long-term value. Watch execution closely.

7. Rush Street Interactive (RSI) — $1.80B Market Cap

- Forward P/E: 48.37x

- 3Y CAGR: 14.5%

Overview:

Operates BetRivers and PlaySugarHouse, focusing on the North American iGaming and sportsbook markets.

Investor Insight:

Smaller scale but consistent growth. RSI is an interesting small-cap pick for early adopters in U.S. online betting.

Casino vs. Gaming: Key Differences

While both casino and gaming stocks operate within the broader gambling industry, their business models, growth trajectories, and risk profiles differ significantly.

Casino stocks are rooted in tangible assets such as hotels, resorts, and entertainment venues. Their performance depends heavily on tourism, travel spending, and local economic conditions. Growth tends to be steady but limited, as expansion requires large capital investments and regulatory approvals for new properties. These companies often provide stable cash flow and dividend potential, appealing to more conservative investors.

Gaming and sports betting stocks, on the other hand, represent the digital evolution of the industry. Their business model focuses on mobile apps, online sportsbooks, and iGaming platforms that can scale rapidly across new markets. However, their growth varies dramatically — from mature markets with slower user growth to newly legalized regions experiencing explosive expansion. As a result, valuations can range widely, reflecting both the high potential returns and the greater execution risks tied to technology and competition.

Feature | Casino Stocks | Gaming Stocks |

Business Model | Physical resorts, hospitality | Digital sportsbooks, apps |

Revenue Drivers | Tourism, foot traffic | User acquisition, legalization |

Growth Speed | Moderate and capital-intensive | High but uneven across markets |

Risk Type | Regulatory, tourism exposure | Tech competition, market saturation |

Valuation Range | 10–25x P/E | 25–90x P/E |

In short, casino operators offer stability and asset-backed income, while digital gaming companies provide faster but more volatile growth. A balanced portfolio may include both, capturing the steady earnings of resort operators and the scalability of online betting platforms.

Comparing Casino and Gaming Stock Metrics

Evaluating casino and gaming companies requires different performance indicators because their business models operate in distinct environments. Casinos rely on physical venues and hospitality income, while gaming and sports betting firms measure success through digital engagement and scalability.

Category | Casino Operators | Gaming & Sports Betting Companies |

Core Revenue Metric | Gross Gaming Revenue (GGR) – total bets minus winnings | Net Gaming Revenue (NGR) – GGR adjusted for bonuses and promotions |

Profitability Metric | EBITDA – operational profitability excluding financing and non-cash items | LTV/CAC Ratio – relationship between user lifetime value and acquisition cost |

Customer Metric | Average Daily Theoretical (ADT) – expected player value per day | MAUs / ARPU – monthly active users and average revenue per user |

Focus | Physical traffic, tourism, and resort performance | Digital growth, market share, and user retention |

In short, casino metrics measure on-site efficiency and asset performance, while gaming and betting metrics highlight digital scale and customer economics. Both sets of indicators are vital for understanding how each business model creates value.

Final Thoughts

The casino and gaming sector offers a balance between steady income and rapid digital growth. Investors can mix both sides to match their goals and risk appetite.

Income-Focused

- Boyd Gaming (BYD) – regional strength and consistent profitability.

- MGM Resorts (MGM) – diversified assets and reliable returns.

- Churchill Downs (CHDN) – stable earnings from iconic racing and online wagering.

These operators deliver dependable cash flow and lower volatility.

Growth-Focused

- DraftKings (DKNG) – expanding leadership in U.S. sports betting.

- Flutter Entertainment (FLUT) – global dominance through FanDuel and Betfair.

- Sportradar (SRAD) – data-driven growth powering digital betting.

High potential, but with greater short-term swings.

Balanced Approach

- Light & Wonder (LNW) – bridges physical gaming and digital systems.

- Penn Entertainment (PENN) – integrating resorts with ESPN Bet.

- Super Group (SGHC) – international scale across iGaming and sports betting.

A blended strategy combining resort stability with digital upside offers the best of both worlds – steady income and long-term growth potential.

Disclaimer: This content is provided for educational and informational purposes only and should not be interpreted as financial advice. Always conduct independent research or consult a licensed financial advisor before making investment decisions.